If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

My questions are in bold italics and his responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I just turned 43.

I was married for almost 10 years, and got divorced just over 2 years ago.

Do you have kids/family (if so, how old are they)?

I have a son who is 9 and a daughter who is 5.

My girlfriend, who I met about 7 months after my divorce also lives with me and has two boys who are 17 and 19.

What area of the country do you live in (and urban or rural)?

We live in the northern part of Nevada, which is around the Reno/ Carson City/ Lake Tahoe area.

What is your current net worth?

It’s not really something I ever paid much attention to, but we were having pizza the other night, and my girlfriend’s younger son asked me that question, so we wrote some stuff down on a napkin and figured it out. I think it was somewhere around six million.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Business

I started a business from scratch in 2005 which sells parts for classic cars.

It currently has 1.5M in inventory, which is our cost. Our average gross markup is 100%, so the retail value of the inventory is about 3M, and the costs of doing business end up being about 25% of our gross sales, so at the bare minimum, the value of the business if we were to just sell out the inventory that is currently on the shelf, would be about 2.25M.

The average annual income from the business usually ends up being in the 600-800K range, so if I were to value the business even based on a really low multiple of like 3 times earnings, plus the wholesale inventory value, that would put it worth somewhere in the 4M range conservatively.

House

Zillow currently has it listed at 1.6M.

I own it free and clear, no mortgage.

Bought it for just under one million in cash in 2013.

Commercial Building

This is the 10,000 sq/ft building which the business operates out of.

I also own it free and clear and bought it during 2012 at the low point of the market after the real estate crash. I rent it to my business (The tenant and I get along great!)

Since I bought it during my marriage, my ex wife still owns half of it. We had not put aside any money for the kids, so we agreed during the divorce that the money from the sale of the building (when it eventually sells) would be allocated for the kids college education and/or other costs for them.

So I don’t really count this as part of my net worth. It was bought for just over 400K and is currently worth probably close to 700K. I also rent the back 1400 sq/ft (which is walled off as a separate unit) for $650/month.

Roth IRA

57K.

My income has been past the maximum limit for making contributions to a Roth IRA for a while, so this is mostly from contributions I made early on (always for the maximum yearly limit), which have just been left to grow over time.

The whole thing is invested in the Vanguard Total Stock Market Index fund, since I expect this to just sit and compound for decades before I touch it.

Traditional IRA

64K.

I started making tax deductible contributions to the traditional IRA after my income hit the ceiling for the Roth IRA, and I always contribute the yearly maximum, although in the whole scheme of things, the maximum is way too low (6K this year) to move the needle very much. But it’s a nice little extra deduction.

The whole thing is also invested in Vanguard Total Stock Market Index, just like the Roth.

Brokerage Account

Just under 2.5M.

I know most of the interviewees on here invest in index funds. I started with funds in 2011, and it just didn’t click for me.

At first, I thought sector funds or dividend funds would take the “guess work” out of investing, since you don’t have to choose individual stocks. But before long, I realized there are actually more funds to choose from than there are individual stocks, and everyone has a different theory of which type of funds you should buy, and what percentage to hold from each sector, domestic vs. international, and on and on and on.

And a fund is essentially just “somebody else’s” collection of individual stocks. I felt like I was collecting baseball cards, but instead of just being able to buy the individual cards of the players I liked, I could only buy other people’s complete collections of cards. So there might be some cards in the collection that I wanted, and some I thought were junk. I didn’t like having to buy the whole collection.

And then, of course there were yearly management fees based on total assets. All these things lead me to looking at individual stocks.

In September of 2013, I came across what is known as “Dividend growth investing” and bought my first individual stock (AT&T.)

The philosophy behind this is that you buy companies that consistently pay (and raise) their dividend over time. Because dividends necessarily come from a portion of the companies profits, this inherently requires that the companies also consistently raise their profits over time.

A company which can consistently raise it’s profits over long periods (often many decades) tells you that they are doing all the right things and they are in a good space in the economy in general.

Something just clicked after that, and I began to see the connection that with every share of stock I bought, I was “purchasing” a certain amount of my future income, and I just started putting all my extra money into dividend growth stocks and building up my dividend income, dollar by dollar at a time.

EARN

What is your job?

So I basically do the day-to-day stuff of running the business.

We have 3 employees plus me. I manage the employees, tell them what needs to be done. I order product, pay invoices, do payroll, look at sales numbers and decide what is not selling well and needs to be discontinued, or what new items we could carry that might be the next great seller.

I run reports and look at profit margins, check over various business expenses to make sure that stuff is optimized. Sometimes I deal with customers, negotiate with suppliers, etc.

Stuff that maybe seems like it would be exciting unless you’ve done it every day for nearly the last two decades.

What is your annual income?

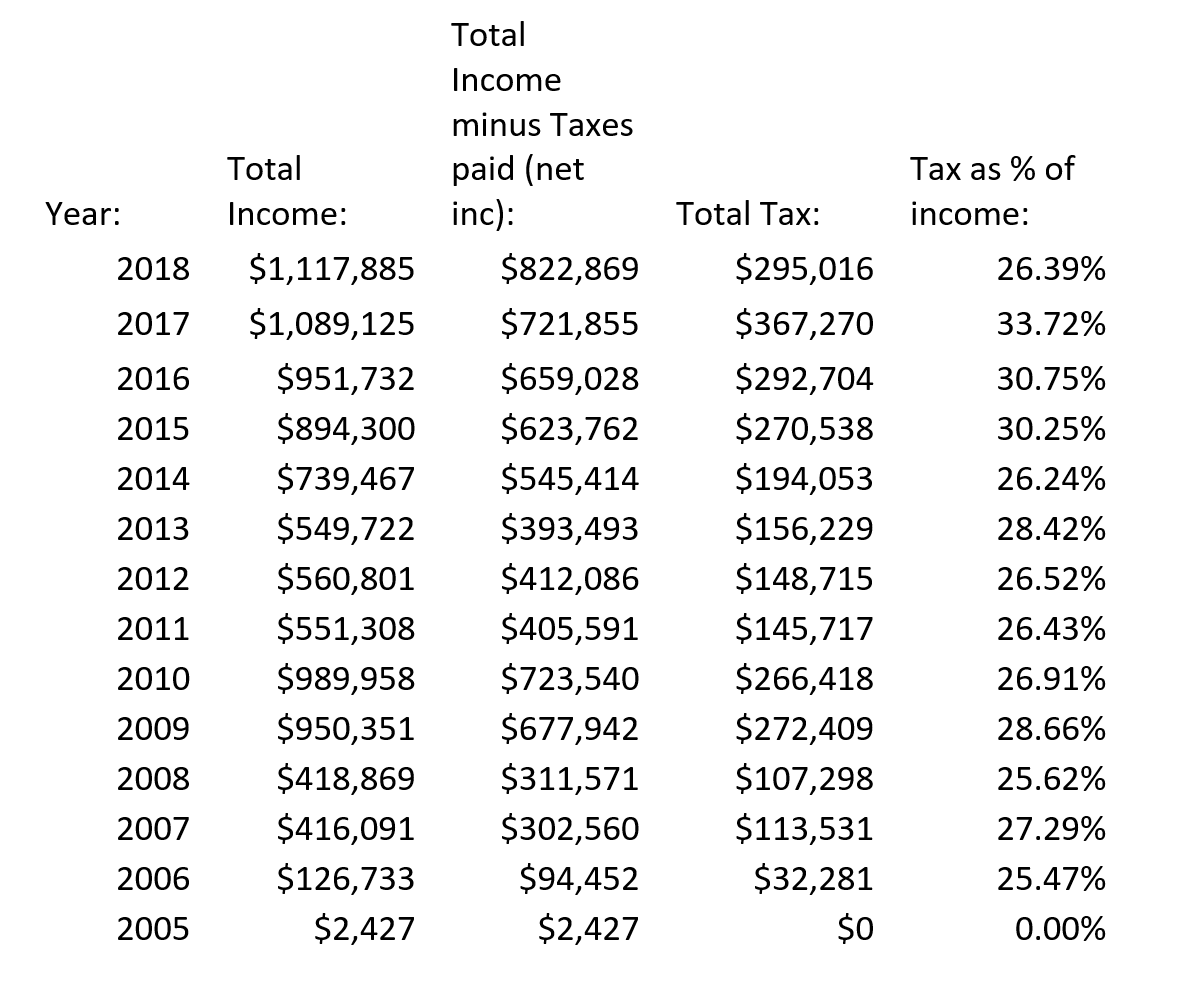

I keep an excel file of my annual income which I copy off my tax returns every year. So I’ll just cut and paste it here and it kind of tells the complete story.

This last year my tax rate was somewhat lower. That was a combination of Trump’s tax cuts on “pass through” income and the fact that a larger share of my income is now coming from dividends and capital gains, both of which qualify for a reduced tax rate compared to regular earned income.

But since I’ve paid Uncle Sam over 2.6 million in taxes now, I’m happy to take the lower rate!

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I’d say over the last several years, my investing results on top of the money the business makes is what has really supercharged my income to well over 7 figures.

It’s really amazing and a great thrill to see the “snowball” effect working in real time.

What tips do you have for others who want to grow their career-related income?

I read this really great book called The Richest Man in Town. Basically the author went across the country and picked like 50 or so of the most successful people in various cities around the US.

And at one point he mentions that 94% of the people he interviewed had started their own business. That is just an amazing number to me. NINETY FOUR PERCENT!! While you can find “some” success working as an employee or doing the typical “climbing the corporate ladder,” I just don’t have any experience with that route in life.

When you work for someone else, you will always be thought of as an expense. And your boss’s job, and their boss’s job, is to always keep expenses as low as possible. So they will always pay you only enough to keep you at your job, or to hire someone else who can do your job. And there is likely someone else who is willing to do it for just an average living wage.

When you own something, you get to keep the associated profits. And with a good business, profits can go up 100 percent, 1000 percent, or more. It’s unlimited.

You NEED to grasp the amazing potential of acquiring ownership. Use the money from your labor to build as much ownership as possible, as early as possible.

Think of common stocks for what they really are, REAL ownership slices of real successful businesses. And never get rid of your ownership once you have it.

Never use debt, lest you should someday find yourself in a position where you would be forced to liquidate your ownership. There is no reason for that. If you can’t pay cash, you can’t afford it.

What’s your work-life balance look like?

When I first started the business, it was pretty crazy.

You can see my income the first year I started the business, was a whopping $2,427 for the entire year. And that was a year of 12-14 hour days, 7 days a week.

I remember getting to a point where I realized it had been over a year, and I hadn’t had a single weekend day I had taken off. I remember deciding to take one Sunday off and just watch TV the whole day, and it was really nice.

I never really figured it out exactly, but my actual hourly rate I was making during that first year must have worked out to literally a few pennies per hour. What really motivated me in those early years was that I loved what I was doing, and it was new and fun, and to see it grow at such a huge rate in those early years was just really exciting.

As the business matured over the years, sales growth slowed down, and employees were able to take over many functions, and for a while my work-life balance on a daily basis was really good. I was able to come into the office for maybe 3-4 hours a day, and do what I needed to do to manage the business.

I would spend the rest of my time at the gym, going on hikes, picking the kids up from school, working on my investing, etc. It probably went along for maybe 5 years like this.

The flip side to this is that when you start and own a business, it is your baby. Even though it didn’t require me to keep my butt planted in a chair for 8+ hours a day, the mental strain of keeping the “huge machine” (as I call it) perpetually running smoothly and the “gears oiled” constantly takes it’s toll.

In almost two decades I have never been able to take a “real” vacation where I can forget about work. The business is always on my mind. I am always up at night thinking about something.

There is always a wrong shipment from a supplier, an employee that has a critical task to do who has just called in sick. A part that has been made incorrectly and you just received 1000 of them. I customer that placed a next day air order and someone sent it out by ground by mistake. A truck just backed into the dock wrong and slammed into the building, doing huge damage to it. They just announced there will be a 25% tariff on a certain item, and if you have to raise your prices by 25%, you know it will absolutely kill the sales. Or any of 1000 other possible things. There is never any mental rest, the machine is always running.

I ran my income during recent years though a website that compares your income to other people’s in the US, and it rated my income in the top three tenths of the top 1%. And I think the reason for this is because 99.7% of other people just aren’t willing to put themselves through the kind of insane hours I described earlier for a possible result that may or may not materialize long in the future.

And even if it does materialize, most people don’t want to shoulder decades of the kind of unending constant pressure that running a business comes with. But as with most everything in life, if you want the real results, you need to pay the price https://esimoney.com/if-you-want-what-i-have-you-have-to-do-what-ive-done/.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

My biggest source of income outside of the business is my investing. I have been doing this daily for over 7 years now, and I absolutely love doing it.

When I sit down with my iPad first thing in the morning and check the market, it is a routine I find super interesting and relaxing. Every morning I can’t wait to see if any of my favorite businesses have fallen in price, so I can pick up some good deals.

And the more you read and learn, and gain real experience by actually doing it, the better you will become at it. Certainly there is a component of luck, but there is also skill involved. Clearly you can study someone like Warren Buffett and it is undeniable that his skill is a large component of his success.

It always feels like I might be wrong when I make a purchase, but I just force myself to do it anyway and trust my intuition.

I must be doing something right. My stock investing profits have been:

- 2016: $467,449.95

- 2017: $314,261.36

- 2018: $347,755.84 (which includes $264,256.95 in capital gains, and $83,498.89 in dividends)

And 2018 was a year which the S&P500 was down 6.2%, so if I would have taken the “index fund” route my nearly 350K gain would have been a loss (“paper” loss at least) well into the six figures.

There a few other small things, like we try to sell possessions we don’t use anymore on craigslist. This might be like a couple thousand dollars a year or so. But it’s not really “profits” since we likely paid several times that when buying the stuff. But at least it’s some money back in the bank instead of old junk cluttering up your life.

SAVE

What is your annual spending?

My personal spending is usually around 70K per year. I don’t track it regularly, at the end of the year I download my entire years bank account info into Excel, and strip out money I move around for investment purposes, and just total the years expenses. There are also some things the business pays for, which could be considered “executive perks” like health care, cell phone, some automotive expenses, etc. So if I didn’t have the business, these things would probably total somewhere in the 20K/yr range. So, even including those, I’m at 90K/yr. Which is well over a 90% savings rate of my gross income.

What are the main categories (expenses) this spending breaks into?

Health care is my biggest single expense. I pay 100% of it for both the kids, plus myself of course. I have the least expensive possible plan, which basically pays for nothing except catastrophic coverage.

For all three of us it’s $1.064/month or $12,768/yr and it goes up roughly 20-30% every year. Thanks Obamacare!

As a plus, my girlfriend works for the state, and her insurance is super cheap, like a couple hundred dollars per month. So at the point at which we would get married, she could add us to her insurance and that cost will be cut by two thirds or more.

My second biggest expense is child support, which is $1,000/month (12K/yr.) My daughter is only 5, so I have 13 more years of this, or about 156K more to pay. Be SUPER careful about who you marry and have kids with. More on this later…

My third biggest is property taxes, which are about 10K/year. My house was the second most expensive house sold in my entire city during the year which I bought it. So the taxes are relatively high for the area because of the value of the house. And they go up a few percent every year. I hate paying them. But at least I don’t have a mortgage. And everyone loves the house.

So again, just gotta grin and bear it and pay them. Oh well. If we ever needed to, we could always move to a somewhat more normal house and probably pay 2-4K in property taxes which is roughly the average for the area, so at least it’s something we would be able to control if necessary in the future.

After these three things, most other stuff just drops down to normal expenses that most people have, like utilities, homeowners insurance, food, movies, clothing, house maintenance, etc. Most of these categories are in the 1-2K/yr range.

My kids go to a great school which happens to be public, so there are zero costs there, so that is awesome.

Do you have a budget? If so, how do you implement it?

I don’t really budget.

I’ve tried it a couple times in the past and it seems like too much of a waste of time to track every expense, when I’m already spending less than 10% of my income. I could be using that time to read or do investing or grow the business, etc.

We just try to minimize costs in general as much as possible. I make coffee at home. When we go to lunch we try to eat off the dollar menu as long as we like the food. We always share one drink (soda not alcohol.) Things like that.

We will splurge sometimes for specific quality things that we want that will last, like certain clothes or appliances or vehicles, (and for me a big house) but for daily recurring expenses we pretend we are poor most of the time. It’s a thing.

I’ve read about it and I think it’s called “artificial scarcity.” I’ve found that what you do with small things, you will do with big things, because you just adapt to that general mindset.

If you watch your small expenses, that will translate in your mind to also watching your large expenses. If you get lazy about reeling in your small expenses, eventually that mindset will creep into your large expenses also. I think this is one of the reasons some tend to complain and scoff that rich people appear to be super cheap sometimes.

It is funny though, because my girlfriend and I both drive Teslas, so we will meet for lunch at McDonalds and park 300K worth of vehicles and then order a $1 McChicken sandwich and a happy meal to eat, and be super excited that we both had a good lunch for under $7 for both of us. I think the people there think we probably have something wrong in the head. But we are just naturally frugal people.

You have to see spending less money as a challenge to optimize things, not as some kind of deprivation. When we can figure out how to do something for less, or for free, it actually makes it more exciting than just paying a bunch of money like everyone else. We get a thrill out of that. Learn to cultivate that…

What percentage of your gross income do you save and how has that changed over time?

Over 90%, as mentioned previously. I’ve never spent frivolously, like went out and bought a Rolex or something like that.

I have made some bad investments and lost tons of money that way (which I’ll talk about in a bit.) But it was because I was a young and inexperienced investor, not because I purposely “wasted” the money or let lifestyle inflation take over or anything.

What is your favorite thing to spend money on/your secret splurge?

For me, it’s probably paying for a personal trainer.

You have to realize that nothing is more important than your health. Money without health is next to worthless. Ask anyone who has lots of money but is terminally sick and bedridden if they would trade it all to be strong and healthy again, and you can bet the answer will always be YES!

I could choose to travel the country on business trips and work 12-14 hour days 6-7 days a week and probably double or triple my income, but at what cost? So I can have a huge number in a computer somewhere at a brokerage and a destroyed, overweight, stressed out, broken body, and not to mention kids who barely know their father? No thanks!

Money you spend on your physical health has a return that is far greater than anything else. Not to mention one of the most important components in investing is time. The way you get the highest odds of having the most possible time is by getting into good health and staying there for life!

INVEST

What is your investment philosophy/plan?

Well, I have never really sat down and written out a formal plan or anything like that. But basically it’s buy (shares of) maybe 50 or so of the highest quality companies out there, then collect the dividends and live off of them for the rest of your life.

What has been your best investment?

I’ve owned a Tesla Model S for about 5 years now, and it’s an amazing car.

We went on a tour of the “gigafactory” (their battery manufacturing facility, which happens to be local in our area) and it was clear to me that they were doing great things. The next day, I bought 100K of the stock. The day after that, they announced that their quarter was actually going to be profitable, and by the end of the week, the stock was up by 40%.

So, I “made” about 40K in a week. But I didn’t sell, I generally invest in things for the long term. However, they’ve been having some issues recently, and the stock is back down close to where I bought it at. It was a good lesson in how capital gains are not the same as dividends. They can be taken away just as fast as they appear.

What has been your worst investment?

Besides my marriage? (Ok, that was kind of a joke. Ok, not really…)

When I first started investing, I made some shaky purchases of commodity companies, like mining companies and oil pipelines, etc. Companies with very erratic earnings. Many of them I sold at a loss. 10K here, 15K there. My profits on other companies more than made up for it, but I took my lumps and learned my lessons and moved on.

And real estate. Ugh! We decided to move out of California at the bottom of the real estate market in 2012. So I took an 800K loss and sold the 5 properties that I had bought during the “boom times.” The silver lining was that there were tax losses that saved me maybe 300K in taxes, so the “real” loss was maybe 500K.

And I took what I had left and bought properties here in Nevada (also at the bottom of the market.) And of course, (as I mentioned earlier) those are all worth more now. So it all worked out.

But all my experience with real estate has been nothing but a pain. I know some people swear by it and make huge money. But that hasn’t been my experience. I’ll stick to receiving dividend checks from my stocks. That’s a skill I really want to practice and hone… Someday I want to be REALLY, REALLY good at collecting checks…

What’s been your overall return?

It’s really hard to track. I am adding various amounts of money throughout the year as business and investing profits allow, and once in a while transferring some back if I need some extra cash for the business or something like that.

It would be interesting some time to track all my buys and sells and compare the total return to the market. I don’t really see the point of “beating” the market. It’s an arbitrary thing. I guess you could consider it the “average” of all the businesses out there.

To me, what is more meaningful is, “Has my dividend income ‘beat’ (been higher than) my expenses?” That’s when you’ve “really” won.

How often do you monitor/review your portfolio?

Every day!

I love investing, it’s so much fun. I’m sure in the next really bad bear market it won’t be so much fun.

But we did just go through a nearly 20% pullback in December and that really didn’t bother me at all. So hopefully I won’t mind.

When you can focus on the income instead of the value of your shares it makes it so much easier to weather the volatility. Plus knowing that you NEVER have to sell the assets to generate income helps as well. More benefits of dividend growth investing over index investing.

NET WORTH

How did you accumulate your net worth?

I started the business with a 10K loan from my mom.

Went out and bought some inventory (items to sell) in bulk.

Put them on the coffee table (literally) and repacked them into individual components.

Sold that stuff at a profit, took that money, bought a little more.

Rinse and repeat. Over and over and over again.

I literally knew next to nothing about business. I knew you had to sell something for more than you bought it for to make a profit. The rest I just picked up as I went along, I learned by doing and by making mistakes.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Well, they are all important, like teeth on a gear. All three are necessary to build. You should always be focusing on your net worth, your “stash” or whatever you like to call it. Understand that actually is your freedom. Always be thinking about how you can build your freedom up until you actually own 100% of your time for the rest of your life.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

Well I think what is probably most interesting about my story is that I’ve made pretty much every possible mistake in the book, and somehow still managed to come out ok.

My divorce cost me well over 2 million, which was a huge portion of the proceeds of much of my life’s work.

Also, years of profits made by hard work in the business ended getting wasted in real estate losses.

Not to mention, even within the business itself, there have been certain items we have developed that have been total flops and wastes of money.

But the few winners that there have been, have carried everything.

You can’t be afraid to keep taking risks, even after you keep failing. You have to always get back on the horse.

What are you currently doing to maintain/grow your net worth?

Dragging my butt to the office every morning! And finding time to read and do my investing in addition to the day to day duties of running the business. I am ready to retire but am planning to retire in sync with my girlfriend which will be December 31st, 2020. She works for the state and stands to retire with about 55K in retirement income.

Do you have a target net worth you are trying to attain?

I think people focus too much on net worth, when income is really what they are looking for.

If you have millions in the bank, what are you actually going to do with millions of dollars? What you are really looking for is the income that millions can provide you with. The “net worth” is really just a means to an end.

So it’s really a target “income” I am looking for. And that income should be stable and growing every year to keep up with (and likely surpass) inflation.

So I see that as being somewhere in the 150K range, which is probably roughly around 4 million in stocks. That would put my combined passive income (with my girlfriend’s 55K) at over 200K total.

And neither of us owe any debt to anyone, period. We can live like kings and travel the world on that kind of money. To work for more than that feels to me like it would be wasting away my life for the purpose of looking at a bigger number in a computer somewhere.

How old were you when you made your first million and have you had any significant behavior shifts since then?

At the time, I never really thought about it, but looking back at the inventory records of the business, it had passed one million in inventory in 2007. So just based on that alone I was a “millionaire” at 31.

But by then I already had owned my first warehouse building for almost two years, and I owned a house which I had put 20% down on and had some equity built up in. So if you count that stuff as well, then I probably became a millionaire at 29 or 30.

What money mistakes have you made along the way that others can learn from?

I’ve talked about all the mistakes I’ve made in other questions here. I always say, the more zeros your mistakes have to the right of them, the better and quicker you learn. It all comes down to Warren Buffett’s top two rules… You should know what they are…

What advice do you have for ESI Money readers on how to become wealthy?

1. Marry well.

This is easier said than done.

I managed to fail in this department despite my best efforts, so I am convinced that a large percentage of this just comes down to luck. Pretty close to 100% of the people getting married don’t think they will ever get divorced, but basically 50% of marriages end in divorce, so you don’t have to be a genius to do the math.

If I would have had a supportive spouse, retiring with an 8 figure net worth would have been very likely, not to mention life would have been a HECK of a lot easier. But, like with everything else, you have to get back on the horse!

My girlfriend is amazing. When I first met her, she was great at defense. She had zero consumer debt and had her cars paid off, all her friends considered her to be great at money stuff.

But she didn’t know where to start as far as investing and how to put surplus money to work. Once I started showing her my investing results and teaching her how it was done (which is really not that complicated once you understand the basic principles,) she and her two boys have taken a big interest in investing.

So now we all discuss it and share our stock picks and results together and it’s great!

2. Read, read, read!

Whatever formal schooling you have had (or not had) was just a foundation to teach you how to learn. All the important stuff, you need to teach yourself. Read every financial book in your local library. Look at ESI Money’s “best personal finance books” and read every single one.

3. Limit your spending and maximize your income.

This is so obvious but so few people actually do it. There are endless resources available out there on how to do both of these things.

4. Get out there and actually start investing!

You can read until kingdom come, but if you don’t actually go out and put some money into something, you won’t really learn what it’s like, and you won’t have an opportunity to get better at it.

Imagine trying to learn a sport, like playing football or something, and reading about the game, but never actually knowing what the ball feels like in your fingers, or what it feels like to tackled by another player. If you want to become a skilled player, there is no substitute for actual time in the game!

5. One other side note is: pay attention to your taxes, and know how taxes work and what you are paying and how you can legally do things to minimize them.

The saying goes, “It’s not how much you earn, it’s how much you keep.” And taxes are a big part of the equation of how much you keep.

We moved out of California in 2013, and the state income tax rate in CA is basically 10%, and an ungodly 13% on income over 1M! And Nevada has exactly ZERO state income tax, period.

So over the last 7 years, because I have such a high income, hundreds of thousands of dollars that would have gone to the state of CA have remained in my pocket due to the move. And my house is literally less than 12 miles east of this “invisible” state line.

Just the one decision to move over that invisible line has more than made up for the huge real estate losses I took, and made a HUGE difference in my net worth. Not to mention, every year going forward that “avoided tax” amount just gets bigger and bigger, and instead of being swallowed up by some massive government bureaucracy, it compounds in my investments.

Getting “divorced” from California should be added to the list of the best investments I’ve ever made.

FUTURE

What are your plans for the future regarding lifestyle?

Once I am FI in Jan 2021, I’d like to do some traveling and spend more time at the gym and going on hikes. Do more things that are health and fitness related, not to mention stress free.

Maybe start a blog with my girlfriend.

I don’t think our spending will change much.

What are your retirement plans?

As I mentioned earlier, my girlfriend and I are both lucky enough to be “retiring” at the same time, and at the “relatively” young age of 45.

Her early retirement was the result of getting a state job with great benefits and starting off with the state at the beginning of her career when she was very young.

Mine was growing a successful business and converting the fruits of that labor into passive income via investing. There is more than one way to skin a cat!

Are there any issues in retirement that concern you? If so, how are you planning to address them?

So far, I really can’t think of any!

MISCELLANEOUS

How did you learn about finances and at what age did it ‘click’? Was it from family, books, forced to learn as wealth grew, etc.?

I wish I would have known about investing earlier, but I just didn’t really stumble upon it until my late 30’s.

That was probably (not coincidentally) about the time I started to have a decent amount of extra money to invest as well. Most of the profits the business had been making before then were being reinvested back into the business.

But when I think about all the money I’ve spent and wasted over my whole life, I wish I would have had a mentor, or someone to show me the ropes at an early age.

I remember when I was around 12 years old, my mom had a friend who was interested in stocks, and I showed some interest in it, and my mom was like “you can’t expect a 12 year old to invest in stocks.” But that was exactly what I should have been doing.

I would take all my video games and make tables on graph paper listing and ranking the features they all had. It would have been a perfect transition to comparing stocks, and a great fit for the way my thinking process worked.

Warren Buffett’s dad was a stock broker and he grew up hanging around his office from a young age and was exposed to all of that super early. I only wish I could have had something like that kind of good fortune.

Everything I’ve learned has come from books and real life practice. But oh well, at least I’m not 75 and just starting to learn about investing. Can’t complain too much!

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

We donate items frequently to our local homeless charity.

Once in a while I will give money to a cause or support a charity dinner or something like that. But it’s not on a regular schedule, and the amounts I do donate are not very big.

I plan to let my money grow for a couple more decades and I will do more of my donating to charity later in life, once the snowball has had a chance to grow for a while.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

I have a trust set up that leaves 1/3 of my assets to each child, and 1/3 to my girlfriend if something should happen to me.

I would like to help out my kids with a house down payment, and maybe when I die leave them enough to passively make a decent “average” income, like 50-60K in today dollars.

But if they want to be more than average, they are going to have to earn that for themselves. I think making things too easy can create more problems than it solves. I certainly want to help them out, but they have to show they can pull their own weight as well.

Well Done! How interesting it is to hear such transparent comments from another business owner about the responsibilities and stresses we all endure. Like you, I wouldn’t have it any other way. Very intrigued by your dividend stock investing style….any chance you can share your top 10 favorite stocks?

Thanks! Here’s a good start:

1. Johnson & Johnson

2. The Procter & Gamble Company

3. The Coca-Cola Company

4. Pepsico, Inc.

5. Exxon Mobil Corporation

6. Colgate-Palmolive Co.

7. Chevron Corporation

8. McDonald’s Corp.

9. Wal-Mart Stores Inc.

10. Kimberly-Clark Corporation

Wow, Nevada must have some very different laws regarding divorce and child support compared to Pennsylvania! In PA you would have probably lost 1/2 of everything earned developing the business. And with an income of 700-800K the past two years and two kids with a primary residence with the ex wife (regardless of how much time they spend with you) your child support would probably be more like 20K/month. Years ago I was paying well close to 1500/month for one child with a gross income of 75-80K/year. I would define your strategy as E-S-I-LiveinNevada!

Nevada does have a cap on child support, I think it’s something like $1100/month per child. The support was lowered from the maximum because I pay 100% of the kids health insurance, and several other factors which are too detailed and would end up turning the interview into a book. I couldn’t imagine 20K/month, or $240,000 per year. You couldn’t possibly spend that much on a child, and if you did it would likely turn them into a spoiled brat with no concept of reality. Child support at those levels is a way to punish the other spouse, not to help the child. That’s not what it should be about. Be SUPER careful who you marry!

Could you share the name of the website that you used to compare income?

There are a bunch of them if you google it, but one is whatsmypercent dot com.

All VERY good specific tips that are highlighted here. Going to check out that book, “The Richest man in town.” somehow I missed that one in the past. Good post.

I concur with Dennis’ comments on the divorce. Perhaps an upfront settlement of 2 million as alluded to earlier called off the attorneys.

Second observation is that when you sell the business, very doubtful if a buyer will pay retail value on the inventory. Most pay cost. Your multiple of earnings might need to be adjusted.

I’m with you on the passive income of dividends and capital gains. No where near your amounts, but I did receive $54,000 in 2018.

A lot of long hours it sounds like but you stuck it out and have been rewarded. Overall, a job well done.

Great article! I know it’s all relative to where you live, but $10k in property taxes for a $1.6M house is charity. I pay over $13k for a $350k house in Illinois! Hopefully that makes you feel better about your payment.

Yep, I pay $26k on an $800k house in NJ. Your deal in NV is amazing.

You can also deduct up to $10k property tax from your federal tax bill. (This new limit sucks for us in high tax states.)

So it’s not so bad for you, you’ve played the tax arbitrage game very well!

I pay less than $20K now on my Westfield NJ house, which was recently re-assessed, and would sell for ~920K or so. $26K seems like Morris or Essex…

But I have to say I find it amusing that MI140 complains about how much taxes he’s paid, and about the cost of his health insurance. Ironically, CA has much better public insurance options than NV. Those of us with primarily W-2 related incomes get hit the hardest on income taxes, and get the double whammy of the elimination of SALT, while our states get back comparatively zip from the FED despite our oversized contribution to the US Treasury

Prior to the SALT change wasn’t the rest of the country just subsidizing your high property taxes with a Federal tax deduction? Tough for me to feel bad for you.

Almost 13K per year is more than my first mortgage was. And that is the least expensive plan available, which basically covers almost nothing except catastrophic coverage. Zero dental, zero therapy, etc. No way is that a “reasonable” expense for what you get back.

I am in a similar situation, but reversed! lol I am a State employee and my boyfriend owns a couple businesses. We currently live in California but just started looking at property in Texas (also no state tax and because we already have horses, they will qualify us for no property tax). I can’t retire with life time medical until I am 50 (4.7 more years to go!!) and at that time I will have 26 years with the state. I didn’t know of any State jobs that let you retire before 50 with medical, lucky you and her!! lol Health care is the only thing that keeps us in California, that 26 years invested will only give me about $1,200 a month in retirement, but the medical is priceless, and that is the only thing keeping us here! We joke because my boyfriend has the $$ and I have the medical! Great read and one of the first ones I could totally relate to!

It’s amazing that no matter how much your net worth, health insurance is still a big factor when it comes to retirement.

Good interview, appreciate the success along with the honesty and humility!

But I take issue with this health insurance comment (and not for political reasons): “For all three of us it’s $1,064/month or $12,768/yr and it goes up roughly 20-30% every year. Thanks Obamacare!”

I don’t understand the snark? Healthcare costs have been growing double digits annually for decades, long before the ACA. I believe for most buyers, cost growth has slowed, and I credit the ACA for that increased competition.

In addition, you are not required to buy health insurance on the ACA open market. You are simply required to HAVE health insurance, like you’re required to have car insurance in order to drive on public roads. If you don’t like the prices on ‘Obamacare’ that’s cool, then buy your insurance directly from a private insurer, or through the religious exchanges several folks have mentioned here. See what prices you can get there.

I for one am super grateful for the ACA (‘Obamacare’) and I am not even using it. I get excellent health care through my employer. I’m just aware that millions and millions of people now have health insurance that didn’t before, and pre-existing illnesses are covered when they weren’t, and kids can stay on their parents’ insurance until they are 26 while they get a foothold in their early careers.

Feel free to point out the many flaws of the ACA, but I think our country is MUCH better off with it than without it.

very well said. I am impressed with his ability to have grown a successful business, and be honest about the mistakes he’s made. At that same time, I was put off by some of his comments, but couldn’t really formulate why. It’s sad that the first marriage ended, and his frustration with that is palpable.

I’ve learned that honesty can be considered the best and worst trait. No one seems to be able to appreciate honesty without taking offense. I enjoyed every bit of this interview. I’ve read so many financial books and I bet this guy would be able to write a book about his experiences and we could all learn something. Great article and I really enjoyed all of your honesty. I will keep an eye out for Teslas at McDonalds now! 🙂

Interesting read. But I’m puzzled.

You state: “I started a business from scratch in 2005 which sells parts for classic cars.”

I’ve never known a car enthusiast, who has fuel running in their blood, have an EV as their daily driver. A car enthusiast loves to tinker. An EV owner loves, well, “appliances.” Doesn’t seem to be a real passion here for classic cars.

The Tesla roadster coming out next year can drive over 600 miles to the race track and click off an 8.8 second quarter mile. On a single charge. And it can do it with a family of 4 inside, and off the showroom floor. No gas car could ever come close to those kind of specs. And this is only the beginning, wait until the technology really becomes mainstream. Henry Ford said if would have asked people what they wanted, they would have told him “A faster horse.” Hugely inefficient combustion engines will soon take their place next to horses and steam engines. Being a gearhead and having a passion for cars isn’t about gasoline. Sometimes it’s about choosing the best tool for the job.

Most people think that electric cars are slower than gas, but in the past they’ve been geared down to save battery power. Once they figure out how to keep more juice in the batteries (and we’re getting better at this every day), they will be able to deliver more to the tires. Electric motors have infinite torque (at least theoretically) – in the real world it’s usually doubling the torque of a gas engine.

Hi, Congratulations on your success and like all good stories I love the transparency about setbacks and pivots.

This is the truest statement I’ve read today as a fellow business owner – “the mental strain of keeping the ‘huge machine’ (as I call it) perpetually running smoothly and the ‘gears oiled’ constantly takes its toll.” — I often imagine what would I do on my first day if I were to retire and my answer is always “take a nap” which to me indicates that maybe I’m more burned out from that perpetual pressure than needing to retire. I’m curious how you’ve determined that you are ready to stop forever vs. taking an extended break or reconfiguring the business so you are no longer part of the day to day?

On another note, you seem to really have mastered dividend investing. What were your go-to resources for learning to do well there? Or was it all learned via trial and error, looking for “maybe 50 or so of the highest quality companies out there”?

I wish you continued success with business, investing, family and health!

Thanks! Generally I think one is ready to stop when they are not excited about getting up in the morning anymore.

For learning Dividend Growth Investing, a great blog that I learned a lot from is The Conservative Income Investor by Tim Mcaleenan. He also publishes a master list of stocks on that site that is a great place to start. Also try the Seeking Alpha web site, there are several good authors on there. And there are also a handful of useful books on the topic. It’s like the old saying: When the student is ready, the teacher will appear.

Congratulations on your success and continued enjoyment with life. Thank you for sharing so many details. My father enjoyed investments and shared that with me as a child and adult and that means individual stocks are in my portfolio too. You provided an excellent list of dividend paying stocks. We are retired and live off dividends and capital gains from mutual funds, so setting up investment strategy early and keeping with the ups and downs of the market is important, but difficult to do. Index funds are great for many people but you need to find what makes you happy and allows you to monitor your investments. Index funds fluctuate with the market and I’m worried about some friends who don’t quite understand what makes up an index fund.

You live in a wonderful area. We discussed moving to the NV side and close to South Lake Tahoe from Texas. We looked at the area, visited Carson City, Minden, etc but decided to stay here for now. We visit for 3 weeks every year to hike in the CA/NV mountains. As others said, your taxes are reasonable for your property value. I understand your point about the Tesla cars at McDonalds. We also splurge on some items and other areas we are frugal. You do what makes sense for you and your girlfriend and family.

Hi MI #140,

Thanks for sharing your story. You have done a great job with your business while keeping costs down.

I too have been a individual stock dividend growth investor the past 5 years and it had been an excellent journey. One that allows me early retirement and supports my current set up of part time work while caring for a growing and young family.

Best regards,

Mike H (MI 30)

Nice story. I like the strategy of generating income from assets. I am 57 and a heart beat away from leaving full time job. I would do consulting if I find interesting work or just focus on health, fitness, learning, etc. My challenge is: I am just not comfortable spending down my assets even if I have enough. I do have a deferred annuity which will provide income in a few years, but I don’t want to buy more annuities and be too annuity heavy. Dividends sound great. I am a student of financial planning but not so much about investing; thus reason I use Etfs. Perhaps I can become a student on income investing to cover living expenses. Life is short and I am eager to retire. What are top 3 dividend income reads? I will look into the web sites you mention. Thanks MI.

Some top investing reads Ive gotten a lot out of (specifically about Dividend Growth Investing) are The Single Best Investment by Lowell Miller and Dividends Don’t Lie by Geraldine Weiss (one of the first professional women investors). Also some great general investing books are Peter Lynch’s three books, Beating the street, Learn to earn and One up on Wall St. Also, Jeremy Siegel’s books, The Future for Investors and Stocks for the Long Run. And, of course, check out ESI Money’s page on required books to read!

Great interview. You’ve struggled in business and life and succeeded which is commendable! Marrying well is a great benefit. And if your spouse is not financially fit, it’s important for them to understand the benefits and peace of becoming financially fit.

Thanks! For sure, who you are with is the most important choice and the biggest investment you will ever make!

I really enjoyed reading your story! Seems you have excelled in all three of the ESI principles:

Earn: hard to beat a 7-figure income

Save: well over 90% of your gross income

Invest: you seem to have an uncommon talent for picking stocks, which I lack

Interesting that you and I have both found real estate investments to be unprofitable. Perhaps this is our Achilles heel. Your comments about ownership and debt are spot on, and your geographic arbitrage from CA to NV was a very savvy move indeed. I have no doubt you will achieve your goal of FI this year, and wish you continued success in whatever you put your mind to!

Thanks for reading my interview, I enjoyed yours as well!

Awesome . . . interesting, contrarian, realistic perspective, challenging many assumptions. I don’t like cars or Tesla’s anymore (mostly Elon Musk’s antics), but I get it, almost completely beside the point. It could be any number of businesses; the philosophy and grit, very important to keep in mind should I ever step out. Excellent recommendations and purview regarding dividend investing. Always a big fan of the dollar menu . . . cheap thrills, babe. Took that a little further in pursuit of bargain liquors, for instance, for those that enjoy an evening cocktail. Trying to act like a big shot, once caught sipping on a $200 bottle of Scotch that tasted like crap, also gave me a headache; that was a real wake up call. Tried a $75 brand, an aftertaste reminiscent of vomit . . . not my own, thankfully. First-rate bourbon can be acquired for less than twenty, tequila in the low 20’s, excellent scotch for around $30, just a matter of homework, trial and error. For $200 I could easily acquire an impressive top-notch shelf, easy. I don’t anymore, however; potential alcohol issues and family traits make me nervous, so just one darling at a time. As with women (lol) . . . keep it simple. Just personal examples, extenuating. Beyond stock valuation, quality and integrity, so often unrelated to price or cost. A great deal or value meanwhile sell themselves, across the board.

Had an eye on NV, particularly Carson City for many years. Never say never, but I have a great house on the WA coast, worth about $180k. Paid $68k five years ago (foreclosed leftover from the Great Recession); property taxes are about $1200 a year. Pride of my life, walking into that. Backyard is killer. Governor’s a dolt and a snake, other state issues, but considering the overall situation, I think I’ll stay.

MI #140,

With all the market turmoil are you continuing to add dividend paying blue chip stocks to your portfolio.

How is your business being impacted by the shelter in place mandates that are in force?

-Mike

Yes! I borrowed a million dollars on margin to buy as much stock as I could during this drop. It was a risky move and something I wouldn’t do again, but so far it seems to be working out. My dividend income is now over 277K, and my goal is to pass 300K in annual dividend income and have the debt paid off by the end of the year. The business, believe it or not has been doing great. I’m a bit surprised, but I guess when people are stuck at home with nothing to do, they tend to go online and order stuff. So I’m very grateful for that!

Hi MI140,

Thanks for replying. I’m assuming that your reply was not an April’s Fool joke even though it was responded to on April 1st.

I hope that works out well for you. I don’t have the risk appetite to borrow on margin to buy more shares but that is because I don’t have a fallback business or income that is producing strongly for me either.

Keep it up!

-Mike