So far there have been three posts in this series and you can read those if you missed them or want a refresher. They are:

- Longevity and the New Journey of Retirement

- Retirement Health, Changing Definition, Work, and Worries

- The Four Stages of Retirement

As usual, I’ll be sharing some highlights of the study and then giving my thoughts on their findings.

Let’s get started…

Four Retirement Groups

Last time in this series we discussed the four stages of retirement — the four distinct sections of time that retirees move through just before and into retirement.

Today we’re going to cover what the study says are four groups of retirees that act in various ways that make them similar within each group.

As you might remember, we saw four other groups (similar to what we’re about to see here) in What Retirees Want, Retirement Segments and Stages of Retirement. The four groups there were named and described as follows:

We have fleshed out the segment characteristics with key demographic, financial, and other background information that aligns with the segment patterns. Roughly 20% of retirees fall into each of the first three segments, which we call Ageless Explorers, Comfortably Contents, and Live for Todays. That leaves about 35% of retirees in the fourth segment, Worried Strugglers.

If you want details on what each of those groups was like, you can go back and read that post.

For now, let’s get into our current study starting with what they say about their four groups:

We found that survey respondents in the heart of retirement divide into four distinct groups, characterized by their attitudes and ambitions, their circumstances and retirement preparations, and their level of enjoyment of life in retirement. We have named these groups Purposeful Pathfinders, Relaxed Traditionalists, Challenged yet Hopefuls, and Regretful Strugglers.

They represent different patterns of life in retirement, and they also reveal the way decisions and strategies for living throughout the pre-retirement years of life can lead to either desirable or undesirable outcomes downstream.

As you can already see, these groups are going to be similar to but also unique from the groups in What Retirees Want. This makes it all the more interesting IMO as these two organizations are trying to make sense of groups of retirees.

Purposeful Pathfinders

The study begins with their first group as follows:

Purposeful Pathfinders is the group that enjoys the greatest well-being in retirement. They are leading active, engaged, happy, purposeful, productive, and contributory lives. Of all the groups, they are the best prepared for retirement, especially financially. They are focused on continued self-improvement, and, among all the groups, they most often say they are able to realize their hopes and dreams.

They are thriving in retirement and doing very well across the four pillars of family, heath, purpose, and finances. They are engaged in a wide variety of activities in retirement, including the highest rates of travel and vacations.

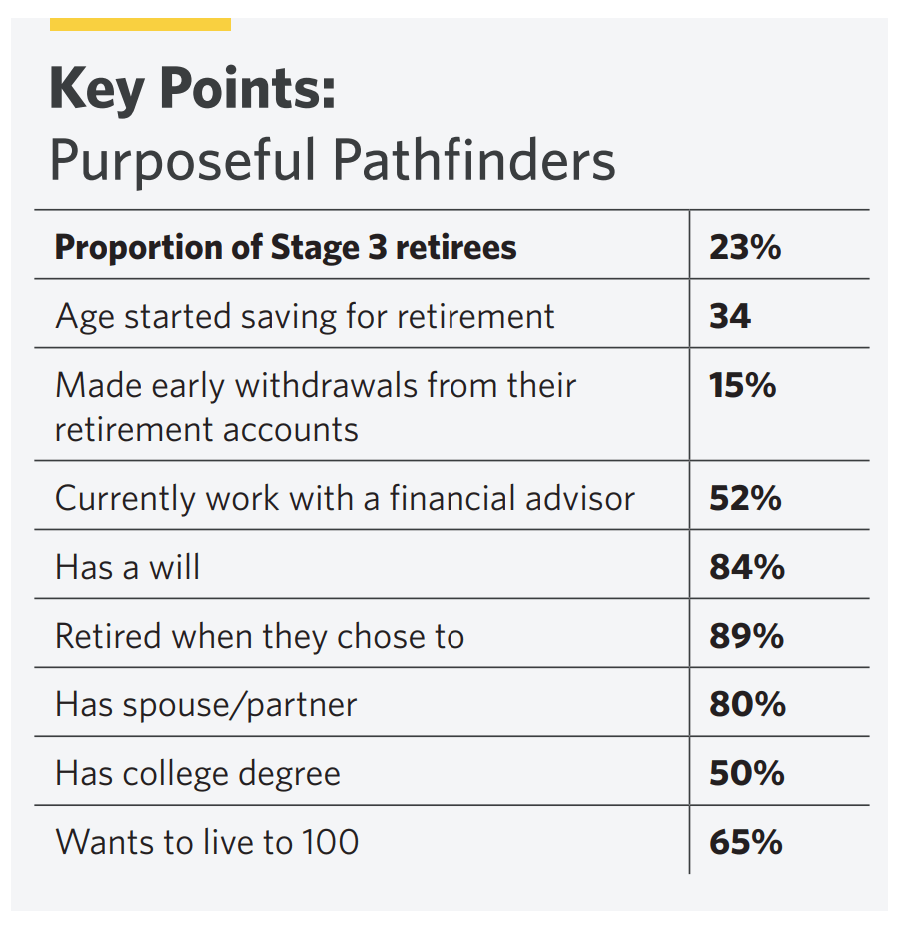

Here’s a visual summary of this group:

My thoughts:

- This is my group. Their description fits my retirement lifestyle completely.

- This group is about a quarter of stage 3 retirees. Recall from our last post that stage 3 of retirement in this study is called “Reinvention” and is described as follows: “This is the heart of retirement, where retirees hit their stride while actively shaping their new post-work identities and lifestyles. They continue to explore what retirement means for them, who they want to be, and what they’d like to be doing in this new chapter of their lives. This is the stage where we see the greatest variety of activity and experience.”

- As you’ll see, they have the best metrics of the four groups (highest percentages on a positive traits). For example, they started saving for retirement (on average) at 34, well before the other three groups started saving.

- “Only” 15% made early withdrawals from their retirement accounts. I’d like that to be 0%, but it is lower than other groups.

- 52% work with a financial advisor. I bet they do. Since this is the group with the most money, planner are most likely all over them to become clients.

- Almost all of them have a will. Another very good financial trait which many ignore.

- All the other financial measures are solid as well. It’s no wonder that they are the best prepared financially of all the groups. Elsewhere the study says, “Nearly eight in ten say they are in great shape financially.” That’s hard to beat and well ahead of average America.

Relaxed Traditionalists

As you’ll see, the groups get less prepared for retirement and are on much shakier financial ground as we progress.

Here’s the description of the second group:

Relaxed Traditionalists are pursuing a more traditional retirement, focused on relaxing, enjoying life, and being free from obligations and past responsibilities. Life in retirement goes smoothly for them, as did the transition into retirement. Overall, they’re comfortable and see little need to change. They are well-prepared across the four pillars, especially finances.

Although they are far less interested in trying new things or reinventing themselves than Purposeful Pathfinders, they are delighted to be free of work headaches and pressures, and they have strong interest in travel/vacations and simply having fun.

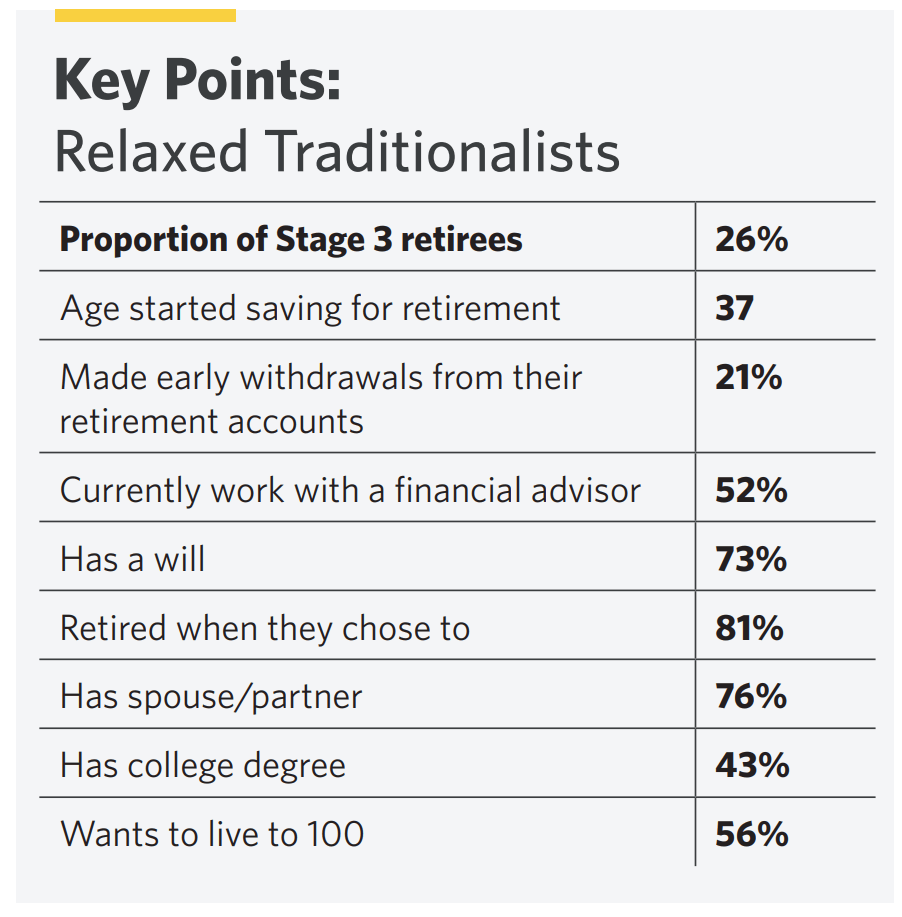

Here’s a visual summary of this group:

My thoughts:

- The Purposeful Pathfinders seem to be more of the new definition of retirement as an active, new stage of life whereas Relaxed Traditionalists are living more of an old-school definition of retirement. Nothing wrong with either of them, just different ways to live.

- As you’ll see, compared to Purposeful Pathfinders they have lower percentages in positive financial traits and higher percentages in negative financial traits. The absolute numbers are still pretty good, especially compared to the average American’s finances, but they just aren’t as solid as what Purposeful Pathfinders are.

- Elsewhere in the study it says “nearly half say they are in great shape financially,” so you can see not as many are as solid as Purposeful Pathfinders. But still 50% feel they are ok, which is much better than what we’ll see from the last two groups.

Challenged yet Hopefuls

The names of these last two crack me up.

Here’s the description of the third group:

Similar to Purposeful Pathfinders, Challenged yet Hopefuls lead active lives and are focused on continual self-improvement, especially around their health. They enjoy engaging in a wide range of activities in retirement, with the most emphasis among the groups on spending quality time with family and friends.

However, their life in retirement is constrained, uncertain, and worrisome, largely because of their insufficient financial preparation. Finances are their weakness among the four pillars.

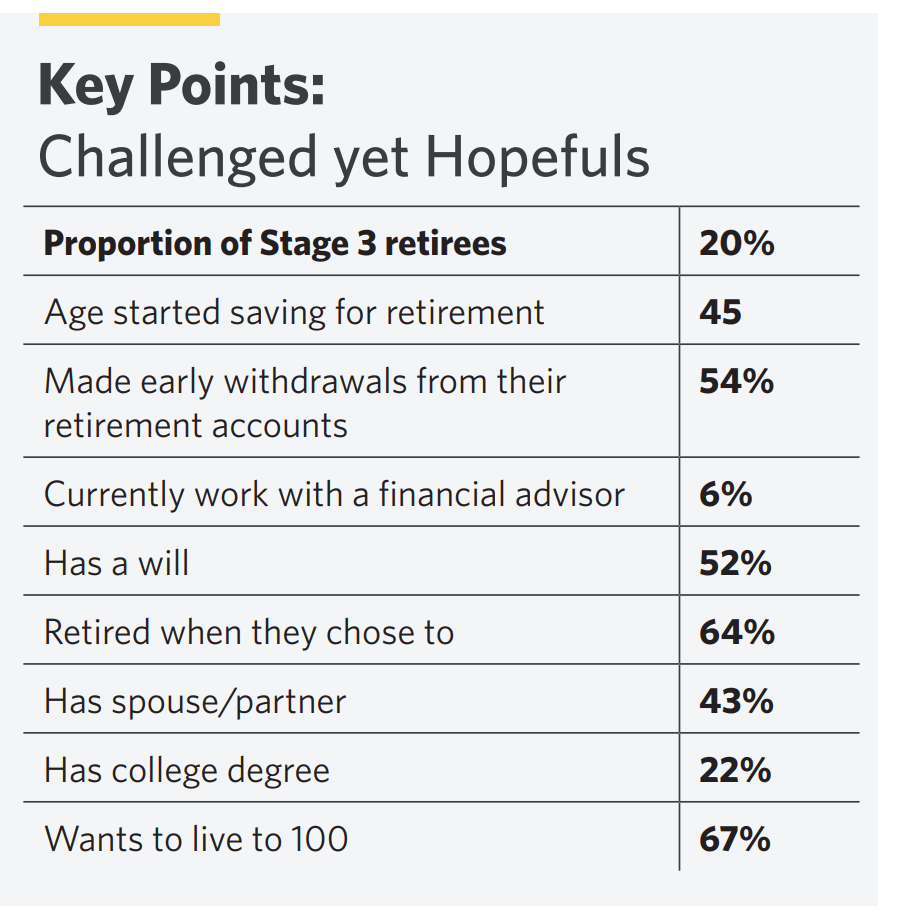

Here’s a visual summary of this group:

My thoughts:

- This is where we start getting into dicey retirement finances (and the worst is yet to come!)

- Almost all of their money numbers are poor. Some “highlights”…

- They waited until 45 to begin saving for retirement. The amount of money they lost because they gave up a couple decades of compounding is gigantic. It’s hard to accumulate enough to have solid retirement finances if you don’t let compounding work for you. Even if you compare them to Purposeful Pathfinders they lost 10 years of compounding — enough time which could have easily doubled their net worth from where it actually ended up.

- 54% made early withdrawals from retirement accounts. So not only did they hurt themselves by waiting so long before starting to save for retirement, but even after they did begin saving, over half of them took money out of their retirement accounts (probably to buy a boat or some such nonsense). Ugh.

- Half have a will and most retired when they wanted. Those aren’t bad compared to the averages, so there’s a bit of decent news.

- Some additional information on this group includes “Nearly three-quarters admit they have financial catching up to do, and half say they often worry about outliving their money. They may feel they’re doing okay in the present, but the future trajectory is not promising, and they may well have to find ways to continue earning money or to spend far less in order to survive in their later years.” They are in tough shape. But they aren’t the worst off…

Regretful Strugglers

I don’t want to be regretful or struggling in retirement and yet this group combines both of those. Yikes!

Here’s the description of the final group:

Regretful Strugglers are the largest of the four groups (31%). They are the least prepared for retirement and overall feel the least positive about life. Only 35% look on retirement as “a new chapter in life,” and 18% (the most among the groups) see retirement as “the beginning of the end.” Their struggles extend across the four pillars, including an inability to find purpose and serious problems with their finances. They engage in the smallest range of activities in retirement and are the most likely to be alone or socially isolated with only half (lowest among the groups) spending quality time with family and friends.

A majority of Regretful Strugglers say they cannot live comfortably on the resources they have accumulated. A third admit they’re in serious financial trouble, and 43% say they are financially worse off in retirement than they were during their working years—even with the support of Social Security and Medicare. They started saving for retirement at age 42, and nearly half have made early withdrawals along the way. Two-thirds say they often worry about outliving their money. They have done the least legacy preparation, and less than a third have a will.

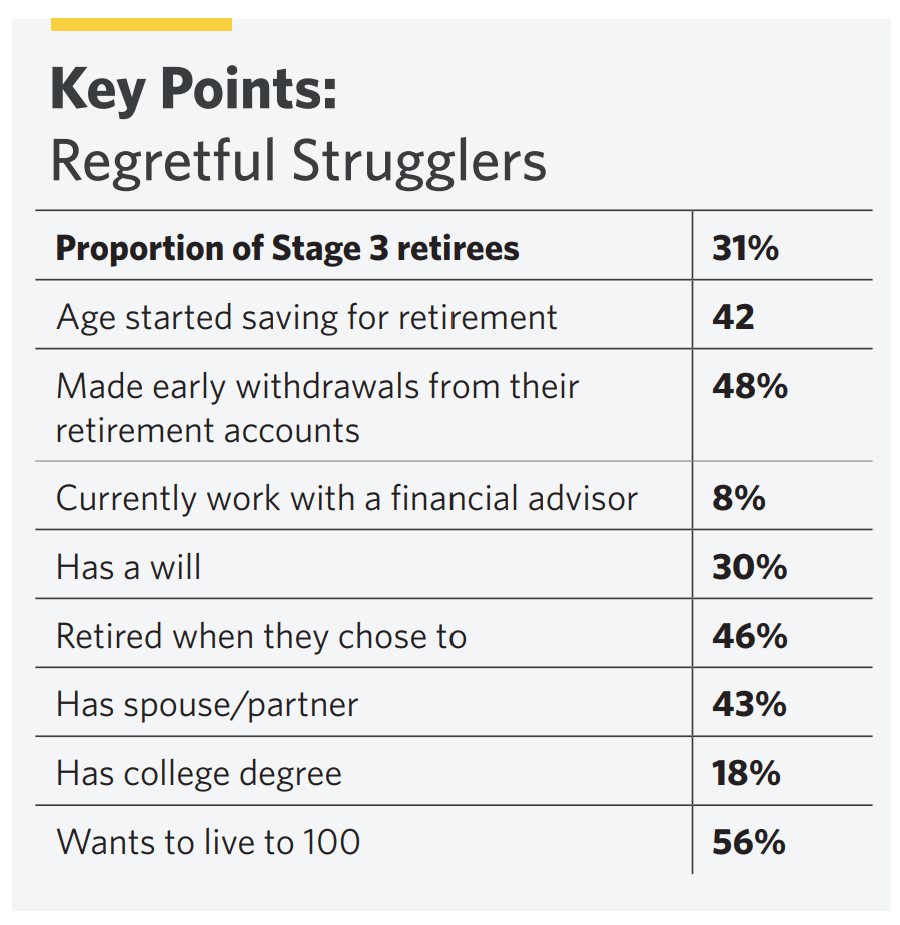

Here’s a visual summary of this group:

My thoughts:

- I’m depressed just reading about this group. No one wants to end up as a Regretful Struggler. And yet they are the largest of the four groups.

- If you read things like “an inability to find purpose,” “serious problems with their finances,” “engage in the smallest range of activities,” and “are the most likely to be alone or socially isolated” you can clearly see that they are an almost perfect description of what author Wes Moss would call the unhappiest retirees.

- One-third are in “serious” financial trouble and two-thirds worry about outliving their money. Is this any way to spend retirement? It sounds brutal.

- Elsewhere in the study it notes, “Although some may have been economically and educationally disadvantaged, without well-paying jobs and opportunities to save, many simply didn’t take the right steps along the way to ensure a comfortable retirement.” Yep, that’s much of America. They make enough to have the retirement they want, but they don’t save it, and when they do, they withdraw it prematurely and kill the work of compounding.

- It’s interesting to me that this group is the worst off but most of their metrics are better than those of the Challenged yet Hopefuls. I can’t figure out why other than perhaps the Regretful Strugglers simply did worse on the basics of earning, saving, and investing.

- The study also says, “Looking back on life, 59% say they have many regrets.” I bet they do. It’s hard not to feel those regrets reading what’s above.

Well, that’s it for this series. I really enjoyed this study as it put some numbers on things we already “knew” but just needed some proof of.

What’s your take on this research?

I find it interesting that the more successful groups financially, had 52% working with financial planner. The other two groups only had 6% and 8%. There is something to be said about using competent CFPs. You have to do your research on finding valid and competent ones, if you are going to use CFPs.

There are some who would just take your money as you have mentioned in the past(free dinners with no good information presented).

If you struggled with money for until you reached retirement age, it’s no surprise that you’ll likely continue to after. That said, there’s more to life than money.

I know various people who you could classify into one of the first three groups who are perfectly content with their retired life. Not everyone needs to retire with some sort of post-career purpose that involves contributing to the world in the traditional sense we think about it. For some, enjoying their remaining years with grandkids and friends is all they could ever want. Throw in a few vacations (with the kids), and it’s as good as it gets as far as they’re concerned.

For others, adopting a cause and pursuing it passionately becomes their life’s work. This may or may not require large amounts of money. There are plenty of overseas volunteer opportunities that require very little money.

Different strokes.

As a retired mother, I am very conscious that my gender and occupation has forced me to be shortchanged in retirement.

When I married and we started our family, it was expected that I would leave my work as a research scientist to look after the family. When my youngest child was 7, I was able to return to the workforce as a science teacher. So not only did I miss out on my intended science career but I had to start over in another field.

I did enjoy spending those precious years with my children with my willing spouse, and I have really enjoyed my teaching career. However, financially, we have been shortchanged in retirement for the good of the community.

How have I dealt with that? Due to our parents’ good management, we did not need to provide much in the way of sustenance for them. We both worked till 75 in jobs that we liked. Seeing as I had come to the retirement game late, I contributed the maximum plus the extra to my 403b account as soon as I could and also contributed to a Roth IRA account. That has left us with a healthy retirement account. And we have stayed married.

In retirement at 81, I now work as a substitute teacher in my city’s elementary school district at $150 a day for 2 or 3 days a week. Not as much as some districts, but my furthest school is 2 miles away and the children are delightful. I love it!

On reflection, not a lot of help is given to female workers, who are consistently overworked and underpaid. And who face considerable poverty in old age. As well as being taken advantage of by unscrupulous employers.