If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in December.

My questions are in bold italics and his responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I’m 33, my wife is 32, married for a year.

Do you have kids/family (if so, how old are they)?

We have one son, with hopes for more children in the future.

What area of the country do you live in (and urban or rural)?

We live in the urban west coast.

I’ve lived in the same city for about 6 years and she moved here 4 years ago. Before that I lived abroad and she lived on the east coast.

What is your current net worth?

Money: $6.1m

However net worth as purely a financial measure is misleading. If we take a definition of net worth as the value of assets under an individual’s control, and we define asset as something that can help you achieve a useful objective, non-monetary assets are often more valuable than money.

Real net worth is ‘potential energy’ that can be used towards a given objective. Furthermore, net worth changes depending on what time horizon you look at. Even if considering money alone, the amount of money deployable tomorrow (cash on hand) is very different than the amount of money available within a year (selling real estate assets).

- Time: How much time do I have awake and available to spend on things I want? (family, career, learning, etc) 336k hours / year.

- Capacity: How much does self discipline and my internal emotional state allow me to do the things I want? 120k hours / year.

- Relationships: What can I accomplish using relationships? This matters both inside the company I work at, friendships I’ve developed and the network of weak ties built up in tech in real estate. ~1000k hours/year

- Organization: How can the people who report to me (in my own business and at work) help accomplish a given objective?

- Money: What are the assets that I have that I can use to help accomplish something?

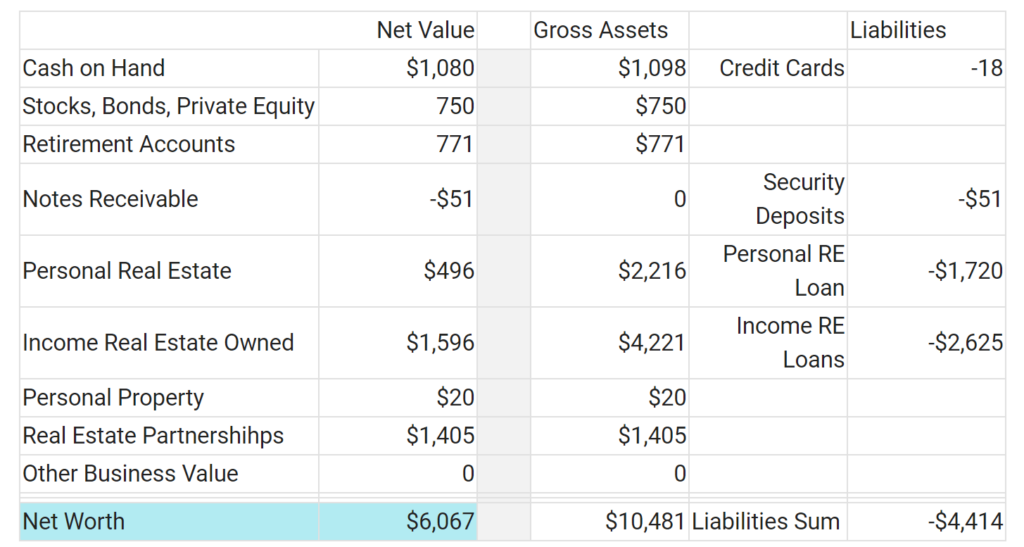

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Time: We all have 24 hours in the day.

Capacity: There are about 20 daily habits that I do in the morning, which keeps most of my life on rails. This includes everything from meditation to a healthy breakfast to catching up on email that came in from the previous night.

Relationships: Perhaps the most important relationships that I have are those with mentors, especially in my tech job. Learning from people who have been there is the fastest and most efficient way to learn.

Organization: Most important people are the ones that I can delegate meaty problems to. Right now that means my construction lead, property management lead, and engineering counterpart.

Money:

EARN

What is your job?

I work in tech as a manager of an org of ~40 that works with an engineering team of ~250 engineers.

I’m about in the middle of the hierarchy, 3 steps to the CEO, but with two additional layers of managers below me.

Since I’ve been riding the tide of a growing tech company, my job has changed substantially over the last 6 years, from engineer, to team lead, and then managing managers across different parts of the company.

What is your annual income?

Between me and my wife and me we are at $2.8m w2 income this year.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

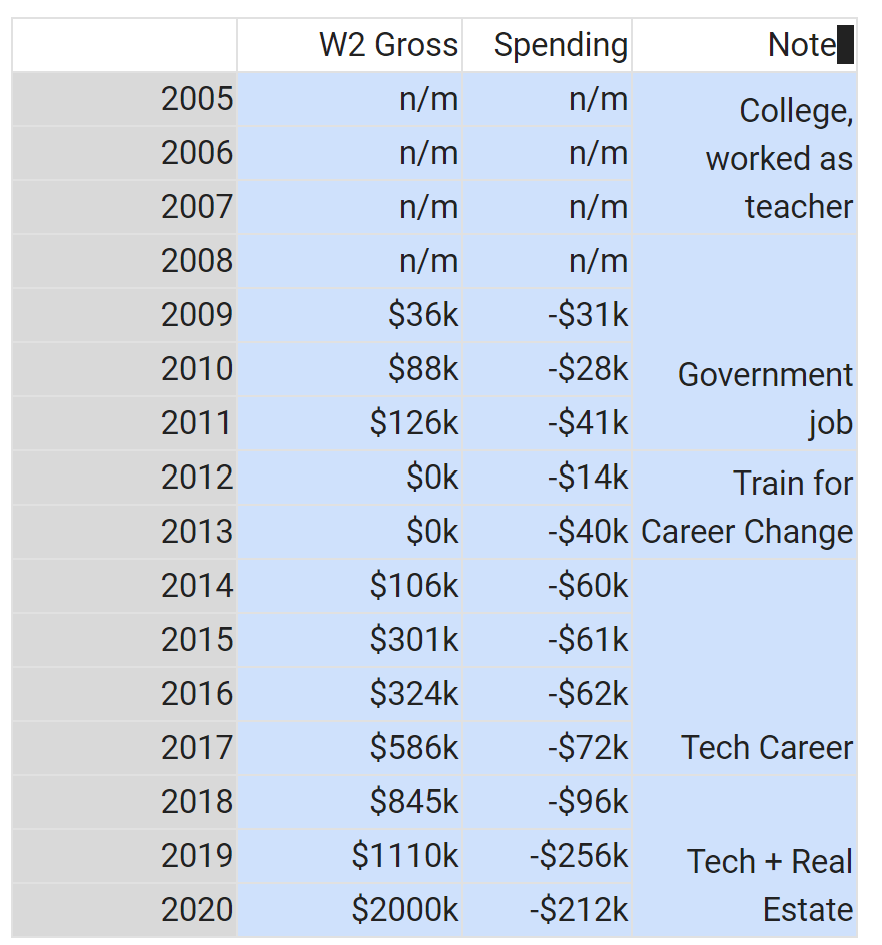

For Money:

I’ve had roughly three different careers over the course of time.

First I worked as a teacher, which made reasonable money for an 18 year old, but was nothing near building a career on.

Next I worked in the government, which provided a solid middle class income with low expenses, and the means to build up a nest egg to do the things that I actually wanted to do.

After I had about $100k saved up I used this to both do what I wanted to (live abroad for a few years learning) and switch to a career that would be the most advantageous (tech).

Once I started my tech career, things really started accelerating, and adding real estate during boom years has led to lucky returns.

What tips do you have for others who want to grow their career-related income?

Pick the right career.

I see people I don’t respect in real estate or the right startups making millions, and then I see others who work very hard and are equally talented struggling to make $50k a year. It’s easy to commit the fundamental attribution error that people who work hard will be rewarded, but so much more of it is about luck.

Over the long run, you can choose the industry you are in, and whether the tide is going with you or going against you. When it comes to income and building wealth, luck (i.e. what industry, what company) is far more important than skill in the job itself, but there are ways to try and stack the deck.

Making the switch from government to tech had a substantial impact on my career-related income.

What’s your work-life balance look like?

For me it’s more w2-invest-life balance.

I took the last month off for parental leave, and will be taking a few more months off in 2020.

A typical work week means about 50 hours dedicated to my w2 job and 5-10 hours focused on real estate.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

The main source of income besides career is real estate.

I started multifamily residential investing in 2016, and did a bunch of calculations to determine that it would only be worth the time if I invested a substantial amount of money into it. So I did. Started with a triplex, then bet on a 12-plex, and kept going after that.

I’ve been slowly building this into a property management, construction, and wealth management business over the last 4 years.

This year the delta in net worth was equivalent to my day job.

SAVE

What is your annual spending?

On track for about $220k this year.

This has expanded rapidly with income. Decisions that would have horrified me 3 years ago, like paying $1.2k a month for a car lease, don’t even give me pause when I think about the time/money tradeoff involved.

When I lived abroad and was single, I spent far less. Not counting tuition, my expenses in 2014 were about $10k, and when I moved back to the US I lived in an RV for quite some time to save on rent.

What are the main categories (expenses) this spending breaks into?

Interest and taxes for our primary residence, and household help are the largest expenses.

I expect childcare and travel to be the largest non-business expenses over the coming years.

Do you have a budget? If so, how do you implement it?

For money, we do not have a budget.

My bookkeeper tallies all of our personal expenses once a month and I review everything that is over $100 to ensure it’s something that makes sense and that we are accounting for it correctly.

What percentage of your gross income do you save and how has that changed over time?

I don’t track this number.

In my experience trying to save a larger percentage of income is both a low leverage and a difficult to track goal. Low leverage because it leads to thinking about how to spend less, which is something of a dead end, and difficult to track because it changes substantially month over month.

What’s your best tip for saving (accumulating) money?

Make more money.

This could be through career, investments, business / side income, but by far the best way to save up is to accelerate earnings.

What’s your best tip for spending less money?

Gosh, I am not the person to ask about this anymore.

When I was frugal I focused on saving money on rent by finding creative solutions (i.e. car camping). In hindsight I’m not sure that was the right outlet for my mental energy, but it’s what I did at the time, and certainly saved me $100k in rent over time.

What is your favorite thing to spend money on/your secret splurge?

Electronics and first edition books.

Often I’ll set a long term goal with a reward for some luxury item for a reward. This year it was completing a set of daily habits in order to buy an apple cinema display. This way I have more motivation to do the things that I think are important, and can still treat myself now and again.

INVEST

What is your investment philosophy/plan?

Ray Dahlio has a good philosophy here: Make multiple high risk uncorrelated bets.

I’m not at the level of what he would consider to be a diversified portfolio, but between tech career, real estate business, and my wife’s investing career we have a few good irons in the fire that can survive if one fails spectacularly.

At one point I realized that the most important thing for long-term wealth building was increasing the rate of return on my investments. Often the only way to do that is to make investments that a typical investor doesn’t want to do, which is what made real estate attractive. Since it requires both time and capital, there are fewer investors that want to participate, and hence higher returns.

What has been your best investment?

Switching careers.

I took 30 months off of work to learn a new language and learn how to code, which put my life on a vastly different trajectory than the government job I was in.

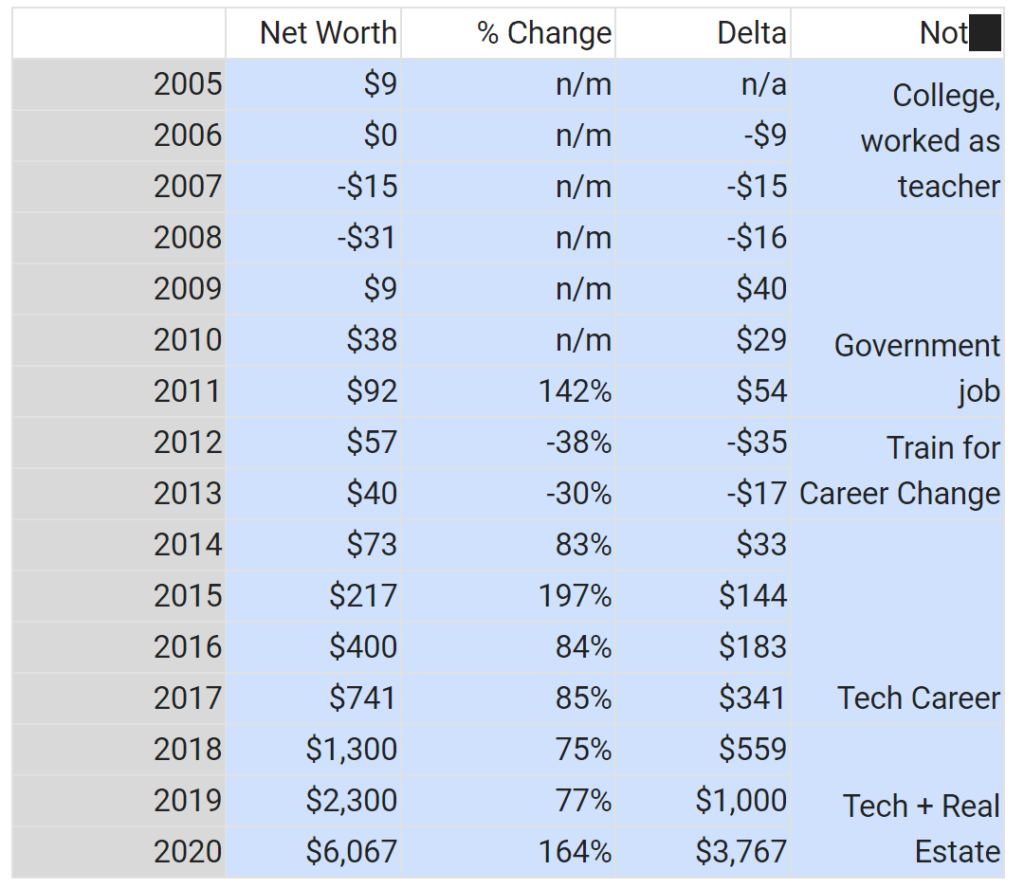

Since starting the new career, my financial net worth has increased by ~100x over 6 years.

What has been your worst investment?

Worst investment has been a specific real estate transaction in 2018.

I made an unnecessary bet with relatively little analysis on a 4-plex in a bad neighborhood. I made the decision in 15 minutes while on a business trip in DC, but the shoddy estimates ended up eating away at the advantages of the deal.

Over time I didn’t do the financing right and am now looking at a ~15% ROI over two years, which isn’t worth the effort that we put into the deal and far below other deals.

What’s been your overall return?

For investments, I target a MOIC of 2.5x over 5 years, which is roughly a 20% annual return.

Having invested in real estate and ridden the wave of the last 4 years I’ve been seeing a MOICs of 3-4 putting returns in the 24-26% range. This is mostly luck, not skill.

I’m waiting for reversion to the mean to strike and for those numbers to come down or even turn negative for a year or two.

How often do you monitor/review your portfolio?

Quarterly financial net worth summary.

Annual investment reviews for every major investment. Right now I do about 20 annual investment reviews, and I’ll need to figure out a way to ‘lump’ investments together so that I don’t have to do as many in the future.

NET WORTH

How did you accumulate your net worth?

Net worth over time…

There were three stages of wealth accumulation so far:

- Government job – I worked in an entry level bureaucratic job saving money as time went on. I left that job for about two years to retool and join the tech industry. While I only ever saved about $100k in this endeavor, it gave me the flexibility to aim higher.

- Tech job – joined a growing company that I enjoyed working for and was relatively successful at. Income grew by roughly 50% each year for the last 5 years as I’ve done higher leveraged jobs for thee company.

- Real Estate Investing – realized I could get above market returns in real estate investing around 2016, and that has been an increasing amount of my portfolio ever since. That accounts for the majority the net-worth jump in 2020 as asset prices have soared.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Earning – while I have saved a lot it didn’t really move the needle.

Investing has been important this year, but only mattered once I was able to earn enough to get the snowball rolling.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

2018 was a tough year as I had to let go basically my entire real estate crew of 7 and rehire a new more professional team.

I also had to improve my ability to deal with stress as both real estate and my day job started getting difficult.

Made a lot of mistakes along the way but our team has come out much stronger for it. Too many career mistakes to list here.

What are you currently doing to maintain/grow your net worth?

Doubling down on the real estate strategies that have worked, making small new bets in other areas (industrial, partnerships, hospitality), and liquidating my failed bets, mostly small properties in rougher neighborhoods.

Do you have a target net worth you are trying to attain?

I don’t. My goals are more around career achievement and projects that I want to achieve.

A higher net worth is helpful but not necessary (nor is it sufficient) to achieve those goals – so most of my effort is on building the capacity, relationships, and organization that can help me achieve that.

How old were you when you made your first million and have you had any significant behavior shifts since then?

That was two years ago.

The biggest behavior shift has been going from: “How can I solve this problem?” to “How can I help somebody else solve this problem?” or “How can somebody else help me with this problem?”

This matters in every substantial area of life, from selecting investments from childcare. If successful, resources and complexity expand, but time remains constant.

What money mistakes have you made along the way that others can learn from?

I could have started dreaming bigger earlier.

It took me until 2014 to really hit my stride with a few failed bets, and if I had persevered on a few higher risk bets, I may have gone a bit more into debt but it would have paid out in the long run.

Still this is a hindsight based learning, and I’m not sure how generally applicable it would have been at the time, especially not knowing if the tech industry / real estate markets would have such a long bull run.

What advice do you have for ESI Money readers on how to become wealthy?

Luck is more important than skill, so spend effort in an area where it’s easier to get lucky. For me that meant tech and real estate.

Especially if in a slower growing field (i.e. real estate) put yourself in a position to capture as much of the upside as possible. Otherwise it’s easy to forever be helping others profit off your labors.

FUTURE

What are your plans for the future regarding lifestyle?

I’d love to do a startup in the next few years.

There is likely to come a point where I will not take a job that doesn’t give me geographic flexibility, but that might still be 5-10 years out.

What are your retirement plans?

I don’t really plan to retire.

There will be a point at which the requirements for what I do with my time change, and I want at least two more careers beyond the ones I am currently in, one doing a startup, and one returning to government. I see these as about 5 and 15 years out respectively.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Not really. I’m pretty comfortable going back to living in a van if I need to, and I’m at a comfortable multiple of that lifestyle with the assets accumulated to date.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

Tech – Back in 2011, I was determining if I still wanted to work in the government when I visited some friends working in silicon valley. They were doing very well for themselves, and it was clear how much different the vibe was in the tech industry than my own. Later that day I decided to leave the government, and haven’t looked back since.

Capitalist – In 2013, while studying abroad with some wealthy scion – I heard him repeating a semi-satirical, semi-serious critique of capitalism: “In a capitalist society, I would advise anybody to become a capitalist”. I used that as motivation to start making money from investments rather than my own labor.

Who inspired you to excel in life? Who are your heroes?

Benjamin Franklin, Marcus Aurelius, and Barack Obama are the role models that I try to emulate.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

The Weekend Millionaire’s Secrets to Investing in Real Estate

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

I’ve done so in a limited fashion.

I hope to give all of our net worth and at least a few decades of my life to causes that we think are good rather than profitable.

Wow – I am really impressed with your accomplishments, congratulations. What I thought was interesting was how you described your net worth to be the potential energy that can be used towards a given objective. You’re one of the very few people who broke down the time they had during a given year and allocated that time to specific activities. You make a great point in that everyone has 24 hours in a day, and that we should be sure to allocate that time wisely.

Choosing the right career path can seriously make or break your future. I sympathize with a statement you made earlier, in that there are some people who put in the same amount of effort for a $50k a year job while there are others who earn significantly more.

Thank you for your candid advice and feedback. It sounds like increasing your income as opposed to solely focusing on savings can help one accomplish their goals.

Cheers,

Fiona

Quite an accomplishment for your young age, congratulations.

My only question is how did you increase your net worth from 2.3 to 6 M from 2019 to 2020? Is that mainly from your W2 and real estate?

It was a combination of markups on real estate assets and a much higher w2 income. I had been conservatively marking up the value of RE investments, and got things reappraised at the end of 2020, which led to the spike.

Thank you for such a great read. If you don’t mind me asking: what programs/languages did you learn during your 2 year break? I am a young professional taking a bit of time off from a high paying but unrewarding corporate career. I would like to dabble in some programming but I would want to maximize the return by focusing on the most in-demand languages.

Learned a foreign language, and then focused my effort at the time on Java so that I could build out an Android app. In general, which programming language you choose isn’t as important as the level of proficiency you achieve with it and what you accomplish with that proficiency.

MI-243, wow what a great story. Congrats on all of your accomplishments at such a young age. Couple of questions:

1.) Can you break down your W2 income among these buckets: base salary, bonus, RSUs/stock options? It is great for you to be in middle mgmt to make this type of W2 income. Also, is the tech company you are working for a public company?

2.) Can you elaborate on your real estate investment strategy and what geographies your properties are located? For example, are you doing a buy & hold strategy? Fix & flip? Residential? Commercial?

Thx

1. Most recently: 15% base, 10% bonus, 75% RSU stock – in the beginning base and bonus were larger percentages. I am at a public company.

2. Investing in the Mountain West and midwest (https://www.economist.com/united-states/2021/04/10/small-cities-in-americas-mountain-west-are-booming). Multifamily and industrial. So far mainly BRRR.

Enjoyed your interview! Our combined income and NW is similar to yours, but I track my income and investments separately from my spouse just because I like to focus on the investments that I control. One of us is in technology, the other a professional. I have a real estate business on the side. Through a series of 1031 exchanges, I ended up with 2 nice, large duplexes in a very attractive location in the mountain west that I recently refinanced for a super low interest rate (equity and great credit), so they now cash flow enough to live comfortably for the rest of my life. I think about leaving my day job, but kids are sooooo expensive, and you want to give them the world if you can (or at least, the best education and opportunities in extracurriculars that you can offer them)!

What you said that really resonates with me is the shift from, “How can I solve this problem?” to “How can I help somebody else solve this problem?” The thing that I’ve focused on the most this least year is how to delegate – at work, and more so, at home.

Do you have a point at which you don’t want to buy more real estate? My two duplexes cash flow a lot now, and when the mortgages are paid off, more than enough, and I can manage them myself (other than I hire out the physical labor involved in the upkeep), so I’m inclined to just paydown the mortgages and not buy anything else, but, maybe it makes more sense to keep buying and hire a team to manage them like you have.

Great interview and best of luck.

With purchasing more real estate, I plan to continue snowballing. A recent 33 unit purchase I did took as much effort as a single family home, and I hope to keep real estate as a professional ‘minor’ to accompany a tech-focused ‘major’.

Wow this is a super impressive story. Thank you for being transparent and going through with all the numbers such as progression of income and progression of net worth. That was the most helpful.

It’s amazing just how much the past 6 years has been for you. It gives me hope that six years could basically be all it takes for someone to go from broke to multi millionaire by taking the right steps and luck.

“In a capitalist society, I would advise anybody to become a capitalist”

Didn’t follow the meaning of this. Can you explain?

It’s fascinating that what people say can have a huge impact and provide us with free motivation for life. I’ve been in a similar situation.

Congratulations on your success, going to bookmark your interview and keep coming back to it!

The first ‘capitalist’ refers to system of society (i.e. as opposed to socialism, communism) The use of the second ‘capitalist’ refers to being somebody who makes their money off of the capital assets they own rather than the labor they produce. The point is that capitalism as a system doesn’t work for everybody but it works very well for those at the top.

How do you have so much time in a year? 336k hours for family? 1000k hours for mentors. This must be the reason how you earned $2m+ in a year!

Seriously congrats, thats great. I can see how the combo of real estate and high income is doing really well for you!

Oops I think these are all off by 1 ‘k’

Awesome!! How much was your tax liability from W2 income? So in effect trying to understand the take home figure.

We paid about $800k in tax last year. The thing is that I can’t really differentiate w2 and real estate because they both interact to affect tax liability.