Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in December.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 41 years old and my significant other is 38 years old.

We’ve been married for 8 years and dating for 5 years before we got married.

Do you have kids/family (if so, how old are they)?

We have 2 kids (a 4.5 year old girl and a 7 year old boy).

They are fun but very tiring.

What area of the country do you live in (and urban or rural)?

We live in the suburbs of NJ.

What is your current net worth?

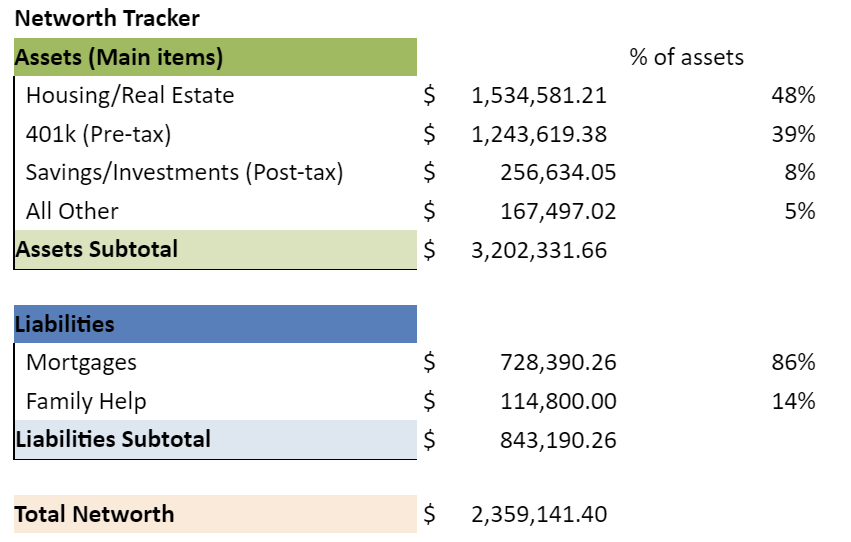

$2.36 million.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

EARN

What is your job?

I work in the financial services firm in the regulatory/compliance space. I am a mid-level employee with no directs.

My spouse is in a more artsy field of architecture.

What is your annual income?

My annual income last year was $223k and my bonus was $41k. My partner’s income was $70k with a bonus of $.5 – $1k.

Our total income was $334k.This year, I am in a higher title position and my bonus band is a lot higher so I am hoping my annual bonus will be around $70k -$90k.

During COVID, my significant other took a sabbatical to take care of the kids. We also made a decision that one of us has to be more local/closer to the kid’s school in case anything happens to them.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I am a first generation immigrant – I came to NYC when I was five years old. My parents didn’t earn much and had low income highly labor intensive jobs. However, we always had enough to eat, enough clothes and a safe place to live/sleep. We didn’t have much money for extracurricular activities (like piano or name brand clothes).

I started working at 14, where I was an office assistant at a local high scale skin/massage salon where my mom worked as a cleaning lady as well as with summer employment programs for teenagers. I also babysat and tutored younger kids in high school to earn pocket money.

In college, I had many part time jobs from federal work study to working as an executive assistant to a wealthy elderly couple to babysitting. Working for the elderly couple taught me a lot of life skills such as the importance of higher education and that I should get a masters degree after college. Surprisingly, my parents didn’t understand why I would want a Masters degree /MBA after college as they think I was already highly educated. It’s probably because I was also the first person to go to a name brand college in the family and I already had a “good” job.

My first job out of college was at a large financial institution, with a starting salary of $60k, bonus of around $8k. At the age of 25, I made my first six digit salary. Five years into my first real job, I quit for business school. I had a great time at business school and it was a very expensive $100k but well worth it. The psychological impact of having a MBA was huge for me as I was no longer the youngest one in the room and there is now a justification for my high salary (this is what made an MBA worthwhile for me).

The real growth of my salary came after graduating from business school and making sure to negotiate for more money every time I switch jobs/roles (even if it is for $3-5k as every increase counts). I made around $150-$250k after business school.

What tips do you have for others who want to grow their career-related income?

I think the subtle things at work matter and definitely differentiates good performers from the star performers.

For example, effective communications skills (both verbal and written), effective networking, and your executive presence (such as how you dress and how you speak) matters as you go up the ranks.

In the post Covid world, being in the office matters the lower your level/rank. With that said, I feel that I am at a point in my career and having young kids, I value being at home more.

Networking matters as I was told that opportunities come up when you are not in the room. This has happened quite a few times, where I was offered roles based on who I know or my old colleagues who gave my name to the hiring manager.

Communication skills such as speaking up matters. I am still working on speaking up in big meetings as I worry about how others perceive what I say. However, I think I have become a subject matter expert at work that I feel like I have a voice.

How you dress and your presence matters. The higher I go up the corporate ladder, it seems that I have to dress and act the part. Also, after I turned 40, my wardrobe / style changed and the clothes that worked earlier in my 20s and 30s no longer fit. I just got myself a new piece that is more suited for my age and of a nicer quality (but still on sale).

What’s your work-life balance look like?

Honestly, it’s great due to COVID and being in roles that were not client facing (and internal), which didn’t require me to go into the office too much (maybe 1-2x a month).

However, due to my new role, we have to be in the office 3x a week. This does make work/life balance a little harder.

Now that we have to go to the office more, I missed working from home. It’s just so much more efficient and I get to see my kids more.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

Yes, we have rental properties (1 studio co-op in the city, 1 3 bedroom/2.5 bath condo in suburban area, and 1 1-bedroom co-op apartment that is in the city (occupied by one set of parents so there’s no rental income)).

We took a strategy that our overall investment portfolio should have real estate to balance things out and act as a form of bond investment. So we keep every house/apartment that we brought.

The 1-bedroom co-op apartment is paid off but it requires a monthly maintenance that we pay. It has a monthly maintenance of around $900-$1000 a month.

The studio co-op should be paid off in the next 5 -6 years and generally covers enough for the mortgage and maintenance fee plus something left over. It generally rents out for $1600 – $2300/month. $1600/month on a bad year when COVID just started and no one wanted to rent in the city. $2300 is now where the city is back. We plan to keep it and sell it if need be to pay for the kid’s college education.

The 3-bedroom/2.5 bath condo should also be paid off in the next 6-7 years and the rent covers the mortgage and maintenance fees plus something left over. We had a 2 year lease of $3100 and just recently it went up to $3450 a month for the next year.

We are currently living in a 4 bed/2.5 bath house in a nearby town close to the condo. We have a great outdoor/backyard space with a deck and grilling area. We love this house and extra space so do the kids. Eventually, when the kids are older and we don’t need this much space, we were going to downsize to the condo and sell the house.

SAVE

What is your annual spending?

I do not track my spending anymore.

I used to track it in a spreadsheet before I got married and had kids. Now that I have kids and a spouse, it’s hard to get free time to look into expenses.

However, it can also be that it makes me sad as we don’t much discretionary income due to the new house and daycare cost for 1 kid. Hopefully when that 1 kid is in public school next Fall, our savings will be higher.

What are the main categories (expenses) this spending breaks into?

Since I don’t track my expenses anymore, it’s hard to calculate this.

Maybe when my kids are older, I will have more time and can start tracking my expenses again.

If anyone has any good way to track expenses, I would love to know.

Do you have a budget? If so, how do you implement it?

I don’t have a budget. I tried to set one up but I don’t keep it up to date enough for it to be useful.

Also, at this time in our life, I feel that we don’t have much money left after paying for all the bills (i.e. daycare costs $1600/month). We will not have this starting next year and can save additional money for home improvements such as a kitchen renovation.

What percentage of your gross income do you save and how has that changed over time?

Before we brought our new house, we tried to save at least 30-40%.

Now, with a new house and 1 kid still in daycare, we are not able to save anything besides our 401k.

This is only temporary until the younger ones goes to kindergarten at our local public school next year.

What’s your best tip for saving (accumulating) money?

Automate. Have it come out directly from your paycheck or an account that houses your paycheck.

Make sure to contribute the max to 401k as the money continues to grow every year.

What’s your best tip for spending less money?

Do your research to see if there are any discount codes or additional bonus points if you use a certain website first. A quick Google search for discount codes for whatever you buy helps. I found discounts quickly.

Overall, I am not good at spending less money; it just motivates me to work harder and try to get more money at work.

What is your favorite thing to spend money on/your secret splurge?

I love shopping and finding good deals but with kids and a full time job, it’s hard to go to a real store and I do a lot more online shopping.

I think my love to buy things just ignites my want to earn more money so that I can buy more things.

I also have a hard time throwing things away and have to actively work on it.

INVEST

What is your investment philosophy/plan?

We invest in low fee funds that follow the stock market or buying real estate.

We keep it simple and just follow the stock market.

What has been your best investment?

Our best investment is education first and then real estate. The majority of our 401k investment is in index funds.

As a first generation immigrant, I feel that education helped set me apart from the rest of the applicants. It gave me a leg up and what I do with it is up to me. It provided me with a world that was not open to me before. There is a difference in people that I met from my private college versus a public one.

What has been your worst investment?

Definitely investing in employee stock plan programs and holding the stock, thinking that it’ll go up.

In both cases, these stocks went down. I should have sold them shortly after acquiring it.

What’s been your overall return?

I think it’s around 4-5% but not sure.

How often do you monitor/review your portfolio?

I look at my Excel net worth spreadsheet every month or so to track how our 401ks are doing. It used to be more when we had 1 kid but with 2 kids and a full time job, it’s hard. So, it’s around every month or so and sometimes, I would miss a monthly entry if I was really busy at work or with the kids.

Having this tracker made me realize that it was all within reach.

NET WORTH

How did you accumulate your net worth?

We earned a decent amount of money and we also had some help (such as paying of college/loans for house/early inheritance) from our family. We left investing to the fund expert and just invested in index funds.

Tracking of our net worth really helped with planning and making FI a reality.

I follow the 4% rule initially to figure out how much we needed to retire comfortably.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

I think it’s all three…you have to earn enough to save and then invest what you saved.

But first would be to earn enough money.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

Finding the right spouse – dating was hard in my 20s.

Currently, it’s hard not saving money due to the house and having 1 kid in daycare.

What are you currently doing to maintain/grow your net worth?

Continue with what we have been doing – saving 401k and paying off real estate properties.

Our two rentals will be paid off in the next 5-6 years, and once that happens, we will have additional cash flow that we can save for the kids or for other expenses.

Do you have a target net worth you are trying to attain?

I think my targeted net worth for us is around $4-5million.

Not sure if we will stop working then or get pushed out (due to age-ism).

How old were you when you made your first million and have you had any significant behavior shifts since then?

We made our first million when I was 35 but it was not a big moment as we still had bills (mortgage and daycare) to pay. Nothing has shifted as my kids are still young.

Like most folks, the second million will come a lot quicker, five years later from our first million.

What money mistakes have you made along the way that others can learn from?

Sell employee stock as soon as you acquire it or don’t buy employee stocks.

Something less finance related but more personal is buying things that don’t last. The older I get the more I am into stuff that will last and is of high quality. I don’t want to buy things over and over again. I just want to buy things with good return policies, just in case, anything happens, it’ll be repaired.

What advice do you have for ESI Money readers on how to become wealthy?

Find a career that is known to pay well so that your starting salary is at a higher level.

Being motivated to keep learning and wanting to move up in the firm/field.

FUTURE

What are your plans for the future regarding lifestyle?

I think in the next 5-7 years, I’ll stay put for now to try to move up the corporate ladder.

After this period, I may consider retiring early at age 50-55 to slow travel and go see national parks or travel internationally.

What are your retirement plans?

I would love to get a RV/trailer to go see all the national parks and to travel the U.S around. I would like a slower form of travel.

We may explore living in a LCOL foreign country for geoarbitrage. However, we have kids so we may be limited in where we go.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

We both have chronic illnesses so we may die from liver cancer earlier than most people.

We’ll try to stay in shape and eat healthy right now.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

I learned about finances from MMM when he first started his blog. Then I started following other FI blogs (such as Financial Samurai, the site before ESI, Go Curry Cracker, J Collins, Mad Fientist, etc).

Finances really started to click when I was 31 and I created my own Excel spreadsheet to track my overall net worth as well as create yearly goals. I have been tracking for the last 10 years now.

I think we’ll be FI in another 5 or so years when we pay off the two rentals.

When I met my significant other, I quickly realized that I was the one who was going to be the more financial savvy one (as I worked in the finance field). He didn’t even contribute to his 401k plan at work and there was an employer match!

So, I built my own Excel net worth tracker and started tracking every month/year and would show it to my husband occasionally. As mentioned above, I have been tracking my net worth for the last 10 years and I really can’t believe that it is only going to take me 15-20 years to be financially independent.

Right now, we are trucking along and it feels like we are in the middle of our FI journey. We don’t have enough to retire chubby but we can coast FIRE. However, we might as well continue working until we are at a chubby level (at least $3 – $4 million net worth with paid off homes), which we should hit in the next 5-7 years. and most definitely hit this number in 10 years. Then our first kid will almost be ready for college.

Who inspired you to excel in life? Who are your heroes?

I worked for an older retired couple when I was in college. The wife was an accomplished artist/sculptor and her husband was the head of Harvard medical school for gynecology so they were highly educated and well off. They were inspirational and treated me like one of their grandkids.

I recall working a full day as their administrative assistant and they would always make me lunch and then we would have afternoon tea together before the end of the day. They were delightful to work for.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

I really like reading personal finance blogs. The first was MMM (Mr. Money Moustache). A few bloggers that I follow stop blogging so now it’s only a handful that I still follow. ESI is one of these blogs that I follow.

I also don’t have as much time to read with young kids and a demanding full time job.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

I don’t give to charity on a regular frequency. I may give $100-$200 a year.

Right now, it’s hard to give time as I have young kids.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

I hope to be able to help my kids when they need it. For example, pay for all or most of their college, help provide money for down payment for their first house, give some money for their wedding etc.

I want to raise nice (but not push overs) hard working kids. I don’t want them to rely on us to supplement their income or help out on a regular basis but I do want to help out with the bigger ticket items in life.

Maybe one day, I can leave some money for a college scholarship at my alma mater for inner city kids to attend.

Well done! I like the transition in your narrative evolve from partner to significant other to spouse. I can tell you prefer spouse but peer pressure is making you use partner. You be you. When you speak about attire and business I assume you don’t have multiple piercings or tattoos that are visible to others. Don’t fall into the trap of American consumerism. Your kids should learn well in your state with highly ranked public schools. I’ll also assume you legally immigrated into the US. These are all traits that allow you and your family to excel in a thriving western society. Again, well done.

Hi Maverick, thanks! Yes, my family came to the U.S. legally when I was 5 years old so I think of myself as American. Now that I read my own interview, I’m surprised at how much I reference being a first generation but it’s a big part of my psyche. Great catch on my reference from partner to significant other to spouse; it’s probably due to responding to the questions at different times and not catching it. As for attire, yes, I definitely don’t have multiple piercings or tattoos.

Great read! Stay steady and keep doing the real estate. Best asset-class on the planet. Anyone here who has. 8-digit wealth has real estate. Housing shortage is real. Keep going and good luck!

Thanks M-124! I do love real estate as an asset class.

Congrats on your journey! We are a couple based in NJ with similar net worth. Two things stood out was how you have your real estate portfolio is well set and a healthy 401K balance. Unfortunately, real estate prices in NJ are bonkers and we have been unable to get a single family home for a while. Hence still in a condo that we own and investing all the extra cash in stocks. Given the current state of real estate, we are worried about getting too expensive a home and monthly maintainance costs as well. Any tips you can share from your experience?

Hi there, Fiesty Fire! Glad to have another fellow NJ on here. NJ real estate is bonkers. My real estate strategy has been buy and hold. As a married couple with 2 young kids, I focused on the suburbs and town with a good schools (it doesn’t necessarily have to be the highest ranked school). I use zillow and see what the school rankings are from there. Do note that each NJ town has a slightly different feel/culture. Another important aspect at the time we looked is how long the commute to work would be. This was a big factor when we first moved to the suburbs. Condo’s are great but I think what drove us to buy a bigger house was the interest rate. At that time, it was at an all time low and it was not going to go any lower. So, we decided to bite the bullet and find a bigger house. It took us a few times but we finally found one with the layout we like and at a price we liked.

One of the reasons I love these interviews is that you learn about roles you never thought of. Who knew you could make that kind of money in compliance! Agree that it’s hard to manage a budget when you have a growing family. You’ve already done the hard work of supercharging your portfolio in the early years. Interested to hear more about your early inheritance and how that plays into you renting to family.

Hi Financial Fives! Thanks for the positivity and encouragement! Early inheritance was not a factor or condition for renting to family. I still view it as a “loan” to pay back eventually and have a special investment account earmarked for it just in case this does happen. Like most things in life, it’s complicated.