That inspired another member of the forums to do the same, sharing his yearlong journey (with a surprise!) with all the members.

I asked him if I could share his story, he agreed, and that’s what I have for you today!

Note that the portions I’m including are simply his posts. As you might imagine, there’s lots of discussion and feedback from the members and mentors along the way, but those are not part of this post.

With that said, please enjoy this countdown to retirement…

———————————————-

My wife and I have set our goal to retire early so that we enjoy a less stressful life, travel and live in different countries, and spend more time with our parents in our country of birth (outside the US). We will be 49 years old when we retire on April 15, 2022 (more on this below).

Our post-retirement budget is set to between $10,000 and $15,000 per month (adjusted annually for inflation) based on the lifestyle that we want in the first 5 to 10 years after retirement. Once we reach 60 to 67 year old, our current plan is to move to our country of birth where the cost of living is much lower compared to the US. As such, we estimated our budget will be half of the nominal amount of the prior year’s budget before moving.

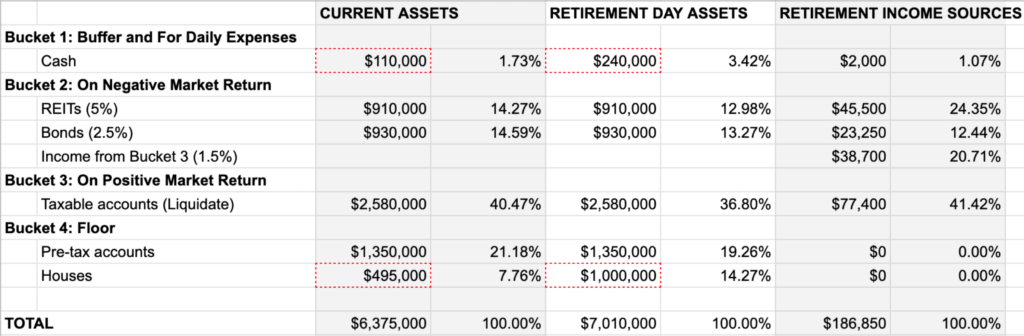

Our portfolio strategy uses the 4-bucket system:

- Bucket 1: Cash buffer (3 years of buffer)

- Bucket 2: REITs, Bonds, and Dividends

- Bucket 3: ETFs, stocks

- Bucket 4: Social Security benefits, Medicare, equity from our houses

Flow of Funds:

- Use Bucket 1 as source of funds for expenses, and for overall buffer

- Replenish Bucket 1 using income from Bucket 2 and Bucket 3, and the rest by liquidating assets from Bucket 3 but only if the stock market return was positive.

Here are the assets per bucket both today and on retirement day (with the market being static):

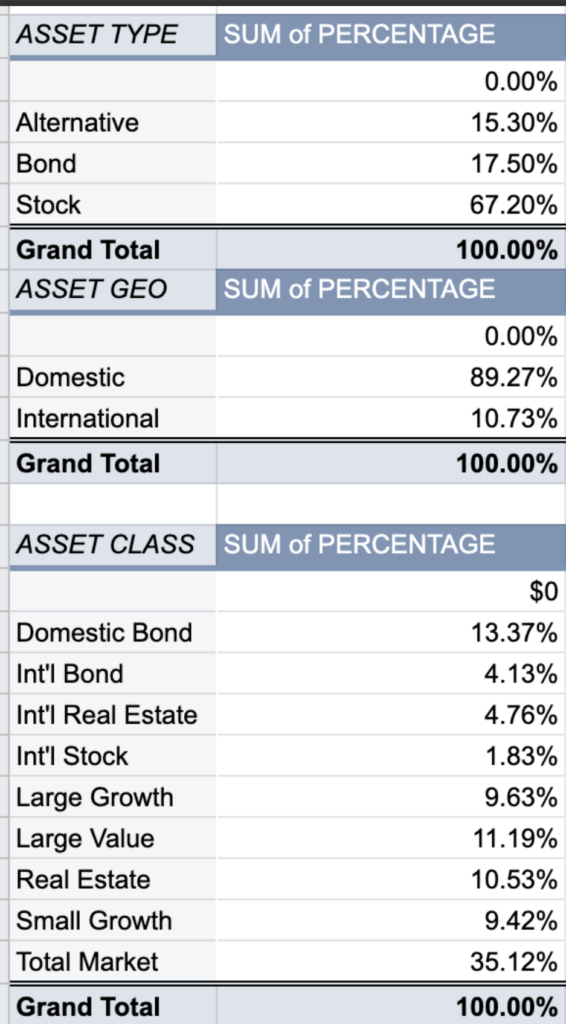

Asset Allocation (Assets Without Cash and Houses):

The reason why I have the retirement day assets is because of the $130,000 to be added to our cash, and $505,000 to fully pay our 2 houses which will come from my final grants, RSUs, options, and bonuses. It is also the primary reason why I’ve set my retirement date of April 15, 2022 which is 4 weeks after the bonus disbursement and grant date of March 18, 2022. My actual target is really April 1, 2022 but I anticipate being requested to stay longer especially with what I will need to turnover. I’m the VP of Engineering (software) at a publicly traded company.

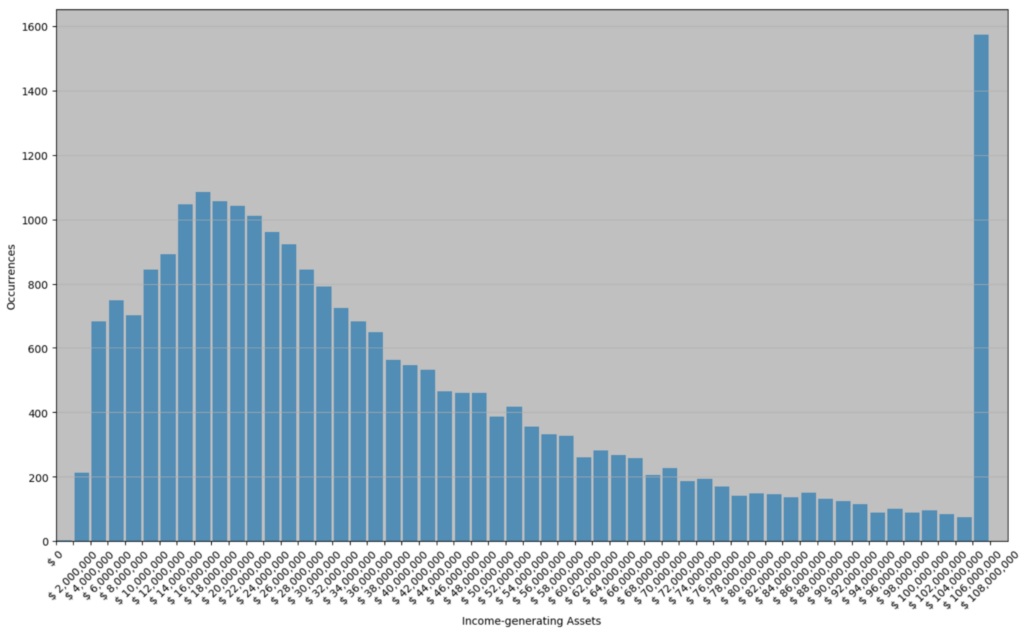

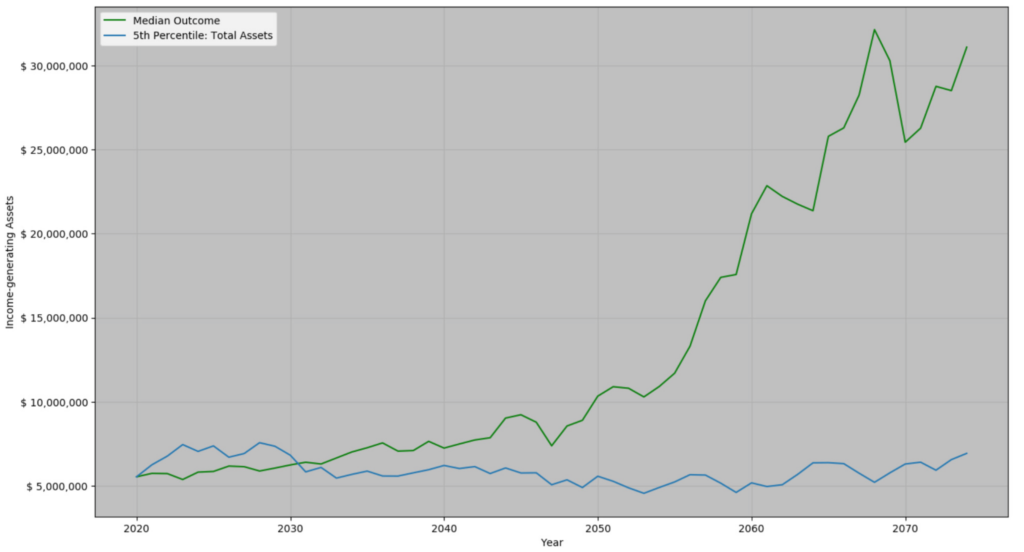

Anyway, I have ran multiple Monte Carlo simulations with 100,000 iterations, and with 95% confidence interval. Based on the output, there is zero chance of us going bankrupt if we reach 100 years old. So, you can argue (and my wife has multiple times) that we can actually retire now but I want to capture the more than $600,000 (post-tax) that I have left in the company which can really help with one of my pursuits of getting into venture investing (startups and real estate).

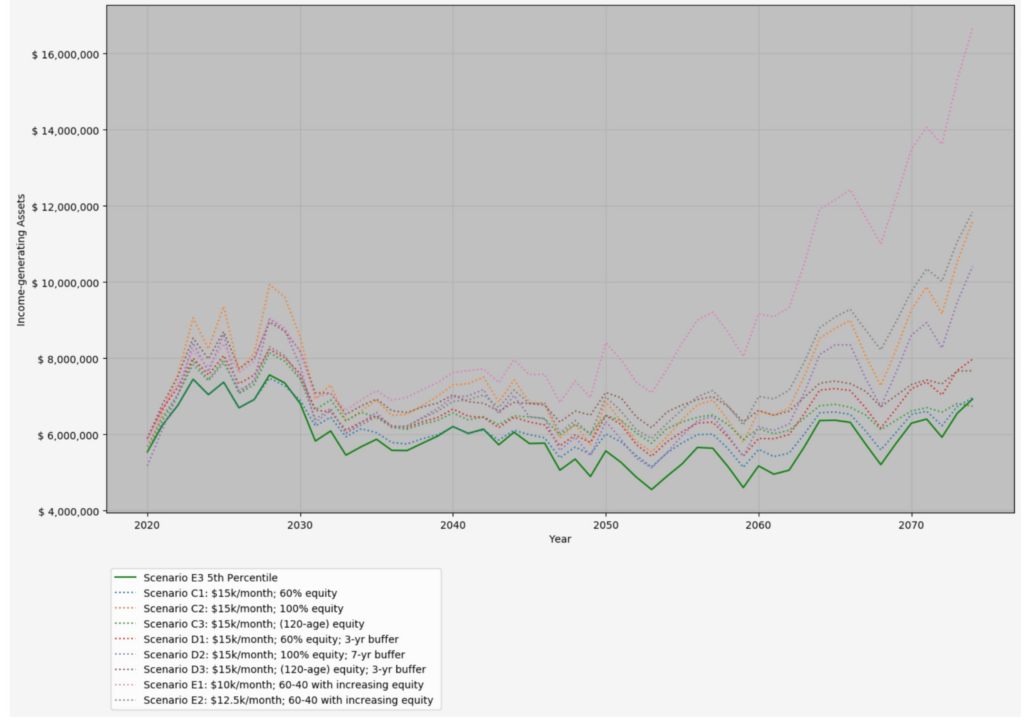

Simulation Output

Income-generating Assets at Age 100:

Income-generating Assets of Median and 5th Percentile Simulations:

Fifth Percentile Outcome With Different Asset Allocation:

Currently, I’m working on Bucket 2 so that the assets produce more income and less correlated with the stock market (the REITs in particular):

I’m currently learning a lot from many mentors about real estate investing. I’m still reading about rental properties to educate myself.

I’m also evaluating Fund Rise, Prosper, Yield Street, CrowdStreet, Farm Together, and Acre Trader. I’m looking into investing in money lending, syndicated farm land, and syndicated real estate. Not sure yet the allocation but I will start with the minimum and learn.

Additionally, my wife and I are finalizing our respective trusts. Thanks to the mentors here for the help in this topic.

We are still coming up with a story that we can stick with so that we can still be stealthy with our wealth to our friends and extended family. Many here have provided ideas but we’re still looking.

I’m interested to hear your thoughts regarding our plan. Please poke holes so that we can improve it and address anything that we missed or misunderstood.

UPDATE: (T – 362 days) Until Retirement

I didn’t think I’ll have an update this quickly, but here it is.

My wife and I while having dinner last night made some changes in our countdown-to-retirement plan. With both of us getting our 1st Covid vaccine dose last week, and getting our 2nd shot in two weeks, we decided for her to stop working by end of November this year (more than 4 months earlier) so that she can visit her mom, and spend a few months with her. I’ll just visit them for Christmas and New Year’s day then fly back to the US for me to complete my march to retirement.

We are, of course, hoping (assuming) that international travel will be much safer come December this year.

UPDATE: (T – 357 days) Until Retirement

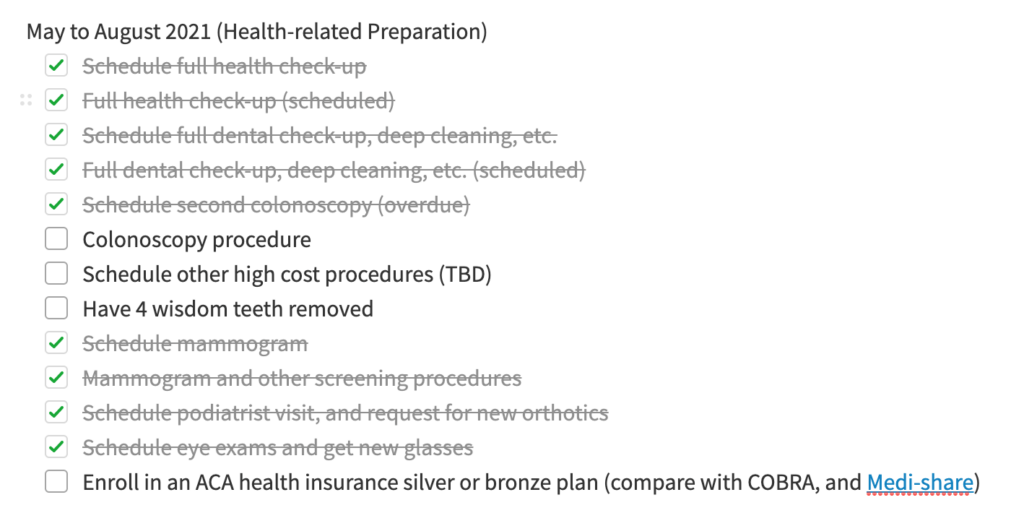

This week, my wife and I started scheduling appointments for health and dental checkups. Last year, we skipped all of them because we didn’t want to unnecessarily expose ourselves to Covid risks.

May to August 2021 (Health-related Preparation)

- Full health check-up (scheduled)

- Full dental check-up, deep cleaning, etc. (scheduled)

- Have 4 wisdom teeth removed

- Schedule second colonoscopy (overdue)

- Schedule other high cost procedures (TBD)

- Schedule mammogram

- Schedule podiatrist visit, and request for new orthotics

- Schedule eye exams and get new glasses

I thought I had a lot of time scheduling 11 months ahead, but there are very limited appointments still so our appointments are not until August (almost 4 months of lead time). I’m hoping that we’ll have enough time to do the higher cost procedures like colonoscopy while we’re still on our employer-provided health insurance.

Did those that retired this year or last year have the same issue?

I’m really looking to only get an ACA Bronze plan with high deductible for our early retirement health insurance, and do maintenance checkups overseas where ever we are at. This is why I’d like to do a number of these expensive procedures this year.

On a related topic, I was intrigued by the discussion of Medi-Share. I’ve only heard about it previously but now that we’re close to needing our own health insurance policy, I’m going to look at it deeper. My biggest question being, do members have to be devout Christians to be part of the group? Do they really interview the priest or church leader where an applicant attends service? I was baptized Catholic and went to Catholic school for elementary and high school; however, I’m not a practicing Catholic even though I live the Christian values.

With all the talk of retiring and with my wife’s retirement date being moved to end of November 2021 instead of with me on April 2022, my motivation to actually do the extra mile at work has significantly reduced. I have been noticing it since early this year when decided on our retirement date.

I used to be excited to go to work and make a difference but these days, I’d rather read books related to one of my soon-to-be post-retirement pursuits. I really need to snap out of it because people will start noticing my lack of motivation.

Did you guys feel the same way, or is it just me having too much anticipating building up?

UPDATE: (T – 347 days) Until Retirement

My Millionaire Interview was released last Friday 13. I’m hoping the readers will find value in reading through it, and also poke holes in it so we can improve our plan.

Regarding health insurance and healthcare, on Sunday, my wife and I ended up discussing this topic further during breakfast. It was a surprise to me that she now prefers to only have annual medical checkups in the US instead of in other countries. I was a bit furious because I assumed that we had already agreed on a plan. Luckily, I was able to control myself and calmly said “Didn’t we agree on a plan for healthcare already?” Well, apparently, we (meaning, I, according to her) didn’t document it, so that’s what I’ll be doing in the next few weeks reviewing ACA, health sharing plan, and other options. More on this topic in future updates.

I had a virtual happy hour last week with a few coworkers, and the discussion ended up going to the market volatility, the VIX in particular, and the market in general. After a little over an hour, only a coworker and I were left in the call. We ended up discussing our respective portfolio performance since February 2020.

At this point I had already consumed around a third of a bottle of Scotch (12-year old Auchentoshan), and I stupidly ended up saying that I had already reached my FIRE goal. I regretted saying it even before I finished the sentence, and hoped that he missed it. Well, he did not. Of course he congratulated me, and I said to keep it to himself for now which said he would.

Well, that was stupid of me.

UPDATE: (T – 42 days) Until Retirement

No, it hasn’t been 305 days since my last update. It has only been 11 days.

Our original plan was to retire on April 15, 2022 then we updated that 3 weeks ago so my wife would retire starting in the end of November this year. However, after evaluating what we want to do this year and valuing my remaining RSUs and options which is the reason for waiting until April next year, we’ve decided to push up our retirement even more. So, we are going to submit our resignation on Friday next week, May 14. My wife will only need a 2-week transition but I will need at least 1 month.

Yay!

Because of the above, my wife and I have accelerated our plan. Fortunately, we were able find much earlier appointments for health annual checkups instead of in August. I am hoping to get my colonoscopy scheduled after my annual check up in a couple of weeks. I’d really like to have that done while I’m still with my employer’s insurance plan.

I have yet to find an earlier dentist appointment including removal of my wisdom teeth. I’m still looking but I will likely end up going with another dentist.

I will also be spending time next week to finalize our medical insurance. I’m still leaning towards having an ACA plan. I will need that to have an effective date of July 1.

I also set our 401(k) contribution to 90% of the pay so that we can get to $19,500 each before our last day.

Fun stuff!

I’m currently revisiting my withdrawal strategy which was heavily influenced by the discussions in Is the 4% Rule too Conservative?, Withdrawal strategy, and the Living Off Your Money by Michael H. McClung. Our existing model calls for a variable withdrawal rate with the maximum being 4%.

More on this once I have implemented the impact of reinvesting the dividends vs. using the dividends for daily expenses.

UPDATE: (T – 36 days) Until Retirement

Transitioning from ESI to ISE.

I initially thought that it was going to be a piece of cake to transition from “wealth accumulation” mode to using wealth to support our retirement. However, I panicked a bit yesterday when I found out that I’d have to pay close to $6,500 for a colonoscopy before insurance adjustment if I used our planned high deductible HSA plan. The feeling set in because I subconsciously thought that I was no longer going to have income. After I realized that I will have passive income and it’s just that it won’t be from a W2 job, I was able to calmly discuss other options with the hospital network’s cost specialist.

The above likely happened only for a few seconds and a few more minutes of pondering, but it motivated me to setup a system for our passive income so that we can still have a steady stream of money much like a monthly salary. It will also serve as a check for us on whether our run rate is good or not.

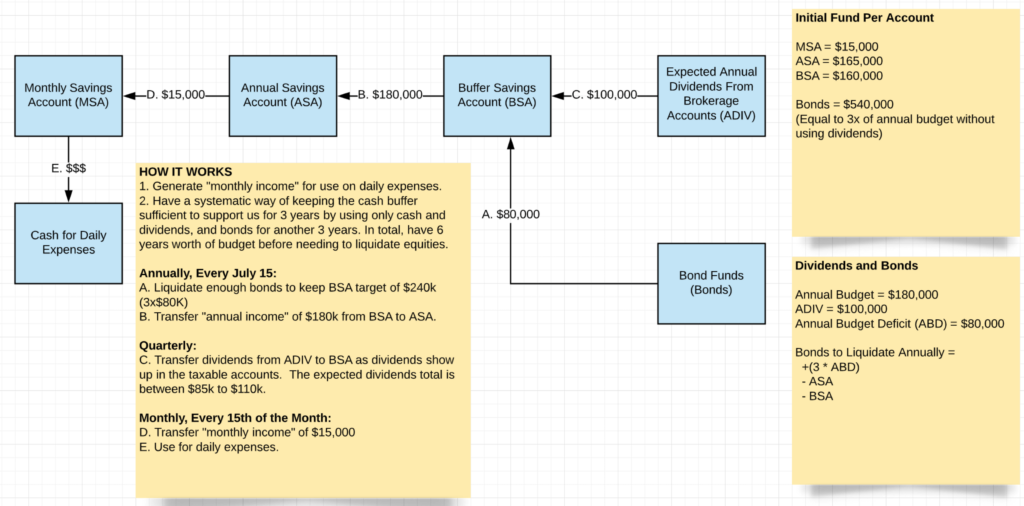

This may end up being temporary as my wife and I ease into ISE, but I’m curious of what others have done. Here’s the system that I came up with:

To understand the process, start with “HOW IT WORKS” which describes the depicted diagram.

- What system do you use?

- Do you see any issue or weakness of this setup compared to yours and other options?

- Is there any reason why I would want to have more than $540k in a bond fund? It’s equivalent to three times our annual budget, so in total this system will provide income for us for six years before we need to start liquidating some equities (when we end up being in a bear market).

The above will be included in the next iteration of our model simulation and backtesting with Prime Harvesting. Plus, it will be a monthly job that will run in AWS (schedule-triggered Lambda) that will provide us with a report on our run rate for the year, and bonds to liquidate including analysis and trigger for Prime Harvesting.

Work Transition Plan

This week I sat down a few times with a few people to discuss my transition. We have decided on an option with more upside than downside, and came up with tasks to mitigate the downside. We also came up with a plan and milestones that put my last day longer than what I had originally planned; it’s 6 weeks of transition.

I guess this is happening. 🙂

Additionally, my wife turned in her resignation letter a couple of days ago; she has a 15-day transition plan. Interestingly, they offered her a sabbatical status. She’s still discussing with the partners to see if it’ll be partially paid or at least if we can ride with their group insurance. She’ll likely not take it but I advised her to explore and find out more.

Health-related Preparations

We got a number of things done in 2 weeks. High-five to my wife for having all of her checkups and procedures done.

I still need to find a way to move my colonoscopy in June instead of mid-July which is the earliest they can find in my hospital network. I’d like it to still be with my work insurance policy to save $1-2k on out-of-pocket expenses.

UPDATE: (T – 21 days) Until Retirement

Today’s my wife’s last day of work! Woohoo!

I can’t wipe the smile off her face. I hope it stays that way for a few more days, weeks, months (?). 🙂

She will start planning our trips for this year and next year. I know, we’re such planners. Hehe.

As for me, I’ve pretty much delegated most of my responsibilities. I’m now just waiting for people to ask me, and I respond by pointing them either to a documentation or to someone who took the responsibility from me. I started having daily virtual lunches with co-workers, and will start meeting others for lunch out next week.

There was an issue today, and my previous self would have been all over it. However, I really just sat there and listened as the issue was being described. Then afterwards, I pointed (figuratively) to another person and said “Talk to him”. It felt bad afterwards, but it also felt good at the same time. It’s a weird feeling especially for someone who cared a lot for years in making the company successful.

We’ve decided to have an ACA High-deductible HSA Silver Plan With Dental and Vision for our health insurance. It’s a little over $700 for us with $6,000 deductible. We could have gotten the slightly cheaper plan for $655 but its network didn’t have our current primary care physician and dentist.

With our planned and expected income next year, we’ll be eligible for subsidy next year 4 – mostly dividend income, cash, and max HSA contribution.

UPDATE: (T – 10 days) Until Retirement

My wife just completed her first week of retirement. So far no regrets on her part. 🙂

She also purposely did not want to have a structured week. She took the approach of, well, doing whatever she feels like doing that day. She has been planning our upcoming vacations, bought and potted new indoor plants, and organized a dinner with our closest friends. However, I don’t expect her to continue to not have a schedule because she is a planner.

Over the weekend, I found the time to reread the ISE thread and the ISE blog post. I did that to find out if there’s anything else that I missed or should be thinking about. As I mentioned before, I am able to structure decisions and tradeoffs better when there is a framework that I can work with. The ISE framework fits the bill.

Investing

I previously described an opportunity to own part of an offshore software engineering firm, and doing business development in the US. Well, after further discussions with my wife, and with influence from fine people discussing the nuances of ISE, we are passing up on investment and involvement with the business operations. However, I will be proposing to the founder the following:

- We acquire only 1% of the firm

- Give us a board seat

- We do very passive business development

I do believe I can provide them with advice and strategy by being in the board. We’re not committing to anything beyond that.

I’m meeting with the owner later this week.

Furthermore, my wife and I have agreed that the only investments that we will be doing this year and next year will all be passive investments. For us, this means only real estate syndication, and debt financing with only a maximum of 5% of our portfolio to start.

Our goal is to get to or closer to $180,000 per year of passive income. I currently project that we’ll earn between $85,000 to $110,000.

Spending

We have our bucket system setup and funds transfer to the buckets. Our fiscal year starts in July, and we’re set to receive “monthly salary” on the 15th of each month (using scheduled ACH). I’m looking forward to our first “paycheck” next month. 🙂

My wife and I still want to be stealthy with our wealth, and so we’re not going to tell people that we retired early. Millionaire 73’s route was very tempting for us to do, but we ended up continuing with our original plan because our circumstances are different – we will be spending more time with our parents who live in our country of birth where everyone from the US is seen as wealthy already. It is really more for us so people don’t come to us for money more than they do now (we almost always say “no” already). My wife and I are also both in our 40s.

Enjoying

My wife and I have agreed on our travel plans and budget for the rest of 2021 and for 2022.

- 3 US-based = $5,000 x 3 = $15,000

- 4 International = $15,000 x 4 = $60,000

- We’re visiting our daughter in one of those international vacations.

We’re starting with a road trip to Savannah then to Miami to meet a few friends and family. My wife is also planning on a road trip to Glacier National Park in the fall and do some hiking. However, that will all depend on whether she can find a place to stay or not. Apparently, those need to be booked way in advance.

Additionally, thanks to another member for the idea, I will be doing some money hacking again with bank account bonuses and credit card points for business class seats. My goals are to earn at least $2,500 from checking/savings account bonuses using our cash reserves, and to have enough credit card cash back or points to have two business class seats by end of 2022. I used to do something similar years ago with credit cards with zero percent introductory interest rate and earning interest on what I would have paid monthly on credit cards. We earned roughly $500 per year in the early 2000s doing this.

Happy hacking to me!

Loose Ends

I already have a list of coworkers to thank directly, and a generic email that will go out to everyone.

I also found out that there’s a going away party being organized a by few people. I don’t really like having me as the center of attention but it would also be a good to meet with people again in person.

UPDATE: (T – 7 days) Until Retirement

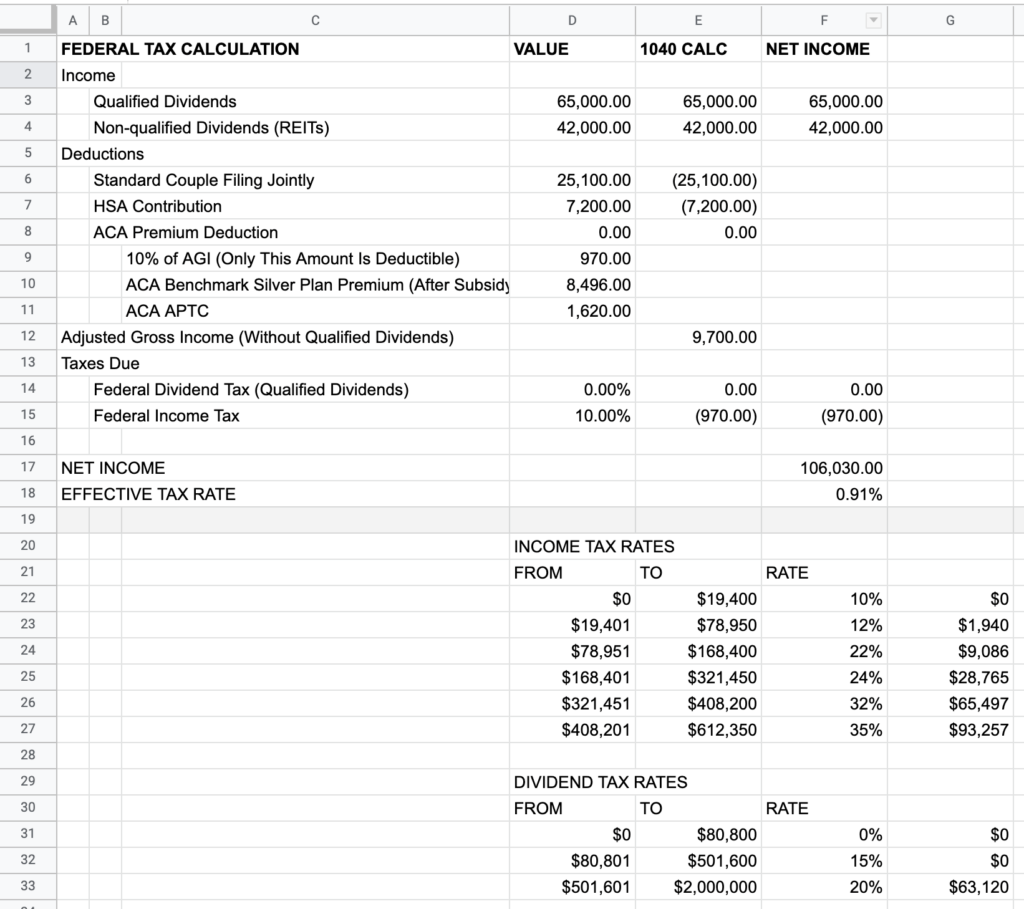

Transitioning from ESI to ISE (Part 4): Taxes

I recently estimated how much taxes we’ll pay for the tax year 2022 which will be the first full year of my wife and me without W2 income. (I shared my findings and thoughts in Will You Pay Less Taxes in Retirement as well). I knew that taxes would be lower compared to the last 10+ years of being in the 32-37% marginal tax bracket, but I didn’t expect to have an effective tax rate of less than 1% and possibly even negative with ACA subsidy.

Here’s how the calculations looked like.

With the following projected dividend income:

- Qualified Dividends: $67,000

- REITs Dividends: $42,000

And the following deductions:

- Married Filing Jointly: -$25,100

- HSA Contribution: -$7,200

And with income of $9,700 (42.0 – 25.1 – 7.2), the marginal tax rate ends up being the lowest bracket at 10%, and a tax due amount of $970. That’s a very low effective tax rate of 0.91%!

I still need to process and think how this impacts our projections, models, and simulations. Directionally, this means we probably have additional cushion and can probably increase our withdrawal rate without impacting our retirement plan survival rate (simulation) of 100%.

Anyway, I’m sharing this analysis for those nearing retirement and have used 15-20% as tax rate (as I did) in their models. Note that the dividends here are from ETFs and stocks in our taxable accounts, so the 15-20% might still be good for you if you’re using your retirement accounts as source of income.

Life Insurance

Should we consider getting a life insurance policy?

We have mostly used our employers’ life insurance policies throughout our career. Given that we’re empty nesters, and our daughter’s doing well for herself financially, I don’t see getting a life insurance as necessary.

What do you think?

Preparations for an ACA plan

I had a pleasant surprise this week. With my available PTOs, although my last day of work is on June 18, my official employment end date is set to July 6. That gives me an additional month of health and dental insurance. This works out perfectly because I have my colonoscopy, dermatology exams, and wisdom teeth extraction in July.

We picked an HSA plan already, and will be applying in late June for an August effective date. I will be opening an HSA account with Fidelity to pair with the high deductible ACA health insurance, and contribute $7,200 per year to the HSA account. Big thanks the folks in the Do You Invest Your HSA thread for providing ideas on how to better handle HSAs.

Additionally, my wife will be rolling over her two existing HSA accounts into a single Fidelity HSA account under her name. That will be around $15,000 combined.

Loose Ends

My wife received her last paycheck today, and she’s maxed out her 401(k). That’s the same for me. Yay!

I’m sharing a post on Saying Farewell Gracefully. It’s a good read, and likely a good resource for those retiring or leaving their jobs soon.

UPDATE: (T – 1 day) Until Retirement

Three weeks ago, I started reaching out to different teams and individuals that I had worked with to let them know that I was leaving, and to thank them for their help through the years.

Since then, I’ve been getting emails, Slack messages, and calls from different individuals to express their gratitude and how I’ve helped them in their career growth. Some even described specific instances that have long forgotten. I didn’t really think that I had the much impact on the careers of that many individuals.

It’s really heartwarming.

It also goes to show how everyday interaction with your subordinates, peers, and superiors can be a learning experience for both parties.

UPDATE: (T – 0 day) Until Retirement

Done with W2.

Thanks to everyone here who helped me navigate the path to early retirement.

I will have more updates in the next few days. In the meantime, I’m vacationing with my wife, and my brother’s family.

Congratulations on achieving your goal of early retirement! In my humble opinion, you DO NOT need any life insurance. You “have won the game”. Enjoy a nice dinner or two with the premium $ that you will save. Best wishes to you and your family.

Erik, thank you!

Yes, we ended up not getting a life insurance. We don’t have anyone dependent on our income apart from my wife and myself.

Woohoo! Congratulations and good for you not hanging on longer than you needed to just for the extra $$. One question, is there any reason that you didn’t consider cobra as an option? I know it can be more expensive than ACA but it seems like a good plan as you transition into your new retirement income and lifestyle. In other words, one less thing to worry about for 18 months.

Jules, thank you very much! Yeah, good thing we were able to accelerate our plan.

I didn’t want to just go with COBRA without knowing the alternatives. Also, I had time to read, so I ended up reading a lot about the ACA including the APTC (subsidy) calculation, and how we could potentially have subsidy ourselves.

We were initially going to be eligible for some subsidy due to the temporarily suspection of the subsidy cliff until the end of tax year 2022, but after factoring in our planned Roth conversion, our during retirement income will end up being too much.

Congrats on retirement to both of you! I’ve been thinking about a 3 bucket system (thanks, Fritz!), and found you’re breakout to 4 buckets interesting. Is there an explanation on how Bucket 4 comes into play?

Good luck!

Thanks! You can read more about the 4th bucket in https://www.physicianonfire.com/buffer-assets/. It is really the floor, insurance if you will. They are Social Security, and equity in fully paid primary house.

Congratulations! Regarding your colonoscopy expense – if you are over 50, I think the colonoscopy will be covered 100% as preventive care with your ACA plan. You could have waited until after 50 and probably gotten it fully covered under ACA. Food for thought for future!

Dave, thank you!

I did not want to wait because of our family history — too many had colon cancer.

Surprisinglly, I did not pay a cent for the colonoscopy with my insurance through my former employer. My next one will be in 5 to 10 years, so I will be over 50 years old by then. Yes, I believe it’s a preventative procedure, so it’s 100% covered.

Congratulations! Great plan. I am curious about qualified dividends. When I get my after tax 1099s most of my dividends are non qualified? I have much in etfs and some index fund accounts. I didn’t realize qual dividends owe no tax up to 80k, but I imagine that is what happens with the qual dividends tax worksheet calc. Curious to hear your knowledge on this. Thank you. Gary

Thanks, Gary. As for qualified dividends, check your 2020 1040 tax form and see what’s in the Qualified Dividends and Ordinary Dividends boxes. Note that the $80,800 is the AGI, so the tax rate on qualified divide are subject to that and not the amount of the qualified dividends. HTH.

Yes… the last year I work, I did my job, but I also leisurely took longer walks with a cup of tea… guilty as charged… felt great!

Yes, my husband and I stealthy enjoy hiding our wealth. We love our life style and have no other wants or needs. I once wondered what I would change if I lived like the multimillionaire I am…. Well, the only thing I came up with was to purchase a new car because we were due.

I love the analysis you did to prep for retirement. Planning snd analysis have served me very well, throughout my life!!!

Great article and best wishes!!!

Thanks, D. My wife and I are both planners, analytical, and technical, so we did the only way we knew how to do things in being comfortable in making such an important decision.

Enjoy your retirement!

I’ve only just given the writeup a quick skim but plan to read more closely tomorrow. Congrats on pulling the trigger. My wife and I pulled the trigger early at 48 and use a similar bucket approach. Good to see others using it as well although I often get feedback that it’s too conservative of an approach. It may well be but we sleep very well at night knowing that we have 2-3 years of “cash-on-hand” at any point in time. Keep up the good work.

Thanks, MikeFI. I get that feedback from time to time as well, but most the source of the feecback have the lense of wealth accumulation insead of using the wealth to fund retirement. They are just different, and needs very different approaches.

It’s about income harvesting and income withdrawal (two distinct activities). Some combine the two by using a systematic approach (e.g., 4% withdrawal), but some use a bucket system to have that buffer.

Very interesting write-up on your thought process to pull the trigger a lot earlier than you had planned for. I went back and read your Millionaire Interview and can’t reconcile your current asset number in that interview ( Our current net worth is around $3.20M) vs this that says $6.3M . Am I reading something wrong?

Thanks, Gerda. You did not read it incorrectly. Two things happened between my interview and my countdown write-up. First, my 7-figure RSUs and options vested which I liquidated and invested in the broader market, then the market appreciation added another 30% appreciation.