Last month I shared The Millionaire Wealth-Building Timeline, a chapter from my buddy, Steve’s, new book called Millionaire Habits.

Last month I shared The Millionaire Wealth-Building Timeline, a chapter from my buddy, Steve’s, new book called Millionaire Habits.

The book releases today and I have another excerpt to share with you.

This time it’s on what Steve lists as Millionaire Habit #3: Millionaires Maximize Income.

This one is near and dear to my heart because it’s my first name (the E in E-S-I.) Hahaha.

The entire wealth-building process is started by earning (you have to have something to save and invest after all).

In addition, assuming you can control your spending, earning more serves as the fuel that can really super-charge your net worth growth. This is why I have focused so many articles on earning more money.

Specifically, I have written a lot about growing your career and starting a side hustle.

But we won’t go into what I’ve discussed, let’s see what Steve has to say on the subject.

Take it away, Steve…

————————————

I won’t lie to you, making more money can be difficult. But it’s also a critical component of achieving financial freedom, and it’s something that nearly all millionaires know how to do quite well.

Why is increasing your income so important to becoming a millionaire? It’s because inflation eats away at the spending power of each dollar you earn.

Inflation occurs when the price of goods and services increases over time, reducing your money’s spending power. Many factors affect the inflation rate, such as supply and demand and fiscal policies. Don’t worry, I won’t bore you with an in-depth discussion of inflation. The important thing to remember is inflation reduces the value of each dollar you earn, making it essential to keep your salary going up each year.

Take home values, for example.

The median home value in 2000 was $119,600. Today, it’s north of $380,000 (and continuing to rise). Doing the math, buying the same home today costs more than three times as much as it did in 2000. This is the result of inflation at work.

The goal: Make your salary go up every year at a higher rate than inflation.

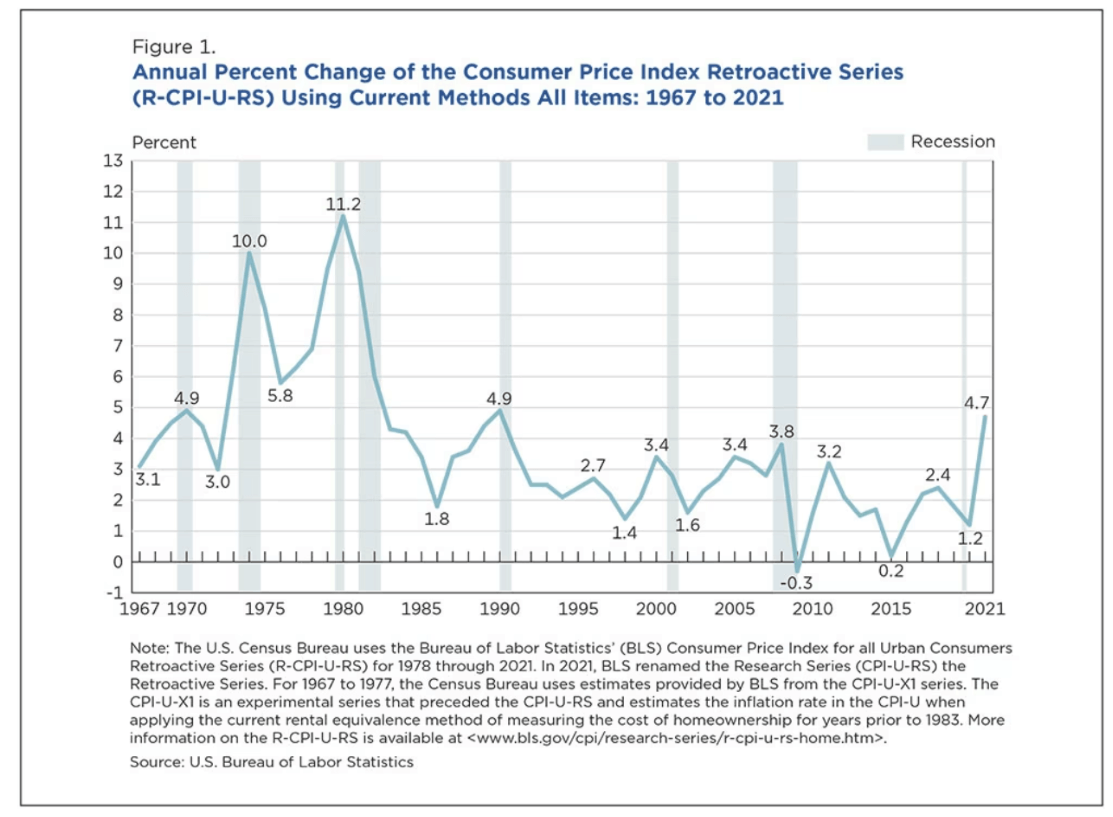

How high, you might ask? Between 1960 and 2021, the average inflation rate was 3.8% (with a total overall inflation rate of over 800%!). This means if you didn’t keep your salary going up by at least 3.8%, you essentially got a pay cut because your spending power decreased. The price of goods and services went up faster than your raises.

I cannot stress enough how important it is to keep your income growing!

Here’s a chart of the U.S. Bureau of Labor Statistics inflation rate. Note the steep rise and fall of inflation. This chart helps prove that deflation is rare (where prices drop), and it’s much more common for the price of goods and services to increase over the years.

My salary reached the 6-figure mark in my late 20s (when earning over $100,000 a year was considered a high salary). Earning a high salary gave me more money to save and invest, which helped me accumulate enough to quit corporate America in my 30s.

It wasn’t because I was the best or the brightest in the company. In fact, my skills were fairly mediocre in many of the offices I worked.

I maximized my income because I did a few important things right over the course of my career. And these choices kept my income going up year after year.

Switch Companies

I kept my salary going up throughout my career by regularly switching companies.

Every three to four years, I looked for another job. In my line of work, changing jobs fairly often wasn’t unusual. Fortunately, it also helped my salary continuously increase faster than it would have and much faster than the inflation rate.

According to one study, wage growth for those who switch jobs is almost 50% higher than for those who stay in their current jobs5. 50% higher! My experience matched that study’s findings.

Traditionally, my employers gave cost-of-living wage increases of around 3% to 4% to keep up with inflation. In the years I switched companies, however, I got anywhere from 10% to 15% raises, typical for most job switchers. My salary easily outpaced inflation because the boost in salary was higher than the cost-of-living raises I would have received if I had stayed put at the same employer.

In other words, a 15% raise is a heck of a lot better than a 4% raise.

Does this mean you’ll always get a 15% raise each time you switch jobs? Not necessarily. But the numbers also don’t lie. On average, those who change jobs regularly throughout their career earn more money than those who stay in place.

“But Steve,” you might ask, “isn’t it possible to switch jobs too often?”

Yes, it is. The downside to changing jobs is if you do it too often, it can hurt your job prospects. If a future employer thinks you’ll bail in a year or two, they might pass on your application. Employee turnover is very expensive.

When it comes to switching companies, carefully consider how much is too much. In information technology, changing jobs every three to four years is typical. But your industry might be different. It will also depend on your level of seniority (switching jobs is more common in lower levels of seniority than higher ones).

Before submitting your resume to other companies, ensure you’re not hurting your chances of finding work by switching jobs too frequently.

Start a Side Hustle

A side hustle is a great way to boost your income without switching jobs or asking for a raise at work (or if you’re properly motivated, in addition to asking for more money at work). Good side hustles can bring in anywhere from $500 to $5,000 a month of extra income. This extra money will make a big difference in your ability to save and invest.

As the name implies, a side hustle is a business you run on the side (in other words, nights and weekends). The idea is for that side hustle to generate additional income outside your regular 9 to 5 job without taking up all of your free time.

A side hustle can provide additional income to help you keep up with inflation.

For example, let’s say you have a full-time job that pays $80,000 annually, and inflation is running at 4% per year. After one year, your purchasing power will be reduced by 4%, which means you’ll need to earn an additional $3,200 per year just to keep up with inflation (80,000 x .04). Starting a side hustle that generates an extra $3,200 annually (or more!) ensures that your purchasing power remains intact.

There’s another great benefit of starting your own small business on the side.

A side hustle can provide a safety net in case you unexpectedly lose your full-time job. It’s always a good idea to have a backup plan if things don’t go as planned. A profitable side hustle provides an additional source of income to help you pay your bills and cover your expenses until you find another job.

Lastly, a side hustle can offer a sense of purpose and fulfillment outside of your 9 to 5 job. Turning your hobbies into profitable small businesses allows you to pursue them more fully and potentially turn them into full-time businesses.

A deep discussion about starting your own business is beyond the scope of this book, but I would be remiss if I didn’t give you a broad overview of the process that so many millionaires have taken to build their side hustle businesses.

Here’s a 6-step roadmap to starting your own business:

Step 1: Commit for at least a year

It’s easy to quit, isn’t it? Really, it’s too easy.

Challenge yourself to commit to your small business for at least a year before giving up and trying something new. I’ve witnessed so many people give up after just a couple of months, and that’s often too soon to tell whether your business idea will pan out.

Keep in mind that most side hustle businesses don’t make money immediately. It can take some time before it becomes profitable. Giving up too soon means you won’t give your business the time to turn the corner into a money-making venture.

Step 2: Identify your money-making strengths

If you’re struggling with what type of business to create, it’s helpful to identify what you’re good at first, then work backward from there.

For instance, if you enjoy working outside, perhaps a landscaping or yard maintenance company is up your alley (people pay handsomely for someone else to mow and maintain their yards!). You could even pull in $15 to $20 an hour just walking dogs around your neighborhood. People spend a lot of money on their pets, too.

Still not sure what side hustle business to start? Here are 20 quick ideas to get your creative juices flowing:

- Tutoring: work with students who need help learning a topic you know about

- Freelance writing: write content for those needing blog posts, articles, marketing material, or other written content

- Graphic design: create logos, banners, and other visual content

- Social media management: manage social media accounts for businesses or individuals who don’t have the time or expertise to do it themselves

- Web development: build websites for businesses who need an online presence

- Dog walking or pet sitting: care for those furry loved ones while their owners are away

- House cleaning: clean homes or office buildings for those who don’t want to do it themselves

- Personal shopping: help people who don’t have the time or can’t shop find the clothes and accessories they need

- Event planning: plan parties, weddings, and other events

- Language translation: translate documents or help people communicate in different languages

- Photography: make photos for clients who need imagery for their websites or social media accounts

- Podcast production: help people create and edit their podcasts

- Virtual assistant: help busy professionals manage email, schedule, and other repetitive or common administrative tasks

- Online coaching: offer coaching services for people who want to improve their skills or achieve their goals

- Personal training: change people’s lives by training them to get into shape or suggesting diet plans for weight loss

- Food delivery: shop and deliver groceries to people’s homes and businesses

- Lawn care: mow lawns and offer yard maintenance services in your area

- Handyman services: offer your skills in plumbing, electrical work, or other handyman tasks to people who need help

- Music lessons: give music lessons for people who want to learn how to play an instrument

- Car detailing: clean and detail cars for people who want to keep their vehicles looking new.

Step 3: Validate your idea with market research

Before diving too deep into your business idea, make sure people are willing to pay you for your product or service by doing a little market research.

For example, let’s assume you want to open a dog-walking business in your neighborhood. To validate your idea, ask yourself a few questions:

- Do people in my neighborhood have dogs?

- Are they willing to pay someone else to walk them?

- Does anyone else in my neighborhood offer these services?

- If so, how much do they charge? Can I do a better job and charge less?

If you’re not sure about your competition, use Google and search for dog walking services in your area. Check out their pricing. What are their hours? Do they have good reviews? Do they appear to be successful at it?

Of course, the less competition you have, the better your chances of success. But don’t be discouraged if you find others out there who walk dogs. Your goal is to differentiate your services from others, not find an idea that literally no one else is doing.

Perhaps you’ll offer the same service for a cheaper price. Or maybe you will offer a better service for the same price. There are plenty of ways to separate yourself from your competition. Remember that every business goes through this same process.

Step 4: Find your first paying customer to confirm your idea

After validating your idea as good, it’s time to find your first paying customer.

You might have to ask around at first to get your first customer because you aren’t yet known as the neighborhood dog walker. Ask your friends with pets if they want to regain some of their time by paying you to walk their dog. Put up a flier. Do whatever it takes to get your first paying customer.

It’s tempting for some people to offer their services for free initially. Resist doing that! This step aims to find out if people are willing to pay you to provide your dog walking service. Don’t give your service away for free!

After finding your first paying customer, confirm that your idea will work.

A few questions to consider:

- Do you like walking other people’s dogs?

- Is this something you see yourself doing after work or on the weekends?

- Are people okay with paying the price you’ve set for your services?

If the answer to those questions is yes, you have your first side business idea!

If the answer is no, that’s okay. Try another one by going through the same process until you find the perfect side hustle business for you.

Step 5: Build your business!

This is where your business really begins to take off. You’ve validated your idea. You even found your first paying customer and are convinced that your business idea is good. Now is your chance to go “all-in.”

When you go all-in, you’ve committed to the idea. You’ve told yourself, “I am determined to make this business work!” It’s your time to shine.

Here’s what you need to do:

- Branding – a logo, website, business card, and vanity email address ( [email protected]) are all a part of your small business’s brand. The branding step may not be critical for some businesses, but for others, it will be. You will at least want a business card or brochure to give to potential customers.

- Find customers – finding more paying customers is the only way your business will take off. Use the branding material you’ve made to help. Give out your business cards to friends. Advertise online or in a local newspaper. Pay your friends a referral fee if they refer a paying customer to your business.

- Develop a process – what happens when someone wants your service? The entire start-to-finish customer process needs to look polished and professional; this step will take some trial and error. That’s okay. The point is to develop one and stick to it. For instance, will you require a deposit before work begins? Will you check in with the customer halfway through a bigger project? After the work is done, will you ask for positive reviews or testimonials online?

- Set milestones for success – establish short-term and long-term goals for your new side hustle. For example, maybe you want to make $250 a month by the end of the year. Or perhaps you want at least 30 customers by this time next year. Keep your milestones realistic and achievable. Expecting $10,000 a month right after starting isn’t practical. But $250 a month might be.

Step 6: Check in regularly

Make it a point to check in with yourself every so often to confirm the business is going well and you’re still enjoying it. Include your spouse and family in the discussion if you can to make sure everyone gets their voice heard. When you first begin, check in every month. Then, check in every quarter. After, have your discussion at least once a year.

A few questions to answer during your check-ins include:

- Are my prices reasonable?

- Do I still want to run the business?

- Is the business taking too much of my time?

- Has it negatively affected my work/life balance?

- Am I bringing in enough income to justify my time?

Use these questions to adjust your business or the hours you work so the side hustle business makes the most sense for you and your family.

Ask for a Raise

Asking for more money at work is often the simplest way to boost your income. It’s simple, but it’s not always easy.

In fact, asking for a raise can be downright nerve-racking!

I remember counseling a coworker who was underpaid to ask for a raise. He was bitter about making less money than his peers but refused to ask for more money. When I asked him why, he said, “I can’t do it because I don’t want them to say no.”

In truth, he wasn’t just nervous about asking for more money. He was fixated on the possibility of getting the “no” and feeling embarrassed. He didn’t want to be seen as a complainer or “not a team player” when in truth, all he did was hurt his career.

By not asking for more money, he set his career income potential back.

Remember the table of two salary trajectories from Habit #1? My coworker’s refusal to ask to be fairly compensated kept him on a lower-paying salary path that, come retirement, will negatively affect his post-work lifestyle.

I cannot stress enough how important it is to get paid what you are worth. You are not being selfish (in a bad way) by asking for more money when you are underpaid. No, you’re being proactive. Proactive people make substantially more money than those who just sit back and hope everything becomes fair. Unfortunately, it probably won’t.

To be paid what you are worth, sometimes you need to ask for it.

Here’s how to ask for more money at work (and get it):

How To Ask For More Money At Work:

Asking for a raise at work can be a nerve-racking experience. I remember how nervous I was the first time I asked for an adjustment to my compensation. I was sweating bullets and afraid my boss would say no or think less of me. But remember, good companies always pay their employees fairly because they know how valuable good workers are. They can’t afford to lose them!

Here’s how to ask the right way for a salary adjustment:

Step 1: Map out your accomplishments.

Write down all of your major accomplishments and accolades. For instance:

-

- Did you deliver on a big project and exceeded expectations?

- Are you doing more work than you were hired to do?

- Did you receive a glowing customer review?

- Did you set a new sales record?

In other words, why do you deserve a raise? Make it easy for your employer to say yes by proving why you are a valuable asset to the company. Your accomplishments are proof. Take time to write these down.

Step 2: Decide what you want

Too many people ask for a raise and then get that deer-in-the-headlights look when their bosses ask, “How much do you want?” If you get this question, you need to have an answer ready, “I don’t know” isn’t a good answer. It means that you’re unprepared and didn’t do your homework. Know your number.

Not sure what to ask for? Remember, this is a negotiation. It’s wise to ask for a little more than you want. This gives your employer a buffer to bring the raise amount down while still giving you what you want to get.

A number of factors will influence your number, including:

-

- Your current salary

- How long you’ve worked there

- How long you’ve worked in your career

- Your performance reviews and accomplishments

In general, I recommend asking for at least 10 to 15% more than you’re making right now. For example, if you’re making $75,000, you might ask for a $7,500 to $11,000 raise. This might seem like a lot, but remember you are giving your employer room to bring that number down. If you want a $5,000 raise, tell your boss that you’re looking for $7,500. If they offer you less (say, $4,000 or $4,500), you’re still close to the raise you wanted. If you only ask for a $5,000 raise, they may only give you $2,500 or less. Always ask for more than you want.

Step 3: Schedule a meeting with your boss.

Understand that timing can be everything. For instance, you might jump the gun if you haven’t had your first yearly performance review yet or have only worked for your employer for less than a year. Or if your employer is undergoing layoffs, it’s probably not the right time.

In addition, always ask for a raise in person whenever possible. After all, it’s an important conversation and deserves a face-to-face meeting (and it’s easier to say no in email than it is in person!).

Send an email to your boss requesting a meeting to discuss your compensation. Try not to send this email when they are busy. Pick a time when things are slower to increase your chances that a meeting gets scheduled soon.

Your email might look something like this:

Hi Bob/Barbara,

I’ve been working extremely hard this year and would love to schedule a meeting with you to discuss my compensation to account for the extra work I’m putting in. Would you have time in your schedule to talk about this on Friday?

Step 4: Confidently deliver your request.

Rehearse your argument, and bringing notes with you to the meeting is okay. Don’t worry, you’re not delivering a PowerPoint presentation here. You’re just talking with your boss. It’s a conversation.

Here is what you might say:

Thanks for meeting with me, I appreciate your time. I would like to discuss a compensation adjustment, given that I’ve taken on more responsibilities in my role, such as spearheading our new customer service initiatives and training our new hires on our software process. In addition, I’ve received exemplary remarks from our customers; many of them ask to talk to me when they call in with a problem because they trust me. Lastly, over the past six months, I’ve put in over 50 hours of overtime to prepare our new software product. I am hopeful we can raise my salary by $X to account for my accomplishments.

Here is another example:

I appreciate your meeting with me to discuss my salary. It’s been more than a year since my last salary adjustment, and I’ve noticed that many similar roles in this area are paying $X more than I am making. My last performance review was excellent, and I constantly go above and beyond in my role. For example, I solved that big issue we were having with our scheduling software, saving Tim a lot of time in correcting scheduling problems with our customers. I’ve also taken on more responsibility in the last year, like coordinating meetings between our customers and us. I would like to discuss at least a 5% cost of living raise.

Understand that it might not be up to your boss to approve your raise request. He or she will likely need to send your request up the food chain before giving you a yes or no answer. If this happens, don’t be discouraged. It’s normal. However, make it a point to follow up in a week if you haven’t heard back.

What about Investing?

You might be curious why I haven’t mentioned investing in this chapter. There is a good reason for that. Investing is a great way to build wealth (in fact, it’s essential). However, this chapter is about increasing your income through salaries and side hustles. But don’t worry, we will chat in depth about investing, how to do it right, and ways to make it simple, later on in this book.

Take action: Here’s how to maximize your income:

- Step 1: Survey the job market. Even if you have no interest in switching companies, it’s always wise to stay up on industry trends and salaries for similar job roles as yours. If you don’t plan to move, you can still use bigger salaries in job listings at other companies to increase your salary at your existing employer.

- Step 2: Start a side hustle. Starting a business along with working a full-time job can be a great way to boost your income.

- Step 3: Ask for a raise. If you think you are underpaid at work, don’t hesitate to ask for more money. Reputable companies always want to pay their staff a fair salary. Do a little due diligence by researching similar jobs at other companies for comparable salaries. Remember that any additional responsibilities you’ve taken at work are also grounds for a compensation adjustment.

————————————-

Good stuff, huh?

I think you’ll find that this is a GREAT book for those who are just starting off on their financial journey or those who are down the road a bit but need an extra push or two.

Know anyone like that?

If so, you can order your book today, just in time for them to make a money resolution. 😉

Stay tuned as I’ll be sharing more from this book in the next couple weeks.

This a nice thorough guide on the most important aspect, even for those well into their FI Journey. Earning is unlimited, whereas you can only cut so much. I like how realistic the tips are, like asking for raises aren’t always up to your boss, and switching jobs too regularly could look bad. Side hustles are hit and miss, but if you can make another $1,000 per month, that’s a great way to pay for fun money. On the other hand, negotiating a $15,000 raise might be better because then you still have free time for yourself.