It’s a sad tale on many fronts, but also inspirational because of how much progress she’s made. In fact, it’s quite remarkable IMO.

I had her adjust the story a bit and include more financials so she could get advice from the great readers here at ESI Money. So please read it completely and give her your heartfelt thoughts.

I also sent her a few money books to read in the meantime so she’s already much more educated now than when the email first arrived! 🙂

So with that said, let’s get to the email…

———————————————

I know you are retired and just blogging now, so I feel slightly guilty bothering you for advice, but I do hope you can help and read my incredibly long detailed email (preferably over tea).

I am very late to the savings game, and have no real market/investment experience. I’m Canadian, so that’s something to consider. I’m late to the savings game because I’ve been on my own since a teen, and struggled through homelessness at one point. I pushed myself to finish high school and even got scholarships for university, but I also needed loans.

I was estranged from my family because of a rough childhood, and just before university my world imploded and I was kidnapped. Yup. That’s right — kidnapped and beaten and threatened by my then partner. I had experienced rape in a few instances as a teen by other men, but never anything that violent or scary.

I was able to finish school, but I needed to work on myself… I still am working on myself… but I worked hard enough on myself to be able to support myself after university. It meant I didn’t work during university because I had a lot of other work to do in other areas of life.

Even though some people wouldn’t see my current job as an assistant being a successful position, I am proud of it and do see it as my success: because of what I survived and how far I’ve come. My coworkers for the most part have no idea, but it takes a lot of work to be as functional as I am. An ongoing battle.

Anyway, I got work out of university, but it wasn’t amazing pay. I realized if I wanted to get out of debt I would need to increase my earning potential, so I worked my way through different offices and temp agencies on short contracts to up my experience quickly.

I moved from 12$ an hour up to where I am now at $56k/year within 8 years. There were periods of funemployment, but I work hard and am happy to do anything requiring skillful attention, planning, or quality assurance for pay.

I’m still working on improving myself so I can increase my earning potential, I’m currently upgrading my math (ie retaking high school maths) in order to learn advanced functions better — the end goal being to be able to understand more big data stats and produce better reports for my office.

The exciting news is that I finally finished paying back all my student loans last month! And that’s why I’m emailing you a long rambling background email for advice…

These loans were not cosigned and were solely my responsibility, and I paid about 65k of them back myself between 2010 and now. I also had to pay off the university between 2007 and 2009 for outstanding tuition for a term (just over 6k), had other credit debts etc., so there was a lot of weight financially on me for a long time.

I did this by keeping my expenses low. Living in Toronto can be hard since it’s so expensive here, but I managed to find an apartment in 2007 that was under 650$/month inclusive…less an apartment, more of like a room with a door. This way even when my income was barely over minimum wage (which was 10.75 at the time) I was able to throw everything I could and all OT at my loans.

Through repairing some family relationships some years ago they helped pay for about 10k of what was owed. Sometimes I wish I had worked during university and not had such large loans, but realistically I couldn’t have handled it all.

I moved into a bigger space a few years ago before the rental market heated up to the insane levels it is at now (thank god), so I’m paying $1200 for a jr 1 bedroom in an apartment with a gym and a pool (saving on gym membership).

I don’t have a car, license, car payments, insurance for a vehicle. I walk to work. I had homeowners insurance for contents, but I cancelled it when things were rough going, definitely thinking I’m going to renew. I have a cat, and do pay for pet insurance every month, which has already paid for itself.

When I increased my expenses my income was slightly higher, I didn’t realize when I became perm at work last year that HR would reset the salary scale and the pension would become required to pay. My best friends have helped me so much during this process, saving me from payday loans when I overestimated how much I could throw at a loan payment and cut myself short.

I definitely treated myself a bit last month…celebrations, eating out a lot, house items I desperately needed and had been putting off like new oven mitts and a laundry hamper without broken handles. I also put a deposit down on a new tattoo being done by my friend who completed her Arts degree and apprenticeship in August (I like to support friends). Blah blah optional unnecessary blah, okay sure…but I did the thing, so I get a tattoo! Thems the rules I don’t make em.

But then the fun begins, I can save like a mad person! 😀

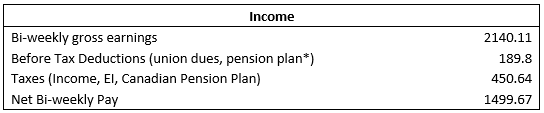

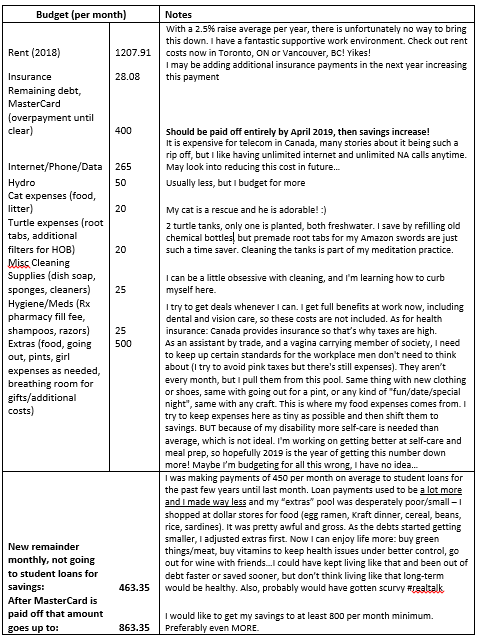

Here’s an overview of my budget, my retirement planning, etc.

*Note that there is no “maxing out” of my pension, it is a set % pulled out based on your salary and no way to make contributions additionally. Everyone gets the same deal.

Without getting into too much detail about pensionable earnings, YMPE and bridging amounts received would be:

- 29619.94/year until 65 (2468/mo) then 21000/year after 65 (& CPP kicks in and Old Age Security) giving me 3040/mo with retiring after 60 as “normal” for my pension plan rules.

- The problem is factoring in early retirement hits…assuming I don’t take a hit to CPP or OAS and do not take those early, but do start my pension early, that means -5% per year (-25% overall):

- 22214.95/year until 65 (1851.24/mo) then 15750/year after 65 (with CPP&OAS) giving me 2602.5/mo. Yikes!

Some questions:

- How much of a nest egg is advisable to keep on hand (in such an expensive city)?

- My first 5k will be saved by May 2019, and my first 10k by 2020, what is the best way to invest this money taking into consideration I need early retirement desperately?

- Are RRSPs even worth it with my income if I intend to retire at 55?

I know I’m late to this game… like super late. I turn 35 next year. But I need to figure this all out and it feels so overwhelming. I read about a couch potato investment portfolio for stocks… not sure if that’s a good idea?

I need early retirement. I mean maybe my job requirements will change, or I will change, but as it stands I’ve lived like 4 lifetimes already. I have a stress disorder from all the bs I survived. I can’t expect any inheritance or help from family ever, and never will I rely on a partner financially (just not my style): so this is all on me, as it always is.

I need to travel, and write, and make art…and not stay chained to my desk until 65/70. There’s no way, I just can’t. I need that time to live, and make up for all the time I was hurt and scared. Even if I will be a poor artist, and take a retirement hit…I need it. So. I must be aggressive.

I just also have had no guidance, no teaching, no knowledge on anything. Hell, I had to figure out taxes on my own at 22 and pay an accountant to help with my back taxes because no one taught me that I needed to file!

Please, please help!

———————————–

What’s your advice for her?

First of all, I am sorry that any person has to experience what you have experienced. I pray that you are able to find peace in your personal life and that you’ve found helpful and loving people to support you.

As for your financial questions, I’d make the following comments:

1) I’d save up 1 month of living expenses first before I did anything else.

2) Is it possible for you to geoarbitrage (i.e. move to a less expensive city and get a similar or higher paying job?). It seems like a lot of your limitation comes from the cost of rent in Toronto.

3) Your cell phone and internet bill are really high for a single person. My wife and I pay about $150 per month for the two of us including taxes and everything for our cell phone and $50 per month on internet. And I’ve heard of much cheaper plans like Republic Wireless of Project FI (by Google). Not sure if these are options in Canada

3) Regardless of whether you plan to retire early or not, I’d advise you to put your money into passive index funds. Just because you are trying to reach early retirement doesn’t mean you should speculate in the market to try and get there faster. Just accept the market return and put money into these funds as you are able.

4) Are there any tax advantages for investing in Canada at your income level?

5) I do know that the retirement account options in Canada are typically the Tax-Free Savings Account (like a Roth IRA in the states) or a Registered Retirement Savings Plan (like a 401K in the states). If you invest in index funds you could use either of these vehicles to invest because they don’t spit off dividends. If you decided to invest in individual U.S. stocks (not what I would advise), then you should prefer a RRSP which doesn’t tax you on the dividends.

All that said, 35 isn’t that late to start. If you get rid of your credit card debt, save up an emergency fund (3-6 months would be ideal), and start hammering away – it isn’t that far away. If you could move to a less expensive city with a lower cost of living, it might just happen even sooner!

TPP

Hi The Physician Philosopher! Great cyber tag, I Kant fault you for it ;D

1.) Okay, this will be priority #1 for sure! I think it’s a good idea.

2.) Unfortunately not, my best work as an admin is done for high profile directors in big cities. If it weren’t here it would be NYC, Silicone Valley, etc. I love working for people with a lot to do, (who are usually stressed out), and need extra hands! It does mean I can’t remote in, however; I need to be near the execs and photocopiers. I also have a very solid career here. The GREAT news is that my partner is going to be moving in with me first thing in 2019, which means my rent will be half! We won’t be moving into a bigger space but collapsing into “tiny space” living in the current place I have (1 bedrooms here now start at 1900/mo! :O).

3.) It is very high. I suspect it is mostly the unlimited internet, but yes cell phone is also very high it’s 115$/mo, unlimited talk anytime, and only 2G of data. As I mentioned, in Canada telecom companies are bad (see: https://www.cbc.ca/news/business/wireless-prices-cell-phone-plan-canada-1.4652550), but I will try to reduce this ASAP. Since my partner is moving in with me and is a dual citizen of the US we are considering picking up a North America calling plan from the US with data for much less… I think that would work if he held the account.

4.) Not that I’m aware of, what would be the best way to research this? Google isn’t much help. I’ll check my local library and see if they have any financial planner/accountant help available.

5.) TFSA all the way! I love mine so far, even though there hasn’t been much action in it. I don’t think RRSP makes sense with my income level, especially the having the money frozen in there until I’m elderly, but I’ll ask my bank point of contact.

Thanks TPP for all your advice!

Hi Gwyn, money in your RRSP isn’t frozen – you can take it out any time, just have to pay employment taxes on it when you take it out, and lose the contribution room. But if you are planning a stretch as a starving artist most of those withdrawals should be at a very low tax rate and you wouldn’t be making RRSP investments anyway so there is no downside in your plan.

Thanks Caro! 😀 I’ll definitely reconsider RRSP if this is the case. I appreciate the help

Hi! First off, I’m very sorry for what you’ve had to experience in your life. I can’t even imagine what you have been through. What you’ve already done for yourself is a huge accomplishment. Congratulations!

I would highly suggest that you check out coachcarson.com by Chad Carson. On his blog he primarily writes about early retirement through real estate. There are a lot of strategies that he suggests (like one called “house hacking”) that can jump start your journey to financial independence, even if you don’t have much cash to start with. I’ve personally found his advice very helpful, and have started to implement several of his strategies.

I hope this helps!

Hi Lauren,

Thank you for your kind words! I appreciate the acknowledgement I’m getting with the article post. It’s not something I usually get, since I keep it to myself in my day to day life. 🙂

I will definitely check out coachcarson.com as well. I think real estate could be a good idea if the bubble pops, which some news outlets have been saying has started. The adjustment would mean lower prices before they start going back up, maybe a perfect time to try a house hack.

Thanks again <3

You are not super late to the game of saving. You are you. Try not to measure yourself against others.

1. You already have a good plan to put your credit card payments to savings once you have that paid off. Stick to that plan. That almost doubles your saving amount. Set up automatic transfers of these dollars to a brokerage account to invest or at least to a high interest savings account to earn something.

2. Cut the internet phone expense. This appears very high to me for a single person. If you still want all this, cut back to more basic plans to reduce the cost.

3. The $500 bucket of items on your list. Review your actual spending in this line item to determine nice to haves versus need to haves. Be honest with yourself. Sure, going out is fun but it also adds up over time. Looks at reducing the number of times you go out but still go out. Gifts are certainly a nice gesture to make to others but put yourself first.

4. Start reading those money books. This is a good start to educating yourself on saving and investing.

You can do this. Much of the challenge is around a mindset of whether or not it can be achieved. I get a sense that you are convinced of your plan/needs which is a good thing. Now you just need to implement a plan.

Best wishes.

Hi Mr. r2e, (reminds me of r2d2 I like it!)

I will keep working on learning to not compare. I’ll add it to my meditations. There’s one thing I’m consistent with no matter what: daily meditations (and mindfulness). You’re right, life is not a race 🙂

1.) Yes, yes, awesome! I am happy so many are agreeing with this.

2.) I mentioned this in my reply to TPP, but I’ll put it here for easy reading as well: It is very high. I suspect it is mostly the unlimited internet, but yes cell phone is also very high it’s 115$/mo, unlimited talk anytime, and only 2G of data. As I mentioned, in Canada telecom companies are bad (see: https://www.cbc.ca/news/business/wireless-prices-cell-phone-plan-canada-1.4652550), but I will try to reduce this ASAP. Since my partner is moving in with me and is a dual citizen of the US we are considering picking up a North America calling plan from the US with data for much less… I think that would work if he held the account.

3.) Yes, this is kinda the pool I use for groceries and going out. Everything unspent from this pool at the end of the month goes to savings. For example, last month I only spent $200 on groceries and beers out, and the rest went into savings (so about $300)… but other months like this month where my symptoms are flaring the cost for food is higher because I order in more 🙁

The great thing about Toronto is that I don’t need to order in pizza, we have Japanese and Ethiopian and Mediterranean all on-call until late, and although it is a hard tempting problem to have when well, when unwell it is a Godsend because it means I can still eat healthy food despite being unable to cook. I’ve been slowly switching my diet with a nutritionist to lean more on fruits and cereals as a go-to when unwell instead of picking up the phone. I’d say that reducing this number is an important goal in life in general right now, so I will definitely take this to heart.

I think in terms of the gifts thing, I do need to be more balanced with it. I can go overboard, especially after being unwell and absent from friends for awhile. I’ll definitely think on this more.

4.) I have been they are AWESOME! Do you have any other reading suggestions? I’m a HUGE bookworm!

Thank you so much for your detailed advice 🙂 Plan activation incoming!

Your story is incredible! You should be proud of yourself for pulling yourself out of a dark situation and choosing and working for a better life. That said, I would recommend saving 1month of living expenses, then aggressively paying down the debt, then saving 3-4 months living expenses, then start to invest toward retirement. This way, every small unexpected financial problem will not become a huge, stressful event, and you will enjoy life much more. You also might consider joining a support group at a church or in the community for encouragement, accountability, and friendship. You are doing great! keep it up!

Hi Chuck,

Thank you for your kind words as well! I think one month of saving expenses is doable and reasonable. I also think it makes sense to have in case of an emergency… the last emergency I had with a pet was quite costly and very stressful, so I feel it makes sense to do what you suggest.

I think I will try to look into a support group at a church of some sort. I myself am Buddhist, but the Buddhist temples in Toronto are not of the sect I practice (Bön, which is an indigenous religion mixed with Buddhism), and I don’t particularly like some of the things I’ve heard about some of the Buddhist temples around here. However, there is a strong Hindu community, and there are several modern church congregations near by I can investigate. Thank you for the suggestion to start looking into community ties more. I am politically active (volunteer, canvassing, protests), but not in other ways that I think would add to my life… so I will take this to heart as well.

Really great advice already shared above, and beyond this, maybe cut that $500/mo fun cost and replace some of that time with reading 30 minutes/day and educating yourself more in finance. This blog is a great start! The book Your Money or Your Life was a great one for me to figure out what was really important and helped me save more. Another blog you may find helpful is Tom Corley’s Rich Habits. I have found this really great for reminders of how to stay on a successful track in life, including wealth building.

And Congratulations to you in your accomplishments in life so far. At some point I would like to read a book about your experiences and the success you WILL have since your are clearly committed to this and already successful in so many ways!

Hi Izzy! Thanks for the new blog to add to my reading list 😀

I replied about the $500/mo grocery and going out fund to Mr. R2e above, if you want to check it out, but basically reducing this number is an important goal in life in general right now, so I will definitely take this to heart. Especially since I’ve seen this tip suggested more than once!

I read every day for about 3-4 hours, but I think switching it up from fiction to non-fiction will be a good thing. I received Your Money or Your Life as part of the gift of books from the writer of ESI, John. It was definitely an amazing book, almost as transformative as Kondo’s The Life-Changing Magic of Tidying Up (which you should read if you haven’t! I have had a much easier time with laundry and cleaning since I read it).

I had a blog at one point, but needed to remove it due to privacy concerns regarding some icky past persons trying to use it as a way to harass me… which is one reason why I’m so careful online, I wrote about healing trauma and raising awareness for C-PTSD/PTSD non-combat victims. Maybe one day I’ll go back that way, but for now I’m going to keep it off-line and do my thang 🙂 <3

Wow, you’ve been through a tremendous amount, but should be super proud of where you are right now.

I’ve seen first hand how what you’ve been through can impact someone, and to come as far as you have, mostly on your own is impressive, and a testament to how strong you are.

The Canadian system is a bit of a mystery to me, but I have some minor thoughts that can help, I hope.

First, having a backup fund has helped ease my anxiety substantially. so keep doing what you are doing to get the $5 -10K in cash saved. That will give you a cushion to help ease that source of stress.

Second, there are of course 2 methods to make additional money available, spend less or earn more. From looking at your budget, I would maybe only look at 2 things, I would definitely get a renter’s policy ASAP. They are typically very cheap, but id disaster strikes, it is worth every penny. the other might be cell phone/internet. You might try to find a cheaper cell plan, and cut out cable and just go with wifi, and then subscribe to hulu or netflix and use an antenna for local channels. Otherwise, given the surplus you have every month, and how I personally like to balance saving and spending, you seem to be doing well.

One way to boost your saving rate would be to add an additional job. Can you maybe work as a receptionist in your friends tattoo business? what about selling some of your art? working as a barista at Starbucks part time? That money can be dedicated to your retirement accounts, and then you might even consider continuing those jobs after leaving your full time gig.

With regard to how to invest, low cost index funds, like those available from Vanguard, Fidelity or Schwab (or their Canadian equivalents) are good vehicles that require no knoledge. Pick an SP500 or total market index fund from one of those companies, and set automatic deposits so you don’t need to actively do anything.

finally, in retirement you might consider moving to a lower cost area of Canada (or the world), where your loonies will go further.

Best of luck to you, and give ESI Money an occasional update.

Hi Jason 😀

Thank you for your words that’s very kind. Post-Traumatic Growth has been a beneficial and unexpected result from everything I’ve been through. It’s an odd way to look at all the trauma through the lens of gratitude, and I certainly would not go through it again if I had a choice, nor wish trauma on anyone, but PTG has been very powerful.

A few people have suggested back-up funds, so I think I’ll make this my priority until I have enough over that to invest. A renter’s policy I think I will definitely get again, I want to try to find one that insures against B&Es. In terms of the phone/internet, I did reply to TPP and R2E above (same response), so a 3rd time seems silly… but I will look into reducing that ASAP.

I never thought about holding down an additional job. I think with my health as it is now, it is not a possibility… but… I think it is definitely something I can do eventually. Even if it is art that I sell. I will definitely keep this in mind.

The Vanguard overseas index funds were the ones I was eyeing, but these other suggestions I will look into!

I think when I am older I will want to live elsewhere. I think being elderly in Toronto in a future of global warming is likely also not a safe plan… I mean, not to sound like a loonie myself 😉

Plenty of good advice already shared. My one addition (which may be worth exactly what you paid for) is to not focus so much on the goal of financial independence that you can’t enjoy your today. Set yourself up with and maintain good financial habits and practices yet also understand that many things take time. It can be hard to feel you aren’t making progress even though you really are. Much of my life has felt like two steps forward and three back, but the reality once I shake off the feeling and look at what has happened has been three steps forward and two back more often than not (even the roughest times have been five forward and four back :-). The problem is when you feel like you’re sliding back or you aren’t moving forward it’s easy to become frustrated and think you’re falling behind and not getting anywhere. It’s so easy to want to be in a great spot right now, not in years, even when you know intellectually it will have to take years emotionally we want it now. So I would encourage you to focus a bit on some of your artistic goals. I have written short stories and a novel, done some sketching and painting, etc. just as an example and all done while working. Also, life is unpredictable, plans fail, surprises happen, but if you stick with the good habits and the plan, you may not get there exactly when you want but you still get there sooner than most people (e.g. I wanted to retire at 55, but now it will be 62, part by choice, part by life happening). I’m not thrilled to go to work every morning, but I appreciate what it gives me and I use my free time to my advantage. Keep plugging along while also enjoying the ride.

Hi getagrip,

Thanks for the comment, I really love it. It can be hard to not feel like you’re making progress, but you’re right it will come if I keep up the habits. I think my artistic goals have been mentioned a couple of times, so I feel this is a sign I should keep pushing myself in that realm. Thanks so much for the reminders and advice.

35 is not too late to start. Get a place with roomates. Your biggest expense is rent. Like others said, cut expenses more as others have advised (phone, fun expenses). Get out of credit card debt ASAP and always pay off in full every month. Invest your non-emeregency cash in a low cost world market index fund and don’t plan to touch it for 20 years.

Feel good about your future and be patient. You past was hell and shows you can get through anything. Just stick to a simple plan based on the advise of these commenters and you’ll be fine.

Hi Phillip,

Great news (I mentioned to above): my partner is moving in with me start of next year! 😀 It was just decided this past month, and I’m super excited for it because not only does it mean more help with the household it also means EVEN MORE FINANCIAL STABILITY! Huzzah! I definitely need to keep cutting my expenses, and I like that you mentioned a low cost world market fund, because those have been the ones I’ve been eyeing on my own for some months now.

I will try to be patient. It is definitely the skill that I lack the most. I think my consistency sometimes fails for that reason, so I’ll refocus and work harder. 🙂

Hi fellow Torontonian,

Thank you for sharing your story. I’m so sorry for all you’ve been through but the silver lining is you’re well on your way to a wonderful, debt-free life. And you’re an independent woman who can handle yourself on your own – and that’s a beautiful thing! I agree Toronto is expensive but there are cheaper places to live than $1200k/month. My husband and I share a 1-bedroom on St Clair West for less than $1000. Sure, there’s no pool or gym and it’s not super modern, but it’s totally fine and we work out at home (just bought a yoga mat and some gym gear) so there are always way to cut down on expenses. I agree with what has been said regarding reading more about personal finance. I read this and lots of other blogs (Millennial Revolution, for example, is written by two Canadians as well as Boomer and Echo so you can learn a ton on there). MoneySense is also a great Canadian online resource to learn more about personal finance. I invest with WealthSimple (a low-fee roboadvisor that basically allocates the money for me based on my investing profile) so I don’t have to worry about anything, the money gets transferred to my investment account each month and voila! And you can change how much you want to invest, if your life changes, and to which account, all online. Pretty simple and easy. Anyway, best of luck! You’ll get there, just keep on it each month and you’ll reach FIRE in no time!

Hi Gio, hooray Toronto pride! ^_^V

I am not so sure there are cheaper places anymore, kinda feeling stuck. Looking at St. Clair listings I see some for 1300, but why move further away to pay more? I’m right down near Dundas. Seriously check out prices on viewit.ca if you haven’t for awhile… it’s quite mad. I found one listing for a “1 bedroom” for 1000, but it doesn’t look like it should be a 1 bedroom… it looks painfully smaller than my current 500 sq ft. The best news is that my partner is moving in soon, so that means rent will be halfed! 😀 Hooraaaayyy! It does mean we will need to collapse into this smaller space, but I think it can be done. I donated 3 garbage bags of old clothes this past weekend and now I think he will finally have a bit of room in the closet 😉 lol

I will add all these reading suggestions to my list! I love to read! 🙂

I have been suggested WealthSimple before. Some people suggested I try it to learn about investing and once I feel confident try index funds. I’ll look into it again and reconsider.

I appreciate all the help 🙂

I wrote an awesome long comment reply to you, and it didn’t post. Maybe posts need to be approved by a moderator? *testing testing* Either way I’ll type it up again later. For now I think it’s a good sign I need to take a break and come back to comments later. Thank you in advance will bbl 😉

Take 2, let’s try it!

Thank you for your thoughtful reply! I have tried to find a cheaper living option in the city, but it seems prices have skyrocketed in the past couple of years. (Check out listings in viewit.ca! Yikes!) I recently got wind that my partner will be able to move in with me next year, so other than trying to fit into the small space, I think it will be a huge help to the budget! 🙂 I will add all your reading suggestions to my list. I have also heard about WealthSimple, but not looked into it much. I will definitely give it more thoughtful review now that I have more than one recommendation of them. Thanks again <3

Take 2, let’s try it!

Thank you for your thoughtful reply! I have tried to find a cheaper living option in the city, but it seems prices have skyrocketed in the past couple of years. (Check out listings in viewit! Yikes!) I recently got wind that my partner will be able to move in with me next year, so other than trying to fit into the small space, I think it will be a huge help to the budget! 🙂 I will add all your reading suggestions to my list. I have also heard about WealthSimple, but not looked into it much. I will definitely give it more thoughtful review now that I have more than one recommendation of them. Thanks again <3

As others have already stated, your internet/phone bill is outrageous and sounds like a luxury item. This is an obvious area to make some small sacrifices. Five years ago I went back to a basic flip phone. The cost for basic service with unlimited texting was only $40/mo (including taxes) and I could still use my deactivated smartphone for internet anywhere that offered free wifi (which is a lot of places these days). So I carried around two phones most of the time. Small price to pay to save a ton of money. I did this for two years but when I started working remotely and traveling a lot unfortunately I had to go back to the smart phone. But unless you need internet for work, get a basic phone and use your current smartphone as a wifi device. If you can cut that bill down to a fraction that’s a nice chunk of money that can go into your investment account every month.

Also, if it were me, I would skip the homeowners/renters insurance. You rent so you’re obviously not worried about paying for repairs on the building, so unless you own things that are exceptionally valuable or you live in a high risk area it seems like a waste of money. Stuff is just stuff.

Best to you!

A lot of people have commented on the telecom it seems, so I think my first priority will be trying to review this cost. In terms of the internet, I don’t think cutting down away from cable line makes sense since I am a gamer (I used to be a pro SC player, so I’ve gotten used to the stability internet through a line offers), but I do think I could maybe reduce the amount I’m using.

Interesting about the renter’s insurance advice, it is opposite what some others have suggested. There’s only one thing I would prefer to have covered, but I would likely grab it if I were home during a catastrophe. I agree, stuff is just stuff. I will look into insurance options and do some research on my area. I think I’m safe from flooding since I’m in a high rise, but fire is always a risk when you live in an apartment. Did you know that 6% of people are hoarders?! I am sure at least one lives in my building unbeknownst to me statistics wise, (fire hazard), so that may be something to consider as well…

35 is certainly not too late to start. 20 years is a decent amount of time to build a retirement nest egg, although it will require some extra sacrifice. Whether or not it is worth the sacrifice to achieve financial independence at 55 is up to you. If you decide the sacrifice is too great, there’s nothing wrong with pushing out the FI date either. If you hate the next 20 years of your life just to get to financial independence, it really isn’t worth it.

That said, here is my general advice (don’t know enough about Canadian retirement/tax to give specifics):

1. Rent is by far your biggest expense. Find a roommate in your 1 bedroom and split the cost, or at the very least I assume you could find a decent 2 bedroom for less than $2400 and split that with a roommate to save some money. You could also house hack (buy a property and rent out unused bedrooms to cover your mortgage). I don’t know if that is financially feasible with Toronto real estate prices, but it’s worth running the numbers.

2. Cut down the phone/internet expense. You said yourself unlimited data was a luxury.

3. Find a way to make additional income. It sounds like you are an administrative assistant of some kind. There is a lot of demand for virtual assistants in many fields (lots of successful bloggers need them, for example) and you could make $20-40 an hour on the side in your free time.

4. Keep a few months of expenses on hand, put everything else into index funds (unless you decide to house hack from #1, then save up for a downpayment on a house).

5. Make sure you are taking advantage of every possible company match and tax advantaged account. Sorry I can’t be more specific, I don’t know the Canadian system very well.

You have persevered through all kinds of trials in your life already and come out stronger on the other side. From a mindset perspective, figure out what you need to do to retire in 20 years, and put a plan into action. Then forget about it. You are not ultimately in control of the markets, policy changes, etc – you can only control what you do. Revisit it once a year or so, but don’t agonize over it every day. The effects of compounding will work to your advantage over time, but day to day it may not feel like you’re making progress. Don’t let that discourage you!

Hi Andrew!

1. I mentioned elsewhere, but I love saying it: good news, I’m moving in with my partner within the next 3 months! It means rent will be cut in half, waaahoooo! 😀 (For your interest, here’s a recent article on house cost in Toronto: https://www.cbc.ca/news/business/home-sales-prices-toronto-1.4773129 “The city recorded 2,574 sales in July at an average price of $824,336” so owning is likely not in the cards anytime soon!)

2. Yes, you and everyone else has mentioned this. I will really need to discuss cutting this down with my partner.

3. Interesting! I’ve never heard of “virtual assistants”! I will need to look into this! 🙂

4. Sounds reasonable!

5. Unfortunately, there’s no topping up or adding additional funds to my retirement above and beyond what is being done already. It is a set amount based on how much you earn for everyone and there’s no additional deposits you can make, which is why I need to invest myself. Index funds seem to be the thing most people are suggesting.

Yup, I think this is all solid. I like the idea of making a plan and then forgetting about it to revisit once a year. Is it best to revisit before or during tax season?

What you have accomplished already is remarkable based on the stuff you have already been through and likely the awful situation you described was already sugarcoated a ton for us readers as the actual details are likely far worse.

You do have a bit of a bonus being Canadian in that one of the biggest worries us folks in the US face is rising healthcare costs, etc. So even though you live in an expensive cost of living space, it is not as drastic as if you lived in a similar area here and have to plan for healthcare costs on top of it.

The advice of setting up an emergency fund and trying to reduce living expenses is well worth following if you can do that. You already have taken great steps to educate yourself and if you continue that path hopefully you can rise up the work ladder and also increase your salary.

Wishing you the best and I hope ESI gets to publish a follow up success story from you in the future.

Hi Xrayvsn, thank you for your kind words. Haha you could tell I tried to quickly gloss over messy details, eh? Yes, it is definitely far worse than most would care to imagine… better not to cause people grief from hearing about the atrocities 🙂

You are right, I am blessed in terms of not worrying about healthcare. It is funded through our incredibly high income tax rates, mind you. I think we’re paying 15% on the first $45k-ish.

I will keep doing my best! Thank you so much ^_^

Her current savings are not disclosed so I assumed she has zero savings in any of the current tax vehicles in Canada.

Since she is in not in the lowest tax rate bracket, contributing to 401k,or RRSP is a better deal.

The tax refunds should be then channeled to her Roth or TFSA.

As it stands now, just invest in index funds or TD e series funds. Those are dirt cheap.

Keep 1-3 months of living expenses is sufficient. Get a line of credit just in case you might need for financial emergencies.

This lady will do fine. She is very fortunate to have a benefit pension that is so rare in Canada.

She is already 50% ahead of those who has none.

I’ll have you know I have $0.88 in savings and an additional $0.18 in my TFSA tyvm *insert false bravado* 😉 lol Yes, it is nothing so far. I’ve really hammered at my debt strongly to the point of NOT putting myself first, but after reading everyone’s comments I think I’ll be changing that this month.

The only thing with RRSP is that it gets locked, and for early retirement it isn’t so great for early retirement because I can’t pay myself an income from RRSP until of age to remove money. On the other hand the tax refunds could also grow, and so long as they are over interest I come out on top, right? Maybe a combination of RRSP and TFSA is a good idea…

Index funds I have looked into TD I have not. Here’s an interesting topic I will put to you here since you mentioned TD: TD invests strongly in oil and TPP project, both of which I strongly disagree with. I want to be a responsible investor somewhat, but at the same time those morals could get in the way of financial growth. I have some friends that refuse to invest entirely beyond socially conscious companies, and they don’t seem to fair super well compared to indexes that don’t discriminate based on social conduct. How do you align your morals and your financial investments? Do you bother? My biggest concern is supporting companies in the top 100 polluters list, which I would not want to do.

🙂 Thanks for the support

Greetings from a fellow Torontonians,

A lot of good advice are already given, so I thought I will provide a few specifics:

Your internet / mobile / phone bill can definitely be cut down. Internet (Carrytel, $40 a month with free modem) mobile (zoomer wireless $40 4GB), phone (voip service $5 a month).

For investing, Questrade provides free purchase of ETF. Setup a TFSA and RRSP account with them, and you can purchase ETF for free online. Vanguard has a few all in one ETFs that offer global diversification. Do some research on VCNS, VBAL, VGRO. Some good Canadian specific resources to look into: moneysense.ca canadiancouchpotato.com. Couchpotato is an excellent way as it is equivalent to index investing. It is a tried and true method used by all esi readers here, and recommended by Warren Buffet and John Bogle.

TD e-series are also fantastics alternatives for beginners if you don’t want the hassle of setting up a brokerage account.

Since your income is not too high, maybe focus on TFSA until your earnings go up higher.

If you focus on saving diligently and don’t make major money mistakes, you should be fine.

Yes, living in Toronto is expensive, but there are always way to find deals. Also check out redflagdeals.com which is frequent by most Torontonians. Just make sure you don’t fall in the trap of buying more because you got a deal.

Hi Andy, thank you for your comments! It seems most people are ragging on the internet and phone plans xD I’m with Rogers, can you tell? Yes, I will look into reducing this ASAP.

Questrade is the company my co-op bank recommends, so I think I will go with them. I will research everything you suggested, including TD e-series as the person above you recommended that as well. Also, please check out my comment there to Taygeta about morals and investing, I’d be curious to see more hot takes on that topic. 🙂

Thanks so much!

Great job getting out of debt. You don’t ‘have’ to keep living in Toronto if your income doesn’t allow it. There are cheaper cities in Canada.

Yes there are, but I’m not sure I’d know where to even start in terms of switching cities. I think to even consider it I’d need savings first!

Believe me that you are doing better than most Canadians. Also you are not late. My remarks:

– cellphone spending as well as fun budget could be drastically reduced, and I think that they must be. You can have great entertainment for a few &$$ or free, believe me.

– rrsp and then tfsa are your best friends.

– deal with one area (the one with the best return) at a time. Ex: just $100 decrease in monthly fun budget will translate to rrsp contributions and then investment growth while it will also save you taxes every month, use a compound interest calculator to be shocked. You won’t believe how well you’ll do in a few years if you fix one key area at a time.

Hi MRT! Thank you for your comments, I will definitely take this to heart 🙂 Do you think RRSP makes sense for any income level, or is there a specific income level where it starts to pay off more/make more sense than TFSA?

Hello everyone,

I am the reader that wrote in, thank you all for your comments and suggestions! Many of you have been so very kind, and that is very much appreciated. I had a death in the family recently which is why I was unable to respond as quickly as I otherwise would. I will do my best to reply to everyone.

Hooray! I replied to everyone 😀 Thanks again everyone for all the help and suggestions. I super appreciate it ^_^

Just reading this now. Plenty of good advice but just wanted to say it seems like you are making a better life for yourself and are doing the right things. Awesome.

I’l just add a couple things that may not say much about financial advice directly but it’s there.

Always invest in yourself and don’t stop. Keep going.

Never give up and always keep the fight in you. Never stop.

35 is SUPER young!! Wow- I wish I was that young again. LOL

You’ve had a tough start but always keep realizing that even though the world has nasty people in it- there are more people that are caring, loving, generous and helpful people. Stay close to the good ones and run from the bad ones. Negative people are draining.

I wish you the best!