Today I have an update for you from a previous millionaire interview.

Today I have an update for you from a previous millionaire interview.

I’m letting three years pass from the initial interviews to the updates, so if you’ve been interviewed, I’ll be in touch. 😉

This update was submitted in January.

As usual, my questions are in bold italics and their responses follow…

OVERVIEW

How old are you?

I am 62 and my wife is 61.

We have been married 38 wonderful years.

Do you have kids?

We have five adult kids (age range from 33 to 20).

Three of our kids are fully independent and on their own.

Our fourth just graduated college as I write this and starts their full time job in the New Year.

Our youngest is a junior in college.

One of our goals was to pay for each of our kids to go to college. We never used a 529 fund or any other tax deferred fund. This was probably a miss on our part and may have helped to have a more efficient saving and spending plan but it has all worked out.

We funded college by saving for each child over the years but the bulk of funding has been cash flowed from current earnings. Each child has helped by working to pay for books and incidentals as well as earning scholarships. Overall it’s been about 75/25 split for parent/child funding their college educations.

Each one will have a bachelor’s degree with no student loan debt (and no debt for us either!). We told them we would help them by investing in a college education and would be spending some of their inheritance now to help them get started.

We also have two grandchildren (under 5 years old). What a joy they are to us. We are thinking about opening 529 accounts for them as part of our gifting strategy.

What area of the country do you live in (and urban or rural)?

We live in a medium sized metro area in the mid-Atlantic.

Our home is in a typical suburban neighborhood.

We are the millionaires next door: nothing fancy about our home, vehicles, or lifestyle.

What was your original Millionaire Interview on ESI Money?

I was Millionaire Interview 203.

The data from that interview was from May 2020 as a point of comparison for this update (December 2023).

Is there anything else we should know about you?

I retired from the military almost 20 years ago. I’ve been retired from active duty almost as long as I was on active duty.

Those years are among my fondest memories both professionally and personally. We lived on both coasts multiple times and saw nearly all of the US. We have friends all across the country. It was a really great experience for our family.

NET WORTH

What is your current net worth and how is that different than your original interview?

- Current: $3.079MM

- Original: $1.937MM

- Net Worth up $1.142MM

We have no debt. Paid off our home in 2018.

What happened along the way to make these changes?

Some key changes I made over the last three years include:

- I took advantage of an increasing interest rate environment by moving some of my cash to I Bonds and T Bills. There is also a tax deferral benefit to not paying taxes on I Bonds until cashing them in. T Bills have the additional advantage of being exempt from state income tax.

- I started investing in Syndicated Real Estate investments to diversify my portfolio into RE without having to own and manage the asset myself. I learned about these in the Millionaire Money Mentors forum. These have proven to be good distribution producing vehicles (~$1,100 per month) with tax depreciation advantages in my high earning years. These are not without risk, however, as I have had one of my investments pause distributions due to an increased interest rate environment as the syndicator looks at refinancing options and headwinds. Fortunately I have not yet had a capital call.

- I started a Donor Advised Fund to take additional tax deductions in these current high earning years. I was able to avoid capital gains by donating appreciated shares directly to the DAF. I will use the DAF for my future charitable contributions once I am retired until age 70.5 where I will start donating Qualified Charitable Distributions from my IRA/401K balance to reduce my tax load of Required Minimum Distributions starting at age 75.

What are you currently doing to maintain/grow your net worth?

As I approached Social Security eligibility age, I began to increase my exposure to stocks (primarily S&P 500 index fund in my 401k and VTSAX index fund in my brokerage) and to Syndicated Real Estate holdings.

I do not plan to take SS until age 70, but I know that I could take it any time once I retire and cover all my expenses with SS and my military pension.

I have enough cash to cover any sequence of returns risk between now and age 70 without touching my portfolio. This increased allocation to stocks has paid off as 2022 was a flat year and I bought heavily while 2023 had the slingshot effect.

EARN

What is your job?

I am a director in a Fortune 50 company real estate group. I lead a team that delivers highly engineered and complex facilities.

I have spent most of my corporate career specializing in this type of facility construction for large companies either on the owner side or as a consultant.

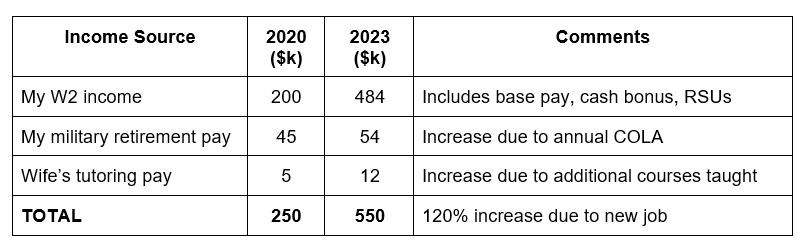

What is your annual income?

Our household total annual income is $550k.

This has gone up substantially since my 2020 interview due to a job change.

How has this changed since your last interview?

In my initial MI interview, I noted that my “total compensation has drifted downward in the last five years primarily due to my inability to relocate (by choice) for new opportunities. If I were willing to move, I could increase my income by 1.5X where I am now (at least pre-COVID-19).”

What a difference a few months make! Shortly after my MI was published I actually decided to leave the company I was working for. I was in a role that I did not like at all. Although I was very successful at it, the role was not a good fit and there were limited opportunities within that company that interested me. So I decided to resign and did so at the end of 2020. I was thinking I might just retire for good but I had an uneasy feeling about retiring with a “thud” instead of going out on top.

Just as I was wrapping up that role, I got a call from my current company for a role that was perfect for my background and what I really like doing. The company found me through networking from a former colleague as I was unaware of the role and opportunity. The power of a great network!

My experience was greatly needed by the company as they were embarking on a new construction program and my prior experience in that area was a perfect fit. After five months of interviewing I was offered the role in early 2021. Given COVID and my niche experience the company did not require me to relocate and my compensation increased by almost 2.5X.

Between roles I was able to do a two-month trial retirement period and realized I was not quite ready to retire and the new opportunity was the capstone to my career and the way I wanted to finish up and I still had two kids left to get through college. This role has turned out to be with one of the best companies I have worked for with great bosses and a great culture. Wish I could have joined 5+ years ago!

My wife is a part time tutor. She has taken on more course load as our last child went off to college. We are quasi empty nesters with our last two kids coming home on school breaks.

Have you added, grown, or lost any additional sources of income besides your career?

Added income distribution stream through Syndicated Real Estate holdings as discussed above.

SAVE

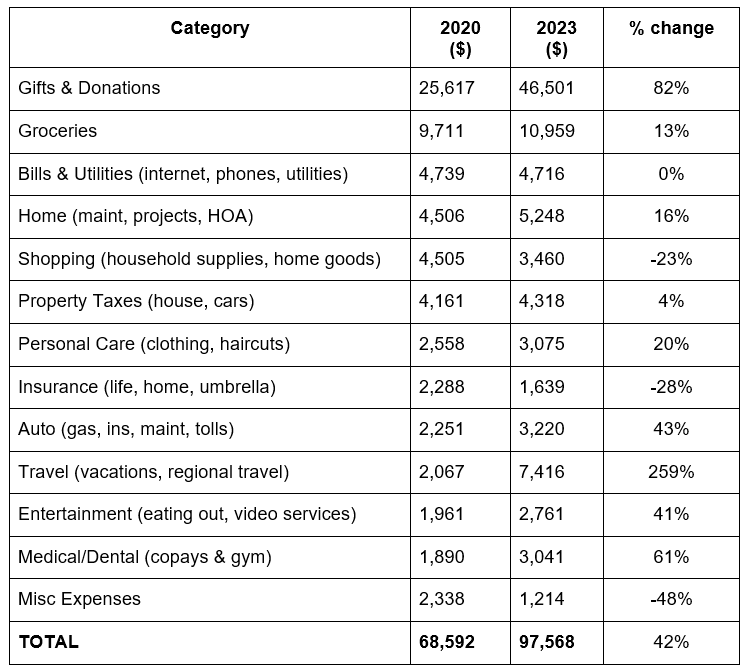

What is your annual spending and how has it changed since your interview?

Below is a comparison of my expenses from 2020 to current.

Not included in these numbers are the remaining tuition payments for my last child in college. We have an account to cover the last couple of years.

What happened along the way to make these changes?

We’ve seen costs go up due to inflation in several categories. However our biggest dollar increase has been in our giving line item (we give 10% to our church and other ministries) due to our increased income.

We have also increased our travel expenses by focusing on more regional travel and experiences rather than things. We have paid for beach and mountain trips for the whole family as the kids have grown up and dispersed. This brings them together and makes great family memories.

Our drop in expense line items are from things like: less insurance costs as we now self-insure for life insurance; less kid school, utility, and food costs as our last two are now in college.

INVEST

What are your current investments and how have they changed over the years?

I mostly follow the Boglehead approach to my portfolio.

I have four primary index fund types distributed among US and International bonds, and US and International stocks.

My current allocation:

- Cash/CDs – 14.3%

- I Bonds/T Bills – 9.2%

- Bond Index – 12.5%

- Equities – 54.2%

- REIT/Syndicated RE – 8.3%

- Other – 1.5%

I have built a bucket of assets out of the market to draw off for retirement until age 70 when I intend to draw Social Security. I like the idea of a bucket approach for money out of the market to protect against sequence of returns risk.

We have been increasing exposure to equities and real estate where I plan to stay within the bands of 55-60% equities and 5-7% for Syndicated Real Estate deals. I don’t love bonds, but follow the guidance to have them for ballast in the portfolio. With interest rates expected to drop in 2024, these may see increased performance.

What happened along the way to make these changes?

I am balancing the “if you have won the game, stop playing” approach with the desire to take a bit more risk for increased returns. It is easy to take additional risk while I have good W2 income, but as I prepare for retirement, I want a sleep-well-at-night (SWAN) portfolio. I think I am about at equilibrium on my asset allocation for SWAN.

Additionally, I am preparing for when I start Roth conversions after I retire. I plan to have more equities in my Roth accounts (draw these last), and more bonds in my 401k/IRA accounts for tax efficiency. I have been doing backdoor Roths for the past five years while waiting for Roth conversions.

I have also been putting additional money into a taxable brokerage VTSAX fund, which is a very tax efficient fund, as I adjust what vehicles to hold various types of assets.

MISCELLANEOUS

What other financial challenges or opportunities have you faced since your last interview?

My best opportunity has been my new role and company.

It has been a great fit and I am at peak compensation for my career.

Overall, what’s better and what’s worse since your last interview?

Without question, my change in job and employer has been a real boon.

What are your plans for the future?

I plan to retire once the major programs I was hired for are completed. I am targeting some time later in 2024 but I can already see I may suffer the one-more-year syndrome. Eventually, we will likely relocate from where we live to a smaller/quieter area. We also plan to take some international trips.

I am also simplifying my holdings. Once I retire I will move three 401k’s into a single IRA and start Roth conversions. I also have accounts in two banks, and one credit union as well as two brokerage firms. I want to reduce the number of accounts I manage and make it simpler for me and my wife as we get older.

Given that you have a bit more wisdom and experience, what advice do you have these days for ESI Money readers?

Be persistent and don’t give up.

I was feeling like my career was ending and that I might not get the opportunity for the type of role I felt I would be best suited. I ended up getting a great role and I have excelled at it due to the depth of my experience. This has supercharged my E-S-I and has been very fulfilling professionally.

Given my unique situation of having kids at home when many of my peers have long been empty nesters, the additional income has allowed me to launch the remaining ones well and send them to colleges that might not have been as affordable had I not continued to work these last three years. (Our goal is to have no adult kids on financial life support.)

Listen to your gut on your risk tolerance. Do not take too much or too little risk (paraphrased from Bogleheads). But to see progress in growing your net worth you must take some level of risk and get comfortable with that.

Be a continual financial learner. This will help with staying the course, managing risk, and avoiding costly errors that could lead to losing money. There are a plethora of resources available. Spend a few hours per week learning to become your own financial planning expert and the payoff over time will be well worth it. While I always saved and invested in my adult working career, I did not become a dedicated student of personal finance until about 12 years ago, but self-education has supercharged my net worth; doubling in the last 5 years alone.

I was just going to ask how you fell into line of work. Great way to finish your career and bolster the spending. Having a great network is so important. That’s one thing that today’s world of remote work somewhat inhibits. You don’t have those bonding or networking times like in the office or events. I wonder what the best way is to have a network so you find an amazing job that’s a better match like you did!

I replied below. I meant to reply to your post, but inadvertently started a new post.

You make a great point in that remote work makes it harder to build a network. I use LinkedIn to continue to grow and nurture my network. I reach out to people on direct messaging and I interact on various posts. In the case of my most recent job, I had quietly let folks in my network know what I was looking for (back in 2019/2020), so when the person that referred me got the call from my company, he said he wasn’t the right guy, but he knew who was (me!). And that is how it has worked for me on more than one occasion.

I like that your greatest increase in money going out is giving ten percent of your greatly increased income to your church and other ministries.

Thanks for sharing your update. May the Lord continue to bless you richly as you follow His plan!

Thank you! I try to remember that God owns it all and I am merely the steward of all he has provided. Giving helps keep me humble and focused on where my true treasures lie.