Today we have our latest interview with a reader who has grown their income to at least $100,000 annually.

Today we have our latest interview with a reader who has grown their income to at least $100,000 annually.

If you’re interested in participating in this series, please drop me a note.

This interview took place in November.

My questions are in bold italics and their responses follow in black.

Let’s get started…

Tell us a bit about yourself (age, marital status, kids, where you live, etc.)

I am a 35-year-old, single woman who is currently living/working in Western Europe, but I spent the first 30+ years of my live in the same medium sized city in the northeast.

What do you do for a living?

I work for large international company (>80k employees). I have had many roles in this company, but I am currently a mid-level manager responsible for a matrixed team of project managers and internal consultants across Europe.

I have an undergraduate degree in engineering and a master’s degree in business. I have been at the same company my entire career thus far.

How much do you earn annually?

In 2020, my income will land at about $199k.

How does this amount break down (salary, bonuses, etc.)?

- $149k: Base Salary

- $24k: Performance bonus

- $7k: Christmas, Vacation, & Special Project bonuses

- $17k: RSUs (Granted in 2017 & vested this year)

- $2k: Capital Gains on sale of ESPP stocks + Bank Bonuses

Do you receive any additional compensation/benefits from your employer (401k match, stock options, etc)?

Currently the international business unit I am working for doesn’t offer much in the way of these types of incentive structures, but I was able to leverage that to have a higher base pay. It’s nice to have that in guaranteed instead of variable compensation, but is not so nice because I tended to get paid out over 100% on my variable targets in USA. Less risk, less reward here…

Anyway, there is however, a required contribution to a government pension that amounts to just almost $8k/year of additional contributions that I receive from the company. Given that I don’t know how long I will stay in Europe, there is a chance I will never see that money.

Up until I moved abroad, I maxed out my 401k and my employer provided a match on the first 5%. Additionally, we had an employee stock purchase plan (ESPP) that I took advantage of for many years. We could purchase up to 15% of our salary at a 15% discount. This amounted to a few extra thousand dollars for me, but when the stock started to have more volatility, I stopped contributing.

Before relocating, I also had an annual ‘Long Term Incentive’ package in the form of Restricted Stock Units (RSUs) that were on a three-year vesting cycle. I will continue to have RSUs vesting through 2022 (thus contributing to my annual income), but I stopped earning new RSUs in 2020. I’ve had to adopt the mindset that “money isn’t everything”!

How long have you been working?

I have been working full-time since Feb 2008 – a month after I graduated from university.

That being said, I had earnings of an average of $8k/year since I was about 15 years old from part time jobs. This was mostly used as play money for myself as I wasn’t smart enough to start saving anything when I was that young!

How long have you earned at least six figures?

Since 2015, at age 30 and being 8 years into working full-time. 2015 was my first full year in a position where I had Management Incentive Plan (MIP), e.g. a performance bonus, which put me nicely over the 100k mark.

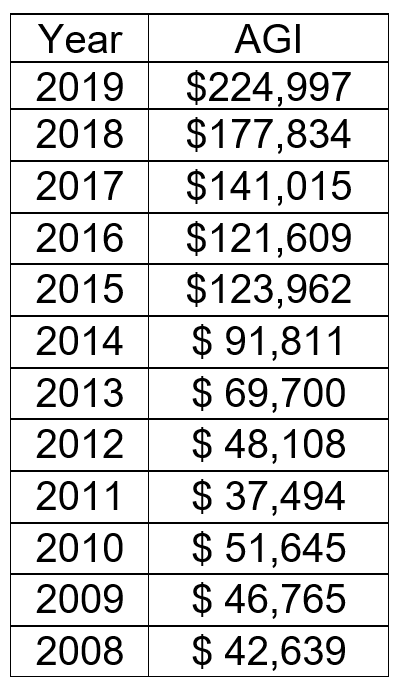

Here is my AGI as reported for the last 12 years for historical sake:

This is nearly all just salary from my primary job.

From 2015-2018 I had the ‘side gig’ doing consulting/advising at a local university for $6k/year (<5% of my total income). Additionally, I have a few thousand here and there for capital gains on my ESPP sales & from bank sign-up bonuses. (I move my money around multiple times per year to get these bonuses! In 2018 I made about $1,500 for nearly no effort. You’ll see later that I keep too much in cash, but at least I’m making something from it!)

Also, 2019 was a ‘fluke’ year for my AGI. The expense for my relocation (~$30k paid by my company) was considered income. I don’t quite understand all the details, but I was ‘grossed up’ so that there as no actual cost to me.

What have been the key steps you have taken that have allowed you to earn this level of income?

My first key step is focusing on Continuous Education. I started off a respectable $45k salary in 2008 after graduating with a degree in engineering. I quickly realized that if I really wanted to get ahead fast, I would need to develop my business acumen and not solely focus on technical acumen.

Therefore, three years into my professional career I decided to pursue an MBA. I advanced my career quite a bit after achieving my MBA & several other industry recognized certifications that I have picked up over the years. Developing myself and my team is something I feel very strongly about, and it shows in what I and my team have been able to achieve!

In 2011 I actually left my company for 8 months to complete my MBA full-time, after doing 3 semesters part-time first. (Hence my AGI being lower in 2011 than previous few years.) When I started working again in the spring of 2012 I grew my income from a base pay of $55k pre-MBA to $75k post-MBA. Funny enough, I landed back with the same original company, albeit a different business unit. That wasn’t the grand plan, but that’s how things worked out.

Additionally I have had the privilege of attending multiple ‘leadership development’ courses while working for my company as I had been identified as a ‘high potential’ talent in my early years due to my skills, achievements, and demeanor.

My second key step was ‘stepping up’. In late 2012 my team was downsized from 6 to 3. I survived this cut, but then the other two ‘survivors’ – one of which was by boss – quit! Therefore, the team went from 6 to 3 to me within 6 months of my starting that position.

I actually attribute the next 6 months of my career for catapulting me to where I am today. I worked like a mad-woman (60-70 hours a week) just to keep the function above water while we worked to replace the 2 who had resigned.

Because my boss had resigned, I got exposure to the leadership that I would certainly otherwise not have had. It was hell for those 6 months, but it helped me build my network and it showed evidence of what I had to offer. My boss & peer leaving put me into a position I was totally underqualified for, but instead of worrying about that, I just did everything I could possibly do to prevent a meltdown!

And my third key step is how I leveraged my network. After the grueling 60-70 hour weeks for 6 months I was 150% burnt out!

Once we had replaced & onboarded the new team members, I made it known I needed to find a different role. I realized I wasn’t passionate about what I was doing, so I took advantage of the connections I had made. I essentially asked our CFO to create a position for me to re-start a dormant process improvement function in our business unit. He had seen how hard I worked in the prior 1.5 years and decided to give me a chance!

Years later when I decided I wanted to move to Europe I leveraged personal connections, not HR or job applications, to find opportunities. I had built up a balance in my ‘credibility bank’ with colleagues over the years, so when I asked them to help me identify opportunities in Europe, multiple people stepped up to the plate for me.

Which of the following career advancing strategies did you employ (if any) and which were most effective: a. Doing well within your current company and being promoted. b. Jumping around from company to company always seeking a higher salary & responsibility. c. Entirely changing your career path from a lower earning field to a higher earning field (going back to school, etc)?

I have covered some of this already, but for completeness sake here it is again.

I have stayed with the same company for my entire career, but I have worked in 4 distinct functions and had 5 different ‘roles’ within the company. I have worked in Implementations, Business Analytics, Product Management, and Project Management/Process Improvement.

In that time, I also left the working world for 8 months to complete the back half of an MBA program. It was very challenging to have zero income for 8 months, but it DEFINITELY helped me in the long run, even though it cost me an arm & a leg!

What are you doing now to keep your income growing?

I’m nearly maxed out in salary at my current level (says HR salary bands). I’ll get some annual COL adjustments, but there’s very little room for any substantial improvements without (1) moving back to USA & returning to some of the additional incentive structures with my now higher base pay or (2) seeking a role at the next level up (VP) – for which I’ll also likely return to the states. I really enjoy what I do, and I am loving living in Europe, so I might plateau here for a couple of years in terms of salary.

That being said, to grow my overall income, I am starting to educate myself regarding rental properties (to be purchased in USA). I have a lot I need to learn, especially with tax implications given my situation. I also clearly need to find a local team I can trust since I will have a long-distance relationship with the properties.

Lastly, I’ve looked into the possibilities of side hustles here in Europe, but its complex and frankly I want to use my down time for traveling and enjoying life here, not doing more work!

What are your future career plans?

Honestly, I’ve been more of an ‘opportunist’ vs a ‘planner’ when it comes to my career. I consistently invest in myself through education and development opportunities, but I don’t have a grand plan of what I want to be when I grow up.

In reality, in a few years I will probably leverage my international experience to return to the US (likely with my current company) to a VP-level role in Operations, Project Management, or something of the like. Fingers crossed.

Longer term I want to get to FI status by age 45 so I can have more options open to me. For me FI will be a combination of about $1.5m in cash/investments and/or $25-50k of passive income streams.

I love the idea of working part-time or maybe starting a consulting business where I could take a few months off from client work to do some traveling or volunteering on occasion. Basically, I don’t think I will join the RE part of FIRE too early, but I want the option to!

Have you been able to turn your income into a decent net worth (what is your net worth)?

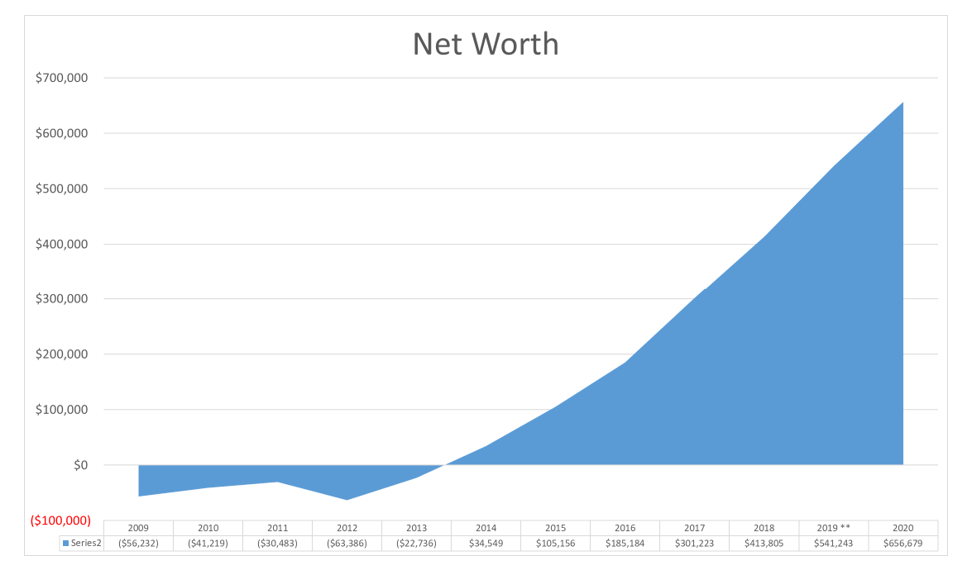

I’d like to think so. My current Net Worth is $656k and I am 100% debt free.

I have about $485k in my legacy 401k / brokerage accounts and about $165k in cash across two continents. I know it’s stupid to have this much cash, but I will leverage some of it for what I said earlier about rental properties.

Again, for historical perspective, here is how my Net Worth has grown over the years, tracked every year on Dec 31 (2020 being as estimate as of Nov 13, 2020). I remember thinking around 2008/2009 when the reality of paying back student loans sunk in that I would just be ‘over the moon’ to have a ‘positive’ Net Worth. I never dreamed I’d be where I am today, and as the first person in my family to go to college, I feel incredibly fortunate to be here now!

Why or why not?

In the end, I think it’s the ESI basics that have helped me achieve this level of net worth! – there’s no other secret sauce! I have worked hard to grow my income, but I’ve also tried to live below my means.

As an example, my apartment is only 14% of my gross income and my total spending is only about $55k/year. Despite this, I’m currently looking to move out of the city and to something less expensive.

My office, which I live very close to, is going to continue to be in ‘work from home mode’ for at least six more months & there’s talk of significant flexibility thereafter. Therefore, I think I can cut my housing expenses by 30-50% if I moved a bit further away.

Also, my investment strategy is super boring (buy balanced portfolio of ETFs and hold hold hold), but it works.

What advice do you have for people wanting to grow their incomes?

Most of my advice is going to be based growing your salary at your primary job as that’s how I’ve grown my income so far. (I could use advice on passive income generation!!):

- Find a job you enjoy – it makes it so much easier to do the job when you have a passion for it!

- Take advantage of all the training/education you can get for free via your company. I have taken over $20k worth of courses in the last 13 years and didn’t pay a dime.

- Realize that no one cares as much about you and your development as you do. Therefore, be sure to make it known what your interests are. It’s not enough to just ‘do good work’. This is especially important for women & introverts of all genders who tend not to ‘share’ these desires with their managers as much as men & extroverts.

- Volunteer for special projects BUT be sure they are full of ‘promotable tasks’. I don’t advise people (especially women) to volunteer for things like social committees. Volunteer to be a mentor or to help on-board a new hire. Don’t offer to plan the next office party.

- Realize that life is 10% what happens to you and 90% how you react to it. Stay positive in the face of adversity & change. This is something that all the best leaders I know do really well.

- PRIORITIZE and “do what you say you will do”. Remember, you can do anything, but you can’t do everything.

- Build a “Credibility Bank”. You need to make more deposits than withdraws when building relationships with people. I hate ‘Networking’ in the classic sense, but I love building relationships with people all across my company.

- When looking for your next role, consider moving laterally or moving departments. You don’t always need to move ‘up’. Also consider what gaps you have and what roles you can take to fill those gaps. Don’t just try to work your way up the same ladder.

- Negotiate your salary!! Gah, I wish I did this more often when taking new roles – I’d be in an even better place now!

- Read!

Here are books that helped me with my career progression, and therefore growing my income:

- The First 90 Days

- How Women Rise

- The Trusted Advisor

- People Styles at Work

- You’re in Charge, Now What?

- The Goal

- The Five Dysfunctions of a Team

- The Advantage

- The 5 Languages of Appreciation in the Workplace

I also subscribe to HBR.

What a great interview – thank you so much for sharing your thoughts with us. I think it’s very apparent that you enjoy educating yourself to always be on top of your game. And I appreciate your suggestion for introverts, to be sure to make it known what your interests are instead of simply hoping your actions will speak for themselves. Hopefully you continue to enjoy your time in Europe and good luck finding rental properties that will hopefully produce passive income streams for you in the future.

Good luck on your journey and I look forward to reading more about your story as you hit the $1MM marker!

Cheers,

Fiona

Thanks Fiona, I was looking forward to your ‘first response’!

Europe is still enjoyable, despite the Corona situation. We’re much more restricted than the USA, but I’m making do with lots of day trips, hiking excursions, and ‘quality time’ with my 2 cats. 🙂

I wrote this article back in November I think and its insane to me that my NW has grown just over $100k since then. The markets are on quite a tear. At this rate that $1M is coming sooner than I expected! Fingers crossed.

Also, since writing the article I have joined the MMM forum. It’s a great group who helped me to make the decision to invest my cash instead of purchasing a rental property. That’s another type of market that’s going crazy right now and it didn’t seem worth it/feasible to find a property in the US ‘easily’ at the moment.

Really nice work. I enjoyed your story, a lot of similarities with my own. You are killing it! Keep it up! Congratulations.

MI#2 – wow , an OG Millionaire. 🙂

Thanks! I just went and re-read your interview from 2016. I hope you loved Italy and are still killing it yourself!

Still same company, across many business units / functions for many years, Also read the Goal early and enjoyed it a lot (operations/mfg, Process mgt). Continued to move around, through all these roles gone across Europe, Asia, Americas back and forth every few years. This is only possible to do in a really really big company. I was able to grow my career and demonstrate (similar to you) a lot of market, function, cultural, etc agilities… Glad to see you doing well.

Enjoy the journey, with your resume and accomplishments money is not your concern, make sure you have other life interests / hobbies so your identity does not become one company or work. I know a lot of people that got let go last week and they had no life outside of work, their identity was their title in a company. They had money, but were really struggling… I try to plan and prepare against that same outcome…

Great job. Love seeing that you are still at the same company you started your career. It just goes to show right there that you DON’T need to job hop if you can find the right company and grow your career within it. Awesome.

Certainly more rare these days, right?!

I didn’t plan for it to be this way, but it’s how it’s happened. I don’t personally feel I ‘owe’ the company anything so I would be open to other options. However, I’m still quite happy with things and not actively looking, inside or outside the company. Each time I am ready for something new I do explore external opportunities but I’ve ‘lucked into’ some internal roles in many cases that kept me around.

In the MMM we recently read “How to Fail at Everything and Still Win Big” and I recall the description of a person who immediately started looking for Job B after he got hired for Job A…..

“He said that every time he got a new job, he immediately started looking for a better one. For him, job seeking was not something one did when necessary. It was an ongoing process. This makes perfect sense if you do the math. Chances are the best job for you won’t become available at precisely the time you declare yourself ready. Your best bet, he explained, was to always be looking for the better deal. The better deal has its own schedule. I believe the way he explained it is that your job is not your job; your job is to find a better job.”

I found this to be an interesting system, but I haven’t quite decided if it’s right for me. I find satisfaction in building teams and creating something from nothing, so I like to stick in a role for at least 2 years – 3 years these days. Maybe I’ll adapt the mindset after 12-18 months. 🙂

No, you don’t owe the company anything. When they decide they don’t need or want you they will let you go, when you decide you can find something you prefer, you can go as well.

It’s a constant alignment of being “mutually beneficial”. Of course there is “goodwill” and “relationships” built over time, so you can put a weight on that in your equation, it should never be just money as the reason. For the company either, my company kept me as an expat through the 2008 crash, Corona, etc, even while they released many others. I was a premium, but they felt they had invested and I still had upside, so why lose that. However the second they don’t come to that conclusion in their equation, I am out like any other. So just remember that it’s a constant mutual decision. you owe nothing, but if you are happy, which you seem to be, then don’t fix it if not broken.

Lots of recruiters call me a lot, it’s very stressful. I just received a very nice offer, MUCH more than I make now, the market is hot. I like interviewing, it is fun challenge and good to meet people, but when the offers come, it is a big stress and decision… good to do every now and then once every 5 years (even if you are happy), but it is not without it’s stresses when you get the big offer and need to make a life changing decision….

I know this is a personal finance site, and folks are going to jump all over my comments since it is not grabbing every last penny, but ESI has some articles and comments out there that say, “when you have won the game, why keep playing”. I look at where you are and you are winning the game, so only disrupt your course if you really really feel it is best for you and not just money (and trust me, I REALLY like having more money, since for me equals freedom and opportunity….)

I like your reading list.

Especially “The First 90 Days” and “The Goal.”

Of course another IE would enjoy The Goal 😉

I read it in university, but actually have re-read it twice since!

Great interview. I agree 100% with this strategy:

“I have stayed with the same company for my entire career, but I have worked in 4 distinct functions and had 5 different ‘roles’ within the company. I have worked in Implementations, Business Analytics, Product Management, and Project Management/Process Improvement.”

I took a slightly different approach in obtaining a variety of experiences. I had two years of Big 4 accounting experience before jumping to the private sector. In my profession (internal auditing), our skills our highly transferrable between industries so I decided to try a few different ones (LOL). Since leaving Big 4, I have worked for companies in the following industries:

*Investment Management

*Real Estate

*Banking

*Chemicals/Oil

*Government

*Insurance

*Healthcare

By working in a variety of industries, it has given me a unique perspective on business and internal audit philosophies. I’ve also obtained six certifications and switched to information technology auditing (you get paid more and I love technology) about 7 years ago.

They key to making yourself a more valuable employee is developing versatility. You can do this a variety of ways:

*Volunteering for a variety of projects in your current role.

*Rotating internally through a number of different departments. This will put you on a path to senior management for sure.

*Getting a variety of expenses by job hopping when it makes sense.

Hi ExpatAshley,

You are doing a great job in your career. Keep it up and I’m sure you will reach your goal in the next ten years, if not sooner.

What is your current annual expenses and do you expect this to go up or down in retirement? For the last full year (2020 for example) what is your savings rate / or savings $ amount?

Enjoy your time out in Europe. I know it is not the same with COVID-19 but you are seeing a side to Europe now that few will ever see.

-MI#30

Hi MI#30 – thanks!

Annual Expenses: I have been averaging just over $60k/year for last 5 years. I have a couple of scenarios, so I plan for $75k/year for retirement calculation purposes.

Savings Rate: 60% of Net Income – including German pension contributions (34% of gross – because of stupid high taxes in Germany!) Its 45% and 26% respectively if you don’t include the German pension. In total value is about $50k USD saved / invested per year.

PS looking forward to our MMM chat next week. 🙂

Those numbers are showing you have a very high savings rate. During my time working abroad, I found that my effective tax rate in my host country was higher than that of the USA and I was maintaining tax credits for extra foreign taxes paid. I found that some of those credits could be offset for US based income including those made from dividends in after tax accounts. You may want to look at this or something along these lines to take advantage of those foreign tax credits in excess of what you would owe in normal US taxes. Another thing you could do is accumulate them and then then go to a low or zero income tax country and then utilize those credits before returning back to the USA.

This is of course if you could make your employment situation work with these options. Please note that I’m not giving tax advice but potential options to look at.

Talk more next week.

-MI#30

Another set of thoughts….Since I wrote this & join the MMM community, I have learned so much! I already felt ‘advanced’ in my knowledge, but I’ve learned I know a lot less than I thought! 😉

For planning purposes I have now factored into my “FI” number inflation, taxes, and adjusted withdraw rates. My ‘F-everyone & everything FIRE number’ is now $2.6m if I assume zero earned income, zero social security, and only enough passive income from investments to meet my withdraw rate. From that could comfortable live my days with little worries & no requirement to generate earned income.

That being said, that’s the place of total financial comfort for me to live life as a complete bum. In reality, I don’t think I need that much to “slow down”. I don’t plan to FULLY RE at age 45 and I plan to grow a stronger passive income over the next 10 years. Therefore, $2.6m is a lot more than I will need to pull the trigger to scale back.

I need to build out some Monte Carlo simulations, but for now I am also using https://financialmentor.com/calculator/best-retirement-calculator to evaluate different scenarios and do some rudimentary sensitivity analysis. In fact, if I take all the same assumptions that I used to arrive at my $2.6m FIRE number and simply use this calculator to add in my social security taken at at 67, my number goes down to $1.9m and I’ll still end up aged 100 with a multi-million dollar estate.