Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in April.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 41 years old.

I have never been married.

Do you have kids/family (if so, how old are they)?

No.

What area of the country do you live in (and urban or rural)?

Mid-Atlantic suburban sprawl.

What is your current net worth?

$3.4 million.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

- Home: $625k (according to Zillow)

- Brokerage: $690k

- Retirement accounts: $2.1 million

No debt.

EARN

What is your job?

I recently retired from a career in software development.

I worked my way up to the senior director level and didn’t like the look of the next rung on the ladder. After several years of that, I demoted myself to individual contributor so I could do some actual work, not just attend back-to-back-to-back meetings.

What is your annual income?

$0, I officially retired in February.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

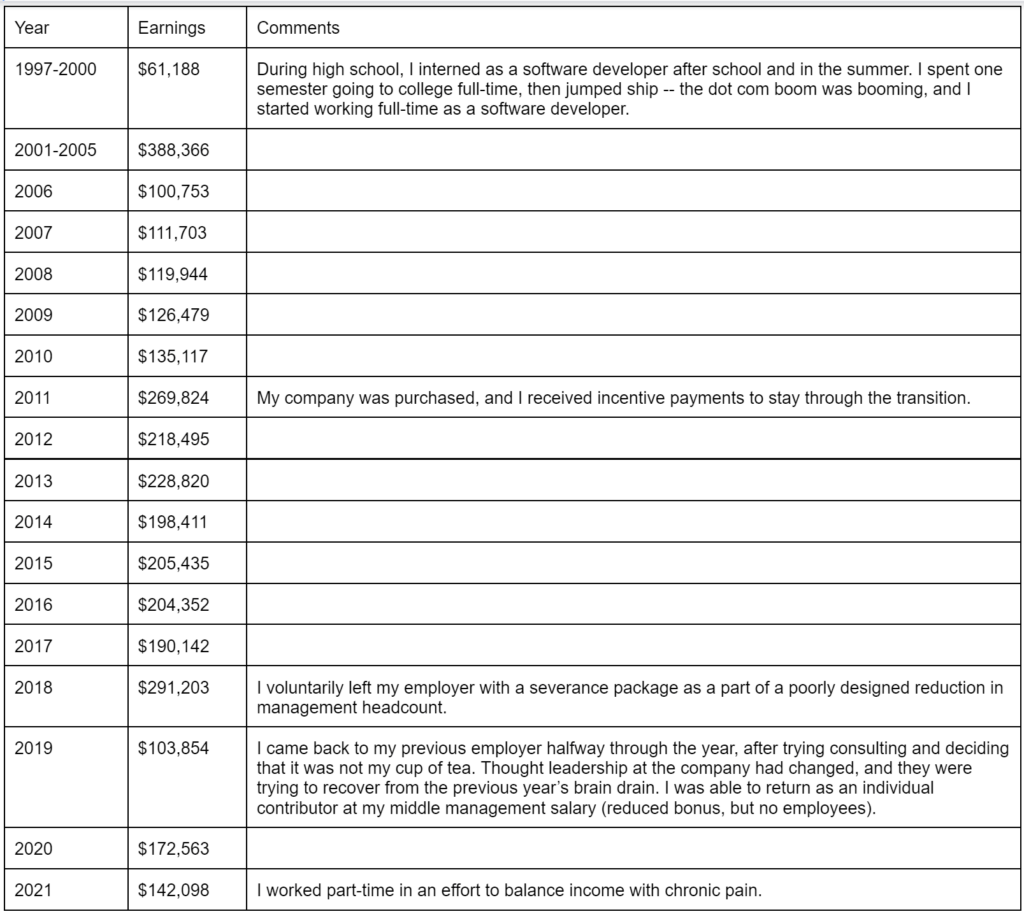

Per the Social Security Administration, I averaged $152k per year during my 22 years of full-time employment, averaging $77k/year when I began full-time employment and topping out at $269k.

I never had a normal young person job working retail or food service — my first job was as a software developer, interning via a program at my high school that placed students with local companies in a career track of interest. That internship set the course of my career.

While interning, I got mixed up with a group of up and coming leaders, and I was useful enough that they took me along on their journey, leaving the original staid firm to have a dot-com adventure, then going on to start the company I retired from 20 years later.

I had intended to follow the traditional path after high school. I had a full-tuition scholarship to a prestigious engineering school, which I attended for all of one semester. When I came home for winter break after that first semester, I went to work again with my colleagues from my high school internship, who had left to start a political venture during the heady days of the dot-com boom and the 2000 presidential campaign.

What a difference from school work … I was building real software, which real people across the country used, and charts that I personally made from the data we collected appeared on national TV! I didn’t go back to engineering school.

Over the course of 8 years of full-time work and part-time school, I did eventually get an utterly redundant undergrad degree in the field I was already working in. I didn’t spend much of my own money to get it — tuition was paid by scholarship for a while, then tuition reimbursement from my employer, so I only paid for books and never had student debt. Tuition reimbursement is one of the unsung benefits of large employers — get in without a college degree, get one on the company’s dime.

After several years as an individual contributor, I was recruited into management. This is when I learned that other people also have ways of doing things that are correct, and they appreciate it if you consider the merit of their alternate ways instead of immediately dismissing them.

I was promoted a few more times, and when the next level was Vice President, observed that I was supremely disinterested in progressing further. The people on the next rung of the ladder wore dress clothes on a regular basis and had to play office politics. I was as far from my technical roots as I wanted to be and felt quite well-compensated with no desire to earn more in exchange for additional management shenanigans.

Below is my earnings statement from the Social Security Administration. My W2 job was my only source of income, and my annual bonus was tied to company performance once I got to the director level, so compensation varied a bit.

What tips do you have for others who want to grow their career-related income?

In an environment where everyone is terrifyingly smart, the ability to organize and deliver and make strategic decisions between alternatives can set you apart.

Your manager wants someone to whom they can safely delegate and not worry about whether things will get done. If you’re the person who can be trusted to make good decisions and not get distracted by shiny technical problems, they will delegate to you, and you will become the person they rely on.

People who are relied upon get more money because the organization does not want them to leave. As the organization grows and new managers are needed, the reliable people are the ones management looks at as candidates.

What’s your work-life balance look like?

As a retiree, it’s great!

As a database administrator, I was on-call 24/7 for years. System maintenance was done in the wee hours on weekends. There were a lot of early mornings cracking jokes with the network admins while we upgraded a SAN, and evenings when the system started spewing alarms and all hands were on deck to put out the fire. My long-time boss would tell you that I liked the adrenaline rush and was entirely too cheerful when the CPUs hit 100% and we had to drop everything and swarm.

For a few years in the middle of my management career, as smart phones became popular, I got sucked into the always-on evenings-and-weekends-email culture. I eventually decided that nothing at work was that urgent, and that I needed to be the change I wanted to see in my company’s growingly-workaholic culture, so I stopped working outside of work hours, and there were no negative consequences. Others continued to overwork themselves and complain about it. I enjoyed my detached evenings and weekends and figured someone would call if they needed me.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

No, my W2 was my sole source.

SAVE

What is your annual spending?

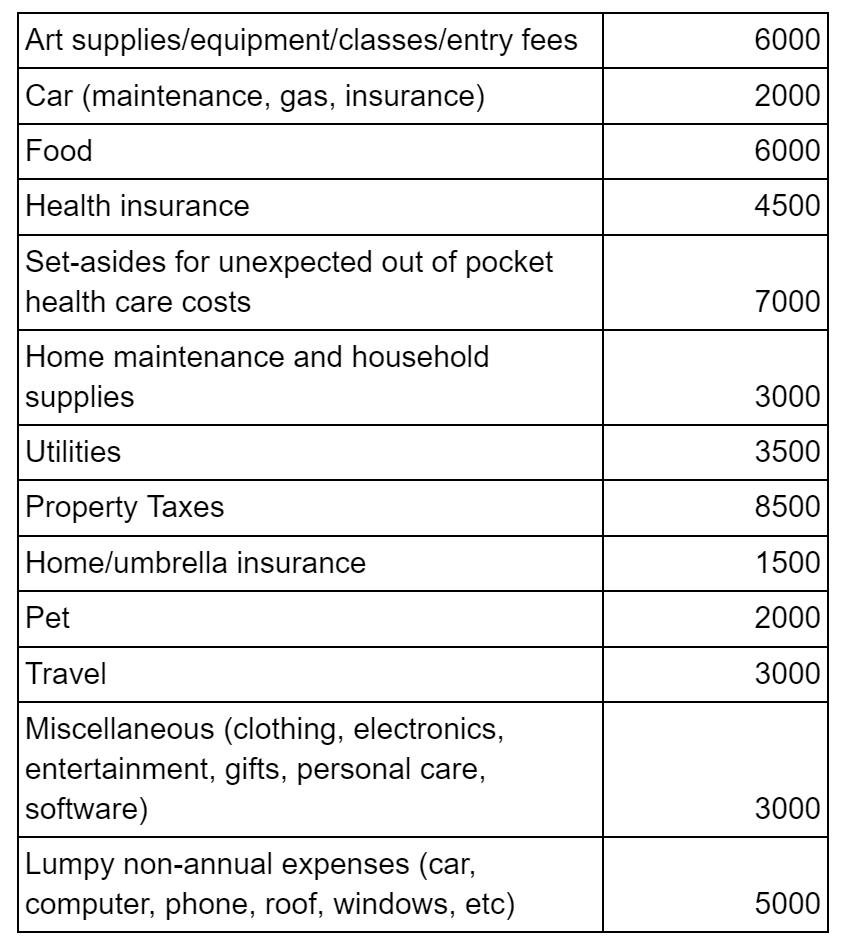

$56k, not including taxes.

Taxes will become a real expense for me as a fresh retiree — previously they were just theoretical money I never saw.

What are the main categories (expenses) this spending breaks into?

Do you have a budget? If so, how do you implement it?

For the first time in my life, I have a budget. I’ve needed to stop working for health reasons for a while, but it was fiscally irresponsible doing so until I’d crafted a budget for the rest of my life and amassed enough to cover it.

Prior to stepping away from work, I spent months tweaking that budget. It feels a bit ridiculous and futile, trying to forecast one’s spending 50 years in the future, but I feel good about the next decade or two.

I have been tracking every penny in Quicken since 2017, so I have a clear picture of what I spend and how it varies from year to year. To create my retirement budget, I added new and infrequent costs to make sure I’m getting the whole picture:

- Paying for my own health insurance, with annual increases based on entering future ages on my state’s exchange website, then looking at estimates of what people on spend on Medicare and in addition to their Medicare premiums

- Having to spend the full out-of-pocket max on my health insurance every other year

- Lumpy expenses that happen every 5-20 years like computer, phone, car, windows, roof, HVAC

- More hobby and travel spending

What percentage of your gross income do you save and how has that changed over time?

I only started monitoring my saving rate monthly in late 2016 when I discovered the FIRE movement, and it averaged 56% (after taxes) until I retired.

It peaked in the 70s during my highest earning year, then came down as I reduced my income via part-time work.

What’s your best tip for saving (accumulating) money?

Earn more money than you know what to do with.

I maxed out my 401k, Roth IRA and HSA and spent whatever I wanted to, and any leftover money went into my brokerage account.

Having a high income gave me the leeway to not plan or conserve and still succeed.

What’s your best tip for spending less money?

Probably don’t acquire children, they sound pricey.

What is your favorite thing to spend money on/your secret splurge?

Art supplies! I picked an expensive medium that requires expensive tools. As consolation, I like to tell myself it’s cheaper than yacht racing.

I also enjoy hiking in Europe.

INVEST

What is your investment philosophy/plan?

Prior to retirement, I was 100% in a total stock market index fund. Now that I’m in my decumulation phase, I’m moving toward a risk parity portfolio to reduce the length and depth of portfolio drops.

I thought I might invest in rental real estate until I spent a year analyzing deals, visiting properties for sale, and going to real estate meetups. It was interesting to learn, but I decided that it was too active of an investment method for me.

I also flipped a house, which was both fun (designing it) and miserable (contractor woes) and not an experience I’m keen to repeat.

What has been your best investment?

It’s a toss-up between side-stepping the traditional college route to start working 4-5 years before my peers without accumulating any student debt, and pouring money into the stock market during the up-up-up bull market of the past decade.

The amount of money that my money has made just in the six years since I’ve started paying attention to it is staggering.

What has been your worst investment?

$1,200 to hire a financial advisor who told me I earned too much money to make Roth contributions without telling me that I could make backdoor contributions.

I lost four years of contribution opportunities, and the growth on them, which would have been significant.

What’s been your overall return?

15% in the time that I’ve been tracking it with the Bogleheads Returns spreadsheet.

How often do you monitor/review your portfolio?

I calculate my net worth monthly.

In my accumulation phase, I only noted the size of my portfolio. Now that I’m trying to shift my allocation in retirement, I keep closer tabs on the performance of desired funds as I’m trying to migrate without buying high and selling low.

NET WORTH

How did you accumulate your net worth?

I earned a lot of money, didn’t manage to spend all of it despite my best efforts, invested it completely averagely, and inherited some.

Software development pays well, you don’t need an expensive degree (or any degree, really) to get into it, and the work-life balance is good.

I tried hard to spend all my money buying personal residences and renovating them, but my income kept up with my multi-year renovation spree. At one point, I owned two houses for two years while renovating them both so I could move out of one into the other. I do not recommend that.

Prior to discovering FIRE in 2016 during a period of unhappiness at work, I only invested via retirement savings vehicles. I didn’t know about brokerage accounts, so money that wouldn’t fit in my 401k just sat in a checking account.

My method of investing was to look at Morningstar ratings and performance over the past five years, trying to pick the “best” three mutual funds in each vehicle I had available (401k, Roth) without regard to the relationship between the funds I picked.

After I learned about low-cost total market index funds, I moved all my money into whatever total stock market index fund was available in each account. I opened a brokerage account, and as new money arrived, I shoveled it straight into VTSAX. During the period in which I was doing my major accumulating, it was impossible not to make trucks full of money with this strategy.

Recently, I inherited 20% of my current net worth. I was on the fence about retiring before this occurred — people retire at my age with less money than I had, but I wasn’t sure that they were leaving adequate margins — and then I had no excuse not to.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Saving.

I know I said above that I have a tendency to blow all my money on chandeliers and drywall, but my peers who commanded similar salaries are not in a position to stop working, so I can only assume that I’m doing a better job of saving.

Earning is #2. I always made well above the median income. I never had to try to live within my means.

I place investing third because I swung squarely for average returns, though I’ve read that average = winning in the stock market.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

None. I had a tailwind all the way.

What are you currently doing to maintain/grow your net worth?

I’m moving from a growth portfolio to a wealth preservation portfolio now that I have enough and no longer have income.

As I’m spending it down, I want it to lurch up and down less.

Do you have a target net worth you are trying to attain?

I attained it.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I was 37 and had no behavior shifts.

What money mistakes have you made along the way that others can learn from?

You can’t delegate your saving and investing plans to a financial advisor. You must learn for yourself.

You can retire earlier in a small house. Or without owning a house, if that’s your thing, but I’m a homebody and I like nesting and beautiful architecture, and so it took me longer and I needed to save more money.

What advice do you have for ESI Money readers on how to become wealthy?

Work in a job that will shower you with money but has no maintenance costs (fancy clothes, country clubs, luxury cars, meal services because you don’t have time to cook) or high entry fees (a degree that comes with six-figure student loans).

FUTURE

What are your plans for the future regarding lifestyle?

I’ve recently retired early, and I intend to stay that way.

What are your retirement plans?

Hiking, biking, lifting weights, pursuing my curiosity, art, travel.

It would be nice if my art became an income-generator, but I have to keep reminding myself not to turn it into a job.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

The spiraling cost of health care.

I accounted for the age-related increase in ACA premiums, a decent amount of out of pocket spending prior to Medicare, Medicare premiums, and data on average out-of-pocket spending on top of Medicare in my lifetime budget, so I think I’m as ready for that as I can be.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

I learned about bank accounts and credit cards in middle school. I think we learned to balance a checkbook in home economics, and my parents taught me that credit cards are these plastic things with which you can spend money that’s in your checking account. I guess my differentiation between credit cards and debit cards was that one was settled monthly and the other immediately. My mental model has never included spending money that I don’t have.

While I definitely did not understand finances at the time, I was fortunate to have a mentor at my first full-time job who explained to me that I needed to fill out the 401k paperwork and open a Roth IRA, and impressed upon me the need to start putting money in them.

Finances didn’t start to click until I was 36, desperately unhappy at work, wondering how I could stand this for another 30 years. I googled “early retirement” and fell down the financial independence rabbit hole. I started reading Mr. Money Mustache, John Bogle, and William J. Bernstein.

Who inspired you to excel in life? Who are your heroes?

Mom was a teacher and a stickler for everything that endeared me to both the educational establishment and employers — accuracy, grammar, punctuality, completion of assigned tasks, and Oxford commas.

Dad was a chemist who did incomprehensible things with computers and large machines. Expectations were high. Achievement was important. I learned to read before kindergarten. A “B” on my report card was a grave disappointment.

Starting at an early age, my parents told me that I would go to college, become an engineer, and never be financially dependent on anyone (I’m certain “anyone” meant “a husband”, though it was never explicitly mentioned). They were very distressed when I tossed aside the engineering school scholarship to go bang on a keyboard at what appeared to be adult summer camp (it was the dot-com boom, and everything that implies), but I delivered on the overall goal of being an independent adult, and they were soon very pleased with my life choices.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

I’ve read a lot of money books, but blogs like Mr. Money Mustache and JL Collins’ stock series and podcasts like ChooseFI taught me more.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

Not much, and not as much as I used to.

I needed to retire for health reasons, and now that I have all the money I’m ever going to earn, I have to steward it so that I’m never in financial straits. I have no family to be a burden to, so my old age is entirely my responsibility.

Money will be given to charity upon death when I definitely no longer need it.

If I find that money is accumulating faster than I could ever spend it, I would start disbursing it before death, but that’s too far in the future to plan for now.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

If I still have any money at death, some of it goes to close friends and family, and the bulk to RIP Medical Debt.

Medical debt in this country causes financial ruin from which people may never recover, and for reasons they couldn’t have prevented, and this organization makes it disappear for pennies on the dollar via economies of scale.

Excellent writeup!!

Fellow single guy here. Same age. Not software but in healthcare and bit behind on FIRE. My advisor said the same thing regarding not being eligible to contribute in Roth IRA. Just dump everything in brokerage account.

I don’t plan to have kids or family either. Was divorced in the past and that brought down my NW significantly. I do get asked as to how would you live alone in old age etc. While I have been habituated to live in solitude, no problem. But want to know your thoughts on that.

Hi Sami, it’s good to keep in mind that being partnered is no guarantee of not living alone in your old age. It’s not at all uncommon for one spouse to die years before the other. You have to plan for potentially living alone in old age regardless. There are always friends, active retirement communities, and renters willing to lend a hand around the house in exchange for lower rent. Having people to gallivant with will help keep your mind and body spry in your dotage.

MI 316, I read your with interest. Kudos to you– regardless of your gender … but your comment regarding not being dependent on a future husband (which my parents also projected), startled me because I had read up to that point assuming you were male. Bad on me (if, unfortunately, not uncommon). But your response to Sami implies you are male, after all. As I said, great job either way …. but now I wonder if my unconscious assumption was misplaced in this particular instance after all. All this is a bit sticky, but I nevertheless ask if you would clarify. No offense intended — quite the opposite.

I HATE to admit it, but it made the same assumption until that sentence either. I’m am myself a single, 37-year old, female engineer, so Shame on me for having an assumption either way!

You’re right, but I didn’t feel that correcting Sami’s assumption was germane to answering his question.

Funnily when I read 41 and single millionaire, I thought that’s never a man 🫣

Kudos to taking ER plunge at such a young age. You sound like you knew what you wanted to do and did it. Seeing how you dictated your career, I am sure your retirement will be good.

Congrats again.

Well done! I hope your pursuit of your curiosity leads to great adventure.

Great story thanks for sharing!

With 2.1 million in retirement accounts, I am curious how you will withdraw cash to spend over the next 18 or so years?

Do you just plan to pay early withdrawal penalties?

Hi Matt, 50% of the retirement accounts are inherited, so I’m able — required, in fact — to access them pre-59.5 without penalty. My challenge is to juggle the taxes on what will be taxed as ordinary income and must be withdrawn over the next 9 years.

Great interview. I am hoping recent market downturns have not created any discomfort in your plans. You said you check your balances monthly. How did recent downturns affect you psychologically? Any impact? Did it result any any changes in plans are confidence in FIRE? Good for you getting out early! Great achievement.

Curious on one of your responses. You said you made your first million at age 37, but your NW is now $3.4M at age 41…how the giant jump over just 4 years?

Hi MI-94, no impact psychologically from the recent downturns. I sold some appreciated tax lots from the brokerage when I pulled the plug on work, so I haven’t had to withdraw as the market plunges further. I’m also reminding myself that I have more than enough for a lifetime and the market will recover before I need the bulk of it.

Regarding the NW jump:

– $3.4M includes my personal residence (which I didn’t consider part of my NW when hitting that first million, but people include it in these interviews, so I did)

– I had all of that first million in a total stock market index fund, and the market has gone up a lot in the past four years. Starting in 2018, my investments out-earned me.

– I inherited some money last year when my remaining parent died.

Good for you maintaining a positive outlook. Although I should not let it bother me, I find when my NW drops from past highs it does weigh on me a little bit. With most recent downturn we are down around $800k off of past peaks. I too try to remind myself i have enough and the 4% rule assumed market ups and downs, but still…. I guess I am human.

Good for you on the very impressive NW! I can only take credit for 1/2 of our total, Enjoy your very young retirement.

The market is up like 400% over the last 14 years vs a couple of 20% drops. We all get anchored on the highs, but have to remember, most of us have still made a ton of money in the market. Some would like a slower uptrend in net worth vs the large swings. At some point, it doesn’t matter until you start taking out money and even then, you aren’t taking all of it out at once.

Sorry to hear about your loss. I can relate. Would be curious to know how you fill up your emotional wellness tank. I’m about your age and FI and not quite sure what to do with next 20 years from an emotional support standpoint…

Wow. Very Impressive. The best thing is you can stay retired, or have the flexibility to volunteer, travel, work part-time (if you want), etc…

Pretty Inspiring.

Thanks for the interview, which is more relatable to my life. A lot of the interviews are couples married 20+ years with two children (not my situation)

How do you occupy your days? Do you have a routine? Is your passion for art a significant part of the time? I assume most people you know are still working, leaving your days fairly open.

This statement rang true to me: “…didn’t like the look of the next rung on the ladder”. I took two rungs too many up the ladder.

A retirement update would be great, as it’s still very early in the early retirement.

Hi Clay, I’ve developed sort of a routine. Coffee and reading to start the day, then an extended period of fitness, then projects in the afternoon — could be creating art, marketing art, working on the house/yard, helping a friend, learning stuff, running errands, gallivanting with another out-of-work friend (people who are also retired or self-employed with their own schedule turn out to be the best retirement friends!). I try to schedule as little as possible so I can do whatever I feel like doing and have the freedom to scamper off for a spur of the moment lunch invitation.

Your post is very similar to my situation except I’m 10 years older and retired 1.5 years ago with similar net worth. I’m curious on the more personal side of your retirement as I’m finding out that life is enjoyable but also vastly different in early retirement. Would love to hear if you would be doing a retirement post and how you are navigating some of the challenges and joys of your new life. Congrats!

Hi Amanda, yes — I plan to volunteer for a retirement post in the future. I hope you’re enjoying retirement as well!

I enjoyed this post as well often single people with no dependents rarely appear in the FIRE interviews and articles, yet we have to understand there is more than one route to happiness than marriage, kids, and a suburban house.

Curious as to how you handled covering for colleagues throughout the years, I’ve found the ones without kids or family get work piled on them when their parent-colleagues have a “kid issue” and need to leave work or when they go on parental leave. Was that ever an issue?

Also, what are some things you thought were challenges of getting to and living through FIRE that others told you about if you are single, that you would dispel since you’ve now achieved it?