If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in September.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 53 and my wife is 56.

We have been married for 14 years and it is the second marriage for the both of us.

Divorce is not great for anyone’s finances — I gave 50% away and my wife walked away with nothing (her choice).

At the end of the we are blessed to have found each other. We spent the first four years of our marriage living in separate states as we wanted her daughter to complete high school in her home state and be near her father. Once she completed high school we sold my wife’s house and moved her to the mid-west.

Do you have kids/family (if so, how old are they)?

My wife has a daughter from her previous marriage and she is 29 years old and has been married for five years. She and her husband have 4 dogs and are in the process of adopting a child from Thailand. They live 5 hours away from us which makes it convenient to visit.

Our family is spread around the mid-west, east and south-east. We spend a good deal of time in the airport.

What area of the country do you live in (and urban or rural)?

We are located in a suburb in the mid-west outside of a major city.

What is your current net worth?

$2.2 million.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

- Home: $670,000

- HSA: $37,000

- Cash: $87,000

- Assets (jewelry, vintage instruments): $45,000

- 401k: $1,106,800 includes 401ks, IRA, Pension and bonds

- Stocks: $80,000 company stock

EARN

What is your job?

I am director for a food company for the same company the past 19 years.

My wife is an assistant for a chemical company for the past 23 years at the same company.

What is your annual income?

Me: $157,000 plus eligible for ~10% annual bonus only paid if the company meets financial milestones.

Wife: $65,000

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

We decided to start with the year we got married 2007. It is interesting to see the slight increases of income over the years. Since we did not change companies during this time there were no major changes. I did have one promotion in title and pay but the job duties did not change.

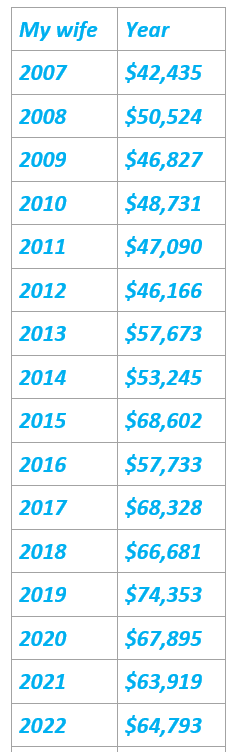

My wife: She started with current employer in 2000 with some years there were no pay increase due to company performance. Since 2007 she had a low of $42,435 and current at $64,793 she is an hourly employee and does spend about 45-47 hours per week.

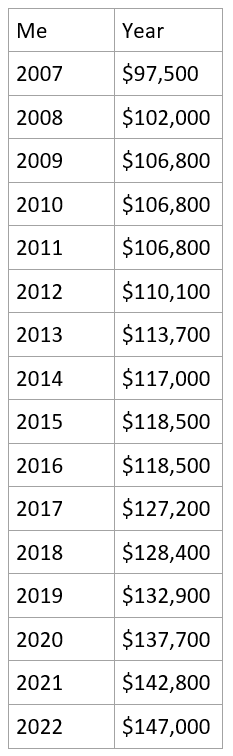

Myself: I have been with my current employer since 2004. I have seen a pay increase each year and have been eligible for an annual bonus of ~10%.

In 2007 I was at $97,500 and currently at $127,200. We never count on a bonus and when it does arrive we use to fund my 401k, churches and non-profits we support. In the event we did not get a bonus that funding would come out of our account.

What tips do you have for others who want to grow their career-related income?

We are not the best people to answer that but have seen many peers move from company to company chasing titles and salary increase. We both like what we do and like working for the companies we are with, factors citing why we are at our jobs for so long is that we like our co-workers and types of products we manufacture.

Yes, there are other companies out there but the grass might not be greener on the other side.

What has worked best for us is to work hard, learn and keep a positive attitude.

What’s your work-life balance look like?

When we are home we work 10 plus hour days, 5 days per week.

Since we have no family in the area we spend the bulk of our time working.

We do take time out for church and our side gig income.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

A few years ago we decided to sell some things on FBMP to declutter the house and found that some of our stuff is worth some money. I started to watch YouTube and got hooked on going to thrift stores, yard sales to find things to flip.

My wife has her platform and I have two platforms of which I found that there was a great market for used golf clubs. Between the last two years we made ~$10,000 off of our reselling.

SAVE

What is your annual spending?

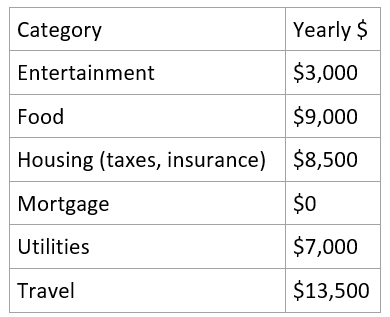

This past year we spent about $90,000 and an additional $24,000 for our mortgage.

This is including all aspects of house maintenance, travel, and purchases for our side business. Now that we have paid off our house we will use the money to fund our investment accounts.

We need to determine if we are going to maintain the side business as I have my days wondering if I want to continue. We keep the business sales money in a separate account and transfer the cash as my wife sees fit.

What are the main categories (expenses) this spending breaks into?

We do not track each dollar we spend but based on our credit card statement and our top spend categories per our bill paying account.

Do you have a budget? If so, how do you implement it?

No budget.

We know we need to talk to each other about spending money outside the normal categories of food and gas. It may sound restrictive but we want to be wise with our money and spend our hard earned cash.

What percentage of your gross income do you save and how has that changed over time?

Since we have been married on average we’ve saved 35-40% of our gross income. Now that we have no debt we can fully fund our retirement and HSA account.

My wife: retirement contribution is an average 35-40% and a max of 50% of her income. It does not leave much afterwards but we do live on my income. Her investment focus is on her company stock and a moderate aggressive fund.

Myself: I am contributing 15% of income in a moderate aggressive fund that focuses on US and non-US funds, bonds and cash.

What’s your best tip for saving (accumulating) money?

Live below your means.

We can say that now we have been married for 14 years but living together for 11 years. My wife was living on the east coast with her daughter so that she could be near her father and finish high school. Since my wife joined me in the mid-west we went down to one car (she works from home), paid all bills off my salary and saved her salary to pay for two new cars and wedding with cash.

What’s your best tip for spending less money?

Don’t think about what the Jones’ are spending money on. Put your nose down and see how you can improve on not spending.

We source a lot of our house from garage sales, thrift stores and cook at home, and packing lunch for work. Additionally we have just one car for the past 12 years as my wife works from home with no need to leave during working hours.

What is your favorite thing to spend money on/your secret splurge?

Travel. As stated our family is spread out so we are fly about twice a month to Florida (especially in the winter). I know this is not a popular option but we use our airline credit card to achieve companion status so I fly free with my wife. Our credit card is paid off each month.

Along with travel we do have a Disney annual pass and have had it the past 12 years. It may seem like a waste of money to some people but we do enjoy the warm weather and to get away from work life. We do have a Disney time share which we bought in 2008 and paid it off in 2012. We have a small HOA feel that we pay each year.

INVEST

What is your investment philosophy/plan?

We like aggressive funds, company stock and this past year we put money in an I- bond.

What has been your best investment?

This is easy to answer. Marrying my current wife. We are on the same page when I comes to money and priorities.

My second best investment was myself. I was encouraged to get a college degree during my first marriage and to be honest it took me ten years (on and off) with student loans and abuse of credit cards.

When I was deciding on which degree I wanted to pursue I contacted a friend who had the degree and he said “coming out of college you will have multiple job offers and always have a job since everyone needs to eat and the food industry is the best place to be”. My friend wasn’t wrong. It has treated me and my family well.

My wife says that I was her best investment. 🙂

What has been your worst investment?

I don’t know if I had a bad investment but I have made some bad decisions with my life like cashing out a few mutual funds after my divorce and some over spending. I can’t say my first marriage was a bad investment as it led me to my beautiful bride and career.

My wife stated that when we leased two of our cars it was a bad move and wished we had just bought a car and forget the “flease”. We learn a lot from our mistakes — not to say that it doesn’t work for others.

What’s been your overall return?

We have not tracked that until recently and from what I can remember we around an 8% return.

How often do you monitor/review your portfolio?

Over the past few years we sat down together on a quarterly basis and looked at our investments and where we were.

We moved to our current house 4 years ago right before the pandemic and it was at that point that my wife took over all bill paying. She started to make double and triple house payments and before we knew it we paid off the house in less than 4 years.

With that weight off of our shoulders we can now focus on maxing out our investments.

I didn’t feel that our lifestyle was affected during this time and now we have the relief that we are free and clear of debt.

NET WORTH

How did you accumulate your net worth?

No inheritance. We invested and saved our money.

We live off of my income and my wife put her income towards daughter’s two new cars, college tuition, wedding, and additional home payments.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Saving money.

While we have a small side income by flipping items it is not a large number.

We are starting to dig in and push more money towards our 401k and HSA.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

Divorce was our bump but we are not complaining as we are with the person we are supposed to be with.

Our finances are doing great despite learning and growing on how handle money (more me than my wife).

What are you currently doing to maintain/grow your net worth?

With being out of debt we can now max out our 401K, Roth and HSA accounts.

We had always taken advantage of our company matching funds at 100% at 3% and 4%.

Do you have a target net worth you are trying to attain?

We are aiming for $4 million and will see how we feel about that amount once we reach it.

I would like to retire any day now but I am reminded by my wife that healthcare cost is a concern. At this time I will work until 63 (maybe).

How old were you when you made your first million and have you had any significant behavior shifts since then?

We don’t recall when we made our first million — we think it was in 2019.

No changes were made. We recently paid off our home in 2023 and can fully fund our 401k and HSA

What personal habits and/or traits have you developed that have made you successful at growing your net worth?

Living below our means.

We see peers that take on debit by making bad decisions either by buying new cars, trucks or campers. Additionally friends that eat out 2-3 times a day plus vacation beyond their budget. Since we travel so much we do take a lunch with us when fly since our airport only has a couple of food options and they are not that great.

What money mistakes have you made along the way that others can learn from?

Don’t cash out your retirement.

It was a good idea at the time and helped me with my financial goals but 16 years later I am wondering where it would have ended up if I had not done that.

What advice do you have for ESI Money readers on how to become wealthy?

Don’t cash out the small mutual funds and take advantage of company matching funds.

We always review how we spend our money and if we can do it cheaper more than likely we will.

FUTURE

What are your plans for the future regarding lifestyle?

We are going to keep working until we hit our financial goal and see how we feel about work.

I am going to look into starting another side gig where I create a digital product and is printed on demand for the customer.

What are your retirement plans?

Our minimum savings goal of 4 million. We have not decided where we will live once we stop work. We like our location where we are as the airport is 20 minutes away. But I like the idea of living in Florida near our family.

My wife is on a similar page but with our daughter living in the mid-west we might miss out bonding with our future grandchildren.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Healthcare.

We have not investigated any options at this time but have friends that use a community based healthcare program that offers low premiums.

At this time we will max out my HSA and see how we can grow the balance.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

My wife’s family had a few businesses while she was growing up and she worked on and off at two of them while in high school and as an adult. My wife enjoys working with numbers and makes sense as she spent 10 years of her career as a bank manager on the east coast. While she offered advice to her family about how to better run the businesses, they did not always follow her advice. As frustrating as that is we see the effects of those decisions with her parents 30 plus years later where they regret their poor decisions. My wife’s financial click was at 15 years old.

I had my first loan when I was 13 years old where I bought 3 milking cows and blended them in with the family herd. I paid off my loan in whatever the term was and continued to buy milking cows as I had money. My brother was nice enough to pay for our portion of the feed and we worked long and hard to receive our milk check every month as our salary. I saved quite a bit of my money but when I left home for college I forgot everything I knew and opened credit cards, student loans, etc.. I had a lot of debt. My financial click was 32 years old.

Who inspired you to excel in life? Who are your heroes?

Financially: I wouldn’t say I have a hero as we grew up poor farmers and struggled with cash flow and that transferred with me as I grew up — money would leave my hands soon after I got it or I charged up my cards.

I took Dave Ramsey in the early 2000’s and some of his theory stayed with me.

My wife and I work well together when it comes to financial goals so I would say my wife has been the best influence on me.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

Dave Ramsey: I have been through his course, read a few of his books and listen to his YouTube series when I get a chance. We do not follow each of his principals but we like the basis of Dave and he is entertaining.

We like to collect books and read them when we get a chance. I became interested in finance once I started to make more money and found Free Money Finance devouring each article. This was around the time I took Ramsey’s course. It is motivating to us to read about people’s financial situation and learn from their errors and success.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

Yes, we do support a non-profit for veterans and give to the church we attend.

On average we give at least 10%.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

Yes, if we have any money left it will go to our daughter.

“I can’t say my first marriage was a bad investment as it led me to my beautiful bride and career.”

This is puzzling to me. There must be more here. Congrats on finding “the one.”

I know of a person in my past who ended up in divorce (a sight impaired person could see it coming). So glad I dodged that bullet. My first (and only) marriage remains a solid return on investment after many decades.

Thanks Maverick.

I can see that. It was a bad for my mental well being and to compare myself to who I am today is very different.

Another great story. It just goes to show your resilience in after an abrupt life change, how you still managed to find someone with similar values to you and live a fulfilling life, coming back up with a $2 million net worth before 60! You mentioned pension as one of your net worth elements. That’s something I haven’t seen recently in speaking with friends and looking at job benefits. Glad to see they still exist.

Thank you Financial Fives!

We are happy to take the pension when it is time. Quite a few years ago my wife’s company stopped offering the pension to new hires.

Great article! Good job in making up for loss time/income from the divorce. Having rebounded from a divorce myself, it takes a while to make up for the financial losses. Glad you found someone who shares your interests and passion for investing.

Thank you SMB116!

I am not disagreeing with how my wife is guiding us on a good path. If she had not pulled me back on track we might have a few extra cars in the garage…

I like your comment, “We do take time out for church and our side gig income.” This has been great for my wife and I as well in directing us to the One who absolutely changed our lives for the better! Selling our gently-used items on Poshmark and Ebay have also given us a few extra dollars here or there to give more to ministry and enjoy activities we like.

Thanks for sharing your story!

Thank you MI 343

It is amazing how these two activities affect our lives and marriage for the better. I have days where I want to get out of the reselling business but then I find an item that changes my mind that I stay in and hunt for the next great thing.

Great work! To persevere and excel after the divorce is very impressive.

Congrats on paying off your mortgage, I cannot wait for that day to come!

Love the side gig idea. That’s a great amount of extra income!