If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in August.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 49 and my wife is 47.

We have been married for 16 years.

Do you have kids/family (if so, how old are they)?

We have one son who is 12 years old.

I am the opposite of Elon Musk in this regard. 😉

What area of the country do you live in (and urban or rural)?

We live in an urban area in the Southeast.

We moved here more than 10 years ago and are loving it — warm climate, lush green, low taxes, good schools and a great regional economy.

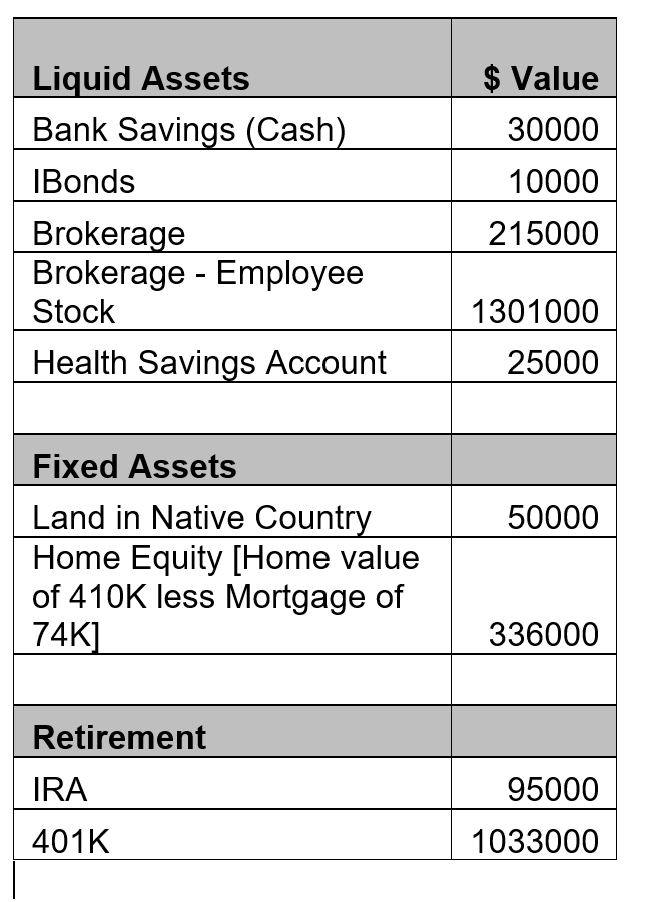

What is your current net worth?

$3.09 million.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

I am not counting my kid’s college plan and the 2 cars we fully own in this calculation.

We have no other debt outside the mortgage of $74K.

I still own my first ever car – a used 23 year old Toyota; the other car is a new one that I paid with cash (under 30K).

I have noted 2 brokerage accounts – one which is diversified and other which is a single company stock. That is the biggest risk as $1.3 million or 40% of my net worth is tied to 1 stock so I need to diversify. 🙂

EARN

What is your job?

I am a Consultant in a global Management/Technology consulting firm.

I am currently working from home with no travel. I am an individual contributor though with a new promotion — I will be a Manager starting next month

What is your annual income?

Gross pay is approximately $135,000.

With a promotion just announced this should kick up to $160,000 starting next month..

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I grew up in Asia in a middle class family. I read many posts of folks who started working while in high school. Back home we were expected to devote all of our time to academics and a bit to sports. So I never worked jobs till I finished college.

I came to the United States as a foreign student having gotten admission in a Masters program in a school in Boston. The only way I could afford it was a scholarship the graduate school offered me that covered 80% of the tuition. As part of the scholarship I also had to help out in the Admissions office as a Graduate Assistant. I lived off campus as it was way cheaper. I rarely ate at the overpriced dining halls in the campus, opting to get food from the local deli at the supermarkets. The rest of the expenses were paid using a loan from my parents which I paid back in two years after graduation.

In the summer when my class load was less I worked extra hours at the school at a then princely sum of $20 per hour.

After I graduated I got a job offer from a firm in California – they arranged for my work visa and my starting salary was $65,000.

I worked there for 3 years and then moved on to a technology consulting firm who offered me $80,000. This was a very well known global firm and had a great workplace culture. I broke the six figure mark in 2008 but as the firm was huge, raises and promotions came slowly.

In 2018 by the time I left the firm I was making approximately $128,000 so not much of a dollar increase in 10 years. At this time I was feeling a bit burned out as I had been managing a team spread across multiple time zones.

I joined a smaller consulting firm in 2018 as an individual contributor (much less stress) at almost the same salary and now I make approximately $135,000.

What tips do you have for others who want to grow their career-related income?

I sometimes feel if I had a high-in-demand tech skill my salary would have been much higher. In my case the income growth has been slow and steady. But working for Fortune 500 companies in the technology area is definitely a career booster.

In consulting it is always great to work at sunrise accounts where a project has just started. You tend to grow quickly as the account expands compared to mature accounts.

What’s your work-life balance look like?

Since I moved to the smaller consulting firm 4 years back it has been great. I have rarely worked beyond 40 hours a week; no weekend work and there has been no travel.

Since Covid its been even better as I work from home and save the commute time. With no team to manage that stress factor is also gone.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

I have invested in REITs and some dividend paying stocks that pay out approximately $20-25K per year. Now on some of them I have paper losses as their price has dropped this year but I am holding on to them as none of them have cut their dividend payout.

On average the REITs yield 8-9%.

The large company stock holding yields way lower dividends and as I start to sell more of it I may invest in more REITs/Dividend stocks to increase my passive income.

Wife started a job as a teaching assistant in a middle school last year and makes about $20K annually.

SAVE

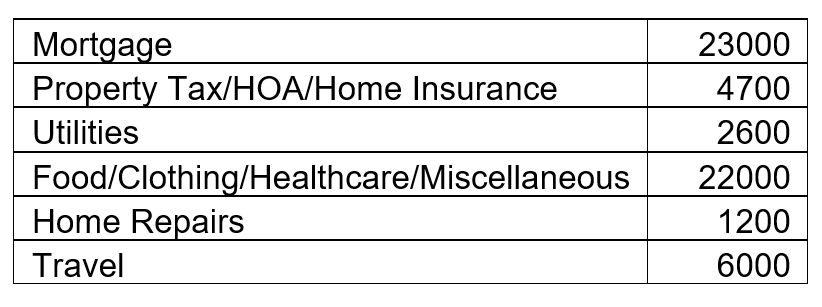

What is your annual spending?

About $60K.

It has increased ever since we bought our home 4 years back.

Prior to that while we were renting a condo — it was about $48K.

What are the main categories (expenses) this spending breaks into?

Mortgage is our biggest expense as I am aggressively paying it down. Hopefully we should be debt free in 2-3 years. Even though it is a 15 year mortgage I don’t want to wait that long to pay off (this may not be financial sound but it gives peace of mind).

I have not budgeted money for any major home renovation as we had done most of what we wanted to do (new floors, Kitchen) when we bought the home.

Once we pay off the mortgage annual spend should be under $40K.

We eat mostly home cooked food and we hardly drink alcohol. We pay off our credit card bills in full every month. Lately I have been taking on many new credit cards since they have offers like $200 bonus for spending $1000 in 90 days. Once I get that reward bonus I stop using that card and since they don’t have an annual fee I think I should be fine though I don’t know if it impacts my credit score. So far my credit score has not been impacted.

On one card I got 70,000 airline miles so next year I can use it for a free trip – it has an annual fee so I plan to cancel that card now that I have accumulated those miles.

We are not into big sports events though my son has developed interest in NFL so we may go to 1-2 games this year. We use our phones for couple of years and replace them only when we get free upgrade offers. We avoid Apple products (maybe nice but are big money guzzlers).

We like to shop at our local Costco – haven’t bought pants for more than $20 in a long while.

We do not have any TV subscriptions – if we want to watch a show like Reacher or Marvelous Ms Maizel or Stranger Things we get a 30 day free trial of Amazon Prime/Netflix and then cancel after we watched the season. We have no cable and cut the cord several years back – there are plenty of free and over the air TV channels.

We have no pets but someday we may get a dog and that will increase the expenses.

Do you have a budget? If so, how do you implement it?

We don’t have a budget but we are thrifty and our spend is consistent over the years.

My wife is not interested in money matters so I handle the Spend/Save/Invest department.

Thankfully my wife has no interest in fancy furniture/dresses/electronic gizmos/jewelry/cars so I lucked out there! Travel is really our only splurge.

What percentage of your gross income do you save and how has that changed over time?

With pretax savings for 401K: 20K; HSA: 6K; and post tax savings of 20K it comes to about 33%.

We were saving a bit higher when we were renting a condo but buying a house is a lifestyle choice and comes with its own expenses. However we like the house we bought and the neighborhood is great.

What’s your best tip for saving (accumulating) money?

Automated savings like 401K, employee stock plans or sweeps into brokerage account is the way to go.

If you can find work at a public company that offers stock options or even Employee Stock Purchase Plans that would be gravy.

Buy a home early in your life and don’t wait that late in life to do so like I did. I could have easily paid off my house by now had I bought it earlier.

What’s your best tip for spending less money?

Be boring. 🙂

But seriously I enjoy lot of the free things like reading books from the library, going on long hikes/walks, playing tennis in public courts and swimming in our neighborhood pool and best of all socializing.

Cooking food at home with organic veggies/meats is way healthier and cheaper than dining out though we do dine out occasionally.

What is your favorite thing to spend money on/your secret splurge?

I enjoy travelling internationally and I see that expense creeping up gradually over the long term.

I have seen a dozen countries but my brother has been to maybe 3 dozen so some friendly competition there.

My wife does not like to travel much so that is a bit of a challenge.

I think travel broadens your mind and I think it is important for my son to see the diversity and wonders of rest of the world.

INVEST

What is your investment philosophy/plan?

I like to invest in diversified index funds, and some REITS and dividend stocks for some passive income.

The only physical real estate is our primary residence. I do not know if I have the appetite to buy an investment property and rent it – handling tenants and maintenance of a property does not seem passive. I keep hearing about real estate syndications so I am interested in learning about that.

I will continue to invest in REITs/index funds/ETFs and maybe dip into farmland ETFs as well. With the coming water crisis I have started investing in water ETFs.

I do not invest in crypto as I just do not understand it and I think it is speculative.

What has been your best investment?

I worked for a blue chip technology firm for 15 years and the firm offered the stock at 15% employee discount. It has been a great run as the stock went from $18 when I joined to about $400 at its peak in Dec 2021.

Since then then it has declined a bit along with all technology stocks but is still a solid company.

What has been your worst investment?

I invested 25K in my brother’s startup but unfortunately he had a fall out with the Venture Capital partners and had to leave the firm.

I have written off that entire amount.

What’s been your overall return?

Not sure but I guess around 8%.

How often do you monitor/review your portfolio?

Till 10 years back I was only tracking my net worth occasionally. After that I started monitoring it on a quarterly basis.

Last couple of years I check my portfolio on a monthly basis.

I just track it using Excel – no fancy software.

NET WORTH

How did you accumulate your net worth?

I did not inherit any money. I earned a decent six figure salary and saved well. Investment in company stock thru the employee stock plan and automatic dividend reinvesting in that stock helped a lot in enhancing my net worth.

I invested in a 401K from the day I started work and with the company match that has grown to a nice retirement nest egg.

I have a long term investment horizon and like to hold stocks/index funds/ETFs for a long duration.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

I think it is a bit of all.

For a while Savings was a great strength and then Investing took over. I lucked out in that the company stock grew so well over the years.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

I became a millionaire in early 2015.

There were some challenges – in 2003 the company I was working for almost went bankrupt and I was worried if they laid me off and I didn’t find another job within 2 months I would have to leave the country as my work visa was sponsored by that firm. Thankfully I was able to move to another (better) firm who also sponsored my green card.

In 2008 with the big recession the West Coast client I was working with went insolvent and was bought by a big bank. With work scarce at that time and with a brutal job market thankfully my firm was able to find a project for me in the Southeast. In a way it was a blessing as I was able to move to a much cheaper area than California at the same salary.

What are you currently doing to maintain/grow your net worth?

At the peak of the stock market in Dec 2021 my net worth was $3.6 million so after 8 months to see it down almost 15% is a bummer but hopefully in the long term it should recover and be more robust.

I am staying the course and not selling any stocks – I continue to invest as before albeit more cautiously.

Do you have a target net worth you are trying to attain?

$5 million will be nice.

I am not sure if I like the 3 or 4% rule – once my passive income can significantly support my expenses and I can make some money working part time in the non-profit sector I would consider myself “retired”.

So I don’t need to wait till I achieve the $5 million goal to pull the plug on the corporate sector job.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I was 41 when I made my first million. I was still a renting a condo and never owned a home. We lived close to my work and my son’s school was a 2 minute walk so we continued renting in that area.

The only change is we bought our house in 2018 at my ripe age of 45. I guess growing up in a middle class family in Asia where both my parents worked but saved all their money in bank deposits (rather than stock market/real estate) and were life long renters made me financially very risk averse and it took a while for me to come out of that shell.

What money mistakes have you made along the way that others can learn from?

I have lost money in individual stocks and so have been gravitating more towards theme based ETFs or Index funds to diversify more.

Tips from so called TV stock gurus like Cramer should be avoided – they hardly know any better.

What advice do you have for ESI Money readers on how to become wealthy?

Earn well, live frugally (but comfortably) and invest the savings wisely for the long term.

Don’t chase the Joneses and live on your own terms.

No magic here – just plain vanilla advice!

FUTURE

What are your plans for the future regarding lifestyle?

I have been noodling over when to say goodbye to the corporate world and do something meaningful and purposeful in life.

I am gravitating towards the non-profit sector in the area of climate change. I’m still in early stages of researching this sector so it maybe 2-3 years before I take the plunge. It will lead to a pay cut but how long can one just do a job for money?

By then I am also hoping to further boost my passive income and pay off my mortgage so the expenses should be manageable.

What are your retirement plans?

As I mentioned above I don’t want to retire fully but in the 2nd inning of my career slow down and work in the non-profit sector. It will keep me engaged as well as bring in some money.

In terms of activities – Do more travel, expand social network and increase my fitness routine by adding a regular sports schedule (tennis/volleyball/swimming, etc). Health will be a key focus – this year I have cut down on some of my chronic ailments by doing intermittent fasting, eliminated sugar and processed foods.

While I will continue the same rigor on nutrition I want to add muscle building routines to get a toned body. I hate traditional gyms so I may look for some Ninja Warrior type classes instead to build muscles. Any suggestions?

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Move to Portugal or some other cheap place in Europe or Asia – at least that’s my fantasy (I watch the Our Rich Journey YouTube channel where this young family moved to Portugal and are happy about it). Not sure if my wife and kid are thrilled by that prospect though.

Like everyone healthcare is the biggest concern along with outliving your savings — hence a cheaper country with good standard of living and good affordable healthcare would be a nice option in our golden years.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

I did study business/finance in graduate school and that helped me immensely.

Talking to colleagues and mentors at my workplace also helped a lot.

I also watch Dave Ramsey, the Money Guy show and listen to couple of podcasts

Who inspired you to excel in life? Who are your heroes?

My parents who lead a middle class lifestyle and inculcated a belief system in not chasing flashy objects. That has helped me be grounded in life.

They were not investor savvy but they imbibed in me the desire to study and get a good career and to save as much as possible.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

I like Millionaire Next Door and Rich Dad Poor Dad.

I am currently reading Psychology of Money which is quite interesting.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

That is something I have not done much.

We give occasionally to UNICEF and Doctors without Borders and at times have volunteered for Habitat for Humanity.

But I hope to step up in this area in the coming years.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

I have not given much thought to this – maybe a portion to our son and the rest to organizations that deal with environment/climate change or charities.

Great job you have done amazingly well.

Re: fitness suggestion – have you heard of Lululemon studio? I know you have no subscriptions but this one provides all the fitness classes where ever you are and the instructors are amazing. No excuse to not be fit doing whatever you enjoy. A tad pricey to start because you buy a mirror but the whole family can participate.

Thanks – will check it out.

Hello M-354, love your write up. Very simple way of living which incorporates most of everything that’s important to you guys , without all the frills of today’s modern living standards. Count yourself as very lucky to hit that home run w your former company stock. However, I worry for you. Get out while ahead. I think that keeping so much of your wealth in one company is unwise. Time to play defense. Engage in some risk management as , You won!

How did u approach paying down so much of your mortgage, since it’s such a recent loan? Large initial DP, or just attacking it w extra principal payments?

One last suggestion , try not to leave your wife in the dark on any matters of family finances. It’s important that she knows all, despite not having a day to day interest in how you are handling it. Be well, good luck w your next step in life after you call it a wrap on your primary career. You guys are doing fantastic, w terrific money habits. Thank you for your interview,

Hi MJ – On the Mortgage I did both – high down payment (30%) and extra principal payments. Yes I am engaging my wife more on our finances now. Trying to trim down the single company stock and hopefully by year end it should be more manageable but the challenges of a bear stock market is making me move slowly on selling the stock aggressively.

Sometimes you read something and think: these are my people! That’s the case here. Loved this interview.

Your vanilla advice is tried and true. Great write up and I loved your approach to not keeping up with the Jones. The only thing that would make me nervous is having that much in company stock. Personally, I would diversify some of my holdings out of company stock to S & P 500. I knew someone that lost $1 million due to being in company stock. Love that you listen to The Money Guy show! I started listening to them many years back and have been working with Bo for several years. They practice what they teach on the show. And, yes, Bo is always excited about our annual review. 😉

Great interview and love the basic investment plan – ESI.

My two recommendations:

1. Can you move investments out of your company stock? You are too heavily invested in one stock and that is risky. Has that value held up since the interview? Diversify into something else, like ETF’s in Total Stock Market or S&P 500.

2. What is your interest rate on your mortgage? If it is less than 3% or even 4% use extra funds to buy the above ETF’s instead or paying down your mortgage. This will better boost your passive income that you are seeking, and especially important in this high inflation environment. Low mortgage interest rate is a great leverage and keep it as long as possible to build wealth. Remember that home equity is “dead” investments and very illiquid.

Hi M22-

1. The stock has fallen about 12-14% since the interview (Aug 2022). I am looking into selling the stock every year (don’t want to sell all at once and incur a big capital gains tax in 1 year) and as I wind down that position I plan to move into a basket of ETFs like VGT, SP500, etc.

2. Good point about aggressively paying down the mortgage. The interest rate is just under 4% so maybe I start putting some of the savings into slightly higher paying dividend ETFs instead of paying off the loan in 2-3 years.

Oh my gosh, I am stealing your “Remember that home equity is “dead” investments and very illiquid.” to use to educate others. All I was saying to them is I couldn’t sell my half bathroom or extra bedroom if I needed to raise money fast but I can get cash out of my no-load index funds. I like the dead investment concept.

Really great work. You should be super proud.

I would absolutely suggest you get at diversifying that $1.3M account in a single stock. That is too concentrated for my blood.

Thanks for leading an exemplery life of consistency and discipline. Thanks for sharing. I agree with the other comments about the need for your wife to know how to access, operate and understand your family financial information.

Is the passive income of ~$25k through your Brokerage account investments alone? Could you please share the exact Dividend stocks and REITs you invest in?

Thank you!

Hi Mathy-

Yes the 25K passive income is thru my brokerage accounts – some of the REITs are Arbor (ABR), Starwood (STWD), Pimco Income Fund (PFL) and some ETFs like ITA, UTG. Many of these are actually in red once interest rates started rising but they have not cut back their dividend payout so I am hoping to ride out the storm and hope the paper losses is temporary and these stocks/ETFs do better next year.

I am glad people like you are out there, hitting multiple 7 figure net worth without owning real estate, or at least just a primary residence. Sounds like you were able to save and invest quite a bit. Also, simple pleasures you mention like parks, free events, etc are really helpful in not getting caught up in the “I deserve this” phase of early retirement, golfing luxury resorts, designer items.

I really like how you described where you live in the Southeast, sounds lovely. Any clues you can give to what it’s like there? Might need to explore it ourselves.

We love the Southeast – lot of folks are moving in here from the more expensive Northeast and West coast. Traffic has gone up but we still get the small city vibe.

Regional economy is strong with good number of well paying jobs. Though house prices have gone up a lot since Covid they are still lower than the coast. Property taxes in our area is less than 1%.

It rains in all the seasons hence the greenery (and pollen levels are high in the Spring). Lot of mountains and state parks within an hour’s drive and beaches are within 3-4 hrs drive. So lot of things to do outdoors.

Yes, listening to all the self-appointed talking head stock guru’s can be devastating to wealth building.

On a different note, I paid my house off early and never regret not putting the cash flow into investments. It truly has provided peace of mind and overtime I had more than enough cash flow to lead to a multimillion net worth and climbing.

You’ll be blessed as you pursue the pathway the Lord made you to follow. God speed!