Today we have a guest post from Your Money Blueprint.

Today we have a guest post from Your Money Blueprint.

There’s been a bit of discussion recently on whether paying off your mortgage or investing was better — both here at ESI Money (see Which is Better: Paying Off a Mortgage or Investing More?) as well as on Rockstar Finance (see Money Match-Up: Pay Off Debt Versus Invest and here Money Match-Up: Pay Off Mortgage Versus Invest Excess Funds Elsewhere).

This post offers some new thoughts (along with a personal example and various scenarios) worth adding to this debate. As someone who paid off his mortgage in 10 years and hasn’t had one for two decades, this post gave me lots of food for thought.

Enjoy…

———————————————————–

The age-old question. Common advice will tell you to pay down your mortgage. This is not always the best thing for your money though. As with all my advice, it comes down to your personal situation. What works for you does not work for everyone else.

One of my biggest financial regrets is actually paying down my mortgage too quickly.

Why I Regret Paying Down My Mortgage

I got my $380,000 30-year mortgage in 2009 and I hated seeing that amount of money owing in my bank account. I wanted to reduce it as much as possible as it felt like a massive weight on my shoulders. Every extra dollar I earned or saved went towards paying down the mortgage. Yes, I was invested in the stock market, but only $50 per month. I was paying $1000 extra on my monthly mortgage thanks to payments from my roommate.

At the time it felt like the right thing to do. It felt good reducing the mortgage amount.

Looking back though, I regret not investing more. I wasn’t nearly as interested in finance as I am now, and I didn’t even consider any alternatives. Everyone I knew said the best thing to do is to pay off your mortgage. Now I know better, I don’t think this advice is entirely accurate.

I was paying down the mortgage with extra repayments between 2009 and 2013. For 5 years I was paying $12,000 per year more than the minimum repayments.

Each year I had a $12,600 cash surplus. $12,000 went towards the mortgage and $600 towards stock investments. I had a lot of my equity in my house and wasn’t very well diversified in other asset classes. My risk levels were not well spread.

The Numbers

Mortgage rates in that 5 year period were approximately 5%, and the compounded average returns from the stock market were 11.7%. In other words, if I invested my extra cash in the stock market, instead of towards the mortgage, I would be much better off financially.

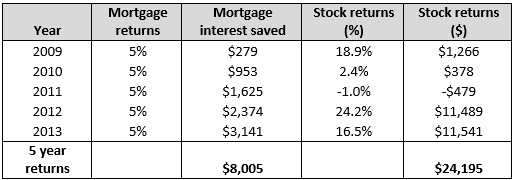

Below is a table to show how much better off I would have been investing $12,000 extra in a stock market index fund, instead of paying down the mortgage. Note – I have taken 0.5% off the stock returns for fees.

In just a 5-year period I was over $16,000 worse off by paying down the mortgage instead of investing.

Luckily, I figured this out in late 2013 and realized this wasn’t working for me, so I reversed the order of extra payments. I started paying $12,000 a year into the stock market and just $600 a year extra on the mortgage.

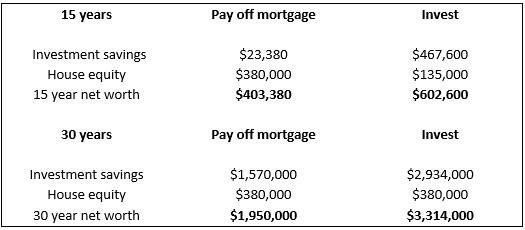

But what if I didn’t come to this realization and the trend continued for 15 years of the mortgage? Paying off $12,000 a year extra on the mortgage and $600 a year on stocks I would have earned $23,380 in the stock market and had a $380,000 house for a year 15 net worth of $403,380

We must always look at the opportunity cost of our decisions though. What would I have saved if I reversed the priorities – instead investing the $12,000 in stocks and the $600 in the mortgage for 15 years? I would have earned $467,600 in returns and have $135,000 in equity in the house for a total net worth of $602,600.

$199,220 better off investing than paying down the mortgage in the 15-year scenario.

For simplicity we will assume the house is still $380,000 as any increases in house price will affect both the pay off mortgage and invest strategies equally.

30-Year Results

What about extending out to 30 years? Does the pay off the mortgage early start to pay off over a longer timeframe?

At year 16 we now have $24,480 a year not being used to pay off the mortgage since that is now paid off. That can start going towards our stock market investments currently valued at $23,380, as well as continuing with our $12,600 per annum stock market contributions. Surely, we can catch up to the 30-year mortgage strategy since our 15-year mortgage pay off strategy no longer has that mortgage payment.

After 30 years, the pay off mortgage early strategy we now have $1.95 million invested and a paid off house.

After 30 years the invest early strategy has $3.31 million and a paid off house.

$1.36 million better off investing than paying down the mortgage in this 30-year scenario.

We are almost ten times worse off after 30 years than we were after 15 years. The gap is getting bigger, not smaller.

The Common Misconception

A lot of people believe that once they pay off the mortgage they will invest. At year 15 in our example, after the mortgage was paid off, we had an extra $24,480 per annum to invest. This is over double the $12,000 per annum that the invest early strategy had available.

Although it sounds better, it really isn’t. The problem is we are 15 years behind. Time investing is critical due to the tremendous impact of compound interest. The longer we are invested, the more our money works for us earning interest, until we reach a point where our interest received is higher than the amount of money we are contributing.

By starting our investing later, it takes that much longer to have our money working for us in the same way.

It really is powerful stuff when your money starts earning more money. It is like having your own team of employees working for you while you sleep. Only wealth creation can achieve this, not debt reduction.

It’s Not that Simple

Of course, your own analysis will never be this simple. We can’t predict the future. We don’t know what the stock market returns will be, just like we won’t know what mortgage interest rates will be.

In the example I provided, stock returns have been high at 11.7% and mortgage interest has been historically low at 5%. This skews the analysis massively in favor of investing and is not a fair contest.

I can hear the nay sayers who are in the pay off the mortgage camp through the computer monitor already. “It’s not a fair comparison” I can hear you cry.

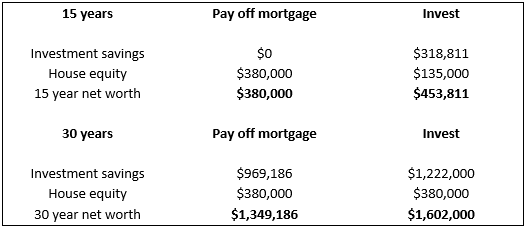

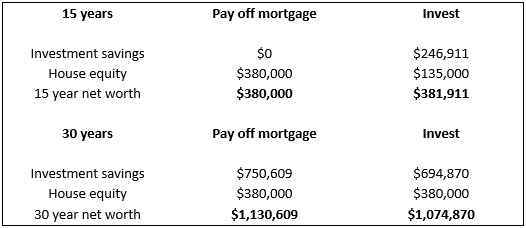

Let’s have a look at a more realistic scenario of 7% stock market returns after fees. $12,000 per year to either invest or pay down the $380,000 30 year mortgage at 5%.

$74,000 better off investing than paying down the mortgage in the 15-year scenario.

$253,000 better off investing than paying down the mortgage in the 30-year scenario.

Again, the gap gets bigger as time and compound interest grow.

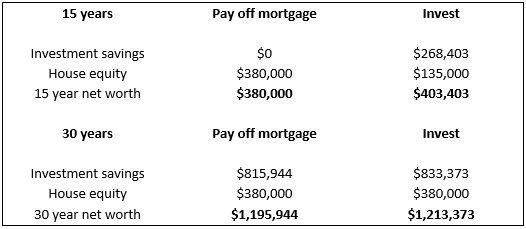

What about like for like? 5% mortgage interest and 5% net stock returns:

$23,403 better off investing than paying down the mortgage in the 15-year scenario.

$17,429 better off investing than paying down the mortgage in the 30-year scenario.

Hang on. If the returns of both investing and paying down the mortgage are the same (5%), then why are the returns for investing better? Compound interest is the key difference. In this scenario, your investments grow more than the interest saved on the mortgage thanks to compound interest and time.

If you invest, you earn compound interest. If you pay off mortgage debt, you are only paying simple interest. The compounding effect of paying off your mortgage comes from varying principal payments, not from compounding interest. Each month you pay the interest amount in full, so that means there is no unpaid interest left to compound.

Let’s try another example.

What if we are unlucky enough to experience 4% investment returns and 5% mortgage interest? Surely it is better to pay off the mortgage now?

$1,911 better off investing than paying down the mortgage in the 15-year scenario

$55,739 worse off investing than paying down the mortgage in the 30-year scenario.

In this situation, we have finally found the point where paying the mortgage off before investing is a better financial decision. It has taken just over 15 years for this to be the correct decision in this unlikely scenario of 4% investment returns and 5% mortgage interest rates.

Just be careful when comparing rates that you are comparing like for like. For example, most investments incur fees and taxes. Some also incur tax breaks. You would need to consider those and look at the returns in your pocket (after fees and taxes).

Further Analysis to Consider

Here are several other factors you need to consider as you look at this sort of analysis for your specific financial situation:

1. Inflation. Those who advocate for the pay off mortgage early, rarely consider the effect of inflation. Why pay off the mortgage quickly using today’s dollars when you can pay off the mortgage using your dollars 20 years from now? If inflation were to rise at a rate of 2.5% for the next 30 years, your $1 today, will only be worth 50 cents in less than 30 years. By delaying extra payments, our future money will go much further than our current money on our current mortgage debt. Our income will generally rise, with our mortgage repayments staying the same. Over time, our mortgage payment will take up a smaller percentage of our income, becoming easier and easier to make repayments.

2. Maybe you don’t like any risk. You would probably be best advised to pay down the mortgage, which is a guaranteed return on investment. Or you only like some risk. In this case, you may prefer to both invest in the stock market and pay down your mortgage. By doing both, you are enjoying the extra risk, whilst also minimizing your exposure to too much risk. The certainty of mortgage payoff vs the uncertainty of investing.

Many people will argue that paying down your mortgage is risk free. I disagree with this. Yes, it is less risky than investing, but definitely not risk free. By putting all your spare cash into paying down the mortgage, you are limiting your exposure to other assets, thus increasing your exposure to risk.

3. You must also consider your personality. Like me, maybe you hate having debt. Student loan debt, mortgage debt, you want it gone. You like the feeling of being free from debt, even if it means missing out on better financial returns. It would be silly to recommend investing to someone like this. On the flip side, how bad would you feel missing out on high investment returns should the market explode?

4. What is the mortgage interest rate? If the rate is 10% or higher then it may be better to pay down the mortgage with ALL of your spare cash. What about an 8% mortgage rate? Then maybe 80% of your spare cash on the mortgage and 20% on other investments. A 5% interest rate may see you put 50% of your cash on the mortgage and 50% in investments. You can come up with your own rule of thumb, depending on the current mortgage interest rate. The higher it is, the better off you will be paying down the mortgage.

Investment returns are unknown, but mortgage rates (when fixed), can be guaranteed. This makes it much easier to use this as the benchmark return, instead of using a hypothetical investment return rate.

5. Do you need the cash? It may not be a good idea to use all your spare cash on paying down the mortgage if you don’t carry any spare cash in the form of emergency savings.

When you run into financial trouble and all your money is on your house, you will struggle to get it back. If you keep it to the side, or in liquid investments, you have that cushion needed in case times get tough.

6. Are you a good saver? Mortgages are great for poor savers because they act as a forced savings plan. You don’t want to miss any of these payments or your house will be taken off you. As a poor saver, if you don’t pay down extra on the mortgage you may not end up investing the difference. Which strategy will you be able to implement with the greatest ease?

7. What are your goals? If you are moving houses every 10-15 years, then paying down the mortgage quickly may not be best. As you saw in the examples, a mortgage of $380,000 that was paid down quickly, took at least 15 years to catch up to the investor, if at all. Even with investment returns 1% lower than the mortgage rate. In my country people move on average every 7 years which is not long enough for this strategy of paying down the mortgage quickly to make financial sense.

Also, you may be paying down equity, but if you are like most, your next house will be more expensive than your current house. It will be a step UP the ladder. In this case, you are only paying down equity, to then get out an even bigger mortgage so you have to start all over again from year zero. Staying put for longer, moving sideways or down the property ladder? Then paying off the mortgage makes more financial sense due to the higher likelihood of being able to stat investment savings earlier than you would otherwise.

Do you want to retire in a nice house with not a lot of cash invested? Or an average house with more cash invested? There is no right or wrong answer, as you may be able to do both. But if you had to make a choice, which one most closely aligns with your retirement goals.

Many people close to retirement have a goal to pay off their mortgage in full before they retire. If you don’t like the idea of debt hanging over your head after your income dries up, then you would definitely be in the pay off the mortgage camp. Taking on less risk before retirement is never a bad idea.

Final Thoughts

I am young (ish), with plenty of time ahead of me. I don’t mind some risk and I wish I wasn’t so quick to listen to popular advice and pay off my mortgage so fast. In saying that, paying off such a large chunk in extra repayments was not the worst thing I have done. Although I may not be better off financially, I still feel pretty good about it mentally.

It does not have to be one or the other. You can do both. Invest and pay down the mortgage.

This is a great way of spreading your risk by not investing too heavily in just one asset class. Instead, spreading your money between two or more asset classes. Then, should the returns from one asset class be mediocre, you still have the returns from other asset classes if you are well diversified. If you are invested too heavily in property, you will be playing catch up later in life to save for retirement. Compound interest will not be your friend as much as someone who starts investing earlier.

Sage advice may be to hedge your bets and bet on both.

This all comes down to your goals, current interest rates, the state of the economy, your money personality, and tolerance for risk. The decision to pay down the mortgage or invest is more than just financial. It also involves emotions around our feelings of debt and risk. That is why this is such an often-heated debate. If it were just financial, investing would win 9 times out of 10. Remember, a 5% return from paying down mortgage is less than a 5% return from investments. Mortgage interest is not compounding, whereas investment interest is. Comparing like for like with incorrect calculations can prove costly.

We are all very different, so we all should have different ideas about what is best for us. The least we can do is consider the options though, as it can be a complex decision. Play out all the scenarios and make a deliberate and reasoned decision.

The key is to do what is best for you, your family, and your own peace of mind, with consideration of both the financial AND mental aspects of the decision.

This is the most well rounded write up that I have come across. Thank you! I’d been paying 1/12th extra each month for a little while. Suddenly it dawned on me that I might not be making the wisest choice with my 3.75% mortgage. All extra cash went to funding a 6 months Emergency Fund and now I have been investing my extra cash in a well-rounded index fund. I set up a separate “mortgage” index fund only for the money I would have thrown at my mortgage. I know me, I need to see the numbers grow over time and I’m at extra $10K now. That will be where my mortgage payment will come from in retirement. Have another “car” index fund to watch my car payment grow over the years for when I eventually have to purchase my next car.

Thanks Debbie. When the mortgage rates increase you will be able to adjust your ratio from 1/12th to something else. It is about finding that equilibrium point that allows us to maximise returns, but also allows us to sleep at night.

If you’ve ever been in a toxic work environment and be “forced” to kiss ass and be a yes-guy, because you have a mortgage, then the choice in this debate is a no-brainer.

I hope I’m not unclear which camp I fall in.

I’m in that group of having to deal with corporate crap for one reason, my employer sponsored healthcare plan, NOT my mortgage. What WE face in early (pre-Medicare) retirement are escalating healthcare from a broken system. Whether or not to pay off the mortgage is a neglible concern. I feel like a Slave to my healthcare plan at work.

A mortgage doesn’t stop you from being FI. As long as you are investing and not spending frivolously, you can live off your investments and pay the mortgage. In fact, in most instances, if you don’t pay off the mortgage quickly, you will reach FI sooner.

This post is wonderfully thought out, meticulously researched, persuasively written … and amazingly narrow in its view.

The author’s experience starts in 2009 and continues to now. In other words, his timeframe coincides almost perfectly with what is now the longest economic expansion since we started recording them. And yes: if you start paying down your mortgage when the stock market is at a low, and look back only at the years of the subsequent expansion, then you are going to see greener grass on the other side of the fence.

However:

1. Markets do not go up every year without fail. I know that everybody reading these words knows that in an academic sense, but I question how many newer investors (i.e., those of you who have become financially aware in the past decade) truly understand that reality. The markets will fall for an extended period. They’ll fall faster than you can believe. You’ll stop checking the balances on your investment accounts, because it will be too depressing.

2. This analysis naively assumes consistent income during the entire period. That’s assuming a fair amount of luck. A household may have steady (or increasing), uninterrupted income for a 15+ year time period … or, more likely, they won’t. You can lose your job (a much more likely occurrence when the economy is in recession) … you may want to leave your job because of a toxic situation … you may need surgery, or become ill, and be away from work for an extended period … your two-income family may decide to have children and have one of the parents stay home full-time, and become a one-income family … you may want to leave your steady-paying job to start your own business … et cetera.

In all of those cases, you have less risk if you do not have a mortgage payment. Your expenses are lower, and you have no possibility of losing the roof over your head.

3. Yes, if you invest, you will have assets that you can cash in if any of those life events happen. But if you have to cash them out during a recession, then you’ll be cashing them out at the worst possible time. (Also, if you have invested solely in tax-favored retirement vehicles, then you will have to pay a penalty on top of taking your money out at the worst possible time.)

4. My last major point (for now) is about this sort of number-crunching, back-testing exercise. Can we learn from them? Sometimes. But more often, they become exercises in self-flagellation. Taking the last scenario: if I have to choose between $3.3 million (the apocryphal result for paying off the mortgage over 30 years and investing every remaining penny) or $2 million (the result of pre-paying the mortgage) … that’s not a bad choice, is it? In either case, I have more money than I can spend. I’ve won the game. I’m really not concerned about winning by more (in the same way that I really don’t care if my team wins by one touchdown or seven, as long as they win).

The point is: I would rather follow a strategy that delivers a winning outcome in a higher percentage of situations than a strategy that produces a better outcome in a best-case scenario, but that has a greater probability of not working (specifically because its assumptions assume too much).

When you look back at life, you can always find places where you could have had a better result if only you had done such-and-such. None of us live perfect lives in which every choice we make is economically optimal. We can only do the best we can with what we know at the time. And if those choices ultimately get us to where we want to be, that’s really all that matters.

(Disclaimer: As you might expect, my wife and I are big believers in paying off our mortgage, which we should have done within a year. That said, it’s not an either-or discussion. We’ve also been putting lots of money in our retirement accounts the whole time, and have a nice nest egg built up.

I also have zero expectation that anybody will change anybody’s minds on this issue. Words rarely do that. Experience is a much better teacher … and I will submit to you that when we do go through an extended economic downturn — and we will — many of those who currently believe “take the longest possible mortgage and invest” will suddenly revise their opinions.)

Fantastic response that puts the original post into the proper context.

Markets surly fall…..but in my 20 years of being a landlord rents have not fallen. At times value may stagnant but not drop in well located areas.

I agree with this. I chose to pay off my mortgage because I didn’t know the future. In a “worst case” scenario, my living expenses can be extremely small….taxes, groceries, and little else.

I thought long and hard about it. I had a 3.5% mortgage, but had the money in the market to be able to pay it off. What convinced me was “if the market fell 30%, would I be happier if I had no mortgage?”. I pulled the money, paid the mortgage off…and I can say that it was a great decision *for me*.

Also, it’s not an “either/or” situation. You should pay off your mortgage as fast as possible *and* invest as much as you can.

1. Yes markets don’t go up every year, but over the long haul (15 or 30 years) they do go up.

2. If you are that worried about losing or reduced income, buying a house may not be the best option.

3. If you have to cash out assets during a recession, after 15 or 30 years, you probably still made money. If you have to pay taxes on your taxable account, that means you made money.

4. I think the whole point of the post is that you’re better off investing over paying off your mortgage, everything else equal – and it’s not even close. And this whole website is devoted to figuring out the best way to put yourself in the best position possible, which would be investing over paying off your mortgage.

Hi John – thanks for your comment. Your first point about me buying a house in 2009 at a great time to invest may be true, but I also gave several examples in the article of different rates of return, including as little as 4% over 30 years, showing financially that investing would have been better.

1. Maybe not the ESI money audience, but the majority of people have a mortgage for at least 15 years. The markets . In 7 of the 11 previous times since 1950 when the market has dropped from an all time, it has only taken 1 year for the market to recover to its previous high. In the most extreme drop in the year 2000, it took 8 years to recover. The point is, over periods of longer than 10 years, the market has always gone up. This doesn’t even include the fact that you are now buying cheaper stocks.

2. In your example of losing your job, how would you fare if you were still in the process of paying down your mortgage? If all your extra income was going towards the mortgage then you weren’t getting income all of a sudden, where would you tap into for cash? It is actually less risky to have more money in savings or investments in this instance, than have your money tied up in a house that you can’t eat.

3. If you have paid taxes on your investments that means you have made money. That is good isn’t it? Also, no one who is needing to cash out soon should be 100% in stocks. The closer you are to needing to tap into your savings, the more risk averse you need to be.

4. “I would rather follow a strategy that delivers a winning outcome in a higher percentage of situations.” That would be investing.

You are right that the best we can do is with what we know at the time That is why I think an article like this is necessary to broaden common wisdom. Pay off the house is generally the advice, but it doesn’t hurt to consider different opinions sometimes right?That is how we make better decisions – when we have the full story.

Like you, I realise that I can’t change your mind. And i’m not here to do that because paying off a mortgage was obviously the better choice for you, because it was right for your risk level and your peace of mind.

1. “The market going up” isn’t the correct benchmark. You need to compare the market results to the interest rate on the mortgage, because that is the effective rate of return you get when you pre-pay.

2. You’re assuming that every last extra dollar has gone into the mortgage. But it wouldn’t be wise at all to pay down the mortgage without first having an emergency fund to get through a rough patch. Also, as I said later in my response, we do contribute to our retirement funds (which could be tapped in case of a calamity). It’s not an either-or decision.

3. I never said anything about taxes. I said penalty — the 10% that the IRS smacks you with if you withdraw early from a retirement fund. But since you brought up taxes: no, it doesn’t necessarily mean that there’s been a gain. If you’ve put $10,000 in your 401k (or other qualified retirement plan) pre-tax, and it drops to $6,000, and then you need to withdraw the money, you will have to pay taxes on the $6,000, even though there’s been a loss. So that $10,000 has turned into maybe $4,000 at best.

4. That is exactly my point: investing provides the superior return *if* all of your assumptions come true. I’m saying that “if” is the most important word in that sentence. As mentioned before, you have conveniently created a world in which, for decades, there is never a loss of income. That assumption just isn’t what most people experience.

I had these exact same conversations in 1999 and 2006, except I was on the other side of the fence then. And I learned that all of my theory was no match for practice. You seem like a good guy, and I hope your plan works out for you. But your philosophy has been formed during the longest economic expansion on record, and I suspect you’ll have a different view once you’ve been through a recession or two.

1. Investing still wins long term

2.. Agree it’s not an either/or.

3., There is more of a chance of withdrawing early from a retirement fund if you have put too much into the house too quickly and have less in investments. You may also still have a mortgage to pay if it isn’t paid off. A ratio of house payments vs stock investing should be well considered I think we can agree on.

4. I have a well diversified portfolio of housing, stocks, and cash invested in different countries. I won’t be changing my allocation in a recession as it is ready as best I can be for a recession. I am not overly invested in any one thing which is really what this article is about.

I have just seen too many people rushing to pay down their mortgage and then not able to start saving until they are too old where time is running out and compound interest doesn’t work.

I appreciate your comments and it seems we can agree it is not an either/or situation. The title of the post may seem polarising but I am a proponent of both.

Thanks for your thoughts on the topic

I crashed and burned and lost everything 10 years ago (as a highly educated business guy). When I rose from the ashes I swore that I’ll pay cash for everything in future. As soon as possible. Every. Time. Grandma’s advice. Only experience will teach you that. And I’m good with numbers!

John is right. Well written post, but unfortunately too narrow in viewpoint and experience. I’ve been on all sides of the fence on this issue. I paid off my first mortgage in short order only to see my invested assets double the next year. Oops. I had a mortgage on my next house but really disliked the extra cash flow required to pay it and the added risk that resulted. My current home is fully paid for again.

I would add that compound interest impacts the pay down of the mortgage as well. I would rerun your numbers to take that into account.

Hi Teebone – Compound interest is baked in to the investment returns calculation. Payment on the mortgage does not incur compound interest.

If you invest, you earn compound interest. If you pay off mortgage debt, you are only paying simple interest. The compounding effect of paying off your mortgage comes from varying principal payments, not from compounding interest. Each month you pay the interest amount in full, so that means there is no unpaid interest left to compound.

Well if you make principal only payments as you earn cash you are immediately accruing less interest. I.e. Mid month payment as a guaranteed return. When making an investment some folks will pay brokerage fees and there will be timing of when you transfer money from where your employer deposits your paycheck to an investment account. I believe you ran your analysis using an even return, wonder how it would look for investing at specific points in time I.e 99 or 08 vs 01/10, using real returns including dividends reinvested. Overall I imagine you are directionally consistent. My mortgage is much lower than the percentages you quoted, so I personally invest.

You definitely earn compound interest on extra mortgage payments. Each month the interest charged is calculated as i/12 × starting balance. When you pay extra you incur less interest next month and therefore pay more principal. And then in turn less interest the following month.

S says – mortgage interest is not compunding interest. You are paying less interest because you are paying more principal and the loan is reducing. Interest does not reduce from the principal for the following month unless you pay more principal. With a mortgage you pay the interest in full each month, there is nothing left to compound the next month. It starts from new principal amount. It has the same compounding effect as a lower interest rate or shortening the term. It is an effect, but not actually compounding.

Whereas, with investing you actually do earn interest on interest. That is compounding.

Thanks

I agree with most of the comments in your post and I think it was a great read. However, I don’t understand what you are saying about this compound interest. Let’s do an example (I used a mortgage calculator).

I put in: 10 years, interest rate = 5%, loan = $200K. First payment = Oct, 1, 2018.

I ran that to get amortization schedule, and also did a second run where I enabled a one time payment of 10k on 10/1/18. Let’s compare.

If you make the one time payment, your final payment is 2/1/28. The principal balance right before that payment is $791.52.

If you did not make the one time payment, the principal balance at that time is $16,656.66. So, as of 2/1/28 you are $15,865 “better off” due to a one time payment of $10,000. This is 113 months later. Let’s calculate the ‘compound’ interest rate you effectively earned on that one time $10,000 payment on 10/1/18.

($15,865 / 10,000) ^ (12/113) – 1 = 5.02%. Call it 5%.

5%? This is exactly the rate on the mortgage. I paid 10k and effectively earned exactly 5%, compounding, on that payment.

Said another way, if I invest $10,000 for 113 months, how much would you expect me to have if I earned 5% compound interest? … $15,865. So they are the same as far as I can tell.

If I am missing something please help me reconcile.

Thanks for looking at the numbers and I can see that you are perfroming the right calculation. But you should be looking at the loan balance At 113 months, not the principal payment.

With the mortgage loan not paying the $10K extra at the beginning you would have a loan balance of $14,605 at the end of 113 months. Whereas if you did pay this $10K then your loan balance would be $0 after 113 months. Interest saved is $14,605 (the difference in loan balances).

Whereas investing this $10K at the start of a 113 month period with the same 5% return you would have $15,865.

A difference of $1,260 in this example of a $10K deposit. Quite a big difference from a relatively small payment, and the difference is compounded even greater with larger amounts. That is the effect of compound interest vs simple interest.

With the mortgage it only seems like it is compounding, yet it is not. Only seems this way because of the extra payments made and diminishing interest payments.

I was looking at the loan balance the month prior to avoid the extra complication of the reduced final payment. If you want to look at the loan balance at the end of the loan, we can do that too.

AFTER the payment on 2/1/18, your loan balance is $14,605 as you mentioned, if you do not pay the extra $10,000.

If you did pay the extra $10,000, the loan balance is zero after the payment on 2/1/18, as you said.

However, you are ignoring the fact that your last payment in the “lump sum” scenario is only $794.81. Instead of the normal $2,121.31. You can’t ignore this. That means you are not only $14,605 better off by having loan balance of zero, you are also $2,121.31 – $794.81 = $1,326.5 better off since you made a smaller final payment.

So, $14,605 + $1,326.5 = $15,931.5. This number is higher than the $15,865 from my last post since we are now a month later (and we earned compound interest again!).

$10,000 * (1.0502) ^ (114/12) = $15,931

It gets messier when you are looking after payoff. If you compare the loan balance at any time = n between these scenarios, you will find that every single time, the difference is equal to the $10,000 extra payment compounded at the mortgage rate (effective rate rather than APR).

Side note: I may be off by one month in my calcs (113 vs 114 for example), but the point is the same and the numbers do not materially change.

Spot on. You’re talking from a point of wisdom. Not numbers. Wisdom has more value than a higher ROI table/spreadsheet.

To be fair to Your Money Blueprint, you only gain this wisdom through experience. Not head knowledge or books. And I’m an MBA grad.

This is a numbers game. I would have thought an MBA grad would be aware of that. Don’t dismiss it to something its not. If you don’t want to invest and experience the mathematical advantage that is fine and your personal choice. For those of us less risk averse it is a better strategy as long as the mortgage rates are so low.. PS I have experienced market crashes.

Definitely agree that the best tactic to take here is to hedge on both. Pay a little extra to pay off your mortgage in 15-20 years, and invest the additional money in the market. You and I have no idea what the sequence of returns will be the moment that you make the decision. The market could go down 5% (there are negative return years coming… we just often forget this because of the large bull market we’ve all experienced the past 9 years).

It’s hard to ignore that “gurananteed” return of 5% on the mortgage when you aren’t guaranteed of anything in the market. It also depends on how old the investor is and their stock/bond ratio, which helps to determine their expected return.

Of course, hindsight is 20/20 and if the market continues to go up you might lose some money. But in the years it goes down you may be gaining handsomely. This is why, I think, that the best plan is to do a little bit of both.

Live a lifestyle that allows you to invest a large size of money in the market AND pay down your mortgage. Though, I’ll readily admit, I hate debt.

TPP

I also follow a strategy of both. Sure, in most scenarios I would end up better off investing it all, but I have to factor in the possibility of large drops in the stock market. The decision to do both allows me to both take advantage of stock market returns and compound interest, but also minimise my risk to stock market falls. We need to make the best decision for our peace of mind so that we can pass the sleep at night test. Thanks for stopping by TPP

I think that saying that the market will go up every year in this example and that your house value will not go up, is erroneous at best. In 30 years it’s very rare for a house to not gain value whatsoever while the stock market just hums along.

On average the market does go up, and considerably more than your interest rate, as shown in the article. And when you’re talking about a time horizon of 30 years, the market has literally never gone down over any 30 year time frame. The value of your house going up doesn’t affect anything because it goes up in both scenario’s.

What Josh said 🙂

I am in the pay off mortgage camp myself and actually wrote a post “Every Blade of Grass” that conveyed the happiness in my decision of doing so when I and not the bank owned my property.

The biggest reward of paying off mortgage is non-monetary. The peace of mind of being debt free is a huge benefit.

Ask anyone who has a paid off home if they would take out a mortgage to invest purely in the stock market. I would bet that the vast majority would think this would be a crazy idea.

You can go into a bank and get a mortgage for a property fairly easily. How about going into a bank and asking for an equivalent amount when you tell them your use for the money is to put it all in the stock market? Only a fool banker would approve that loan.

I’m glad you did a breakdown of how you would come out ahead with the various differences in interest rate but I do want to point out a huge flaw in your reasoning: you use average return of stock market. In a long bull run like we had reality and theory work out pretty well.

But you need to take into account sequence of risk. Say you happened to start investing at an absolute awful time, the beginning of a recession.

If your stocks drop 50% year one it takes more than a 50% return to get back to even (you need a 100% return).

There will be a market correction eventually. We have been spoiled with the longest bull run in history and everyone looks like a genius investing. When the maket does correct the economy goes down, jobs are lost, and you will never regret having a paid off home that is not at risk for foreclosure like what happened in 2009

Nice summary on my thoughts as well. What this article leaves out is the risk factor in not paying off your mortgage as soon as you can. If the math were this simple (i.e. market returns > cost of debt) one would just continue to take on debt at a lower rate than the market return and come out ahead. Unfortunately, this is not likely to work on a consistent basis.

Otherwise why not recalculate the numbers above such that as soon as you have paid off your mortgage you would get another mortgage for the value of your home and invest all of it in the market. I wonder what those numbers would show as a net effect?

This of course would be crazy, at least for someone like me who has paid off their home. I can’t imagine going to my lender and taking out another mortgage for the value of my home and putting all of it in the market.

What about the risk factor of paying off your mortgage early? By having all your net worth in the house you will not have liquid assets for when you need them. There is also the risk of lack of diversification.

Going to your lender to borrow against the house to invest is a bad idea. You are right. Not because paying off the mortgage is necessarily better than investing though. It is because this results in a poorly diversified portfolio of too much invested in stocks and not enough invested in housing.

There is risk in any which way you go.

Thanks

You should be debt free, with an emergency fund, and slowly funding retirement when that house finally gets paid off. Thus, there’s no real measurable “risk” in having a lot of net worth in the house, and I challenge anyone to honestly compare being debt free with a paid off home, emergency fund in place, and able to not be burdened in the remaining decades of life with home payments with that of trying to keep debt in order to be diversified. Key word there was “honestly compare”.

The risk isn’t even comparable in any way between the two options, mountain to mole hill.

Thanks for your thoughts XVSN. Your decision to pay off your mortgage has given you happiness and peace of mind and that is what it is all about.

I probably have a higher tolerance for risk though and I expect to be compensated more in return for that. Our risk levels are all different and that is why the decision is different for everyone.

I have never bought into the argument of borrowing money from the mortgage to invest. The point of investing instead of paying off the mortgage is diversification. A good portfolio of assets needs to be well diversified and by investing, instead of paying down the mortgage we allow ourselves to have assets in stocks and the house. If we only pay down the house, then we only have assets in a house. That is more risky in my opinion. If I were to borrow from the bank to invest then that would defeat the purpose of diversification because then I would be over exposed to stocks and under exposed to housing.

The numbers in the article did include poor stock returns, as low as 4% over 15 and 30 years which has never happened. Sequence of returns is covered because the market returns are based on a CAGR compounded average.

People have been saying the market will correct since 2011. Are you sure there will be one soon? Finally, when the market does correct isn’t cheap stocks a good thing if you are in it for the long term? Do you invest mainly in stocks or bonds? If it stocks, I am sure it would be because of the better expected returns. The mortgage is more like bonds.

I’m not here to change your mind at all. I’m glad you made a decision that is best for you. I’m just here to say financially, more often than not, investing is by far the better call. We all know that we have to consider our emotions though and that is why this is not black in white. By the way, I like to do both. Invest and pay down the mortgage. May not be the best decision for me financially, but it is the best decision for the level of risk i’m willing to take on at this point in my life.

Love this response. Especially highlighting that a mortgage is like a bond in theory. Friend of mine mentioned this and has made me rethink my portfolio allocation. Thanks for writIng this post. It’s brilliant!

Thanks MPF. Glad you got something out of the post.

Another great post on the topic. The one thing I would still be wary about, however, is timing of the investment vs mortgage payoff. In other words, sequence of risks, and assuming that the “market will go up X%” over a certain period of time.

I recently published a post looking at the average returns of the S&P over shorter periods of time (5, 10 years), which demonstrates that you need to be lucky with your timing to expect ‘average’ returns in a shorter investment period.

Thanks Adam – I enjoyed your article.

I completely agree, when you start getting into shorter mortgage payoff periods the equation does change a bit and for shorter periods of investing you do need to be luckier.

But remember if there is a big drop in the markets, you are now buying much cheaper shares and with the extra 10 years of compounding this will be beneficial to a long term investor.

Short term investors will be much better paying off the mortgage.

Like others who have commented on this post, I agree that the author’s analysis doesn’t consider the all-important factor of RISK – a pretty huge and fundamental omission. Of course stock market returns are, on average over the long term, higher than those for ‘fixed investments’ like mortgage loans (lest we forget, every mortgage is a fixed investment for the issuer, which is also backed by collateral – the property itself – and therefore relatively low risk). If the author’s numbers/analysis are taken at face value without considering relative risks (as well as market fluctuations), then the following would always be true:

1) Everyone should take out and hold interest only mortgages in perpetuity, because why would you ever pay off the principal if the cost of that capital (the mortgage interest rate) will always be significantly lower than the expected rate of return from the stock market?

2) Everyone who has a paid off house should immediately mortgage it to the hilt. In fact, mortgages with interest rates significantly lower than the expected rate of return from the stock market would then be perpetually self-funding money machines – you could just turn part of the market returns each year into cash to pay the mortgage and bank the rest, year after year – while also enjoying the long term capital gains on the property itself. A magic money machine!

Bottom line, good investing is largely good portfolio management – after building up a good emergency fund, some of your savings should go to aggressive investments (i.e., the stock market) and some to less aggressive ‘investments’ (i.e., paying down a mortgage). How much should go towards to each is a factor of many variables which are different for each investor, including time horizon and liquidity needs.

Agreed, using average returns over shorter time periods ignores risk. However there can be risk on both sides. Say you are putting everything towards your mortgage but lose your job before it’s paid off. Now you still have the mortgage payment but little savings to fall back on. Borrowing against your equity without a job might be problematic as well.

I think this is a bit of a straw man argument. If you follow a plan (for example, Dave Ramsey’s baby steps), you would have 3-6 months of emergency savings available to cover the mortgage and you would be putting 15% toward retirement before you even started paying extra on the mortgage.

Following a plan like The Total Money Makeover is well diversified, in my opinion. If you’re putting 15% into retirement before any match and aggressively paying off your mortgage, you are set up to win in a big way. As previous posters have mentioned, at that point, you’re winning, so any argument of how much better a win you could have is moot.

If you’re facing a possible layoff in the near future, obviously you wouldn’t payoff mortgage. You would build an umbrella. So, your argument is for a slightly different topic, methinks.

Hi Russ – mortgaging the house to pay for investments is a terrible idea. For exactly the reason you mentioned – risk. By borrowing against the house you are reducing your housing assets and increasing your stock assets. This is reducing diversification which is greatly introducing extra risk.

This doesn’t mean that stocks returns are worse than mortgage returns though. It just means that diversification is king.

Of course stock investing has risk, but isn’t that why we invest in the stock market?

For the potential of greater returns. Paying off the mortgage also has risk in that your money is tied up in the house and you are less diversified.

Risk is everywhere.

Thanks

YMB,

Your money is not, in a sense, tied up in your house because you need a place to live. You gotta have a roof over your head. Hello. Your home is a consumption item, strictly speaking. It’s not supposed to be an asset that gives you cash flows.

You don’t defer buying groceries because you want to earn a little more interest with your cash in the bank.

The point is if you don’t have enough saved/invested outside of the mortgage to pay for your non mortgage related expenses. Asset rich cash poor is a common problem.

One other point … really, a set of questions that I would like to ask to all of the “keep your mortgage and invest as much as possible” adherents …

Why do lenders issue mortgages? If mortgages under-perform so much compared to other investments, then why would anybody ever issue a mortgage? Wouldn’t it make more sense for them to put that money into stocks as well?

Remember, there are two sides to every investment. And the ones who issue mortgages tend to be the ones with big buildings and lots of money. I don’t think that is a coincidence.

Here’s an interesting thought someone left on reddit regarding this subject:

“If you paid off your house today, would you take out a HELOC to invest in an extremely bullish market?”

This is the right way to look at it, except that it’s impossible for most people to know if a market is bullish or bearish.

I’ve taken out a HELOC to invest in a Real Estate market that I was bullish on-I knew the demographics and the ROI had a margin of safety.

My example: would you refinance a mortgage to take out equity to invest? Yes. I did a refinance when I was young and took out $11k to invest in rental property. The $11k is now worth $310k. With my 2 homes and mortgages at 2.75% and 3.375% I in retirement have no interest in paying them off any faster than necessary. I have plenty of other assets because of my strategy to invest instead of pay off a mortgage. Use other people’s money. Invest your extra $ in the market or real estate instead of an illiquid asset such as your home. Also the mortgage provided tax deductions in many cases and one more importantly item is paying off with ever cheaper dollars in the future.

M22,

In that case when you were young you should’ve borrowed $110k or $1,1 million. Because you knew your strategy was gonna work. And you knew you’d never be laid off.

Well, you didn’t borrow to your upper follicles because ….. RISK.

The article leaves out Beta (risk) in the calculation.

I’ve had my mortgage paid off for over 15 years and set up a HELOC to invest in the market if the situation looks right. I hate debt and sleep better without it even though statistically, I’d be more wealthy if I took on a low cost mortgate and invested it in the market. Furthermore, in 2008 I thought real hard about drawing on that HELOC (I’m a contrarian investor) during the crash. But I didn’t pull the trigger since I already had more in the market than I could draw on my HELOC so I felt I was sufficiently exposed already. Obviously, if I pulled the trigger, I’d be way ahead vs any other scenario. I still have my HELOC and may be tested again when the next downturn happens. And you know, I’d probably do the same thing and not pull the trigger on the HELOC.

I was thinking the same thing ESI. To me it appears that getting a HELOC only to invest more is too much of a gamble.

Each individual has to make there own decision/guess. I have a very small mortgage left with a high equity/loan ratio but I’ll keep the loan even though I can pay it off now. I would NEVER take money from a HELOC to invest. That’s like maxing out credit cards and just rolling over the balances each month.

I have little debt and my financial planner asks me to pay off my mortgage and my one car loan (all at very low rates)- I don’t want to. Not because I want to invest this money but because I’m not confident I’d safe everything I’m paying out now. I like seeing the money in my account.

I’m a hybrid. LOL

I’m a fan of doing both. I prioritized the mortgage and then slowly shifted money to the market as interest portions dropped. Once I hit ~$200/mo in interest, I made almost no extra payments. I like the guaranteed return and the satisfaction of the paid off home. And I believe most people don’t have the self-control to invest versus pay off debt. The mortgage payoff is more tangible and satisfying versus betting on the market in the future.

I read a previous write-up about this topic where a commenter (who had prioritized mortgage payments) noted that if they had spent ~8 years heavily investing versus paying off their mortgage in the early 2000s, and then the 2008 crash happened and they lost their job, they would be in serious financial trouble. Because this person DID lose their job (and tens of thousands in investments) but had a paid off house, they weren’t as worried. That’s the peace of mind that you pay for.

Thanks George. I am also a fan of doing both.

What if the person in your story was paying extra on the mortgage and lost their job whilst they still had mortgage payments? They would still have a mortgage but no invested cash to draw upon.

There is risk any which way we look at it. The question is which risk are we most comfortable with and that is why I chose both, and I suspect you are the same.

Paying off your mortgage is essentially a form of market timing.

You’re making a bet that the 4% return by paying off your mortgage is a better deal than whatever you’ll get in the market. If your mortgage is lower than historical returns in the market, the answer is just to let it ride. Yes, you can use hindsight to beat yourself up, but what is the point?

The picture gets WAY muddier if you are quickly approaching FIRE. Paying off your mortgage at that point can lower your sequence of returns risk by an incredible amount…at that point it’s worth considering.

100% agree on considering the mortgage as you are approaching FIRE. Sequence of returns are killer, and if you are needing access to your savings shortly, paying off the mortgage more quickly is a great idea.

Thanks POP

Amen! Great article and I concur though the ultimate decision is based on each individual’s own circumstances. Your case, good example of your decision. My own case (which I’ve recently posted on my blog) I am keeping my mortgage as my rate is locked in very low at 2.80% and I’m having no problem with my excess earnings from investments and trading.

For some, it might never best to pay it off, especially if they loathe debt so much.

Agree Mr Fire – what is best for me is not best for you or anyone else. As long as we carefully consider our decisions and the implications for our own situations, we can’t be wrong!

This has been a great debate for many years. You can argue either side. Hind sight is 20/20 in this time period (or any period when looking backwards). Risk must always be considered in this debate. I personally chose to carry a mortgage for decades until I was financially independent then paid it off in a lump sum with cash I had accumulated after I felt I was in a good financial position, knowing I would sell my house within 6 years. The avoidance of the upcoming interest in that 6 year period made it an easy decision. It does feel good to have no mortgage, I will admit. In the end, it’s a personal choice. No right or wrong.

Exactly! You had a great plan in place and it worked for you. I’m on the same plan as you were, planning on paying it off in one lump sum in 3-4 years time.

No right or wrong – 100% agree. We all have our own set of circumstances, goals and risks tolerances that should be considered. That’s why we never come to the same conclusion.

Paying off the mortgage as you approach financial independence is a smart move

Thanks

Personal take…

Post 9-11. Wife’s employer belly up within six months. My business down about 75%. Once we recovered; my wife found a good paying new gig, my business slowly recovered, paid off our mortgage while still adding as much as possible to the retirement accounts.

No monthly mortgage payments allowed us to sleep so much better at night and not worry near as much about the future. We both still think this is one of the best moves we ever made.

Peace of mind…priceless.

Congratulations on a decision that worked out fantastic for you.

Curious, if piece of mind is priceless do you not invest in the stock market at all?

Have plenty of money in the market, no issues on our sanity.

The piece of mind came from knowing that know matter what happened the house was ours. If another event caused our incomes to drop 70-80% we had a home. We could pay the taxes and insurance from savings. Even if one partner died, the survivor was in a position to not have to make a rash decision.

Saw a few people we know lose their houses, including a client, so that really had an effect on our thought process.

So maybe I should have said it “piece of mind knowing we’re not going to be homeless” priceless.

So true. After losing a job you’ll never look at mortgage payments (and car payments) the same way again. It happened to me.

I’ve never understood why the 30 year mortgage is the default option in this debate. It seems an easy solution to this question would be to finance one’s home at 15 years to begin with (or refi to a 10 or 15 now), which would reduce interest paid from the outset (15 yr rates are typically .5-1% lower than 30 yr) and cut payback timeframe in half or more. The *new* minimum monthly payment serves the interest of those in the “pay the mortgage” camp and all leftover dollars can be invested, appeasing the other side.

For critics that say the marginal increase in monthly payment by moving to a 15 year note would diminish leftover investable dollars or reduce available home options, I’d argue that this is a good stress test for whether a home is truly affordable or not. Similar to financing financing a car over 72 months instead of 36 months in order to “afford” it. If it doesn’t make sense at 15 year, it probably shouldn’t over a longer period either.

I think it is because the author is from NZ. In NZ the longest term on a mortgage is 30 years. The term is based on the rate at which you pay it back, and can be variable from 1 year to 30 years. My current term is 10.8 years. Interest rates are the same if you work on 30 year, or 15 year term.

Where interest rates change is if you lock your mortgage into a rate for a time period. Periods come in 6 months, 1, 2, 3, 4, or 5 years. Each have different rates. Generally the lowest rate is for the 1 year interest rate lock. Once you lock period is up, you re-negotiate with the bank for a new rate and lock period.

Thanks for the comment Alex.

I guess 30 years is the default because you have to pick a number and it is good as any. With the countries low savings rates, most people do take closer to 30 years than 15 years to pay off their mortgages.

Just bear in mind, the opportunity cost of a 15 year mortgage. Yes there is less mortgage interest, but shortening the term means more money going on the mortgage.This means more money that couldn’t be invested and less diversification.

My belief is that your mortgage payments are the equivalent of a bond or saf allocation purchase. I only ever pay more to keep my percents in balance with my chosen allocation. Bonds are better comparable to mortgages then stocks.

Thanks FTF – I agree. I too use the current mortgage rate as a barometer for what percentage pay down on the mortgage and what percentage to invest.

It’s not an either/or. You can do both. Returns are likely better with investing, but on the other hand, it’s also much riskier. The only no-risk investment paying a pre-tax return of 3.875% that I have available to me is to pay extra on my mortgage. On the other hand, that money is basically non-liquid until the house is paid off or sold, unless I borrow against the equity, which would defeat the whole purpose.

BB i agree – I like both too. Helps to stay well diversified while minimising risk. The ratio on each depends on the mortgage rate, which I use as a benchmark. The lower the mortgage rate, the more I invest in stocks. The higher the mortgage interest rate, the more I pay down the mortgage.

Thanks

Very interesting post and analysis, thanks ESI!

It has always been on mind whether I will repay my mortgage after I buy a house or invest instead. This kind of post is very helpful!

Thanks for your kind words. Lots to consider!

I can’t believe people are still pushing the debt leveraging fallacy in personal finance. I can prove that staying in debt to invest is wrong mathematically with full context, because it must include risk and beta in any financial math equation. Then on top of that risk equation added in, once you include the “personal” context in personal finance, it’s goes from wrong to just plain negligent to push the “good debt” claim. Anyone living a debt free principled life can tell you the opportunity cost of debt, the negative affect it has in your finances, career, health, and home all of which will reduce your financial progress in life AT BEST. At worst, meaning any hiccup in life in or outside of your control, any macro economic event outside of your control, debt is a huge factor of another destroying your life and future either by decades or fully. Look further than a decade or two in historical study of the debt leveraging proponents and you’ll see the vast majority end in bankruptcy. Look into the actual history of the concept, you’ll find a few decades back that theory of debt leveraging took hold in the financial industry and academia simply because it was easy to promote due to lack of context, and then propagated because of lemming activity of drowning out or ridiculing anyone that challenged that theory. Your idea is historically, demonstrably, mathematically, and in nearly every major full context study wrong.

If you want to have personal financial success over the long run, do what self made millionaires do and use their principles. You’ll find ever majority of study of those types showing they either are and stay debt free, or made their money by not dealing in debt.

Wow…pretty strong words! I have no idea what you mean by “proving that staying in debt to invest is wrong mathematically with full context.” I’d be very curious for you to write it out, including the negative affects using debt to invest has on one’s finances, career, health, and home.

I know quite a number of self made millionaires who “deal in debt” constantly with very positive outcomes that simply would not have been remotely possible otherwise. They all seem pretty set in their finances, career, health, and homes.

Whether you know the few outliers or not isn’t the point. Every single major study shows those with personal financial success absolutely correlate around debt freedom, or not using it as leverage.

Sure, you can find the few that managed to squeak by for a decade or two and have absolute no personal issues in or out of their control, and not major economical crash out of their control that targeted their situation, that became millionaires. For every one of those there are thousands who failed. This is the exact situation that caused 2008, the leveraging theory.

As someone who is debt free and even invests in real estate with cash only, I can tell you those people doing it on debt and borrowing look like high rollers, even write books about how to do that without using their own money, only to bankrupt every 10-20 years. The rest of us in the industry wait for these cycles, and buy up all those properties in cash once those people crash and burn, either because of a tiny slip up in their life that they might or might not have control over, or because of economic changes they didn’t get in and out of debt quick enough to finish the project/investment. In the rental investor arena, these people are the equivalents to the $30,000 millionaires that drive used BMW’s around town on debt.

The short of my statement “proving that staying in debt to invest is wrong mathematically with full context” is that people use a shortened math equation to “prove” that debt leveraging is mathematically the best choice. Yet, it leaves out of the equation risk and other context, of which even basic finance 101 education will teach you there IS a mathematical equation that represents risk. So, in full context of a personal financial decision, even just mathematically speaking, they are either ignorant or being dishonest about that “proof”, they design the equation to reach what they wanted the result to be by dropping the risk part.

Now, as for one’s finances, career, health, and home, it’s far too much to list here. There aren’t only major studies showing these factors, but entire books written on it. Some of Dave Ramsey’s works hit on a lot of it, and reference the studies as well. Fascinating reads (I didn’t believe or even know about any of the affects either before I took the time to learn about them). It’s a real-world, personal, and hugely measurable affect, being debt free, to every aspect of life which of course also vastly affects your financial success (not just in math either).

That is interesting, I’ve never heard of “every single major study” that concludes that investment debt leads to financial ruin. Would you care to point me toward one?

You state that people who argue for using debt in investing leave risk out of the equation. You then seem to jump to “…and if using debt adds any risk, it’s a bad idea.” That’s quite a leap – there is a spectrum of risk, and while few would argue that taking outsized risks using debt is a good financial strategy, there are certainly many investment scenarios where taking a responsible level of debt involves minimal additional risk. And speaking of risk, if we take your argument to its logical conclusion, we shouldn’t invest at all because all investing involves some level of risk.

Anyway, i know neither of us is convincing each other of anything with these comments, but I will say that for me the debt we’ve taken on to invest (which includes cash-out refinances on rental houses to put toward additional investments) has supercharged our income and net worth, putting us years ahead in our financial goals compared to had we not done so.

Food for thought: for our debt to give us problems in our finances right now, a dozen different major things would have to go wrong in our lives at the same time. However, if we hadn’t taken on the debt as part of our investment strategy, we’d be in a position where only two or three things would have to go wrong in our lives to have the same kind of financial problems. So the debt has truly put us in a position of strength.

“… a dozen different major things would have to go wrong in our lives at the same time.”

Major things went wrong to me … at the same time. Major things go wrong to more people than you’d imagine. They don’t talk about it. Talking about failure is still a taboo.

Hitting 3 pointers feels great, until they stop falling. Then we realise it’s a risky game plan. Experience teaches you not to rely on 3 pointers for a position of strength.

I hope your streak continues… because I don’t wish major things to go wrong to anyone.

Brant,

I just paid off my bond (as we call it in South Africa) this week. I’ve framed the title deed in a photo frame. And took selfies with it. (I have no idea where my Masters diploma is). The tiles feel different under my feet. I can’t capture that feeling with spreadsheets.

I think this debate is polarising because transferring your cash to the bank to pay off the bond is a very hard decision.

“Tyranny, like hell, is not easily conquered”

Thanks for having me over ESI and everyone for your great comments. It’s a polarising debate for sure with some passionate reactions.

For many of us it seems it doesn’t have to be an either/or decision. Having extra money is a great luxury and the envy of many people who are struggling just to pay the minimum of the mortgage.

If you are in the position of being able to make this decision though, I just wanted to show the other side. Many people in this space are proponents of paying down the mortgage quickly and that is fine. The invest side doesn’t get much attention and I just want people to have all the information before making a decision on what to do, hence this post.

For the record, I do both.

Thanks

As others have stated, I’m in the camp of doing both; pay down the mortgage while you invest in the market. About 9 years ago we refinanced to a 15-year mortgage and went with bi-weekly payments which adds one extra payment toward principal per year.

Our mortgage by year’s end will be around 500K and represents our only debt. We currently have about 150K in Series EE and I bonds paying an average of ~3.5%. The remaining interest on our mortgage, if level loaded, would be ~1.8% per year before any tax deduction benefits, with 6 years remaining.

I’m considering moving 350K out of equities into a CD step ladder of 1-3 year maturities generating between 2.5%-3%. I like the idea that if we had no other income, we’d have the remaining mortgage covered through CDs and Savings Bonds that we could liquidate monthly to cover our only remaining debt, rather than having to sell equities during a correction. Since we would earn double the effective interest rate of our mortgage in risk free assets, it doesn’t make any financial sense to go ahead and pay it off and gives us some additional liquidity over time in case something unexpected pops up, rather than have it all tied up in our home.

I’m doing both and here’s how I’m doing it (I wrote about this in greater detail in my most recent blog posting):

Mortgage balance: $168k @ an APR of 2.80% (7-year ARM), $394/mo!

In an effort to pay down my mortgage and save myself interest charges, I’ve been making a fixed payment of $1,250/mo. towards my mortgage. Each and every month for the past year I have $1,250 automatically transferred from my checking account to my mortgage account. Considering that my payment is only $394, I am making a substantial payment toward my principal ea. month. I found an online savings account that pays 1.90% interest and I’ve invested an amount equal to my mortgage payoff (I invested $170k into this account). This difference of 0.90% is the effective rate I am paying on my mortgage. Who wouldn’t jump at the chance of only paying less than 1% for their primary residence?

Emergency fund? Check ($50k in liquid savings)

Diversified investments: Check (low 7-figures)

Real estate investments: Check (net income of $30k/year)

Monthly savings contributions: Check (30% of gross income)

Plans to retire early: Check, end of 2022 @ age 55

Plans to pay off mortgage: fully paid off by retirement date

Nice, love it!

Excellent well-rounded and easy to read article – thankyou!

Thanks Elise. Glad you got something out of the post.

Many of you may already know about this book, but this may help with the debate of what actual millionaires have done to become millionaires. I”m betting many of these 10K+ millionaires (myself included…I contributed to the study) became wealthy specifically because they avoided debt.

https://www.chrishogan360.com/

I would say that many more millionaires have had a mortgage and leveraged off a house than not. Buying a house with all cash is not a reality for most.

Most millionaires didn’t buy the biggest house they could. We bought way under what we could have qualified for and paid off the 15 year $225K loan in 8 years. We paid it off during the height of the financial crisis when we had Countrywide as our servicer and I wasn’t sure if they would exist by the end of 2009. We were already maxing out our retirement so we had the extra money to pay down on the mortgage. If you aren’ maxing out retirement, then you shouldn’t be paying down on the mortgage. Yes, we have plenty of non retirement money to live off of once we retire in two years. I don’t regret paying off the house early.

Great post man! One of the best explanations so far in this ongoing debate. Some of the responses on the psychological and social benefits of paying off the mortgage debate are also interesting. I have a higher risk tolerance as well, so like you said it’s all about the individual.

Thanks for writing this. Well written and well said.

All the best,

My. PFC

I agree with the comments. It’s interesting to read all the different viewpoints and take on board a bit of everything and everyones experiences.

For the sake of the robustness of this debate, if your answer is DOING BOTH then you’re chicken. It doesn’t help much.

Sitting on the fence hurts. Taking a side and motivating your choice is interesting.

I’m in the pay off camp, because I crashed and burned 10 years ago. (It still hurts when I think about it). After rising from ashes l have never looked at debt the same way again. The revolution will not be televised, y’all.

I feel like i’m in the schoolyard again. Being called a chicken. You left out the ‘bwok bwok’ sounds. On the fence would be 50/50 in both camps. If you read the article you would see that is not the case.

Good for you for rising from the ashes.

I’m going to assume that your thoughts of “invest, then pay off the house” (forgive me if I’m oversimplifying) apply to an “invest or pay off a big student loan (let’s say $50K, $100K, whatever)” as well. The main difference is probably that if you’re in the “pay the house off first” camp, at least you end up with a paid-for house (hooray!), whereas paying off the student loan–as wonderful as it is to have that debt behind you, no doubt–leaves you with just a receipt via email.

Am I missing something, Mister ESI et al?

Hi Daniel – it’s not necessarily doing one first, then the other. It is more a case of paying a higher percentage into one option over the other depending on the current mortgage rate. Higher mortgage rate would mean more cash going on the mortgage. A lower mortgage rate would mean more cash going into investing. The mortgage rate is the benchmark rate as it is generally fixed and known. The same would apply for student loan vs invest, where I would use the student loan interest rate as the benchmark.

Great write up, appreciate the thought-generating discussion. For those that invest and pay down mortgage – do you use any dynamic tools to decide where to allocate funds? In my rudimentary thoughts, I’m pondering some sort of Value-Averaging tool that takes into account Shiller’s CAPE ratio. Eg high CAPE would shunt proportionally more funds to mortgage payoff, and vice versa. Anyone do something like this now?

I’ve thought about this one more times than I could count. Unless I’m really missing something I think having a home mortgage is the way to go. I don’t see the benefit of moving money out of an investment to pay off the one thing the gov’t still gives a tax credit for and for a primary residence rates are still very low (4’s). My worst investments will earn a far greater return than saving me the monthly P&I by paying off my mortgage. Now if I could pay off my Real Estate taxes and insurance that’s a different story! (Just kidding)

I think people love the idea of no mortgage for a couple reasons……The mental joy of the thought of “Debt Free” and those that are really investors planning on living on standard means in retirement (SS, pension, 401K, etc).

The only way I would think about paying off my mortgage would be if my net worth was so high that the returns were more than my children would ever need……I’m think north of $5mil? Maybe…..

That is those that are really NOT investors……..Typo

You don’t keep a mortgage for the tax benefit. You are still paying the bank $1 to avoid sending the gov’t .25 cents. Most people aren’t even getting the tax deduction with low interest rates. Nobody has suggested moving money out of an investment to pay down the mortgage, but to send money to the mortgage instead of investing. On a 30 year mortgage, the interest cost is huge. Most people never actually track the money invested for just the portion of the mortgage they would have paid.

I’m not saying “just for the tax benefit” but the lost equity creation of where the capital could be positioned. I invest is apartment bldgs…..On average over the last 20 years I normally receive 6% on my cash invested (down payment), pay the loan down at about 4% return of my dp, and over say a 10 year period average 2% appreciation per yr on the value of the bldg. 2% appreciation (of course not every year) can translate to 10% return on my down payment. So overall I would be looking at somewhere between 10%-20% return on my capital.

For comparison assume my primary home loan is the exact same amount as the apt bld 30% down payment…..Say $500k. Yes saving on future interest is great but give me cash flow and equity growth. Untimely net worth will determine you income.

Revisiting/rereading this thread to hope to get some insight/ideas for myself since I last posted on this thread. The remaining mortgage on my home is ‘only’ about $125K (3.25%) and the value of the home is approximately $600K+. Last month I paid off my $15K LOC that was at 5.5%- that decision was easy for me as the rate as been increasing and it annoys me! I recently benefited from a stock options payout and I have the opportunity to easily pay of the the mortgage but I’m still on the fence! Being in my 50s it would be nice to have it paid off but I really like to have as many liquid assets as possible (‘money in the bank’ per se). As of now- the money that I would use is in a high yield savings account making 2.05%. Still not sure.. LOL

My two cents is that either option is fine, it’s really a personal preference at this point.

I would probably pay off the house, but that’s just because I prefer to owe nothing to anyone (which in itself is simply a personal preference).