Today I have an update for you from a previous millionaire interview.

Today I have an update for you from a previous millionaire interview.

I’m letting three years pass from the initial interviews to the updates, so if you’ve been interviewed, I’ll be in touch. 😉

This update was submitted in February.

As usual, my questions are in bold italics and their responses follow…

OVERVIEW

How old are you?

I am 65 years old and currently unattached.

I married in 1980 and have been divorced and living on my own since 1990.

Do you have kids?

I have one 39 years old daughter. She graduated from a highly ranked university and earned a law degree from a top law school and works as a Vice-President of legal affairs at a major studio. She is earning a higher salary than daddy ever dreamed of.

She is brilliant, hardworking, and fun-loving, but has little interest in managing her finances. This is where I step in, encouraging her to maximize IRA, 401k and ESOP contributions, and looking after her investments.

She became a millionaire at 35 — I should get her to do a Millionaire Interview.

What area of the country do you live in (and urban or rural)?

I live in a large California city in a smallish house we bought in 1983, prior to divorcing.

What was your original Millionaire Interview on ESI Money?

I am Millionaire Interview 169. Go read that post — it’s guaranteed for a chuckle or two.

I wrote it in October 2019, published in January 2020, right before Covid hit, oy!

Is there anything else we should know about you?

I wrote ESI Retirement Interview 41.

My family immigrated to the United States in 1973 from USSR. Our family of 6 was allowed to leave the country with $600, a few pieces of jewelry, and some personal possessions.

I earned Master’s degrees in engineering and business, and started my professional carrier in 1980 as an engineer.

NET WORTH

What is your current net worth and how is that different than your original interview?

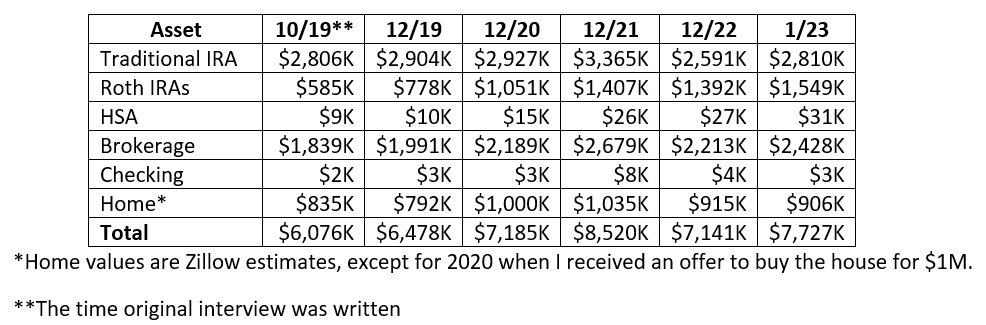

My current net worth is $7,727K. When I wrote the original interview my net worth was $6,076K.

If I had to liquidate everything at once today, I estimate I would end up with approximately $5.4M after taxes.

I have no mortgage (paid off last century) or other debt besides credit card balances, which I pay off every month, this has not changed from the original interview.

The above numbers include my investment portfolio and estimated value of my home. The numbers do not include car, household items, or the net present value of my pension nor Social Security.

If I include present values of pension and Social Security, total net worth would increase from $7.3M to $8.9M in the 3 years since the original interview, reaching a peak of $9.8M in November 2021 (so close to an eight-digit number!)

What happened along the way to make these changes?

The growth in my net worth is mostly in my equity holdings which benefited from the secular bull market we enjoyed since the Global Financial Crisis in 2009.

Along the way my investment portfolio saw two bear markets with paper losses of over $2M in each.

What are you currently doing to maintain/grow your net worth?

I am sticking with my aggressive asset allocation for now, but starting to consider moving some funds into real estate, specifically real estate syndications.

At this stage of my life, I am not focused on growing my net worth for myself, I have enough. I am interested in developing multi-generational wealth and look beyond my lifetime as an investment horizon.

EARN

What is your job?

I retired in 2018 from a supply chain program management position at a major aerospace company. I was a senior manager when I retired.

Overall, I have been working for the same company for over 34 years since graduating from graduate school, with a 4-year break spent pursuing an entrepreneurial opportunity in computer accessory area.

What is your annual income?

This year I will receive $32K from a pension and an estimated $150K in dividends and interest from my investments, $40K in after-tax accounts and $110K in tax deferred and tax free accounts.

The most I ever earned from employment was $235K in 2015.

How has this changed since your last interview?

Pension is slightly lower due to an expired Social Security offset provision at age 65.

This will be offset by reimbursement of up to $2K for medical insurance premiums, including Medicare IRMAA starting this year.

Dividends are about the same.

Have you added, grown, or lost any additional sources of income besides your career?

I stopped doing consulting work.

Redistribution of some investment assets (described below) should result in slightly higher dividends in the future.

I still have not started drawing my Social Security. If I filed today (February 2023), my monthly payments would be $3,286. If wait to file until age 70 the monthly payments will be $4,625 plus COLA.

I am inclined to wait to file as a form of longevity insurance, but truth be told, this decision will not have a significant effect on my finances.

SAVE

What is your annual spending and how has it changed since your interview?

At the time of my original interview my annual spending was $63K. Since then, my spending was as follows:

What happened along the way to make these changes?

My core spending remained fairly consistent at around $25K a year, remember no mortgage or car payments. The variations in annual spending are mostly due to timing of income tax payments on Roth IRA conversions.

Since I retired in 2018, I was covered by former employer’s retiree medical plan which was heavily subsidized and cost me on average $140 a month. Starting this year, I am covered by Medicare and paying Medicare premiums of $600 a month, including IRMAA.

I expect my spending this year will increase substantially due to Medicare, boosted gifting, planned home entertainment purchases, resumed travel and possibly a replacement of my 20-year-old car (somebody please make an electric sports car).

So far, I have not removed any funds from my retirement accounts and only raided my after-tax brokerage account to pay for Roth conversion income taxes.

INVEST

What are your current investments and how have they changed over the years?

My investments since the original interview are as follows:

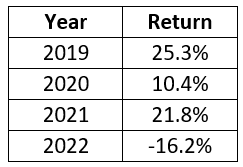

My investment returns since the original interview have been as follows:

The compound annual growth rate (CAGR) since 1988, when I started tracking my investments, is 8.3%, internal rate of return (IRR) is 7.1%, and average return is 9.7%.

What happened along the way to make these changes?

Every year since I retired in 2018, I have been converting traditional IRA funds into Roth IRA to fill the 24% federal tax bracket. To date I converted just over $669K, which is reflected in the growth of my Roth IRAs balances and relative stagnation of traditional IRA balance. Since the conversions are taxable events, I paid $228K in federal and state taxes out of the after-tax brokerage account.

If I don’t do these conversions now, between dividends, pension, Social Security and Required Minimum Distributions (RMDs) from IRA, my federal tax bracket will be 38.8% (or higher if government increase tax rates) when I turn 73.

My net worth reached a peak value of $8,598K in November 2021 thanks to a raging bull market. Since then, my investments saw a decline of $2,140K through October 2022; my current balance reflects a recovery of 69% since that low point.

In 2020 during the Covid bear market, my balances were down $2,113K from peak to trough, but recovered quickly the same year, even managing a 10.4% return for that year. This level of volatility is due to the fact that vast majority of my investments are in equity index funds, which makes for quite a rollercoaster ride during turbulent times with multiple daily 6 figures swings and annual 7 figures swings in portfolio values.

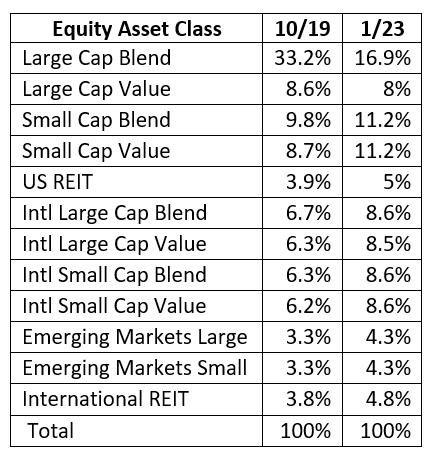

The following compares my equity investments by asset class when I wrote the original interview in October 2019 to now (January 2023):

In 2019 equities were about 98% of total portfolio with remaining 2% in a Money Market Fund. At that time, I said: “This is a very aggressive portfolio, and I will have to do something more conservative when I grow up…maybe.” Today, equities are 99.9% of total portfolio; I guess I haven’t grown, even regressed a bit.

The main difference from 3 years ago is that I abandoned the Dual Momentum strategy I used for the lump sum pension distribution, which was invested in a S&P 500 index fund at the time of the original interview, and redistributed the funds among the other asset classes shown above. If I would have followed the momentum strategy during the Covid bear market in 2020, I would have gotten out of equities too late and got back in also late, costing me a few hundreds of thousand dollars. Besides, every first market day of the month when the strategy resets, caused me a great deal of stress, which I can do without.

My current investment approach closely follows Paul Merriman’s Aggressive Ultimate Buy and Hold Strategy. In hindsight, I probably would have been better off just holding a S&P 500 index fund or a total US market index fund, since factor investing has not worked very well the last decade or so, and US equities soundly beat internationals. Still, I am counting on reversion to the mean to correct for this underperformance, as often happened in the past.

MISCELLANEOUS

What other financial challenges or opportunities have you faced since your last interview?

I have not faced any other major financial challenges since the original interview, besides surviving two bear markets with drawdowns of over $2M in each.

Opportunities, on the other hand are around every corner: crypto coins, cannabis stocks, meme stocks, private equity, ARK, NFTs and countless other innovations can turn your FOMO level to “11”. Just watching gigantic fortunes being made overnight makes your head spin; staying the course is getting harder every year. Market volatility the last few years does not help either.

I managed to keep my portfolio mostly intact except for a few tweaks.

Overall, what’s better and what’s worse since your last interview?

My financial position is better, and so is my social life and my poker game.

My fitness level is about the same, however minor health issues keep creeping in, the “gifts” of growing older.

I am more worried about being on my own as I get older, studies show that single men don’t live as long as married men. They probably mean happily married men. I bet for unhappily married men life just seems to be longer. 🙂

What are your plans for the future?

Continue to enjoy retired life, travel more, date more (hopefully find a mate), keep an eye on my investments, possibly downsize to a condo closer to city center to be closer to family and to take better advantage of entertainment and cultural venues, and to reduce maintenance required in a house.

Now that Covid is subsiding, I will look into volunteering opportunities, including a local automotive museum and immigrant organizations.

Another area that could use improvement is transition from saver to spender; it is still hard for me to spend my savings after so many years of diligently growing my nest egg. I also find that the older I get the less happiness I derive from material possessions. I used to get excited getting the latest electronic gear, now I get annoyed that manufacturers stop upgrading operating systems on my devices by practicing forced obsolescence.

Given that you have a bit more wisdom and experience, what advice do you have these days for ESI Money readers?

ESI Money has conducted 350 and counting millionaire interviews. Each is unique in how to reach millionaire status and keep your net worth growing. In my case it took good education, a decent earnings history, prodigious savings and aggressive investment strategy to achieve my level of wealth. Others have done it through real estate investments, very high salaries, businesses, hedge funds, inheritances or a combination of these. So far nobody admitted to stealing, collecting ransoms or finding a buried treasure. 🙂

Find your niche that you enjoy doing while having potential for enrichment and dive into it with both feet. Set your goals high, never stop learning, network, value people, and give back in terms of your knowledge, time, and if you can afford funds.

If none of this works, find a wealthy spouse. 🙂

When planning for retirement, pay as much attention, if not more, to non-financial aspects, than finances. Retiring to something, rather than from something will make the transition go much smoother.

The earlier one learns how to invest and puts it to practice, the longer compounding will work its magic, and increase probability of building a successful financial life. Good investing is usually long term and boring, such as buying and holding index funds, or investing real estate.

For every highly publicized get rich quick story, there are countless untold get broke quick stories.

I enjoyed reading your update.

A great read, thanks! I’m curious if you have any regret about working so many years, when you could clearly have retired much earlier and still had more than enough? Or maybe those years were worth it for the generational wealth opportunity ?

My original plan was to retire at 55 in January 2013 when I first became eligible for a reduced early retirement pension. But a combination of factors kept me doing the One-More-Year bit for 5 years in a row, including: my net worth was somewhat smaller than projected, my retirement accounts took a big hit during the 2008/9 global financial crises, I was promoted and my salary increased, I was working on an interesting and vital national program, with a wonderful set of colleagues and frequent international travel. The extra 5 years definitely boosted my net worth, from $2.4M at the end of 2012 to $5M at the end of2017. This will significantly enhance my daughter’s inheritance.

Great interview with lots of wisdom! Bolshoe spasibo!! All the best to you in finding the right mate. I could not agree more that it is lot better to enjoy the fruits of your labor with someone you love and care about.

Thank you and pozhalusta.

Thank you and pozhalusta.

Great interview! Sounds like you are enjoying your retired life! Would be nice to hear what your hobbies are and how you spend your time. I am looking forward to retiring next year and like you, need to get used to spending down the nest egg that took so long to build. I am frugal now and know it will be a struggle….

Thanks! Retirement Interview 41 has information on my hobbies and how I spend my time. I am still struggling with spending and doing some research on how to spend more without being frivolous. But I would rather underspend, than worry about having a sufficient nest egg.

I’m really impressed with your IRA balances. Wow. I’m guessing you went hard early. Goes to show the power of compounding!

Like you, as I get older I don’t seem to need material things as much. But it’s hard to know how much is ‘enough’ to have in the bank.

I think some of us really know but feel the need to get just a little more. Lol. I think the social, financial and psychological value of continued work is undervalued in my opinion. Of course not all careers are worth continuing.

Everyone has different perspectives. All good.

PS. Sounds like your daughter is doing just fine as well. I wouldn’t worry about her too much.

All but around $300K in IRA balances came from 401k conversions and pension lump sum. I have been contributing the maximum amounts into 401k account for many years and took majority of my pension payout in a lump sum, which was rolled into 401k to postpone income taxes.

I am fairly sure I have enough, so does Warren Buffett, yet we both continue investing for growth. At some point it’s not a question of having enough and more of an ego trip. I honestly do derive great satisfaction from watching my portfolio grow.

I am not worried about my daughter’s financial future, she is earning a great salary, saving a good portion of it and stands to inherit a substantial sum from me and possibly even a larger inheritance from her mother.

I have not told my daughter about my financial position and I am unsure if I should. I only found out about my parent’s finances 5 years ago, since we rarely discussed money in my family.

Personally I would not tell your daughter too much other than you are managing fine in retirement. With your help she is obviously creating her own wealth and when you eventually pass on she will get a nice surprise. My wife and I accumulated our wealth without thinking what we might inherit. We had already retired when my father died and we received a small inheritance. It was a nice bonus but not something we had ever relied on. We received nothing from her parents and are pleased our parents got to enjoy what they had accumulated

Thank you for the details and your humor. That is always helpful in life and not everyone can joke and have fun. Medicare and IRMAA, the financial pain for having saved too much and being a saver all your life. So many people don’t know about IRMAA since they aren’t in those brackets. We learned as my husband was signing up. I had hoped medical insurance would be lower after he moved to Medicare off my corporate retiree healthcare program, but the savings wasn’t as much as we hoped. But, one of my dear friends said, “IRMAA is a good problem to have, since we have the funds to be in that category”. I just wish the brackets were higher for the super rich.

Good luck on your travel plans. I enjoy planning and taking trips and we are traveling 90-120 days each year (except for 2020/2021). It is fun to review our travel spreadsheet and discuss all the trips we have taken and future ones. Plus in retirement, the trips can be much longer vs worrying about returning to a job. You might check out travel tours and go by yourself and perhaps you will find other travel buddies (male or female). Best of luck and be happy.