Today I have an update for you from a previous millionaire interview.

Today I have an update for you from a previous millionaire interview.

I’m letting three years pass from the initial interviews to the updates, so if you’ve been interviewed, I’ll be in touch. 😉

This update was submitted in December. It’s the second part of the interview. If you missed it, you’ll want to read Millionaire Interview Update 52 before moving on to this post.

As usual, my questions are in bold italics and their responses follow…

NET WORTH

What is your current net worth and how is that different from your original interview?

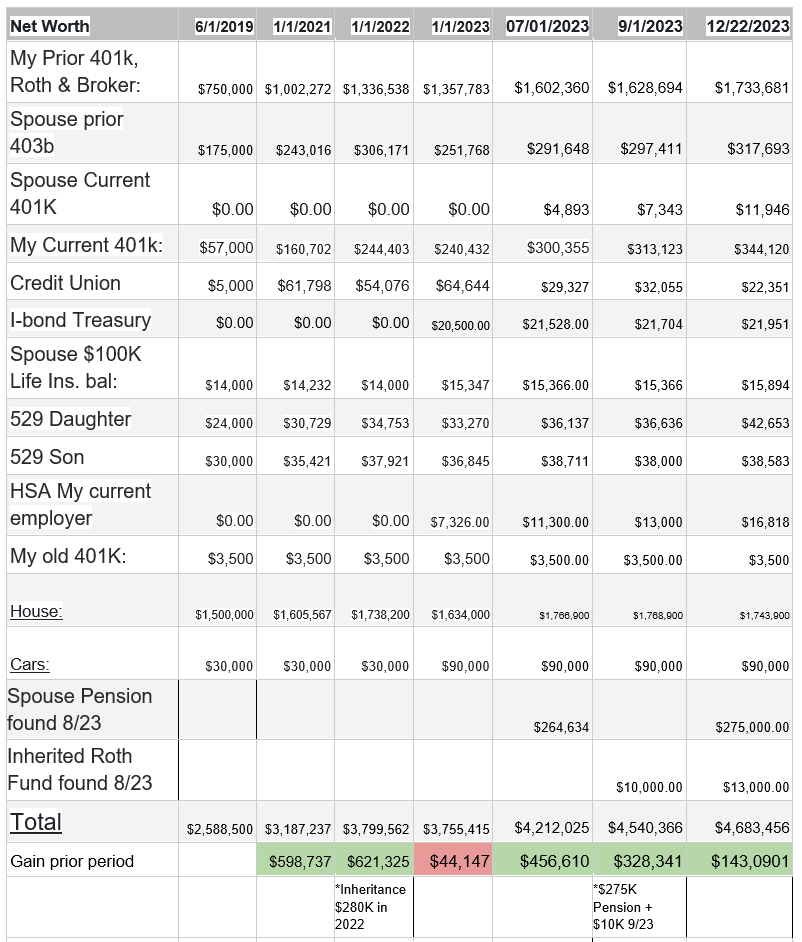

Here is my yearly net worth increase since June 2019, and then the last six months.

What happened along the way to make these changes?

Well, our net worth increased from $2,588,500 into $4,683,456 in 3.5 years (81% gain).

My snowball of compound interest and 34 years of saving every year no matter what finally materialized. Dual incomes also helped a lot as 7 years ago our household gross was “only” $175k as I was the only one working. Stable employment really helps to have consistent yearly savings.

Even taking out the inheritance and the pension of $530K, our investments had an appreciation of $1.28 million and our home had a $250K for a total increase of $1.53M or a gain of $510K per year. We had over $50K in 401(k) savings in each of the three years.

As they say, the 50’s are your highest earnings years and also the high savings accumulation years. Savings is the foundation of my good personal finance. Ever since I had to pay for college, I have always had a scarcity mindset, as it is always easier for me to save than to spend money. I still remember running out of money during my senior year of college, and had to borrow a couple thousand dollars from the parents to make it through to graduation. Not having any money in your bank account leaves a lifelong impression to have an extra cushion.

The biggest change since the MI-150 interview was that we paid off our house, and then we poured the $40k/year in mortgage payments into savings, investments, and Roth 401(k)s.

I find it ironic that the 3.5 years since the pandemic would be some of the best cumulative 4 years for stock returns. Again, the key is to stay in the investment game and not try to time the market. Dollar cost averaging works. I did not see the market decreasing 20% in 2022, at the same time I did not see it gaining all of the 20% back in 2023 and it looks like even more.

I have the majority of the investments in the S&P 500 index fund, and if you invested $100 in the S&P 500 at the beginning of 2019, you would have about $186.65 at the end of 2023, assuming you reinvested all dividends. This is a return on investment of 86.65%, or 14.31% per year. The returns of the S&P 500 were 31.5% in 2019, 18.4% in 2020, 28.7% in 2021 and -18.1% in 2022. The returns in 2023 are 26.2% through 12/15/2023. If only I had my money in the Magnificent 7; as the magnificent 7 stocks of Tesla, Amazon, Meta, Apple, Microsoft, Alphabet and Nvidia have a 87% return YTD to 12/2023.

In 2019, I had about $1,088,500 investible funds. If you reinvested all of the dividends, this would be a return on investment of 86.6%, or 14.31% per year if I did not add any funds would total $2,031,682. The magic of compound interest and reinvestments. Again, stellar returns have been great. I would not expect this to continue, but I have a much greater cushion now than I did in 2019.

Finally I would not have thought our net worth would almost double in the 3.5 years. Stay in the game and have an investment plan.

What are you currently doing to maintain/grow your net worth?

More of the same for the next two years: contributing to my Roth 401(k) to the maximum of $30K, plus $10K Company match.

My wife contributes $15K to her Roth 401(k). I have another $10K go into my HSA account, and another $10k in company stock purchased with a 5% discount. We purchased $20k in I-bonds in 2021.

We also are contributing $5K per year to our 529 account. We have 529 savings for 2 years of college for my daughter, but will prioritize saving for her final 2 years of college in the next 2 years of working on funding this HSA at 36K in 2024 and $36K in 2025.

EARN

What is your job?

I am still a Senior Vice President at a major broker handling medical malpractice / professional liability claims for doctors and hospital systems that I have been doing for 30 years. I currently am a manager and oversee 9 other claim advocates in the Pac South region, and the national healthcare advocate leader.

My wife was also promoted to supervisor as a Clinical Laboratory Scientist handling patient specimens at a specialty lab. She still only works 7 hour days Monday through Thursday and half a day on Friday.

As stated above, we are working to pay for our daughter’s private high school education, as well as, funding her college 529 fund, and our Roth 401(k)s. My son, who is in his 4th year of community college, most likely will not be obtaining a 4 year degree. I now fully understand that not everyone is a good candidate for college, and each child has their own strengths and weaknesses, and college classes with abstract concepts are beyond some peoples skill set. We hope he will get his AA degree, and get a certificate in a trade or a railroad certificate, which is his passion.

What is your annual income?

I make more now than at any time in my career at about $195K, and my wife makes $100K.

As stated above, we are now earning $15K per year in interest and dividend investments (3.5 years ago it was $400.00 per year).

My goal is for both my wife and I to continue to work until December 2025 and we will earn a total of about $600K in gross earnings over those two years. We will only net about $470K after all 401(k)s etc. deductions, taxes will total $175K and we will net $293K over those two years, or $146K per year. Our monthly expenses are $8K per month or $96K per year. This will allow us to save another $50k for the 529 college funds.

We probably have too much in our cash account for 2.5 years of fixed expenses. Given the cash and other non-retirement investments for the first time in my life, my dividend and interest payments are now about $15K per year.

Thus our income plus interest for 2024 should be $310K per year.

How has this changed since your last interview?

I only had several nominal raises over the last 6 years, but my bonus has increased from $5K per year to over $20k per year as well as an increase of $12K per year on my base. It is hard to believe no one was getting raises from 2019 to 2021 in corporate America (if you don’t change jobs), and then inflation started.

My salary over the last six years since I started in 2017 has basically only kept up with inflation from $160K to about $195K now per an inflation calculator. The inflation calculator states: $160K in 2017 is equivalent in purchasing power to about $200K today, an increase of $40k over 6 years. The dollar had an average inflation rate of 3.83% per year between 2017 and today (2023), producing a cumulative price increase of 25.27%. Inflation was 4.7% in 2021, 8% in 2022 and 4.92% to far in 2023. I have gotten raises over the last six years but I’m still making less now than I did in 1997 after inflation (195K versus $200K).

Over 70% of the employee’s that I manage have not kept up with inflation during this time and most of them have been with the company over 20 years.

However, I remember in April of 2020 when our company made an announcement that no one was going to be laid off and everyone would be working from home full time. It was better than some of our competitors who both laid off employees and instituted a 10% salary decrease for the entire workforce for the remainder of 2020. The main thing that happened is a lot of our competitors’ good employees left those companies and came to work at our company.

2020 and 2021 ended up being two of the best years at our company in its 100 year history in both profits and growth. My company finally offered some raises, but I know as a manager the standard raise is just 2% per year over the last 6 years, and you have to be an excellent employee (only 10% are standouts in Workday) to get a 4-6% raise, otherwise it is just a 1-2% raise for an average worker. Again, a standard average worker does not keep up with inflation.

Have you added, grown, or lost any additional sources of income besides your career?

I do not have any additional sources of income other than our two W-2 jobs and our investment income of $15K per year.

We had the two one-time additional funds of my parents inheritance and the pension. Most likely another inheritance for my wife.

SAVE

What is your annual spending and how has it changed since your interview?

Our spending has been about $8K per month or $96k per year.

Monthly Breakdown is:

- $ 2,500 High School Tuition (This will continue for the next 2 years into a 529)

- $ 550 Insurance for 3 cars, home, umbrella (insurance premiums have doubled for these in the last 3 years in CA)

- $ 1,000 Car payment and gas for 3 cars

- $ 700 Utilities

- $1,000 Taxes: Property, auto, licenses

- $ 250 Timeshare for maintenance fees, taxes & other fees ($3K / year)

- $1,000 Groceries

- $1,000 General merchandise & restaurants

—————– - $8,000 per month ($96,000 / year)

Over the last 3.5 years, our monthly spending has not changed much, as it as $7,500 per month in 2019.

Fixed costs are about $5,500 per month or $66,000 per year if you take the tuition out of the equation.

Again, we basically transferred our $3,000 per month mortgage payment in 2019 to a $2,500 per month tuition bill for the last 3 years. That is essentially the main change from 2019.

I always felt that unless someone went to an Ivy School and graduated in the top 10%, then an Ivy League School would be worth it. However, that is like .001% of all graduates, and any University of California School or California State University would be as good or similar. I know from experience, any student gets out of college what they put into it, and it does not not matter where you went to school other than your degree.

I have told my daughter I will pay for what a UC School will cost, and if she wants to spend more than that, then it is her responsibility. She does not want to get a job, so I guess it will be a UC or Cal State.

The last thing any twenty something needs is a $120K in student loans that most private school graduates will have to take as they cost $35 to $45k more per year than a UC university. I feel that her having skin in the game is important, and to guide her on making the huge economic decision on what school to go to.

I hate all of the private colleges and how they market directly to these 17 year olds, and they don’t tell them what the full cost to attend the college with their handwritten written marketing letters. It is like medical billing, they only tell you the price after you have already committed to going there.

What happened along the way to make these changes?

I touched on my parents dying above, and this has made me want to finalize my early retirement of age 60. It does not feel that early to retire as my daughter is still 17, but then again, I only know two people who retired before 60.

My college roommate retired at 50 after he sold his company, but has since gone back to work as he started a new company. My cousin who is a year younger than I am is retiring as a teacher at age 56, but he has a fully funded teacher pension next June. He told me he is not retiring, but “transitioning” to his side hustle of fixing up homes while having his pension and medical paid for.

I myself don’t feel comfortable retiring without having my daughters college savings fully funded before we retire. I know I can use some of my retirement funds on this, but I have basically had buckets of cash and I have never taken my retirement funds before, and don’t want to do so this late in the game.

INVEST

What are your current investments and how have they changed over the years?

This has been explained above with mainly simplified investment in a S&P 500 index funds with very little expenses. Dollar cost averaging over the last 30 years.

I feel I got a little lucky with my home equity, but it really does not do anything until, or if, we sell (I guess we are realizing about $72,000 per year in comparable home rental income for our house). As my wife has only lived 5 miles from where she was born, I don’t believe we will be moving in the next 10 years. Maybe after the kids have been established and on their own. Until then, I think we are most likely staying put.

There are a lot worse places to live than Southern California. I had a dream of moving to Hawaii for 8 months in the winter, and summer on a lake house in Minnesota for 4 months of summer. However, I believe I could spend 2 months in each state.

What happened along the way to make these changes?

By tracking my finances over the last 3 years, this has made me realize that age is not the reason to retire, but when the numbers add up that I will be able to retire.

Consolidating my finances and tracking them while still living a very frugal lifestyle. I can’t say it was totally frugal these last three years as we paid for private high school, and my wife got a new car 2 years ago, our first new car in 10 years. The other two are 11 and 7 years old now.

I do believe that we need to live a little bit. I keep on remembering my Dad, and the last two cars he purchased he would always say it would be his “last car.” You can’t take it with you and you have to enjoy today as well as tomorrow.

I wish I would have saved more in the 529s, but then again, I don’t want to save to much in a 529 as my son is essentially not using his funds. I am still short of saving of 2 years of college expenses for my daughter to attend a 4 year university.

However, my greatest fear or unknown is how we will live from age 60 to age 70 without my income or my Social Security. I have come to realize this is basic math and looking at investment calculators. This is the time where we will have to live off of our investments as my wife will not take Social Security until I’m 63 (when she turns 62), and I will not take Social Security until I turn 70. Thus, the 10 years is what I’m most concerned about.

However, as of 12/2023 we have about $2.8M of cash/stock investments that will most likely expand to over $3.3M with just new investment money over the next two years. I estimate $125K per year for year 1 to 3, then $100K for year 4 to year 10 (as my wife will be receiving about $25K/year in Social Security).

I believe that when I am aged 60 to 65, my healthcare bill will be $20K per year. Even without any investment returns (which is unlikely and I would estimate to be 4% per year), this only totals $1.075M to live on for 10 years. There would still be $2M in investment returns which will most likely have an increase in value or break even on what I take out.

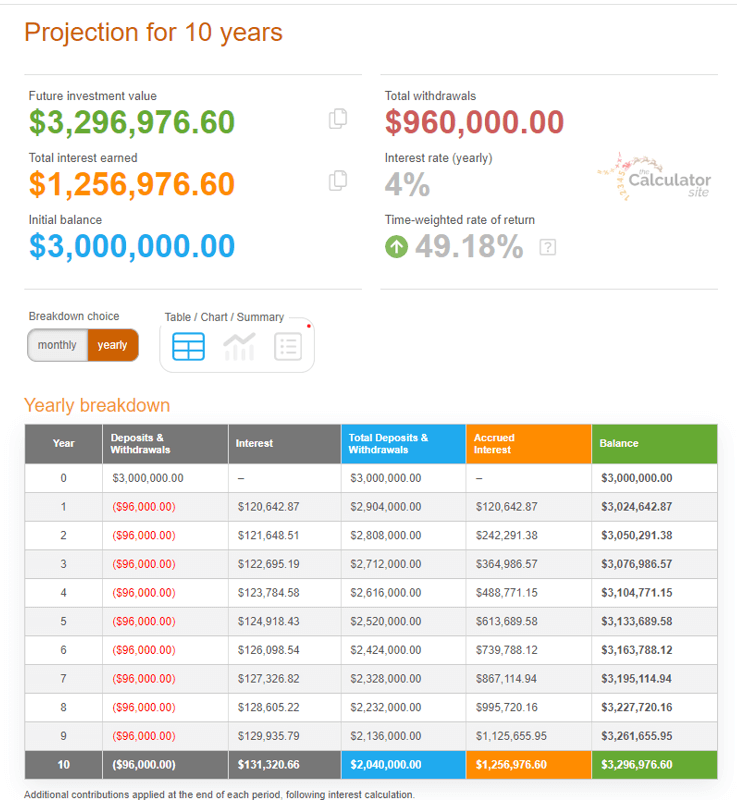

Looking at a simple Withdrawal ($8K/month) & Invest Return (4%) savings Calculator:

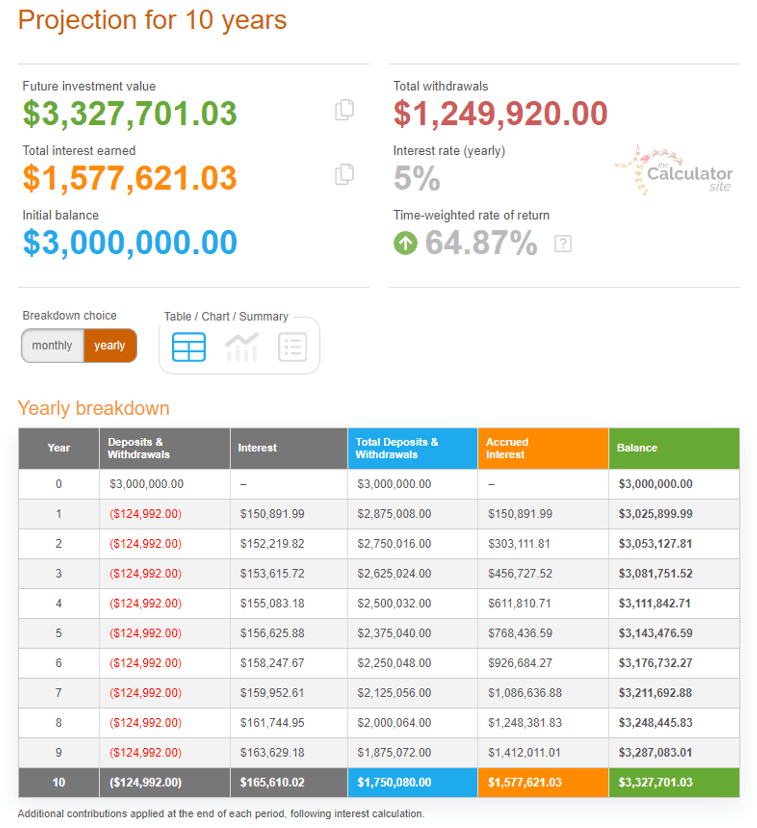

Taking $10,415 out monthly ($125K/year) for 10 years and increasing the investment return to 5% which is still much less than I have made the last 5 years, the numbers are similar.

These calculators are all in the assumptions and knowing the the future investment returns will be (which is impossible but taking your last 5 year investment returns is a good starting place):

Either way, I will most likely not be reducing my principle over these 10 years from age 60 to 70. I will most likely have an earning of $1.57M and only have withdrawals of $1.25M. Most likely scenario is that the $3M will be greater in 10 years, even taking out $125K/year for 10 years. The total amount of the $3M funds would be $3.327M.

However, once I turn 70, we will have 75% of our yearly expenses in Social Security (for both my wife and me) that increases with inflation. I’m sure the investments will continue to snowball during this time as we will be taking much less from our investments after I turn 70.

The other item that has been on my mind, is converting about $2.1M in pre-tax 401(k) to Roth 401(k)s. I know that taxes will have to be paid on the pre-tax 401(k), and this will be in addition to the above totals. I will have to do some more calculations when I finally retire to see if it makes economic sense to convert to Roth 401(k)s as I know that it will be worth a lot more for my kids if we pass down a Roth versus a pre-tax 401(k).

However, as outlined above, they will still have to withdraw the funds in an IRA BDA fund within 10 years after both of us have died. I will also have to get a full Estate Plan, an updated will, and healthcare directive fully in place once I turn 60.

Overall, what’s better and what’s worse since your last interview?

As outlined above, the investment returns have performed much better than I expected.

However, at the end of 2022, and a 20% loss of my portfolio (but the home increased in value), I felt like I was treading water from the beginning of 2021 until December 2023. 2023 came back strong.

I did not expect that both of my parents would have died, as I hoped that I would still have more time with them.

What are your plans for the future?

As stated above, I will work for two more years, continue to max saving in 401(k)s, 529s, etc. Retire in 24 months from now.

I don’t have a “side hustle” like most people who write into ESI have. I don’t know if I need one, as I already won the game.

Then again, I am somewhat concerned about how I will spend all of my retirement free time. I will also have the time to create some side hustles, but more how I will have purpose in filling my time then for financial reasons.

I already play racquetball weekly, lift weights 3 times a week with my son, and walk 6 miles a day, so I keep active.

Given that you have a bit more wisdom and experience, what advice do you have these days for ESI Money readers?

Make plans, but be flexible.

Don’t try to time the market, and the main issue is to have consistent savings, keep investment costs down, live within your means, and paying off your house is a wonderful psychological and financial goal.

I will now be able to live essentially free for the next 12 years except for utilities and low taxes based on 1997 home values. I also want to have some slow travel when I retire, spending 30 days in places about 4 months out of the year in my 60’s. However, plans can change and health and mobility may change. My wife will want to be close to our kids (and hopefully grandkids), but they will most likely be “launched” in my late 60s. I had my children later as I was 40 when my daughter was born and she will be 20 when I retire.

Households and investors need to make forecasts to set baseline expectations of gains or losses for financial planning purposes. Forecasting is fine. But it’s important to understand how often life gets in the way of your expectations, as surprises occur more often than anyone could imagine. No one can predict the future or your future gains or the true financial needs.

I know the psychology of not working will also be a challenge and finding a purpose will be a transition once I retire. However, I feel that after the honeymoon of year 1 of being retired, that I will find my rhythm.

My wife has not yet decided to retire at age 59, but we will cross that bridge when we get there. The main thing I need to focus on in my 2 year ramp up to retirement is my health and get all of the check-ups, preventive care, dental procedures, etc. and keep up my active lifestyle. You never know when your book will end, but I feel confident that my slow and steady growth of my earnings, savings & investments has won the race on the financial side of retirement.

We will all face a health issue when we age, as without your health, all the money will not matter or make you happy. Relationships, family and good health are priceless. If nothing else, I have the above financial plan that I can fall back on.

I want to thank John and ESImoney.com for providing me (and everyone else who reads) such a great service with my financial education with consistent, interesting and outstanding articles on finance and retirement. This is the one finance site that I have enjoyed the most out of all of my personal finance sites, and it has provided me the education and incentive to change my way of thinking and provided action plans regarding my own retirement and personal finance.

When I found it over 5 years ago, I knew I had found my rich uncle who would provide sound, realistic and non-marketing financial advice. The mainstream media (used to be magazines, but now is websites and newspapers articles) has nothing on the insights this site has, as I used to always subscribe to Money, Kiplingers and Smart Money 25 years ago. By doing these interviews, it really has solidified my financial picture and has given me the incentive to go from someday in the future, to actually having a plan.

Luck was part of my net worth, but it also was increasing my earnings, finally having savings with an emergency fund, and then having enough money in the 401(k) to start the investment snowball moving over the decades.

Get an education, get a good job, and buy a house to raise your family. The American dream is still alive.

Stay in the investment game, enjoy the journey of life, and strive for an early financially independent retirement.

What a great “steady Eddie” story! I hope young people are consuming all of the amazing wisdom ESI has to offer. Slow and steady not only wins the race, but provides tremendous balance, focus and stability along the way. This is a dream come true. Congratulations!

Congrats on your success, and thank you for sharing your journey. I agree with you completely on your compliments of ESI. I have learned so much, and the site has been of great value to me as well.

What an incredible progress since 2019! Having a paid off home and that much equity, plus your investments, have set up you up for success to retire at any point from here on out. You’ve worked hard and your kids are lucky to have a strong start in life because of you. I only wish buying a house was as easy to today as back then.

I love the focus on savings, while earning solid, but not superb salaries. A couple questions: 1) have you thought about changing the 529 from your son’s name to your daughter’s? 2) have you looked at monte carlo simulation sites to model future net worth? There are a few free financial independence calcs that are great for running scenarios and getting a bit more granular vs. steady return simulations. Again, congrats on your success so far.

Yes, that is the plan to transfer my son’s unused 529 to my daughter. It has been a grind, but the easy path is to be consistent in your savings in the 401K and now a Roth 401K. My net worth in 1997 was $30,000 which was used as part of the downpayment on the house. I never considered 23 years as paying off a house as fast, as in the Midwest they take out a lot of 15-year loans (or at least they used to). I just ran my net worth as the markets have continued their upward movement in the last two months. My net worth increased from $4,683,456 to $4,868,555 to go up $185K in two months, or 4%. Crazy to have a six-figure net worth increase (or about my current annual salary) in two months. I’m aware, that this could also go down 4% in two months as well as 2022 went down 20%. Time in the market always beats timing the market. I have run Monte Carlo simulations, but for this evaluation I just wanted basic numbers to demonstrate the assumptions on withdrawals and the time value of money returns. I like https://www.newretirement.com tool for this or http://www.empower.com. Any simulation is all based on the assumptions of the percentage increases and consumption levels you input. The 4% and 5% are very conservative when you consider my 5-year or 10-year returns are about 8-9%. Whenever you run one of those “are you saving enough for retirement” calculators, they always have very very low return assumptions to tell you are behind and you need their help to increase your returns. The “secret” is to continually save to add to your retirement funds. Thank you for reading and I’m glad everyone enjoyed the update.

Yes, it is the plan to use my son’s 529 for my daughters. I have used Monte Carlo simulations, but I wanted to keep it basic for this demonstration on what would happen with 4% and 5% returns, which is very conservative, and the withdrawal would still be less than the investment return/income. I have used https://www.newretirement.com/ which I found to be a very good tool. Yes, hard to believe that in the two months since I wrote this, our net worth has increased another $200K to $4.8M. I know it can decrease just as easily over the next 2 months. I remember treading water from 2001 to 2011 when there was essentially no return after the dot.com and then financial crisis downturns. Then again, I was dollar cost averaging and investing while prices were very low. Without that foundation of continual saving/investing, I would not have the returns today.

Thanks for sharing the second half!