If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

My questions are in bold italics and his responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 46, my wife is 49.

Married 16 years.

Do you have kids/family (if so, how old are they)?

Two boys 11 and 13.

What area of the country do you live in (and urban or rural)?

Southern California.

Suburb outside of Los Angeles.

Unfortunately, not cheap!

What is your current net worth?

$3.5M.

$3,504,854 to be exact. I track it much more closely than is probably healthy.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Zero debt, paid off our residence 14 years into a 30-year loan.

- $850k in primary residence equity

- $300k in cash

- $800k in a brokerage account, this is invested in index funds, and a few individual stocks

- All the rest is in stocks spread out in several 401ks, Rollover IRAs, Roth IRA, about $180k in company stock grants.

EARN

What is your job?

I am an engineer, but do most of my work in project management now.

I also manage a group of other engineers.

My wife has a senior position with a large medical device manufacturer doing business planning and marketing work.

Both of us literally started at the bottom and worked our way up.

What is your annual income?

$390k salary last year (this is household of me and my wife combined), however that is an all-time high.

This does not account for investment returns. I do not consider that income (yet). Investment returns all get reinvested into the overall investment pile.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I started working in high school. Many minimum wage jobs which I continued to through college. Busboy, shopping cart pusher, cashier, pizza delivery etc. Tip earning jobs (waiting tables and pizza delivery) in college years were pretty lucrative and paid the bills.

My first job out of college in 1994 paid $28k per year, or $14/hr. It was a tough economy and I actually took a pay cut from waiting tables to accept a very entry level engineering position.

Today my W2 shows a little over $200k per year in income.

Income has climbed steadily over the years as our careers have advanced and has really peaked lately. We are likely in our top earning years right now and don’t expect to make much more.

Income growth was simple. Work hard even when the work was unpleasant, be of value to the company and always try to do a little better job than others around me. It has always been noticed and always been rewarded with advancement and increased income.

Both my wife and I have benefited from occasional stock grants or stock options offered by our employers over the years. I would estimate that approximately $300k of our net worth could be attributed to stock grants/options from our employers.

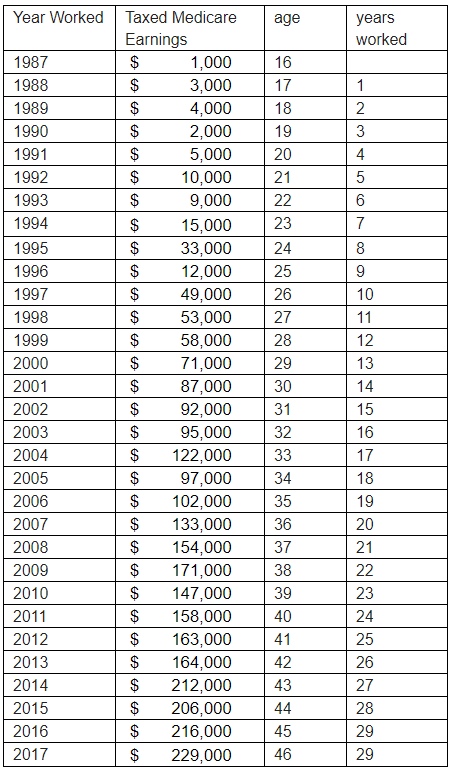

Below is a chart detailing my income from SS records, rounded to nearest thousand. My wife’s follows a similar trend earning about 70% of what I typically make.

What tips do you have for others who want to grow their career-related income?

Do something you like and/or you are good at. Much easier to work hard and be an exceptional performer at something you don’t hate.

Pay attention to what the successful people in your business do, learn what they do, and mimic them.

Whenever you can, err on the side of “it must be my own fault”. Always assume if something is not going well that it must be your fault, rather than somebody else’s.

Always be looking for what you could be doing better, rather than what somebody else can be doing better for you. This helps you improve and typically helps you advance.

You can control yourself, but not others. If you focus on improving you rather than worrying about others, it just works. I have noticed this pattern everywhere I have worked – top earners or folks who look to see what they can do better, not the ones who spend their time complaining about what others are not doing well or how others have done them wrong, are the ones that get ahead.

What’s your work-life balance look like?

As we are in SoCal so I spend much more time driving that I would like, but my employer is relatively flexible.

I do 30 to 50 hours a week depending on the level of activity at the office and am able to fit in time with the kids’ sports and school events.

Clients however are a top priority. If a client asks for something, personal obligations typically take a back seat.

I am able to work from home occasionally. I am pretty involved with the kids’ sports by coaching and volunteering. Luckily my employer allows me to do this.

I wish we could do more frequent extended vacations, but these are difficult to do. Being away from work for weeks at a time just doesn’t really work in my line of work or my wife’s.

We typically get at least one good camping trip in every summer and every couple years a better fly-away vacation.

I wish I had more time with the family, but earnings don’t happen without work.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

We have no other sources of income other than our salaries.

This is a financial shortcoming of ours I feel. We have no diversified sources income.

Technically we do have income from investments as we have over $2.5M in various stocks, however that all gets reinvested and added to the net worth pile. We do not treat the returns on investment as income yet.

SAVE

What is your annual spending?

We average about $100k/yr. in spending.

This number shocks me. I consider us fairly frugal people, but somehow we do spend what to me seems like a ridiculous amount.

We only recently paid off our home which used to consume $24k per year in mortgage payments. I expected our spending to go down after paying the house off, however we seemed to have increased our spending in other areas.

As the kids have gotten older, and are now right in the expensive phase of orthodontics and more involved in sports, their expenses have increased.

A few years back we also had a large house remodel project that throws my numbers off a little bit.

What are the main categories (expenses) this spending breaks into?

I am a Quicken fanatic and track all our spending closely. Per Quicken the breakdown of our spending in the last few years is as follows:

- Kids Expenses (Sports, school, clothing, medical, dental etc) 9.2%

- Restaurants (Eating out and take out) 9%

- Groceries 9%

- Automobile Related 7% (gas, insurance, service, repairs etc)

- Housekeeper 5% (as we both work full time, this is a necessary expense for my wife’s sanity)

- Vacations 4.9%

- Utilities 4.3%

- Property Taxes 4.2% (California is brutal on taxes)

The other 50% falls into a bunch of smaller buckets.

We have never had any car payments or debt of any kind other than the house mortgage. As I mentioned above the house has been paid off.

When we buy cars we try to buy newer used and then hold for a long time. Currently both cars are over 7 years old.

We follow The Millionaire Next Door advice of living way below our means and delaying gratification whenever possible.

Do you have a budget? If so, how do you implement it?

I do not have a budget, but I do have a number I want to stay under each month on average which is somewhere between $8k and $9k.

I am the one who monitors this. I use Quicken to track our spending and am frequently comparing spending in various categories to the same categories in previous periods.

If the spending is higher than it should be or I see an unexplainable or unnecessary trend upward trend in any categories, I inform the wife she needs to step off the gas pedal a bit. Typically, after a “step of the gas please” talk I see a correction downward the next month.

I have tried to make recurring financial meetings part of our life, but my wife isn’t really that interested. We have had a few talks where I try to review the Quicken data but as I said, she is not that into it.

She knows I am an extreme worrier and trusts me. She feels that if I say everything is ok, then all must be ok and doesn’t want to get more involved than that.

I wish the financial worrying was more of a joint effort, but it’s mostly on me. This goes back to a common piece of advice of marrying the right person. I succeeded in this area.

What percentage of your gross income do you save and how has that changed over time?

We save approximately 35% of gross income.

Our savings as a percentage of gross income has gone up as our income has gone up. Although our income has increased we have not proportionally increased our spending. We could spend much more, but we don’t.

We both max out our 401ks which is part of this savings number.

Unfortunately, our tax rate is now quite high so an alarming amount of our gross income is consumed by state and federal taxes.

We have had a few one-time expenses like a new car or some projects on the house that may cause the savings rate to dip.

What is your favorite thing to spend money on/your secret splurge?

Starbucks, good food, occasionally a nice trip someplace where we don’t count the pennies too closely.

Having been so cheap in our younger years it is nice to buy a quality meal or cup of coffee and not worry about the cost.

This is one area where my spending has changed significantly over the years. As our earning went up, this is a spot where I felt like “I have earned this, I am not making minimum wage anymore, it’s ok to spend a few bucks on food l like.”

In years past it pained me to spend on anything that wasn’t a necessity and even then only if it was some sort of a super bargain.

INVEST

What is your investment philosophy/plan?

Just invest and hold for the long term.

I buy mainly index funds.

All paychecks and bills go in and out of one single account. The balance of in this account is my gauge of how we are doing cashflow-wise. If the balance is going up we are saving, if the balance if flat or declining (which doesn’t happen often) we are burning more than we are earning. When this account hits $100k it is time to invest more. I roll this into more index funds a few times a year.

I try my best to avoid the temptation of trying to time the market. I do try to follow Warren Buffets advice to be “Fearful when others are greedy and greedy when others are fearful.”

Don’t get alarmed by swings in the market. If there is a big drop or panic and I have cash I may invest a bit more if I can. Slow and steady has worked for us.

What has been your best investment?

401k plans, invest and hold. We have over $1M in these now.

Employer matching plus time in the market really creates growth of wealth over the long haul.

The mutual funds/index funds have beat returns I have made on active trading of individual stocks.

What has been your worst investment?

Several individual stocks over the years have lost money for me. Some made a profit, but overall individual stock trading did not do any better than my index funds.

I played the market and actively bought and sold stocks over the years. In the end however, long ignored boring 401ks invested in mutual funds outperformed all my stock trading, with a lot less stress. In general, I have given up on trading individual stocks.

Another regretted investment was a home remodel project. Cost a few hundred thousand, it did not increase the value of the home by a similar amount and resulted in zero increased happiness. That was a poor use of our capital. Would have rather kept the cash which could have resulted in earlier retirement or perhaps an investment property.

What’s been your overall return?

As we do index funds, I generally match the market. Probably average around 11% however I actually don’t track this number that closely as I can’t control it.

Employer match on 401ks is easy money offering great instant returns. Where else can you make a 25% return on an investment with no risk?

How often do you monitor/review your portfolio?

I check in on all our accounts daily via Quicken.

I am mainly just tracking and categorizing spending, but when you are in there you can’t help but see your net worth number for all your accounts as they update automatically as well.

I am the first to admit, this is probably unhealthy.

NET WORTH

How did you accumulate your net worth?

All self-made. Very simple: maximize earning, minimize spending, invest the savings into the market on regular basis, avoid debt.

I have an excel file I use to track our progress and plan our finances. In this file I have also have written a few goals and strategy items down. Below is how I have summarized our strategy:

- Spend less than we make

- Spend wisely when we do spend

- Spend on what we need, avoid spending on frivolous wants

- Invest wisely

- Be patient

- Delay gratification

- No Debt – If you have to borrow for it, you can’t afford it

On maximizing earnings…

With some help from our parents, both my spouse and I worked through college and left school without any debt.

We started at the bottom of the working world, worked hard, attempted to be high performers in the work place and were rewarded as a result with promotions and raises.

It’s a pretty simple formula: Do your best, try hard and work to be the person the boss is happy to have on the job rather than the one they wish they could replace. Follow this approach and you can’t go wrong, your boss/employer/customer/client will reward you, if they don’t someone else will notice and hire you away.

As a person that now manages a pretty large group of people (and have input into their raises), I know exactly who the top performers are and always make sure they are taken care of financially in the form of bonuses and raises. I want to reward good behavior and also encourage them to stay. If I don’t pay the top people well, somebody else will and hire them away from us. Be one of these people.

On minimizing spending…

Again it is very simple if you don’t need it, don’t buy it. Avoid the temptation to try to keep up with the perceived spending of others. Delay gratification.

On investing…

As soon as you can invest in stocks do so. I started in college with some small dollars in mutual funds.

As soon as you can contribute to a 401k, do so. Max out this contribution as soon as you can, even if it means living on less money, you get used to it. Eventually you get raises and you barely notice it. If you don’t have a 401k option then do an automatic investment into a Roth or IRA.

Once you have maxed out these options, invest in a brokerage account. Go for no load, low expense ratio index funds. No matter how tempting, don’t cash those outs for any unnecessary wants (cars, clothes, trips etc). Treat the investing as an unavoidable bill you must pay before you even think of buying anything you don’t absolutely need.

Marry somebody with a similar mindset and an ability to earn or to help you earn.

Delay having kids until you can get your career established a bit if you can. Kids are the greatest thing in the world, but I am pretty sure I could not have built the career I did in my 20s I if had the kids then. 30’s was the right age to have them in my case after career and earnings were more established.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

Rough patches in the work life where it felt like the job was too much happened a few times. The stress and demands to do things right can sometimes become overwhelming.

Several times in my career I got to a point where I wanted to just quit. Especially right after the kids came around, it took a while to figure out the work life balance, I had to ratchet back work a bit to make time to be a dad.

During those rough patches you have to just have a positive attitude and motor through them with the confidence that better times will come, they always do and in many cases these rough patches are great learning experiences. My struggles through some of my worst/most hated work assignments later led big career growth I had not anticipated.

The stock market tanking and job market tanking created some uncertainty and stress at the time, but it all worked out. Read the book “Don’t Sweat the Small Stuff (and it’s all small stuff)”. Lots of great advice here that helps in dealing with work stress I found.

What are you currently doing to maintain/grow your net worth?

Maximize income, minimize expenses, avoid unnecessary luxury expenses, continue to invest, maximize 401k contributions. Try to invest wisely.

Do you have a target net worth you are trying to attain?

Yes. $3.2M in investments is my target.

In general, I want an investment pile large enough to provide income forever and also be able to tap into to fund the one-time large expense of the kids’ college educations (assuming they go this route).

My target is to have $100k per year of income in retirement after taxes.

Apply the 4% rule (meaning I can withdraw 4% per year out of our investment pile every year and not deplete it) and assuming a 15% tax rate on long term capital gains I need $2.9M to kick off $117k per year, which after 15% taxes are deducted should provide us $100k per year.

I am conservatively assuming I will need $350k to put two kids through college, so I then add this amount to the total pile required number. Hopefully we find a cheaper college alternative (or maybe even no college) I but I like to plan for the worst.

Adding the kids’ college expenses in, I need an investment pile of $3.2M. This of course assumes no major new expenses, no new houses, no vacation homes or other big expenditures.

I would like to pad this a little more if possible and either provide a greater safety margin, or allow a few luxury items like vacations, travel, or perhaps a vacation home or even an investment property.

How old were you when you made your first million and have you had any significant behavior shifts since then?

Net worth hit one million in 2006 when I was 35.

By this time was tracking our household net worth closely. I knew when it happened almost to the day.

I was tighter with the spending back then. I was a constant coupon clipper, deal finder, always in “save a buck” mode. Now that our income and net worth has increased we are more likely to occasionally spend a bit more than we used to, however I do still feel uncomfortable spending money. Being frugal, saving rather than spending has been a lifelong habit.

My wife is the one constantly trying to talk me into enjoying life a bit more via spending. Previously I would say “no way” to unnecessary spending however now with the goal within reach I feel ok spending a little more now, but just barely.

Many of my peers shake their heads at my lack of spending/self-depravation. A few of my co-workers are driving Teslas. It is so temping join them, but I still focus on separating wants from needs. My $20k econo-box car with 150,000 miles on it still seems to get the job done.

What money mistakes have you made along the way that others can learn from?

When the time comes to buy a home, try to buy a house you feel you can live with for the long term, or something that will later become a great rental property.

Although my house is now paid off, I wish we had spent just a bit more for a slightly nicer home. I feel married to a house I don’t love right now, looking back I could have afforded more and been much happier. Real estate price increases and property tax implications make it difficult to upgrade later.

Capitalize more on down markets. I could have done more buying more stock or rental properties when markets were down. In this case, hindsight is 20/20.

When markets were down, I was just as worried as everybody else and it was hard to pull the trigger on burning some of our cash safety net on uncertain investments. In 2007-2009 we were all worried about our jobs and future income.

Avoid day trading and frequent stock trading. Index funds are easier and you will likely get better returns in the long haul.

If you get an opportunity to diversify into rental properties or other income streams consider them. I never did this. It bothers me now that all my eggs are essentially in one stock market basket. I failed to diversify.

When I do the math now, return on equity on rental properties just doesn’t make sense, prices are too high. If I could have bought 10 years ago, I might have been cash flow positive. A time machine would be a great thing to have! Maybe Elon Musk will come up with one.

Don’t loan money to family or friends. If you follow the advice above you will wind up being more successful than a few relatives. They may come to you for a loan, or multiple loans. You may think you are doing them a favor, but you are likely not. Give them good advice on how they might handle their finances if they ask, but don’t give them money. I learned this the hard way.

What advice do you have for ESI Money readers on how to become wealthy?

Read The Millionaire Next Door.

Everything in this great book is true. Very simple advice provided by this book works: make as much as you can, spend as little as you can, invest continuously, don’t fall victim to trying to keep up with the spending of others.

We could certainly spend more than we do and give a much greater appearance of wealth to the outside world, but it would not be wise. We have a modest house, older used cars, live in a middle income neighborhood with happy kids, but we are looking at an option to retire in the next few years – it’s a very nice feeling.

It is so much easier to deal with work knowing we don’t really have to do it anymore. An expensive house, expensive new cars, flashy stuff are all tempting, but would all wipe this out quickly and put as back onto a mandatory 20 year trip on the work treadmill.

Choose a spouse wisely that will help you along the financial journey rather than fight you (assuming it’s not too late already).

Delay gratification, if you need to finance or borrow for it, you can’t afford it. Even if you have enough money to buy something, always ask yourself, do you really need it?

Avoid debt above all. Only exception is a home and maybe an education, and even then only if the education will provide a return on the investment in the form of increased earnings. I see lot of people getting into huge debt for nearly worthless college degrees. If you are going to get a degree, get one that results in enough pay to cover the cost of the education and a lot more.

Track your spending. Track your savings. Know where your money goes. Make sure you are always saving. If you are not saving change something ASAP to get yourself back on track.

I love Quicken, it’s great for doing this. I can tell you exactly how much we spend on just about anything. If you can’t do this, setup direct deposits and payments in a single account. This way, with all your money going in and out of one spot you at least you know the overall big picture – are you gaining or losing ground?

FUTURE

What are your plans for the future regarding lifestyle?

Very soon (I hope) work will become optional for us. When this occurs, I would like to reduce my time spent at work and spend more time with the kids, travel, fun or maybe even change jobs entirely to something more enjoyable.

Sadly based on current trends I will hit my magic number right about when the kids are nearly done with high school.

What are your retirement plans?

Enjoy our family, travel, projects around the home, maybe resume old hobbies (fixing old cars, motorcycles), contribute our time to a worthy volunteer cause, or perhaps start a second more fun career in the something different.

Possibly downsize the home but to a more desirable area. Where we live now is nice, but not sure it’s a great place to have a lot of time on your hands. It would be great to have a small beach place or mountain home. I have pondered the idea of buying a vacation rental that we also use occasionally. Need to run the numbers on that option.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Biggest concerns:

- Future health care costs

- Market downturn wipes out wealth and forces longer time in the work force

- Running out of money before we run out of heartbeats

- The kids’ failure to launch into successful financially independent adulthood.

- Boredom / lack of purpose in retirement.

Items 1 and 2 I have no control over so I continue to simply attempt to maximize the size of my investment pile to mitigate against these.

Regarding item 3, again maximizing investment pile and living efficiently is my defense against this.

Regarding item 4, the kids have been taught that we will help them get started via an education, but they will not be allowed to be dependent on us into adulthood. It is up to them to make their own way and create their own success just as we did.

We talk about this a lot. Hopefully this lesson sticks, but you never know! I sincerely hope I don’t have to find out if I am really willing to stick to this mantra and say “no” to a financially needy adult child. That would be really tough to do.

With cell phones, video games, downloadable TV, YouTube etc, kids of this generation seem a lot less motivated to do boring work stuff that might actually lead to earning. It’s far too easy to sit at home and be electronically entertained rather than going out and actually doing something real. I worry about this not just for my kids, but all kids today.

Item 5 we will just tackle it when it comes and see how we do. A good problem to have and try to solve I suppose.

MISCELLANEOUS

How did you learn about finances and at what age did it ‘click’? Was it from family, books, forced to learn as wealth grew, etc.?

Neither of my parents were four year college graduates, my mom was a stay at home mom, money was tight. We did ok mainly because my dad worked very hard and earned. My mom was very tight with the money. His hard work was apparent to me as kid as was my mom’s worry over managing the money wisely.

The examples of maximizing earning through hard work while also being frugal stuck with me.

I learned the power of compounding in college and began investing as soon as I could.

Like-minded older coworkers provided some guidance as well as books like The Millionaire Next Door.

Who inspired you to excel in life? Who are your heroes?

My Dad – simple as that. I work now just as he did (and still does today).

I have the added benefit of a college degree which opened a bit more earning potential for me.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

We do give to charity, but not a huge amount.

We give to the hospital the kids were born in. We liked the place and feel it is a great cause.

We also donate to various school, PTA and sports organizations our kids are involved in.

As a percentage of our income our giving is relatively low, under 5%, however the focus of our strategy now is maximize our own wealth building for our kids’ education and our eventual retirement. If we have achieved our goals and our plan has been confirmed as a success we will likely give more.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

We do not plan to leave much behind. Although we do have a will and living trust set up that would transfer what is left of our estate to our kids should we pass on, we have stipulated it is not to happen until after they are age 40. The trustee has specific instructions on this — provide the kids enough to get educated and start a career, but no more until after age 40.

Giving a large inheritance to a young person likely removes all motivation to work and create value in the world. I want my kids to overcome some struggles, learn the value of a buck, how to earn it, learn how to manage it, and from this I expect they will learn how to appreciate it. They need to get the satisfaction of making their own way.

If we are lucky, we will live a long life and spend the last dollars of our investment pile on something fulfilling together, hopefully involving family and friends in some great spot in the world.

Assuming we do a make it a good long time there is a good chance that after healthcare expenses there may not be much left. If there is any left it would of course pass to the kids, but I do not expect or desire a large inheritance to be passed on.

Thank you for the book recommendations! Definitely going to read it this weekend.

I really like the income from the Social Security site.

I was wondering if ESI can make this a required information to all future millionaire articles.

Thank you very much!

I give the interviewees a lot of latitude about what to/not include…so it’s really up to them.

There was an interview a couple of weeks ago where at the end, the interviewee possed

a few questions to the ESI site readers. I thought that was a good idea. ESI should consider adding that as a standard question as part of the interview format. “Is there anything you would like to ask other ESI readers? “. I thought it generated some interesting conversation

I actually make it even broader than that — I give the interviewees the chance to add ANY sort of question they like.

Here’s the exact wording from my questionnaire:

“Feel free to add any questions you think I missed that I should have asked.”

🙂

Glad you liked the table, finally somebody appreciates my nutty attention to detail. My wife has never complimented me on this during our infrequent financial meetings. My guess is few would have this information readily available. Excel is like a hobby for me and I track any data i can get my hands on so this was an easy cut and paste for me. Enjoy reading The Millionaire Next Door. Good book. You can read all the interviews on this site here and learn a lot of the same things. It is pretty simple actually, make as much as you can, spend as little as you can, invest the difference and repeat.

So – did you read the books yet?

For anyone that projecting a high reliance on Social Security – you need to understand that social security will use the highest 35 years of your income to determine benefits. See

https://www.ssa.gov/planners/retire/stopwork.html. If you FIRE and retire before that it will impact your assumptions in your FIRE plan.

But then again, if you are reading this ESI blog and are aiming for FI or FIRE that should not be a problem because your plan should not be dependent on social security benefits.

I should have mentioned, my plan assumes zero income from social security. If I get a dollar from social security it would be an unexpected bonus. I am using the social security earnings history table only as it is a good reliable record of my earnings. I didn’t do as good a job of tracking my earnings when i was 16, the feds however never forget. It is an interesting data set for a nerd like me

Right there with you MI-94. Don’t take social security to the bank!

If there’s any left by the time I’m old enough to collect I will be very surprised. Pleasantly.

Really enjoyed this article and found very similar to my wife and I’s journey as well. Kudos to the success that you have had to date and found it interesting that you mentioned tracking your network daily was unhealthy (I said the same thing) but the more I have reflected on it the more I wonder as if it is actually a very healthy thing assuming you are not making rash investment decisions as it helps you be very conscious of spending + seeing the net worth chart go up and up helps reinforce you are on the right track and encourages positive behavior.

Millionaire 73

https://esimoney.com/millionaire-interview-73

I have been tempted to hide the net-worth and investment account numbers in Quicken, view only the day to day income/spending accounts, and then just be surprised at the end of the year. Above I say I am not making any decisions based on the investment data, maybe I should just focus on month to month spending. Would probably be mentally healthier. BUT – Seeing that net-worth number go up does make me feel good though, sort of my reward for all the work and the self deprivation.

I read your interview. Very interesting. Congratulations. You’ve really done well for yourself. Far above the average American….or Canadian!

We’re almost the same age and our kids too.

Found it interesting that you were also shocked by your level of spending. I still can’t believe we spend what we do.

I have always wanted to find a financial advisor I feel comfortable with and that I felt would do better than me on my own, as I don’t consider myself an expert. It would be nice to have an expert check in and say “yes you’re doing the right thing”, or “no, you could do better, here’s how”. Every advisor I’ve ever spoken with, quickly lead to them attempting to sell me mutual funds which were no better than the funds I was picking myself, but with the benefit of them collecting some fees from me in the process. I also have a fear of putting all my money in the hands of someone else and of putting all my money into one basket.

Do you have any concerns like this? That a large portion of your funds are being managed by one person? Too many eggs in one basket?

I found out shortly after the interview with ESI (in April) that the Investment Adviser that I speaking glowing about above had a great opportunity to manage a very large Family Office and was shutting down his fund. It came as surprise but at the same time it was a once in a lifetime opportunity and I was very happy for him.

So I spent the month of May researching 100’s of different options and briefly considered a basket of ETF’s but I am personally of the belief the market is due for a correction (have thought that way wrongly for two years though as well) :-). As I mentioned above investing and understanding everything I could on that industry has been a passion of mine since I was 15 so consider myself have above average knowledge. I believe that finding the top 5% will outperform the overall market over time so I had multiple interviews with various hedge funds and financial advisors and asked them 40-50 questions and out of that came up with 3 I was extremely comfortable with, that said, there are SO many weak/poor advisor/funds out there so due diligence is the key.

I also realized that I needed to diversify my risk so I did the following

30% Cash/Bonds (Mostly 12-13 month CD’s at 2.5 to 2.65%)

20% Hedge Fund 1 (Long/Short)

20% Hedge Fund 2 (Long/Short/Quant)

15% Hedge Fund 3 (Long only….Buffett like approach)

15% Stocks (Took the top 6 ideas from my current hedge fund and will sell over next 2 years)

I know that 95% (I think that is the number) dont beat the index over a long duration but I believe with a strong conviction (perhaps naively) that I can identify the ones that will do that. Time will be the ultimate judge ?

That said, I realized in hindsight that I did have all my eggs in one basket and feel a lot more diversified today which I am thankful for.

Diversification does make you feel a little more comfortable. I also feel a correction seems long overdue, part of the reason why i have $300k sitting on the sidelines. Just does not feel like a good time to sink more cash into stocks, however i suppose if I really felt that strongly i should pull more cash out and wait for the correction. Having a bunch in various index funds and some cash on the sidelines feels like an ok compromise for me right now. Good luck on your new fund mix, i hope you beat the market!

Another really super, interesting and well thought out interview- thank you so much for doing this. Curious about your thoughts on real estate investing- you really think it is too late? Possibly where you live but surely there are other places where you can drive a reasonable yield?

Based on current real estate prices versus rental income, minus expenses rental properties never make sense to me, according to my calculator. So based on this math i guess i am always going to see myself as too late. Real estate seems crazy over priced here so banking on making my money back on increased property value seems like a risk to me. Every time i have done the math on real estate anywhere near hear the return on equity is near zero or even negative. An investment that is not cash flow positive to me is not very attractive. Real estate comes with all kinds of landlord headaches I am not sure I want to deal with. My index never complain about anything and provide a return on equity as good or better than what real estate my yeild. I do have friends making a little money or just barely breaking even on rentals, but they are doing it by buy 5 to 10 unit apartment comlexes in really rough neighborhoods, then evicting tenants (by paying them to go away) and raising rents, seems like a huge pain in the ***. Similarly properties driving distance away might do ok, but not much better than index funds and with lots more headaches

Just forwarded this interview to a buddy of mine who thinks index funds are to “boring.”

If my advice isn’t good enough for him, hopefully advice from someone worth $3,500,000 will be good enough!

Funny thing is those who knock index investing when they’re younger, turn around to regret it when they are older. Pride and ego are one of mans worst downfalls.

Great interview!

Ha! They are indeed super boring. And as a result you ignore them. Stocks are exciting (and stressfull!). They are a lot like Vegas, occasionally somebody hits the jackpot (and they always advertise that they won) and therefor you think it could be you next time! I have frequently done the math on where I would be if i had put just $10k into Apple stock on they day my 13 year old son was born. I had the money at the time, i could have done it, I just needed to buy the right stock and whammo, just like that I would now have $481k! Unless you are stock genius, and few are, you are not likely to beat index funds and if you do, not by much. I traded actively for years, then compared the results of my active trading to long ignored roll-over 401k account. The roll over account i never touched did better than i did, and i spent a ton of time worrying, watching stock prices, setting up trade triggers, not paying attention to work etc…..it didn’t gain my anything. Another thought on this topic – nobody ever goes around talking about all the money they LOST on stocks, everybody talks about their wins, and downplays the losses, they happen a lot too!

I see you have blog site – how is that working out for you? For fun? for income? both?

Are you taking lessons from Aoki there Benihana founder?! I remember reading news about his will. His kids don’t get access to Benihana funds until age 44. I think there’s more lawsuits regarding that but I absolutely agree with your philosophy. Giving kids a boat of money when they’re under 35 is looking burning cash. I consider myself frugal but even I wouldn’t be good at 21.

I have eaten at Benihana, but I have not read about his will. Will have to Google that. A young person being handed a pile of money is unlikely to lead to a good outcome. Its just human nature.

That said, at age 47, I am totally ready for somebody to magically hand me a pile of money! I think i am now wise enough.

Congratulations on your success! Seems like you have a great handle on your finances and life plan.

I’m 57 and just now getting a revocable living trust together, so I applaud you on your having that in place.

“We have a modest house, …live in a middle income neighborhood…” Wow, an $850k house would be a mansion where I live in the South. I grew up near San Francisco, but left soon after college. Real estate values are much more down to earth where I am now.

Great interview overall! Thanks for sharing.

CA real estate prices are indeed crazy. I often wonder if we are making a mistake raising our kids here, and launching them into this housing market. $850k, and 1,500 ft2, it really is a basic house. NUTS! Maybe we will come to our senses and join you in the south someday!

You’re always welcome in this neck of the woods! An added bonus is the population density is way lower than the west coast and very little traffic. We do have air conditioning, so the summers are bearable.

PS. Get that trust done – that was money well spent. Peace of mind. We put it all in writing and set up a couple of trusted similar minded friends as trustees. hopefully we never need it, but it’s good to know its done if ever needed.

Don’t feel bad about not having rental properties. Rentals are not for everyone. I probably check my net worth too often and have a personality similar to your personality. My personality was not the right personality for a landlord. I worried way too much about the rental and was devastated when one of our renters left us with a mess and we had to fork out extra cash to get the place back in shape to rent. Not to mention the times we paid the mortgage out of pocket because we could not find “good” renters. Now that the rental is sold, I love investing my money in good mutual and index funds.

This is comforting. I am probably not suited for landlord duties. Index funds never complain, never break anything and are never late on the rent : )

Hi MI-94, I really enjoyed your interview and reading your story. You have developed some really good habits at a relatively young age. You set goals, you eliminated debt and a mortgage, you save better than 1/3 of your gross income, you spend wisely, you don’t worry about keeping up with the Jones’, you take advantage of indexing rather than taking on more risk and trying to beat the market, you have a spouse that is on the same page with you, you work hard and are financially rewarded for it, you seem to have a pretty decent work-life balance, you track everything so you know exactly where you are financially at any moment in time, etc.

My only advice would be that once the kids are through high school, get the heck out of CA. Fina an awesome place that addresses many of the things you want to do in retirement that also offers a much lower overall cost of living. You guys are well on your way to meeting all of your goals and achieving a successful life in retirement.

Congrats and God Bless!

I seriously consider getting out of CA frequently. Work, friends and family connections keep us hear, but each year I must say the benefits vs the cost ratio seems to get worse. We may someday relocate. I read your interview too a while back – good one!

Just re-read your MI-27 article. Good job. Interesting “Large European conglomerate in the same area of medical devices” I would not be surprised if you work for the same company my wife does. Hint – starts with an “S”. Its interesting, seems you have some regret about buying too much house. I have regrets about not buying enough. I suppose the grass is always greener. Great interview, i enjoyed reading it, and re-reading it.

That is pretty funny because I’m guessing it is the same company. Not only does it start with “S” but it ends with “S” too.

I have always kind of felt we did more than we should have with the house but the longer we are here the less I regret it. We have now lived here 14 years and have determined this home will be our primary retirement home and it offers everything we want or need. Like you, we will wind up paying it off early due to refinancing to a 15-year and making bi-weekly payments. I’ve toyed with the idea of paying it off even earlier but it doesn’t make financial sense to do so. Since interest is front-end loaded, the remaining interest on the years left on the mortgage is almost nothing, in fact, it is about 1.4% averaged annually over the remaining 6 years. What I’m doing is leaving money in savings bonds and new CDs to cover the balance in case we ever get to the point where job income is gone and we just use that to make the payments. I’m getting about 3.5% risk-free returns between the two so it makes no sense to pay off a 1.4% mortgage rate with that money and tying it up in a rather illiquid asset.

Thank you for re-reading my interview and glad you enjoyed it as well. Continued success in your career and with your investing!

“With cell phones, video games, downloadable TV, YouTube etc, kids of this generation seem a lot less motivated to do boring work stuff that might actually lead to earning. It’s far too easy to sit at home and be electronically entertained rather than going out and actually doing something real. I worry about this not just for my kids, but all kids today.”

This is so true. I noticed a huge difference even in my own kids between the oldest (now 30) and the youngest (now 21) . Apparently, though, generation Z has a different mindset and might turn things around. Fingers crossed.

We shall see! Hoping for the best for my kids and our country, but I predict we may see a lot of lazy under productive people that will be just happy enough to sit around and just barely get buy because their phones, and legal drugs keep them just entertained/sedated enough to not be unhappy with their low earning. Like a slow morphine drip. I have told my kids that I predict the folks that will be successful among their peers will be those that can actually sit down and focus on solving a problem undistracted for just 15 minutes and those that can communicate with other humans face to face effectively. My kids and their friends can’t seem to go more than a few minutes without looking at their phones, and many don’t seem capable of old fashioned conversation. Never should have bought those damn phones for them! I see the same thing in some of the younger employees at work – they focus as much on their phones as their actual work.

At What age did Mill#94 hit 1M net Worth?

It’s buried in the text someplace. Age 35.

Wow, you’ve got an $850,000 house and wish it were nicer? I’m not criticizing, I’m just marveling over how high housing is in a major metro versus my rural area. I’ve got a $200K paid for house in Arkansas and I absolutely love it. I’d never ever wish I had bought more house because now that our three kids are on their own this thing is massively over sized for just the two of us. Four bedrooms and four bathrooms for two people is a bit excessive but for such an inexpensive house there is no incentive to downsize. I think the beauty of rural living is that your house generally represents an insignificant portion of your net worth, while it can be a big chunk in an area like yours. Of course it can appreciate a lot more too, so there can be an upside if you geoarbitrage later and hit the cycle correctly.

Housing here is outrageously overpriced in my opinion. There are many reasons to leave California. This is one them. When it comes to housing there is a huge gap between expensive and nice. Yes our home is expensive, but no, it is really not that nice. I grew up here, but I am originally from the midwest and visit frequently. I am amazed by how much more house you can get in other parts of the country compared to here for pennies on the dollar. Those houses back there I do consider “nice” and are so much more affordable than here. When we bought back in the early 2000’s we could have bought much more, but didn’t because I stuck to the “buy what you need not what you want” motto. Now that our family is larger, a larger nicer house could be categorized as more of a need. Unfortunately that house I could have comfortably afforded way back then is now out of reach, the purchase price and insane property taxes make it a no go for me. Enjoy Arkansas! I am willing to bet you have a very “nice” place there.

Great job MI94! I’m also fully invested in the market with no rental income. Seeing a daily market change (up or down) exceed my montly paycheck can be unnerving. My conclusion is the same as yours (Seattle area) that ROI on residentail real estate is not attractive and I don’t want the headaches associated with rental property either. I’m investing more in REITs (yeah, not the same and are performaning badly … time to buy?) but those provide more income streams than dividend stocks typically. For now, only in tax deferred accounts but once I’m FIRE, I plan to invest more in taxable accounts for the income.

Debt for the right education can be wise. Both my wife and I invested in graduate degrees that doubled our salaries once we graduated. So at age 30, we had a net worth close to zero. But we’re doing pretty good now.

Good to hear another thinker has made the same assessment on rentals. I am seriously considering stopping looking at the investment pile so frequently. I look daily. And like you I now see $20k swings on wild market day. As I am not making any changes in approach based on the number, maybe I should just stop looking and focus on the monthly cash flow. I could hide all the accounts in quicken and then maybe check in once a quarter or even less.

If it were me, I’d start the post with…

“This ain’t no country club

And it ain’t no disco

This is LA”

“All I wanna do is have a little fun before I die, ”

[All I Wanna Do – Sheryl Crow]

😉

Thanks – now that song has been stuck in my head the last 2 days! catchy tune.

hi MI 94

congratulations on your successful journey

When you invest in index funds are they all equity? any bonds?

I am in my 50s and wonder if I am too conservative; though may not be a bad thing right now.

I have a chunk (less than 20% of net worth) in a fixed index annuity for income later, a good chunk in cash (15% or so) and then re: my invested moneys, it is perhaps about 60/40 towards equity. I am looking to leave corporate America and semi retire perhaps within a year.

You also say you do not believe in short term or swing trading type things (I am not talking about day trading). I have never really tried to be a trader, but there is this course in So Cal (metro LA) that people all love and say it has helped them. I really don’t know how “with it” these people are though. It costs $2,000 and it starts tomorrow. I was planning on going to learn and ease my curiosity. it takes years to become proficient supposedly. and you paper trade at least a year after course. This course includes trading stocks and options and long term investing too.

I don’t know if I really would ever do this. I read books like the intelligent investor and millionaire next door so this course is certainly a departure from those books.

Are you familiar with a course called “Profits on wall street”? I don’t want to slander anything, but just curious on other takes from perspective of investors pursuing 1) retirement or time freedom asap and 2) useful education.

I too am uncomfortable spending money and don’t like to spend foolishly. But I do believe in investing and learning.

thx

Let me know how you like the $2,000 course. I don’t have time to turn trading into even a part time job. Index funds spread across a few categories is all I do, it works and I spend very little time thinking about it.

@ESIMoney – My first visit to your blog – amazing to think you have interviewed 94 millionaires. Well done! I always find how other successful investors operate to be really interesting/helpful.

Very nicely done! I truly enjoyed reading every bit about your journey. I am in so cal as well. Would be nice to connect with you. Would appreciate if you could share your list of funds that you started with and currently own. Thank you. You can also reach me at [email protected].

Glad you enjoyed reading. Low cost index funds are easily searchable using any number of platforms. Fidelity, Schwab and Vanguard all have very low expense ratio offerings. As no one should buy funds or stocks based on the recommendation of some anonymous blog posting, I won’t provide a fund listing here. Another guideline I always follow that I should have put into my interview – be skeptical of anything that smells like a sales pitch. This comment strikes me as such.

Just went back and found this based on your comment in the M139 post.

We have a lot in common, age, kids, marriage and more.

Great read seems like you are thinking about the right things. Marriage is critical, having the same goals. I’ve done the house upgrade and think it was worth it. Had huge gains in my last house and rolled that all into the new house. Did have to pay some capital gains but improvements helped with the tax situation. Now our property taxes did almost quadruple and with the SALT caps it’s especially painful. But with my two young kids I think we will get a ton of enjoyment by having a bigger nicer house. But it’s dangerous I still look at bigger houses. I just have to remember there are always going to be people with more it’s not a competition.

Anyhow also worry about setting the right examples for my kids. Don’t want to raise slackers. But they just don’t have the hunger my wife and I grew up with. But they are still young and there is time.

As you say I try to tall to them a lot about it and also talk about how lucky I am to have the job that I do.

Good job and good luck!

Thanks – glad you liked your house upgrade! wish I did too, ha ha. Some one else commented on this topic elsewhere, regarding the lack of money as kids driving their success as adults. What motivated them and motivated them (and me) to strive was the lack of a safety net. I knew if i didn’t make it myself that was it, there was no trust fund to tap into. Despite all my proclamations to my kids that someday they will be supporting themselves i think they probably sense there is a safety net in their parents wealth. I hope that does not detract from their motivation to make something on their own.

MI-94, Than you.

Ha, I just read your fantastic interview as well and your right, lots of common threads.

Given your two teenage kids, I wrote a post on MMM titled “Should you pay for your children college education?”

https://forums.millionairemoneymentors.com/t/should-you-pay-for-your-children-s-college-education/5826

There were alot of comments (176 to be exact on this topic).

It may be worth the read for you given you stage in life with college bound kids.

Best of luck!