Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in September.

It’s a bit long (which I LOVE) so I’ll be covering it over the course of two posts this week.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 51 and my spouse is 55.

We have been together for 22 years, married 10.

Do you have kids/family (if so, how old are they)?

We have no children.

What area of the country do you live in (and urban or rural)?

We live in a fairly urban area of central Texas.

We both came here for school and personal reasons, but stayed for the mild weather, the diversity of outdoor activities, and the employment opportunities.

What is your current net worth?

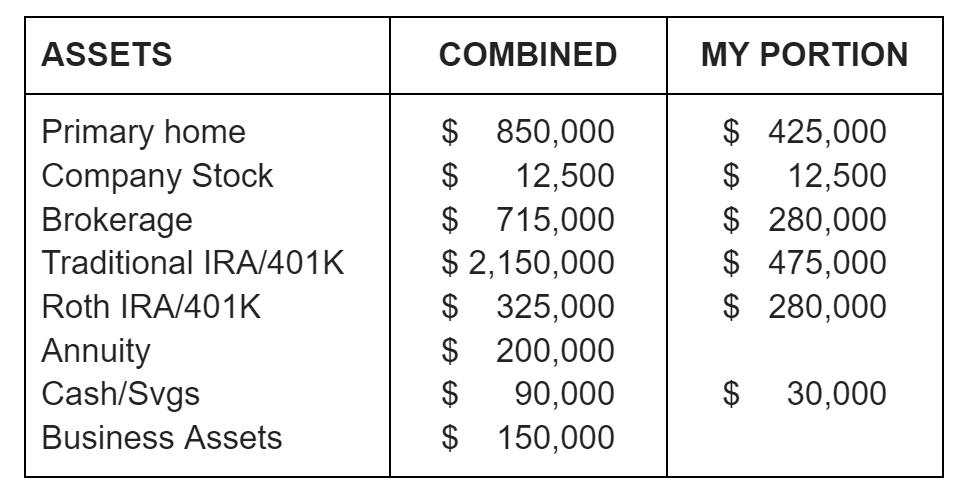

Together, our current net worth is $4.4+ million. Of that total, my portion is $1.5 million.

Although we are a dual income household, most of this interview will center on my experience. We had different career paths and had built up our individual net worth differently.

We also did not combine our financial life until we bought a house together 15 years ago — later in both our lives.

Fortunately our financial philosophies are pretty well aligned.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Here is a breakdown of our combined net worth as of 2Q22, along with a breakout of my portion.

While we track and manage our investments together, we still maintain mostly separate accounts.

I manage all of our investments. My husband is happy not to be bothered, other than periodic check-ins.

We have no liabilities.

NOTE: The business assets noted above are an estimate of the value of my husband’s business (mainly materials and specialized equipment). He is the sole employee and his business is not likely one that he would sell outright, but the assets could be.

We just paid off our home last year. We were able to do this in large part due to reduced spending during the last 2 years of the COVID pandemic.

Also, we had accelerated our payments when the 2017 Tax Cuts and Jobs Act took effect and it no longer made sense for mortgage interest deductions, etc.

Our two cars are paid off. They are both more than 5 years old, but we expect them to last at least 5-10 more years barring any catastrophe as they are reliable foreign makers and both have low mileage for their age.

We do not have any second homes or other real estate investments. We find our primary home maintenance to be more than enough.

EARN

What is your job?

I am currently not employed. I have retired from corporate work, but may consider short term or part-time work in the future.

For the previous 8 years, I was part of a management support team at a prominent IT company. I preferred to remain at the individual contributor level and not move into management even though I had been encouraged to do so. I knew this would affect my earning potential, but I knew myself enough to know that I would not enjoy being a manager.

Don’t get me wrong, I have great respect for good managers. It is my belief that a good manager can get you through a less than ideal job, and a poor manager can drive you away from a great job.

All that being said, I really enjoyed my work up until the last few years. There were lots of challenging opportunities I took advantage of and even changed roles. I enjoyed nearly all the people I interacted with and really missed that once COVID took hold.

I left my job in late 2021 during the ‘Great Resignation’ and haven’t regretted it at all. I did not enjoy being fully remote, which we still were. In addition, all the worst parts of ‘corporate’ work were just becoming too much for me – metrics, performance reviews, meaningless reports, online meetings, etc. With our nest egg as noted above, I took the opportunity to leave and take some time to decide what’s next for me.

In contrast, my husband has been self-employed with his own business for the last 10 years. His business doesn’t make a lot of income, but it’s an area he enjoys and involves activities he would do anyways. This way he monetizes it and can take business deductions for pertinent materials and activities. It is essentially an ideal semi-retirement job for him.

What is your annual income?

Last year, our combined income was $77,000.

This is lower than previous years for a few reasons. First, I left my job before the end of the year. Second, my husband pays himself a relatively small salary of $16,000. Lastly, his business income was essentially negative last year due to some capital purchases.

The previous few years before this, our annual income ranged between $86,000 – $114,000, the variation was largely due to the business income which can be quite variable.

I have never earned a lot, but I always earned enough to support myself and eventually save and invest. My highest annual income was $86,000.

On the other hand, my husband spent over 22 years in the high tech corporate world before he was laid off. His salary at the time was at least double or triple mine much of the time, especially when bonuses, etc. were included. This allowed him, and later us, to save a good hunk of what we brought in.

The last 9-10 years, we have been able to live well on my corporate salary (and benefits) along with his contributions and still save some money. In the meantime our investments were able to grow untouched.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I grew up in a solid middle class family. My father worked for the federal, and later state government and mother was a teacher, although she did stay at home when we were young. They divorced when I was in 8th grade. I worked during high school years – babysitting, ‘retail/mall jobs’, etc. I enjoyed earning and having my own money, but I wasn’t a spendthrift. I saved some for college expenses and enjoyed being able to buy my own things and go out without having to ask my parents for money.

While my parents had saved to pay for most college costs, I worked every summer during college, plus odd jobs during the school year to pay the balance. I graduated college in the early 90s when the job market wasn’t great and I was struggling with some direction as well. I didn’t prepare well for life after graduation — and finding a good career.

Fortunately, without school debt, I could flail and it was not the end of the world. This didn’t mean I didn’t work and earn money. For the next 5-6 years, I tried a lot of things, moved around the United States, and really didn’t focus too much on saving and investing – just earning – and just enough to afford living. I waited tables, worked for a small mom and pop contractor business, a moving company, a large insurance company, a business that refinanced RVs and mobile homes, a realtor and a large corporate bank. I even tried going back to grad school. Often, I would be working 2 jobs, or at least picking up odd jobs on the side.

Per Social Security, my income during those years ranged from $9K to $14K. It was not a lot, but my expenses were low.

For a year post college, I initially lived at home, but afterwards shared rent with roommates and had a basic car I had already paid off. Admittedly, it was a bit of a vagabond existence to some extent but I was self-supporting and not ready to settle down in a place or a career. I would often take short breaks between jobs and/or locations to visit friends and family having saved enough to carry me through the time. When your expenses are low, you don’t need a lot of money to do that. My only regret looking back on this time was in not attempting to travel and work abroad.

It wasn’t until I landed in central Texas that I began to settle down. Given my erratic work history and my initial need to fund my life quickly, I took a temporary position for a non-profit company. The initial assignment was unappealing long-term, but I liked the company and the people, and they liked me. I was able to move into a full time staff position in the IT organization which turned out to be a great fit. My initial salary was pretty sad though, even for 1998 – $25,000. (I didn’t negotiate. At the time it sounded great to me, especially with the corporate benefits.)

I stayed with the company for 9 years — my title and responsibilities changed over time but I largely stayed within IT, mostly supporting the management team and leading projects. My salary more than doubled by then to $56,000. Working at a non-profit company was not especially lucrative, but what they didn’t have in company stock and higher salaries they more than made up for in a good work-life balance, great work opportunities, and other non-monetary employee benefits.

I left the company when they relocated to another state. I did get hired back for two projects on a consultant basis in their new location. As a consultant, my income increased to $65,000.

After the project work, I took a break and traveled with my partner before searching for my next job. (I guess I was taking a mini-sabbatical before it was a thing.) This was also 2008, during the housing and financial crisis so it wasn’t ideal to be job hunting. This time I did make a more concerted effort networking and being open to different options. I was looking for a similar work and work-life balance as before and thought it would more likely be found in the non-profit sector. I was less concerned about higher income and more with a good fit (and at least commensurate income).

I spent a year at a state job for a significant reduction in pay (~$45,000). I then took a position in a nonprofit health care start-up for about the same salary level. Neither were good work environments for me and certainly didn’t make up the pay discrepancy.

Still working at the health care start up, I took stock of what wasn’t working and what I wanted and started a more targeted search. I opened up my search to for-profit companies — but ones that met certain criteria based on my research or my network as far as being a desirable place to work, work-life balance, diversity, opportunity, etc.

I was able to get my foot in the door at an IT company that seemed to meet my criteria. It was almost like a start-up with all that energy and excitement, but with the stability of a large company behind it. There was a lot of project work, a lot of growth and new challenges. In 2012, my starting salary was $52,000 but with the opportunity for growth and better benefits than past employers.

I stayed at this employer until 2021. For the first 6 years, it was probably one of the best jobs I had. It was challenging and rewarding. I was able to get promotions and salary increases on a regular basis and felt appreciated and rewarded for the work I did. The team was great and management was supportive. I couldn’t imagine a better place.

Unfortunately, change is inevitable and it is not always positive. When there were some major shifts in the executive management of the company, they decided to take our team in a different direction. This caused an irreparable decay in the working environment for many of us.

Not long after this, COVID hit and sent us to work from home on a full time basis. As noted earlier, working remotely became limiting and I felt I was doing more corporate ‘busy-work’ than being productive. I no longer felt connected to my team, nor our mission. I left my position last fall and honestly, I lasted much longer than I thought I would. My last full year salary was $86,000.

In contrast, my husband’s story is nearly the opposite of mine. He is a first generation American, but also had a middle class upbringing. He received a job offer before he even graduated college with a degree in computer science.

He worked for them for 2 years before the company decided to shut down that location and move employees to their headquarters in California. He opted to stay in Texas.

He quickly landed another position at a different high tech company and made a career there for 20+ years — shifting groups/positions and making a high salary the entire time. He enjoyed what he did for a long time, but eventually got tired of the continual lay-off and re-org cycles that he was ready to leave when he did.

Since then, he has been semi-retired with his own small business for the last 10 years.

What tips do you have for others who want to grow their career-related income?

I am probably not the best to advise on this based on my track record. I just know I wanted a little more than enough income based on my needs.

That being said, here are my tips. Take them for what they’re worth:

- Know your worth and be prepared to negotiate for yourself.

- Aim to be very good at what you do. This will allow you to negotiate for promotions/raises, etc. Or to easily find a better position somewhere else where they will pay you what you are worth.

- Network!

What’s your work-life balance look like?

My work-life balance usually was pretty good. There have been times where projects have caused it to get out of whack but my mental and physical health start to suffer if that goes on too long.

Most of the time though, I worked 40-45 hours/week. I had my weekends and evenings free to go camping, attend outdoor concerts, meet up with friends, etc. I tended to ensure I used all my vacation every year. I wanted to make sure I could enjoy life and work.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

Our primary income sources were from our careers. This includes the varying income from my husband’s business.

We do have about $10,000-12,000 in annual dividend income from our taxable accounts, which we have been re-investing. We may start pulling it out in 2023.

SAVE

What is your annual spending?

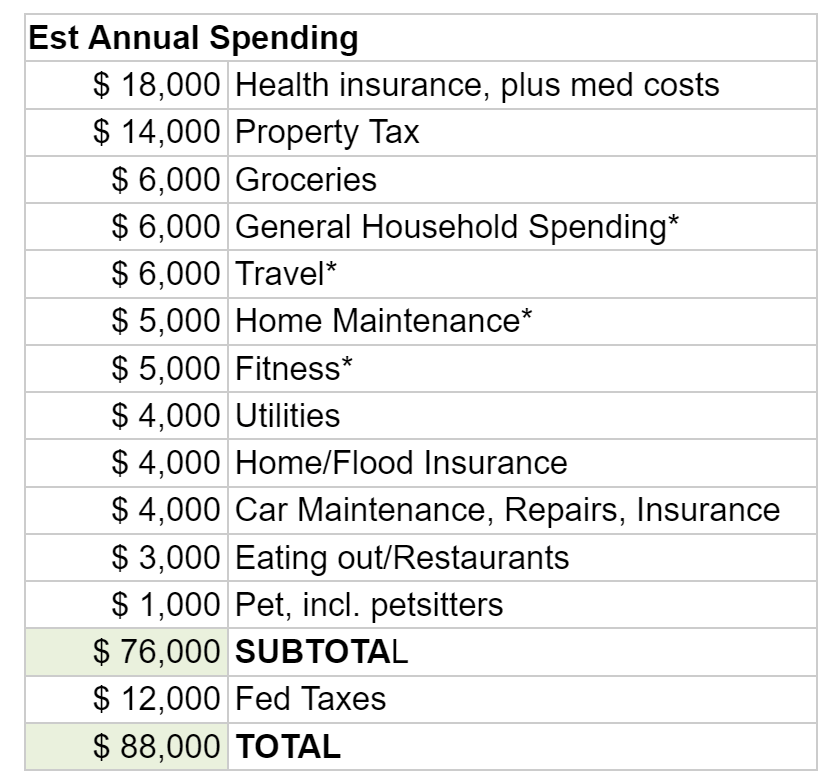

Our annual spending is currently around $77,000-88,000.

We expect this amount may increase some if pandemic concerns continue to lessen and we feel we can travel more freely.

What are the main categories (expenses) this spending breaks into?

This is our estimate based on past spending and adjustments this year for changes to our health insurance.

When I left my company we opted to sign up for COBRA until the end of 2022 since it is a very good plan. We also have a few chronic health issues and thought it would be good to stick with it for a year and give us plenty of time to do our research for a decent ACA plan in 2023.

The categories with an asterisk (*) are a little more on the flexible spending side and less predictable than the others. We aim that if we are doing major home maintenance/remodeling activities, then we spend less on travel to balance it out. It doesn’t always work out that way but that’s the aim.

The estimate for Federal Taxes is a little high but we expect to do Roth conversions and that will account for some of that. We have already done some with the market low, but may do more before the end of the year.

Do you have a budget? If so, how do you implement it?

We don’t have a budget. Neither of us are big spenders in general. I track our spending on a monthly and annual basis and lay out an estimate for the year based on last year.

I can see the slow creep of increased spending — whether it is due to inflation, climate change (more A/C) or lifestyle creep. If there is an issue of concern we decide what, if anything, to do about it.

We can comfortably spend over $100,000 annually based on our investments but our aim is to stay under that for now as long as we are not hurting for anything. Besides, I think we need time to adjust to spending versus saving.

What percentage of your gross income do you save and how has that changed over time?

This is a hard one to gauge. As a couple, I would say it was around 20-25% over the long term.

When my husband still worked for a corporation, it may have been closer to 35-40% with him being the main contributor.

After he went into business for himself and I brought in the primary income, it was closer to 20% of our gross income, but I was the main contributor.

It allowed me to continue to pour money into my retirement accounts and our brokerage so that our nest egg included a significant contribution from me. I did not want to quit without having over a million in my accounts.

What’s your best tip for saving (accumulating) money?

Out of sight, out of mind & automate!

Move it out of your spending account so you aren’t tempted to spend it. If you get a regular paycheck and can direct deposit to more than one account, open another account and send money there you want to save. Set up auto-transfer to send the money to your various investing accounts. Use a High Yield Saving Account or similar to build up initially and once you have a decent emergency account, start investing.

I had direct deposit into 3 accounts:

- My main spending account – day-to-day bills and spending

- A secondary checking account – investment savings, then I would auto-transfer from here to my IRA and brokerage accounts

- A high yield savings account – emergency account, if this got too high, I would just transfer some to my brokerage account.

What’s your best tip for spending less money?

Avoid lifestyle creep, especially early on.

I lived like a student for so long, I don’t know any different. I also was raised very middle class. We cook most of our meals, we don’t buy a lot of meat. We try to buy in bulk when it makes sense. We do most of our home maintenance. We keep our cars for more than 10 years, aiming for 15+. We try to repair things before just buying a replacement.

Also, if you are just starting out, don’t expect to be able to live like your parents do. If you are trying to furnish an apartment — check out thrift stores, estate sales and Facebook marketplace or Craig’s list for some things. You don’t need brand new items right away. Upgrade over time. I have found some really nice quality furniture this way — way better quality than some of the new stuff these days.

If you feel like your spending is out of control, try a spending diet for 30 days — where you really scrutinize all your spending. The blog, Frugalwoods has an “Uber Frugal Month” Challenge that you can sign up for anytime. She will send daily emails to help you along. This is a good way to break the cycle and allow yourself to scrutinize your spending and ultimately decide what stays and what is no longer necessary for you. I found it was a good reset and reminder.

What is your favorite thing to spend money on/your secret splurge?

My splurge has been buying new cars once I was making a regular income. However, I keep my cars for a long time. (This has amounted to only 2 cars.) The main reason I bought new is that I prefer manual shift cars — but not sports cars. These days, with so few Americans knowing how to drive manual shift, I wouldn’t trust buying a used manual shift car. I also know that my current car may be my last manual shift given the likelihood of buying a hybrid or EV for my next car 5-10 years from now.

As a couple, we have splurged on fitness training at a small gym near us. It is close (walkable) and was COVID-safe (only small group or personal training). It is centered on functional strength and mobility training which is good for us as we get older. Both of us spent a large portion of our careers stuck behind a desk looking at a monitor. That takes a toll on your body so we are making a concerted effort to get into better shape.

—————————————

Wow! What a great story so far, huh?

To read the rest of the story, check out Millionaire Interview 358 Part 2.

Great interview.

P.S: I think in the section “What are the main categories (expenses) this spending breaks into?”I think the table is wrong, as it should be about what they spend on (but in reality it is the assets table from above)

Thanks. Got it fixed.

Great interview – just a format note = I’m seeing the same asset table instead of what I assume is supposed to be a spending table

Thanks. Fixed it.

Such a great interview. I love that this is a great example for those who may not always be so lucky in the corporate world. A good and early retirement is still possible. Love everything about this. I would love a part 2 of this to know what the plans are now that you’re retired. How do you spend your days?

Well, you’re in luck! There’s a part 2 on Thursday! 😉

Amazing!

Hey Sam – Thanks for the kind words. I think this is why I wanted to participate – to show another take on retirement saving even at a lower income. Many people say that it is possible but it can be hard to believe it if you don’t see/hear of examples. Part 2 is out today which might answer some questions on the rest of our plans, but let me know if you have other specific questions.

Read part 2 and absolutely loved it. Will you be joining us on the forums? Hope so as we have fun there. Also I’m in NE so if you want to explore this area, happy to share recommendations.

It never makes sense to keep a mortgage just for the tax deduction. With higher interest rates most will probably start to take the deduction again, but being mortgage free is much better than a tax deduction.

Hello Jeff –

I agree with your first statement, but it wasn’t JUST the tax deduction for us. Our mortgage was far enough along that within a few years, it would not have been worth itemizing on our fed taxes. The 2017 tax changes just accelerated our timeline. Prior to that, we prioritized our investments into our brokerage/retirement accounts. At a relatively modest income level, we had to make trade-offs on where we thought our money would work best for us.

Thanks

Understand completely.

Never knew Central Texas was known for it’s outdoor activities and mild weather!

A great story indeed. Thank you sharing that you don’t need to earn enormous sums of money and can enjoy life while getting to financial security on your own terms.

Hey there! Thanks for your comments! I hope it inspires others.

My husband and I met rock climbing on the edge of Hill Country. A lot of our early time together was camping and rock climbing (outside, not inside). The heat here never seemed worse than along the mid-Atlantic where I grew up, but it lingers much longer – typically April/May to October. I would say the best times of the year here are from mid-October until April/May.

I like the comment, “Avoid lifestyle creep, especially early on.”

This is very important for wealth building and maintenance.

Thanks for sharing!