Today we are treated with an interview with Mr. 1500 from 1500 Days! If you’ve ever read his site you know that he has a GREAT sense of humor. Thankfully for us, he’s brought it with him for this interview!

My questions are in bold italics and his responses follow in black.

Let’s get started…

How old are you (and spouse if applicable, plus how long you’ve been married)?

I’m 43 and my spouse is 44. We’ve been married for 15 years and life is good.

When we fight, it’s about trivial things like not putting gas in the car. My wife’s super power is that she can manage to bring the car home with .00012 gallons of fuel left in the tank. The low fuel warning light means nothing to her.

Do you have kids/family (if so, how old are they)?

We have two daughters who are 10 and 7. Their favorite activities are Dairy Queen and fighting with each other.

What area of the country do you live in (and urban or rural)?

We live in Boulder County, Colorado. It’s an urban setting. Not a big city, but there are enough people around to keep life interesting.

We like our neighborhood enough, but we’ll probably move on once our children finish school.

What is your current net worth?

About $1,850,000.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

I was hoping you wouldn’t ask that. Just kidding. Well, kind of because it’s complicated. Here goes:

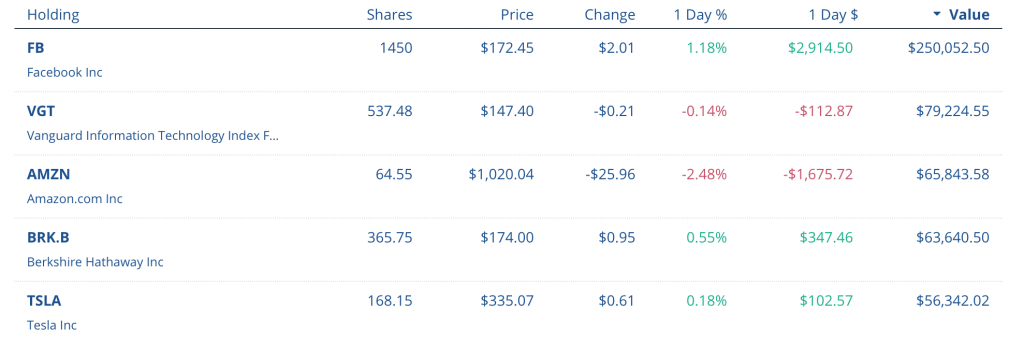

Stocks

- Facebook stock: $250,000

- Other individual stocks: $260,000

- Index funds: $200,000

Real estate

- Private loans: $316,000

- Real estate syndication deals : $100,000

Home/silliness

- Home equity: $390,000

- Silly sports car: $45,000

- Other cars and random junk: $20,000

- Cash: $280,000

Now, I’ve got some explaining to do!

“Why on earth do you have $250,000 in Facebook stock?”

Calm down, I have a rational explanation. When Facebook IPO’d, I know it would be a long term winner, so I bought 1,000 shares at $42. Other investors soon lost confidence, dragging the stock down to the teens. I knew my hypothesis was still valid, so picked up another 1,000 shares bringing my cost basis for 2,000 shares down to about $30. I’ve since sold 550 shares, but with the current stock price of $160 (5 bagger), Facebook stock is starting to take over my portfolio.

“$280,000 in cash? What’s wrong with you?”

This money is about to fund at least one more private loan ($95,000) and two more syndication deals ($100,000). If there isn’t another real estate deal ready to fund soon, I’ll throw the rest of the cash into an S&P 500 index fund.

I hate keeping cash. I prefer that my dollars are working for me instead of sitting in a savings account rotting away to inflation.

What is your job (type of work and level)?

I worked as a software developer from 1999 until April of this year. I had enough money and decided to pursue passion projects, so I left. It’s only 4 months into retirement and the adjustment wasn’t as easy as I thought, but I’ve never regretted leaving my full-time job.

What is your annual income?

Between my blog and some freelance writing gigs, I’ll earn about $60,000 this year. There are some monetization screws I could turn on the blog (Monthly Income Reports!), but I don’t feel comfortable doing that. Besides, the $60,000 funds my basic needs and pays for extravagant vacations with money left to spare for the 401(k). Did I mention my wife also works?

In my final years as a software developer, I made north of $150,000 per year. I was a contract worker, so didn’t have any benefits. However, contracting allowed me to open a self-directed solo-401(k) which is a super tool for investing.

How did you grow your income so high?

I’m not a rockstar programmer, but I worked harder than anyone else. I’d come in early and stay late. I’d also volunteer for the difficult assignments. More than once, I came up with creative solutions to difficult problems.

My advice is this: If you’re a corporate minion, work your ass off and keep careful track of your accomplishments. When it comes time for your review, remind your manager of your contributions and ask for a commensurate raise. If you don’t get it, quit and find a manager who will appreciate your hard work.

What is your main source of income?

As I stated previously, I expect the blog to bring in about $60,000 this year. My wife makes a similar amount of money at her job. We also have significant income from our private loans and investments, but most of that is in pre-tax accounts, so we don’t use that money to fund our lives now.

“Wait, your wife works? How do you consider yourself retired? It sounds like you’re just a single income family!”

It’s hard to argue with that, but here goes. My wife stayed home to raise our kids. She wasn’t looking for work, but when our youngest child started school, a dream job fell into her lap.

I tell her that she can quit any time she wants, but she loves it, so stays on. And here is where I have to step back and make a philosophical point. Brace yourselves ESI Readers!

Meaningful activity (some may even call this “work”) is the one of the pillars of a happy and fulfilling life. If your idea of retirement is watching TV and eating donuts, stay at work. I’ve seen this in person and it doesn’t work out well.

I have enough money to never have to write another word in my life, yet I just spent a couple hours working on the interview you’re reading here.

For free

Why? Because it gives me a sense of accomplishment which makes me happy. This is why my wife works too.

What is your annual spending and what are the main expenses you have?

We need about $2,000 per month to fund our basic living expenses and another $1,200 to pay our mortgage and property taxes. This comes out to about $40,000 per year, but will drop in 10 years when our mortgage (3.25%, 15 years) is paid off.

We do spend slightly more than $40,000 per year now because of our vacations. We love to travel, so we’re happy to trade some of our dollars in early to spend time at the beach.

How did you accumulate your net worth?

My wife and I stumbled onto home flipping. We built the core of our nest egg buying ugly homes and remodeling them while we lived in them (live-in flip). The beautiful thing about a live-in flip is that we never paid any taxes on our significant profits because of the IRS 2 out of 5 year rule. I highly recommend this strategy for anyone who isn’t afraid to put in a little elbow grease on nights and weekends. Just do it before you have kids.

What money mistakes have you made along the way that others can learn from (or something you’d do differently)?

My silliest mistake was buying two new cars. The first was a 2003 Honda Element ($19,000) and the second was a 2010 Mazda5 ($17,000). Neither of these cars is worth more than $5,000 now, but had I invested the money, it would be worth about $100,000.

What have you learned in the process of becoming wealthy that others can learn from (what can others apply to become wealthy themselves)?

Anyone can do it. My childhood wasn’t a Norman Rockwell picture. My father struggled with alcohol and it was traumatic. The money part wasn’t perfect either. He was a sole bread-winner for most of my youth and was laid off when work slowed down. It was stressful. However, I knew education was a way to rise above. Many of my childhood friends went to jail or prison, but I went to college and secured a solid financial future for my family.

What are you currently doing to maintain/grow your net worth?

I love making money and writing is my passion. While I don’t make the big bucks as a software developer anymore, I still make enough to fund my life and max out my self-directed solo 401(k).

Our private money loans and syndication deals earn about $4,000/month for our pre-tax account. And I expect my real estate ventures to earn about $6,000/month before year-end as we sign-on for more deals.

Do you have a target net worth you are trying to attain?

Hmmmm, I haven’t thought about this recently. My original goal was $1,000,000 and no debt. Now, we have $1,850,000 and $100,000 in mortgage debt.

I don’t have financial goals, but I do have a life goal. For about 6 years, I lived on the water and loved it. One goal I have for the next 5 years is to buy a property on the water. I’ll rent it out when we’re not enjoying it. We’ve considered San Diego, Florida and lakes in the Midwestern United States.

What are your plans for the future regarding lifestyle (for instance, will your net worth allow you to retire early, downsize jobs, etc.)?

I’ve already retired and that was my main goal. Other goals include:

- Slow travel: The world is big and I want to see it, but at a leisurely pace. We’ve done a lot of that this summer. We took an 3 week Midwestern trip and then a 3 week trip in the Northeast.

- Keep on doing the same thing: I’m happy with my current home, current cars and current family. No upgrades needed there. Hopefully my wife feels the same way. (Wife, who is sitting beside me, comments:

“Yeah, probably. You’re OK. For now.”

- Stop doing the same thing: As much as I love writing, I see a day soon when I quit and move on to the next thing. It may be writing code for a personal project or working on more home flips. A life of growth and change is a well lived life.

Is there any advice you have for ESI Money readers regarding wealth accumulation?

Pay no attention to what anyone else is doing. Your life is yours to live as you see fit. Live frugal and with confidence. Your neighbor may think you’re strange or eccentric for driving a 20 year-old car. Don’t worry. It will all make sense when you’re living your dreams. He’ll have a new car while you’ll be taking a three-month trip through one of your bucket-list regions of the world.

The latter is better. Living free trumps just about everything.

Thank you for sharing! I am heavy in FB too. Every urge to sell is resisted and it has grown 5X like you said. Love the comment about meaningful activity and following your own path.

Facebook has been a monster! I knew it was destined for great things, but I’m surprised at how aggressively the company (and share price) has grown. Crazy. Good crazy. Very, very good crazy.

“Anyone can do it.”

Completely agree. Too bad not everyone will do it, and the sad part of that is that they themselves are what stops them.

Thanks for sharing, Mr. 1500, nice seeing you here!

Thanks Amy! I had to work with ESI since he lives right down the road from me!

“Pay no attention to what anyone else is doing.” That is the best advice. And so hard. But yes, I agree, when you’re able to do what you want to with your life (like slow travel or retire or travel around the world) and your values and your actions are in alignment, nothing is sweeter.

And every. single. time. I see your renovated house picture I think it’s a fake. Your flips are flippin’ amazing.

Laurie!

Thanks for the kind comments!

I’m surprised with how well the house turned out, even though I designed it and did most of the work. If you’re ever in Boulder County, swing by and see it in person!

Thanks for sharing!

What are some of your favorite blog resources?

Favorite blog resources? I have a post on that topic coming up on Budgets are Sexy soon…

Thank you for sharing! I love that you and so many other millionaire interviewees talk about how anyone can do it. And it’s so true. Go down the right path and make sacrifices, and anyone can achieve financial freedom.

Yep. It’s not hard if you’re willing to put the time into it. There are so many cool paths to wealth these days…

Thanks for sharing your story.

I love the advice: pay no attention to what anyone else is doing.

To your search for water front properties, Minnesota has some very nice lakes 😉

Minnesota is soooo beautiful. Don’t tempt me!

Great interview. My wife and I also bicker over trivial things like forgetting to put the rain gutters back on after mowing the lawn. That is just married life. We are on the same page when it comes to the big things like trust and finances. It is nice to read that you enjoy your success with nice trips and a sports car. In my opinion, once you reach FI, it is ok to spend some money on your passions. Plus, you still have a decent income. Thanks for sharing.

Thanks Dave!

And man, I won’t have the silly sports car forever, but it is so fun to drive. I’m going to get arrested some day…

Good advice. Life frugal and with confidence. I think that could be the FIRE motto. We could post it on shirts and our beater cars.

I was visiting my friend yesterday in LA and he had a $330,000 McLaren delivered to him. $330,000!!!!! While he remains in business and school debt he is buying a car worth more then my first house. Different strokes for different folks I guess. If you gave me that $330,000 my FI life would sky rocket.

I type this as I just paid $26 for a buffet at the hotel I am staying at. Also bananas. I am going to drop by the grocery store after my meetings today and get some bread and peanut butter.

Nice interview and enjoy life to the fullest!

McLaren! Will he give me a ride? 😉

I love these stories and as many of the interviewers share there are many different ways but at the foundation of every one is hard work.

Yep, you don’t have to be smart, just willing to work hard.

Great interview and congratulations Mr. 1500 on being retired. I was just talking to my wife about this special blog community writing about FIRE (i know of other 5 or 6 bloggers that consistently leave comments on ESI). I was saying that it really becomes a safe place to exchange ideas and let others know what you’ve done, and the pitfalls, and the hardships that makes it all worthwhile.

It is so great you can write about the different approaches to becoming FI without a whole lot of judgement. Since talking about money is a still taboo for a lot of people.

Thank you,

Isn’t it sad that money is soooo taboo? I know folks who will disclose intimate details of their sex lives, but you bring up money and they clam up. Really people, really?!?

Retirement to me means doing what you want to do. Seems like a significant number of retirees still “work” even if blog or something else, but it is more of a passion. So freedom to do what you want, even if that is still “working” to me is retirement, as you are retired from having to work.

Congrats on the balanced life and a great family.

Yep, writing is my passion. And it happens to throw off some $$$, so life is good.

HI, Great information!

I was wondering if you could explain a little bit more about this:

private loan ($95,000) and two more syndication deals ($100,000)

Do you have links on your site about the specifics of this type of investing?

Check out this post for private lending: http://www.investmentzen.com/blog/how-to-invest-in-real-estate-without-owning-real-estate/

Syndication is a little more complicated, but here is the company that I’ve now handed over $150,000 for 3 separate deals (just did another $50,000 last week): https://praxcap.com/

Hi – Very informative interview. Your approach to real estate investing is quite unique.

How do you get comfortable that your investment money in the crowdfunding platforms such as RealtyMogul is safe i.e. is this is regulated industry? How would anyone be sure that it’s not another Bernie Madoff like scheme? Thanks.

I always enjoy reading these interviews. I am always looking for ideas that I can use to better manage my finances. Great!!! Keep them coming.:-)

Thanks Elizabeth!

Love how creative you’ve been with your investing. You truly must not care what others think, to your benefit! My road is soooo much more boring. Just the old Vanguard index scheme. No big winners like facebook growing my money by 500% (jealous). I’ve not had the stomach for that. I’ve done well enough to hit my goal of 2.7M & retire at 57 (two more years – thank you bull market!) but by the time you’re 55, you’ll have a lot more than I have today! I think you’re just getting started.

There is absolutely nothing wrong with plain old index investing! I think that should be the core of any portfolio.

Thanks for sharing, Mr. 1500 – love your blog and your posts on BAS. My wife has the uncanny ability to leave an interior light on every time she uses my car :).

Thanks Working Optional for the kind comment! And interior lights! We have cars that can drive themselves, but auto manufacturers can’t think of a way to automatically shut those off?

Always encouraging to hear your story 1500s! Keep up the good work.

Thanks Brandon!

These Millionaire Interviews are growing stale. When will we have your first Billionaire Interview?

I will admit Mr. 1500’s got a good story and a good message. Maybe you can have him back on when his net worth has doubled another 9 or 10 times.

Cheers!

-PoF

Ha! I’m waiting for you to get to $1B and then a new series is born!!!!

Love the attitude . . . yeah, on-site management or a live-in flip seem excellent. My 1/3 acre city lot is oversized compared to others here, but I don’t think it can legally or reasonably be split or divided considering the principal home’s aspect. Still trying to hack the possibility since I’m not too enthused about side hustles, that despite my low workload (30 hours a week w/ perks and full medical, 36k gross). I was thinking, hey, let’s do his and her tiny homes, connected on the ends to form an L, in the back where the gardens and funny birds are, then fence off and rent out the main home to cover it all. She says no, can’t be swung, but loves the double tiny home thing . . . I’ll look into it further. What I don’t want is a roommate in that unused second bedroom, sharing our kitchen, living room and bath. That’s a 20’s thing that will not be missed. A story like this gets the wheels turning, though; father thought real estate was the thing, but this is WA state, crazy land basically. The strength of this roaring economy and the price escalations/speculation madness have put mild play out of reach, hence the navel-gazing where I currently sit. Homeownership is all right, I’m seeing the advantages on paper, but a duplex or quad is where I really belong, farming out the rest to cover the expenses.