Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in December.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

My wife and I are both 39 years old.

We met way back when we were 12. We were never close friends then. We lost touch throughout college and for a few years afterwards.

We reconnected again in our hometown at a hole in the wall restaurant. We celebrated our 10 year wedding anniversary this year!

Do you have kids/family (if so, how old are they)?

We have two daughters ages 6 and 1.

We also have 2 dogs. Caring for so many small creatures keeps us very busy.

Our older daughter goes to private school and the younger is in day care as we both work full time. Our older daughter is at the age where she is trying out every sport/activity imaginable to see what she likes. Martial arts and soccer seem to be leading at the moment, but nothing has really stuck just yet.

What area of the country do you live in (and urban or rural)?

We live in a sort of an in-between area in the Northeastern US.

We are 10-15 minutes outside of the nearest city, which is in the middle of the pack in the state. While there is plenty to do, we still have to head to a much bigger city for quite a few things.

I spent a decade living in the largest city in my state and I enjoyed some of it as a young person, but I don’t have any intention of moving back to a city full time, especially while our kids are young.

What is your current net worth?

Our current net worth is $1.5 million.

It has been a very interesting journey to this point, and I feel like we have 6-8 years before we reach FI if we continue at our current pace.

The first time our NW was estimated, it was done by our bank when we bought our home. This was in 2015 and they said our NW was about 142k. I still have the hand written note on the side of one of our application forms.

At the time, I had no idea what that number represented.

The first time I calculated our net worth was mid-year in 2018 and it came in around 325k. After that, I started tracking regularly and optimizing our finances.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Our NW can be broken down as follows:

Assets

- Cash – 50k

- Taxable accounts – 252k

- Tax deferred accounts – 648k

- Roth balances – 149k

- Real estate – 550k (estimated)

- Other assets – 130k This includes investments in private businesses, cars, life insurance, etc

- 529 account – 35k

- Health savings account – 6k

Debt

- Primary mortgage – 211k @ 2.625%

- Rental property – 94k @ 3.875%

- Student loans – 13k

We are both fine with having debt, especially at these rates, so we don’t have any plans to pay down ahead of schedule.

EARN

What is your job?

I work for a small company as a sales/business manager. I have a sales team that reports to me and I report to the owner of the company.

Because it is a small company, the number of hats I wear seems to keep on growing — product development, marketing, purchasing, logistics, technical service, sales, etc. etc. etc.

My wife works for a large university hospital system, but outside of direct health care.

What is your annual income?

My base salary is 150k, my wife’s is 110k.

I receive an annual bonus based on company performance. This year my bonus was 150k.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

My earning history is shown below.

My wife graduated with her PhD in 2012 and has grown her salary from 66k at her first job to the current 110k.

I started working when I was 12 years old washing dishes at a friend’s family restaurant. A few of us would clean up after parties and wash dishes while listening to music and split $20 and a pizza at the end of the night. We made a few bucks and more importantly, stayed out of trouble.

My first real job was cleaning tables and later waiting tables at a different place when I turned 16. I worked at that restaurant until I was 17 and just about to leave for college. During my time there, I saved every single paycheck I received, only spending tip money, which was about a 50/50 split. The first time I took any money out of my account was to buy a car stereo and speakers.

In college, I worked factory jobs in the summer and grinding through 12 hour night shifts made me 100% certain that I needed a white collar job. I spent everything I made during the summers on food, beer, and entertainment.

During college, I worked at a local gym, continuing my spending spree while also discovering that credit cards let me spend more than I was making.

My professional career has seen me work at 3 different companies all in the same field: chemicals, and all in the same market: agriculture.

I started my career off in R&D with a significant disadvantage. I spent far too much time having fun and far too little time studying and learning how to be an adult during my 4 years of college.

I couldn’t find a permanent, full-time gig coming out of school so I decided to take a job as a temporary lab technician until I got my feet underneath me and caught up to my peers. I turned myself into the model student/employee and was able to pull a full-time job after 6 months.

I learned everything I could from anyone who was willing to teach me anything. I never turned down a task, I always made sure my bosses looked great, and I looked to do all of the little things that everyone else hated doing but needed to be done. A few of the particularly hated jobs were managing lab inventory, washing all of the glassware, ordering supplies, safety inspections, and lab waste cleanup.

Management noticed and kept giving me more things to do. I worked like crazy for 3 years and at the end of that time, I was managing as many projects as any of the 100ish people who worked on my site. My pay did not grow as fast as my responsibilities, and I started interviewing to leave.

As this was happening, my business unit got a new boss who asked me to take a different role which made about half of my job supporting the sales team. With it, I got my first decent raise and firm slap in the back of the head. I was still way too nervous talking to people I didn’t know and actually found myself practicing conversations before making phone calls.

I haven’t mentioned this before, but I’m perfectly ok being alone with my thoughts (which are few) and spending most of my day in silence. I didn’t realize it, but this role set me on a completely different career path.

After a few years in this role, I realized that I had to pivot in my career if I wanted to maximize my potential. It turns out I can get a lot of stuff done because of hard work, but I’m not a talented scientist. I started to get much more interested in how our business worked, so I started taking business classes at a local community college in prep for leaving work to get an MBA.

I talked to my boss about the company paying for it as they had for him, but it never really got very far. My boss told me shortly thereafter that he was leaving the company to go out on his own and one of his last efforts before leaving was to push for me to get a transfer to a business role.

I graduated to a junior sales role looking after the accounts that nobody wanted and didn’t expect to grow. It came with a >30% salary increase and a company car. I was absolutely thrilled at the time thinking that it can’t get much better than this.

I was pretty bad at first, because I’m not naturally outgoing and I had sales people 30 years older than me telling me there was only one way to do things. Their way was all about dinners, drinking, and “smooth talking”. I could only do one of those things “well”, so I felt lost and inadequate. I spent several days at home face down on my bed when not traveling to see customers wondering how long it would take to get fired.

As with many things since, my wife and one of my customers helped snap me out of it and start focusing on being myself. I found my own way and it turns out that most of my customers just wanted me to make their lives easier. Nobody wants to deal with crises, so I kept them well informed, asked questions about what they were trying to do instead of trying to push my agenda, and everything worked out just fine. I gained a TON of confidence in public speaking and had some really successful years in sales.

I look back and can barely recognize the guy I was at the start of my career. It helped that during this time I got to spend a ton of time with my friend and career mentor as we worked together quite a bit. I also had a really bright boss (who loved me and helped to nearly double my compensation in 5 years).

I could have stayed with my company for an entire career. It was a really good place to work. I was liked by a lot of people, but I didn’t have any options. I couldn’t get promoted to director without moving and I did not have any desire to move. I made my case to my boss, to HR, and to anyone who would listen for about a year with no success, so I moved on.

My second employer was desperate for someone with my background and business contacts, and one of my former bosses was working there at the time. I knew they were desperate so I negotiated really hard to get a good raise for myself and over the course of a months-long process, I convinced them to give me what I wanted.

I resigned, started work and it was an absolute disaster from week #2. I had a boss who hated me and worked to undermine all my efforts to the CEO, a supplier who changed the rules on me multiple times before our contract start date, and sales people who were fired as soon as I got them trained on our products and introduced within the industry. I was gone in half a year. The final straw was an e-mail from my boss to myself and the CEO questioning my work ethic. I resigned immediately after that.

It shook my confidence for a bit because I had just left a job where I had already made my career to head to an absolute dumpster fire. I landed on my feet at my current company where a friend offered to give me a year as a consultant to try to help them expand their business geographically. I saw pretty quickly that it was a great opportunity and jumped right to it.

In the past 6 years, I’ve been able to run it as my own business with as much or as little help from the owner as I want. The first company I worked for was a global multinational, and the current company I work for had just a handful of people when I started. It is a totally different world and you are asked to do a lot, but the sense of satisfaction I get when we get big wins just can’t be compared.

I hope that I’m able to finish my career out at my current employer. Everyone there is like an extension of my family (I like them much better than some of my extended family).

What tips do you have for others who want to grow their career-related income?

I think that growing your career-related income is a relatively simple proposition in most cases:

- Rule #1: Do what your boss tells you to do. Do it without complaining. Do it well enough that they don’t ever have to question if it is going to get done right. Bonus if you can do extra things that you aren’t paid to do that bring some value.

- Rule #2: Once you master your job, start working on mastering the next job up or a different job. Skill building is essential to not getting stuck in career neutral.

- Rule #3: If you are stuck, unhappy, or bored start shopping for a new job. When you are unhappy, EVERYONE is going to know and feel the tension eventually.

- Rule #4: When in doubt, focus on things that bring in more money (revenue generating, or measurable cost savings). I was quite successful in R&D, but I realized that the company I worked for treated it as a cost center despite paying lip service to innovation. They valued (and PAID) the people who were customer facing and could bring in more money. I had an interest, yes, but it was also where I felt I would be best compensated.

What’s your work-life balance look like?

Today my work-life balance is pretty great. I make my own schedule and I don’t have to travel extensively. I will average between 35 and 40 hours a week.

The work is lumpy, so there are definitely days, weeks, and even months that are more hectic than others but it is all pretty easily manageable compared to my first company sales days where I spent 50+% of my time on the road visiting customers.

I love my coworkers, and everyone gets along quite well. That makes a huge difference to me as I find negativity completely draining.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

We have some rental income from a property that we bought in 2021. The income has been extraordinarily good for the first 3 years, but we haven’t had to turn the place over and we haven’t had to complete any major repairs. I’ve been able to do all of the repairs myself except for a minor roof repair while I was on vacation, and a some plumbing for the furnace.

In each of the first three years we collected over 20k in rents and our expenses were around 10k. I expect that 2024 will not be good. We have to repair or rebuild 2 porches which will likely cost at least 10k as I have no intention of doing it myself. Even so, that will be around 6k/year income from the property which isn’t bad for our first go at rentals.

We originally had a plan to purchase 5 similar properties, but then decided on a second child which has at least made us pause, if not rethink this strategy completely.

My wife also has a side gig that she started about a year ago. She is a consultant to a government agency and brings home about 15k/year from this. I don’t know if she will continue this side gig long term.

SAVE

What is your annual spending?

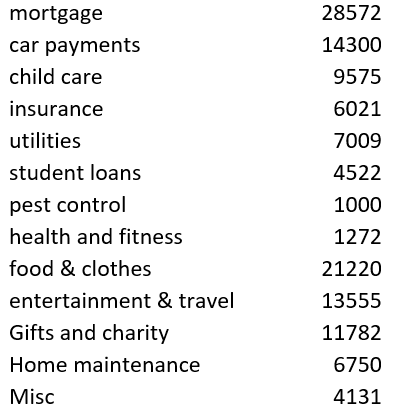

In 2022 we spent just under 130k.

I expect that when I run the numbers in 2023 that we will have spent around 145k as we didn’t change very much, but added another child and child care for part of the year.

The numbers below are for 2022 as this was complete and fully broken down.

What are the main categories (expenses) this spending breaks into?

Do you have a budget? If so, how do you implement it?

My wife and I have 100% combined our finances. We joined everything through a single checking account about 2 weeks after moving in together.

Being married for 10 years, we have learned a lot about each other. My focus on money and retirement can be a little bit intense compared to my wife, and she has often felt that I was judging her spending. I never felt like I was judging, but that doesn’t matter. I was doing something to make her uncomfortable and we worked to find a system that eliminated that feeling.

I would often ask about credit cards, account balances, and let her know when large amounts were coming into or going out of our accounts. She read into a lot of those conversations, when they were really just informational. I don’t do those things anymore and we don’t follow a traditional budget.

We have simply instituted an annual savings/debt reduction goal in the place of a budget. We set our goals in 5 year increments and have set out to add 100k to our net worth through savings, investments, and debt pay down each year.

When the 5 years are through, we will re-set based on our expected income. How we operate is as follows:

- We put savings and debt reduction are on auto-pilot through 401k max, and paying down of other debt on schedule. This usually comes to 70-75k/year.

- 30-50% of my annual income comes at the end of the year in the form of a performance based bonus, so we planned to save at least 25-30k/year on this. Our income has increased, so we usually have enough money for one major house project per year, gifting/donations, and still save more than our goal.

It is incredibly freeing for us to buy whatever we want, whenever we want until the money is gone month to month. I have also learned that we value very different things. I will give up a lot to buy myself time in the form of an early retirement. My wife will also give up a lot for this, but even more than this, she values our home as her comfort zone and wants to continue to update and improve it. I lived on the road for years, so anything is better than a hotel room and I find less value here.

Neither of us is wrong, we just value different things. We have found a way to make it work by releasing any of the stress of budgeting and discussing money. We both agreed on the plan, and we are doing our part to carry it out. We still discuss major purchases, but this has drifted into the 500-1000$ range lately.

What percentage of your gross income do you save and how has that changed over time?

I don’t have exact numbers on this for most years, but I’ll put them into ranges of savings & debt reduction:

- 2007-2012: 0-10%

- 2012-2017: 10-20%

- 2018-present: 20-35%

In 2023, We will have saved, invested, and paid down debt of about 170k in total. This is on total income of just over 440k. Seeing this, it makes me think that we should be revising our annual target for 2024 and beyond. The good news is at this rate we could likely shave a year or more from our retirement target date.

What’s your best tip for saving (accumulating) money?

I believe that you can’t or won’t spend what’s not there, so automatic deductions from payroll or auto transfers to savings and investment accounts are the way to go, particularly in years 5-15 of your career when you are likely able to make larger jumps in pay.

Setting it aside before you get used to spending it will set you up for much success.

What’s your best tip for spending less money?

I don’t have great advice here because I spend so much. We pay so little attention to spending that I’m sure we are fairly wasteful in this category. We are just lucky enough to have out-earned our spending desires.

If forced, I would say that learning to fix things yourself will save you a lot of money, making wise decisions on vehicles, and buying the smallest house you can fit in comfortably.

What is your favorite thing to spend money on/your secret splurge?

I spend money on 3 things: food, golf, and booze.

My wife and I both enjoy food. We can cook it ourselves (and usually do) or go out to eat, but we appreciate a good meal.

I don’t have enough time to play a lot of golf, but I plan to play as much as I am able once retired.

I like a good dark beer, and whiskey.

We are just too tired right now, with our small kids to want to travel extensively. I also traveled enough during my years in sales that I got a pretty good fill during that time. There are a few places that both of us want to go, but I don’t see us traveling much for the next 4-5 years. After that we will probably travel more, mostly internationally.

INVEST

What is your investment philosophy/plan?

As with most things in my life, I like to keep it simple. When I diverge from the path of simplicity, I tend to fail.

Because of this, I’m currently in the camp of S&P 500 or total market index funds for the majority of our investments. We have less than 5% of our NW in cash/bonds and I don’t intend to add to that total for the near future.

We own one rental property, and despite my original plan to get to ~10 doors for some income in retirement, I’m not sure I’ll continue on that path because I have seen how much of a time requirement it can be.

What has been your best investment?

I opened my first brokerage account and bought a handful of stocks in 2020 that turned out to be big winners, quickly. Tesla was probably the best.

It was pure luck and likely played against me because I had to learn my lesson by giving back most of those gains before I started converting everything to index funds.

Even so, it was small money. I always had half of the account in an S&P 500 index and that percentage should keep creeping up over time.

What has been your worst investment?

This one is a tie between whole life insurance that my wife and I both got suckered into in 2013-ish before either of us knew better (100% my fault despite being flat out lied to as I never read the paperwork) and buying 1200$ worth of paypal in late 2021.

I didn’t even have a reason for the second which makes it so much dumber.

What’s been your overall return?

Wouldn’t have the slightest clue on this one as most of our early investments were in 401k’s that got rolled over as we switched employers.

I’d guess 6%. Whatever it is, it is below market returns.

How often do you monitor/review your portfolio?

I will check account balances on a monthly basis and usually calculate NW quarterly.

I am considering moving the calculation of NW to 2x per year as I am not acting based on the result and have nothing to rebalance at the moment.

It is mostly just curiosity and the game of seeing NW move ever so slowly forward.

NET WORTH

How did you accumulate your net worth?

We accumulated our net worth by earning a lot and eventually shifting a large portion of those earnings into savings and investments.

I was clueless about money for the majority of my life until I woke up one day and found that I was making more money than I wanted to spend. This “magically” coincided with my relationship with my wife, so I’ll just throw it out there (though it is obvious) that she is the best thing that ever happened to me.

I had to figure out what to do with the money, so, like anyone else I looked to the internet. I found some early retirement blogs and leaving full-time work ASAP made sense to me, so I followed a few of them and found over time that virtually everyone in the crowd was marching to the same tune: spend less than you make, invest with a simple, inexpensive strategy consistently over a long period of time. Poof! You’re a millionaire.

After discovering the millionaire interview series, I was absolutely set on my path and started serious spreadsheeting to make it a reality. Earning a lot, and continuing to increase our earnings has overcome a lot of my bad habits and minor challenges.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Earning is our strength, 100%.

We spend more than we need to out of convenience and my investment history is riddled with judgement errors.

I have a firm belief, that no matter what happens I can always find a way to earn more money.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

We have actually had a host of professional “bad things” happen that have always turned out ok.

I left my first company where I was in great shape to become the youngest director at the company. I chose a miserable place, only to end up at a third company working with a second family and making even more money.

My wife left academia within a year of becoming a tenured professor because of the toxic work culture and chose a completely different career. She now makes 25% more and has a better work life balance.

With the help of Millionaire Money Mentors, we finally broke through the indecision to buy real estate and it has been a great investment. However, the indecision cost us at least 3 AWESOME purchases at incredibly low prices. Who could have known covid-19 was coming?

What are you currently doing to maintain/grow your net worth?

We are both still working, and intend to keep doing exactly what we are doing for the next 5 years. This means setting an annual savings target, putting as much as we can on autopilot, and finishing off the goal when annual bonuses come in.

My wife has taken on a side gig as a backup to her primary job and is considering opening up a consulting business with a friend of hers as an option to maintain income and leave full time work a bit earlier than our current plan.

Do you have a target net worth you are trying to attain?

We are working to get as close as possible to 5 million at 50.

Many of our expenses start to go away when we reach 50 as this is when our older daughter will get close to graduating from HS and our mortgage will be paid off. This should cut our expenses down quite a bit and allow for a very comfortable retirement.

How old were you when you made your first million and have you had any significant behavior shifts since then?

We crossed the 1M threshold in November 2021, at the age of 37.

We haven’t done anything drastically different since becoming millionaires, except maybe feel a bit more secure/validated with taking a step back at work.

My wife purposefully took a job that was a step or two down from what she is capable of in order to reduce work stress.

What personal habits and/or traits have you developed that have made you successful at growing your net worth?

I love to read and learn. This has helped me tremendously in making up for lost time in learning about personal finance.

Outside of this, there are two things that help me in terms of net worth building:

- My parents helped me to develop a strong work ethic. I had part time jobs from when I was a kid, and they both put on a work responsibility clinic for me as a kid.

- The last is that I am not a very reactive or emotional person. I’m not sure if this is a bug or a feature for the rest of my life as it makes some parts of being human difficult, but with regard to NW it helps me brush off market volatility surprisingly easily.

What money mistakes have you made along the way that others can learn from?

A few pieces of advice that I would give to my younger self would be:

- Never get that first credit card. I have had tens of thousands in credit card debt at times in my life and it seriously hurt my net worth building early on, even though I couldn’t tell you what NW was at that time.

- Don’t drink alcohol. It is expensive, and it makes you so, so stupid. Unfortunately, you don’t know you are stupid, but you are.

- Don’t panic. If you do panic, talk to someone who isn’t.

What advice do you have for ESI Money readers on how to become wealthy?

Live below your means. Invest the rest simply.

You can’t do anything but become more wealthy than you were before.

FUTURE

What are your plans for the future regarding lifestyle?

I plan to work another 10 years or so and retire near enough to 50.

In that time, I feel like there is more than enough time for us to get beyond our FI number and have a bit of cushion in our finances as well. If we can build our NW faster somehow, I am not opposed to retiring sooner.

I can definitely see my wife moving to part time work or to self-employment in 5 years versus the full 10. She currently provides our health insurance, so it would add another complication, but nothing we can’t figure out somehow.

What are your retirement plans?

I believe that I’ll have 4-5 core activities in retirement:

- Physical Fitness: running, walking, weight lifting, golf, and other sports

- Reading: I can read or listen to audiobooks for hours per day

- Volunteering: I don’t know what it will be yet, but I value education and charities to benefit children. I can see myself landing there.

- Cooking: I love to cook and I have a dream of learning more about making food from around the world. I can eat cookies like nobody’s business, so I may also refine my baking skills.

- Music: I want to learn to play an instrument. No idea if it will stick because I’ve failed at this already a few times.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Health insurance and unexpected child needs.

I want to add a buffer into our numbers so that we could pivot to help out our kids or family should they ever be in need. Health insurance is very expensive, and I don’t think it is going to get less expensive.

We have a decade and a half (give or take) before Social Security and Medicare, which is a pretty long time to have to deal with such an expense. I haven’t figured it out, but worst case I can probably work and extra year and it goes away.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

My parents never really talked much about money, though I learned bits and pieces from them in various ways growing up. My parents did give me great advice to contribute 10% of my salary to 401k when I first became eligible. My dad’s theory was that Social Security wouldn’t exist for me, but I never really considered the reasons, I just followed along.

I struggled with money for a long time until I started to earn around 100k at which point I felt like I should be getting ahead. That happened around 2014 at which point my automatic transfers into savings and increases in my contribution to 401k started in earnest.

I thought 401k was the only thing I needed for the next 4-5 years, after which we started using taxable accounts and then real estate for additional investments.

I think everything clicked for me around 2018/2019, when I started making my own financial models of my income, savings, and investment growth in an effort to figure out when I could retire. I would say that I become confident in my plan in early 2021 after holding course and investing into the covid recession.

Who inspired you to excel in life? Who are your heroes?

My parents, my wife, and Ron Swanson.

My parents are incredibly loving, hard working, and honest people. They were this way while I was growing up and will continue to be this way until their last days. Once I launched, I recognized that my world was small and not every human is a good one. My parents gave me everything I ever needed to be successful and they suffered through my late teenage years/early 20’s without killing me, which meets most of the requirements for canonization.

My wife is perfect and she lets me be myself, which is better defined as me living in my own world while she carries the mental load of 12 adults. I couldn’t organize a one man parade, and she is my opposite. My wife’s superpower is being fierce in the face of injustice. Where most people will shake their heads and continue, she will not stand for it, even at great personal risk.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

The Simple Path to Wealth. I think that a lot of people are intimidated by the finance community and think you have to be an astronaut to get rich. This book is an easy intro into personal finance and the simple concepts that govern becoming wealthy.

The Richest Man in Babylon – You can read it in one sitting and it teaches you nearly all you need to know about managing your finances. What is not to like?

The Count of Monte Cristo – It’s a money book I assure you.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

Since we are building our early retirement plan to not need Social Security, we plan to donate this money once we reach eligibility, provided our plan is on track.

It has been brought to my attention that suddenly donating tens of thousands per year is unlikely to happen without a little practice (thanks MMM). With this in mind, we are making a conscious effort to gift/donate ~1% of our net worth per year.

Right now that money is mostly going toward gifting our nieces’ college funds. We are doing this through my mom as I don’t really want to telegraph that we are making/giving this much.

We will also give a few thousand per year to other charities and fundraisers.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

We will likely leave something for our kids, but we hope to help them get onto a path of their own where it is an insignificant sum, no matter the amount.

We don’t want to hoard all of our money until we die, we would rather spend it, gift it, or donate it beforehand so we get to make sure it is enjoyed or put to good use.

All hail Ron Swanson! Seriously, great story and congratulations to you and your wife. I have a Ph.D. also and the best thing I ever did was to leave academia. Never looked back. Tripled my earning potential and was able to shed the bureaucracy and self-importance that abounds in academia. You are on an amazing path and should be very proud. MMM has changed so many lives!

Thanks! I am definitely better off having a few hundred millionaires around to learn from on a daily basis! Academia can be great in a lot of ways, but it just wasn’t what it was supposed to be (for her).

Make sure your funds going through your mother to your nieces for education doesn’t impact anyone’s taxes. If you are pretty sure they will go to college, you could look into 529 accounts for them as well as your own children.

We did not set up 529s for our two kids because the 529 rules were more restrictive at that time. That worked out great because they were awarded large academic scholarships. The extra funds in their stock accounts helped them launch into their careers, buy homes, and start their long-term “nest eggs”.

Thanks for the comment. We ran the plan through my parent’s accountant, so we are at least aware of the tax implications(there are some). They are both incredible students, so I assume that they will both go on to college, and hopefully receive some scholarships. Admittedly, a 529 would have been a better choice, but this was decided before I involved myself.

Really enjoyed reading this. A few years younger than you, and like how you enjoy your life without being stingy, and still have accumulated the 7 figures NW before age 40. Your plan for retirement is commendable. Sharing your shortfalls and how you think shows vulnerability and confidence. Wish houses were more affordable out West, I couldn’t imagine forking over 20% for a rental in 2021!

I think I would call myself selectively stingy. I like to save money, and we have saved a lot by doing work around the house ourselves. My wife and I built our deck together, which was probably the biggest money saver on household items. As our NW (and income) grows I find myself doing this a bit less.

I think that sharing your mistakes and weaknesses is one of the most important aspects of these interviews. It proves you don’t have to be perfect to get ahead and build wealth, otherwise it is just an exercise in stroking one’s ego. Our duplex was 129k if my memory is right. Today, we would probably pay ~175 for the same, though inventory is finally creeping back up so that might weaken a touch.

I live in a major city and your child care for 10k is absolutely mind blowing! I have a 1 and 5yr old and childcare is almost $75k a year. I keep telling myself thing will get better when they’re both in public school 😆

That 10k is private school preschool, and we did not start day care for the second until 2023, so those expenses didn’t show in 2022 tally. Infant care in 2023 was in the range of 12500, so combined we are over 20k but nowhere NEAR 75k (thankfully for me). Public school was in our plan, too but now we aren’t so sure. Our current kindergartner is miles beyond her public school peers(about 1.5 years), so we are hesitant to rock that boat.