If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

My questions are in bold italics and her responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

My age is 55 and my husband is 60.

We have been married 24 years this June.

Do you have kids/family (if so, how old are they)?

We have no children; however, we have helped raise children. Our calling was to be aunt’s and uncles.

- Nephew and niece ages 33 and 32, my parents raised them, my husband and I assisted financially as well as provided vacations, extracurricular activities, time and attention needed from a younger generation.

- Nephew and niece current ages 12 and 9. My brother became permanently disabled a few years ago we help financially as well as assisting with vacations, sports, etc.…

- We have an additional 8 nieces and nephews on my husbands’ side of the family that do not live as close, they are in their 40’s.

What area of the country do you live in (and urban or rural)?

We live on the west coast in the suburbs, about 20 miles from a major city.

What is your current net worth?

Our current net worth is $3.5M.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

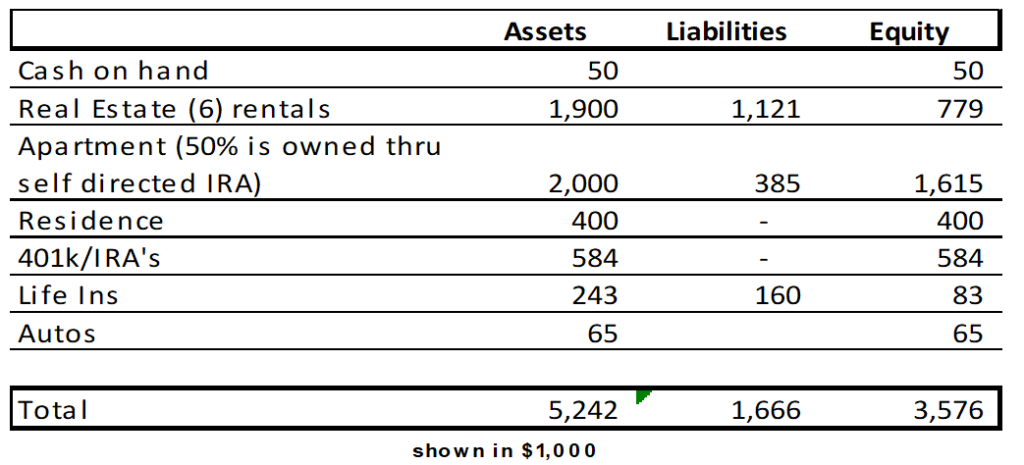

Our assets are made up of the following:

EARN

What is your job?

My job is a financial controller for a mid-size company, middle management.

My husband’s career was in manufacturing application. He trained customers and provided technical support. My husband retired a few months ago.

What is your annual income?

My annual income is $120k plus bonus.

My husband’s income was $100-$130k (he just retired). He has a pension $17,500 per year.

We also have passive income from rental houses and apartment building. We have been using this income to pay down mortgages.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

My income performance has always been above average. I did not complete college. Given my profession in finance I am fortunate that my career has turned out so well.

I was tempted to go back 10 years ago and complete my degree, but I made the decision to focus on real estate and less on improving my career path.

My first job guided my destiny. I worked for my grandparents and uncle in their construction business after school from the time I was 10 years old.

I learned how to operate a calculator and tabulate employees’ timecards. I could reconcile a bank statement by the time I was 11. Learning these skills at a young age provided me with a lifetime of skills and advantages. During my teens as my grandmother’s health failed, I worked directly with the CPA.

I also nannied for my uncle and his growing family during the summers from the time I was 11 until I was 18, he had 7 children.

I remember earning $1,000 a month when I was 16, which was near what an average household family made.

I became responsible for my own wants and needs at the age of 12. My mother made it clear that I was perfectly capable of taking care of myself. I became acutely aware that I had more spendable cash than my parents most of my life.

I did not receive any support from my parents for college, financially or otherwise. As my friends began talking about college, I approached my parents about this. They did not give me any clear direction. They ignored the question and buried their head in the sand. My parents were not planners.

I was very industrious growing up. I used work as an escape from my older sister. At 18, my father informed me that my sister was moving home. She had been away for a couple of years. If she moved home, I would be leaving. She moved home, so I left.

I figured out how to pay for college and support myself. I would not say this was easy.

I began working for an accounting firm that paid commission. This was a great environment, at 18 I was more proficient than most of the staff 5 – 10 years my senior. I was making more than the average family, it provided me enough money to live and attend school.

My education and career derailed in my early 20’s. I began dating a “serial entrepreneur”. l put my schooling and career on hold to help him in his businesses. I earned enough to get by financially.

I focused on having a flexible schedule. After 5 years of revolving my life around his I finally realized that the relationship would not be going any further. For someone that had it together, this was extremely painful to realize I wasted so much time.

I married in my early 30’s and began working as a controller for 3 different companies during my career. I would say that my income alone was generally 2 or 2.5 times the average family income. My husband’s income was slightly less than mine. Combined we were doing very well.

What tips do you have for others who want to grow their career-related income?

Do more than what is expected of you. Figure out what you are good at and exploit that as much as possible.

Solve your bosses’ problems.

If you manage others, don’t make yourself invaluable in a position — this limits you from being promoted.

Master something and move on to the next thing to master.

Train others to do your work as you expand your career.

Don’t settle for stagnant income growth. Develop a career and income path for yourself that supports your goals.

Don’t give away your time, it is one of your most valuable assets.

What’s your work-life balance look like?

W-2 Income: My work life balance is pretty good, but it has not always been like that. If I am not careful, I will let others influence my time. My husband can easily maintain work life balance.

From 2012 to 2018 our life balance was very hectic; we expanded our real estate extensively during this time. We also cared for my mother whose health was failing. She eventually moved in with us and required care around the clock.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

Real Estate Investments:

- House Income $100k EBITDA

- Multifamily Income $110k EBITDA

We developed additional sources of income through Earning, Saving, Investing and Relationships.

Houses: The houses we own today we purchased most of them from 2010 – 2017. We purchased these houses when we realized the opportunity after the housing crisis.

- (2) houses were purchased from acquaintances that were in financial trouble and needed to sell, but also maintain income. We accomplished this as part of the purchase we negotiated down their credit card debt and paid this off. We then placed the balance owing on Notes secured by the properties. This provided them with the same income they were accustomed to and paid off their debt which ranged from $50k to $70k and dramatically improved their retirement years.

- (4) of the houses were purchased by what I would call equity transfer. We had one house paid for. As we purchased a new rental, we would place financing on the house that was paid for and purchase the next house with the available funds. This become the house we owned free and clear. We would invest time and resources to improve the property and we would hold and rent. When the next house opportunity arrived, we repeated the process. We essentially self-funded each purchase. The power of doing this bought us time to improve the value and make needed repairs. It also prevented us from becoming over leveraged. By the time we placed the financing on the property we had more than enough equity in the property to finance without any additional cash and often we could pull out our cash invested and move to the next project. We own 6 houses that are in the same neighborhood and we can see from our personal residence. Any house we owned prior to 2010 we have sold and used to fund other projects.

Finances:

- Initial Equity utilized for startup funds $150k, initial cash used $100k

- Current Value of (6) houses $2M, debt $1.1M, Equity $885k, LTV 54%

- Net income $100k, cash flow available after principle & interest $55k

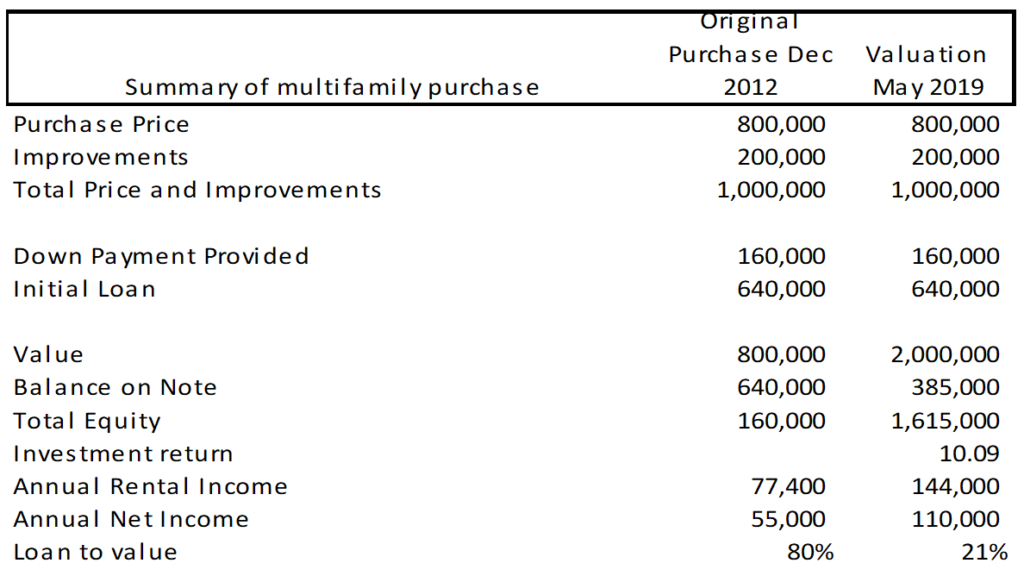

Multifamily: We purchased this in 2012 from our neighbors who noticed we were fixing up houses in the neighborhood. We purchased the apartment building for $800k, with 20% down. The neighbors financed on an Owner Contract for 7 years. This property was 85% original. We are just inking new financing to pay off the original note. We were hoping to have it paid off in 7 years. It did not happen, however we just received the appraisal on the property of $2M. The balance owing is $385k. The building is .8 miles from our home. 10 of the units are 1 bedroom, (2) 2 bedrooms. We manage ourselves.

The multifamily project has been far more lucrative. The houses have been more work, but are easy to renovate, sell or use for capital when needed.

For years I diligent tracked real estate investment opportunities on a spread sheet. It forced me to find a new deal to evaluate, compare it to similar deals, and to spot trends. This one habit helped us tremendously when we were ready to make a purchase. I could easily adjust numbers or financing costs. I don’t track new deals each week currently, but I do evaluate new opportunities.

SAVE

What is your annual spending?

Our spending is $80k

What are the main categories (expenses) this spending break into?

- Non-discretionary: $50k

- Discretionary: $10k

- Giving — Charity & family: $10-$20k

Details:

- $12k Food, dining

- $10k Insurance/Auto/Life (need to determine when to stop funding life insurance)

- $6k R/E taxes and house repairs

- $4k Utilities/Cable

- $8k Medical Ins (husband)

$10k discretionary is primarily travel.

Our house and cars are paid for. We do not have trouble making ends meet.

My mother was also ill and moved in with us for 3 years. This limited travel and spending during that time but created the need to employ caregivers. She passed this year.

Do you have a budget? If so, how do you implement it?

Yes, we have a budget. I monitor expenses through QuickBooks.

For several years our spending revolved around our investment projects and capital we needed to finish a project. Our discretionary spending was determined by what cash and time was left over. We have not used credit cards to fund vacations or discretionary spending.

At one point we had too many projects going and were out of available cash. We did max out our Lowes account, 2 credit cards and I sold a new car we paid cash for to finish funding the projects.

This is not a good feeling and was a reminder to invest within our means. It took about 6 months to work out of that situation. In hindsight it would have been easier to get a LOC. We forced upon ourselves self-funding, which sometimes created unneeded stress.

We just recently started working together on a budget, inspired by my husband’s retirement and an overdue need to monitor our insurance, cable and cell phone costs.

What percentage of your gross income do you save and how has that changed over time?

Our actual “savings” has been between 5-15%. Investing in real estate would increase that an additional 10-15%.

What is your favorite thing to spend money on/your secret splurge?

Travel is our favorite thing to spend money on for me. My husband’s splurge is a car to rebuild.

We travel with friends to the Caribbean each year for a week. We have a condo at the beach with a fractional ownership — 4 weeks a year. We use 2 and give or donate the other time. I enjoy traveling to Europe and would like to do so every 2-3 years.

We like taking others on a trip they would not be able to make themselves. We recently did a Universal Studio VIP tour with my niece, nephew and sister in-law.

INVEST

What is your investment philosophy/plan?

Consist savings. We balanced our retirement savings and our after-tax savings equally early on which benefited us later to have available cash for real estate investments.

We left our 401k’s alone, never borrowed from those funds, and let them grow over time. Job changes often resulted in a year without 401k savings.

We currently are working on becoming more active participants with our paper assets. We are reading anything we can to get up to speed. We currently use Financial Engines as an advisor. They currently are selecting our investments.

Investments Real Estate: I monitored and tracked real estate deals for years. This taught me to evaluate one deal next to another as well as market trends.

What has been your best investment?

The apartment building has been our best investment.

We had a single stock that did well. We eventually sold it on the advice of our investment advisor to diversify. (it doubled in value within 6 months of liquidated that position, darn)

What has been your worst investment?

Vacant land purchase (this was my bright idea).

Unsecured Note. After paying the attorney we earned 2.8% during the most incredible bull run ever.

Missed opportunity: Multifamily property in 2014. A friend offered us the deal. He would provide owner financing. This property sold for $1.3M is now worth $3M (my husband would not consider another project at the time). This missed opportunity was extremely painful for me. I was tracking investments and knew what a great deal this was. I was actually physically distraught over this missed opportunity. It really highlighted for my husband and I our differences in investing and risk taking.

What’s been your overall return?

I have no idea on the real estate side — leverage works its magic in this arena. Return on cash invested is usually 30%, but the longer we hold the calculation changes. With real estate we also invest our time which is harder to measure.

Paper assets our returns are around 7% over time. This asset class we have been less focused on, but we are looking forwarding to becoming more educated on this.

How often do you monitor/review your portfolio?

Real Estate, we monitor monthly and quarterly. We have regular meetings at an offsite location to stay on the same page and address issues and assign projects and responsibilities to.

Paper assets we review quarterly. We are less comfortable in this area and are forcing ourselves to spend more time on this.

NET WORTH

How did you accumulate your net worth?

I would say that we acquired our net worth through a balance of ESI and relational opportunities.

- Earnings: Our income as a couple over the last 8 years has averaged $200-$250k per year, not bad for 2 people that did not graduate from college.

- Savings: We were always good savers and had savings on the sidelines to take advantage of opportunities. This was key to our success many times. A lack of funds or debt prevents people from investing.

- Investing: I think we did a decent job with our real estate investing; we are extremely proud of every property that we have improved and added value to.

- Relational Opportunities: We purchased houses from individuals that were in serious trouble. We are proud of the help this provided them at that time. Market timing benefited us later. Every improvement we made was noticed by someone and opened a door for another purchase. The apartment building we purchased from our neighbor may not have happened without having a great reputation for improving our properties and maintaining a solid reputation over the years.

- Inheritance: My husband received no inheritance from his family. I did receive an inheritance; however, I gave it to my brother to purchase a home as well as funds have been set aside for my sister’s support. I was already very blessed, and I ultimately wanted to say that I accomplished everything on my own.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

I would say that a healthy mix of the ESI model is our greatest strength. I will let you be the judge.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

The economic downturn in 2008 felt like a road bump at the time. We owned a house on a Lake that declined in value tremendously. However, the downturn ultimately presented our best opportunity. We stayed employed, we owed very little and we had cash to invest.

My style and my husband’s are very different. I can juggle multiple projects and he likes to focus on one thing at a time. He is the ultimate do it yourselfer and a perfectionist. At times we missed opportunities because of this, but ultimately his attention to detail and follow through has benefited us.

I would have bought every deal we looked at. That would not have been realistic and may have led to failure.

What are you currently doing to maintain/grow your net worth?

We are currently doing the following:

- Maintaining and improve our properties,

- Working with my cousin on a 10-12-year plan for her to assist with property management and maintenance so we can travel, snowbird.

- Grow our paper assets. Since this is not our strength, we are applying extra attention here to get on solid ground currently our asset distribution plan requires very little funds from our paper assets.

This is an interesting question, since I love to plan, and look at deals, I hate to admit that we have no idea what our next step should be. We are at crossroads. We have concluded that we have so many ways to play our hand, we are having trouble deciding our next step.

- Do we sell the houses? The investment return on value is low. The peak may be in what we have already accomplished. Values have risen out of proportion of rents.

- Do I retire now and adjust our cash flow to accommodate this?

- My entire life has had a calculator or spreadsheet attached to it. Am I ready to give up working?

- My need to pay everything off, is this the best course? Should I continue to work to have less debt? I have a habit of creating scarcity where it does not exist.

- Do we stop investing in projects and just maintain what we have, is this enough?

- For me walking away from the thrill of a deal is difficult, but life is short, and it just may be time to do that.

- Who are we working this hard for anyways?

Do you have a target net worth you are trying to attain?

5 Million has always been a target over the last 10 years, which I thought was unattainable. We are not there yet but it is on the horizon and will eventually arrive.

We do not actually “need” $5 million. With rental income $2.5M would do, it is just a number.

I focus more on the cash flow piece, that is what will pay the bills. The net worth piece, once you gain momentum on the number and limit your debt it grows without much effort.

How old were you when you made your first million and have you had any significant behavior shifts since then?

44 years old. However the market crashed shortly after that and brought it down for a few years.

No behavioral shifts however, I think we realized that 1 million was not enough to retire on then, so it did not make much difference to us.

I distinctly remember a couple we socialized with; they were the “big spenders” in the group and they had mocked some of our more conservative choices. We see this couple occasionally. They recently admitted they have no idea when they will be able to afford to retire. The mocking has stopped.

Not many people realized we were millionaires back then. Even now, we don’t behave differently.

We recently received an appraisal on our apartment building. It was higher than we expected. This news created an increased sense of success. We dined out 3 times that week to celebrate.

What money mistakes have you made along the way that others can learn from?

- Purchased land to build apartment building. The neighbors sued us over a property line and the market crashed after we settled the lawsuit. Ultimately, we sold the land for what we purchased it for. We had sunken costs of $50k between the attorney and engineering and development costs. It was easier to buy an existing apartment. Moral of the story: we wanted an apartment building, we were not developers.

- Loaned money to an acquaintance in 2009 that was an Unsecured Note for $80k at 10% interest on an apartment building. The apartment eventually sold for a 20% IRR to the investors. The Manager of the LLC decided not to pay the noteholders. We had to hire an attorney to collect on this. We finally received our money in 2018 after a mandatory mediation prior to going to court. The return on our money was 2.8% for the 10 years it was tied up. The attorney made out well and received 40% of the settlement. Lessons learned: do not give up your cash to an unsecured note. I questioned this at the time and was informed that the note had to be written as unsecured because of the primary bank. Don’t be afraid to walk away from a deal and have a good attorney review these types of agreements. It is a lot less expensive to pay an attorney up front to review a contract than to resolve in mediation.

- My husband says he would have accepted one or two multifamily deals I suggested earlier in our marriage. He thought this was out of our league at the time. He realized now that he spent 10 years remodeling houses — he could have spent collecting rent.

What advice do you have for ESI Money readers on how to become wealthy?

We earned higher than average incomes, but not exceptional. We saved and invested a high percentage of our incomes. We lived below our means.

We also figured out where we could excel, and we took advantage of relational opportunities we had developed.

FUTURE

What are your plans for the future regarding lifestyle?

Our net worth will allow me to retire early. I have not been envisioning early retirement — I am struggling with making that transition and taking that step.

I have serious job dissatisfaction right now, which is something that I rarely experience, maybe it is a sign for change. When my husband retired, we decided I would wait 1 year and then make my plans to follow.

We have friends that live in Palm Desert California and would like to try renting in the desert this upcoming season for extended periods of time to see how we adapt to this lifestyle and leaving our life behind for several months. I am arranging to work remotely for 4 months, hoping this will point me in the right direction to retire or continue to work.

We have been working on downsizing our lifestyle. We are in the process of adding an ADU (mother-in law cottage, 950 square feet) to our property. We live on an acre and the ADU is situated behind our house on the back-half acre, very private and secluded. This will give us a “lock and leave” lifestyle without changing locations.

We are hoping this will serve as the impetus to begin traveling. Our home will be rented, my husband can keep his garage. We can change this arrangement at any-time and move back. We are hoping this situation works well for us for the next 15 years.

We will be celebrating our 25th wedding anniversary next year and are planning to host a dinner at the location we were married and chartering a bus for the event. The venue is beautiful and we are looking forward to a fun evening.

What are your retirement plans?

We would like to purchase an Airstream and travel (why Airstream, we think they are so cool). We would also like to purchase a winter home in a warmer climate, something that will allow us to entertain friends that visit and use as home base for travel adventures around the country during the winter.

We would like to create a travel plan. There is so much to do and see, we need to get organized. Time waits for no one.

Financially I believe we will maintain what we have and grow our assets. I do see us letting go of some of the houses. If a multifamily opportunity presented itself, we would sell houses to make that purchase.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Maintaining our heath and staying in shape is a number one priority. Medical costs are also a concern. We have access to great coverage through my husband’s former company. He pays $605 per month, which is 2/3 of the actual costs.

Long Term Care costs. We have been researching this. We will probably pass on this and self-insure.

Managing our properties is a concern. We are working out a property management arrangement with my cousin who has helped us with many projects over the years. We are working with an attorney to develop an equity plan for her over the next 10 -12 years that will give her retirement income when she is 60.

This arrangement keeps more cash flow in our pockets now and helps her build equity and ownership. We do not have all the details worked out but am confident we will work out a plan that works for everyone.

When do we exit our real estate, when to start this process and how to execute a strategy? We have been researching the DST (Delaware Statutory Trusts) — more to learn on that front. We do not seem ready for that yet and have plans to take us through the next 10 years.

MISCELLANEOUS

How did you learn about finances and at what age did it ‘click’?

I was involved in finances at an early age, helping my mothers’ side of the family in their business, running and operation of a business. It clicked when I was 11.

I earned a lot in my teens. My mother informed me at 12 that I had the funds to take care of myself, which I did.

In my 20’s I helped someone with his business and the inner working of starting and building a business. These lessons were invaluable.

I did not really understand the saving, investing or compounding until into my early 30’s. I was married and my husband and I started saving a good portion of our income and it grew quickly.

My parents were raising their grandchildren and I became aware that my fathers’ pension and social security were great for my parent’s retirement, but not nearly enough to raise 2 children or to cover normal family emergencies.

I became the go to person for family emergencies, bailing them out of financial pickles. My father passed in 2000. He asked me to look out for my mother — she was ill prepared to handle things on her own (at that time their grandkids were in their early teens). My father was right, my mother needed to be looked after. She was horrible with money.

In 2001, my aunt asked my husband and I to move in with my grandfather who was in his 90’s. He had 4 rentals that were suffering from a lack of maintenance as well as someone to keep an eye on him. This was a perfect arrangement. We could help my grandfather and we were in the same neighborhood as my mother. We rented our home to my brother, who was recently divorced.

Living with my grandfather on my fathers’ side, I learned a great deal about money and saving and investing. I was still in my 30’s.

My grandfather had ledgers in his office of loans he had made to family and neighbors, a ton of history. He provided the financing on each house that his children bought from him when they married, he financed house remodels and grandkids braces, and two wives’ long term care needs.

He sold a commercial building he owned. When I asked him why he sold this, he said he now regretted selling it, but he used the funds to pay for his children’s college education.

Self-made for sure, he looked after everyone. I realized who I take after, it is my grandfather.

Who inspired you to excel in life? Who are your heroes?

My uncle whom I worked for and baby sat for during my teens. He was my hero, very generous person, who understood how to connect to people emotionally. He understood me at an early age; by creating a need for me to help him and his family he saved me from my horrible emotionally abusive sister. He recognized that my parents were in denial about her problems. I am eternally grateful.

My parents. They were always proud of me and let me know it. I always felt like the responsible grown up from a young age. They were carefree, had a wide circle of friends and would worry about tomorrow another day. I became inspired to excel because I looked around and felt I needed to take care of everyone.

Below are the stories of the people that were successful. I studied and learned. I was determined not to follow in my parents’ financial footsteps. My father worked and had a pension, but they never saved or invested. My father was a good man and became part of his generation that had to raise grandchildren.

My grandparents on my father’s side retired in their mid-50’s in the early 1960’s. They worked hard and were part of the Depression. They put 3 of 4 children through college. My grandfather owned his own business in trucking and logging. He built or acquired 8-10 homes. Each of his children were offered a home to purchase when they married. He passed away just shy of 100 years old as a millionaire. He did this through slow and steady saving and investing as well as his real estate. I never fully realized how many people they helped during their lifetime.

A neighbor. He was a builder in the late 1960’s and early 1970’s. He built 60 rental properties and retired from construction in his 40’s and collected rent and managed his properties. He and his wife are wonderful people and have also used their good fortune to live an amazing life, fishing and traveling. They also help those in need by providing work for anyone that needed it.

Family friend. He was a successful business owner. He sold his business in his early 50’s but kept the real estate and divided up into commercial building and rented that for many years. This afforded him a great lifestyle. Like my parents, he raised several of his grandchildren.

The common theme is they were successful with real estate, worked hard, saved and invested and helped others. Ironically I was not aware of anyone that was successful without real estate.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

- The Millionaire Next Door

. I read this in my 30’s. It helped me realize those around me that I could learn from.

- Start Late, Finish Rich.

I used this book in my early 30’s to guide savings principles and planning. I used this material for years to track and monitor progress.

- Dave Ramsey books. He is very inspirational. I always have 3-4 of the The Total Money Makeover

books on hand at any time. If you ask to borrow money from me, you are given that book to read first. It is a great ice breaker for a tough love conversation. I have a niece who has been given 3 books. She stopped asking.

- Rich Dad Poor Dad

. Because of the real estate connection, I enjoyed this book. This book also taught me the importance of “cash flow”. Some of the principles on leverage I don’t agree with, but I connected to the author’s relationship with parents that did not manage money well.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

Yes, we give to charity and find this important.

- $5k per year we donate to organized charities and community food banks.

- $5k per year approximately we donate to family or extended family. I am a big believer that charity begins at home. Over the years we have given around $5k per year to help immediate or extended family or friends in need, from assisting with school clothes, moves, camps for kids or lunch money.

- $5 – $10k per year assisting my disabled brother and his family. $5k directly to his kids to support sports, the balance to assist him or hire services around his house that he cannot perform.

- My sister, who I did not have a connection with for over 25 years. Her husband passed away and she is unable to always care for herself. I am encouraging her kids to help her, but am not successful at this. I struggle with how to help, given her many issues and declining health. We are looking at purchasing an inexpensive home for $55k in an affordable area about 75 miles from where we live. The cost to maintain and keep the lights on would be around $7k per year. Some of these funds would come from her inheritance, the majority would come from my husband and me.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

We expect that we will leave an inheritance, given our current net worth, assets and living below our means. Without any children imagine how much more difficult this decision is.

We set up a Revocable Trust 4 years ago. This was inspired by our growing assets, outdated will and my brother’s disability. My brother was a beneficiary in our existing will and life insurance. My attorney informed me that this could disqualify him from Social Security Disability benefits if he received those funds.

Initial Revocable Trust:

- $500k Special Needs Trust for my brother, to be used to assist him in his day to day living needs.

- Special Needs trust for my mother, who was alive at the time. Funds were to be used to maintain her lifestyle in the manner that she was accustomed to that I currently provided or future needs that would be reasonable to assume I would have provided to her, but no specific dollar amount would pass to her directly.

- $300k to my cousin who is a contractor and designer. She has helped us the last 10 years and we would not be where we are at today without her.

- Up to $1.5M Education Trust would be funded for descendants of my grandparents and my husband’s parents. (we have since lowered this to $1M)

- The rest would be divided up between my husband’s siblings and my nieces, nephews and cousins.

Since my mother’s passing it is time for a re-write of this document. I felt that our first version was relevant at the time.

We are hoping that we can help fund some educations in the future while we are alive, rather than wait until we pass. We are looking at ways to do this without enabling the recipient or the parent or creating an expectation. We are considering gifting after the completion of college or a trade school a meaningful amount.

Kudos for using special needs trusts to bequeath funds without endangering the beneficiary’s government benefits. An inheritance is a one time event, but government benefits likely Medicaid and SSI go on throughout the disabled person’s life.

Also, great job at realizing that your situation changed an updates to your estate plan are needed. Too many folks write a will and then forget about it. Estate plans should be reviewed at least every 3-5 years. Tax laws change; minor kids become adults and no longer need guardians; people die and are not there to be primary or backup executors/personal representatives or beneficiaries; your mix of personal assets may change.

Great job!

Very thoughtful and well written. Thank you for sharing your journey. I am impressed by all of the hard work and success on the real estate front.

I’m more impressed with how you are giving back to your family and the community – congratulations to you!

Wishing you continued success!

MI81

Thank you for your comments, the trust was one of the hardest things we did as s couple.

I wrote this over mother’s day, not only as a reflection of my journey with my mom, put also my aunt who had just passed away. She had asked us to move in with my grandfather, that single choice we made changed our entire life.

Wow, wow, wow! This is by far my favorite ESI millionaire post so far. And it’s probably my favorite FIRE post in the last 2-3 years that I’ve read anywhere.

I felt very kindred spirits with most everything you wrote, especially the hard work and helping family part.

Congrats on a life “well done” so far!

Thank you Mr Hobo, I appreciate the feed back. People are often skeptical that they can create wealth in 7-10 years, but it can be done, if anything I hope our story inspires others to save and be ready for their opportunity, sometimes the opportunities are disguised as work!

Family is super important to me, most of my older generation is gone and I truly feel a bit lost. I am struggling how to shift to a “its my time”

I really liked this interview. I’m based in Southern California and have used rental real estate to grow my net worth as well. I’m also an accountant by trade and now CFO for a small company. My parents live right next to Palm Desert and it is very nice except for the summer and if you love golf. Very relaxing.

I wish you best of luck in dealing with your sister and her care. That sounds like a tough situation.

Thank you for your encouragement.

I am hesitant to own real property, so we own REITs instead. I am curious to know if you have any books or learning materials to suggest to get a handle on owning real estate directly. The promise is there that hold my attention, but the reality of the horror stories of folks with bad tenants that I know here in the NY area has kept me hesitant to get involved. The fact that I don’t have a friend or family member to learn from is part of my issue.

I do not have any books on owning real estate that I used, I do belong to a regional housing association that keeps me up to date on all the proper forms and laws. I watched several people handle their properties and tenants, with very few problems. The selection process is key, the right tenant usually comes along after I talk to 10 applicants, I call prior landlords and check references. When someone needs to leave, I usually create a win/win situation for everyone. We also keep our business model simple and go above and beyond on maintenance and upkeep. Our tenants realize we take care of our properties, they usually fall in line and do the same. We also are not on the bleeding edge with rental increases, we avoid turn over.

A great book to read about real estate investing is

“ The Millionaire Real Estate Investor”

– Gary Keller

It’s the best I’ve seen so far about the basilica. You’re going to find that it’s jot that risky if you follow a formula.

Good luck !

Wow! This was an amazing millionaire interview. Exceptional accomplishment in a very short amount of time. Congratulations and god bless you for all the things you have done for your self and your extended family. I would love to get your input into something that I am trying to do for my self and I am barely starting to get into this. If it is ok with you then I can be reached at [email protected].

Thanks so much for sharing your story! Its very inspiring. When I read your story about your serial entrepreneur – ex, I was thinking – Ah! She took care of him too…

I’m like you when it comes to helping others (not this generous though) and got burnt out because unlike you, I was doing it at my own expense and not taking care of myself – financially or emotionally. I missed 15 yrs of prime time where I could have focused on my own growth as well. I’m now on track.

So much to learn from you.

Hi Sam,

The serial entrepreneur was very capable of taking care of himself, that one is on me though, a generous person teamed with a selfish person is not a good combination. We remained friends and we both learned a lot from each other.

Only regrets are over the time spent and not completing college.

That’s exactly it!!! You put it so succinctly! That was my problem too – not knowing really needed my help and who I was enabling. I didn’t realize it for a very long time.

Congrats on the great financial job, but more importantly, congrats on being a good person. It’s easy to get so laser focused on achieving retirement or reaching “your number” that one looks past the opportunities to make a difference in the lives of others. You kindness to your extended family will make a difference long after you are gone. That is truly the measure of a person.

I like reading interviews like this. They make me think that ESI should change to ESIG- Earn, Save, Invest, GIVE. Everyone reading this blog is lucky in more ways than they can imagine, and I find inspiration when I read about people who put others needs before themselves.

Hi Matt, thank you for the comments, when you don’t have kids it is easier to give of your time and resources to others. Helping my grandfather was the greatest gift my husband and I were given, my husbands father died before he was born, the two became kindred spirits.

The giving part after you have covered your basic needs and then some is actually a lot of fun. We try to make a difference in others lives. This week we gave a neighbor kid $200 as he headed off to college, he works hard and has limited means, he said he would pay it back someday, we said no need to, pay it forward when you are able.

I hope we inspire others and we hear more about other Millionaires giving as well.

Great story, real estate is definitely helpful. I prefer the passive method with REITs.

I was wondering the 10-15% of saving your income. Do you include interest and dividend income earned and reinvested into that percentage calculation?

In the past we have saved from our W-2 Income approximately

Tax Deferred Savings 10% – 15%

Non Tax Deferred 10% – 15% (these savings we used for R/E investments primarily)

All profits/cash flow from houses and apartments have gone back into those investments via paying down mortgages or funding another real estate project, we currently do not use any of these funds for lifestyle, but will convert to using this when I decide to retire.

We will move the properties into a more passive mode via property management and no remodeling projects when we start to travel.

Terrific insights in this interview – thank you! I love the advise about practicing the discipline evaluation of real estate deals before jumping in. Are there any tips or guidelines you’d be willing to share on evaluating single family or multi-unit rental properties, such as key characteristics or financial metrics?

Great share. This is probably the best example I’ve seen here in some time to a family truly diversified across several assets classes. Market Equities/life insurance / cash / real estate. This is true diversification.

You make a point here that I’ve made all along – the greatest wealth is built from some exposure to actual real estate – hard real estate that creates cash flow / appreciation / depreciation and protection of principle. ( Reitts are not real estate folks). Cash is not king – cash flow is king and it appears that you have created that.

You ask about getting rid of the houses. That’s a decision that you have to make but my experience is that if you are not prepared to transfer the gains into another property / properties through a 1031 exchange, the tax bill will eat you alive. It’s very difficult to justify a “cash out “ against an income earning property without the 1031.

You’ve gone about acquiring this real estate in the best way possible as well – you bought off market through people needing out of their homes. You solved their problems and created an impressive portfolio. I LOVE that the apartment went from $800k purchase price to a value of over $2 million ! Fantastic. Try doing that in the market! Lol.

Rather than selling the houses, you might consider repositioning the loan on a cash out basis. That will not create a taxable event and you’ll keep the asset.

This is a great share and you illustrate a true understanding of how money works and how to nicely defray taxes on your W-2 income through cash flowing real estate.

You’ll easily reach $5 million butvat your ages – $7 million is attainable if you continue to leverage the real estate.

But you know that already.

Btw – how many units does your apartment complex have ?

Great share.

Finally someone that gets it !

Thank you for your comments and advise, very much appreciated, I went back and reread your post, you are very wise and accomplished, and I value your feedback, we share similar experiences. I laughed at your comment regarding a new kitchen, our rentals often have nicer kitchens than our own as well.

Our apartment has 12 units (10) 1 bedroom (2) 2 bedrooms. We really love this building, it was old and dated when we purchased, we renovated and added value, the building had great bones. My husband loves to say “we increased the value of the property $100k by just having the screen doors removed”, he is right. We turned the building non smoking and updated the landscaping, the place is meticulous and we have built up a system to easily maintain the property.

As I evaluated apartments (1) bedrooms always had greater return per square feet, they are easy to turn and generally you are dealing with just 1 tenant, which is great. Over the last 3 years we have only had 4 late payments.

The valuation of the property from a recent appraisal is based on the net income approach.

We definitely understand the impact of selling a property and the tax consequences, we hope that we find a multifamily in the future that we can do a tax exchange with the houses.