Today I’ll continue telling you how I ended up buying almost $200k in dividend stocks recently.

Today I’ll continue telling you how I ended up buying almost $200k in dividend stocks recently.

In case you missed part 1 and want to catch up, see How I Added Dividend Stocks to My Portfolio, Part 1.

In that post I set up the background (my interest in dividend investing), how I educated myself on dividend investing, and how I developed a set of criteria I wanted to see in any potential stock purchases.

Be sure to read the introduction warning on that post before you read this one since it especially applies to this article.

The summary: I am not giving investment advice or recommendations. I make my investments for our family and no one else. I could lose everything I’ve invested here so be warned. Any investing you do is on your own.

Now let’s get into the specifics of how I evaluated stocks and what I eventually purchased.

Here we go…

Assembling and Evaluating Potential Dividend Stocks

Once I developed my investing goals, I wanted to get a list of potential stocks to review.

Of course that begged the question, “What metrics would I use to evaluate them?”

This is where the work I did in detailing what I wanted to accomplish really came in handy.

Here’s how I proceeded to get my “stocks to consider” list:

- I started by looking at Dividend Aristocrats. These companies have long histories of paying and increasing dividends. Even if they “only” held dividends where they were, that would be fine, but most of them would probably do everything they could to keep the streak, even during tough times. (BTW, I’m not saying none of them will lower or even suspend dividends. Some may. But by buying several I could hedge that risk. I figured that surely all of them wouldn’t cut dividends completely.)

- From this list I selected ones where I was at least somewhat interested in the business. I have a broad spectrum of interests so this didn’t eliminate a ton, but there were a few I took off the list at this point.

- I also cut out almost all of the stocks that didn’t yield at least 3.5%. Income was my primary objective after all, and if they didn’t pay enough, they weren’t worth the hassle. I did keep some that were below this level, but I needed a good reason for doing so (like the company intrigued me in some way).

- At this point I added the remaining stocks to a Quicken watchlist. I added a few others that Mike had suggested plus some companies I just wanted to keep an eye on. At this point there were about 40 companies.

- Next I needed to begin evaluating the stocks. To do this I used several sources including the Quicken Watchlist (I set it up to report a wide amount of data), Yahoo Finance, Google Finance, Seeking Alpha, and MarketWatch Investing.

Then I started to evaluate the companies based on the following:

- Dividend yield. Obviously I had already created the list using yield as a filter, but now I wanted to compare yield among the survivors. After all, if everything else was equal (it’s not, but you know what I mean) then a 7% yield would beat a 4% yield.

- Payout ratio. I want stock where earnings per share (EPS) are significantly higher than annual dividends. I know that some companies support dividends out of cash flow and pay amounts way higher than earnings, but I prefer to be conservative. This is why I prefer stocks with earnings at or above dividends.

- Price-to-earnings (P/E) ratio. With this metric I move more into an analysis of growth potential. I don’t have a hard and fast rule for a P/E ratio, but generally I like stocks where it’s 20 or lower. After the market meltdown we had, this wasn’t hard to find.

- Revenue growth. I literally Googled “XOM revenue growth” and ended up with a chart like this from Marketwatch. I wanted companies which showed moderate growth (or at least had a reason for not doing so if growth had recently been tough).

- Price to book ratio. I want it to be no higher than 2 and preferably below 1. This is my number to make sure I would get at least some money back if the company went belly up. Yes, I realize they might have to pay debts first, but it’s an easy way to get at least some downside protection.

The stocks I would ultimately pick didn’t have to be winners on every one of these metrics, but they did have to have enough of them that I felt good about the stock.

My List and Picks

Based on the above, I was ready to develop a list of stocks I was very interested in.

When all was said and done, here was my preferred candidate list:

- Abbvie (ABBV)

- Aflac (AFL)

- Archer Daniels Midland (ADM)

- Armanino Foods (AMNF)

- Eastman Chemical (EMN)

- Emerson Electric (EMR)

- Exxon (XOM)

- Franklin Resources (BEN)

- KeyCorp (KEY)

- Minnesota Mining (MMM)

- Nucor Corp (NUE)

- People’s United Financial (PBCT)

- Sysco (SYY)

- Westrock (WRK)

- Store Capital (STOR)

- T. Rowe Price (TROW)

- Wells Fargo (WFC)

Now I had to decide how I wanted to break up my $200k among these 17 stocks.

One thing that helped was that several of them were in the same general industry (financial services). So I knew I wanted to cut at least two of those so as to not be over-weighted in any one industry.

I also had a “wait and see” attitude about some of the stocks. For instance, Store Capital is focused on real estate and I have enough of it in my portfolio for now (or at least I’d prefer to be in some new industries).

At this point I did a ton of reading about each stock, what they had done in the past, where they were headed in the future, what people thought of them, etc. Seeking Alpha was a great resource for this.

That said, there was a lot of conflicting information and no clear path on any given stock. I had to soak in all the information I could, then make an educated guess that I felt was right for me. It’s likely that other people, reading the exact same information, would proceed in a completely different way.

In the end I settled on 10 different stocks (investing roughly $20k each) to give me a good amount of ownership in a breadth of companies and industries.

Here’s my list and why I liked each one (note, these are rough numbers as I’m pulling them a few hours after I actually made the trades. There are even conflicting numbers between sites, plus I may have recorded something incorrectly, so consider the below a directional estimate at a given point in time):

Abbvie (ABBV)

- Dividend Aristocrat with 46 consecutive years of dividend growth.

- Impressive 6.8% yield.

- $4.72 annual dividend with $5.28 earnings per share.

- 13.1 P/E ratio.

- Flat revenue but solid cost-cutting over five years makes it increasingly profitable.

- 0.88 price to book.

- Under-valued rating on Yahoo Finance.

- I like having at least one stock in healthcare and this seems like a solid option.

Aflac (AFL)

- Dividend Aristocrat with 36 consecutive years of dividend growth.

- Solid 3.9% yield.

- $1.12 annual dividend with $4.43 earnings per share.

- 8.0 P/E ratio.

- Flat revenue over 5 years, but up recently.

- 0.67 price to book.

- Under-valued rating on Yahoo Finance.

- Will they send me a t-shirt with the duck on it? 😉

Archer Daniels Midland (ADM)

- Dividend Aristocrat with 44 consecutive years of dividend growth.

- Solid 4.5% yield.

- $1.44 annual dividend with $2.44 earnings per share.

- 13.7 P/E ratio.

- Flat revenue over 5 years but solid cost-cutting makes it increasingly profitable.

- 0.89 price to book.

- Fair-value rating on Yahoo Finance.

- Good, solid, consistent company.

Eastman Chemical (EMN)

- Steadily grown dividends over the past 10 years (Not sure why they aren’t on any of the lists I could find. Perhaps it’s because they took more than a year to raise dividends sometimes.)

- Impressive 6.4% yield.

- $2.64 annual dividend with $5.48 earnings per share.

- 8.7 P/E ratio.

- Flat revenue.

- 0.93 price to book.

- Fair-value rating on Yahoo Finance.

- Earnings provide lots of room for dividend growth.

Emerson Electric (EMR)

- Dividend Aristocrat with 56 consecutive years of dividend growth.

- Solid 4.5% yield.

- $2.00 annual dividend with $3.51 earnings per share.

- 13.8 P/E ratio.

- Good revenue and profit growth the past few years.

- 3.20 price to book.

- Under-valued rating on Yahoo Finance.

- Lots to like on this one.

Exxon (XOM)

- Dividend Aristocrat with 36 consecutive years of dividend growth.

- Impressive 9.8% yield.

- $3.48 annual dividend with $3.36 earnings per share.

- 11.4 P/E ratio.

- Flat revenue (and at risk).

- 0.72 price to book.

- Fair-value rating on Yahoo Finance.

- This one was more risky IMO. But I think oil has been beaten down so much that it’s bound to come back and XOM is a strong company.

Franklin Resources (BEN)

- Dividend Aristocrat with 37 consecutive years of dividend growth.

- Impressive 6.5% yield.

- $1.08 annual dividend with $2.51 earnings per share.

- 7.1 P/E ratio.

- Flat to declining revenue.

- 0.83 price to book.

- Fair-value rating on Yahoo Finance.

- I went by the numbers on this one. Seems solid.

Minnesota Mining (MMM)

- Dividend Aristocrat with 56 consecutive years of dividend growth.

- Solid 4.4% yield.

- $5.88 annual dividend with $7.81 earnings per share.

- 16.9 P/E ratio.

- Good revenue growth.

- 7.14 price to book.

- Over-valued rating on Yahoo Finance.

- Very strong earnings over decades. I wanted a company like this in the mix.

Nucor Corp (NUE)

- Dividend Aristocrat with 45 consecutive years of dividend growth.

- Good 5.0% yield.

- $1.61 annual dividend with $4.14 earnings per share.

- 7.9 P/E ratio.

- Good revenue growth.

- 0.89 price to book.

- Under-valued rating on Yahoo Finance.

- Earnings allow for long-term dividend growth.

Sysco (SYY)

- Dividend Aristocrat with 38 consecutive years of dividend growth.

- Impressive 4.6% yield.

- $1.80 annual dividend with $3.49 earnings per share.

- 12.6 P/E ratio.

- Good revenue growth.

- 7.11 price to book.

- Under-valued rating on Yahoo Finance.

- Leader in a business I like.

All of these could be winners or all could be losers. Odds are that some will tank, others will soar, and in the end I’ll get solid dividends with some growth.

Time will tell, but buying now when prices are much lower than they have been is certainly putting me in the best position possible for them to do well.

FYI, my next set of dollars will probably go to the ones that didn’t make the cut this time, though other stocks might rise to the occasion. I’m still uncertain on financial stocks, especially banks given the state we’re in and the pressure the government might put on them to cut dividends, so waiting isn’t a bad idea.

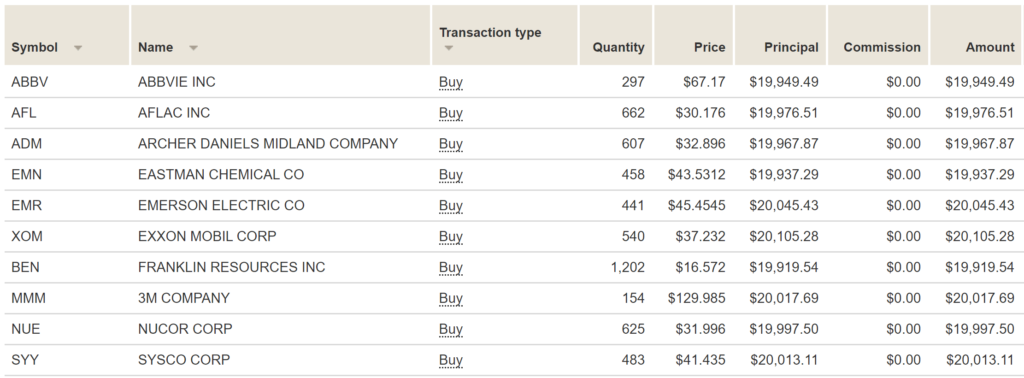

Here are my final purchase results:

And my summary:

- Total stocks: 10

- Amount invested: $199,930

- Estimated Annual Dividends: $11,067

- Estimated Annual Dividend Yield: 5.54%

BTW, I didn’t hit the bottom prices on these (as I knew I wouldn’t) but I got what I consider to be good deals. I kept telling myself to be happy because “pigs get fat, hogs get slaughtered.”

I’ll keep you informed as to how these perform, what I add, and so forth.

Any questions or comments?

FYI, I’m not going to get into a discussion on any particular stock since I’m not here to defend any of them. Besides, discussion of specific stocks and whether to buy or not is beyond the scope of this site and best left to investing forums IMO. As I said, different people could look at the same data I did and get completely different results.

So if you ask me about this stock or that one, I won’t reply. Let’s assume that I’m an idiot, missed the boat, and should not have purchased any of them. Time will tell whether this is accurate or not.

I’m completely open to discuss methodology, why I bought now, etc.

ESI,

Thanks for sharing that. You did a great job, both in your analysis and execution. All solid picks. It is likely that share prices have not bottomed and that after earnings come out there may be more carnage.

But that being said, my prediction is that you will realize a compounded annual return of 15% per year or by 2025 if you look at the value of your holdings bought today plus dividends received this will be greater than $400K or greater.

Let’s see what actually happens. Since you already “won the game” this is just icing on the cake.

-Mike

I had a great teacher… 😉

I really enjoyed reading how to add dividend in vestments to your portfolio. I have been dollar cost averageing and divided reinvestment since 1990 with some of the same companies that you already mentioned on your list it’s amazing what compounding can do to your portfolio.

Newbie here, what are the tax implications of reinvesting dividends. What type of account should I use to decrease the burden. Any other articles or books you recommend that are specific to taxes and dividend investing

Taxes for stock dividends are very simple.

1. If they are in a tax deferred account like a 401-k, 403-b, or IRA then the taxes on dividends are deferred and not due until withdrawn.

2. Otherwise taxes are due on all stock dividends in the year they are paid whether they are reinvested or not.

3. There is no 3.

Qualified dividends follow the capital gains rules. Those rates are currently lower than income rates and for lower adjusted gross incomes (below about 40K single, 80K married) there is no federal tax on capital gains or qualified dividends.

There are other kinds of dividends that may be tax exempt at federal or state levels such as municipal bond funds etc, but that is effectively tax exempt interest on loans to government backed projects. That is not the case for stock dividends.

Any book on the subject is just going to be a lot of pages to say the same thing.

thank for your for answer. Do the stocks named above provide qualified dividends and can you use roth accounts

All stocks that are not REITs provide qualified dividends. OHI and STOR are REITs and would thus not produce qualified dividends. The rest will.

You can definitely use Roth accounts to purchase dividend stocks. If you do then the qualified nature would no longer matter.

I just realized REIT’s arent qualified dividends. Been buying up O and STOR and some OHI…. .crap. Thanks for sharing.

Great article. I initiated XOM … too early but plan to add more. Of all the big oil companies I think they are best positioned to come out of this decently.

ESI,

Thanks for sharing. I was wondering if your plan was to reinvest the dividends or to use them as income. I know that you currently don’t need the additional income.

As a side note I have been enjoying your site for the past 6 months or so. Keep up the good work!

For now, I’ll reinvest dividends since I don’t need the income.

I’m surprised that CVX and/or RDS.A didn’t make the list. I also own XOM but I’m concerned about their debt and they aren’t covering their dividend from cash flow at present.

CVX has too great a span between EPS ($1.54) and their dividend ($5.16) for me.

Also their PE ratio is 45.

So on both these measures they didn’t fit the criteria I used…

With RDS.A, you would pay a foreign tax on dividends if a US account. With RDS.B, no foreign tax. BP is also a good oil stock.

Great Analysis- really enjoyed both posts! Thanks

Great post ESI. thanks for the info. Is there a reason you used EPS over cash flow? I like to use cash flow as EPS is easier to manipulate, but you can’t fake cash coming in the door.

Primarily that it’s easier to find. Most sites report EPS but you have to dig for cash flow.

Thank you for the details on your purchases. You have certainly put much thought into this process.

I’m glad to see Eastman Chemical on your list. I worked for this fine company for 30+ years before retiring at age 53 a couple of years ago. The company has made some smart and strategic acquisitions in the past 10 years. Incredible how Eastman Chemical now completely dwarfs its former parent company, Eastman Kodak. Quite a success story, IMHO.

Agreed – I also work there so cool to see! Congrats on your retirement!

Interesting post. I realized two things about myself when I got into dividend investing. 1 is that I can easily get analysis paralysis when looking at individual stocks (why I love indexing) and 2 I’m not afraid of losing money (in some cases a lot of money) as long as I know I’m not losing more than I should be. So to fix both of these I made my own “index” using the DJIA. I just regularly buy all 30 companies and when the DJIA goes down, I lose money but it doesn’t bother me.

All of them pay a dividend (except BA now… sigh) and 10 are aristocrats. But there are also some nice dividend achievers and big time growers like V, NKE, HD, AAPL, DIS, etc. So far so good. Good luck!

Thank you for a very well done piece! You thoughtfully answered every question I had along the way except for one. Do you plan to evaluate and replace any of these periodically?

I’ll probably add to them (through dividends and other cash) and will certainly keep an eye on these.

That said, things would have to change dramatically before I dumped one since I bought (at least in part) based on my expected long-term performance.

Did you consider two Vanguard dividend ETFs?

1) VYM – Hundreds of domestic high dividend payers. Yield = 3.66%. 6.9% five year dividend growth rate.

2) VYMI – Hundreds of international high dividend payers. Yield = 4.75%. 16% three year dividend growth rate.

Both these ETFs offer diversification across hundreds of quality companies, including the companies on your list.

I considered dividend funds versus stocks but:

1. Wanted more control.

2. Thought I could do better (which I have — US stocks getting roughly 2% better yield than what you have above).

3. Didn’t want just income — I wanted growth as well.

4. It’s more fun. 😉

Similarly I am considering NOBL which is ProShares S&P 500 Dividend Aristocrat fund. It shows a 2.13% dividend yield right now, which is lower than VYM — not sure why but will look into it.

I also have $200,000 to invest as I recently sold some SPY. I think a Dividend Aristocrat fund is less risky than SPY and less risky than individual Div Aristocrat stocks — though ESI makes a great case for the ones he just bought.

Also I think the market will continue to drop substantially as the COVID crisis gets worse, so I intend to wait a while to get back in.

Hey ESI (and other readers), what do you think of Closed End Funds (like Eaton Vance) that have yields of over 10% given the recent stock market downturn? Funds like EXG, ETW and ETV are using an options strategy to pay dividends that are essentially tax free since the accounting for it is “Return of Capital”.

I don’t know much about them…

I hold EXG (Eaton Vance Tax-Managed Global Diversified Equity Income Fund). I hold it as a component of my overall passive income strategy. I have been pleased with it.

Pays monthly dividends. Holdings are about 100 primarily blue chip global companies. Expense ratio is high at about 1.07 percent. However, you can mitigate that if you buy when the market price of the fund is trading at a discount to the NAV. It has been trading at significant discounts the past few weeks.

I have been enjoying you posts for a few years now. This was as informative as always. Do you recommend any good dividend producing index funds?

You can see the ones above that readers have suggested…

I hold EXG (Eaton Vance Tax-Managed Global Diversified Equity Income Fund). I hold it as a component of my overall passive income strategy. I have been pleased with it.

Pays monthly dividends. Holdings are about 100 primarily blue chip global companies. Expense ratio is high at about 1.07 percent. However, you can mitigate that if you buy when the market price of the fund is trading at a discount to the NAV. It has been trading at significant discounts the past few weeks.

Thanks so much for doing this research and putting it into yet another well written post!

It’s like you read my mind in terms of wanting to do this same exercise.

Our wealth advisor is doing some things that have me slightly concerned right now so we may pull our money from them and go on our own. And div stocks along with some etf funds (stock and bond) will form the foundation of our strategy.

ESI,

Any reason why no “blue chip” international company made the cut? In the spirit of diversification, that’s what I would do.

They didn’t make the cut based on the methodology I used…

ESI,

Thank you for the informative series on the topic.

I wonder if you have compared your picks vs a low cost dividend paying ETF based on past performance.

I’m not sure past performance matters that much in this unprecedented time (it’s no guarantee of future performance anyway). 🙂

I most certainly will compare them after a year or so and at meaningful intervals after that. Not much use in doing so this early IMO.

Very timely article and discussion! Now is the time to buy stocks at a discount (and yes, they may have further to fall).

It’s great to peek into your process ESI, very helpful as I think about pivoting my approach from munis and dividend mutual funds to individual stocks where I have more control — and more risk!

I’m a newbie and it’s great to see how others approach this.

Great analysis – I am in process of doing the same thing you did. I freed up about $300k to deploy, mostly in dividend stocks. I was a little less focused on the highest dividends, and a little more focused on growth potential too. I’ve also been establishing small stakes over the past week, with some limit orders. So I’ve deployed about $190k, with $100k to go, and three of our stocks overlap. After reading your article, i think a fourth is likely to make the cut, as I’m starting to look more closely at Abbvie. Looks like WFC just missed your cut, and it was one of my faves.

My situation is different, as I’m 5-7 years from retirement. Plan is to reinvest for the next 5-7 years, so hopefully there’s a really nice income from these 7 years out when I switch them to income producing. But a recession is a great time to get blue chip dividend stocks in your portfolio.

All in all, this is a perfectly timed article!

It did just miss my cut. I’m a bit leery of banks at the moment…

Can you help me understand why dividend paying stocks are considered steady income, considering every quarter when they declare the dividend, the stock price is adjusted (reduced) by the dividend amount?

For instance, if you invest $100 in ABBV and if they declare 1.5% dividend this quarter, the stock price adjusts to $98.5. While the $1.5 is income, the investment just dropped in value. What am I missing?

You’re asking two different questions: 1) why are dividend paying stocks are considered steady income and 2) how are they considered a good investment if the value falls by the amount of the dividend.

They are considered good, steady income, especially the aristocrats, because they have a long history of paying and increasing dividends.

They are considered good investments because there are several studies that show dividend stocks outperform other stocks on a total return basis. Google around a bit and research it for yourself.

Here’s a quote I found from JP Morgan:

“Stocks that pay dividends have historically outperformed non-dividend-paying stocks over the long term. Not only are total returns driven by dividend growth over the long term, but dividend-payout policies may also help drive smarter capital-allocation decisions by management.”

Quick question about Abbvie.

I have been researching these kinds of stocks in more detail recently. I like a lot of your choices. I have never heard of Abbvie. I found out why when I found out it was a spin off of Abbott Labs in 2013. Abbott split the biopharm into Abbvie and kept the medical devices for itself.

I was a bit shocked actually to find out a stock that is listed on the Aristocrats has only been a company for 7 years. I don’t know enough about the previous strength of Abbott Labs to know if the medical devices or the biopharm was more important to its long term stability, but it is difficult to put a lot of stock (not pun intended) in a 46 year history that is based on a parent company prior to a spin off.

Did that concern you at all? Obviously the dividend is quite large and dwarfs a competitor like Johnson and Johnson but with JNJ I would know I had real history and not history based on a parent company that is no longer in the picture. I am trying to determine if Abbvie truly has reliable historical strength. I am not sure if it does or not.

Thoughts?

As I said above, my picks could be different than anyone else’s based on the same information. Here are a few thoughts that might lead you to decide one way or the other:

1. One key factor for me was the dividend yield. To me JNJ is more like PG and PEP than the sort of dividend stock I was looking for (i.e. solid, long-term growth potential with a low dividend — or at least low to me), so it was out.

2. I think ABBV will do all it can to maintain it’s “history”, just like the others. Could I be wrong? Of course. Am I willing to take the risk? Yes.

3. ABBV is strong on other criteria I used. In particular EPS is higher than the dividend and PE ratio is low (JNJ is too high for me).

4. ABBV gave my overall portfolio a strength as it added healthcare to the mix. I wanted healthcare and it was the best option for me IMO.

5. ABBV is in the middle of an acquisition that appears to be very favorable. This makes things risky as well since it could go south, but I’m willing to roll the dice based on what I know.

6. The real strength of the portfolio is in the portfolio, not in any individual stock. My philosophy is that of the 10 I selected it was likely that 2-3 would be losers, 2-3 would be winners, and the rest would do “ok to good” for an overall return that I would be happy with. At least this would probably be the result under normal circumstances. I was also banking on the fact that if I buy now, while the market is down, I have the wind to my back which would be a big boost. Perhaps I’d move to 1-2 being losers, 3-4 being winners, and the rest doing better than most others, for a very good return.

Of course this has nothing to do with ABBV specifically but with the group, which was where my primary focus was. I wanted great individual stocks, of course, but I wanted an even better team.

FWIW (which is nothing at this point given the market is so CRAZY), ABBV is my second best-performer of the 10, up 9.3% and with another 1.8% in dividends coming out April 14. Unless, of course, they lower them. 😉

In the end, am I ok with their history? Of course. Or I wouldn’t have purchased the stock.

Should you be? That’s up to you, your risk preference, your goals, your criteria, etc.

One other suggestion for you: Go to Seeking Alpha, sign up (free), and put in the stocks you are considering. Every morning they’ll send you an email with articles about those stocks so you can keep up to speed with them.

Here’s one I received just this morning about ABBV:

https://seekingalpha.com/article/4335443-abbvie-illogical-6_3-yield

Best of luck! I’m interested in hearing about which stocks you actually buy and why!

Those are good reasons. Thanks for the thoughts.

Hi ESI,

Welcome to the dividend world!

I have found Brian Bollanger’s site, https://www.simplysafedividends.com/, to be of use in managing a dividend stock portfolio. I’ve done the free trial, and even ponied up the $100 or so for a year’s worth of access, in the past.

Full disclosure, though: I took a job where I have less free time for tracking individual stocks, so rebalanced into index funds for the equity portion of the portfolio.

I too have been contemplating getting into dividend investing, and decided to jump in mid March due to the market correction. I sold a few index funds to realize 18k of capital losses. This was my first time tax loss harvesting. I took the proceeds and bought 13 aristocrats (10k of each). This was my first time buying individual stocks. I now own MMM, ABBV, ADM, CAH, CAT, KO, EMR, XOM, GPC, MCD, PG, VFC, and WBA. That’s five of the ones you purchased. Happy dividend investing!

Last year I started a taxable brokerage account to save enough to pay the property taxes on my house ($5500 a year). When the tax bill came due, I found it painful to sell those assets to pay my property taxes. Selling an asset to pay a yearly expense. So this year, I am building an account of dividend paying stocks and will use only the dividends to pay on my property taxes. It will take a few years to buy enough shares of dividend stocks for the dividends to pay my property taxes, but mentally I like the idea of using the earnings of an asset to pay an expense, rather than sell the asset itself. It is like another level of wealth.

You can apply the same concept of using dividend stocks to pay for rest of your living expenses.

This is a really great idea! I was thinking about doing the same thing and avoiding escrow.

Looking for any advice. I read this blog often but have never commented since I am early in the game and just learning. I’m hoping someone will have some widsom to share with me…

I recently rolled $100k into a traditional IRA from an old employer’s Employee Stock Ownership Plan. I am 29. All of my other IRA/401k funds are invested in total market index funds. I planned on purchasing total market index funds but then I saw in the comments of this article where it was cited that “stocks that pay dividends have historically outperformed non-dividend-paying stocks over the long term” and thought maybe I should diversify with some dividend stocks.

If you were in my position would you invest the funds in a total market index fund or dividend stocks, possibly a dividend ETF?

At 29 I would personally go with stock index funds.

IMO you’re looking mostly for growth now (not growth and income) and my personal preference for growth investing is index funds.

Some here will have a different opinion and, as usual, YMMV.

Can you please share how your picks have performed vs your expectations?

Here you go:

https://esimoney.com/my-dividend-stock-results-after-one-year/