If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in April.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 40 years old, and my wife will turn 40 in a few months.

We have been married almost 16 years!

Do you have kids/family (if so, how old are they)?

We have one rambunctious two-year-old.

They keep us on our toes and have made us ruthlessly prioritize our time and money.

What area of the country do you live in (and urban or rural)?

We live in a suburban city of a large Midwestern city…although our house does abut a corn field. So, it’s kind of like the best of both worlds?

We are only 45 minutes from the downtown area, so we don’t feel we are missing out on anything currently.

What is your current net worth?

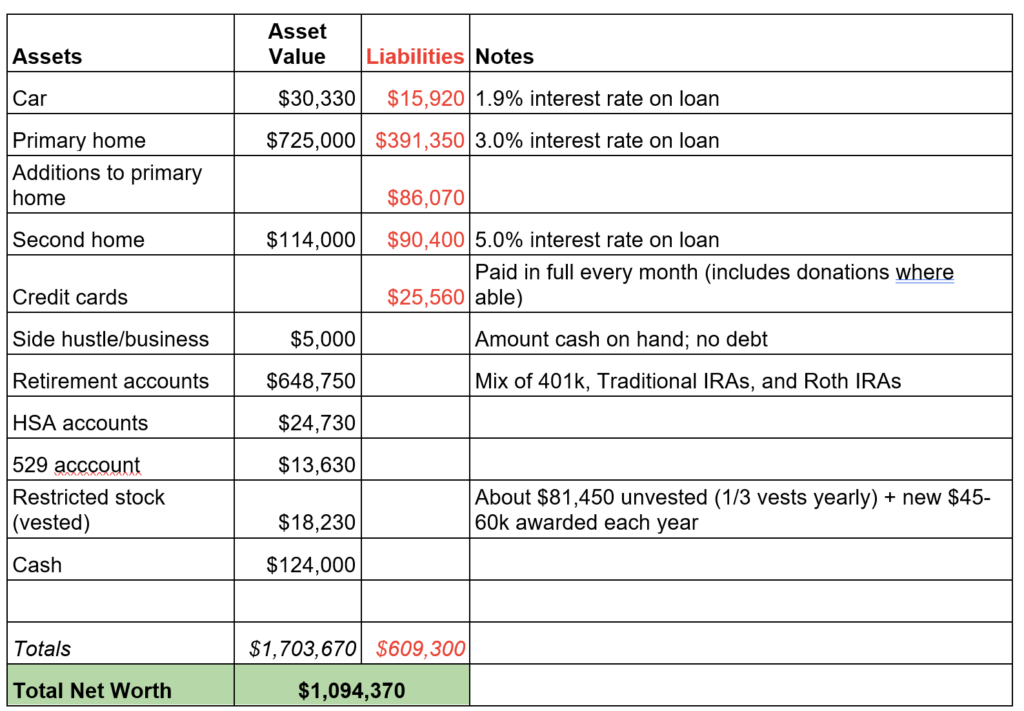

Our current net worth is about $1.1 million, depending on the day.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Our major assets are retirement accounts and real estate. Our primary house has been a beneficiary of the hot housing market, but it is by no means the only source of net worth.

Our major buckets are broken down in the table below, rounded for ease of calculations and market fluctuations. I do include our car for the time being, since we still have a loan on it (could easily sell it and be okay without a car), and its worth, as a used car, has been increasing to the point where it’s now worth more than we paid.

As for a second home, this purchase was made at the last minute earlier in 2022, and it was a “heart” purchase instead of a “head” purchase. We wanted a second homebase near our families to make long-term visits easier for everyone. As we have jobs that are done remotely, we can displace for extended periods of time while still working to see family more often.

You also notice a lower value to my side hustle/business; I track it as cash on hand because based on the type of side hustle, a valuation would be extremely difficult to calculate.

We put all monthly spending on credit cards to get points, airline miles, etc., including donations where able. Cash position is high due to some planned purchases and debit servicing.

EARN

What is your job?

I hold a Director level position at a large pharmaceutical company. I have no direct reports (thank goodness!!) but a wide sphere of influence and/or responsibility.

You’ll see below that I’ve bounced around some in my career, but in my current role, I think I’ve found my home. The opportunities within my current employer are quite broad, and I may not ever change employers again!

What is your annual income?

In 2021, my W2 gross income was about $211,000.

I will only focus on my income in this piece (but my wife has had a similar salary trajectory (well over $100,000/year).

I expect this to increase markedly in 2022, and in fact, I already have earned $137,000 in W2 income as of the beginning of April 2022.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I pulled my “Medicare Earnings” below from the SSA website into a table, but read on for the full story!

Oh man — I’ll start with my first W2 job, which was when I was in high school (in 1998) for $5.15/hour working in the tourist industry.

I then held a series of retail jobs over the next 3-5 years where I topped out at $5.50—big money!

These were all part-time jobs while going to school. Definitely less than $5k per year. The last 2 years of college, I was making $9.27 working as a lead in the retail space, making around $13,000 per year, working 30-40 hours a week and going to school full time.

After college, I entered grad school, where salaries are fixed at the institution level, starting at $23,000 and ending at $25,000. I hung around in academia for another 3 years, where salaries were fixed by grants from the federal government, starting at $39,000 and ending at $42,000.

You’ll notice some huge variations in income 2007-2013, which does not reflect my actual earnings but was a function of being paid from certain types of federal grants, which were not taxed.

I exited to the private sector (after 4 job offers), and accepted one at a biotech for $100,000 (woah big money!!!) in 2014—notice this jump in the table below. My education and experience within academia (8 years) are what commanded this salary and allowed a huge jump in base salary (increase of 2.4 times my previous salary).

I was at this company for 8 months and then it was restructured, and my next job was for an agency/consulting group (remote) that specializes in helping biotech and pharma clients, where I got a $105,000 salary. After 11 months, I was surprised by a promotion and given a 6% raise ($6,300). It was sprung on me suddenly out of cycle, so I was not prepared to discuss it. However, I did do some market research and went back to management, negotiating a raise to $130,000.

After about a year, I shifted to another company (remote), negotiating at $20,000 raise to $150,000. I ended this position after about at year at $155,000 and then took a lateral move for the same salary (but $20,000 sign-on bonus) to a different company (on-site, in office) where I would wear many hats and gain a lot of invaluable experience. It ended up being quite toxic, and I exited without another job lined up (thanks side hustle!) after a year. I used my side hustle to bridge my income until the next thing.

I took a full-time contract job for 3 months (on-site, in office) before one of my side hustle contacts offered me a job at $140,000 (remote). Since I like health insurance and guaranteed hours, I took it. I received a promotion after 4 months netting another $10,000/year (up to $150,000).

At this company, there was a restructuring (noticing a theme of volatility yet in my industry?) that severely impacted my work-life integration/balance—I missed my first Father’s Day from working 13 hours due to poor planning by project leaders. This pushed me to began to search immediately for another position.

I found one that was a jump in salary to $160,000 (with a $1,000 sign-on bonus) and responsibilities (remote).

After another 8 or 9 months, I had an unexpected opportunity present itself that I could not turn down (my current role; remote). At sign-on I negotiated a $15,000 sign-on bonus, salary of $177,000 base salary and 3 extra vacation days (plus bonus and restricted stock mentioned above in net worth calculations).

I recently received 3.5% raise, so currently sit at $183,000 base salary (with 20% target bonus).

What tips do you have for others who want to grow their career-related income?

Always negotiate everything, every time.

Be indispensable to not only your immediate manager, but your team and your organization. Building positive relationships where you demonstrate value is never underrated. It can reap rewards many times over the time and effort investment.

Don’t be afraid to jump jobs if you need to (or are forced). Sometimes it’s for different skills, sometimes it’s for the money, and sometimes it’s the environment (or some combination of the 3). Everyone’s career narrative is different—don’t stress it!

You can achieve high-earning status with a successful career and be completely remote—I’ve been doing remote long before COVID, and I’m never going back. 😉

What’s your work-life balance look like?

My work-life balance is amazing and better than it’s every been.

My 9-5 is very manageable and quite flexible, so I am able to spend time with my family every day and/or take care of life things during the workday (so as long as I get all my work done!).

As a result my working hours can be a bit weird, but it works best for my family and my mental health.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

I have had side hustles in some form since 2008.

All of my side hustles have been developed through professional contacts or previous employers—I have never advertised. My niche is highly specialized, and dependable and good work can command high hourly rates.

Right now, I have a side hustle that netted me an additional $62,000 profit in 2021. This can vary from year to year, but considering I did not dive into it deep until May of 2021, it’s still pretty good. My hourly rates are $150-200, currently, depending on the “client.”

SAVE

What is your annual spending?

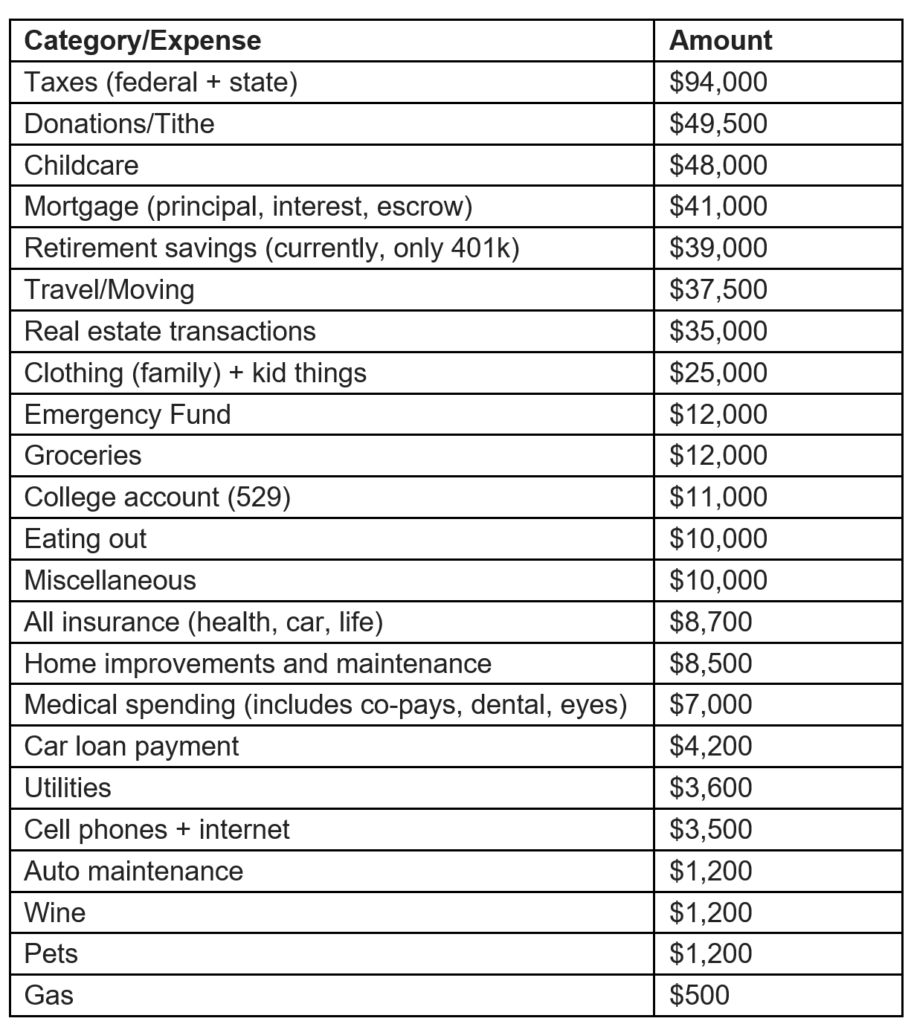

Our “spending” for 2021 was around $460,000. This includes all money in and all money out.

What are the main categories (expenses) this spending breaks into?

Our largest expenses, by far, are taxes, followed by donations/tithes, childcare, housing, and retirement savings.

2021 was an odd year because we had various costs associated with moving and buying/selling houses.

Do you have a budget? If so, how do you implement it?

We operate on a zero-based budget-ish.

For a long time, I religiously tracked and managed every transaction, but having a toddler zooming around makes you prioritize your time differently. This is broken out above a bit more, as our spending also goes to our “savings buckets” to even out the variability in things like medical expenses, car tabs, etc.

Now, I try to not sweat it too much as long as we are able to max out our retirement savings and have more money in than out!

What percentage of your gross income do you save and how has that changed over time?

We save about 10-15% of our income, designated as pure savings in retirement or cash.

Earlier in our marriage, we aggressively paid off our student loans while saving, so back then, as a portion of our income, it was around 30-40%.

What’s your best tip for saving (accumulating) money?

Spend less than you earn??! Growing your income through all avenues possible is also very helpful. Also, a side hustle never hurts.

Take advantage of all employer fringe benefits, for example, the 401k match or discounts at various service providers. Never turn down free money—these little things together really do add up. For example, my employer has a 4.5% match on 401k that vests immediately.

What’s your best tip for spending less money?

Prioritize what really matters.

If you have to take on debt, then do it as cheaply as possible.

What is your favorite thing to spend money on/your secret splurge?

Not so much a secret because it’s a budget line above, but wine!

We are members of several wine clubs (4 different wineries in 2 countries). We are not collectors because we buy the wine for enjoyment. It is great to be able to share great wine and conversation with friends and family.

INVEST

What is your investment philosophy/plan?

Automatically put as much money as we can into index funds that track major indices.

Boring, I know!

What has been your best investment?

Marrying a great partner!

Other than that, investing in a high-paying career has been very helpful.

What has been your worst investment?

Without a doubt, using a mortgage to buy a house. The amount of money spent to service the debt is insane.

I put this as the worst investment, but in general, I do not consider our home as a major investment vehicle. With the hundreds of thousands of dollars it takes to service mortgage debt, it is virtually impossible to make any money or even break even when selling a house (after factoring in interest, realtor payments, taxes, inflation, etc.)

What’s been your overall return?

7-8% (based on the 10-year return from my Roth IRA at Vanguard).

Otherwise, I don’t really track it very closely. Our investments are very much on autopilot.

How often do you monitor/review your portfolio?

Maybe monthly, if I’m updating net worth calculations.

Even when I do look, I am not checking individual asset classes. I am not actively tracking or reviewing investments because we use index funds.

NET WORTH

How did you accumulate your net worth?

We have not received any inheritance. A major part of our net worth accumulation has been to pay off debt as quickly as possible. I started tracking our net worth in June of 2009 (when it was -$30,000) but after we had paid off our car loan at the time.

For us, the psychological relief and cash flow options, pushed us to pay off these debts rather than focusing on investing. While we did do some small investing in retirement accounts during that time, the major focus was debt pay down.

Eliminating credit card and student loan debt early on helped us catapult our way to a better net worth. Because all our investments are essentially some sort of index fund (regardless of holdings of the fund), our major accumulator was our salaries.

After that, leveraging education and experience to increase salaries (detailed some above) has also been a major factor.

I would be remiss if I did not point out the side hustle. It has supercharged our ability to pay down debt!

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Greatest strength is definitely the EARN.

If I look at my first “salary” out of college, which was $23,000, I have essentially increased by salary 10 times in 15 years—not too shabby!

I suppose that investing could also be a close second but because we set-it-and-forget-it once we max it out, and it goes into our retirement accounts.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

We had a very rough start. At the beginning of our marriage, we had to take out a personal loan to consolidate credit card payments because we did not have the cash flow to pay all the minimum payments across the various credit cards. This was not a very fun place to be in. It took us several years to dig out of this, with no help from family, and a lot of self-learning on books, blogs, and internet forums.

The oldest post I have in my email from ESI Money was August 2009 (from FMF). Is he the key to all our success? We report—you decide!

What are you currently doing to maintain/grow your net worth?

Continuing to maximize retirement plan contributions.

We are considering outside-of-retirement-plan real estate investments in the next 5 years.

Do you have a target net worth you are trying to attain?

I don’t really have a specific net worth in mind but rather amounts I’d like to have $2 million in retirement accounts and another $1 million deployed to either be drawn down or generate income.

Realistically, once the mortgage is paid off, then it may be time to stop accumulating.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I was 39 when we passed the million-dollar mark.

No changes since then. Slow and steady wins the race.

What money mistakes have you made along the way that others can learn from?

From above, credit cards can be the devil. Since getting our house in order, always paying off credit cards, where to put the majority of our spending, has been key.

Additionally, debt can be a tool, but we like to avoid/minimize it where able.

What advice do you have for ESI Money readers on how to become wealthy?

Save more than you earn and then invest the difference!

It’s okay to pay off debt for mental health reasons. Being able to sleep at night can be more important than getting an extra couple of % for a year or 2.

FUTURE

What are your plans for the future regarding lifestyle?

I am hopeful by continuing to increase our net worth, I can “retire” around age 50. By retirement, I mean not having to have a 9-5 if I don’t want to—really more of financial independence.

I would probably continue to do some consulting, but it would be on my terms and not for needed income.

I would love to be able to have much more free time as my kiddo enters their teen years to support their various endeavors and activities.

What are your retirement plans?

Not working sounds amazingly fun.

Financial plans include maintaining a high net worth to support our family at a comfortable level.

For activities, I’m planning on some consulting/freelance work as well as more fishing, travel, and community volunteering in the healthcare space. I will not have any problems filling my time once a full-time job is not on the table.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

100% healthcare.

Given the skyrocketing costs and the needs of our family, it may be necessary to work part-time somewhere to maintain decent health insurance. There is no defined plan right now, but we’ll start to figure that out when we are about 5 years out from “retirement.”

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

I did not learn about finances until my early 20s and after I was already married.

I did not have much of a financial education growing up. Everything I learned was self-study in the form of books (Your Money Your Life, The Bogleheads’ Guide to Investing, The Total Money Makeover) and blogs (Free Money Finance, ESI Money, Get Rich Slowly, Simple Dollar). It clicked for me around 2007-2008.

Who inspired you to excel in life? Who are your heroes?

I have a very high internal drive to push the boundaries on success that I define.

But my grandparents inspired me in general through their perseverance and tenacity. They had a lot of hardships (besides the Great Depression and World War II) to overcome, and they never quit.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

Yes, we do give to quite a bit in absolute monetary terms to charity and/or church.

Since 2008, we have been donating at the very least 10% of our gross income. This includes side hustle as well, where we give 10% of gross receipts (before expenses).

Early on, we were very convicted that all we have been given is not our own. While we could have increased our net worth a lot earlier, I have no regrets about giving away this much money over the past 15-20 years. We have passed on hundreds of thousands of dollars at this point, and there are no plans to stop these donations.

Even after we stop our 9-5 jobs, we will still continue to give away at least 10% of our income.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

Our tentative plan is to give a small-ish inheritance to our kiddo.

Really, we want them to be okay, but nothing extravagant that would preclude them from working.

I expect most of our net worth will be supporting us in our golden years or given away.

Solid start and good fundamentals building toward FI. I love the focus on the tithe and charity. Your commitment to this is pretty rare and I also ascribe to the same principles. You may have some opportunities to lower expenses and put those savings to work but that depends on your goals and timing for what you want to achieve in life.

I like your philosophy around “negotiating everything, ” not being afraid to take chances and embracing change when it helps you achieve a higher level. Many people miss out because they are afraid to “ask for the order.” And wine helps which is one of your vices 😉

Keep up the good work and best of luck to you in achieving your future goals!

You are right. Expenses are definitely on the high side for this and probably next. But then we have plans to diversify savings outside of retirement accounts. Real estate maybe? TBD

You have the “golden ticket” when it comes to working in the healthcare industry. Most employed in healthcare will never com close to your income. Having said that, congratulations on achieving high net worth at such a young age. My wife and I were both employed in healthcare and have a NW ~ $2 million, but didn’t reach it until much later in life.

Golden ticket or handcuffs? Hard to tell. 😉 One part luck, one part education, and one part networking to get there. It also helped that we were debt free for a period of about 5 years before buying a house.

Golden ticket or handcuffs? Hard to tell. 😉 One part luck, one part education, and one part networking to get there. It also helped that we were debt free for a period of about 5 years before buying a house.