It’s from Edward D. Jones, Age Wave, and The Harris Poll. It’s full of interesting data.

Here’s a summary:

Edward Jones and Age Wave initially joined forces in 2019 to explore people’s hopes, dreams, and concerns in retirement. Together with The Harris Poll, we conducted a groundbreaking study of more than 9,000 people across North America to understand more deeply what it means to live well in retirement.

The bottom line — it’s a pretty robust study.

As many of you know, I’m well ahead on my posts (several months ahead in fact), but I wanted to get this information out sooner than next January, so I’m going to be doing a special Saturday series on it. I’ll share some highlights from the study and express my thoughts on their findings. If you’d like to know more, you can then read the study for yourself.

Let’s begin with some summary/overview points from the study:

- Today’s retirees appreciate their longevity and they now count the ideal length of retirement at an average of 29 years.

- The majority now view retirement as “a new chapter of life,” while only a quarter still think of it as the traditional “time for rest and relaxation.”

- Work/retirement lines have blurred. There is no clear definition of when retirement starts, and 59% of retirees and pre-retirees say the ideal mix of work and leisure in retirement includes some work.

- The pandemic has made life difficult for all, but especially for today’s new retirees as they make the transition, organize their time, and find new purpose in retirement.

- Retirees who are thriving today were well-prepared for entering this lifestage and made more focused preparations across all four pillars.

- Financial foresight is central to retirement preparation. Retirees on average began saving for retirement at age 38 but say they should have started nearly a decade earlier.

Some thoughts from me:

- We’ll get into all of these topics in more detail, but these summary points already highlight many interesting things in how people approach and think about retirement.

- “They now count the ideal length of retirement at an average of 29 years.” I’m sure they might like to be retired for 29 years, but the real-life stats tell a different story. According to Investopedia, “On average, women retire at 62.3 years and men at 64.6 years.” And according to the CDC, “In the U.S. male life expectancy is 76.1, and female life expectancy is 81.1 years.” This means retirement lasts, on average, 18.8 years for women and 11.5 years for men — both well below 29 years.

- My hope is that I can be retired for at least as long as I worked (which is 28 years). Since I retired at 52, that means I need to live to at least 80. The statistics say that the average life expectancy for a male my ages is a bit over 81, so it should be close. 😉

- Several years ago, the traditional definition of retirement started to change. I think this study shows that it has now made that change with the majority (over 50%) of people defining it in different ways than they (and society) have in the past. We’ll highlight those differences throughout the review of this study.

- The first change is in what people see the purpose of retirement being — it’s now “a new chapter” (a time to reinvent yourself, try new things, etc.) rather than the traditional “rest and relaxation.” That doesn’t mean resting and relaxing isn’t part of today’s retirement — it is — but it’s no longer the primary focus it once was.

- The next change is that most people (59% in this study and my guess is the percentage will grow over time) see work as a key part of retirement. In the past it was impossible to work in retirement since the definition of retirement, at least in part, expressly excluded work. That is no longer the case.

- Imagine that: retirees who plan for retirement do better than those with no plan. Who would have guessed? Haha. And yet I see articles all the time where people give almost zero thought on planning for retirement. I don’t get it. How do you not plan for a several-decades-long multi-million dollar decision?

- The fact that retirees start saving at 38 isn’t terrible, but it’s not great. That means they lose about 10-15 years of compounding which can make a HUGE difference in their savings. I’d also guess that they don’t save aggressively when they get to 38 — they likely do a minimal amount and then let that ride for a decade or so, until they get near 50 and decide they better get serious about retirement savings. That’s just my guess based on talking to others and reading on the subject.

Purpose in Retirement

As we transition into the beginning of the study’s findings, we approach the age-old question of “purpose” in retirement.

Here’s what the study has to say:

People find their sense of purpose in such a variety of ways that no individual preparation actions stand out. The most common are exploring new activities, volunteering and giving back to one’s community, and improving skills with technology, which helps retirees stay informed, connected, and entertained—and provides access to services including telemedicine. Since choices vary widely, the important thing is to be taking some actions to prepare for having purpose in retirement.

Retirees reporting higher quality of life are more likely to have taken each of the purpose preparation actions, including 40% who explored new pastimes, hobbies, or interests. More significantly, their sense of purpose is reflected in their active lifestyles in retirement. They are more likely than the average retiree to say they are spending quality time with family and friends, engaging in creative projects, and volunteering, mentoring, or helping others. And almost all (87%) say they are able to realize many of their hopes and dreams in retirement.

That was a short statement, but there’s a lot to respond to:

- I agree that there’s not one over-riding definition of “purpose” that fits unless it’s “doing whatever makes you happy.” Some try to define it as “making the world a better place” which then translates into volunteering or something similar, but I’ve seen people whose purpose is tennis or golf or watching their grandkids, so some sort of saving the world option isn’t the only choice.

- If you look at the tasks mentioned in the first paragraph, they basically boil down to doing things you like and that interest you — whatever those may be. If a person is curious about life and willing to try new things, then that’s purpose enough IMO as I think they will always find something they enjoy doing.

- I would rephrase “the important thing is to be taking some actions to prepare for having purpose in retirement” to “the important thing is to be taking some actions to prepare for having multiple activities you enjoy in retirement.”

- In the second paragraph what stands out to me is that these people are active and doing things they enjoy. Those are enough for creating a great “purpose” in retirement IMO.

The Retirement Planning Disconnect

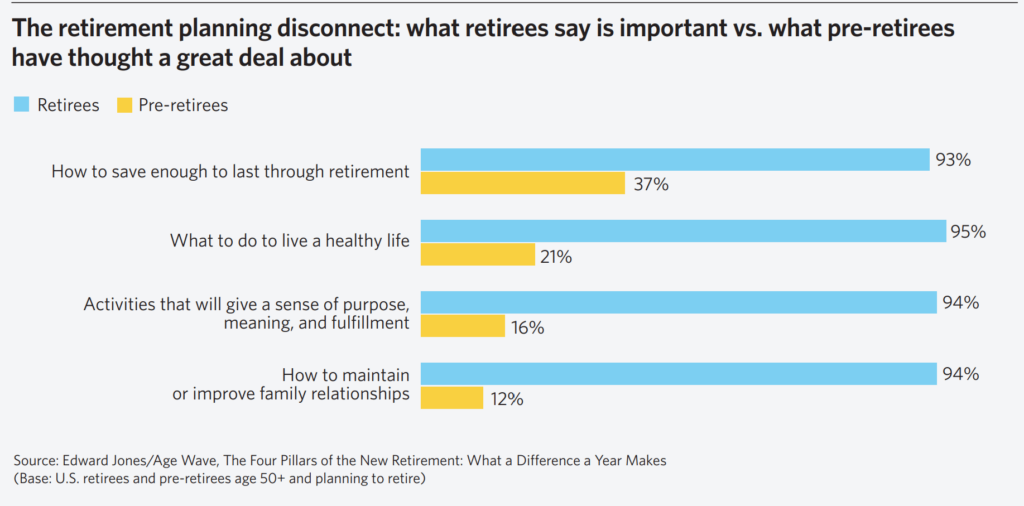

Take a look at this chart:

There is a HUGE gap between what retirees say is important and what pre-retirees think is important.

The result is that pre-retirees are not working on the most important things to having a great retirement — something that could cost them dearly when they retire.

Basically the important stuff boils down to money, health, activities, and social/relationships — a very similar list to my five categories in Huge List of Awesome Retirement Activities.

At this point the study makes some general conclusions from what it’s shared so far:

- As we’ve seen throughout our recent studies, the four pillars of family, health, purpose, and finances are all essential to well-being in retirement. Unfortunately, most Americans enter retirement far from fully prepared. But early, holistic planning can have big payoffs.

- Finances build the foundation for living comfortably and securely in retirement, and that requires financial foresight—starting to save early in life, maximizing savings, and staying the course by staying out of debt and avoiding early withdrawals from retirement accounts.

- One of the biggest disrupters to thriving in retirement is having to retire earlier than planned, and in retirement people must continue to anticipate what course corrections they’ll need to make if health problems or caregiving responsibilities arise. Everyone should consider a contingency plan.

- The ultimate hallmarks of overall well-being in retirement are being active, engaged, connected, purposeful, and positive in life. Retirees also thrive by being generative—giving back to family, community and society, sharing their wisdom, and preparing to leave a lasting legacy.

My thoughts on these points:

- “Family, health, and purpose.” Again, these are similar to my five categories for the life side of a successful retirement: Health and Fitness, Fun, Work and Work-Like Activities, Social Interaction, and Mental Stimulation.

- “Unfortunately, most Americans enter retirement far from fully prepared.” Every time I see this I just can’t imagine it. Retirement is a two to three decade, multi-million dollar decision. Why are people not planning for it? It’s mind-blowing!

- “But early, holistic planning can have big payoffs.” And according to author Wes Moss, it doesn’t take much. In Wes Moss Interview on the Happiest Retirees, he said, “My research showed that happy retirees spend at least five hours per year (and usually more) planning for retirement.” Five hours per year. That’s less than one book read in a year. Sheesh — seems like a low hurdle to jump over — and yet most retirees are “far from fully prepared.”

- “One of the biggest disrupters to thriving in retirement is having to retire earlier than planned.” This is a great argument for financial independence ASAP. Even if you want to keep working, you may not be able to. It’s much, much, much, much, much easier to have to stop working if you are financially free. If you are not financially independent and are forced to stop working, you could be in for a very rough time — potentially for the rest of your life.

- “In retirement people must continue to anticipate what course corrections they’ll need to make if health problems or caregiving responsibilities arise. Everyone should consider a contingency plan.” Retirement isn’t a once-and-done thing. It’s a continual process of adjusting — managing your finances, managing your life, etc. And as for having contingency plans, that’s what margins of safety are for. 😉

- “The ultimate hallmarks of overall well-being in retirement are being active, engaged, connected, purposeful, and positive in life.” I would say that these things make for a good life in general — retirement or prior to retirement. If you have things to do that you enjoy and fill your time with pleasure/fulfillment, you’ll likely be a very happy person. The trouble generally lies when work is the only (or at least majority) of a person’s life. then they retire, work is gone, and their joy and happiness are gone. Develop activities outside of work before you retire, then expand those (and add to them) once you retire and you’ll be set for an awesome retirement life.

- “Retirees also thrive by being generative—giving back to family, community and society, sharing their wisdom, and preparing to leave a lasting legacy.” This doesn’t have to be part of your retirement life, but odds are these things will add to it in a very positive way. For me, I am really enjoying sharing what I know on the Millionaire Money Mentors site as well as continually providing good content on ESI Money for millions of people. It’s very satisfying. We’re also upping our commitment to helping others through giving, something I’ll write about later this fall.

Retirees’ Advice to Younger Generations

Next we have some advice retirees would give to those coming behind them:

- “Plan for your life in retirement, including family, fun, and purpose—as well as your finances.”

- “Save, save, and save. Start saving early and put away as much as you can. But if you haven’t, know that it’s never too late to start.”

- “Find work that you enjoy and that you can even continue to do part time in retirement—if you need to, or if you’d like to.”

- “Seek out mentors and advisors from all walks of life, people who have had life experiences ahead of you and can guide you.”

- “Retirement is a new beginning and a big new phase of life, so plan for how you’ll stay active and engaged with life.”

My thoughts:

- I love, love, love to hear from people who have actually done what they are giving advice on. I see so much trashy advice in mainstream money articles, written by people who have never retired and aren’t even close to it. I much prefer hearing from people with experience in something.

- Of course 1) saving is vital and 2) the sooner you begin, the better off you’ll be in the end. This is why those who started at 38 (the average) are advising others to begin sooner — they waited too long to start saving and lost out on 10+ years of compounding.

- “Find work that you enjoy and that you can even continue to do part time in retirement.” To me, this is an argument to begin a side hustle while you’re still working. Find something you like to do and can earn some money at. It will help you save for retirement now and will allow you to retire earlier as the income from it will shorten the years you need to save. Plus it will give you one activity that you enjoy that you can take into retirement! Now you only need four more! Hahaha.

- “Seek out mentors and advisors from all walks of life, people who have had life experiences ahead of you and can guide you.” I agree 100%. This is what the Millionaire Money Mentors is for. It’s also why I do Millionaire Interviews and Retirement Interviews here on ESI Money — so you can read about people who have done what you want to do. Then you can learn from their successes and mistakes, taking what works for you and developing a plan to make your finances and retirement the best it can be for you and your family.

- “Retirement is a new beginning and a big new phase of life, so plan for how you’ll stay active and engaged with life.” Lots of truth in one sentence. I’ll cover parts of it in the bullet points that follow.

- “New beginning” — Allow yourself to dream about what could be. Retirement is a great time to reimagine your life.

- “Big new phase of life” — Very big, in fact. As I said, it’s a 2-3 decade multi-million dollar decision. Do yourself a favor and plan for it.

- “Plan” — Yep.

- “How you’ll stay active and engaged with life.” One huge hint: watching a ton of TV does not count as “active” or “engaged” and it’s a sure path to a terrible retirement for most people.

Ok, that’s it for this time. For the next post in this series, see Retirement Health, Changing Definition, Work, and Worries.

Good point on the “optimism” around life expectancy but once they’ve already made it to 62 (and avoided dying for six decades), life expectancy shifts to 20 and 23 yrs remaining for men and women respectively. Still significantly less than 29 of course….

I can see how planning works for some people. I can also see how taking an approach that not only allows for but fully embraces discovery along the way works better for others.

Given the length and large number of variables and unknowns, I tend to view it more as a journey. And I’m comfortable with a loose plan that leaves open some of the pillars.

Once finances are understood, let the rest unfold. Different strokes.

I think you need a plan no matter what. And in saying that, I do not mean you set the plan and then stick with it no matter what.

What I do mean is that you have a plan going into retirement and then adjust if you need/want to.

There’s no way (or at least very little likelihood) to have a set plan at the starting point and have it be valid 30 years later. Life just doesn’t work that way.

I’m a perfect example of this. I had a plan and then pickleball came along…so I changed my plan. 😉

But in the end, I think it is wisdom to have a plan going into retirement. Otherwise you are rolling the dice and sometimes they come up snake eyes.

Change is inevitable and often the best laid plans, of mice and men, fall asunder. However, even a changing plan is better than no plan at all.

So what is the definition of retirement? A lot of the articles I read say the definition is changed but then don’t define it.

Most I read say it is changing (in the process of changing) so they don’t define it because it hasn’t settled on one specific definition yet.

My belief is that any of these could be where it ends up:

1. Defined as the end of full-time work

2. Defined as the end of a multi-decade career

3. Maybe even reimagined completely where it’s a different part of life, separate from school, college, marriage, parenthood, etc. to become it’s own thing.

Time will tell where we settle.

FYI, this is why I ask my retirement interviewees for their own definitions of retirement — to see what people who have “retired” think the definition is. 😉