If you’re interested in participating in this series, please drop me a note.

This interview took place in November.

My questions are in bold italics and their responses follow in black.

Let’s get started…

Tell us a bit about yourself (age, marital status, kids, where you live, etc.)

My wife and I are both 48 years old, and we have been married for 26 years now.

We did have a child right after we got married but she passed away before she turned 2 years old because of complications related to a congenital disorder.

We have another daughter who is now in her 20s and currently lives overseas for her PhD.

We live in a metro area in the Southeastern United States.

I’m including my wife in this profile because the collaboration that we have done through the years has shaped our respective careers, earnings, investments, and combined net worth.

What do you do for a living?

My wife and I are both in software development. We both have Computer Science degrees, and MBAs. She also has a Master in Computer Science degree.

I manage the software development department for a public company while she leads multiple teams of software engineers both in the US and overseas.

How much do you earn annually?

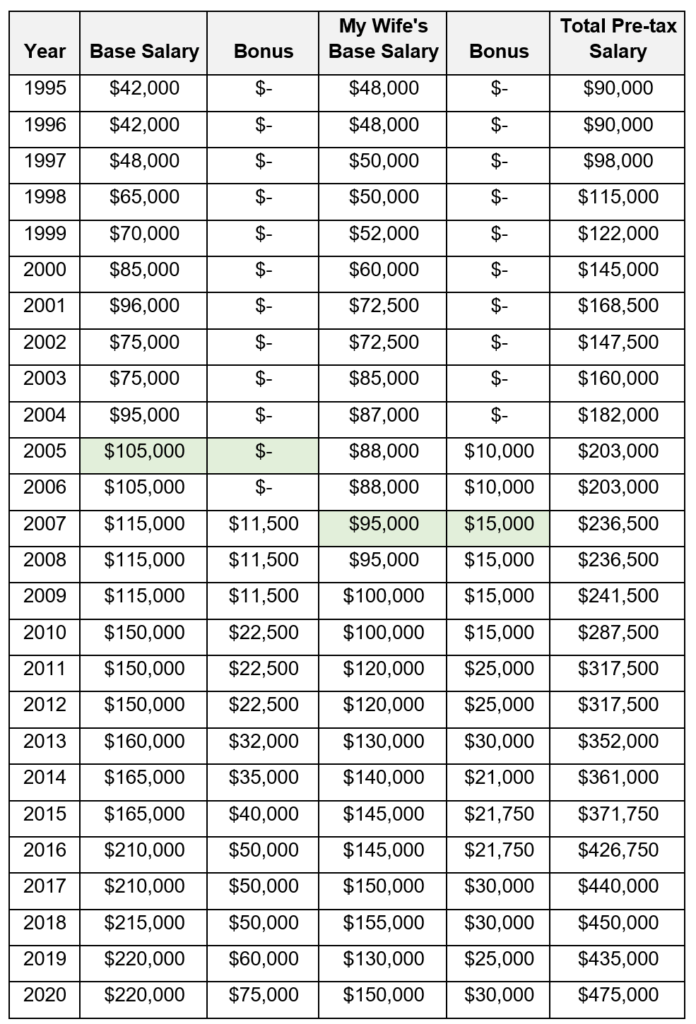

Our current combined compensation is around $475,000 per year.

How does this amount break down (salary, bonuses, etc.)?

My current base salary is $220,000 with a bonus that has ranged from $30,000 to $70,000 in the last four years. In the last 2 years, I received more than 100% of my bonus due to exceptional financial performance of my employer. However, for 2021, I will take a big hit in bonus due to COVID, so I expect that to be around $20,000.

My wife’s current base salary is $155,000 with a bonus of $30,000 which she receives almost always 100%.

Do you receive any additional compensation/benefits from your employer (401k match, stock options, etc)?

My wife and I have mostly worked for companies that provided generous restricted stock units (RSU), employee stock purchase plans (ESPP), stock options, 401(k) matches, and bonuses. As a matter of fact, the additional compensation has been a big part of our strategy in accumulating wealth.

My wife and I have maxed out 401(k) contributions since our late 20s. We got to the maximum contribution by using our salary increases to add to our 401(k) instead of spending more and changing our lifestyle.

We also took advantage of employee stock purchase plans which we often did up to the maximum allowed monthly purchase. In some years, my wife used more than half of her monthly net pay to purchase discounted shares. Those shares have also produced decent growth through the years.

More recently, my compensation included RSUs apart from the bonus and the ESPP.

How long have you been working?

Both my wife and I have been working for almost 26 years now. We continued to work full-time while we studied on a part-time basis.

For a couple of years, we were working and studying at the same time; it was challenging both for us and our daughter.

Fortunately, we got through all of it in one piece and stronger as a family.

How long have you earned at least six figures?

I reached the six-figured mark in 2005, and my salary has continued to increase since then. That’s a total of 15 consecutive years that I have earned at least $100,000.

My wife reached the milestone in 2007 when she moved to a different employer. Her compensation continued to increase from there as well, so that is 13 consecutive years.

The below table shows our salary and bonus compensation through the years. These numbers do not include any 401(k) match, discounts in ESPP, and RSUs.

What have been the key steps you have taken that have allowed you to earn this level of income?

I grew up with not a lot of resources. Money was always a challenge in my household. Fortunately, I was able to complete my degree in Computer Science through scholarships and help from family members. I also got lucky that I graduated during the infancy of the Internet which allowed me to start a career with decent income.

Throughout the first half of my career I focused heavily on improving my market value as an individual contributor by learning and mastering hot new technologies, programming languages, and systems. This not only allowed me to command a higher starting salary as I switched employers but also gave me the chance to lead high profile projects. The latter in particular translated to big compensation increases especially when the projects had very successful outcomes.

In the second half of my career I focused more on developing my management and leadership skills and experience. That also led me to go back to formal learning to get an MBA. The compensation increases continued as I learned how to scale myself and teams of engineers. In particular, most of the compensation increases came in big increments and often included RSUs and options which helped significantly increase our net worth.

Which of the following career advancing strategies did you employ (if any) and which were most effective: a. Doing well within your current company and being promoted. b. Jumping around from company to company always seeking a higher salary & responsibility. c. Entirely changing your career path from a lower earning field to a higher earning field (going back to school, etc)?

In retrospect, I actually did all three in different times within my career. It was less of a grand strategy though but more of decisions that I made at the time.

Early in my career, I jumped from company to company while the market and my new technical skills were hot. Later, I stayed longer and sought promotions while I developed my skills needed to change my career path from individual contributor to leading people and managing projects.

What are you doing now to keep your income growing?

I continue to learn new skills that help me do my job better.

These days it’s about finance, marketing, sales, and psychology and how they relate to software engineering and people.

What are your future career plans?

I am currently building something on the side with a couple of business partners. If it proves to have a market then I will jump ship and be full-time in that startup company.

If that does not work out, my backup plan is to concurrently work on my skills that will allow me to shift and be a general manager or a C-level employee.

Have you been able to turn your income into a decent net worth (what is your net worth)?

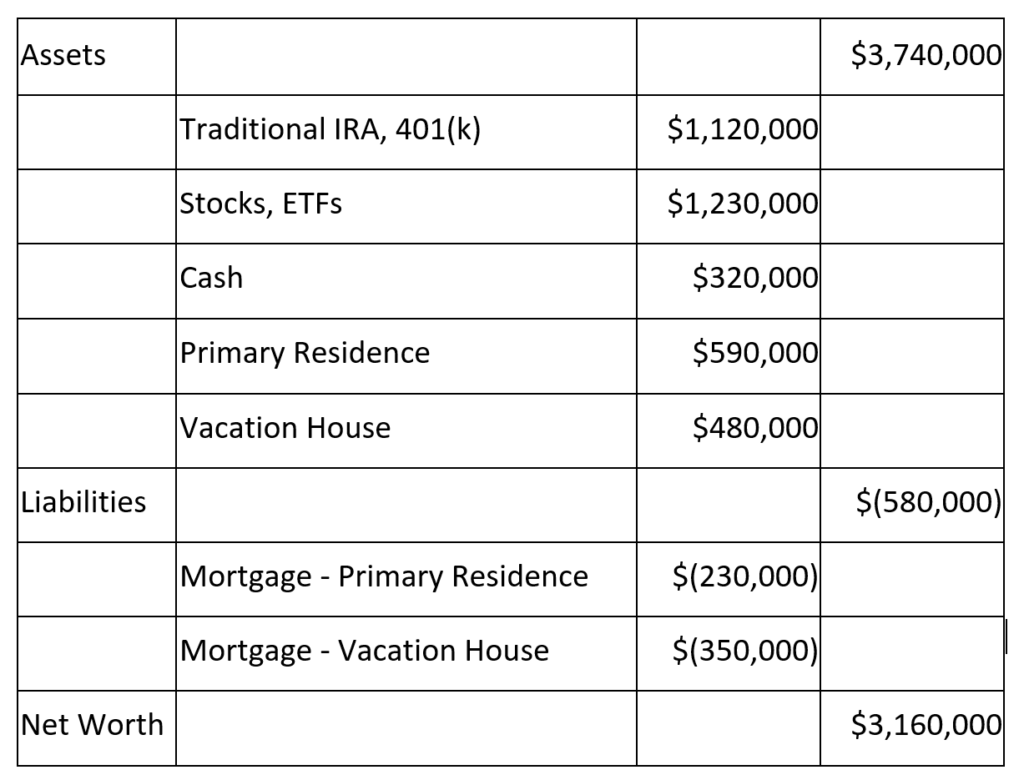

Our current net worth is around $3.20M which is broken down into the following:

Why or why not?

The short story is that we worked hard in improving our earnings, saved between 20% to 40% of our gross income, and invested diligently in the stock market.

The long story has more color and would likely be more interesting to ESI Money’s readers.

My wife and I decided not long after we got married to combine our finances and to have a common retirement plan. To this day, we still decide together on our monthly budget, all large expenses and investments including the various retirement models that we have developed through the years. This may not work for other couples, but I truly believe that this decision led us to a path towards financial independence.

Furthermore, for the first 18 years of our marriage, we lived off of my net pay only. We used all of my wife’s earnings for investments and for paying off our hefty student loans from three master’s degrees. All of our student loans were paid off within two years after graduation.

The investments that we have in traditional IRAs and 401(k) are a product of diligently maxing out contributions to 401(k) for more than 20 years. We also got lucky that the stock market has performed decently in those 20 years including through the Dot Com Bust and the Financial Crisis of 2007-2008. All our pre-tax investments have been 100% in equities split between the US total stock market, US small cap growth, US large cap value, and a small percentage in the international total stock market.

Additionally, ten of those years I did not have 401(k) because my employers then did not offer it to their employees. That is how I got started with investing in ETFs and stocks. I basically took what I would have invested in a 401(k) plan and invested them in Vanguard ETFs instead.

We did set up and fund a 529 plan for our daughter; however, she mostly used scholarships to fund her bachelor’s, master’s, and now her PhD degrees. She also worked to support herself, so we were lucky in that regard. We’ll see if she ends up doing the same if/when she gets married. 🙂

In any case, we already decided that the 529 fund is our daughter’s which is why we do not include it in our net worth.

Lastly, we primarily live in a downtown area and have another house close to the coast where we spend most weekends during the summer. We have a 15-year mortgage and a 30-year mortgage for our primary and secondary houses, respectively. Both now have interest rates under 3%.

Our primary mortgage will be paid off in 6-7 years which will be two years ahead of schedule. We will refinance the vacation house to a 15-year mortgage once our primary mortgage is fully paid off.

Our plan is to pay off both mortgages before we retire (early), keep the houses through retirement, and leave them to our daughter eventually.

What advice do you have for people wanting to grow their incomes?

Develop your technical skills and be very good at it. This does not apply only to engineering but also accounting, marketing, sales, finance, and others. The idea is to hone your skills so that you become marketable. It also helps to be in an industry and profession that is growing and sought after. Then develop your leadership and management skills so that you can scale yourself and your scope of responsibilities.

Seek leadership positions in companies that have sound business models and preferably backed by private equity firms so you can command higher equity grants, options, and later RSUs if you’re lucky enough for the company to go public.

Have a goal in mind of what you want to achieve in your career then back track to figure out a plan on how to get there, and identify key milestones to hit at specific dates. Adjust your plan as you hit milestones, and keep your eye on the goal. If you are true to yourself and commit to achieving that goal, it will force you to take action.

Thank you so much for sharing your story with us! I think you bring up a fantastic point that to increase your income, you certainly always have to learn new skills for your job to stay on top of the changing environment and adapt to new conditions. You also bring up a great point in that to grow your net worth as a successful husband-wife duo, it would be in your best interest to share your household expenses – and that’s exactly what my husband and I do as well. We thought that to be successful (not just in our marriage but also financially speaking), we should share our finances with each other and build our wealth that way. To date, we have been saving and investing north of 65% of our gross annual income. We know that for the long term, it’s certainly worth the hard work and effort today.

Thank you so much for sharing and continued luck and success on your journey!

Cheers,

Fiona

Fiona,

My wife and I shared our finances because we didn’t know any better because it’s the culture that we grew up in (we’re both immigrants). However, we found out later that it’s not typical (anecdotal) at least with our friends and family in the US. For us, it’s the best financial decision that we did early in our married life — we have had a common financial and life goals from the beginning.

It’s great that you’re saving and investing 65% of your gross annual income. We tried for a couple of years but we just had to drop to 30-40% but found ways to still save more through the RSUs and stock options from the employers that we chose to work at.

Thanks and good luck to you as well!

I enjoy these interviews. It gives me ideas, inspiration and motivation to improve and advance my career options.

Arrgo, good luck and keep pushing!

I think that all dual income households should try to live off of only one income and invest/save the other! Really smart and great job!!

That’s what tell my friends and family, but they all look at me like I’m a crazy person. 🙂

Hey ESI…apologize for the off topic comment. Just wanted to know if the mentor forums were still available to join. If not, any updates on openings? Thanks!

Yes. Anyone can join at any time.

Details here:

https://millionairemoneymentors.com/

Great post! I 100% agree with this approach:

“My wife and I decided not long after we got married to combine our finances and to have a common retirement plan. To this day, we still decide together on our monthly budget, all large expenses and investments including the various retirement models that we have developed through the years. This may not work for other couples, but I truly believe that this decision led us to a path towards financial independence.”

I believe combining finances with your spouse and talking about money/budgets is one of the quickest ways to building wealth. Keeping separate bank accounts and “splitting” expenses just seems to add unneeded complexity and headaches. Marriage is about compromise and unless the other spouse is an out-of-control spendthrift, agreeing on a family budget and being open and honest about spending helps you grow even closer as a couple.

Just my two cents and I know everyone won’t agree 😉

No disagreement from this side 🙂

I’m actually curious about early retirees where the couple each managed their own finances. Is there already a profiled retiree with this situation? There’s likely something that we can learn from how they successfully got to early retirement.

Looks like it’s going well, growing the income and the net worth!

How do you decide when to jump into the startup, considering the high base pay at your current position?

I prepared myself and my wife for the potential for that event. It would definitely change our early retirement plan; we haven’t decided if my wife would stop working while I continued with the startup.

From a financial standpoint, I did a rough NPV calculation of the future cashflow from employment and from the startup.

For continued employment, I included estimates for base salary, bonus, RSU, and 401(k) match and discounted by inflation rate + a risk factor (my own estimate).

For startup, I included estimates some low compensation in the beginning, projected/gut-feel growth that’s in the business plan, and a terminal value (for cashing out after 5-10 years). I used a high discount rate for this especially for the startup value assuming that it started and that 1/10 startups fail.

I’m not really looking for the NPV of the startup to be higher than the continued employment’s, but just enough for me and my wife to understand the trade-offs. There is going to be an element of leap of faith if we end up at the fork in the road.