If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in August.

My questions are in bold italics and his responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 34 years-old, my wife is 33 years-old.

We have been married for 8 years.

Do you have kids/family (if so, how old are they)?

We have two children.

A daughter that is 3.5 years old, and a son that is almost 2.

What area of the country do you live in (and urban or rural)?

We currently live in a small city on California’s Central Coast.

It is a high cost of living area, but we are only here temporarily. I am an Active Duty Servicemember, therefore we tend to move every two to three years.

Additionally, our housing allowance adjusts based on the location of our duty station and the local housing market, so our income changes based on our location- offsetting some of the higher costs.

What is your current net worth?

$1.38 Million

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

- Cash: 120k

- Taxable Brokerage: 600k

- TSP Traditional (military 401k): 127k

- TSP Roth: 26k

- Wife 401k: 136k

- 529: 26k

- Wife Roth IRA: 80k

- Wife Traditional IRA: 43k

- My Roth: 108k

- Inherited IRA: 124k

Across our investment accounts we are roughly 55% in Total Stock Market/S&P Index funds, 20% International Index, 20% Small Cap Index, and 5% alternatives.

I don’t value my anticipated pension or the GI Bill that I have transferred to my children as part of my net worth, but they certainly factor into our future.

I start collecting the pension upon retirement and it will yield about 55k a year in present dollars and adjusts with the cost of living each year.

The GI Bill will cover 4 years of in-state tuition at a public university, so it will certainly defray a huge expense for us in the future.

Debt: 6k on credit cards, we use a card for everything. Payment happens automatically each month, have never missed a payment or carried a balance.

EARN

What is your job?

Me: I am a mid-grade Military Officer with 11 years of service.

Wife: Contracts manager in the pharmaceutical/clinical trials industry.

My wife currently works part time (24 hrs/wk) from home which began after our daughter was born. She could easily be the breadwinner of the family if she remained full-time and switched companies a few times as opportunities came to her.

She enjoys the part time work as it allows her to spend plenty of time with our children, while still allowing her to work and be fulfilled in an area outside of just her children.

After our next move in the summer of 2021, she will likely transition out of her current position to homeschool the kids. Decision isn’t yet final, but I think it’s trending in that direction.

What is your annual income?

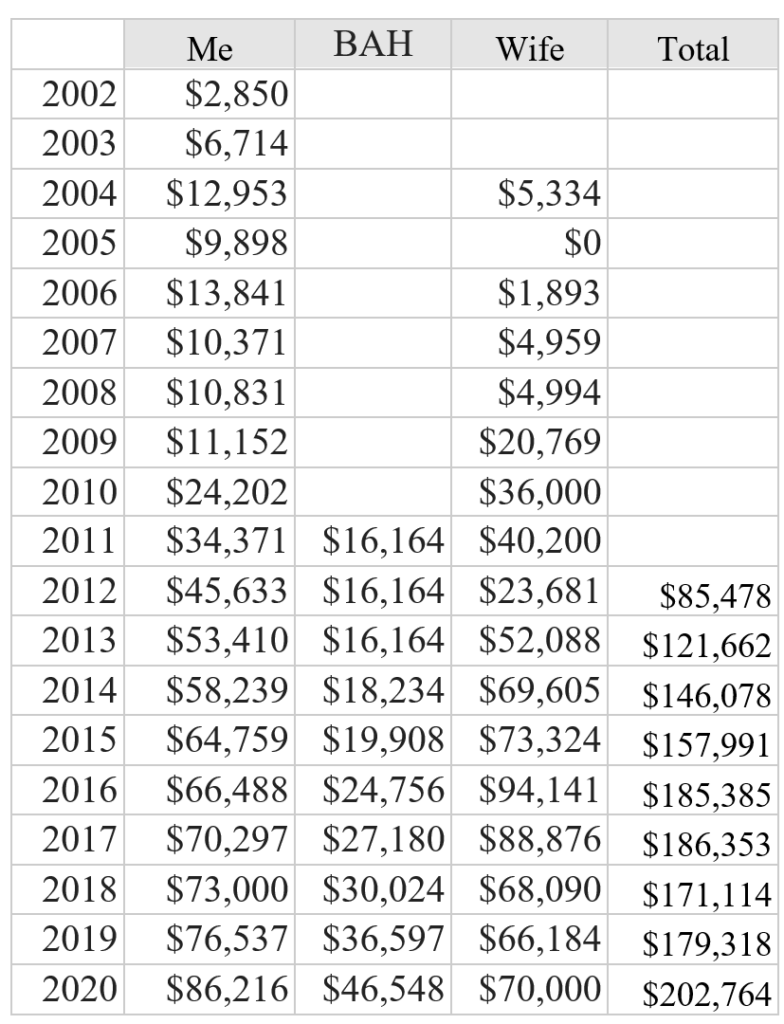

For 2020 our total income before taxes will be $202,764. The breakdown of who earns what is below.

One note on military pay, we receive our base pay, a housing allowance, and some folks with special skills also receive special/incentive pays (aviation, language, undersea pay, jump/dive, etc). Pays are taxed, allowances are not.

The housing allowance increases as you promote and varies based on your geographic location. I have broken out the BAH earnings below as they do not appear in my SSA earnings record and as our last 3 moves have brought us from a very low cost area to a very high cost area, the portion of our income generated from BAH has increased.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

My first job was assisting the groundskeeper at a local church during the summer’s and school breaks when I was 13 years old in 1999.

I transitioned that into a payroll job when I was old enough and took a second job at the local gas station the summer I was 15. I wasn’t old enough to drive and opened the place up each morning at 0500, so I would get up at 0415, walk 2 miles through the woods (it was shorter than the roads), work my shift, then walk across the road to work at the church. Both jobs paid minimum wage.

The summer of 2004 I worked as a laborer for a chimney company. I started at $15/hr, but worked hard enough that by the end of the summer they were paying me $20/hr, pretty big money for a young kid. I worked the same job in the summer of 2005 except overtime pay was done a little differently that summer.

What I learned from those summer jobs was the value of working hard. I didn’t get that $5 raise at the chimney company from just putting in the average effort or matching the effort levels of the other guys. I got the raise because I outworked everyone else and used my brain a little more to anticipate what we needed to do and did it before being told (which often caused me to work a little more).

From then on, all those earnings are military related, first as an enlisted service member, then through the service academy days, up to today, where salary growth is tied to promotions and time in service. There isn’t much I can do to influence wage growth.

Below is the breakdown of our salary over the years, before taxes. I include a total starting the year we were married.

What tips do you have for others who want to grow their career-related income?

As a military officer with zero civilian work experience I do not have much control over the growth of my salary. My raises are controlled by the federal budget and the timings of promotions are largely based on time in service. You need to perform in order to be competitive for promotion, but aside from that, there isn’t much else one can do to get ahead of your peers.

That being said, I truly believe that the career growth is a mix of buckling down and doing unpleasant assignments well, while being willing and open to taking risks by getting off of the “prescribed” career path for a given job/industry to take fun and unique assignments as well.

The military is keen on its officers following a somewhat rigid career path, but I have certainly deviated from it throughout my career and feel that I am better off for it. I have gained different but excellent experience, I feel it has improved my ability to lead and relate to my subordinates, and it has kept me fresh and wanting to succeed versus burnt out and bitter.

What’s your work-life balance look like?

In my current assignment it is very good. I work 40 hours a week, short commute, no deployments, a ton of family time.

My next assignment will not be as balanced, much more work, and I will likely deploy for 6 to 12 months, but that is the nature of the business.

In the military we often rotate between operational and support type assignments. If I retire at 20 years as planned, I will likely spend 3-4 years serving in a demanding operational job with long workdays and a good chance of 1 or 2 deployments. The other 3-4 years will be in a support role, which tend to be more like your average 9-5 job in the civilian world.

This will vary based on available positions, the timing of one more promotion which I expect to happen in 4-5 years, and they types of jobs I am assigned to.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

No, we have never generated any income besides our jobs and interest/dividends which are all reinvested.

SAVE

What is your annual spending?

According to Mint, which I update and categorize almost daily, over the past year we spent $7,031 a month, $3,200 of which is rent in our high cost of living area. A far cry from being Mustachian, but we work hard to keep our frivolous spending down and I think it shows.

This has increased over the past few years as we have added children into the mix and they began to grow, but for the past 2 years the number has been fairly consistent when factoring in the fluctuations in housing costs. (Our current rent is almost 2.5x the cost of our rented home from 4 years ago due to cost of living differences.)

What are the main categories (expenses) this spending breaks into?

- Alcohol and Bars: 2,000

- Auto incl Insurance: 2,100

- Kids: 1,300

- Childcare: 19,330

- Charity: 2,900

- Food (in/out of home, mostly in): 13,000

- Phone/Internet: 870

- Gifts: 1,600

- Pets: 800

- Rent: 38,400

- Travel: 4,000

- Clothing: 1,100

- Entertainment: 750

- Personal Care (haircuts and toiletries): 800

- Home Stuff: 500

- Misc: 1,100

Do you have a budget? If so, how do you implement it?

We do not have a budget.

We have worked hard to be wise and “frugal” with our money. We’ve trained ourselves to make good spending decisions and do not need to have a budget to govern our spending.

In lieu of a budget, I use Mint to track our cash flow. I monitor our spending daily via Mint transactions, I use the budget functionality as a means to graphically show me where we stand throughout the month, and outside of Mint I maintain a monthly spending spreadsheet that is updated at the end of each month.

The spreadsheet allows me to track all our spending, investments, and income, summarizes it all, and feeds into a yearly total sheet.

My wife and I review the spreadsheet each month and discuss any issues that arise. If a category seems to be exceeding our typical spending, we talk through it to identify the cause and put it on our radar so we monitor that type of spending going forward.

The spreadsheet itself is probably redundant, but I have gotten the process to be very efficient, so it only takes about 20 minutes to do. I feel that it allows me to get up close and personal with where our money is going and grounds me, so I keep it up.

What percentage of your gross income do you save and how has that changed over time?

We save about 50% of our after-tax income. This has been fairly steady over the past 11 years, some years higher, some slightly lower, but 50% would be about average.

What’s your best tip for saving money?

Do free things, especially hobbies. When doing free things, do them with quality used gear. Avoid subscription services.

I know so many people that play golf, go to the movies, go skiing, have ten streaming services and cable, etc. All fun things, but all pay to play.

We do a lot of walks, we run, I surf with one used board I bought 7 years ago, we kayak with one used kayak we bought 8 years ago, I fish with bait I catch and freeze myself, we bike with two used bikes and a used kid trailer. These activities are fun, healthy, and can be done well without the need for the best and newest board, bike, or name your consumer goods item.

Some people have a fascination for new and shiny toys, a lot of which end up gathering dust or sucking up a monthly fee for minimal use. Be smart with your choice of hobbies and the money you spend on the gear to do them.

Find good things that someone else paid a premium for, let gather dust for a few months or years, and are offloading at a bargain.

Pay close attention to things with monthly fees, they are often underused and can be a massive drain on your money.

My wife and I are in great shape without the cost of a gym membership. I run, bike, and use 3 kettlebells I bought used. She runs and does workout classes from home using Beachbody on Demand which only costs $100/year versus $100 bucks a month in gym memberships and class fees.

Never buy your young kids new clothing — high quality used clothing is so easy to find and can usually be purchased at a 90% discount when compared to new clothes.

What is your favorite thing to spend money on/your secret splurge?

We don’t really have any big splurge items at this time.

My wife would say it’s beer for me.

After living in the Northeast for three years and drinking beers from the likes of Treehouse, Trillium, The Alchemist, and Hill Farmstead, I have grown fond of high-quality craft beers. But I only have one pricey beer before I switch to “normal” beer, and typically only have 2 “fancy” beers a week. What’s the saying? “Life’s too short for cheap beer.”

INVEST

What is your investment philosophy/plan?

A (mostly) true follower of the index approach championed by MMM, JLCollinsNH, and many others.

We do all our investing outside of my TSP and my wife’s 401k with Vanguard. I have automatic transactions scheduled for every Monday to maximize our ROTH IRA’s and to contribute to our brokerage account.

These transactions are 60% total stock market index, 20% small cap index, and 20% Total International Index.

I used to do it monthly, but about 3 years ago decided to make the transactions weekly.

Long term buy and hold, no thought of selling, even during the COVID slide.

What has been your best investment?

As we’ve been mutual fund investors, and predominantly index investors, I do not have any exciting stories of a big IPO purchase or a home that doubled in value.

I think the best investment has been choosing to join the military and to attend a Service Academy.

It has provided me a rewarding career that I enjoy, has allowed me to get both my Bachelor’s and Master’s degrees at no cost to myself except for longer commitments to serve on Active Duty, provided me with the GI Bill which I have transferred to my children (saving us the cost of one kid’s college education), provided me a stable career in turbulent times (I graduated from college in 2010), and will provide me with a pension that begins the day I retire if I reach 20 years of service.

What has been your worst investment?

A boring investment strategy also doesn’t lend itself to any horror stories of poor investments either. My International Index fund has underperformed both my Total Stock Market Index as well as my Small Market Index funds, but I think that may change sometime in the next 50 years and I will be happy I continued investing in it over the years.

I sometimes wish we had bought a home at our first duty station and rented it out over the years. We like the area, intend to go back again, and may even retire there. House values have appreciated well over the time I have been on Active Duty and it would have been nice to capture some of those gains.

The main reason we didn’t buy back then was the fact that we like to keep things simple, and maintaining a rental home, even with a property management firm, while working a full-time job with two kids just doesn’t seem simple. Too many potential headaches, especially since the area is prone to major hurricanes and flooding.

What’s been your overall return?

For everything I have tracked over the years, I really haven’t ever tracked my overall return.

Combining some information available on some of my investment interfaces, I would assume it is between 7-9%.

How often do you monitor/review your portfolio?

I check Mint daily and when doing so will look at the values in each portfolio, but that is about the extent of it.

I have set everything from bills to investment purchases to automatically execute so it really doesn’t require all that much day to day maintenance.

NET WORTH

How did you accumulate your net worth?

We live below our means, don’t let our lifestyle expand as we earn more money, stay frugal, and consistently invest in Index funds.

My Father passed away in 2018 from lung cancer, a horrible disease that I do not wish on anyone. He left his three kids with the balance of an old 401k that was valued at 116k in 2018, as well as 50k in a small life insurance policy.

We donated a chunk of the cash to some of the organizations that helped my Father fight his cancer over the year and a half battle, and everything else was immediately invested into Index Funds (the inherited IRA and the cash into the brokerage account).

Outside of the inheritance, everything has been earned through income, maintained through smart spending that translated into a high savings rate, and has grown through steady investment.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

I would say our greatest strength is in the savings category, especially compared to our peers.

By no means do we lead a stingy life, but we are smart in what we spend on, and we limit the wasteful spending that seems to be so common among our friends, family, and larger society.

This smart spending allows us to enjoy life, while also feeding our investment accounts that will fund our post-retirement life.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

Honestly, I cannot really identify any major hurdles or road bumps. Our long term outlook allows us to look past any market fluctuations and we have been fortunate to not experience any issues that impacted our ability to earn an income or force us to spend money on things like health related issues or any large and enduring emergency expenses.

Getting my wife on board with my frugal and save first mindset was probably the closest thing to a road bump for us. By no means was she an excessive spender before we met, she wasn’t carrying credit card debt or anything like that, but she also wasn’t investing and saving that much either.

It was a bit of an adjustment for her to throttle back some of the excess spending and see that money flow into investments. Now there are times when she is even more fugal than I am.

What are you currently doing to maintain/grow your net worth?

Continue to remain smart spenders and feed our investment accounts.

If/when my wife stops working we will not be able to invest nearly as much as we have in the past, but based on my calculations, the lack of her income will not set us back on the path to an early retirement – it simply limits the eventual size of our net worth, which really isn’t a current concern for us as we anticipate maintaining enough to stay retired.

Do you have a target net worth you are trying to attain?

No, not really.

I’d like to see 2,000,000 before I retire, but we don’t actually need that much in order to retire due to my anticipated pension.

How old were you when you made your first million and have you had any significant behavior shifts since then?

32. No, not at all.

It was cool to see our net worth crack a million, I took a picture, then moved on.

What money mistakes have you made along the way that others can learn from?

Hard to say if I would do anything differently, who’s to say things would have worked out any better?

I guess I wish I would have started investing even sooner, but even then, it might not have been beneficial.

Through high school I kept all my earnings in a checking account, but there’s almost no chance I would have invested that money in a smart way back then. I likely would have gone to the local bank and allowed them to put my money in a load fund with a high expense ratio. Who knows, I might have been worse off now.

What advice do you have for ESI Money readers on how to become wealthy?

ESI Money has this thing figured out. Earn Save Invest — such a simple mantra, just rarely followed.

I highly encourage young folks to look at where their money goes and truly evaluate the expenses in your life. Do the things you are spending your money on really contribute to your happiness in life? Should we tie our happiness to spending money on material things and monthly subscriptions? Will you be happier by spending your money more efficiently, saving a larger share of your income, which then opens a wide range of opportunities for you a little later in life. Breaking your back each week to bring home just enough money to support a ton of frivolous spending doesn’t sound fun to me.

We live in a time period that almost everyone has a supercomputer in their hands that costs more than a fridge and ties us into a contract that forces us to send large sums of money to a service provider each month. These devices then enable other companies to entice us all to sign up for a multitude of subscriptions that siphon money from us each month and also make it way too easy to order a cab, take-out food, or really anything with a few swipes and clicks.

Figure out where you are hemorrhaging money, stop the bleeding, and invest it smartly. Not everyone needs to be so frugal that they can retire at 30 on 100k, but everyone should be frugal enough that they can retire at 65 with enough money to live on it until 85.

I believe the key to doing so is understanding the power of compounding and the long-term costs of frivolous spending. If more people understood that money saved today will double every 10 years, folks might be more apt to trim their spending, delay some gratification, and fund their early or traditional retirements.

FUTURE

What are your plans for the future regarding lifestyle?

I reach 20 years of military service when I am 43, and I have every intention of retiring and never having to work a “real” job again.

Between our savings and the military retirement pay I will begin to receive immediately upon retirement, we will be financially independent (throw in the transferred GI Bill that will cover one kid’s college tuition, and we are in even better shape).

What are your retirement plans?

I’d like to be involved in the kids sports teams, volunteer in some military related financial counseling organization, serve beer at a brewery or pour wine in a tasting room a few times a month, and maybe do tax prep during the tax season to stay busy when it’s cold outside and the kids are in school.

I’d also like to get involved in some more interesting pursuits like building some houses with Habitat for Humanity to stay busy and learn some things, maybe start a small business doing kayak tours or guide fishing trips, maybe flip a house or try my hand at being a realtor.

That’s one of the exciting aspects of FIRE — the ability to go ahead and do some things in life that may not make sense, may not work out, don’t necessarily pay well or anything, but it doesn’t matter — you don’t need the money so you can go do them.

We also hope to begin fostering children, which will certainly keep us busy in early retirement.

Financially, I plan to be receiving my military pension that should be worth roughly 55k/yr in present dollars and adjusted with cost of living increases each year. We will likely not be able to live completely off my retirement pay, so we will likely supplement it with part time work (like the part time tax prep gig mentioned above) or draw down our investments in our brokerage account.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Health care is a slight concern. Each year the retired military healthcare benefit gets a little more costly, so who knows what will happen over the next 40 years. That being said, it is certainly not as costly as the open market, so it’s not a huge concern.

I am slightly worried about being bored, but I have the desire to try a lot of different activities and pursuits, so I don’t think boredom will become an issue.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

I have always been frugal and a saver. I can remember squirreling away birthday money as a kid and keeping a ledger on an envelope to keep track of it all from a young age.

I started investing a bit when I joined the military in 2006, but really got interested in it during college in 2008/9.

It wasn’t until I was introduced to MMM in 2012/3 that I figured out this whole FIRE thing existed. By then, we had already begun accumulating our stash, we just now had a name for it, and a little more motivation to trim some spending and aim for the goal of financial independence.

Who inspired you to excel in life? Who are your heroes?

I’ve been extremely fortunate in life to have several inspirational and genuinely good people in my life.

I likely learned a lot of my frugality and hard work ethic from my grandfather. He grew up poor, lost his Mom when he was very young, and gave up a college scholarship to play football because he didn’t have enough money to buy shoes and didn’t think he could go to college without shoes. He also needed to get to work in order to help provide for his younger brothers.

My grandfather and grandmother worked hard and became the typical millionaire next door — he was a cop, she was a nurse, never had fancy cars, the same house for 60 years, but they used their money wisely and didn’t waste their money on frivolous things. That allowed them to travel a bit as they were older and freely spend money on their children, grandchildren, and friends.

My father was also a huge influence on my life, teaching me a lot about loyalty and resiliency. He worked for the same company as a salesman, then director of sales for over thirty years.

He was laid off in 2010 and spent a good year or two struggling to find a job. The job market was tough, especially for someone in their 50’s. He took on a few jobs that he was way overqualified for, managing a school bus lot at one point, but finally got back into industrial sales.

Just a few years later he was diagnosed with lung cancer and fought that for a year and a half, coming to the brink of death at least twice over that time period. He never complained, he never whined about how it was unfair, he never did any of that. He just took it a step at a time and tried to beat it. Everyone who knew him believed it was completely unfair, he probably did too, but he didn’t dwell on it or let it ruin the time he had left.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

If/when I get into discussions about personal finance with folks (my wife has directed me to limit my unsolicited financial advice-giving discussions with people we know/meet), I always direct them to The Simple Path to Wealth and jlcollinsnh’s blog. I find that his message is very clean, easy to understand, sprinkled with some good humor, and approachable.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

Yes, we do, but it isn’t a staggering amount.

We also do some volunteer work and help contribute to different ministries in our church (like preparing meals for the homeless, or for people in the community in need of some meal prep due to hard times, surgeries, etc).

I don’t think we will ever increase this that much until we are much older and know our savings will sustain us till death, but we plan on volunteering a lot and I think that certainly helps to offset the lack of monetary charitable giving.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

I have yet to fully figure this out and I hope to have a lot of time to think it through in the future.

According to most of the retirement calculators that are out there, we are likely to have a good chunk of change kicking around when we get older. We certainly plan on leaving some of it for our children, but I hope we live long enough to see them have successful careers, save and invest smartly, and earn their financial freedom as independently as possible.

If not, I hope that we are able to give them enough money so that they can at least scale back their work in order to spend time with their families and pursue fun and interesting activities like I plan on doing in retirement.

As we get closer to “old age”, I also hope to be in the position to significantly increase our charitable giving. I’d prefer to distribute whatever percent of our net worth we don’t intend on using or giving to our children before we pass away.

I’d like to see the results of any charitable giving we do. Not for recognition, I’d probably do it anonymously, I hate attention, but to see what our money did. We made it, saved it, and invested it. Might as well see the fruits of all that effort instead of missing out on the end result because we’re dead.

I like that he mentions “being a Mustachian”. That means he spends time reading about being frugal.

The idea of retiring at 43 and being financially independent sound so good.

Congratulations.

Nice going man. Congrats

THIS.

I love that you’ve traveled the ‘boring road’ to Financial Independence. It shows that its possible for just about anyone. My road runs parallel to yours in a civilian world, but also a boring, simple approach with the ESI principles.

Two favorite take aways:

1) You can absolutely still buy/trade/aquire “stuff” that makes you happy in a cost effective way. It boggles my mind why people buy most stuff “new”. I’ve always loved flea markets, estate sales, etc. so maybe it’s just in my DNA. I relocated from USA to Germany 2 years ago and the ‘culture of consumerism’ is SOOOO much better in Germany vs USA. Also, there’s an unneccesary stigma in USA about ‘second hand goods’ thats just never made sense to me…

2) Smart wife regarding advice-giving! I’ve taken a very similar approach by trying to simply share some resources that were interesting/helpful to me. I leave it to the other person to then bring it up again.

Yes, she is quite intelligent.

I agree about second hand goods. We never thought twice about accepting hand-me-down kids clothes (before they became teenagers) from relatives/friends even through we have a multi-million NW. The clothes were hardly worn and still in fashion since kids grow out of them so quickly. We did the same with our stuff once our kids outgrew them. Lot’s of my electronics are refurbished, not new. I don’t mind last year’s model as they are more than ample for my needs.

What an incredible journey to read.

First of all, congratulations on your success – and for maintaining your amount of wealth.

And second, I wanted to say that I really admire your father. I’m so sorry to hear about his struggles – financially after he was laid off and health wise – but his path and how he fought through the difficult situations is truly incredible.

I think there is a strong lesson to be learned: Don’t waste your time complaining over a situation that’s out of your control. Focus on what you can control and make the best of it.

I’m really impressed and wish you luck on your journey.

Fiona

Thanks Fiona. I look forward to reading through some of your posts on your site when I get some free time.

First let me thank you for your service, and second please accept my sympathies for the loss of your Dad. Thank you also for sharing your story and planning details.

As someone is who is in the last third of their working career, I would urge you to think about developing more plans around your post military retirement career. You have listed several good options and choices for what you might do, but I would consider a career that resembles the same work and discipline effort you have now. Old habits die hard, and your training and regimen will translate well to many different career options. Start learning now about your possible choices and you will be far ahead of the game when your military career ends.

Thanks for the advice, I agree old habits die hard and know plenty of folks that have gotten out of the military (usually after 4-8 years) that regret it and want back in.

I’ve kicked around a bunch of ideas, but I don’t think going into a regimented, full time, 9-5 type job is what I am looking for after I retire from the military- you may be 100% right and after a few years trying it when I get out I may be eating my words… After experiencing some flexibility in my current assignment due to the nature of the assignment mixed with COVID, I can certainly get used to the idea of more freedom and flexibility.

That’s where the idea of financial counseling volunteering, tax prep during the late winter early spring and some mixture of part time work as a kayak/fishing guide, craft beer server, etc the rest of the year comes in. Try to stay busy, be productive, but not committed and locked in to a grind.

Really liked the part about looking at where your money is going all the time. Many people have excessive money leaks and dont put any effort into correcting it. Really start questioning the status Quo and understand and challenge all of your expenses and spending habits. I know they say to focus on the big expenses, but over time you should fine tune all of your expenses. Its not just about being cheap or frugal but about the principal. Companies love to coral the sheep and get them to believe that you “need” this car, product, or to eat at this restaurant to be happy. Plus they keep on raising their prices and “fees” that they sneek in there on you. Dont accept it. Find ways to cut back or cut out the things you dont really need. Have a fight back attitude and also learn to do things yourself when possible.

Awesome job! Really shows what discipline and having the right mindset can do. It’s also awesome that you have your family who came before you as inspirations and how they have instilled the importance of financial education and being comfortable with what you have.

Great interview! Clearly, this family is well-grounded with a great financial and life plan for the future. I was never this grounded in my early 30s but they have learned the critical lessons of financial planning at an early age that they are now acting on in order to assure financial independence.

Well done and best of luck on the road to lasting prosperity!

Well done!

Don’t underestimate your potential VA rating, if you’re broken through the military the VA will compensate you tax free for the rest of your life.

Don’t be too proud to go through a VA medical evaluation prior to retirement. You deserve it

Wonderful post. Thank you for sharing.

Great post!

I would recommend you factor SBP into your retirement planning process as protection for your spouse/family.

Are you stationed at Vandy? My Dad was stationed there in the mid 70s and I was stationed there in the late 90s. My parents actually built and owned a house in Vandenberg Village. Looks like it would’ve been a nice return if they had held onto it. I definitely miss the Central Coast. My wife and I enjoyed the area immensely. We definitely miss the wineries. Congrats on the progress to FIRE!

Regards,

Ryan

No, down in Monterey, but I too have enjoyed our time here. I’d consider retiring here but it is so expensive and my wife wants to be a little warmer…

Monterrey is beautiful. We used to vacation to the military lodging at the Naval Postgraduate School. We were telling our kids the other day about our trips up there and how the peacocks used to wake us up in the morning.

Unfortunately, no more peacock s…

A very impressive journey that shows what you can achieve with a high level of consistency and discipline! Chapeau!

Im just wondering how you were able to maximize your investment returns.

Assuming you have saved around 50k per year for the past ten years and everything went into S&P 500 index funds (approx. 14% average yearly return over the past 10 years), you would have ended up with close to 1 mEUR.

You managed to save close to 1,4 mUSD! (Congrats to that!)

Have you invested in single stocks as well in order to boost your yearly returns even above the extremly good SP500 performance?

Thank you for your answer,

Tobi

Tobi,

Thanks for your kind words.

I purchased a small amount of individual stocks about 5-10 years ago, but never really invested heavily in single stocks. I no longer own any single stocks and am mostly an index investor with some allocation in alternatives indices, (real estate index, energy index, emerging market index) but still index funds. The difference is likely from us investing more than 50k a year in some years.

Congrats. A millionaire at 32 is a commendable achievement.

My condolences on your Dad’s passing. That had to be very difficult.

This is just an observation and not meant as anything other than exactly that, but for a 34 year old, you come across much older. I mean, you are still in the “young folks” category from my perspective 😉

That’s probably your military background speaking and experience in communicating and “thank you for your service”. You are prior enlisted which is awesome. When I was in the service, that was the issue I had with the bootstrapping process from enlisted to commissioned because you were forever after considered prior enlisted. I thought of it as a little elitist given the only difference was a relevant degree a few years earlier in most cases and decided not to do it even though I was being hounded to at the time by superiors. I left after one term but I firmly believe that the military provided the basis for my subsequent successes in life.

The frugality here is a little too much for me but that’s why you hit a million in your 30s versus those of us hitting that status much later. and what you have done is difficult to do and requires a LOT of discipline. It all depends on your life goals. I’m a technologist and having that piece of equipment in my pocket is just as necessary for me as having a fridge is for you. Now if I was in a different job, then I’d choose the fridge of course.

Some great tips on “knowing” where your outgoings actually are. You can control how much you spend on subscription services etc., if you “know” where your money is going and are constantly evaluating the worth of those services to you. Just my 2 cents.

It all comes down to perceived value versus cost within the context of long term goals. And of course, being deliberate and intentional.

Kevin,

Thanks for your post and observations. I totally agree that subscriptions can be and are extremely useful, if used. 30 dollars a month to some company for a service that is never used is wasteful, and I know of many people that have 2-3 of these types of subscriptions going at the same time.

Additionally, many folks have gotten comfortable or conditioned to think that 100 bucks a month for unlimited to access to youtube or social media is a necessity, when it’s really not, and could be argued that it may even be harmful. If you run your own business, make a bunch of money as an influencer, etc, maybe it is a necessity, but for the average consumer it’s probably not.

Like your last comment, the deliberate and intentional use and savings of one’s income and money is what I think is lacking in society. Paying more attention to where and why our money is going certain places could help many people get out of debt and become better postured for their futures and retirement.

A fantastic job, you reached your first million about a decade before I did. I am also a military officer, we reached FI about a year or two ago with a net worth over 2 million and with my current commitment, a pension a bit over 100k in three years. I too planned on getting out at 20, but Uncle Sam keeps giving me one interesting job after another, even if the moving seems to get less fun each time. One of the things I tried to do is put a value to the pension, if you considered it a very safe annuity, risk low that it is not paid, then based on a post on Financial Samurai, I use 3%, which for your 55k pension, would mean an annuity with a value of about 1.83 million. Puts the pension value into perspective, makes you consider a few more years working for Uncle Sam not seem so bad.

Congratulation to you as well Sir. We aren’t locked into leaving at 20, but it would take a great job to keep is in much past 20. I’ve thoroughly enjoyed the last 12 years in the military and have 0 complaints, but would like to just try some new things. There is just so much to do, explore, and try in the world to justify staying in if I don’t “need” the income. But the option is certainly on the table, heck, I need to get to 20 in the first place!

The value of the pension is certainly in the back of my mind (and my personal capital retirement planning calculator) but I don’t include it in Net Worth for a variety of reasons like not making 20, dying the day after I retire, etc. Just like to see the value of tangible assets- just my preference though.

Thanks again for the comments and I hope the juicy assignments keep rolling in and you continue to enjoy working while building your nest egg!