If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in November.

My questions are in bold italics and his responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

My wife and I are both 48 years old, and we have been married for 26 years now.

Do you have kids/family (if so, how old are they)?

We did have a child right after we got married but she passed away before she turned 2 years old because of complications related to a congenital disorder.

We have another daughter who is now in her 20s and currently lives overseas for her PhD.

What area of the country do you live in (and urban or rural)?

We live in a metro area in the Southeastern United States.

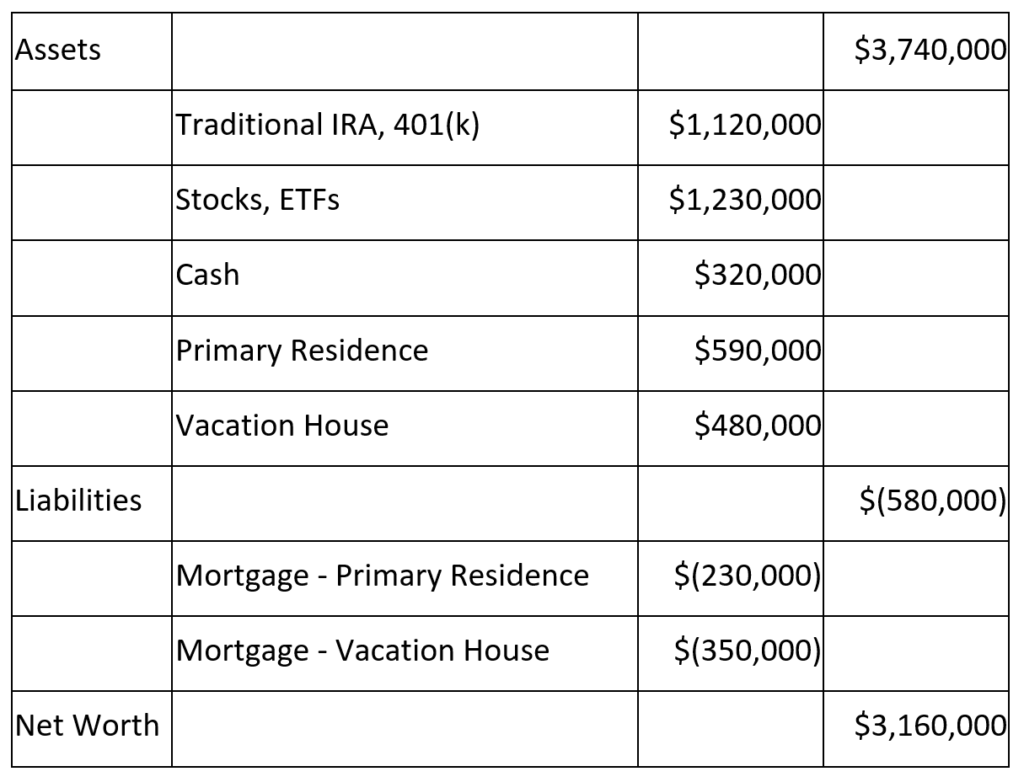

What is your current net worth?

Our current net worth is around $3.20M.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Our main assets are in stocks particularly in mutual funds, ETFs, and individual stocks.

Below is our family’s balance sheet.

We did set up and fund a 529 plan for our daughter; however, she mostly used scholarships to fund her bachelor’s, master’s, and now her PhD degrees. She also worked to support herself, so we were lucky in that regard. Around 8 years ago, we decided that the 529 fund was our daughter’s which is why we do not include it in our net worth. It is currently valued at $152,000.

EARN

What is your job?

My wife and I are both in software development. We both have Computer Science degrees, and MBAs. She also has a Master in Computer Science degree.

I manage the software development department for a public company while she leads multiple teams of software engineers both in the US and overseas.

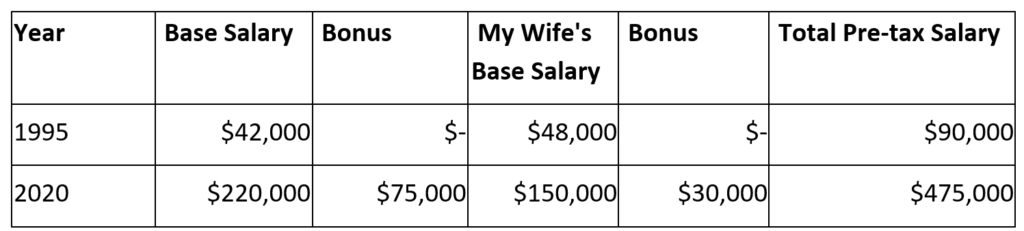

What is your annual income?

Our current combined compensation is around $475,000 per year.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

My current base salary is $220,000 with a bonus that has ranged from $30,000 to $70,000 in the last four years.

In the last 2 years, I received more than 100% of my bonus due to exceptional financial performance of my employer. However, for 2021, I will take a big hit in bonus due to COVID, so I expect that to be around $20,000.

My wife’s current base salary is $155,000 with a bonus of $30,000 which she receives almost always 100%.

The below table shows our salary and bonus compensation when we started working compared to today. These numbers do not include any 401(k) match, discounts in ESPP, and RSUs.

I grew up with not a lot of resources. Money was always a challenge in my household. Fortunately, I was able to complete my degree in Computer Science through scholarships and help from family members. I also got lucky that I graduated during the infancy of the Internet which allowed me to start a career with decent income.

Throughout the first half of my career I focused heavily on improving my market value as an individual contributor by learning and mastering hot new technologies, programming languages, and systems. This not only allowed me to command a higher starting salary as I switched employers but also gave me the chance to lead high profile projects. The latter in particular translated to big compensation increases especially when the projects had very successful outcomes.

In the second half of my career I focused more on developing my management and leadership skills and experience. That also led me to go back to formal learning to get an MBA. The compensation increases continued as I learned how to scale myself and teams of engineers. In particular, most of the compensation increases came in big increments and often included RSUs, options, and grants which helped significantly increase our net worth.

What tips do you have for others who want to grow their career-related income?

Develop your technical skills and be very good at it. This does not apply only to engineering but also accounting, marketing, sales, finance, and others. The idea is to hone your skills so that you become marketable. It also helps to be in an industry and profession that is growing and sought after. Then develop your leadership and management skills so that you can scale yourself and your scope of responsibilities.

Seek leadership positions in companies that have sound business models and preferably backed by private equity firms so you can command higher equity grants, options, and later RSUs if you’re lucky enough for the company to go public.

Have a goal in mind of what you want to achieve in your career then back track to figure out a plan on how to get there, and identify key milestones to hit at specific dates. Adjust your plan as you hit milestones, and keep your eye on the goal. If you are true to yourself and commit to achieving that goal, it will force you to take action.

Take bold calculated moves within your organization and with your career.

What’s your work-life balance look like?

I would say that it has a good balance but it is definitely more of a work-life blend than a balance.

During the first 10 years of my career, I worked between 40 to 70 hours per week which sometimes included weekends. However, with my line of work, I really only needed my laptop and a VPN to the company network. These days, I still spend between 35 to 60 hours per week depending on the quarter.

I also take a total of 25 to 30 days of personal time off per year.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

The only other source of income for us are dividends and capital gains from assets we have in pre-tax and taxable accounts. The dividends are 100% reinvested, and in the taxable account that we use for ETF investments, we also use dividends to rebalance our portfolio to minimize capital gains.

Most of our capital gains are in the brokerage account that we use for individual stock investments. It initially started as a “sandbox account” where I experimented, learned, and made higher risk (speculative) investments; however, it has grown from being below 5% of our total assets in taxable accounts to a little over 25%.

Also, I do tax loss harvesting on my own to offset some of our capital gains.

SAVE

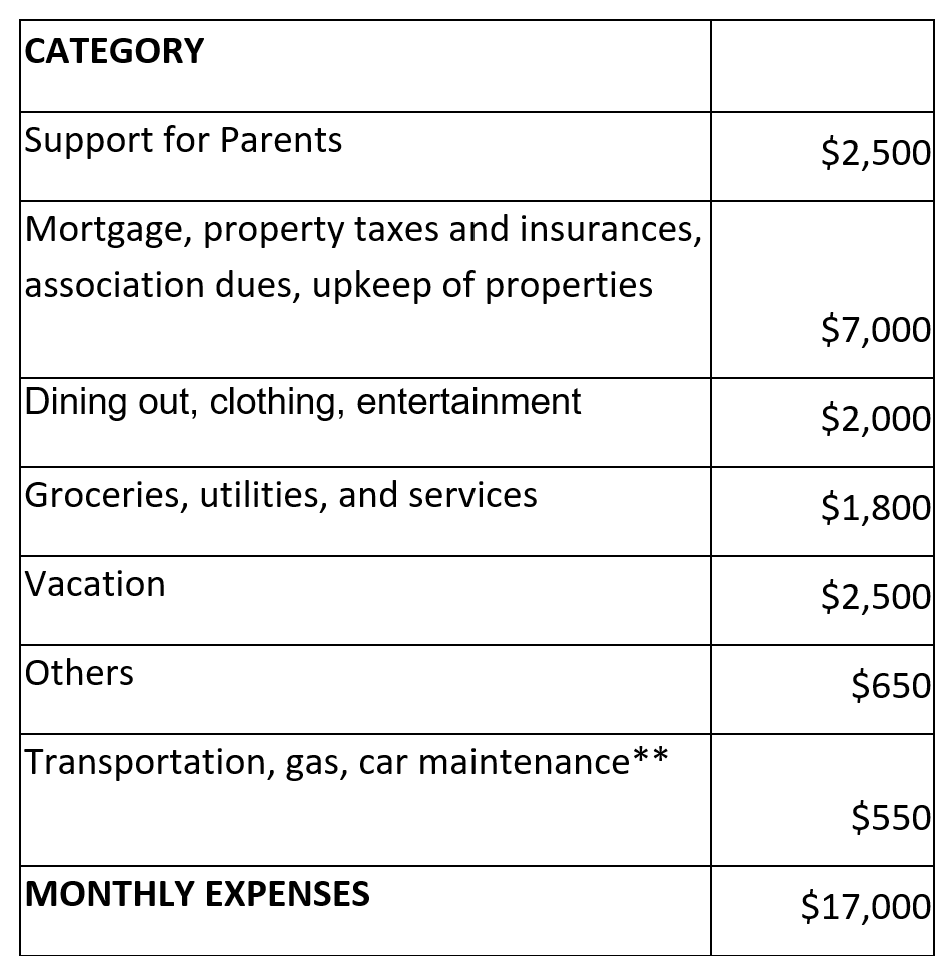

What is your annual spending?

Our annual budget is around $204,000 per year.

In the last 6 years since our daughter went off to college, our budget has not significantly changed.

What are the main categories (expenses) this spending breaks into?

**Our one car is 3 1/2 years old and already fully paid.

Do you have a budget? If so, how do you implement it?

Yes, we do have a budget that we’ve continually updated through the years but our enforcement of it has become lax as our net worth increased. However, we have not wavered on tracking every single expense. We started with Excel which eventually transitioned to MS Money then to Mint.

My wife and I decided not long after we got married to combine our finances and to have a common retirement plan. To this day, we still decide together on our monthly budget, all large expenses and investments including the various retirement models that we have developed through the years. This may not work for other couples, but I truly believe that this decision led us to a path towards financial independence.

During the first 10 years of our marriage, we figured out ways to cut down our fixed expenses and controlled even more our variable expenses. We found ways to reduce insurance rates and car payments, and for years had one car.

We also found ways to reduce our grocery, dining, clothing, utilities, and other expenses. Some of these were rather contentious because although my wife and I have a common goal/budget, she prefers to lean more towards enjoying the moment while I lean more towards saving. Some of those discussions ended up being very heated. 🙂

What percentage of your gross income do you save and how has that changed over time?

Through the years, our savings rate has been between 20% to 40% of our gross annual income. It fluctuates depending on my bonus percentage and on any big expenses during the year. For instance, our savings rate was closer to 20% when we were paying for our student loans but was around 40% after we had fully paid them.

Recently, our savings rate has been around 30% plus proceeds from liquidation of RSUs and options.

What’s your best tip for saving (accumulating) money?

Ideally, as your income increases, trick yourself into thinking that it never happened and save all your additional income.

It’s hard to do but in the spirit of the above aspirational goal, as much as 50% to 75% of our monthly income increases went to savings (and later investments), and the remaining part went to upgrading our lifestyle.

What’s your best tip for spending less money?

Prioritize where you want to spend more money on (presumably for quality) and the rest find ways to purchase good-enough equivalents.

Have a budget and track/check your spending a few times a week. Knowing is half the battle.

What is your favorite thing to spend money on/your secret splurge?

My wife and I enjoy traveling, and we do at least one international vacation and one US vacation per year. We generally travel to places where there’s rich history and food culture.

For instance, in one trip, we spent almost 4 weeks discovering the regional cuisines and wines of Spain’s southern and eastern regions, driving from village to village, staying in B&Bs and farm houses, and dining in hole-in-the-wall and in Michelin-starred restaurants.

On international trips, we fly business class especially when flying to Europe or Asia where one-way flights are between 6 to 23 hours. Between 15% to 25% of the airfare is typically covered by our credit card cash back regards.

INVEST

What is your investment philosophy/plan?

While we have full time jobs, have 100% of our investments in equities and have a 12-month buffer fund.

Once we are in early retirement, have 100% of our investments in equities and have cash that is equivalent to 5 years of our early retirement budget. The idea is to keep the assets growing and to have enough buffer to ride market downturns and economic shocks.

Once we’re in full retirement, convert to a 40-60 split between equities and fixed income.

What has been your best investment?

The top three are TSLA, VBK, and VTI.

What has been your worst investment?

Our portfolio has total international stock market index funds and ETFs. They haven’t really moved much, and we’re currently negative.

What’s been your overall return?

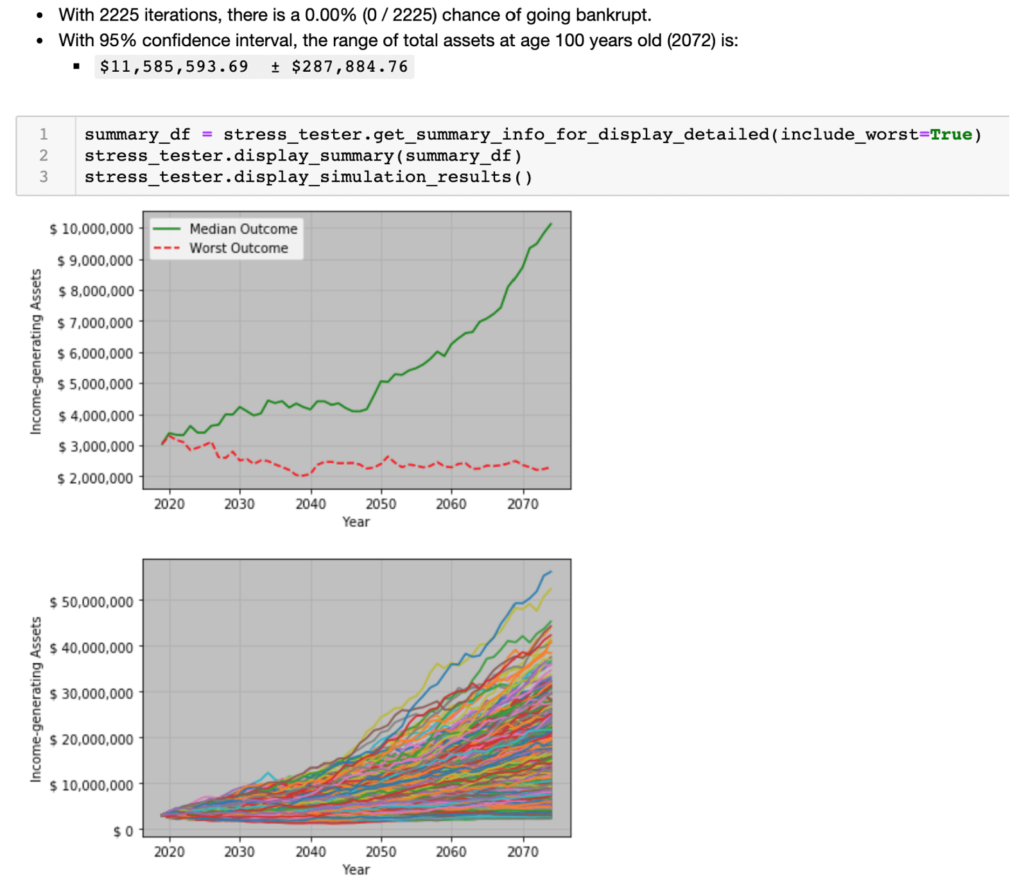

Our overall return is around 10%. I don’t expect that during retirement; we’re assuming 7%.

Also, in our retirement model simulations, the worst case had a consistent return rate between 4% to 6%.

Even with that return rate, our retirement plan still funded our retirement expenses albeit with a tighter budget.

How often do you monitor/review your portfolio?

I check our portfolio once a day. I don’t make a lot of drastic moves but seeing the portfolio forces me to read the news about our holdings and the market in general.

I rebalance our portfolio every quarter. I use Personal Capital for a singular view of our entire portfolio, Portfolio Visualizer for backtesting, and Mint for budgeting.

Pre-COVID 19, I also kept track of our portfolio’s Sharpe ratio apart from the market returns. I’ll get back to it once market volatility normalizes.

NET WORTH

How did you accumulate your net worth?

The short story is that we worked hard in improving our earnings, saved between 20% to 40% of our gross income, and invested diligently in the stock market. All of that so that we can fund our early retirement plan.

The long story has more color and would likely be more interesting to ESI Money’s readers. Here’s the general path that we took:

- Established a budget and found ways to cut expenses so that we have positive monthly cash flow

- Maxed out our 401(k) contributions

- Built out our buffer fund for emergency and for providing cushion to take on risks in our careers (e.g., switch jobs, take on new roles, etc.) which increased our income

- Invested the additional savings in the stock market

- Sought companies that provided generous RSUs, ESPP, and bonuses then pull all of them into our investments

Savings and Investments

For the first 18 years of our marriage, we lived off of my net pay only. We used all of my wife’s earnings for investments and for paying off our hefty student loans from three master’s degrees. All of our student loans were paid off within two years after graduation.

The investments that we have in traditional IRAs and 401(k) are a product of diligently maxing out contributions to 401(k) for more than 20 years. We also got lucky that the stock market performed decently in those 20 years including through the Dot Com Bust and the Financial Crisis of 2007-2008.

All our pre-tax investments have been 100% in equities split between the US total stock market, US small cap growth, US large cap value, and a small percentage in the international total stock market.

Additionally, ten of those years I did not have 401(k) because my employers then did not offer it to their employees. That is how I got started with investing in ETFs and stocks. I basically took what I would have invested in a 401(k) plan and invested them in Vanguard ETFs instead.

Along the way we also acquired our primary and secondary residences, and funded our daughter’s 529 plan.

RSUs and ESPPs

For 8 years my wife worked for a big public tech company that offered very generous RSUs and ESPPs. Including my RSUs in the last few years, they have mostly funded our taxable investment account.

We have mostly liquidated them and bought Vanguard’s VTI, VBK, VTV, and VXUS. The idea here is to reduce risk by going with the broader stock market instead of our respective employers’ stocks.

Retirement Plan

In our late 20s, my wife and I agreed on the retirement lifestyle that we wanted, calculated the cost of that lifestyle per year, and figured out what income-generating assets we need to support that lifestyle.

It started out as a simple model in Excel but that has grown more sophisticated through the years as we learned more about finances and investments, and as our target retirement lifestyle evolved.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Initially, it was earning and saving. We had to find ways to save more as our earnings increased.

However, once we had enough assets, the impact of compounding interest significantly improved our net worth. As mentioned above, it took us 16 years to get to the $1M milestone but only 7 years to get to the next $1M. The latter is largely due to the return in our investments and proceeds from RSUs, options, and ESPPs.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

Health issues and medical bills incurred by my family and our parents took sizable chunks of our initial savings.

This led us to bulk up our buffer fund and also to find companies that provided bonuses and later RSUs and ESPPs.

What are you currently doing to maintain/grow your net worth?

We have pulled back a bit on the saving part and spending more on enjoying life; we are now only saving 25-30% of our gross income.

We are just making sure that our investments are allocated properly, and we are doing well at work for more RSUs and ESPPs.

Do you have a target net worth you are trying to attain?

Yes, we have a target net worth which is part of our retirement plan.

To be more specific, our target amount excludes the equity that we have in our two houses and only includes our mutual funds, ETFs, stocks, and cash.

Below is a partial output of the code that we have written through the years. It’s a simulation of us going bankrupt when we reach 100 years old given an asset allocation strategy, budget changes throughout retirement, withdrawal rate, forward looking asset class returns, inflation rate, and a number of economic and market assumptions.

Additionally, my wife and I have agreed and put in writing how our budget and lifestyle would change on specific economic conditions such as a market crash just like what happened in 2007-2008. The document started much like an investor policy statement; however, it has morphed to also include our retirement model assumptions and retirement plan. We review the document once or twice a year to discuss any impact based on economic events and life changes.

This is how we ended up with our target income-generating assets (excluding equity in our houses) of $2.6M to $3.0M for us to retire when we reach 50 years old which is in two years.

How old were you when you made your first million and have you had any significant behavior shifts since then?

Excluding our residences, we hit our first million when we turned 38 years told. Most of the total assets were in pre-tax accounts; it was probably around 75%, and the rest cash and assets in taxable accounts. It took up 16 years to get to the $1M milestone but only 7 years to get to $2M.

Once we hit the milestone, we consciously made riskier investments and career moves. For instance, we started putting in more money in our “sandbox account” for individual stocks. It’s because we figured that we had enough assets that we could use towards a decent lifestyle when we retire at age 67. That is our income-generating assets could grow 4 fold in 20 years, doubling to $2M (nominal) in 10 years, and doubling again to $4M (nominal) in another 10 years.

What money mistakes have you made along the way that others can learn from?

I’ve made a lot of small mistakes through the years, but from a completely financial investment standpoint, the biggest mistake would be our vacation house. It costs to maintain a second house especially when it is close to the coast — e.g., new roof, renovation, etc.

However, we’ve also created a lot of fun memories in that house with our family, friends, and extended family. I just treat the house as an expense and expect little return.

What advice do you have for ESI Money readers on how to become wealthy?

Focus on your career and find ways to increase your earnings.

As your earnings increase, increase the gap between your income and expenses then save and invest the difference.

FUTURE

What are your plans for the future regarding lifestyle?

We are on track to retire by the time we reach 50 years old (in 2 years).

All the financial work that we’ve done is for trading money for time instead of time for money, and we are close.

What are your retirement plans?

Once we reach our target income-generating assets, my wife will stop working and I will follow after a year.

I have more generous RSUs at this point so we want to maximize that and use the proceeds to add to our cash reserves and fully pay our mortgages.

The portfolio that we are setting once we’re retired is the following:

- Have cash that is equivalent to 5 times our annual budget

- Put the rest into total stock market, value index, small cap growth, and international total stock indices

Once my wife and I no longer have full time jobs, we will travel initially in the US then internationally. We will try to move from country to country every 90-180 days, and discover culture, food, wine, and the people along the way.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Health insurance cost is my #1 concern. We need to have insurance coverage until we become eligible for Medicare.

The healthcare.gov plans have a high monthly insurance cost which is roughly between $1,000 to $1,500 per month for high deductible (more than $6,000) Bronze plans. There are also short term plans that we have looked at which might be an option for us because we really do not need all the benefits available in ACA plans such as pediatric and maternity coverage.

Here’s our rough plan on how to address the health insurance cost and medical expenses during early retirement:

- Get a high deductible health insurance plan or high deductible catastrophic health insurance or short term plan

- Get routine checkups and minor procedures outside the US particularly in the countries where we temporarily live

- If health insurance costs and medical expenses end up becoming more than 30% of our budget, we would work part-time at companies that have good health insurance coverage.

In our planned early retirement budget, we have allocated $2,000 per month on health insurance and other medical expenses. This allocation grows as our budget increases due to inflation.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

When I was 13 years old my parents converted my allowance from daily to weekly. During the first two weeks I ended up spending most of my allowance by Wednesday. My parents basically just said “deal with it” when I asked for more. That’s when I learned to budget.

The whole ESI framework didn’t click for me until my late 20s. At that point, I had already learned the basics of financial modeling, investing in assets, managing debt, taking advantage of credit, etc.

Who inspired you to excel in life? Who are your heroes?

That would be my parents (same for my wife). We did not have a lot of resources growing up but my parents figured out ways to pay for my education.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

Retire Early Sleep Well – Introduced me to modern portfolio theory, asset allocation, and retirement planning in general. It served as my gateway towards a methodical and scientific approach to our retirement plan.

The Intelligent Investor – Got me to focus our investments in index funds early on instead of investing in individual stocks.

Family Inc. – Provided me an approach in handling our family’s finances holistically using frameworks that are used in running a business.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

We do but it is very minimal. The reason is because we have been supporting our parents since we started working. It’s the culture that we grew up in, and we are happy to do this for our parents. Through the years, we have allocated 10% to 20% of our net income for supporting the monthly expenses of our parents who live overseas.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

Our current plan is to set up trusts for the education of our future grandchildren, leave the houses to our daughter including 25% of the remaining assets, 25% to our surviving parents and siblings, and the other 50% to foundations that educate girls and mothers on how to be entrepreneurs in the country that we grew up in.

The reason is very simple in that education was the foundation that helped us build our wealth, and we’d like to provide the same opportunity to our future grandchildren, and future generations of daughters and mothers.

Great post. Many similarities to our family’s FIRE approach and experiences. I love your pragmatic approach to backing into your plans, goals, and objectives. Once again the IT thought processes shine through, by breaking down a complex process (how to early retire) and modularizing the steps to complete a holistic solution. It’s clear to me that we “IT Techies” seem have a similar approach and special innate ability to break down and back into FIRE solutions. Loved the post! Congrats on a well planned well executed FIRE!

Thank you! I agree with your assessment. Also, it helps that the demand for software engineering talent is much more than supply which drives up compensation.

My wife and I hope to be retired just like you and your wife starting next year. I’m currently documenting my journey to early retirement in https://forums.millionairemoneymentors.com/t/p-boone-countdown-to-retirement/2357 .

Excellent article, thanks for sharing and looks like you have done a great job preparing for your retirement. The plan of moving from country to country sounds so exciting, I hope eventually to do something similar, at least for a couple of years !

One question – you’re targeting about $3m in income generating assets once you reach 50. How much income will that generate for you, and what types of assets do you think will give you that income ?

Sam, my wife and I are excited to travel more next year. We already have an itinerary for the first two years including our budget. It will certainly change as we go, but doing the planning and learning adds up to the anticipation of retiring early.

Regarding the income that we wanted to draw from the $3M, our simulation pointed to returns (appreciation and dividends) in the range of between 30% and -10%. We averaged at 7.0% because our model assumes a normal distribution with 7.0% being the mean.

However, our net worth has increase from $3.2M to $6.3M since the interview on Oct. 2020. Because of the significant change, my wife and I ended up “upgrading” our desired travels, and activities during early retirement.

We also went from 100% equities with 3-5 years of buffer to 65-20-15 for equities, bonds, and alternatives. We use the 4-buck system, and we’re currently improving the resiliency of the income in Bucket 2 (low Beta) which is for during depressed market returns.

There’s more information in my countdown thread including portfolio allocation, and tables and graphs:

https://forums.millionairemoneymentors.com/t/p-boone-countdown-to-retirement/2357

Can you share how you managed to increase your NW by $3mm in 6 months?

@MMiguel, I wish I could say that it’s because of my investment skills 🙂 but the biggest reason is because I ended up cashing out on a privately held grant that was close to $5M. It’s also classified as income tax so I’m paying almost ~45% of it on taxes (federal, state).

Plus, I benefited from the small dip in the stock market that happened in Feb this year. I used dollar cost averaging when I invested the money in index funds and stocks, so I earned an extra on that.

Sweet deal on those grants!

FYI, former S/W developer, hacker, coder here too 😉 Started in high school learning BASIC in a special program for advanced kids before there was a such thing as personal computers… career switched to finance long time ago, figured that was where the big money was. Silly me.

@MMiguel, same here, I started writing code early which really started just as hobby. I didn’t even consider having a career as a software engineer. BASIC was my first language, and from there learned Pascal, C, assembly language (80×86 instruction set), C++, Java, C#.NET, VB.net, Python, Go, Javascript, and a host of other script languages. There was a time that I wrote a lot of PERL and bash scripts 🙂

Python and Java are a language of choice these days.

Have you considered using your programming experience to do today some algorithmic trading, or for financial analysis?

I did a stint as a very specialized trader years ago. Now, much of the work I do prevents me from trading due to conflicts. When I retire, which could be any day now depending on level of aggravation, I will definitely do some trading, if only for fun.

Spent some time coding professionally in Pascal, FORTRAN, C+++, SQL and various proprietary database languages (some of which probably don’t even exist anymore). There is definitely something about coding that makes whatever else you’ll ever do in life seem so much less challenging.

Great interview well done.

I love your output of code. I would like to figure out logically the difference between taking $ out of our retirement plans which will be taxed now in a lower bracket vs leaving it in the funds where they continue to grow tax sheltered. If we leave them tax sheltered there is a large amount left eg $3 million and the tax rate will be over 50%. We are in Canada so things work a tad differently here but I think our retirement funds are similar to your 401(k)’s.At 71 yrs we have to start taking a minimum amount out. Lots of moving parts.

Would an output code be possible to figure something like this out?

I like your travel plans as well. Spain sounds marvelous. We have not done much travel as we were too busy working and raising 4 kids so we need to venture out and figure out B & B’s and VRBO’s.

I hear you on the healthcare front. In Canada while we are covered for Dr visits, procedures, etc we have to supplement for all drugs, physio, massage,etc and travel insurance so my husband is working part time where he has a fabulous health plan. Hopefully he can keep it up for several years while we do some big trips. Thank you

@Jane58, your withdrawal strategy is very different compared to ours, so it will require changes in the code to make the analysis meaningful.

I’m currently reading the book “Living Off Your Money” which has a number of withdraw strategies that include proofs, pros, and cons. If you have a software development background, you might enjoy reading the book because the author’s a CS major, and he structured the book and content much more like a software engineer would — theory, data, proof, pros, cons, etc.

https://www.amazon.com/Living-Off-Your-Money-Retirement/dp/0997403403

Also, in the US, qualified dividend income has 0% tax (tax free) up to ~$105K/year ($80,800 + $24,000 deduction). So we are going to take advantage of that as much as possible.

Regarding withdrawal, I did a quick read on retirement plans and taxation in Canada, and I didn’t see a tax rate of over 50%. Are you considering pulling out the entire amount (e.g., $3M) instead of spreading out the withdrawal annually? Even with that, I didn’t a higher tax rate than 30%.

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/making-withdrawals/tax-rates-on-withdrawals.html

Your case is likely much different, but I would rather pull the funds annually based on living expenses to minimize on the income taxes, and also to reduce the temptation to spend the money. If your intent is to move the money to a taxable investment account then that’s probably acceptable. That’s basically what most are doing with Roth IRA conversion. However, they do it gradually to reduce the income taxes so it’s spread out to a few years.

(I actually had a long response but I don’t know why it didn’t show up. Below is what I could recreated.)

@Jane58, thank you! 🙂

The assumptions for your case are very different fro, mine, so the code will need to have changes before it can be general purpose. However, I did check the taxation on retirement fund withdrawals and I didn’t see a rate that was more than 30%.

Could you elaborate a bit on the 50%?

https://www.canada.ca/en/revenue-agency/services/tax/individuals/topics/rrsps-related-plans/making-withdrawals/tax-rates-on-withdrawals.html

Regarding healthcare, we’re looking forward to being eligible for Medicare, but that’s not the case for another 18 years from next year.

It went to moderation because you included too many links and my system thought it was spam.

I approved it.

Interesting post, nice plan. My one concern would be medical financing. In our experience (we are in our mid 70’s), as one ages, the medical costs go up, and up, and up. Even being fairly healthy, time takes it’s toll! I suggest over time plan on allocating more to medical. As it it is, hopefully, not used place it in a dedicated account for the future. It never hurts to have too much money saved. If it is not needed, at some pre-determined level (but pretty high), reduce allocations or spend it!

@AZ Joe, I completely agree with you regarding the medical expenses. Our plan currently is to have our allocation for medical expenses to keep up with inflation while we are not eligible for Medicare. Once we are with Medicare, I anticipate that we’ll have both Parts A&B and a supplemental plan.

That said, our budget for medical expenses of $2,000/month is real money adjusted from 2022, so the nominal amount will be much more than as we age.

I’m curious though about your actual medical expenses. I’m assuming that you have Medicare and paying a bit of premium for Part B ($148.50), and perhaps a supplemental plan. What other medical expenses and how much should we be factoring in?

Thanks!

By dumb luck or good planning my wife and I are able to tap group medical and dental insurance through my former employer and get a subsidy toward the payment of that insurance. We also have been on Medicare since we were eligible at about age 65. Last year we paid about $12K in insurance premiums for Medicare and a Medicare supplement plan and the subsidy was $3 or 4K. In addition, we have co-pays on doctors, hospitals, other medical treatments and medications. Most years that is another $9- 15 K depending on health events – last year was about average, $11K. We have been very fortunate and have not had any super serious illnesses or accidents (but looking toward that as we age!) Through the about 17 years of our retirement, we have had a slight but steady increase in our expenses.

Indexing for inflation seems like a reasonable plan to cope with those issues and having a reserve to cope with catastrophic events makes sense to me. Medicare (and I believe most insurance) has an out of pocket cap beyond which point the insurance pays near or at 100%.

However, not all health related expenses are covered by insurance. Personal assistance, Long Term Care, and some assistive devices come to mind. Of those, the most potentially expensive is Long Term Care, which may (or may not) be covered for up to 90 days through Medicare, plus another one time 90 days after a substantial deductible. Call a couple of long term care facilities (Nursing Homes) in your area, tell them you need a daily rate to shop for Long Term Care insurance. Multiply by 365 (the average LTC stay is a year, which means some stay a few weeks and some stay 5 years). You will probably decide to shop for LTC insurance! The younger you are the cheaper it is, since you will pay on it longer before you need it (that is assuming you can qualify for it… the younger you are the more likely you will qualify for it). I don’t know the current statistic, but it used to be that about 20 percent of seniors wound up in a care facility (20 for you and 20 for your wife…). Some LTC policies allow a person to stay at home, hire personal care at the insurance expense and age in place, that can be really nice if the stars are right.

Sorry this was so long. I tried to boil it down to the high points but it is a complex topic! Best of luck.

> Last year we paid about $12K in insurance premiums for Medicare and a Medicare supplement plan and the subsidy was $3 or 4K.

Wow, I didn’t think it would be that much. Fortunately for you, you get subsidy.

> Multiply by 365 (the average LTC stay is a year, which means some stay a few weeks and some stay 5 years).

For us, our plan is to move back to our country of birth once we hit 60 or at most when we hit our official retirement age of 67. The cost of long term care there is lower compared to in the US. There are trade-offs but I figure that if both my wife and I end up not being able to take care of ourselves, I’d rather not prolong living like that. It’s a little morbid and my wife certainly disagrees with my viewpoint.

I also wouldn’t want our daughter to have to take care of us as well.

> Sorry this was so long. I tried to boil it down to the high points but it is a complex topic!

I appreciate the information.

I love that you have an agreement in writing with your wife for how to deal with a potential market crash in retirement. I think that is great preparation, which you hopefully will not need, but is critical to not having to panic if/when that happens. I recently put a financial plan together for my wife and I and I think it has really helped to put us on the same page, and now I need to work in a quarterly and yearly review of it!

Actually, my wife and I ended up writing things down out of frustration. 🙂 We would discuss things only to repeat the same topic a month or two after. That’s how I bumped into the investor policy statement which gave us a high-level format.

Here are a few of agreements that my wife and I have documented:

1. On 2 consecutive double-digit market returns, drop our annual expenses to 65% of the previous year’s expenses

1. If we end up tapping into our original principal, slash our annual budget to 70% of the previous year’s budget.

1. When we reach 67, move to our country of birth where the cost of living is significantly lower than in the US, and slash our budget by 50% of the previous year’s budget.

1. Our budget shall not exceed 4% of our total investable assets.

There are 15 items in our list.

We spent countless dinners and bottles of wine before we got to agree on these things — we’re both very opinionated :-).

How was your experience deciding on the specific actions documented in the financial plan?

There’s a lot of power in this statement:

“Take bold calculated moves within your organization and with your career.”

At my current company, there was an obvious need for data analytics to assist a number of departments in cost recoveries and financial visibility. Nothing like it existed at the time so I formed a team of three people and we hammered out a data analytics program in a few weeks and recovered over $300k (and counting) in vendor overpayments.

The CFO liked it so much that he had us train his own people so they could do it. Earned me a lot of kudos and visibility across the organization 😉

@Success Tringles, that’s great! Since you’ve proven yourself to the CFO and likely a few department heads, you’ve likely earned their respect, and established yourself as an expert. The question that I have for you is, how you planning on using that capital to further you own career?

My long timer mentor used to always say, “if you’re always successful at what you do, you’re not pushing yourself or risking things enough.”

Congratulations for being on track to retiring in 2 more years! What an incredible accomplishment, and I really enjoyed reading your stories. The number one takeaway from your journey for me, at least, is that your partner really is the biggest financial decision of your life. It sounds like you and your wife were very lucky to have found each other. I know colleagues of mine who have very lucrative jobs, but their partners don’t support them and have quite atrocious spending habits, and that’s a pretty bad combination.

Lastly, I just wanted to say that I think what you and your wife are doing in terms of leaving a portion of your assets to charities – especially those dedicated to educating girls and mothers on how to be entrepreneurs – is incredible.

Thanks for sharing your story.

Cheers,

Fiona

@The Millennial Money Woman, thank you for the kind words. Yes, I agree that having my wife as a partner in our FIRE journey was instrumental in reaching our financial goal. We may not completely agree on a lot of things, but the good thing is that we have been paddling in the same direction which is what matters. 🙂

I grew up in a country where a lot of the educated people leave to work in other countries. That’s why I’d like to help educate small scale entrepreneurs because they are the ones that stay and develop the local economy. My wife on the other hand has conviction that equal pay will _only_ happen once there’s a critical number of female business leaders. We combined both, and came up with the theme of “educating girls and mothers on how to be entrepreneurs”.

Nice story. You talked about qualified dividends and their low tax rate. My qualified dividends seem to be about 1/3 of my total dividends. How do I increase that percentage? Of course I can go try googling that too. Thx

@Gary, thanks! As for qualified dividends, they are taxed at long term capital gains tax rates. From https://www.investopedia.com/terms/q/qualifieddividend.asp, the rules are:

1. The dividend must have been paid by a U.S. company or a qualifying foreign company.

2. The dividends are not listed with the IRS as those that do not qualify.

3. The required dividend holding period has been met.

Other dividends are ordinary. Note that dividends from REITs are taxed as ordinary income.

The question for you is, what are the sources of your dividends? Do you have dividends from REITs, foreign companies, and other non-qualified sources?

Any chance you’d share the country of your birth where your parents live and you plan a return to yourselves? I’m curious on both hearing of the traditions of sending money to ones parents and also just a love to travel and plan to slow travel and see different places myself.

Most Asian families have a culture of educating their kids in the hope of improving the family’s financial status. Remitting money to family, and in our case our parents, is part of the culture. My wife and I feel that it is our obligation to do this for our parents.

Lots of options in Asia for extended travels — Thailand, Vietnam, India, Philippines, China, and others. Happy travels! 🙂

MI238,

Rereading this as there is a wealth of good info and perspectives here. I love how thoughtful and systematic you and your spouse have been about many of your choices (career, retirement, travel, etc.). The output code is priceless – I have a 50 tab excel worksheet going, but I need to get back to some real coding.

One thing you made me think about was the value of employer RSU’s and stock options. Wish I’d given more thought to targeting employers with generous plans, as this has been a recent theme in the MM interviews – perhaps because millionaire techies seem to be coming out of the woodwork ;-). Wish I’d stayed in tech too but c’est la vie. That said, things haven’t turned out too badly.

When I look back over my career and add it up, I’d say over $1mm of my current NW (upper 7 figures) can be traced back to RSU’s and these were really important especially at early-mid career. In the beginning wife would look at me cross-eyed like “what the heck is this funny money… we can’t put it n the bank, we can’t spend it, its not going to pay the bills”. And the paperwork was intentionally difficult to decipher and figure out when shares would be released.

The RSU’s were more a source of aggravation than anything – every time I switched employers I would have to negotiate how to get compensated for the RSU’s I was leaving behind (usually with new RSU’s in the new employers stock). I was lucky to work for a couple of companies that saw massive appreciation in their stocks and was able to time my sales with the peaks, and role the proceeds into diversified funds.

I realize now that the fact that my comp has been highly variable (commissions, bonuses, incentive pay, RSU’s) for 30 years has been more blessing than curse. Wife who was the original budgetmeister hated this because planning ahead was near impossible. But on the whole it forced us to live below our means (in hindsight well below) until we had built up a sizable savings cushion. Because there was always that fear of the disaster year… terrible bonus or lay-offs in a bad market. We did not have much of a family safety net so were a bit on the paranoid side.

Thanks for reminding me how valuable those RSU’s have been and all the other great info.

@MMiguel,

> I have a 50 tab excel worksheet going, but I need to get back to some real coding.

That’s precisely how I ended up writing code. It got too difficult for me to track the changes, the formula, etc. especially after a few months.

> Because there was always that fear of the disaster year… terrible bonus or lay-offs in a bad market. We did not have much of a family safety net so were a bit on the paranoid side.

Same here. Since the bonuses, RSUs, and options came in at the 2nd half of our careers, we mostly lived off of one income. Once we started having compensation packages that included those, we ended up saving and investing most of them and continued with the same lifestyle.

> Thanks for reminding me how valuable those RSU’s have been and all the other great info.

You’re welcome!

And in the end, it looks like things worked out for you and your wife.

Lastly, I hope more people see RSUs and options as probabilistic/risky part of their compensation. Both are ways to share in the success of the company both in the short term and the long term, respectively. I would go with an employer offering average salary but with RSUs and options (with upside on stock price) than another with above average salary without those extra compensation. I just see the difference as being conservative or taking a little bit of risk but with a much higher potential.

very impressive how well you can do in software dev in the right market!

Congrats on the growth, if you both enjoy your work then you’re right on track!

What would you do for additional income vs the budget if you had to stop working for the employer, since there’s still a gap between expenses and the amount you could withdraw from the investments?

@Charlie, we don’t have a gap anymore; however, if we did, we’d just reduce our spending, or do side consulting gigs, or both.

Well done on everything you’ve accomplished MI-238.

I especially applaud the mission to educating girls and mothers to be entrepreneurs. Is there a particular charity or non-profit you’ve already decided to support? I’ve donated to the One Girl Foundation in the past, not sure if there’s a similar charity for your home country or region, but just thought I’d share.

https://www.onegirl.org.au/

I also wanted to acknowledge the loss of your little one, just before their 2nd birthday. My heart breaks for you and your wife. Realise it’s probably been decades now, but I imagine those memories and that pain just doesn’t go away, it lingers.

This resonates with me, as my youngest recently spend some extended time in the hospital. He got better thankfully, but it was scary, and I know other kids in that ward weren’t as lucky.

Life is short, enjoy it now. Best of luck with early retirement! Looking forward to reading all about your adventures in the MMM forums.