If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in August.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 58 and my wife is 59.

We’ve been married for 31 years.

Do you have kids/family (if so, how old are they)?

We have three great kids – 28, 27 & 23.

All live close to us and after finishing their degrees are gainfully employed.

What area of the country do you live in (and urban or rural)?

We live in the suburbs of one of America’s great Rust-Belt cities.

What is your current net worth?

Our current net worth is $18,000,000.

I sometimes wonder how that happened, but I also dumbfounded that I’m 58 years old.

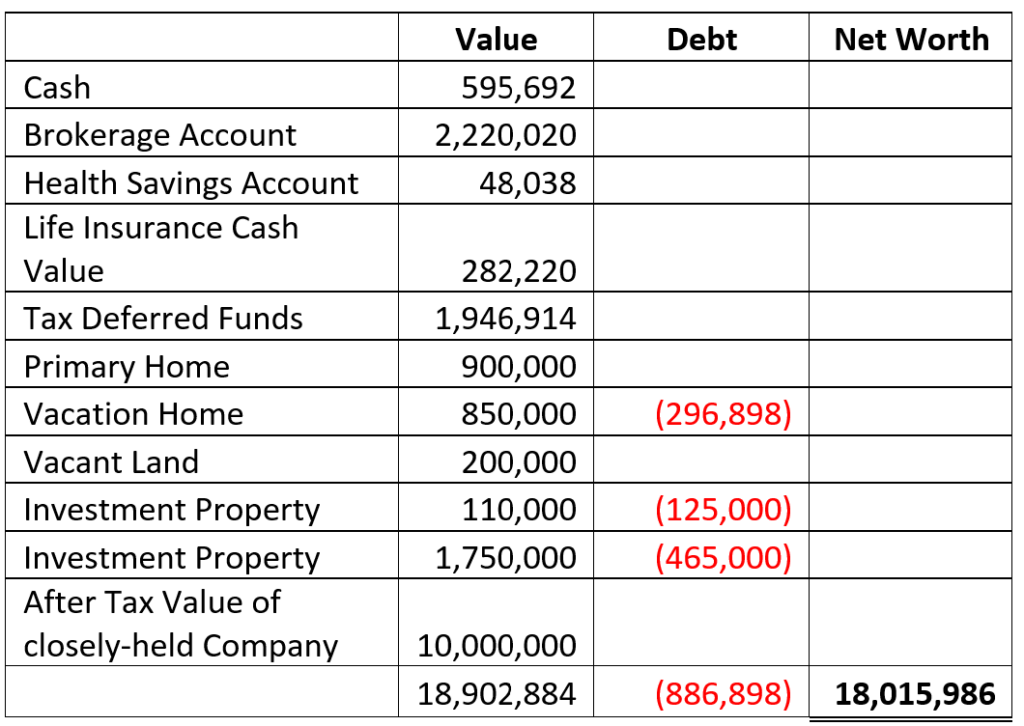

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

In addition to real estate, tax-advantaged funds, stocks, and cash, we have a sizeable amount of our net worth tied up in the value of a business that we are 50% owners of. The value of our business is approximately 7.5x EBITDA.

We do carry some debt on our real estate but with the interest rates being so low on the mortgages, it doesn’t make sense to accelerate the payments or eliminate the debt.

EARN

What is your job?

I am a founder and co-owner of a medical device business. While I wear many hats, my responsibilities are mainly leadership, strategy, and growth. I try to have others take care of the day-to-day operations while I stay out in front of the company ensuring our continued success.

The emphasis in the previous sentence is on the word “try” as I also deal with hiring and firing, managing large accounts, putting out customer fires, and making Costco runs. Glamourous, eh?

What is your annual income?

It varies, but has really risen in the past few years with. Last year we paid taxes on $2,100,000, and we are on track for a similar year in 2022.

From 2009 – 2018 our income combined was between 350,000 – 625,000.

My wife is also an employee of our company and earns approximately $45,000 per year which allows her to maximize her contribution to the 401K plan for the regular limit plus the catch-up amount.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I’ve been a hustler since the age of about 12. Seemingly there was never enough money in our household and if one of us kids wanted something extra, we had to figure out a way to pay for it. I shoveled snow in the winter and cut grass and detailed cars in the summer until I turned 16 and was old enough to get regular employment in food service.

With my freshly printed marketing degree I got into sales and landed my first job with a 7-person computer company for $20,000 (plus commissions) selling inventory management software. The typical install was approximately $30,000. Unfortunately, there was little sales activity, and in three months, I was terminated.

A couple of important lessons were learned that fateful day; make sure the job is a fit and your employer always has the ultimate power over you. I quickly filed suit for commissions that were owed to me, and while only 23 at the time I prevailed and was compensated.

From there I entered insurance sales with a large company that provided excellent training. Within 18 months, I was making approximately $50,000 per year. It was a great, three-year run, but I didn’t like business to consumer sales. They did however train me to successfully sell intangible products that virtually no one wanted to spend money on.

In the early 90’s if you were in sales, the best paying jobs were in the ever-expanding field of medical devices and equipment. I landed a position with a European distributor of medical instruments. My salary was 12,000 per year plus commissions, and that year I earned $45,000. After a couple of years of solid results I received a promotion to management and my income rose to over 100,000 and ended fourteen years later in the low 200’s.

Looking back, it was a grind; the stress of sales, along with relentless travel took its toll after many years. But it didn’t matter as there was constant professional growth, and tremendous gains in clinical knowledge and market insight, not to mention a nice income to support my young family.

I always wanted my own company. After we lost over half of our net worth in the dot com crash, my wife told me that she would rather bet on me than bet on Wall Street. That’s all I needed to hear, but it took three years to identify the right opportunity, construct the proper business plan, and accumulate the necessary funds. With a family to support, it needed to be more than a chance….it had to be a home run.

When I jumped from the corporate payroll, we lived off savings and credit lines until the business gained traction. It was scary, but with a wealth of contacts, a great product line and plenty of motivation we eventually turned the corner and became profitable. The early years were good, and my previous income was replaced in three years. During that time, we had to stop all savings, so that has been a drag on our tax-advantaged savings.

We could have withdrawn more of the profits in years past, but always opted to re-invest in the company, avoid debt and let it blossom and grow.

What tips do you have for others who want to grow their career-related income?

Hard work, good people skills, and an abundance of curiosity are cornerstones of building a successful career.

Many young people have a strange sense of entitlement that doesn’t serve them well. They get dejected easily, avoid hard work and thus, never get ahead. Success just doesn’t happen by itself and requires you to be an active participant. Just work your tail off and do so smartly while ensuring you are compensated commensurately with your value. Drive, hard work and grit, win.

Having worked with and employed a tremendous number of people those that can get along with others and also help other people succeed always do well. The trite phrase, “nice guys finish last” is false. There are few very successful people I have met that don’t genuinely care for others. You have to be a good soul – it pays on so many levels in life.

Curiosity, to me, is more and more, a critical facet of a person’s make-up. Curious people learn about their environment, their peers, their leaders and their subordinates. They also learn about the macro things that affect their life – economics, politics, history, and this human life we all live. The curious have more purpose, more insight, and experience a much higher and faster level of personal and professional growth. They are also some of the best conversationalists.

What’s your work-life balance look like?

My current work-life balance is and has always been tilted toward work. While I didn’t miss much (kid’s birthdays and sporting events, vacations, relaxing weekends) I also have not taken more than two to three weeks off per year in my entire career.

My free time eroded in the past couple years with labor shortages, supply chain issues and frequent employee vacancies caused by the pandemic. It hasn’t been an easy ride recently.

Spending time with a lot of retired people at our vacation home has really helped me see the future and what life can be like without full-time employment. This has accelerated plans to re-adjust my work-life balance and I am currently working on an exit strategy to reduce my responsibilities and allow a transition to being a business owner, as opposed to an owner-operator.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

I wish that we were more diverse in our income streams. 95% of our earnings are derived from our main enterprise.

We do have a couple of real estate investments, but nothing like what we wish we would have created.

SAVE

What is your annual spending?

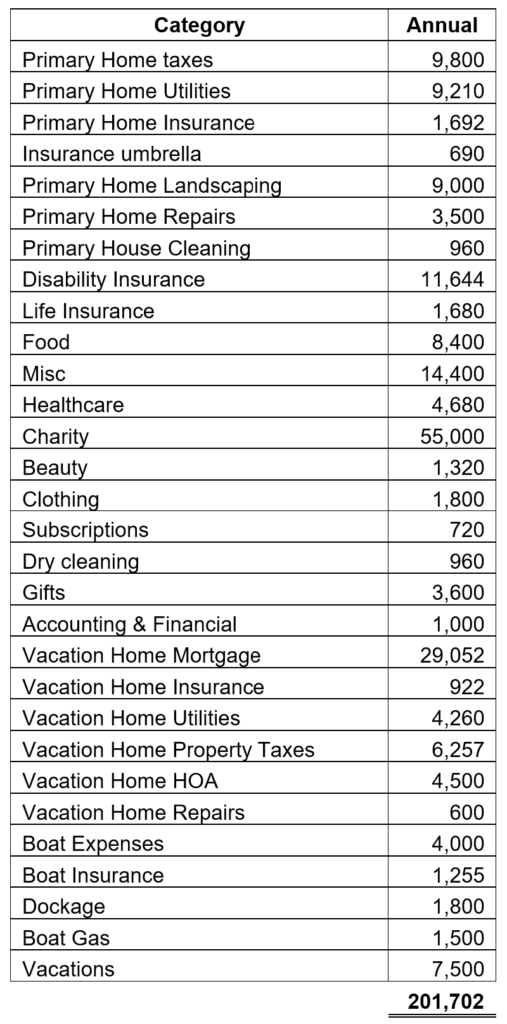

We currently spend approximately $200,000 per year in after tax income. This tends to fluctuate with remodeling projects, donations, and vacations.

While I track everything in QuickBooks, and have for at least 12 years, we really do not have a budget per se.

I do pay all of the bills and review every line on every credit card statement so I have a solid handle of our spending.

What are the main categories (expenses) your spending breaks into?

Do you have a budget? If so, how do you implement it?

We do not have a budget, we just live how we live.

What percentage of your gross income do you save and how has that changed over time?

That’s a tough question to answer. I started tracking this approximately six years ago, when I did some financial modeling to see where all of this was headed. We are currently saving the balance between our earnings and our spending.

With the added net income, our ability to save and work on our cash position has really improved and I hope to balance my after-tax cash position in the coming years to equal the value of our company.

Additionally, we continue to invest in our company which is like forced savings as the value of the enterprise builds every year.

What’s your best tip for saving (accumulating) money?

Once you maximize your earnings, it’s all about living within your means and burying the margin.

I have always (except for a few years) maxed out my 401K savings, in addition to taking advantage of an HSA we started some years back.

We try to never pay retail – we like the game of it, buying almost everything on sale, acquiring slightly used cars, and using credit card points for travel and anything else we can apply them to. As we see it, getting great deals on nearly everything affords the occasional splurge.

I’ve also been a believer in not carrying debt.

What’s your best tip for spending less money?

My wife is the consummate saver (still shopping in thrift stores) and I am more of the spender.

I am a firm believer in the value of having great insurance coverages yet I have always taken large deductibles to drop the costs. Simply divide the change in the deductible by the premium savings to determine how many years it will take to offset the savings by an insurable event. The numbers will surprise you.

What is your favorite thing to spend money on/your secret splurge?

Lots of things – probably too many to list.

However, I do have one thing that I spend very little on. I always sprinkle my coins from any visit to a store or other establishment on the sidewalk and in the parking lot outside. It’s such a little thing that I hope changes other people’s attitudes and makes them smile and feel lucky when they spot the coins.

I also like to pay for those behind me in-line at drive throughs.

INVEST

What is your investment philosophy/plan?

Most of my investing has been on my own. I have had a couple of advisors and have not seen the benefit.

Currently I do have a relationship with a Fidelity Advisor, and we have transitioned most of my investments in the past couple of years from more volatile equity exposure to a more balanced and conservative mix to reflect our stage in life.

We have a lot in cash right now and will deploy much of that into dividend-paying stocks.

What has been your best investment?

I’ve made a few.

Choosing the right spouse has been much of the secret to my success. She keeps me balanced and grounded. Without her, I’m not sure any of this would have been possible.

The gamble on a small business has been fantastic for us. While certainly not a passive investment, it has performed year in, and year out and has grown phenomenally.

I had an advisor suggest a purchase of Apple Stock in 2014 at $29 per share. I only wish I would have bought more!

What has been your worst investment?

We invested into an electro-static spray disinfection business about 10 years before the pandemic – lost approximately $100,000.

We were just a little ahead of our time!

What’s been your overall return?

Frankly, I don’t know.

We have money in a number of places, and I don’t track the returns that closely.

How often do you monitor/review your portfolio?

On the first of each month before the market opens, I update every account balance and asset value in a spreadsheet.

I’ve been doing this for over ten years, and it is fascinating to see how the numbers have changed and grown. The spreadsheet auto calculates our net wealth, and provides an ongoing YTD change.

Those monthly numbers feed into my future projections to age 70 that I have pegged to a conservative 6% annual growth rate.

NET WORTH

How did you accumulate your net worth?

There was no inheritance provided to either of us. The one great gift I was given was a fully paid college education from my parents.

My dad was the first to graduate college (nine years of night school with a wife and five kids at home) in his family and it was important for him that I get a degree. I did the same for my kids, and in retrospect should have only paid half, with an offer to retire their share, upon graduation, on a sliding scale based on performance. Skin in the game, it’s a powerful motivator.

I have done well by betting on myself and accepting the risk that poor performance brings. That risk is not for everyone. Many need the security of a guaranteed amount in their paycheck with no fluctuations. No judgement from me, as we are all very different. I just always chose variable pay, and actually never had a set salary without a commission or bonus structure.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

I’m an earner, and a lucky one at that.

Thankfully, I’m now becoming a better investor. There’s so much to learn, and now that we have attained some level of wealth, we feel a great responsibility to preserve and grow it for the benefit of our family and others.

Save…I feel I’ve spent way too much in the past to ever call myself a strong saver.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

For the most part, professionally it has been an adventurous and relatively smooth ride.

Personally, it’s not always so easy. Marriage and parenting issues are common in any family. With a divorce rate of nearly 50%, it’s easy to give up. Thankfully, we have soldiered through our issues, getting help when necessary to get back on track.

What are you currently doing to maintain/grow your net worth?

It’s easy to sell a privately-owned business right now, and believe me, we’ve come close.

Rather than sell, we have elected to stay the course and try to re-position ourselves to business owners and continue to reap the rewards of a profitable enterprise. While this is the harder route, it is the more lucrative one.

We may completely exit someday, but for now we are enjoying the fruits of what has taken almost twenty years to build.

Do you have a target net worth you are trying to attain?

I don’t, although my projections take me to approximately 34 million at age 65.

I’ve always said that I want to have enough money without selling my company that I could burn it to the ground and walkaway. We’re currently working on that.

I’ve always been motivated by financial freedom, and that’s how I define it. Some would say we have achieved financial freedom, but according to my measuring stick, we’re not there yet.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I was 43 when our account balances (excluding the value of our business) eclipsed a million dollars. While our company was likely worth more than that on that day, it was still a great moment.

Nothing has really changed with us. I still occasionally eat Kraft Macaroni and Cheese, and Top Ramen noodles which I lived on in college. I have two mis-matched sandals that I wear and whatever loose change we have in the house, I roll and cash it in the week before we go on a vacation. It’s usually just over $200 and it always feels like found money.

What money mistakes have you made along the way that others can learn from?

Lots, but fortunately not any really big ones.

I should have lived a more frugal life as my wife always suggested. Had life and business not turned out as it has, I would have really regretted that.

What advice do you have for ESI Money readers on how to become wealthy?

Own a money making-machine. It can be something as easy as vending machines or a coin-operated laundry, or a rental property. Figure it out and start somewhere. Make your plan and associate with others who walk that capitalist path. Learn from them and let your income producing venture eventually take care of you and your family.

Having traveled extensively to many places including Cuba and China, there are billions of people in this world who do not have the same opportunities that America provides. We live in the best place in the world that will meet you half way if you only work hard and take some risk.

Obviously, there are other ways to make it, but for me there is nothing like being the captain of your own ship, and the master of your destiny.

FUTURE

What are your plans for the future regarding lifestyle?

I would like to be out of full-time work in 18 months, scaling back to a day or two a week.

This will afford time to slow down and spend more time with my wife and family.

What are your retirement plans?

Retirement for me will be different than most. I will still be involved in our company (hopefully not too much) and will have a large percentage of my net worth tied up in it. That said, I would like to more generously pay key people to take important work from me. This will reduce our profit distributions, but we trust it will lucrative for many years to come. This situation will allow us to still have access to group health care, and contribute to a 401K.

I would like to pursue some form of teaching if one of the local colleges will have me. There is tremendous value for students to hear from someone who has real experience to weave into academics. Maybe a one night per week course, or even some guest lecturing would be ideal.

I have a number of things I would like to pursue in a variety of areas; I want to learn to fly fish, become a competitive sporting clay shooter, and travel more in the US and Europe.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Health and healthcare costs.

The other thing that concerns me is the adjustment to a slower life. I’ve been in the game for so long that it may take me a while to get used to a slower schedule. Retirement can be as great as you make it, and we’re currently working on how to make the most of it and be as happy and fulfilled as we can possibly be.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

The first person that taught me was my older sister offered her then ten-year-old brother a free candy bar from her fundraising candy box if he sold the other 23. I took the deal, and that was the best candy bar I ever tasted. Crazy how that deal affected my psyche for the rest of my life.

My Dad got me a subscription to Money Magazine just after I got married. While I skipped over much of the content there was always a section that featured a family/couple and their finances. This was helpful as they had three financial advisors write a short summary of what the people should do in their situation to set them up for success. Much of this information was really helpful and we put it to use in our own life.

Who inspired you to excel in life? Who are your heroes?

My Dad has been a huge influence. He worked his way up in a large corporation and had a lot of responsibility. He’s provided keen insight and helped me through some sticking points in my career and my life.

As a corporate man, he had a hard time understanding my desire to start a company, and watched warily from a distance in the early years. It’s just such a different perspective we all have.

His father was a steel worker who did carpentry on the side to support his nine children. My father succeeded through hard work and education working for the same corporation for 42 years.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

None of my favorite books are completely financial, but all have great lessons that can be helpful to help a person succeed in all facets of life and work, and consequently with attaining and building wealth.

Rich Dad/Poor Dad by Robert Kiyosaki.

How to Stop Worrying and Start Living by Dale Carnegie.

The Seven Habits of Highly Effective People by Steven Covey.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

We do. We set aside approximately 2% of our income into a donor advised account, and give approximately 60% of it away every year. We are allowing the balance to accumulate so we can make some more meaningful gifts in the future.

We also give cash donations of approximately 1.5% of our income annually.

My wife devotes much of her time to church and charitable activities and I suspect I will join her when time permits.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

Funny you should ask. We are currently working on our estate plan and will be resolving these heady issues.

To be frank, yes, we will leave an inheritance to our children. How much, is something we have yet to settle on.

We hope to more than double our net worth in the next 7-10 years, and in doing so should be in a strong position to help them and many others. Ideally, we will give a good portion away while we are alive.

$18M net work is def one of the biggest on ESI!

Yet, I find it somewhat comical that you are worried about healthcare costs. With $18M NW and 4% SWR, you could almost 4x your current spending level (which is already 2-3x the average American household) and not feel one bit of sacrifice! Plus you give $55k/year to charity, which honorable is something that can be pulled back easily.

My point is (1) Congrats on accumulating such wealth, but also (2) apparently money is stressful no matter how much you have!

The cost of private healthcare in America is staggering. Our group insurance rates have more

Than doubled in the last four years. My wife and I both have both have manageable health issues that will likely get worse in time. We will also help loved ones as life and health crises work there way into our families. Can we afford healthcare, yes we can, but it will be an ever growing part of our expense structure as we age.

Great interview and great job building your company into what it is today.

I appreciated your frankness regarding marriage and parenting and was wondering if you have anything else to say on that topic.

It’s easy to say that the best decision you ever made was arraying your spouse, yet if you have been married for over 30 years like we have, there can be tough times. We’ve had them, and have almost called it quits a couple of times. Fortunately, either of us are quitters and took our vows seriously and have gotten professional and spiritual help to work through our problems and return to a better place. It’s hard to work through marital problems, but utimately we believe) worse to break up a marriage and a family. Pick your hard.

This is one of the most interesting ESI interviews I’ve read in a while. So many important topics you cover here – parenting, relationships, building a business, the psychology of knowing when you have “enough” (and it’s personal, not simply being able to live off 4% of your assets).

I certainly hope you join the MMM forum. I’m there and would love to learn more from you. Congratulations on all your success, and I wish you the best as you transition to the future!

Thanks so much for the kind words. What an interesting exercise it is to confidentially answer the interview questions and share some of your personal thoughts on an array of topics. The money aspect of these interviews are certainly necessary, but this human existence we experience as we work these many years is where the real treasure is.

Great interview!

You have a very smart wife. Love the thrift shopping. I also enjoy a good treasure hunt at the thrift store… and mingling with the other millionaires doing the same thing… so fun. Yes and I too enjoy a good used car.

You are right, it is incredibly valuable to have a college professor who has walked the talk. I taught Computer Science for ~2 decades and it was always a pleasure when a student would recognize the value of my experience.

I too could not retire to nothing per se. I spent so many years moving at the speed of light and it is just the way I am. So anyway, when I retired, I immediately returned to college to get a Culinary Arts degree, as well as learn to play piano and harp. Retirement has been a blessing.

Great job and best wishes on your future endeavors!!!

D

Wow – 20 years of post-retirement teaching, and a culinary degree, what an inspiration! I love hearing about successful retirements, and you sound like you are certainly living one. Bravo!

Hard work, good people skills, and an abundance of curiosity are essential for building a successful career. Great insight that many need to hear! Thanks for sharing it.

Thanks for your note. I have learned so much from all of these interviews, and can only hope that I provide a couple of takeaways. I wonder how many times, on average, these interviews are actually read…..

Please consider giving more. As Christians we’re called to tithe. That can require discernment in judging what figure to use for a complicated income structure, but my wife and I just use our taxable gross. We tithe 10% of w2 to church and 10% of other income to a donor advised acct.

You won’t regret it. We’re fortune to be able to give ~$50k this year, and it’s one of the most enjoyable things we get to do. No, this is not my name or real email. Yes, these are correct figures. Give in secret, it’s more of a blessing. 🙂

Did someone offer you $10M for your business? That is a big number to not say hasta la vista baby. Even if it’s worth 0 $8m is quite a feat. $8m at 3% has you covered with $40k for the unexpected or to travel.

Actually it was 14, with an additional 2 if the business performed at a certain level for two years post-sale. I included the after-tax value of the business based on just the 14M buyout. Some people want to just exit their professional lives as soon as the numbers work to have a comfortable lifestyle. I happen to enjoy what I do, and will stay involved with my company on my own terms as long as it is personally rewarding, and fun.

“I always wanted my own company. After we lost over half of our net worth in the dot com crash, my wife told me that she would rather bet on me than bet on Wall Street.”

Congratulations on your success! The interview was inspiring and motivating to read.

I’m in 30’s in Sales pulling in over $500K W2 but the stress of travel remains and I’d like to get started with something of my own someday preferably with as little risk as possible. Would love to learn from you since it’s rare to see a successful transition from sales to business owner. Please let me know if you’d be open to connecting/mentorship?

It sounds like you are doing really well. I would be more than happy to speak with you – not sure how we can be connected – perhaps they can put us together.