Today I have an update for you from a previous millionaire interview.

Today I have an update for you from a previous millionaire interview.

I’m letting three years pass from the initial interviews to the updates, so if you’ve been interviewed, I’ll be in touch. 😉

This update was submitted in February.

As usual, my questions are in bold italics and their responses follow…

OVERVIEW

How old are you?

I’m 47 years old. My wife is also 47.

We’ve been married for a blissful 11.5 years.

Do you have kids?

Yes! We have an 8 and 4 year old girls. They are completely different!

The 8 year old is our calm, collected, fun-loving child who takes time to warm up to others.

Our 4 year old is off the rails and the craziest things come out of her mouth. I swear she’s born to go into acting!

They are both wonderful kids in their own way. We are lucky they get along so well.

The 8 year old definitely takes a motherly/sisterly role with the youngest. It’s sweet to watch them grow up.

What area of the country do you live in (and urban or rural)?

Urban area of the large Southeast city.

What was your original Millionaire Interview on ESI Money?

I was Millionaire Interview #163.

Is there anything else we should know about you?

I love reading this blog, especially the different stories on how people achieved their wealth, and how different the definition of “FIRE” is for each of us.

I’m a big Excel and math nerd. Over the past years, I’ve owned this side of me to the rest of the world, which has been liberating. I’ve often felt that others would not look upon me with the same level of professionalism if they knew more about me. Now, I simply couldn’t care less. 😊

NET WORTH

What is your current net worth and how is that different than your original interview?

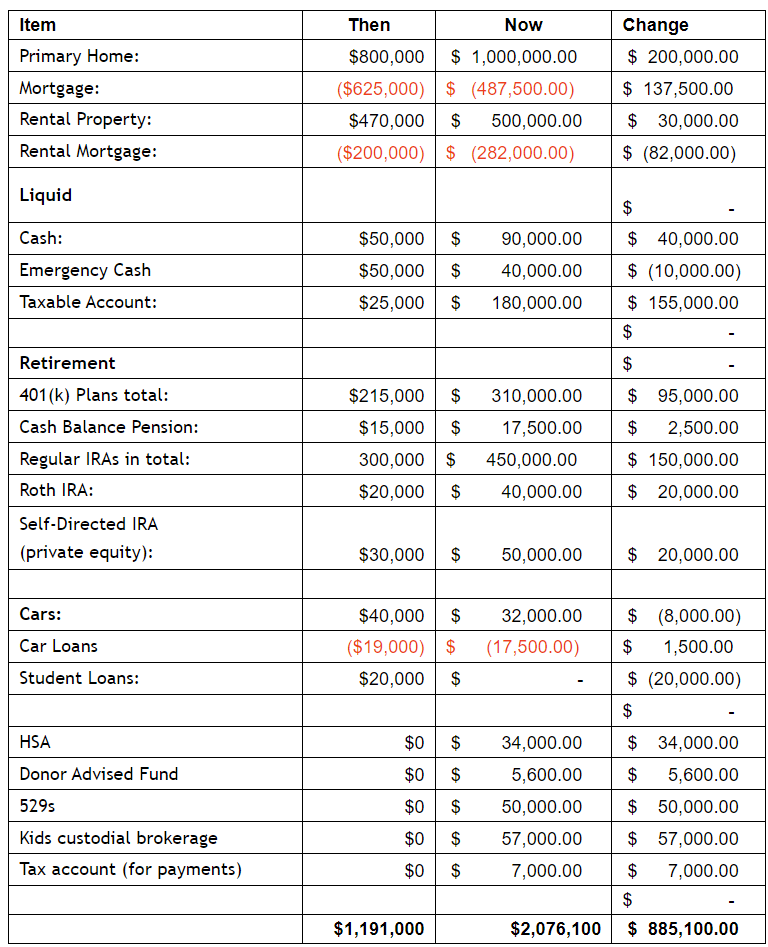

Our net worth then and now is:

What happened along the way to make these changes?

Primary House: We accelerated our mortgage payments for awhile, paying a good chunk extra towards the principal. Why? Because even though it was probably a better investment choice to slow-pay the 2.75% mortgage, the mental relief of paying off the mortgage outweighed this choice.

Starting in December 2022, I cut the extra principal by 50% and am now investing those dollars. We will still pay off the mortgage early by 2035 or so. The house was purchased in 2019.

Also, the lot next door has a much older home on it. I would love to hear feedback about whether purchasing that lot makes sense or not. The inflated value last year was $550,000. I think we can get it for high 400s now. I wish I would have moved on this in 2019, where it was low $300s.

Rental: I’ve had this property since 2008 and my wife is dying to sell it. However, it’s in a fantastic part of town that is rapidly growing with younger tenants. So far, we’ve been very lucky. I increased rent by 15% this year to the same tenants, and they didn’t flinch. I plan for this to be a long-term hold.

Also, shortly after my last interview, I refinanced this mortgage and cashed out at 3.6% with the intention of using that money towards another rental. That money is still sitting in relatively safe funds while I look for a good opportunity.

The bad: See below: Our assets would be worth a lot more if I had pulled out of high-risk equities shortly after my last interview.

EARN

What is your job?

I’m still a lawyer and left my last firm in February 2020 to start my own practice, less than 30 days before the full impact of COVID. Luckily, my practice was portable and we easily survived the relatively short economic downturn in the legal industry.

Since then, we have thrived as a firm.

My biggest problem right now is getting my partner on board with many of my decisions. I am fiscally conversative and he is not. We also have a 10 year age gap, so my desire to retire does not match up with his desire to spend lots of money.

Luckily, I manage the books, so I keep tight rein over expenses and forecasting.

We had a great hire in 2021, but he was elected as a judge beginning in 2023. I plan to hire 2-4 more people this year, and then stay right there.

I have no desire to manage dozens of people at this age anymore. I’d rather spend more time at home or traveling while still making great money.

What is your annual income?

Last time in 2019, I was in the low 200s.

In year 1 of opening my own firm, I earned $250k.

For the past 2 years, I have earned between $300k and $350k.

For the first time in my career, I really feel like I’m doing better than my peers. If you read my last interview, I spent a good 15 years making substantially less than my peers.

Part of this growth is simply keeping track of firm expenses. Another part is capitalizing on fixed fees and contingency fees in ways that other attorneys are not doing.

Going off on my own has been a top 5 best decision. Not only do I earn substantially more money, but I feel more in control over where our financial life is going.

My wife now earns $125,000. She may experience more rapid growth as her hospital system is merging with others. She has a strategic brain and uses that to create high value for her organization. She also keeps our family’s benefits, which is critical since my firm is small enough not to offer those types of benefits.

Have you added, grown, or lost any additional sources of income besides your career?

We have not added other sources of income yet, but I am looking into a beach or mountain property as a rental to diversify.

I have also decided to start training for Business Valuation work. If successful, I can use this as a tool to wind down the level of work I do and focus on things more ‘math driven’, which is energizing for my brain.

SAVE

What is your annual spending and how has it changed since your interview?

In 2019, we spent $131,000 per year, not including retirement and savings contributions.

In 2022, we spent $147,000. That increase mainly came from paying extra principal payments on the mortgage.

We try hard to keep our lifestyle as close to static as possible, except for some new changes this year that I’ll outline below.

INVEST

What are your current investments and how have they changed over the years?

This is where I really struggle. 2019 was fine pre-pandemic. But, I was invested in tons of risky things (Peloton, anyone?)

I didn’t learn my lessons from ESI or the books fast enough. While I was slowly moving things into Schwab Total Stock Market, I was too slow to avoid a ton of losses. I had heavily invested in a few tech stocks which are still down 75%.

Within the past 8 months, I have put $20,000 into I-Bonds and another 20k (emergency funds) into CDs at 4.5%.

Because of quarterly taxes, I also plan to ‘save’ my estimated taxes and stick those into another CD at 3 month intervals as ‘safe’ money. I know it’s probably smarter to invest those dollars, but I don’t want to have to scramble to find tax money if the market tanks.

I’m considering doing a Roth conversion on those ‘down’ stocks to see what happens. Most of those are in my retirement accounts.

The taxable account has generally done fine, and we are focusing on putting more funds towards this on a monthly basis. I have redirected the extra principal payments towards the taxable account.

I have a Roth 401(k) at work, but I’m trying to decide whether or not to do a backdoor Roth. In order to do so, I would have to liquidate my current IRA investments in order to my those to my 401(k), which would allow me to do the backdoor Roth. This means locking in a bunch of those losses.

The good news is almost all new dollars go into the index funds. This has relieved a ton of stress overall. I still have unresolved fear over these articles I come across about how index funds and passive investing is going to change, etc, etc, but so far I’m staying on the index fund course.

MISCELLANEOUS

What other financial challenges or opportunities have you faced since your last interview?

One major opportunity is that we have extra cash flow.

When that started happening in 2020, my wife and I decided to allocate the extra into “buckets”.

Anything over our regular monthly expenses goes into the following buckets:

- Estimated Taxes

- Charity

- Investment

- Travel

- Projects

This method reminds us to use the charity dollars, the travel dollars, and the project dollars. We contributed a hefty amount to various charities last year in addition to putting money into a donor advised fund.

This year, we have planned 4 trips and are considering a trip to India near the end of the year. This bucket method has helped us be more intentional about how we can spend our money.

Honestly, very few aside from being a crappy stock picker! My career is where I want it to be. My work-life balance is fantastic, and I’ve loosened the purse strings on a few discretionary expense categories.

I want to diversify and buy into some real estate investments, but I don’t have the confidence to figure out where to start, even after reading all the ESI posts.

Overall, what’s better and what’s worse since your last interview?

I made conscious decisions and have implemented the following positive choices:

- I started coming home at 2:30 on Mondays to pick up my 2nd grader from school. We do whatever she wants for the rest of the day, and I unplug from work completely until after she goes to bed. I will have to find something similar for my 4 year old so she doesn’t feel left out. In my line of work, I see too many parents wishing they had spent time with family earlier. I’m trying to learn from those mistakes and be intentional about spending time with my family. After all, what the heck else am I working this hard for? It’s been 14 months now, and she loves our time together. Sometimes it’s soccer, chess, reading books, watching a movie, or just painting. I can tell the difference!

- Vacation: We are intentionally spending substantially more on vacations this year. This will increase our annual spend by $20 – $25k per year. I want to go out of the country at least once per year, and in the next 10 years I’d like to visit every state. Sometimes with kids, and sometimes just with my wonderful wife!

- I am working hard to stay away from keeping up with the Joneses. It’s tough. I see so much money flowing around me in this city and I get jealous. I have to remind myself that acquisition of those dollars has come at some other cost, and that I don’t want to be those people. It’s not that I want the cars or the 5,000 square foot homes, it’s simply a feeling of unfairness. I’ve worked my butt off to get where I am, and sometimes it pales in comparison to what others have achieved seemingly easily. I’m sure that sounds ridiculous but I’m just telling you what’s in my brain. I’m a work in progress.

Negatives:

- See #3 above. 😊

- Health of my father. Physically, he’s fine. Mentally, he’s not happy. He and I have never been aligned in how we see the world, and so we have minor clashes often. Typical family stuff. He’s been with a partner for the past 15 years, but now they both get on each other’s nerves. One major problem is my dad can’t take care of himself. The man needs help boiling water to make pasta, no exaggeration. He is in a co-dependent relationship, doesn’t want to leave his house, can’t drive very well, doesn’t want to go to a retirement community, doesn’t want to ditch the partner, and feels like there is nothing good to look forward to in life. I think he stays in our city because of the grandkids. I want him to be happy, but my sister and I are at a loss as to how to help him. Certainly, he does the opposite of whatever I suggest.

- I’ve declined on my exercise, and it’s catching up with me. Lately, my wife and I have started doing yoga in the morning. That has sparked my interest to get back into shape. I have some immune-related issues and need to make sure I can stay alive at least long enough to get my kids through college! My mom died at 57, so that age is definitely a mental black cloud over my head. I was doing great in 2019 on the exercise front, but starting this firm has taken a toll on my available time (hence taking Mondays off to be intentional).

What are your plans for the future?

I’d love to achieve FIRE by 55 years old. I don’t know if that’s possible given that $700k of our net worth is tied up in real estate.

“Being done” doesn’t mean not working. It means looking into different options for things I have put off. It will involve spending even more time with my children before they are off to college!

Given that you have a bit more wisdom and experience, what advice do you have these days for ESI Money readers?

- Don’t do what I did. Go directly into index funds right now!!

- You can live for ‘the now’ and also towards retirement if you balance properly

- My wife and family are definitely the cornerstone of my success. Don’t neglect or forget to express appreciation

- Keep reading this blog!

Thanks for the share. You have a lot going on here.

I don’t understand why you would spend extra cashflow to pay off a 2.75% mortgage loan and then borrow money at 3.75% on another mortgage.

Sure , you live in the house but leveraging as much debt as possible at 2.75% (and now 3.75%) would be a good thing. It’s not difficult to find rental property that can return 12-15% year over year. That’s 11-12-% net. I hear people say “I wanna pay off my home mortgage, it makes me feel better”.

The question is , would you loan me $1mm at 2.75% or at 3%? I’ll give you 4%. How about that ?

It’s the same thing when you pay off a mortgage at 2.75%.

You ask about buying the house next door. The answer is “it depends on what you’re trying to accomplish”. Again , it’s mathematic. The house being next door has no bearing on the math. If you can tear both houses down and rezone both lots as a multi , may be. But there’s no real advantage to a house being next door – unless you can buy the block. I’ve seen this. Multiples would give you leverage over comps. Otherwise , it comes down to math.

You’re in the SE in a large city ? Nothing is coming down for the long term in the SE. Selling likely wouldn’t make mathematic sense. Borrow money against the asset , keep the asset and deploy the money you borrowed and find more property. It’s not a taxable event to borrow. A lot of money has been made leveraging debt at 7%.

You say that you can’t retire with $700k tied up in real estate but It would seem to me that real estate is the only chance you have at retiring at 55.

Use your income from the law practice and build a real estate portfolio outside it.

Prob a great idea to contact one of your FIRE pals who used real estate to leave. There are many.

Good luck !

Some short answers:

* The 3.75% has deductible mortgage interest;

* Good points, though, that you raise.

* The house next door thing is not an investment thing, it’s an average to poor financial decision in order to keep a mini-mansion from being built next door. Both houses next door were built in the 80’s. Our neighborhood is tearing these down and putting up 5000 sq foot houses, which will eat up our buffer and view from our current home.

* Definitely agree on not selling the rental. That’s my wife’s desire, but not mine.

THanks for your feedback!

Wait until your kids start making more than you. The feelings are mixed:on one hand you’re happy for them, on another you feel you wish those opportunities existed when you were young. I’m retired, and worked in healthcare for over 35 years and topped out at about $45/hr. My wife, a nurse, still works and makes about $50/hr. Both my kids are in the tech industry and make $70-$100/hr in there still young careers.

I have questions related to you going out on your own regarding your law practice. What was your biggest unforeseen expense? Do you provide your employees with health insurance, retirement etc? In the malpractice insurance high? My husband is an attorney who wants to go out on his own and the expenses of that make me nervous. Thanks for sharing!

* Biggest unforeseen expense was all the various insurances (Disability, Key man, life, etc). I had mapped out virtually all other expenses prior to opening up shop.

* We don’t do health insurance, yet, because our spouses had insurance, and all the employees at that time had insurance through spouses. However, I think this is critical to add for future growth, so I’ve started vetting insurance. That is *very* expensive

* We do a safe harbor plan, which is 3% of everyone’s salary regardless of what they contribute. This comes with a profit sharing component which allows great flexibility in large (or small) one-time contributions per year when we see how profitable we have been.

* Malpractice insurance will vary. It’s not high for us given our practice area.

* DEFINITELY go out on your own. He will make more money working the same hours, OR he will make the same money working less hours!!

Wow, quite the positive change over the last few years, almost a million more! Great work. I can understand how you feel about trying not to keep up with the Joneses, especially when you’re working hard and in the throws of your career. I’m guessing you are in ATL? When I visited there it was like the LA of the South.

Glad to see that starting your own practice has paid off. Would you have any advice for someone thinking of transitioning to self-employment, or what you wish you knew/did differently?

Thank you! Not in ATL…a little north of there. 🙂

The biggest advice on self-employment is to talk to a CPA and attorney about the right business structure. I feel like everyone I talk to wants to default to an “LLC”, but there are significant tax advantages I learned about over the past 3 years.

For instance, now certain pass-through entities can pay *state* income taxes through the business. When that is done, it allows for greater utilization of itemized deductions on personal taxes. Also exploring different retirement plan options instead of only an SEP option was helpful. That may not make much sense if you are solo with no employees.

The biggest thing I wish I did differently: Having the confidence to go off on my own much earlier than I actually did.