Most ESI Money readers know that I also run the Millionaire Money Mentors (MMM) forums.

Most ESI Money readers know that I also run the Millionaire Money Mentors (MMM) forums.

But what you may not know is that I have help with that — a LOT of help.

My buddy, Steve, does all things tech related with the site, just like he did with Rockstar Finance before that.

You probably know Steve too. He’s been covered extensively in the media. For example, there are stories on him here, here, here, here, and here. He also has around 300k+ followers on Twitter. Before all this he started, grew, and then sold a personal finance blog. He’s done a lot of impressive things for a young guy!

And now he’s adding to this fine list of accomplishments by writing a book. It’s called Millionaire Habits and is currently available for pre-order (it makes a great holiday gift if you’re looking for one). It will be released on January 11.

Over the course of the next month and a half I’ll be sharing several excerpts from the book so you can see for yourself what a great piece it is.

Today we have the start of part 1 where Steve shares The Wealth-Building Timeline.

So without further ado, take it away, Steve…

————————————-

Like Rome, wealth wasn’t built in a day.

Before diving into the nuts and bolts of millionaire habits, let’s discuss the process virtually everyone goes through to build wealth. All millionaires go through this exact process, including me. The speed at which we go through each stage can differ from person to person, but it’s almost impossible to skip any of these basic steps.

Sadly, some people work their entire lives and never get to the last stage, but this book will ensure you aren’t one of those people.

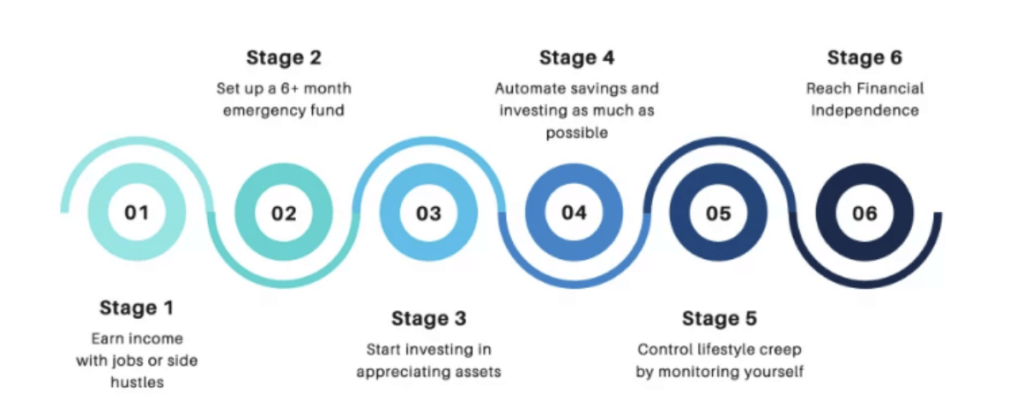

I like to call this process the “Wealth-Building Timeline.” It begins with earning income through jobs and side hustles and ends with reaching financial freedom, which means no longer having to work a day for the rest of your life (though you might still choose to).

Imagine getting up each morning without the horrifying beep of an alarm clock and deciding what to do with your day right then and there. This is what achieving financial freedom is all about. It gives you options. You can take full control of your life.

For some of us, this process might take several decades. For others, maybe just four or five years. But with few exceptions, this is the accumulation process we all go through.

The 6-step wealth-building timeline looks like this:

Let’s discuss what happens in each stage of the timeline.

Stage 1: Earn income with jobs and side hustles. This is where the magic begins. The accumulation of wealth begins with earning an income. Building wealth without earning an income is impossible unless you’re the fortunate beneficiary of a large inheritance (this is rarer than many people believe). The larger the income, the more growth potential (but also the easier it becomes to spend money, which we will discuss later in this book).

Most of us will earn our income by working a full-time job. However, starting a business while working full-time (often called a “side hustle “) can accelerate our income accumulation. For instance, you might design websites, walk dogs or offer weekend landscaping services to make a little extra money. Interested? Ideas to maximize your income are in Habit #3. Every dollar you earn gets you one step closer to financial independence, regardless of where it comes from.

While earning a big salary is great, you don’t need six figures to achieve financial freedom. Bigger salaries only shorten the time it takes to reach Stage 6.

Never forget that this is a process, not a race.

Stage 2: A 3 to 6-month emergency fund. Putting a little money aside for unexpected expenses is your emergency fund, and it should come before investing – and definitely before spending on non-essential items.

An emergency fund of at least three months of living expenses means you can endure most financial emergencies, sudden job losses, a leaky roof, or anything else that requires cash. While most financial “experts” recommend three months, I like six months to be extra safe. Whether you choose three months or six months will come down to your risk tolerance and whether you are a dual-income household. We will discuss how much to save in your emergency fund in more detail in Habit #9.

Your living expenses include everything that you spend money on month-to-month, including

- rent or mortgage payments

- utilities (electricity, water, etc.)

- food and groceries

- insurance (health, car)

- cell phone bills

- household maintenance items like cleaners, etc.

Everything you spend during the month is a part of your living expenses.

For instance, if you spend $5,000 a month, saving three to six months’ worth of living expenses adds up to $15,000 to $30,000.

“But Steve,” you might say, “that’s a lot of money to save! I don’t have anywhere near that!”

That’s okay. Three to six months is the goal, which takes time to reach. Later in this book, I will teach you exactly how to build your first emergency fund (or, if you already have one, to expand it) using automated techniques that will make this super easy. Believe me, it’s much simpler than you probably think.

We will talk more about emergency funds and how to set your first one up in Habit #7.

Stage 3: Invest in appreciating assets. Nobody ever got rich by saving money alone. Instead, investments are what build wealth. There is always risk associated with investments, but investing in appreciating assets over the long term is how most people build enough wealth to achieve financial freedom.

Examples of long-term investing include:

- Dividend-paying stocks

- Traditional 401(k)s and Roth IRAs

- Real estate (properties and homes)

- Index funds, mutual funds, and ETFs

- Gold, silver, and other precious metals

- Collectibles like art, antiques, and rare coins

The stock market is one of the most common tools that millionaires use to build wealth over time. Most millionaires devote a portion of every paycheck to investing in the stock market, and many are rewarded with consistent growth over the course of 20, 30, or more years. This is called Dollar-Cost Averaging. More on this in Habit #6.

Stage 4: Automate savings and investing as much as possible. Automation is the secret that millionaires use to take the discipline and guesswork out of accumulating wealth. It’s the difference between humans tightening every screw on a new car and an assembly line of machines doing it instead. It’s easy, repeatable, and consistent.

Automation refers to using computing routines to take action on our behalf at set intervals. Once we set these routines up, they work on their own without our involvement. We don’t have to lift a finger! Automation helps us make Stages 1 through 3 easier because we no longer have to remember to save, invest and transfer money between bank accounts. It just happens.

A few examples of automation include

- Your employer’s payroll system that automatically contributes a percentage of your paycheck to your 401(k) or Roth IRA

- Bill pay systems that pay relatively consistent monthly bills such as your cell phone, television, streaming services, and utilities

- Budgeting apps that help you save by transferring money from your checking account to a separate savings account every month

I will show you how easy financial automation is to set up in Habit #6.

Stage 5: Control lifestyle creep. This stage sounds simple, but it’s one of the most difficult steps for many people. Lifestyle creep happens when we inflate our lifestyle by spending more money as we earn more. It’s also called lifestyle inflation, which plagues so many people. I was guilty of lifestyle creep when I was in my 20s, big time.

Here’s the problem: when our lifestyle inflates alongside our income, we make it more difficult to build wealth because we keep spending more money. As I like to say, it’s impossible to out-earn bad spending habits.

Sure, we see high-income earners driving around in fancy cars, living in big homes, and wearing expensive jewelry and suits, but that doesn’t tell the whole story. So many of these “millionaires” are actually in debt. Even with a high income, they’ve chosen to spend so much money that they aren’t building wealth.

And here is why this stage is more difficult than it may sound. We work hard for our money. When that much-deserved raise finally comes around, we want to reward ourselves by spending a little of it to celebrate. All that overtime should count for something, right? After all, it’s no fun to just save and not enjoy all that extra cash, right?

Actually, that’s right. It is no fun.

This stage isn’t about sacrificing your happiness by penny-pinching. It is okay to spend money to reward yourself for working hard and being successful. However, it’s not okay to turn those celebration expenses into a regular part of your lifestyle – if you want to become a millionaire, that is. Spending all of your raises won’t get you rich.

It will, however, increase the stuff you have lying around your house.

Controlling your expenses is an uncomfortable part of building wealth that many millionaires don’t discuss. But I will show you exactly how to balance your life so you and your family can enjoy yourselves and build wealth simultaneously in Habit #9.

Stage 6: Financial independence. Congrats, you’re there! This is what you’ve been working so hard to achieve. You’re finally at the point where you have accumulated enough wealth to never have to work again, though you may still choose to work.

But don’t be deceived! Never let your guard down. It’s possible to lose financial independence if our spending gets too extravagant.

How do you know when you’ve reached financial independence?

I discuss the simple formula many millionaires use to calculate when they’ve reached financial independence (or how much they need to achieve it) in Part 2 of this book. The math is simpler than you probably think.

The wealth-building equation controls our journey to a million. The better you understand it, the faster the journey will be.

For the rest of Part 1, we will dive into 10 millionaire habits that will help you breeze through each phase of this process as quickly as possible, without sacrificing the things that make you happy.

Are you ready?

————————————-

Good stuff, huh?

I think you’ll find that this is a GREAT book for those who are just starting off on their financial journey or those who are down the road a bit but need an extra push or two.

Know anyone like that?

If so, you can pre-order your book today https://amzn.to/3MAAqjf and they’ll have it early next year, just in time to make a money resolution. 😉

Stay tuned as I’ll be sharing more from this book next month.

Appreciate the post, pre-ordered copies for my kids.

Having lived through all these stages and having achieved financial independence in our fifties, I agree with all that Steve has laid out here. This looks like a very practical, and easy to understand book. We were good earners but not the president/executive salaries and we got here just the same with consistent earning, saving and investing. A great read for young people who need a plan for success. Looking forward to more exerts from this book. Congrats to Steve!

Hi. Is it available in kindle ebook version? Thanks much!!

According to Steve, it should be available the day after the book ships at the latest.

Enjoyed the article, I’ve read multiple books on becoming financially free and I’m well on my way. Thanks for reassuring what I already know 🙂

I had no idea that Steve had gained such a following since selling TSR. Good for him! Just watched the 9 minute video on the CNBC link.