Today we continue the ESI Scale Interview series where people answer questions about their success at working the ESI Scale.

Today we continue the ESI Scale Interview series where people answer questions about their success at working the ESI Scale.

In short, the series focuses on what the interviewee is doing in the areas of earning, saving, and investing. They also get an opportunity to ask ESI Money readers for suggestions if they choose to do so.

If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

Today’s interview is with Dom from Gen Y Finance Guy.

With that said, let’s get started.

My questions are in bold italics and his responses follow in black.

OVERVIEW

The Earn-Save-Invest blog model you have created is absolutely brilliant, because of its simplicity.

Was it Einstein who said to make it as simple as it needs to be, but no simpler?

You’ve accomplished that, ESI, and I salute you!

Please tell us a bit about yourself.

Hey, I’m Dom. I’m a 31-year-old male, married six years (together 13 years), with our first kid on the way in November.

We live in the always-sunny Southern California, in Temecula, a city I describe to others as the “Napa of Southern California.”

I wear a lot of different hats: C-Suite Executive, Husband, Blogger, Investor, Intrapreneur, Finance Geek, Soon-To-Be Father, Fitness Fanatic, Brother, Friend, and Opportunist! To name a few.

After reading this interview, some might find it hard to believe that I grew up on welfare to drug-addicted parents. As you are about to discover, I live the truth of “it doesn’t matter where you start in life. What matters is how you play the hand you were dealt.”

We live in unprecedented times with more opportunity for success (and riches) than at any other time in history. To get your piece, you only have to decide if you are willing to do the work. If I can start where I did, and end up in the C-suite by age 30, you can set your own eyes on your own prize and achieve it. Will you do the work?

Note: All financial numbers shared below reflect the team effort between my wife and me. Teamwork makes the dream work! [Editor’s note: This interview was conducted in July 2018.]

What is your current net worth?

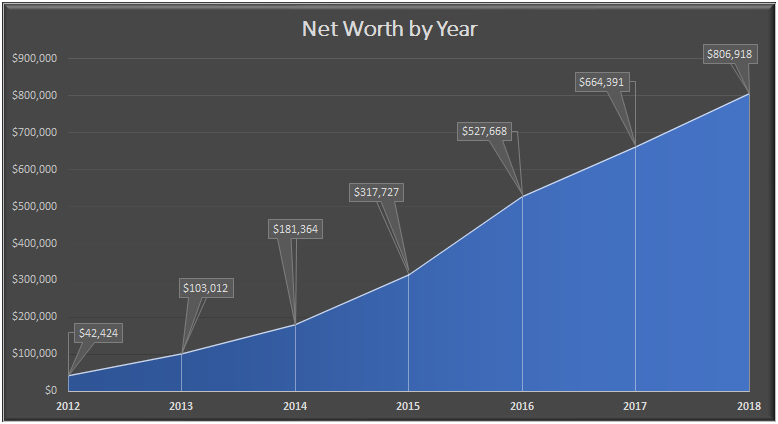

Our current net worth is $806,918 as of June 30th, 2018.

It has been a hell of a trajectory! My wife and I graduated college in 2008 into the worst financial recession since the Great Depression.

Because of some student debt and a misguided house purchase, we entered our careers with a net worth of negative $300,000.

However, we have climbed our way out of that massive hole, reversing our situation by increasing our net worth by $1,106,918 in about nine years.

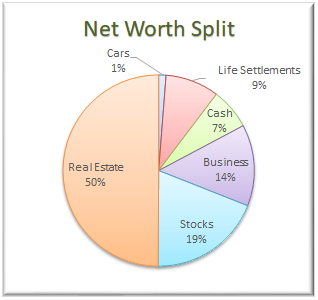

Our Net Worth Break Down:

The Real Estate category comprises $402,654 (or 50%) of our net worth. It includes the equity in our primary residence ($243,686), our investment in a commercial REIT ($55,369), and our hard money lending portfolio ($103,599).

Cash makes up 7%. We are currently holding $55,871 in cold hard cash. This does include about $1,700 sitting in a peer to peer lending account that I have been slowly withdrawing as the funds become available.

The Business category (at $111,045 or 14%) represents the ownership I have in the privately held company that I work for.

Life Settlements make up $73,178 or 9%. We currently have investments in seven separate policies.

The Stocks category (at $154,171 or 19%) represents the cumulative value of our brokerage accounts (retirement accounts and one after-tax account) that are invested in stocks. However, it is not all of our retirement money, as the majority of our hard money loans are made through a self-directed IRA (worth about $75,000 and are counted in the Real Estate category of the pie chart).

That leaves the Cars category at $10,000 or 1%. I include our cars because the goal is to keep the value of our cars as a percentage of the overall net worth pie as small as possible.

How did you accumulate your net worth?

To date, the primary drivers in growing our net worth have been a very high income paired with a very high savings rate – especially the past five years.

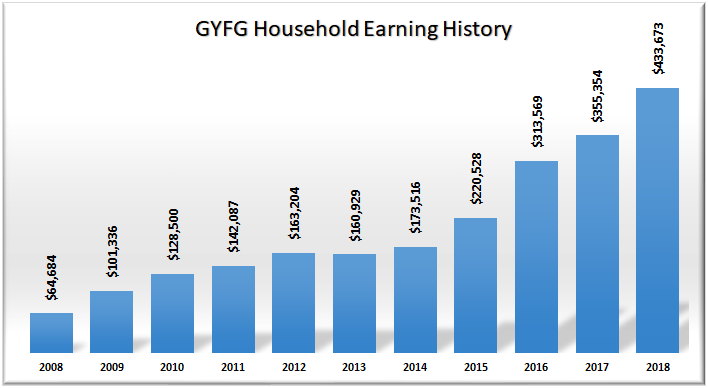

In 2008, the GYFG household graduated college and earned (combined) less than $100,000 in annual gross income.

Our income from 2009 (our first full year of working) compounded at a respectable rate of 11.4% through 2014 and then it was off to the races from 2015 to the present.

Since 2015 the compound growth of our income has more than doubled to 25.7% over the past four years (see earning history in the chart below).

Note: This is gross income before any side hustles and earnings from investments (both of which I don’t have a lot of detailed history on).

As you can imagine, this level of income has allowed us to save an incredible amount of money.

Today we aim to save at least 50% (we are on track for 61% in 2018) of our after-tax income (a goal we put into place in 2015).

I did mention above that we started our financial journey with a net worth of negative $300,000; however, I didn’t start tracking our net worth regularly until 2012. Nonetheless, below you can visualize the growth of our net worth over the past seven years.

We are currently projecting our net worth to finish 2018 around $900,000 before any investment gains (assuming the market continues to cooperate). I would be remiss to not also mention the fact that this growth has happened during a bull market but until recently that has played a relatively small role in growing our net worth.

EARN

Tell us a bit about your career.

I’m a 31-year-old C-suite executive with a title and role that I designed.

I got my start in corporate finance making $52,000 per year. That quickly jumped to $63,500 within three months when I changed companies.

Initially, I wore the traditional FP&A hat (financial planning and analysis), but I was fortunate to participate in some mergers and acquisitions.

After a few years, I transitioned into trading, where I helped run all the hedging activities for a private $3B oil company, and traded West Coast products (gasoline and diesel fuel) and options (on NYMEX) for profit.

I eventually left the oil industry and joined a public $2B company in action sports. After doing a small stint in FP&A again, I weaseled my way onto the eCommerce team, where I helped launch a global analytics team to support the fast-growing $100M online business. I am fascinated with the online world because of how measurable everything is.

Presently I’m 9 years into my career working for a consulting company in the construction management space. So, what do I do for a living?

I get paid an obscene amount of money ($300,000) to play with data all day. I spend a lot of my time frolicking around a spreadsheet. I’m a lot more technical than your typical finance guy, but not so technical that I can’t interface with operations.

My tentacles go far and deep throughout the entire organization and my job is to measure the things we want to manage in order to make fact-based decisions that will help increase both top and bottom line results.

I don’t get to play in a spreadsheet all day as I once did, as I’m also heavily involved in our strategic planning and I manage a team of about 15 (mix of IT and Finance folks).

My wife, also 31, she is currently being groomed to take over a family business (in real estate), and she will represent the third generation to run it.

She started out working for a firm that specialized in reducing property taxes for large real estate holders.

She started at $35,000 per year and by the time she left to work for the family business, she was earning about $75,000 (2013).

She strategically took a pay cut to work for her mom as her base salary was cut to $48,000 per year, but added monthly bonus potential.

Today, she is earning a base of $72,000 and is on track to earn about $62,000 in bonuses ($134,000 total projected for 2018).

Do you have a side hustle?

As natural born hustlers, we have a few side hustles.

- I have a blog that is earning about $1,000 per month. I’m currently reinvesting all the income to grow its reach.

- I also sell tradelines, which is currently earning an additional $750/month. This is currently my favorite and easiest side hustle.

- My wife is also a notary and earns anywhere from $400 to $2,000 per month depending on how much she feels like hustling.

- We churn credit cards for the rewards and this typically amounts to $5,000 to $10,000 a year in additional income – enough to pay for a really nice vacation.

Then, of course, there is the income generated from our investments. Others may disagree, but I consider these to be side hustles as well. We are currently earning about $1,000 per month from interest and dividends off our investments.

If you were rating these results on a scale of 1 to 10 (with 10 being best), what rating would you give yourself and why?

I would give our household a nine!

It’s not a ten because I know others in our peer group who have done significantly better than us. That said, we have compounded our earnings to a point that puts us in the top 1% of earners in the USA, an accomplishment we are very proud of.

My sole focus out of college was to climb the corporate ladder as quickly as humanly possible. Being in finance, I always got to see all the compensation of everyone in the organization, which was highly motivating to me.

I graduated from college in 2008, with my first job paying $52,000 a year. Ten years later, in 2018 my income from just my day job will finish at $300,000.

My wife has done well herself, growing her income from $35,000 to $134,000 in 2018. I haven’t always been ahead of her in compensation and I wouldn’t be surprised if she surpasses me again in the future. Let me be clear though: our success is a team effort, and the whole is greater than the sum of the parts.

Some say we are a power couple. I’ll let you decide!

I believe that a high income is the first step towards financial nirvana.

Sidebar: My goal early on was to earn 3X my age in income (check), then it was 10X (check), and now I am working towards a 20X multiple over the next couple of years. As I was coming up in the corporate environment this was always a fun game to figure out how I could add enough value to hit my own income goals.

What are your future plans regarding growing your income?

There could still be significant upside from our careers but I don’t expect the increases to sustain 25.7% compounded growth as they have the past few years. We will be happy if we can deliver a 10% compounded growth in our income from our day jobs.

We will be shifting our focus in mid to late 2019 to aggressively start building our passive income. This aligns with the timing of paying off our mortgage, which will free up a significant amount of cash that we are currently throwing against the mortgage ($227,000 over the next 14 months). Our goal will be to acquire five to ten rentals over a three to five year time frame.

I think we could be earning seven figures in the next five years (earned income + passive income).

To infinity and beyond!

SAVE

What percent of your gross income do you save?

Over the last three years (2015-2017) we have saved 37-38% of our gross income. However, we set our goal of 50% based on an after-tax savings rate. Here is what our after-tax savings rates were for 2015 through 2017:

- 2015 = 44%

- 2016 = 50%

- 2017 = 38% (we missed our 50% goal because we paid to put my brother through rehab)

In 2018, we are on track to save 43% of our gross income, and 61% of our after-tax income.

How did you get to this level?

I can tell you that it wasn’t by practicing extreme frugality. Luckily, Mrs. GYFG and I intuitively understood that in order to build wealth we needed to spend less than we make. Instead of focusing on the expense side of the equation, we decided to focus on the income side. There is a floor to how much you can cut in expenses but no limit to how much income you can earn.

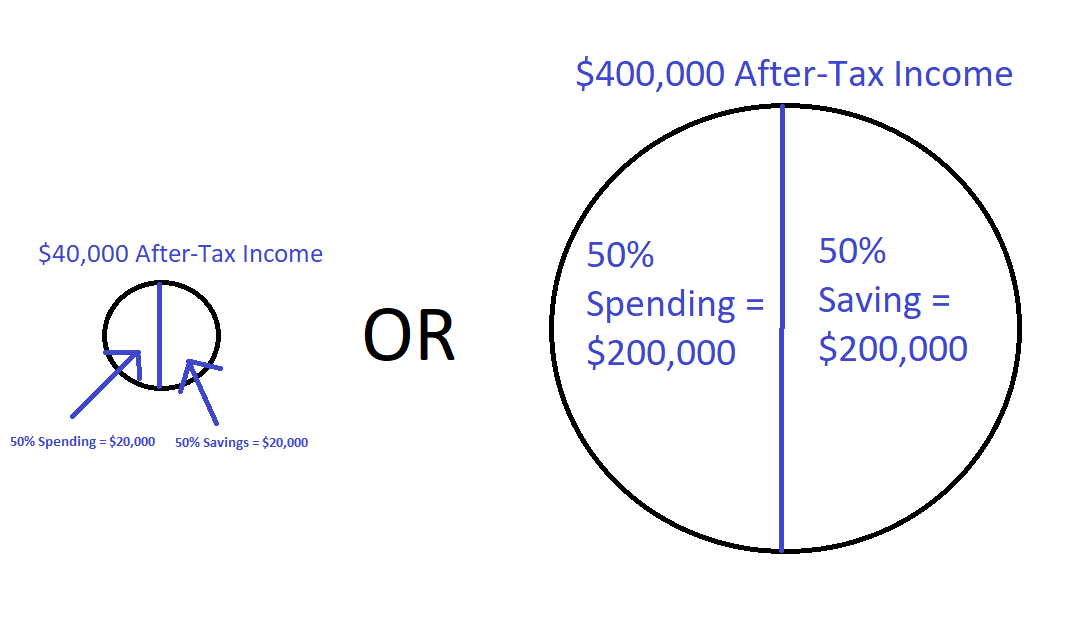

In the early part of our journey, we hadn’t set our goal of saving 50% of our after-tax income. I know a lot of blogs and financial pundits tell you to avoid lifestyle inflation but we have a different view. When we adopted the law of 50/50 (in 2015) whereby we save 50% of our after-tax income and spend the remaining 50% guilt free, we gave ourselves a free pass to inflate our lifestyle as our income grew.

We hit an inflection point in 2016 when our income growth outpaced our desire to increase our spending. We have settled into our sweet spot of spending around $120,000 per year.

Unfortunately, I don’t have the exact numbers, but if I had to guess, we started out saving about 20% of our after-tax income. Most of that savings was in the form of 401K and IRA contributions. It was our high income that has allowed us to increase our savings rate to where it is today.

If you were rating these results on a scale of 1 to 10 (with 10 being best), what rating would you give yourself and why?

Nine out of ten.

Again, there is always room for improvement. As our income has grown, we have continued to increase our savings rate, with an ultimate goal of reaching a 50% gross savings rate over time (on track for 43% in 2018).

However, if we want any chance of achieving that 50% gross savings rate, we are going to need to continue diversifying our income streams to streams with more favorable tax treatment (i.e., away from earned income). We are working to increase our passive income to around $120,000/year over the next five years.

We realized early on that frugality was relative to the amount of income brought home. And if you’re like me and enjoy the finer things in life, you have to increase your income to a point where you effortlessly reach your savings goal, while also living your desired lifestyle.

We also realized that by focusing on the income side of the equation that any time we wanted to live a bigger lifestyle all we had to do was increase our income.

So, relative frugality permits you (and me) a free pass to lifestyle inflation, until you reach that point where increased spending no longer brings you joy.

I channeled my inner Einstein and came up with the Theory of Relative Frugality. Who knows, maybe one day I will win a Nobel prize for the 60 seconds it took me to fine tune the theory.

Here is a copy of my original work (completed in Microsoft Paint):

Which would you choose?

What are your future plans regarding saving your money?

Our goal is to keep saving aggressively as we continue growing our income aggressively.

At this point we don’t see our spending increasing much beyond our current annual $120,000, so most of our additional after-tax income will go to savings.

INVEST

What are your main investments?

Stocks (mostly index funds). As I mentioned above, this represents 19% of our overall net worth and is concentrated in pre-tax accounts. At the very least we will continue contributing as much as we can to max out all pre-tax accounts we have available to us. We currently can contribute $37,000 per year (combined) into our 401k’s available through our employers (plus any matches). Because we mostly invest in index funds, we can’t expect much better or worse than the index.

Real Estate. This currently makes up 50% of our overall net worth. We currently have a heavy concentration of equity tied up in our primary residence (currently 30% of the 50%). We expect this to grow to 40-50% as we work to pay down the mortgage by July of 2019.

The other 20% of this piece of the pie is made up of exposure to commercial real estate via a public non-traded REIT and the hard money lending we do through an online lending platform. We are currently earning a 7% annual dividend with monthly payments from the commercial REIT. We are also earning about 7% in interest payments from our hard money lending portfolio.

We are currently contributing $1,000 per month in additional capital to the commercial REIT. We stopped contributing to the hard money lending account once it reached $100,000 in value. That is our goal for the commercial REIT as well.

The last piece is the amount of capital we need to contribute to achieve our goal to be mortgage free by July of 2019. This will require us to make an additional principal payment of $16,214 per month on average.

Life Settlements. This is one of my new favorite asset classes. We would like to invest another $30,000 over the next 12 months in order to increase our investment to $100,000 even (a theme of ours is to round off investments to $100,000).

Private Business. We made a one-time $105,000 investment in the company I work for. All additional increases there will come from appreciation and the value of the options I receive every year.

Cash. We aim to keep $30,000 to $50,000 in cash. It doesn’t earn much return but it provides optionality and flexibility, which leads to a lot of peace of mind for us.

If you were rating these results on a scale of 1 to 10 (with 10 being best), what rating would you give yourself and why?

I would give us a six on the investing scale.

We haven’t been uber aggressive here, and have probably left a decent amount of money on the table by sitting on the sidelines for too long.

However, we are getting better at this. We all only have so much bandwidth, and I chose to focus most of my energy earning, which takes the pressure off needing to earn super high returns from investments.

This is particularly important to me in light of our $10M net worth goal by the time we are 48.

Based on our earnings alone, with a 0% return, I am confident we will become multimillionaires. That said, I also realize we could blow even our biggest goals out of the water if we get more aggressive at putting money to work (something we have made significant progress in 2018 – having put almost $260,000 to work so far this year).

Now that I’ve made my goal of making the C-Suite by 30, I feel like I can spend more time in this area of wealth building (investing), which should help make our ascent to financial freedom exponentially faster. We have no plans of retiring anytime soon (as of now).

What are your future plans regarding investing?

To do a lot more of it, especially after we have the house paid off. Our two focuses will be:

(1) To max out all of our pre-tax accounts investing in index funds.

(2) To begin aggressively building our passive income through real estate. As stated above, our goal is to acquire five to ten properties in the next three to five years.

WRAP-UP

What money mistakes have you made that others can learn from?

While I was still in college I got allured by the easy money.

I was offered the “opportunity” to be the credit partner to someone who was supposedly a sophisticated investor. I didn’t do my homework.

I was to be paid $1,000 per month for letting him use my credit to get financing on a home and then after three months we would do a “formal loan assumption” (which did check out to be a real thing). At the time of the formal loan assumption, my name would be removed from the mortgage and property and I would get a $5,000 bonus.

Things didn’t work out as planned and the credit markets started to tighten up. Come to find out this “sophisticated investor” had over-committed himself and didn’t make the payments during the first three months (a requirement to do a formal loan assumption).

To make a long story short I ended up paying him $4,000 to remove his name from the property. I also had to come up with about $12,000 to bring the loan current with payments. I then got renters in place to stop the bleeding as best I could all while finishing my last two years of college (2007/2008).

Because of my naivety, I ended up holding the bag on a house with 100% financing and a negative cash flow of about $1,100/month for two years before I let the house go to foreclosure.

I tried to work with the bank to do a short sale but they wouldn’t approve it. They ended up selling it for $280,000 with an original loan on the property of $442,000. The short sale was for $325,000, so their loss I guess. I also got lucky because Obama made a temporary reprieve so I didn’t have to pay taxes on the debt forgiven due to the foreclosure.

This ended up costing me $36,000 and tanked my credit score down to the 500’s. The good news is that it motivated me to become the person and investor that I am today.

At around the same time, I had just started taking classes related to my finance major (as I had just completed my general education). I became obsessed with all things related to finance (including personal finance). I was determined to become a savvy investor. I’m just glad I learned this lesson very early on when I had very little at risk.

The moral of the story is that if the deal sounds too good to be true it probably is and you should run away from it as quickly as possible. And always do your due diligence!

Are there any questions you have for ESI Money readers regarding any parts of your finances?

The thing I love most about the personal finance community is how these blogs act as a magnet to bring the best and brightest together. Maybe we can crowdsource the best locations to invest in real estate?

If you were in my shoes, would you pay the mortgage off early or invest with that money?

Any interesting ideas for reducing our growing tax bill with such a high income?

Thank you for the opportunity to hang out on your blog, ESI. I’m looking forward to meeting more of your readers in the comments!

GYFG, great interview. It’s incredible to note where you came from to where you are now. Good for you, man. Seriously.

You are doing an incredible job. I am 33 and so far behind you it is laughable at this point. Different career paths, I suppose.

It looks like you have the resources to both invest and pay down your mortgage quickly. Why not choose some form of moderation and do both?

P.S. I like the idea of Occam’s razor – the simplest explanation is usually the correct one. It goes along well with your Einstein quote.

Thanks, Physician Philosopher!

We all have to start somewhere and our journey will be uniquely ours. Don’t feel too bad, I’ve seen how fast you physicians can build wealth (through the many physician PF blogs that have popped up).

I may not have bee clear in my post above but we are still investing and paying down the mortgage at an accelerated clip. Through September of this year we have deployed $327,922 to the following:

Hard Money Lending: $18,000

Commercial REIT: $44,000

Mortgage Pay Off: $110,456 (only 34% of total deployed in 2018 so far)

Stocks: $98,421

Private Business: $17,045

Life Settlements: $40,000

We had a lot of idle cash coming into 2018 due to the sale of our investment condo in late 2017 and about $80,000 of idle cash in a 401K. So, I think with that extra color you might agree that we are attacking both fronts. This probably makes the mortgage pay off look less aggressive than it sounds. In 2019 our deployed capital will probably be closer to 50% mortgage pay off vs. 50% other investments.

Cheers,

Dom

Given your relative wealth, and that it seems you’re very close to paying off the mortgage, I might opt to just finish the mortgage pay-off. But I’m more debt-averse than some!

And great job! My husband and I have finally started hitting the bigger income numbers, after accruing $600k in combined student loan debt (law, medicine). You give me hope that if we “stick to the plan” for another 4-5 years we will get a solid foundation laid as well!

Hi Sara!

Rest assured, we are so close to paying the mortgage off, we will see it through to the finish line. As I type this, we are only ten months away now.

Paying down the mortgage may not be the most optimized strategy to maximize our potential returns but it sure does provide a lot of piece of mind to be free of the shackles of debt. I haven’t met one person that has paid down their mortgage and regretted it.

I also think that people forget that a paid off mortgage can be a substitution for a bond allocation. The “experts” say that you should have a bond allocation equal to your age. Based on that rule of thumb, we should have about 32% allocated to bonds, our home equity currently makes up 33.5% of our net worth (pretty close). Yes, I look at our paid off mortgage as a bond substitute.

I’m glad you and your husband are starting to make the big income figures. I can’t imagine what it would be like to have $600K in student loans. That said, I have seen the earning power in the medical and law professions and have no doubt that you and your husband will be on solid ground in your 4-5 years projection.

Onward & Upward!

Dom

Earning power developed in your twenties and early thirties pre kids was a great call. You have a great base developed through hard work and hustle that will set you up well for arrival of a kid and potential changes in income (wife time off) and expenses.

Paying off the house makes sense if you are going to stay there long term. Consider if its the right house for you to raise a family, good schools Etc. We bought a nice house but with two kids it now feels a little cramped. Damn their stuff fills up a lot of space!

Investment in real estate brings a tonne if debt to service and exposure to fluctuating interest rates. Having more of mix between real estate and passive income from dividend paying index funds may give you more balance and flexibility.

Onwards and upwards from what is a motivating story

Hey Marty,

I couldn’t agree with you more. The focus of growing our careers and income has been well worth the effort. We wanted to be in a very strong financial position by the time we had kids. One of the drivers for paying off our mortgage, which I didn’t state above, was to build more flexibility and optionality into our financial decisions. Although my wife doesn’t currently plan to become a stay at home mom, she feels much more comfortable with the potential of doing so without a mortgage hanging over our heads.

You’re so right, our son is still a month away, and there is already so much stuff. I can’t even imagine what it will be like when he is finally here.

Thanks for the comment!

Dom

Great article! Very motivating. I grew up in a paycheck to paycheck home and I knew nothing else, except for how to work hard. I worked three jobs to pay my way through college to get a Bachelors & Masters degree. Even then, I didn’t know how to handle money, but I was determined to have a different life for myself & my family (having a wife with a child on the way can be very motivating -Daughter is 6 days old today)!

I started at the bottom in a sales position & in 3 months moved my way up to be a regional sales manager; then moved up to a different company as the director of sales (grew their territories by 500%); now I have the opportunity to work as the General Manager of a multimillion dollar business.

I was intrigued by you saving 50% of your income. That’s an amazing goal to have & one that I will be working up towards. Might take a little more time while living in Orange County, but definitely achievable.

Thank you for sharing your personal story & numbers. Best of luck to you & your wife as you continue to exceed your goals! Also, congrats with the baby on the way!

Cheers,

Mark

Hey Mark,

It sounds like you were born with an innate hustle pulsing through your veins. I love that you took the helm of your own life and charted a path you envisioned you and your family. I’m a big believer in manifesting the future you desire.

Congrats on working your way towards a general manager position. Although we have exchanged a few paragraphs, your story sounds inspiring.

Keep in mind that the 50% savings rate is after-tax.

Onwards and Upwards!

Dom

I like the idea of paying off the mortgage. We paid off our house in eight years and never looked back. We have been living in the house for 10 years now mortgage free. It is a peace of mind. We did invest at the same time as paying the loan off. The last 10 years we have poured more money into investing.

You are echoing the same thing I have heard from anyone I’ve spoken to that’s paid the mortgage off early.

We have continued to make investments in other places. As I shared above, of the $328K that we have deployed so far in 2018, only 34% of that has gone to pay down the mortgage.

One thing I didn’t note in the post or any of my comments thus far is that we also believed that there would be a market correction sometime between when we started to pay down the mortgage early and before we had it paid off. It is still to be seen if our opportunity cost is as high as it seems.

I am excited to do the math either way when we get there. I look forward to joining the mortgage-free club.

Cheers,

Dom

Aren’t you that cartoon guy? Just kidding! I’ve read your blog before and could tell you have a lot of motivation. Impressive that you’ve moved up so fast in your career. Having that hustle mindset is an important quality that I think many people don’t have. It can really help you get ahead. Sounds like both you and your wife are doing great. I say keep it going and you should do really well. This will give you more choices once you get to around 45 or 50. You may not want to stay in a high pressure job forever that takes up all of your time etc.

Arrgo – it worked! When I started my blog four years ago, I wanted people to recognize me as the cartoon guy. It was one way I intentionally tried to stand out in the PF community. It’s taken four years but I finally have validation that the strategy worked on at least one person – LOL.

I think we can continue the path we are on until we are 40 but only time will tell. Some many twists and turns that can’t be planned for. That said, we will continue to make ourselves as resilient as possible.

Dom

Dom: Kudos on how far you’ve gone in life with the minimal resources you had initially. You’re a model of what can happen when we accept responsibility for our lives and choose to arise.