Today I have an update for you from a previous millionaire interview.

Today I have an update for you from a previous millionaire interview.

I’m letting three years pass from the initial interviews to the updates, so if you’ve been interviewed, I’ll be in touch. 😉

This update was submitted in December.

As usual, my questions are in bold italics and their responses follow…

OVERVIEW

How old are you?

I am 55 years old and my wife is 49 years old.

We have been together for 28 years and married for 25 years.

Do you have kids?

We are the proud owners of a 21 year old son who is a Junior in Nursing School and plays division three soccer for his university.

Our middle child is 17 years old and is in his senior year of high school. He decided to attend the same school as my oldest son. He will be pursuing a Finance degree and also playing division three soccer for the same university and is patiently waiting for his NCAA offer letter from the school.

Our youngest is 12 years old, in seventh grade and is a budding soccer star playing club soccer.

What area of the country do you live in (and urban or rural)?

We live in the northern suburb of a large northeast city.

What was your original Millionaire Interview on ESI Money?

Six years ago, I participated as number 32 of the millionaire interview series.

Is there anything else we should know about you?

My wife stays at home with the kids and our three dogs.

I have a clinical bachelor’s degree in Occupational Therapy, which I completed in 1992. I also have an MBA that I completed in 2006 when I was 38 years old.

When I finished college and past my state license exam, I began working in an acute care hospital but quickly decided to take on a second job to earn extra money. I worked two evenings a week for about 13 years and occasionally signed up for weekend shifts.

When I went back to school to pursue my MBA, I also transitioned into a hospital leadership position. My career progressed from a hospital clinical leader to hospital administration when I was 35 years old.

I have been in the C suite for 20 years. My C suite experience includes working for a non-profit community health system where I worked in many roles for 16 years before leaving as a Vice President of operations.

I then worked for three years for a Fortune 100, publicly traded for-profit community hospital system. I spent the next seven years working for a large urban academic medical center and now I work for a large non-profit community health system.

I also participate on three non-profit boards as a way of giving back. My wife and I contribute ~ $20,000 per year in donations to schools, church and other non-profits.

NET WORTH

What is your current net worth and how is that different from your original interview?

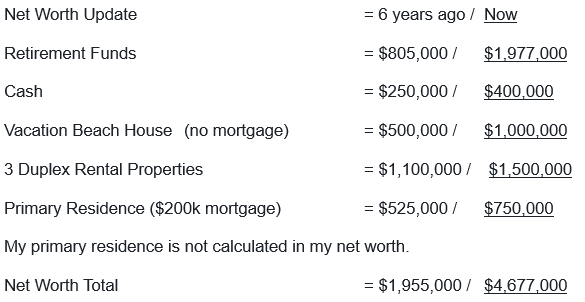

Our net worth was $1,955,000 six years ago and our updated net worth is $4,677,000.

This does not include the value of our primary residence or our cars, including a Torch Red C7 Corvette sports car.

The reason I do not include them is because if I stopped working, I would still need them regardless. I will also never sell my C7 Corvette as it is the last classic front engine version and fun to drive.

What happened along the way to make these changes?

When I was 35 years old my first child was born and I anticipated that the expense line item in our budget for children was going to significantly increase so I decided to heavily contribute to my tax deferred employer sponsored retirement plan.

I started investing more money in my 403b account and then when I turned 41 years old I started maxing out my 403b account and also because of my job title I was able to participate in a 457 account, which I also maxed out every year and will continue this strategy until I retire.

My goal was to contribute the maximum amount allowed into these two plans until my kids started college, then I was going to shift my retirement funds to pay for college tuition.

My income has grown significantly over the past 10 years and as my oldest child started college I was still able to contribute the maximum amount permitted into my retirement accounts and I will continue this until I retire in 4-5 years.

I have a high propensity to save versus spend so I should not have to make any changes to this strategy while paying two college tuitions, which will begin in 2024.

What are you currently doing to maintain/grow your net worth?

I continue to work as a hospital administrator and also manage my rental properties.

I invest in stock index funds with a focus on large cap and S & P funds.

I will continue this strategy into retirement. I developed this approach after reading an article many years ago where Warren Buffet recommended VFIAX and other index funds as an investment strategy. I took his advice and it has paid great dividends.

I recently hired a financial advisor to evaluate my investment strategy and retirement goals. I expect this engagement to start in 2024.

EARN

What is your job?

I am a Hospital Administrator in the C suite.

What is your annual income?

I have an income of $510,000 which includes a yearly bonus.

I also enjoy approximately $50,000 in free cash flow from my rental properties.

I hate referring to rental income as passive income because unlike dividend payments, managing rental properties is not passive.

How has this changed since your last interview?

I am in the same job as I was six years ago.

My work portfolio has expanded, and my income and yearly bonus has also increased.

Have you added, grown, or lost any additional sources of income besides your career?

My responsibility at work has expanded and I am also paying more attention to the local rental market rates.

Several times over the past 30 years of managing rental properties, I tended to fall behind in the rental market and was not increasing my tenants rent.

I now do a yearly assessment of the market and adjust what I charge each year. Most of my tenants are long-term, because I take good care of my properties and I am a responsive landlord.

SAVE

What is your annual spending and how has it changed since your interview?

My spending has changed as I have a child in college which costs us $33,000 per year.

Our other two children are still in private Catholic School at a total cost of $16,000 per year.

Two of my children are driving and they each have their own car which we paid for in cash. I’ve learned that kids are most expensive in their last two years of high school when they start driving and while attending college. We are providing all car, living and school expenses so that our kids can enter adulthood debt free and with a car which will last them another four years after graduation.

I have also started a Roth IRA for my child in college and will do the same for the other children. I plan to teach them how to invest in index funds and retire when they are 55. The amount I place into their Roth accounts depends on how much they earn while working. I match a percentage of their yearly income and place these funds directly into their Roth account.

INVEST

What are your current investments and how have they changed over the years?

I am an index fund investor, and my portfolio is primarily Vanguard funds. VFIAX/ VOO (ETF)/ VINIX and Total stock market fund.

In 2023, my investment returns exceeded $250,000. Let’s hope we get a few more good years like this before I retire.

What happened along the way to make these changes?

Along the way when the market declined especially in 2020, I moved any retirement funds which I had placed in low risk and target retirement accounts and moved them into S & P index funds.

MISCELLANEOUS

Overall, what’s better and what’s worse since your last interview?

All is better since my prior interview.

My expenses have increased significantly due to education costs for my three children.

However in anticipation of this I paid off a lot of debt.

What are your plans for the future?

During Millionaire Interview 32, my goal was to retire at 61, but because of my gains over the past six years, I am able to retire whenever I want.

My new goal is to retire between 59 and 60. My two sons will be finished college, and my daughter will just be starting college.

I feel that true freedom is financial independence. I enjoy the reality that I no longer need to work. I also know that having good health in your 60’s and beyond requires commitment and adopting healthy habits. I exercise daily and alternate between walking 3-5 miles per day and going to the gym to perform heavy strength training.

Given that you have a bit more wisdom and experience, what advice do you have these days for ESI Money readers?

Time in the market is better than timing the market. Max out everything that you can in your retirement funds. The calendar year that you turn 50, you are also permitted to utilize the IRS retirement catch-up provision to defer more of your income. I work for a non-profit so I am able to put away $30,000 per year in my 401 k and another $22,500 in a 457 plan.

I also suggest that you develop a plan to pay off your debt prior to retirement.

If you are in your twenties and in the beginning of your career, set financial goals and invest in yourself to help achieve those goals. Go back to school and get an advanced degree, and then put it to work. Consider saving extra money to help establish passive income streams, real estate and dividends.

Be careful when you move your career, do your research and take your time with these decisions. I have witnessed friends change jobs for 10k or 20k only to be miserable and then find themselves unemployed a few months later. Develop a yearly retirement contribution goal and keep adding to it until you are maxing it out.

When you experience career growth, don’t worry about the vehicle you drive or the size of your house. I have many friends and colleagues who waste too much of their income trying to portray an image.

There are several positions in my organization which include a monthly car stipend, and the people who receive this stipend all drive expensive imports instead of just driving a basic car and saving the rest.

The cost of ownership for driving a luxury vehicle is not worth it for me. I would rather spend that money going to eat with my family. I have always driven basic cars while having a fun weekend car in the garage.

I mentioned earlier that I own a 2016 torch red C7 corvette which I purchased when it was three years old and paid half of the price a new one would have cost. I also keep my vehicles until they approach 200,000 miles or more before I get rid of them. My current daily driver is a 2016 Toyota 4 runner with 150,000 miles on it.

When it is time to purchase a house and / or an investment property, buy in a good school district. The demand for these houses and apartments will remain high and yearly appreciation is usually higher than the national average.

Great update and congrats on all your success!

Like you, I am financially independent and working until at least my youngest goes to college. Is that your thought process on retiring? What keeps you working? What will you do when you retire? Asking because that’s what I’m trying to figure out!

When my youngest starts college I plan to retire. I already have her college funds segregated. My goal is to be on the other side of the window. Not sure where or what I will do. But plan to use my time to work on healthy lifestyles mentor leaders and help the non profits that I am affiliated with.

You have created a terrific balance sheet! Well done!

M24

Thank You and love sharing this information so others can develop a plan.

I love reading these interviews because you learn about careers that many people didn’t know existed or paid that much money. Who knew you could make that much at a nonprofit! You’ve done very well and are now set up to enjoy the fruits of your labor. The fact that you work full time in the C-suite, have a family, and manage your own rental properties is impressive. I hope you find some time for fun too, and thanks for the tip on buying in a good school district. Trouble is, they’re all high priced in California!

Yes I also prioritize fun with a large group of friends, my rentals are on auto pilot. I have good contractors that I pay immediately so they always prioritize my needs.

Great update and thank you! Wondering if you feel like the beach house has been a place you have time to enjoy or if it was purely for investment? Always curious if folks are happy with a second house purchase.

Hi, we purchased the beach house for family enjoyment. The appreciation was not expected.

Great update. I’m curious about your rental properties. Can you provide more details on when you purchased them and for how much. Also it seems as if each property cash flows about $1400/mo which is great. What are the rents and expenses on these properties. Thx

2000 = $275,000

2011 = $340,000

2014 = $305,000

The rents are growing fast, $1400 to $2100 a month

Thank you for sharing!

Financial independence definitely provide more freedom than most people ever experience.

That is well said…. true freedom comes from having enough wealth. Queen Latiffa the actress and rapper said something similar 20 years ago about freedom and money