Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in December.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 32 and my husband is 40.

We’ve been together for 6 years and married for 2 years.

Do you have kids/family (if so, how old are they)?

We don’t have any kids and aren’t planning on any.

I look forward to helping to raise our friend’s kids and being an active part of a community with kids, but we don’t have the desire to have any of our own.

What area of the country do you live in (and urban or rural)?

Right now we live in a very high cost of living west coast city, but we’re eager to move closer to our family who are all east of the Mississippi.

We’re already scoping out the potential areas to see what best fits our needs for when we’re ready to move in a couple of years.

What is your current net worth?

We’ve just crossed $1.0M of invested assets earlier this year, while it’s fantastic to have hit this threshold, it’s just one rung on the ladder and we’re looking forward to continued growth.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

The following are approximations captured in November 2023:

- Cash: $45k

- Taxable Investments: $300k

- Tax Deferred Investments: $700k

- Debt: $0

We’re accumulating cash over the next few months in order to give us the option of purchasing a lot of land that we might one day build home on or to invest in real-estate syndications if we decide not to purchase the land.

EARN

What is your job?

My husband and I can both be described as mid-level management at hardware tech start-ups. We’re working full time and for the most part it’s an office job.

We both started our careers as hardware test engineers for the military before moving to private industry to increase our earnings. My work now is to develop the program level testing strategy for the next 1-5 years while my husband is at a different company building a team to be able to execute hardware testing.

What is your annual income?

Last year we made $500k before taxes, and that’s our projected average income for the next five years as well with some fluctuations year-by-year based on company shifts and long term bonus payouts.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

In my first job during high school I was making $7.25 an hour and the only raise I received was a bump to $7.50 when the state minimum wage went up. I was part of the staff of a local flight school and it was my job to check general aviation rental aircraft in and out of the system and ensure everything was fueled and ready to go between flights. I also taught ballet classes for a small sum per class, small enough that I can’t even recall what it was.

I worked for my college’s rapid prototyping lab making $15 an hour which was a step up in pay, but I didn’t get a lot of hours. I also had a college internship that paid me a GS4 level salary which isn’t much, but was a lot for me at the time. This is when I learned that, even when you’re making a lot more than you’re used to, money can also be spent a lot faster than you might expect. I made ~$10k in 5 months and saved almost none of it. When I realized that at the end of my internship I was gutted and resolved to do better in the future.

The first real job of my career, I was making ~$65k a year which was solid but with payments on student loans it still took me several months to have the equivalent of 1 month of rent saved up and I was only putting enough in my 401k to get the employer matching.

Over the next 4 years, through a series of saying yes to opportunities that others weren’t interested in and taking on more responsibility and challenging roles my salary grew to ~$99k. I was living comfortably but I wasn’t getting dramatically ahead on savings.

I decided to leave my government job because I’d reached the only role that I wanted to have at that location and had done it long enough that I was starting to get bored. I didn’t want to spend the next 30 years doing just that role for my entire career. It also wasn’t a pleasant place to live and most of my close friends had moved away for various reasons. I was ready to move on, and while that decision dramatically increased my salary, that wasn’t the primary reason for the change.

My career experience was fairly niche, so I was lucky to find a start-up that was reaching a phase that valued that exact experience and was willing to pay me almost 3x my government salary. My new total comp included a base salary, bonus structure, and a stipend for being deployed overseas for consecutive months – not to mention, a much nicer area to live in.

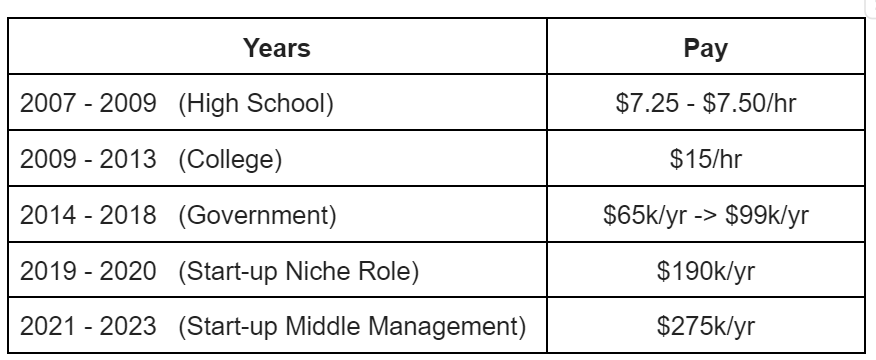

I include the table below to give a concise snapshot of the discrete jumps that a salary can take when you search out new opportunities, because it still blows my mind how much my salary has grown. From reading other millionaire interviews, I know my situation is not abnormal but when I reflect on where I am from where I started it still doesn’t seem real.

What tips do you have for others who want to grow their career-related income?

Say yes to opportunities that are offered, even if you don’t feel qualified. Taking on more responsibility that my coworkers thought I was a good fit for but that I wouldn’t have deemed myself ready for has led to some of the biggest steps in my salary growth.

Additionally, have an idea of what you want to do next and be vocal about wanting to get the training and experience necessary to set yourself up to make those changes.

What’s your work-life balance look like?

The hours-per-day and work location of my job varies depending on whether there’s ongoing test activities or other on-site, team-dependent, work to do. Last year I only worked ~20 hrs per week and primarily from home because the program wasn’t very demanding. This year I’m working much closer to a typical full time job and I’m in the office or at a test location about half of the time.

My working hours are really flexible, nobody worries about my daily start or end time and generally I’m working less than full-time and that’s fine as long as I’m getting done what is expected of me. I love this arrangement and take full advantage of it. I can take appointments (dr., dentist, etc.) during working hours, I can flex my time around my husband’s schedule, and I have had enough free time to complete multiple pilot ratings.

I am also fairly strict with myself about not checking work accounts once I decide I’ve stopped working for the day. I found out a few years ago that noticing an e-mail or a message, even if it didn’t have to be responded to right away, would derail my personal time. My company has employees in nearly every time zone, so there’s new messages coming in around the clock.

I took it upon myself to fully segregate my work and personal accounts so that I don’t get distracted by off-hours notifications. Just that little change made a huge difference to my mental health when I was regularly feeling overwhelmed and stressed by work.

I acknowledge that this is a very privileged position to be in. I am paid well and still able to knock off early for personal hobbies or take a couple of weeks off at a time for a vacation. It makes continuing to work for a company instead of myself reasonably tolerable, at least for a couple more years.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

Right now we don’t have any additional income sources but I expect that to change next year.

I just finished my certified flight instructor rating, which allows me to earn income teaching new pilots. I’ll do this part-time while maintaining my full-time job and plan to continue to instruct part-time after we retire.

SAVE

What is your annual spending?

Our spending has varied widely over the past few years because we decided to build our own airplane and we went all out to make it exactly what we wanted.

We don’t plan to continue the “building a plane” level of spending into retirement so I track our spending into two categories – expenses we expect to have after we retire and expenses that are not expected to continue.

For the expenses that we plan to continue, they’ve been ~$100k per year for the past two years.

What are the main categories (expenses) this spending breaks into?

For 2023:

- 25% – Rent

- 25% – Flying

- 15% – Discretionary

- 10% – Travel

- 5% – Groceries

- 20% – Other (Medical, Gas, Insurance, Automotive, etc.)

Do you have a budget? If so, how do you implement it?

We have an annual spending target of $100k a year, which we break down into monthly spending to see if we’re over-spending at any point throughout the year.

We don’t have a budget that we try to keep to each category per month.

As long as we’re not overspending annually I don’t want to micromanage how we spend our money month to month.

What percentage of your gross income do you save and how has that changed over time?

This year, we will save ~64% of our gross income.

While we were building the plane the savings rate was ~25%.

By the time we retire, I expect our savings rate to be close to ~80%.

Our income is expected to increase every year but we don’t expect our spending to increase much if at all.

What’s your best tip for saving (accumulating) money?

I have had success in making the growth of my savings accounts a game or challenge for myself. I make a forecast of how much I plan to save and what the end balance of my savings account will be and see if I can beat that.

I also get a feeling of deep satisfaction seeing larger and larger account balances as my savings and investments grow, enjoying that feeling motivates me to save more instead of spend.

What’s your best tip for spending less money?

Keep a regular eye on your spending, you don’t need to micromanage the categories but make sure that you aren’t regularly exceeding whatever target that you set for yourself.

It’s very easy to fall into a habit of buying just a little extra each month and way overspending for the year.

Overall, I try to think through each purchase of how that thing or experience will bring value to my day and not just clutter to my house.

What is your favorite thing to spend money on/your secret splurge?

Our splurge isn’t a secret, it’s a very conscious choice for us. Flying is an expensive hobby, and while I’ve reached the point where I can earn money now by instructing, we also still fly for fun.

Now that we’re done building and are flying our plane regularly for fun, it costs a couple thousand a month to keep maintained and to buy the fuel to operate. We expect that to be fairly stable and to be offset in the future with my instructing income.

INVEST

What is your investment philosophy/plan?

I invest as lazily as possible, I don’t believe that I can game the system and just want to see growth for as little time investment as I can.

We’re generally invested in market ETFs and letting that ride for as long as possible. So far that’s done well, but we are looking to start investing in real estate syndications as well.

What has been your best investment?

My best investment has been in the ETFs in both my 401k account and brokerage accounts.

What has been your worst investment?

My worst investment was buying individual marijuana stocks.

I bought the stock when everyone expected the industry to be nationally legalized in the US instead of just legal in a few states. It has since lost 90% of its value, but I keep it to remind myself not to join bandwagons and to just keep investing in the market.

What’s been your overall return?

The overall return of all my ETF accounts is ~20% today.

It is enough for me to know that my money is growing with the market, I’m not too concerned with tracking that growth closely or maximizing it.

How often do you monitor/review your portfolio?

I don’t review the portfolio often, I’m happy that it’s generally invested in the SPY. I do update a tracker of our balances and expenses at least twice a month.

I’m actually somewhat addicted to updating my tracking spreadsheet. Playing with potential scenarios for when we quit or how much we make after retiring. I look at it on the side during particularly frustrating meetings at work to remind myself that I have an exit plan, even though I can’t execute it today.

NET WORTH

How did you accumulate your net worth?

All of my net worth has been accumulated by saving what I earned through my various salaried jobs. When I wasn’t making a lot, I was still contributing to a 401K enough to get the employer matching.

Once my salary spiked, I was fully funding the 401k and then saving the excess into a brokerage account.

Consistency in that habit and the market have done the rest.

I wish I had known about the magic of Roth IRAs before I earned too much to qualify for them. I should have been saving more during my jobs in high school and college, but I didn’t know about them and didn’t have a mentor to educate me.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

I am a motivated saver, seeing our savings rate increase is a driver of my behavior – sometimes to my husband’s frustration.

I feel average about my earning and investing skills. I have grown my earning potential, but not to crazy heights. My saving strategy is simple and mostly passive, though it is doing well for me.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

Building the plane was a road bump to my original plan of growing my net worth. It was expensive and prevented me from being able to save as much for a couple of years.

However, road-bump is a really harsh term for it. Flying has been a lifelong passion for me, getting to build our own plane with my husband was an experience of a lifetime and I have no regrets about doing it.

What are you currently doing to maintain/grow your net worth?

We are earning, saving, and investing as much as possible. I make a target at the beginning of each year to help us see whether we’re on track or not.

Developing our ability to earn money through self-employment that we enjoy after we quit our corporate jobs is also a priority during this phase. Becoming a flight instructor is one of the ways I intend to minimize how much we need to draw down our net worth and do something that I enjoy in “retirement”.

Do you have a target net worth you are trying to attain?

~$2.5 million would be a comfortable number for us. The real variability is how much we need to spend on our future home, whether that is financed or paid for outright.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I made my first million at 32 years old, just 6 months before writing this interview.

I haven’t changed any behaviors since our target next worth is still a ways off.

What personal habits and/or traits have you developed that have made you successful at growing your net worth?

I think self-discipline is the biggest factor along with being strongly motivated to reach a future state.

I am disciplined in how I distribute my money as it comes in between paying down debt (back when I had that) and saving. I am also disciplined in always paying off credit cards and never carrying a balance.

I am motivated to reach a net worth that allows me to work for myself or not work at all, financial independence. A future where I don’t have to deal with office politics or answer to a boss is what I’m working towards. Flight instructors don’t make a lot of money, so I want to have enough to not have to worry about how much I make and just enjoy the experience of teaching people to fly.

What money mistakes have you made along the way that others can learn from?

Don’t buy individual stocks.

It’s just not worth it, you are much more likely to succeed buying the market as a whole.

What advice do you have for ESI Money readers on how to become wealthy?

Figure out your priorities and make a plan that supports them.

Changes will disrupt the original plan and you’ll have to make adjustments, but without any plan you can easily drift through life spending money on things that don’t really support what you want in the long-run.

FUTURE

What are your plans for the future regarding lifestyle?

I am counting down the months until we can retire early.

I started from a net worth of almost $0 five years ago and have a few more years to go still, but I have been eager to retire from the mainstream corporate career and build a life of various experiences since I first learned about the FIRE movement.

What are your retirement plans?

We’re saving and investing to have enough to be able to live off the passive growth of our investments.

We are also planning to have “hobby jobs” as we call them to offset our expenses and keep ourselves engaged, such as flight instructing. Ideally these are jobs where we can work as much or as little as we want based on how many clients we pick up or what else we want to be doing with our time.

We want to be able to travel slowly, there are a lot of places that we’ve never been that aren’t so expensive to visit if you plan to spend an extended amount of time there. I also want to be able to spend time with friends and family who are scattered around the country, which is hard to do when I’m locked into a job.

Lastly, I want to change up what I do and try different things, also hard to do with a standard day-job.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

I don’t have a very solid plan for healthcare in retirement, but there are enough options arising for people outside the standard “employer healthcare” system that I’m not worried enough to be stressed about finding that solution today.

I’ll deal with that closer to our retirement date.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

It clicked for me in college, I didn’t like the feeling of worrying about whether my bank account had enough in it to cover my weekly expenses. This kicked off my original motivation to grow my savings account.

After college, I started learning from my peers who seemed to have long-term plans for their money and I vaguely started thinking about saving for retirement, just enough to get the 401k employer matching as a priority.

Once I moved to the start-up realm it really clicked. I learned about the FIRE movement and found various blogs that encouraged me to really focus on saving and investing. Once I had a projection for how long it would take to be financially independent I became focused on achieving it.

Who inspired you to excel in life? Who are your heroes?

My dad inspired me to excel at school and work. He encouraged my interest in aviation and funded my private pilot’s license – which kickstarted my primary career as an aerospace engineer and my future career as a flight instructor.

My financial hero is MI 373, he opened my eyes to the possibility of breaking out of the cycle of working until I was 60 and has been my sounding board for my financial plans whenever I needed it. Having someone that you trust to talk to about the realities of your current financial state and plans for the future is invaluable.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

I haven’t read any money books but I have devoured the Mr. Money Mustache, ESI, and Mad Fientist money blogs.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

We do but not with consistency.

Volunteering our time in retirement is something we’re looking forward to doing.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

Neither of us have blood-relative heirs, so we are not planning to have an inheritance to leave.

Whatever is left will go to our closest friend’s children to help them in whatever way we can.

I’m 57 and learn so much from you FIRE guys. You’re amazing – as is your reference to the other millionaire from late last year. It’s so cool to see a culture built around working less and “dropping out “ with money and options ! Dropping out is an old term that usually meant ski bumming with little money. I chose “greed is good” route , always longing to escape to be a ski bum. I was trapped under my work. It was usually one or the other. You guys get the best of both and it’s fantastic !

I’d set a goal to “turn it off “ at 48 and let my business continue to run without me. I made it and started another passive business for fun.

The point is , I wish I’d had the support that you guys all offer one-another. It’s a great culture of accountability and I love your comment about “gaming” your savings ! Me too. Makes it fun and the money is a by-product.

Sky is the limit for you both. Enjoy the intentional lives that you’ve created. Keep creating !

Always encouraging to hear from the 30-somethings in these interviews. As one myself, it’s nice to learn various ways to increase income in your career or live a life that you enjoy fully without conforming to societal pressures. Flying sounds like such a blast and a great use of conscious spending.

High five to 30 somethings! I hope we can inspire others in our age group and younger to reconsider their assumptions about money management too.

Great interview.

“I wish I had known about the magic of Roth IRAs before I earned too much to qualify for them. ”

You can still contribute using a Backdoor Roth IRA. It is super easy and most brokerages are set up to handle it almost automatically now.

2 questions for the poster:

1. At age 32 are you 100% definitive on not having kids? I know feelings on this can change over time, particularly when relatives begin to pass away.

2. What if your feelings do change after early retiring?

1. I’m as sure as I can be. Most of my life I have dreaded the idea of having to be pregnant and parent young kids but I thought I’d have to do it “for my partner”. First of all, looking back that’s not a good reason to have a kid. Second, when my husband and I started dating and I realized that he didn’t want kids either, it was huge relief to me – like a burden being lifted. I’m grateful every day to kid free, so I’m pretty sure.

2. If it means enough to me that I change my mind, then I’m sure I’d find a way to make a kid fit into the future. I’ve succeeded at recognizing and pursuing my priorities so far in my life, I doubt that change in priority would be any different.

General Aviation and experimental aircraft … I’m surprised I haven’t seen this flying passion in an interview before. Thought I might be the first, but you beat me to it!

I have to ask … what did you build?

Congratulations, clear skies, and tailwinds to you.

Thank you for the kind words! It is really lovely to see the community here and I’m glad you’ve found the support now.

We built an RV7! I’ve been wondering if aviation is just too expensive of a hobby too lend itself to early retirement. I’m glad to hear we’re not the only ones.

Awesome! I have a few ribs for a Skybolt biplane built. See you at Oshkosh, but I won’t be there the whole week because I’m not retired yet. Most likely next year though …

First million is the hardest. I’m years ahead in age but followed a similar trajectory. We ended up having kids and ran into other obstacles but are still able to FatFire now if we want to. Barring a total collapse in our economy, I predict you two will be ready to FIRE just as you plan. Best of luck!