If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview was conducted in July.

My questions are in bold italics and their responses follow in black.

Let’s get started…

GENERAL OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

At the time of retirement (April 1, 2020) I was 56, my wife was 54 and we had been married for 29 years.

Do you have kids/family (if so, how old are they)?

We have three kids, 29, 27 and 25.

Two of three are married, all are financially independent.

What area of the country do you live in (and urban or rural)?

Urban, Mid-west.

Great place to live, not a great place for a vacation.

Is there anything else we should know about you?

As you will read below, I am part of the “gray divorce” community.

A month post-retirement, I found myself “exactly where I planned to be” and “exactly where I never planned to be” at the same time!

RETIREMENT OVERVIEW

How do you define retirement?

I view retirement as the point in time when I can take a job despite the paycheck.

I also subscribe to the point in time, I no longer trade my time for a paycheck.

How long have you been retired?

By the time this is published, I will have been retired for over 3 years.

My official last day of employment was April 1, 2020…I kid you not!

Is your spouse also retired?

My ex-wife is still working, by choice, not by need. This was part of the disconnect. However, out of respect, I WILL NOT be sharing more on the “spouse” topic.

If you find yourself in a similar position and would appreciate a sounding board, I am happy to chat privately and share how I managed myself, emotions, family connections, relationships with my children and finances throughout the process.

What was your career and income before retirement?

I was an IT executive working for a British multinational information and analytics company headquartered in London, England.

My career with the firm spanned 24 years and my starting base was $50k in 1993.

My AGI was over $237k in my final year of employment.

Why did you retire?

As stated earlier, my objective was by age 55, reach FIRE status and have the option to take a job despite the paycheck.

Additionally, I became aware that my position was up for elimination which would result in a rather nice severance package.

In short, the stars aligned and the time was perfect.

PREPARATION FOR RETIREMENT

When did you first start thinking seriously about retirement and when did that turn into a decision to do it?

Around age 50, I realized my goal was attainable.

My career had progressed to a desired level without total sacrifice of my work/life balance. Climbing higher would only result in additional sacrifice of my family time, which was a deal breaker.

By age 53, I had reached FIRE status; zero debits, mortgage paid in full and enough cash reserves to cover annual expenses for at least 2 years. At this time, I consulted with two different financial planners, allowing them to run their own “Monte Carlo” scenarios to ensure my personal plan lacked any major blind spots.

The plan passed and by this time, ESI Money was part of my daily reading. I must credit ESIMoney.com as a terrific resource. The site content provided a wealth of information to help me being plotting my exit strategy.

By age 55, the work environment was quickly souring, leadership direction conflicted with my leadership values. The business fell into a never-ending cycle of expense reductions which translated into job cuts despite a growing list of responsibilities. Never a fun time for a leader who appreciates the value of their people.

There were strong indications additional reductions would take place within the following two years, including the elimination of my position. This presented the opportunity to obtain a 39-week severance package. Due to my age plus years of service, “early retiree” healthcare coverage would also be available.

Properly executed, I could achieve a full year’s earrings, max out 401k & HSA contributions within Q1 of the year.

Attempting to minimize personal risk to my career, I made the decision to inform my boss I was planning to retire within the next 18 months. I asked to keep this private until I was about a year out. As a known high-performer, I DID NOT want to be presented with any “new” opportunities.

Toward the end of 2019, the stars were aligning for a potential job elimination. Therefore, I informed my boss that I was not ready to retire which set in motion job elimination, effective April 1st, 2020.

This was a key date, as it enabled me to achieve several financial goals in 2020 along with securing healthcare coverage until I would qualify for Medicare coverage:

- Fully fund 401k for the calendar year, within the first 3 months of the year.

- Fully fund HSA for the calendar year, within the first 3 months of the year.

- Receive 100% payout of my annual incentive plan.

- Experience a full month of health benefits (April 2020)

- 39 weeks of severance, resulting in receiving a full year of compensation for only 3 months of actual work.

- Taking “early retiree group medical coverage” (unsubsidized), beginning May 1, 2020 and continuing until I qualify for Medicare. As most early retirees already know, healthcare coverage can be a significant barrier to early retirement.

What were the major steps you took from deciding to retire to developing a plan to do so?

- Subscribing to ESI Money and reading other’s Retirement Interviews, Millionaire Interviews, etc. Kudos to ESI for providing example after example of others journey down this path, which helped me truly realize my accomplishment! In a world that says…you can never retire, ESI Money is a strong voice that says “YES, you can!”

- Planning out potential dates for consideration to maximize earnings and funding of 401k and Health Saving Account (HSA).

- Enlisted two separate financial planners to perform a complete financial review, run respective “Monte Carlo” simulations and identify gaps.

- Having PASSED the financial reviews, I then had to mentally pivot and prepare for the impending questions and statements: What are you going to do with your time? How will you avoid being bored? You’re too young to retire!

We truly live in a world where mainstream media and the financial industry influences thinking regarding retirement. IMHO…not in a good way!

What did your pre-retirement financials look like?

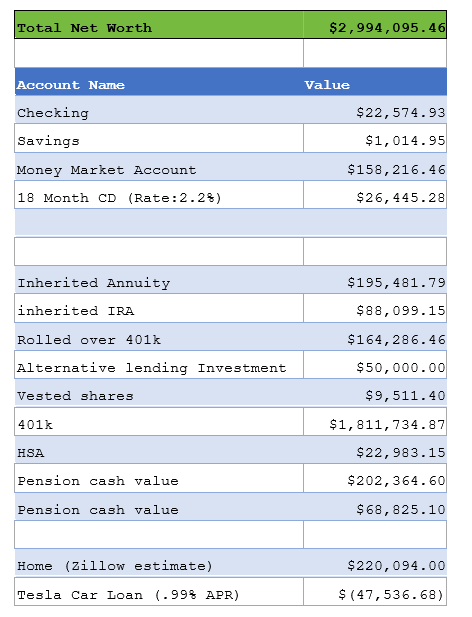

As documented below, in addition to about $200k of cash, I also had access to an inherited annuity and IRA.

Likewise, at my company, I qualified for the “rule of 72” which is age plus years of service equal to or greater than 72 would enable me to withdraw from my company 401k without the 10% penalty. Note, this option would only be available so long as my 401k funds remained with the company.

What was your overall financial plan for retirement?

I used personal finance, now empower, to track annual spending. When you are 99% debt free, annual expenses are easy to forecast. The Tesla car loan, at 0.99% basically represented free money, so there was no reason pay off the loan early.

Worst case, I would need about $60k in annual income.

Cash on hand, coupled with the inherited accounts would provide ample income to cover estimated expenses until 59.5. Of course, the divorce changed things, especially “cash on hand”.

However, as stated above, so long as I left my 401k with the company, I could withdraw funds without paying the 10% penalty.

Did you make any specific moves to prepare your finances for retirement?

I paid off the mortgage, but this was more a “peace of mind” action.

Who helped you develop this plan?

As stated earlier, content available at ESI Money most certainly helped.

Likewise, my financial planner provided a great sounding board, as did a few close business associates.

What plans did you make in advance to leave your job?

The most significant plan was confirming and executing a full year funding of the 401k and HSA plans.

Additionally, I chose to pay off the home mortgage.

What were your pre-retirement concerns (financial or non-financial)?

In the back of my mind, I was greatly concerned with respect to how a divorce would impact my plans.

Therefore, I ran additional scenarios with the help of my FP to validate I could financially survive such a decision without needing to return to employment.

How did you handle deciding on and paying for healthcare?

Due to my age plus years of service, I was able to continue with the company provided health insurance until I qualify for Medicare.

The group plan is superior to what is available through my local ACA and so this was somewhat a no-brainer decision.

How did you tell your family and friends of your plans?

I really didn’t make a huge deal about the decision to retire.

The topic would surface during discussions with family and friends, but I honestly think many thought I was bluffing.

THE ACT OF RETIRING

How did you ultimately retire?

Due to the pandemic, the majority of employees were home-based by April 1, 2020, including myself. Therefore, I walked into an empty office building, collected the last of my personal belongings, said goodbye to the few staff whom were onsite and walked out to an empty parking lot.

In a sense, what should have been a huge event, felt like a non-event.

No matter, I was FREE. I had WON THE GAME and no longer needed to play said game.

What went well?

Honestly, everything went according to plan.

What didn’t go so well?

Due to the pandemic, there was no opportunity for any type of celebration with friends, co-workers and family.

How did you ultimately find the courage to do it?

Honestly, this was very easy. I performed portfolio reviews on a quarterly basis and realized, with a long-term view of the market, I would have to truly do something stupid for the plan to fail.

As stated above, I had WON THE GAME and unlike the Vegas gambler who continues to play…it was time to walk away.

RETIREMENT LIFE

How was the adjustment, especially the first few months after retirement?

As I alluded to earlier, divorce followed soon after my retirement. So, I was dealing with a whole new level of emotional and financial challenges.

But, at no point in time, did I ever entertain returning to the workforce. No, I had done my time, made my contributions, earned a good salary and was looking forward to what turned out to be multiple new chapters in my life.

How is retirement life now? What do you like about it and what do you dislike?

I absolutely love retirement life!

No two days are the same and I enjoy spending my time exercising, reading, both educational and for entertainment.

Gone are the days of waking up way too early and going to bed way too late. And, while I might have a notion of what I will be doing tomorrow, I am always open to change.

Honestly, there is nothing about retirement that I dislike…zero!

What do you do with your time? What does an average day look like?

I spend my time exercising, woodworking, gardening, fixing things around the house, helping others, learning new skills (I now make baby blankets for family members), traveling, cycling, avoiding the crowds at shopping malls, super markets, restaurants, etc.

The average day begins around 6 am, when I let the dog out, then feed said dog, then let the dog out again (Who let the dogs out!), then back in bed for a few hours of good “REM” sleep.

A fresh pot of good coffee and it is time to open up the electronics to catch up on the news, ESI Money posts, stocks, finances, and on workout days, a little something small to eat.

Then it is off to Orange Theory Fitness for an hour of exercise. Side note, while I was still working, OTF became my mental retreat. An hour in my day when all I had to do is follow instructions and focus on my mind and body. After 3 years in retirement, I still love the place, the members, the vibe.

After the workout, I’m back home for breakfast/early lunch, shower and then decide what I “want” versus “need” to do for the day. Sometimes, that is a woodworking project, gardening, or just sitting by the pool with a great “hardcopy” book in hand. Other days, it is reaching out and checking in with friends.

For the most part, dinner decisions are based on what looked fresh at the market, the weather (love to cook out) and if I really want to be bothered by dishes.

Evenings are typically entertainment time. Catching up on the latest movie, TV series or current reading materials.

What are the major activities that fill up your time in retirement? Are there any new ones you’re planning to try?

Cycling, exercise, travel, re-connecting with past friends, concerts, dining out, movies, boating, etc.

Just recently, I completed my open water(scuba) certification.

I am interested in paragliding, having completed a tandem flight, which I loved.

I participate in a number of cycling events, both road and gravel bike.

Recently came into possession of a small CNC machine, so I’m learning Fusion360, tool paths, feed rates, etc.

I plan to continue scuba activities and would like to complete 50 dives in the next few years.

What is your social life like?

I have a great balance between social gatherings, both large and small.

Of course, the divorce resulted in some changes with respect to my social circle of friends.

However, as one door closes, others open and I am constantly surprised by the new people joining my circle of friends.

Looking back, what would you have done differently?

Nope, the whole plan really played out well.

Was there any emotional impact from leaving the workforce?

It took a few months to decompress, but then I was also dealing with the divorce, so if there were emotions from leaving the workforce, the emotions associated with divorce certainly trumped them.

What surprises (financial or non-financial, good or bad) have you had since retiring and how have you handled them?

Beyond my divorce, I am surprised by how well retirement is going; mentally, financially, socially, and spiritually.

I have a great perspective on investments and take time to appreciate how blessed I am to have this life.

So many people, upon finding out I am retired, exclaim how much they wish to be retired too. This opens the door by which I can start asking them how they are preparing and then give them some coaching points.

What are your future plans?

Well, I plan to keep doing what I am doing. Enjoying life, traveling, spending time with family and friends, appreciating each day.

A few 50+ mile bike rides, a bit more scuba, spending winter months…away from winter, Italy in 2024 along with Paris and the United Kingdom.

RETIREMENT FINANCES

How has your financial plan performed compared to what you had estimated before retirement?

As documented earlier, at retirement my net worth was $2.9M.

After 3 years, divorce, moving into a rental home (gave home to ex-wife), trips to Florida, Hawaii, Colorado, Mexico, my current net worth is $1.6M and I’m debt free.

I subscribe to the 4% rule. Therefore, my goal is to keep spending at or below that level as a general rule of thumb. If change is warranted, then I can make adjustments to my expenses. But, if things trend in a more positive manner, I will still stick to the 4% rule.

Can you give us some insights into your post-retirement spending and income? How much do you spend annually and on what? And where does the income to pay for your spending come from?

The first few years, spend was around $100k, due in part, to recovering from the divorce, two home moves, combining households with an amazing gal who is totally “my person” in this life.

All expenses have been covered from the inherited IRA and Annuity.

2023 expenses are projected to be around $60k

How are you handling Social Security, required minimum distributions, tax issues and the like?

Social Security decisions are 3+ years away, but I’m leaning toward taking it early, because I don’t really know how long I will be on this earth, so why chance “leaving money on the table”.

Did you return to paid work? Why or why not?

No, my financials are solid and I won the game!

I refuse to ever give another entity power over my time.

Did you find it hard going from being a saver to a spender?

Having watched my parents struggle in this area, I have made a conscience effort to spend, with-in reason.

Case in point, first-class tickets to Hawaii. Then, extending the trip to Hawaii by another 7 days, because we were already there and wanted to see more of the island.

Looking back, what do you wish you knew in advance?

Honestly, nothing.

I really didn’t have any anxiety with respect to retirement.

What advice do you have for those wanting to retire?

- Don’t be afraid! Remember, time is your most precious commodity and none of us know how much time we have between the dashes (DOB – DOD).

- Once you have full control over your time, never give it away!

- Build your financial model, track spending, take a long-term view of the financial markets/investments.

- Always be willing to adjust your plans.

- Take advantage of market downturns.

- Once in retirement, give it a good 12-18 months. At the firm, when I took on a new role, as a rule, I had to give it 12-18 months. I really like this concept and applied it to retirement.

- Find ways to “give back”. We are all blessed with Time, Talent and Treasure. Seek opportunities which allow you to share your Time, Talent and Treasure.

- An article I recently read said that 60-70 is typically your go-go years, 70-80 your slow-go years and past 80, your no-go years. Don’t sacrifice your go-go years!!!

- Take care of your body. You only have one life, and it is NOW! Develop and maintain “core” strength.

- Take time and reflect!

- Learn something new. Challenge yourself, mentally and physically.

- Mental Health – be sure to take care of your mind. In today’s world, it is so easy to be bombarded with negativity; especially, mainstream news. Turn off the screen, get outside, walk in the woods, mediate.

- Live the life YOU want to live vs living the life others want for you.

- Forgive

- Share your love

- Carpe Diem – Don’t sacrifice today, for the promise of tomorrow.

Thank you for your interview! I, too, retired in my early 50s (Retirement Interview #19) and can concur with your thoughts on getting out ASAP. Just finishing Year 6 and still loving my retirement. We are a small group of people who have achieved the opportunity to now spend our time exploring, learning and giving back. Why wait when you can do it today? Ive had a chance to meet up with some others from ESI who have retired early. Your bullet points at the end of your interview sound like things I would say as well. Have a great week and hit me up if you’d like at [email protected]

This is a great share – relatable. Best of luck and may you always have enough money for hardback books and really good bicycles !

Way to keep it together and move forward after a divorce. You definitely retired to something. Sounds like a busy , joy filled retirement. What millionaire interviewee were u? Good luck w you new found freedom

My MI will post in April of 2024

Love your upbeat attitude even after a tumultuous life event like divorce so close to retirement. You’re doing all the right things and soaking it in, while still being productive in your own ways. Also great advice to ESI readers, simple yet so important and we tend to forget until we have our own time to reflect.

Congratulations on a successful retirement in spite of unexpected challenges!

I wonder if financial planners run retirement simulations assuming for couples together and separately. Given number of gray divorces, they really should.

My journey is much the same as yours except for the divorce. I certainly enjoy the extra time I have to deliberate on tasks and challenges. I very much enjoy trying to be a good stewart of God’s money and helping others along the way. Life is short, but I am hoping for another 25 years to make a positive difference for God and His children. Enjoy the journey.

FWIW – It’s the “rule of 55” concerning the withdrawal of 401k funds. It has nothing to do with the length of service. If you terminate your employment at 55 or over you can take it from your employer’s plan and not pay the 10 % penalty. Otherwise, you have to wait until you are 59.5. I didn’t learn about this until after I rolled my 401k over to an IRA. Unfortunately, I had to wait until 59.5 before being able to make penalty-free withdrawals.

How do you like your tesla?