If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in December.

My questions are in bold italics and his responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

By the time this interview is published, I’ll be 55 years old. My wife will be 54 years old.

We’re both on our 2nd marriages and have been married to each other for 11 years.

Do you have kids/family (if so, how old are they)?

My wife & I have a blended family of 5.

I have two sons; 27 & 26.

My wife has 2 sons & 1 daughter, 27, 22, & 21 with the daughter being the one in the middle.

My oldest son has provided me with 2 wonderful grandchildren, a grandson that’s 5 and a granddaughter that’s 2.

What area of the country do you live in (and urban or rural)?

We live in the Dallas, TX market with a home in Frisco, TX & a Lakehouse at a lake ~60 miles Southeast of Downtown Dallas in a town called Gun Barrel City, TX. (You can’t find a name of a town that’s more TX than that!)

What is your current net worth?

When my wife & I married, it was agreed we keep our assets separate with the rationale that I preserve my legacy to my children, so all numbers provided are my assets with the exception of the lake home which is titled to both my wife & I.

- Investment assets (brokerage account balances, cash & municipal bond portfolio): $4,504,300

- Net Home Value (See next question for more details): $1,132,500

Net Worth: $5,636,800

Note: Since putting numbers to it are difficult, I don’t count home contents, autos, motorcycle, waverunners, boat & golf cart in my net worth, but I’m happy to report all are paid for.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Taxed Brokerage Account Summary:

- Folio Investing Brokerage Account: $18,000

- Vanguard (After Tax) Brokerage Accounts: $500,000

- Merrill Lynch (After Tax) Brokerage Account: $1,025,000

- Brokerage Account Balance: $1,543,000

Municipal Bond Account Summary:

- Municipal Bond Account: $1,035,000

Note: While checking my Muni Account balance for this interview, I noticed a large bond issuance within my Bond account has been called, so before this interview is published, $191,440 of this account will be liquidated. I will take these proceeds over to my Vanguard Brokerage account & allocate accordingly.

Private Equity Investments:

- Various Investments into companies yet to go public: $610,500

Note: I invest approximately 15% of my net worth into appealing investments on promising unicorn companies that haven’t gone public.

For this interview I only list what I’ve invested vs. what these investments may be valued at as it’s difficult to assess value at this time. However, 2 of these investments have gone public this past year & I have yet to liquidate these assets.

The initial investment for those two companies was $125,000 with a Current Value of $250,000. The initial $125k is included in the $610,500 provided in the summary.

Cash Accounts:

- Credit Union (Working Capital Account): $17,000

- Bank Of America Deposit Accounts: $3,000

- Chase Deposit Accounts: $2,300

- Capital One Deposit Accounts: $1,300

- PayPal Balance: $2,200

- Personal Ally Demand Note Account: $70,000

- Old Company Ally Demand Note Account: $50,000

- Cash Account Balance: $145,800

Retirement Account Summary:

- Vanguard (Rollover & Roth) IRA Brokerage Accounts: $265,000

- Merrill Lynch (Rollover) IRA Brokerage Account: $800,000

- Fidelity (401k) with Current Employer: $105,000

- Retirement Account Balance: $1,170,000

- Investment Assets & Cash Balance: $4,504,300

Home Summary:

- Frisco Home (Titled to me) – Estimated Value: $650,000

- Mortgage Balance: ($8,000)

- Net Value (without consideration for points paid to liquidate): $642,000

- Lake Home (Titled to my wife & I) – Estimated Value: $800,000

- Mortgage Balance: ($309,500)

- Net Value (without consideration for points paid to liquidate): $490,500

Net Worth = Net Home Value $1,132,500 + Investment Assets $4,504,300 = $5,636,800

EARN

What is your job?

I currently work as an Information Technology Service Delivery Consultant.

I’m currently on assignment supporting a significant undertaking by one of our banking clients attempting to penetrate the Merchant Market by creating their own Merchant Services solution.

I’m trying to decide if I want to continue within this opportunity or retire. It all depends on the intrigue within the future role I’m expected to support.

What is your annual income?

For 2020:

- $250,000 in pay from my consulting gig

- $45,000 in tax free Muni Bond coupon payments

- $360,000 – $485,000 in portfolio growth (depending on if I decide to liquidate my 2 private equity investments and cash the growth)

Note: Portfolio growth = Capital Gains + Dividends + Market Appreciation

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I grew up in Kansas City in a home my Mom still lives in that my parents purchased in 1962 for $17,000. My childhood was one with plenty of penny pinching and frugality.

I knew at a young age I wanted to attend college & I also knew I would primarily be on the hook to pay for it. Below are some of the things I did to accomplish this.

Without knowing it, by switching colleges a couple of times & staying home my sophomore year while attending a local college, I was applying “Discount Knowledge” Principals to my end goal which was to pay for my Bachelor’s Degree all by myself.

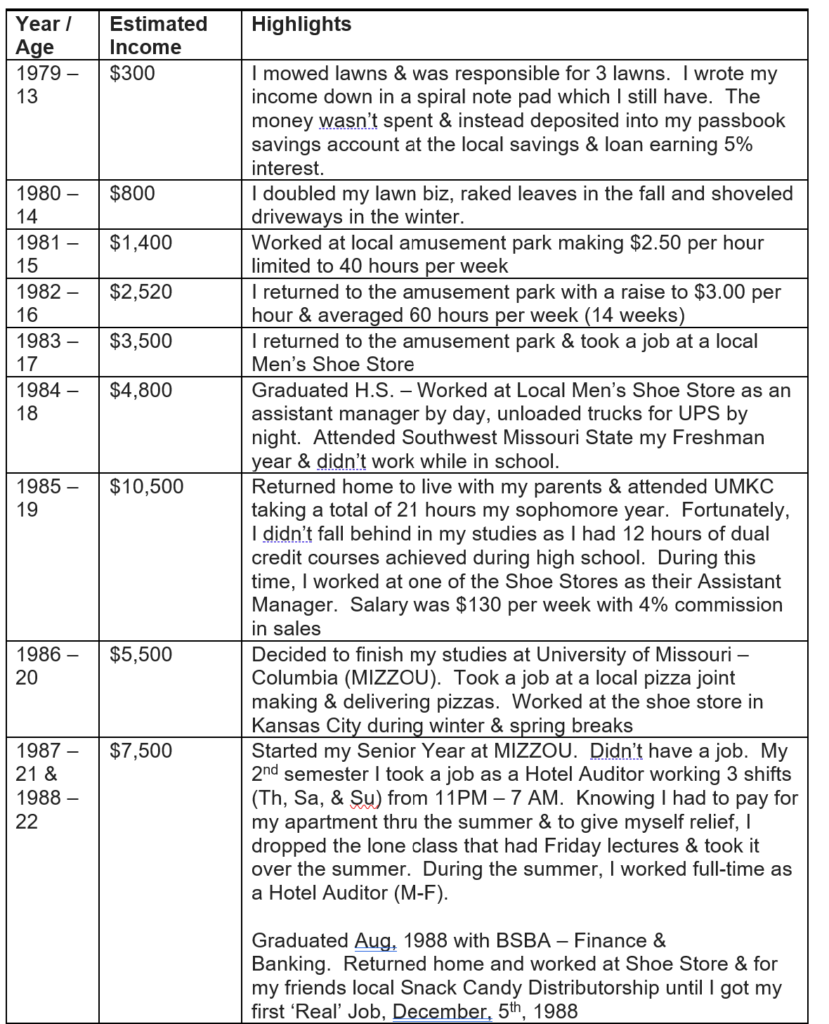

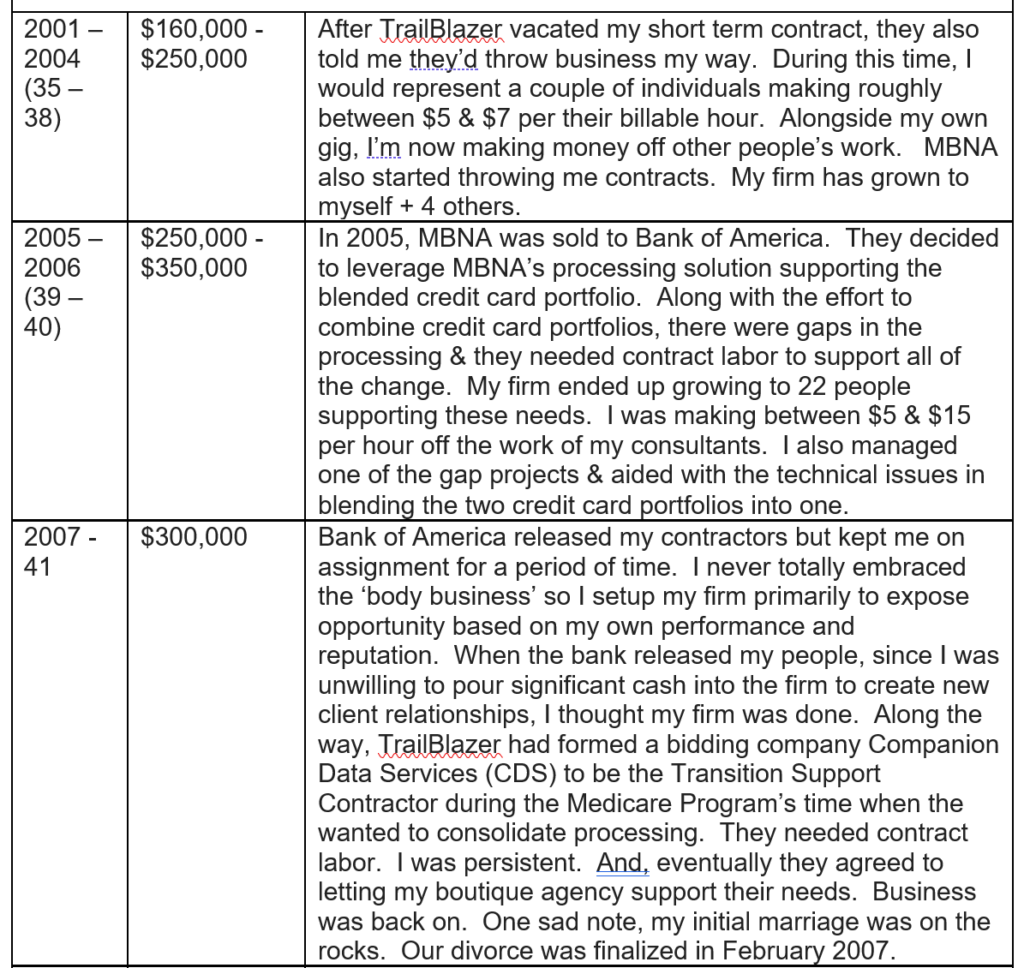

Early Years – Youth through College

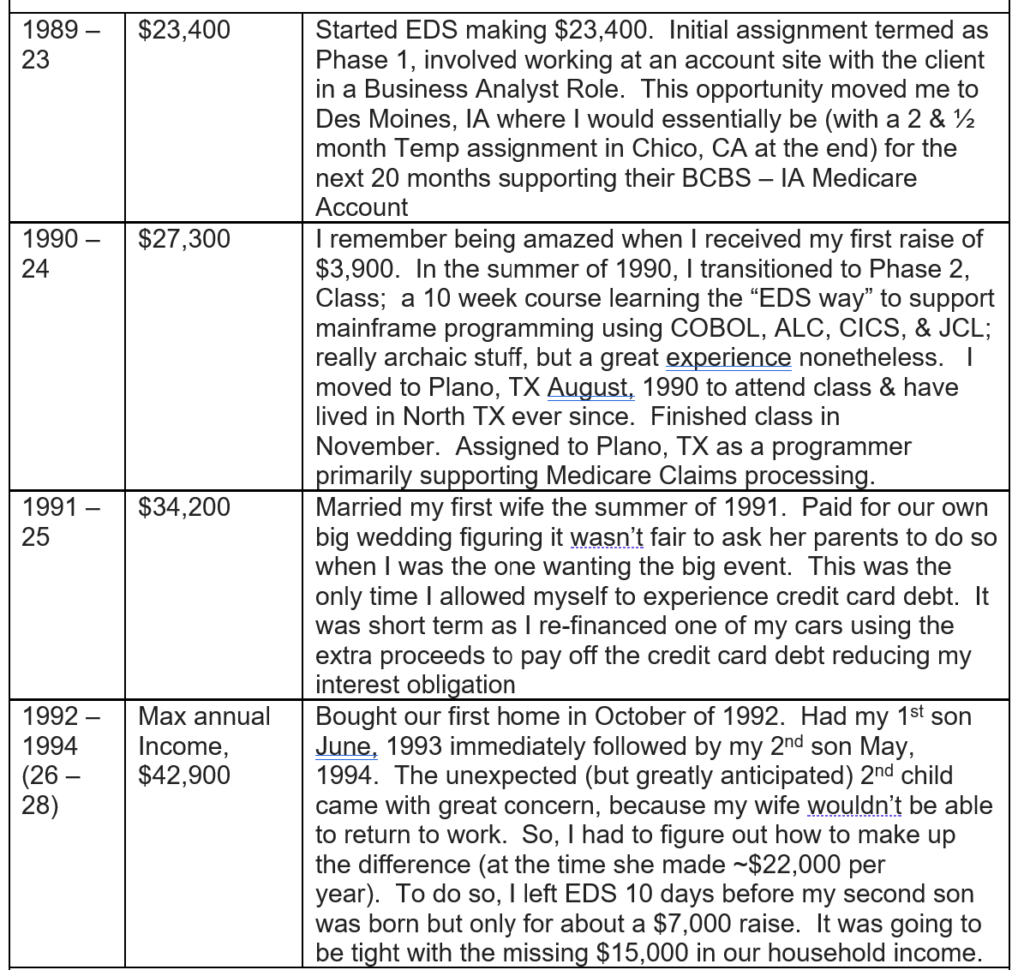

Early Professional Years – Electronic Data Systems (Participating in their Systems Engineer Development Program)

For those who don’t know, EDS was founded by Ross Perot. He sold it to GM and became an instant billionaire with the transaction. It was the 1st company to recognize the need to offer software programming services to large clients. I started with the company after GM took ownership & operated it as an independent subsidiary.

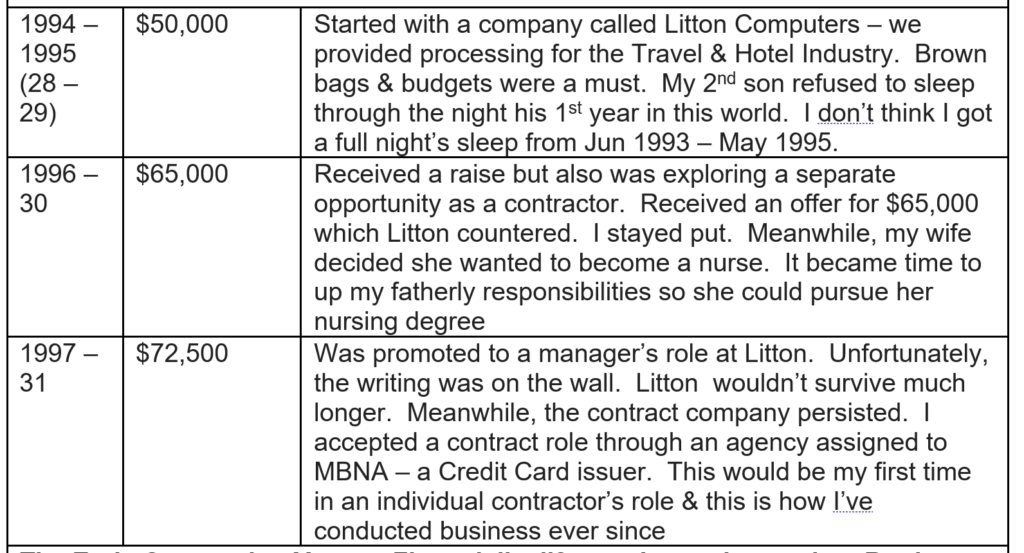

Early Fatherhood with a mortgage we’re struggling to afford, now what should we do?

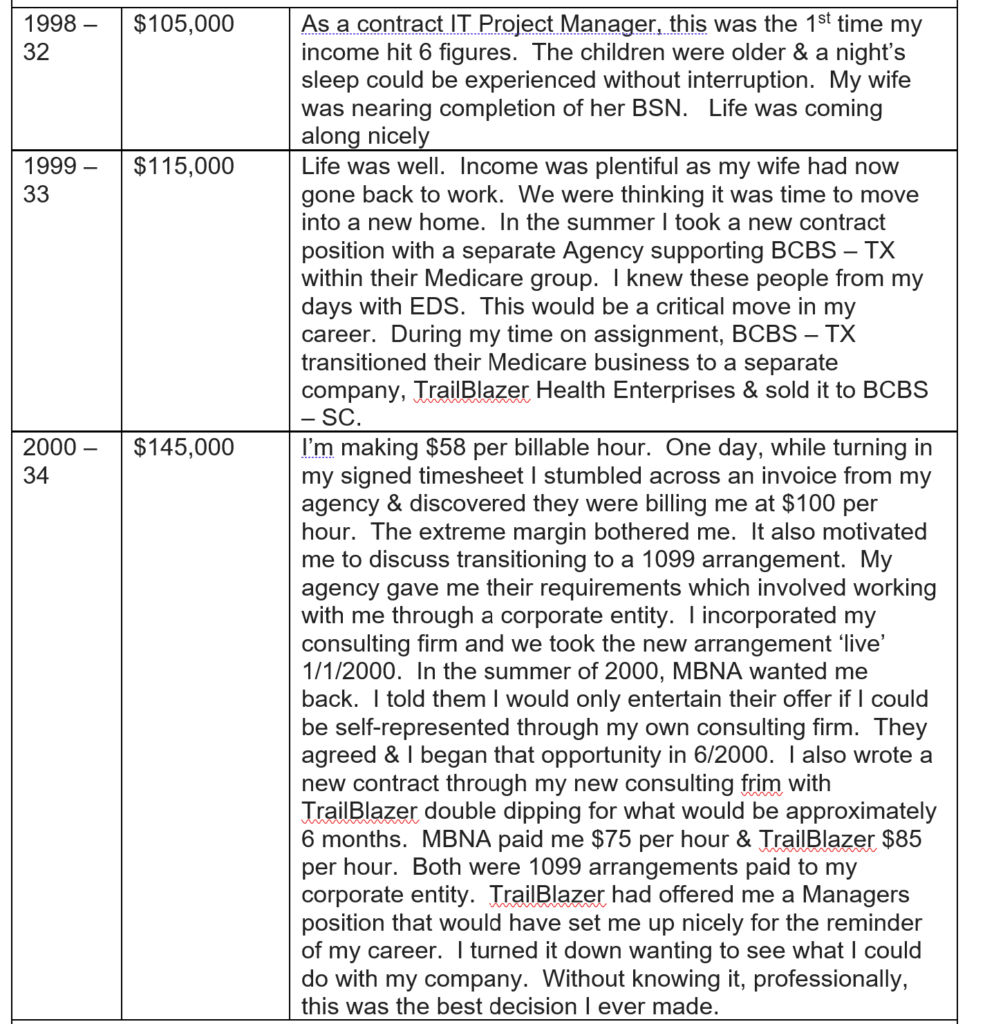

The Early Contracting Years – Financially, life was becoming easier.

Betting on one self was a good bet for me. My performance managed to stand out enough to the point I didn’t have to worry about downtime that typically comes with contract labor.

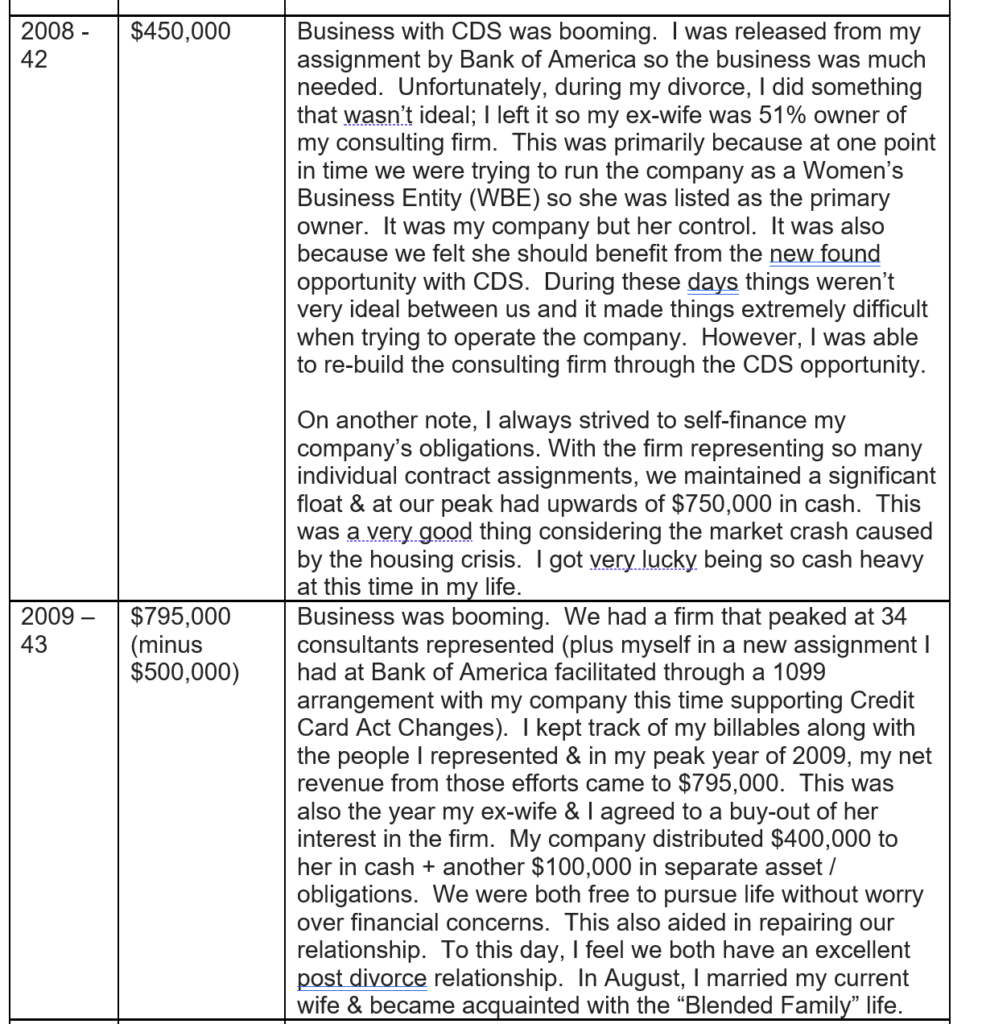

Working in a Dual Capacity – Both as a Contract IT Project Manager & Running My Consulting / Contract Labor Firm

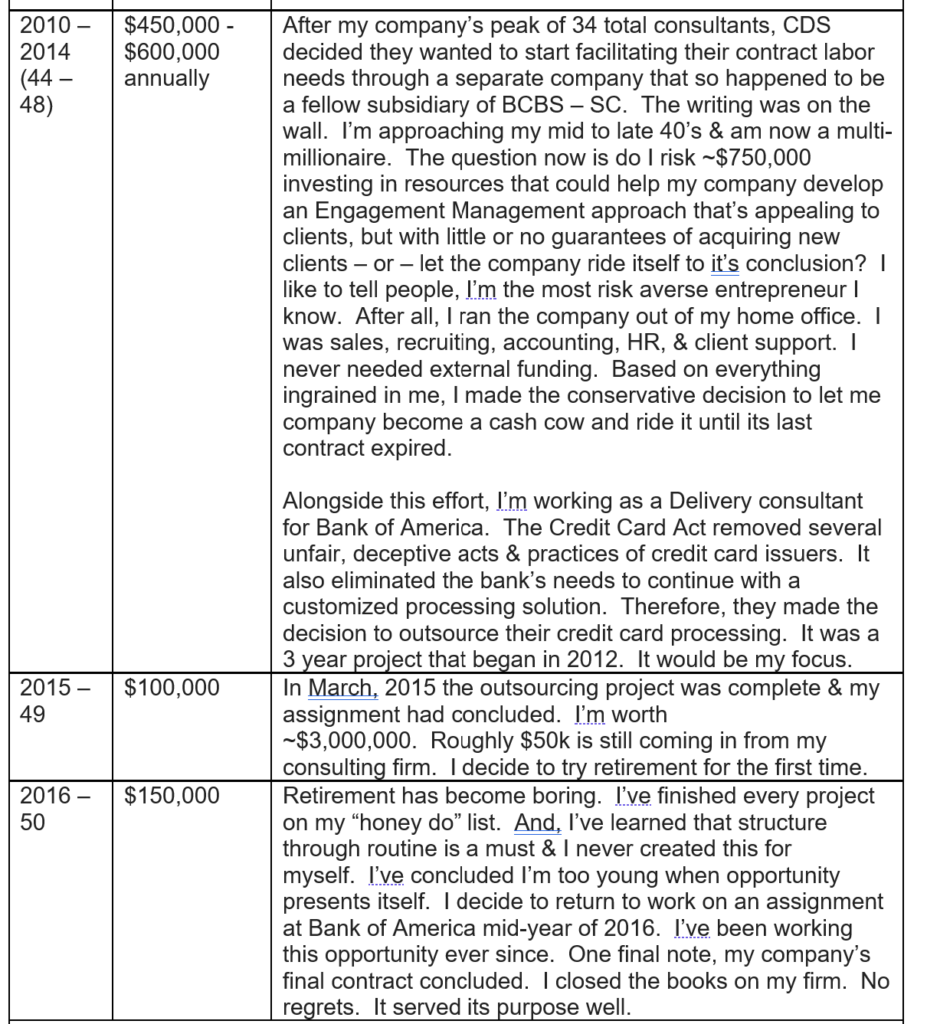

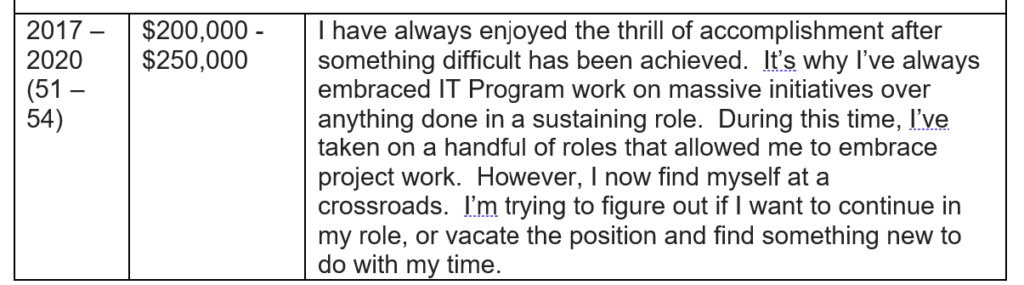

The Maintenance Years – Approaching the time to transition to the next stage in my life.

What tips do you have for others who want to grow their career-related income?

- It’s perfectly fine to work hard, but it’s better to work smart – I’ve applied this throughout my career. I believe this is why my opportunities have been so recurring. I also believe it’s a significant reason why I was able to convince my former client to do business with my consulting firm.

- Never burn bridges – I have only vacated a contract opportunity twice in my career. And every time I handled it like a champ being very forthcoming with my reasons for the change. This helped me keep my options open for a potential return.

- Set yourself up for opportunity – Had I not started my consulting firm & learned what it takes to facilitate & support individual contract labor, I wouldn’t have been positioned when my two opportunities (MBNA Transition & CDS Transition Support) presented themselves.

- Be persistent – It took several phone calls persuading CDS hiring managers what I could offer through my firm before they agreed to my firm providing staffing for their needs.

- Be creative – When the MBNA transition occurred, I was overwhelmed with my role as PM & supporting their staff augmentation needs. I created a pyramid opportunity by teaching some of my existing consultants how to present their own candidates & when hired, sharing the hourly bill rate difference with them. It was better to do it this way than to lose opportunity or present the impression that the company couldn’t deliver.

- Establish relationships and cultivate them – When my firm was at its heyday, one would expect recruiting was difficult. Remember, I started the company because I was upset with the portion of the total bill rate I was being paid. So, I decided to never be greedy with those I represented & established the reputation of being a preferred agency to work for as I paid my consultants much more than my competitors. As a result, several of the candidates I placed were brought to me through ‘word of mouth’. On a personal, professional note, my own gigs have been brought to me by my own reputation and how I’d performed in prior roles. Maintaining those relationships & keeping in touch with a continual demonstration that one can deliver is key.

- Don’t be afraid to travel the path less travelled – When I started my company, TrailBlazer was trying to hire me into a manager’s role that would have given me ample security for the rest of my career. Instead, I decided to take on the riskier path and launch my own company. Several of my peers thought I was crazy for making the choice I made. It turns out the opportunities presented with this chosen path proved to be significantly more lucrative and a much better choice.

- Don’t be afraid to bet on yourself – Above, I basically journaled my career. You may have noticed, I’ve been working individually as a Contractor / Consultant for the past 23 years of my career. This can come with risk when opportunities are vacated or the labor augmentation is no longer needed by the client. My downtime between gigs (other than when I tried retirement for 15 months) cumulatively has been less than 6 months time. I like to tell people that permanent employment is relative. If you work in a way that separates yourself from others & continually be part of the solution, then good things will happen in your career.

- Don’t Count On Others To Take Care of You – This may go against the advice from others interviewed by this blog, but I never wanted my career to be dictated by the subjectivity of any of my superiors. I felt burned a time or two during the early stages of my career, so I decided that my chances of making it to the top of the totem pole were slim. If I honestly self-evaluated, I’d also conclude that had I made it to an extremely high executive role, I may not have thrived as I would have wanted to, primarily because my point of view was more ‘in the weeds’. Regardless, I still wanted immense success. The side hustle I created through my staffing firm created that success for me.

What’s your work-life balance look like?

While supporting massive IT program initiatives, there are extreme peaks & valleys.

This past summer when approaching our initial installation & then stabilizing our processing solution, I was working 65 – 75 hours per week.

However, since we’ve stabilized & now that we’re trying to figure out the capabilities we want to bolt on next, we’re in a bit of a lull period.

One thing that’s stood out that I have yet to mention, approximately 2006, I began working from home. And, other than travel, I’ve primarily worked from home ever since.

Without the freedom to work from whichever venue I choose to is key to me continuing in my role. Without it, my retirement is immediate. I find it key in helping me maintain a desirable work life balance even when we’re on heightened alert trying to deliver our solution to production.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

Above, I went into detail about the consulting firm I started & ran successfully for 17 years.

While active, it was an immense source of my income.

Nowadays, my source of income will be through my portfolio growth.

SAVE

What is your annual spending?

If I were to guess, roughly $140k per year.

What are the main categories (expenses) this spending breaks into?

- $54K – Mortgage Payments (This will cut in half in March when the Frisco Mortgage is paid for)

- $20K – Property Taxes

- $6.5K – Homeowners & Auto Insurance

- $5.5K – Utilities

- $4K – Programming, Internet, Streaming Subscriptions

- $15K – Entertainment (This is a guess)

- $20K – Travel

- $15K – Maintenance (This year we actually spent $22k on improvements to both homes, but $15k seems like a more reasonable annual expectation.)

Note: My wife & I agreed early in our marriage the needs of the children would be handled by the biological parents. Therefore, I’m not privy to what’s paid for my younger step son & step daughter’s educational needs.

Do you have a budget? If so, how do you implement it?

No budget, but within my Merrill Lynch account, I have the ability to aggregate all my investments & liabilities so I can determine my net worth.

What percentage of your gross income do you save and how has that changed over time?

I have always been a big saver but sometimes life throws curves at one and it inhibits their ability to meet their plans.

In my early adult life the surprise of my 2nd son & the loss of my wife’s income is an example of one of those curveballs. Even though we were faced with a 23% loss in income (15k / 65k), we figured out a way to persevere.

What percentage of your gross income do you save and how has that changed over time?

On average, I would guess I’ve saved 20 – 25% of my income over the years.

What’s your best tip for saving (accumulating) money?

- Start Early – Investing is a long game. The longer your timeframe for investing, the more you’re likely to accumulate. Early investing also allows for more risk increasing one’s risk tolerance during those early years of investing.

- Don’t Worry About How Much You Invest – If you start today with a small amount & have faith in time’s ability to appreciate your investment, you’ll be thankful years later that you did.

- Max Your 401(k) / Retirement Accounts – This is only if it’s possible. If it’s not, then be sure to contribute up to your employer’s matching. It’s free money that if counted as a gain insures an incredible ROR.

- Be Consistent – After determining an appropriate 401(k) contribution, I’d suggest creating monthly recurring transactions taken from one’s checking/savings account into a brokerage account where purchase instructions are in play to invest on a monthly basis. Over time, other than notating the transaction, one never misses this money & instead witnesses a sizeable growth in their brokerage account balance.

- Have a Cash Reserve – It’s wise to grow a reserve for those rainy days when life throws a curveball.

What’s your best tip for spending less money?

During the Housing Crisis, I was glued to the news, & I remember a talking head on MSNBC saying, “Somewhere we lost the lesson that it’s noble to live within our means”. That message has always resonated with me.

Above, I was asked if I have a budget and not if I’ve had a budget. Believe me, after my 2nd son was born & things were tight, you better believe I had a budget. And, if I deal with setbacks down the road, then a budget will come in play for me again. So, if you’re at your infancy in accumulating personal wealth, I would recommend a budget.

To this day, I always try to do the little things in saving such as…

Shop your “necessary evil” expenses:

- When the gimmick rates expire, call your TV programming provider or switch to another. They will typically work with a persistent customer with hopes of preserving the relationship.

- Shop your Insurance. Provided the carrier performs when a claim is necessary, it’s all about the premium cost. Why pay more if someone will provide the same coverage for less?

- When appropriate, shop your Mortgage Rate – This summer I re-financed the lake house on 15 year fixed 2.5% terms. Before this loan, I was always big on making principal payments, but with these rates, I’ve re-thought that. I now take the principal payment I was making & have turned that into a recurring investment into my Vanguard brokerage account. However, if mortgage rates aren’t as ideal, then I recommend principle payments wherever possible. What’s best is to build the principle payment into your house payment. That way, you begin to treat it as part of your payment & you never find yourself missing the money.

Have Credit Cards work for you – I have it setup to where I get 5.25% cash back on groceries, 3.5% on gas, travel, & entertainment & 2.625% on everything else. I strive to put as many of my expenses on my cards and pay the balance every month. It’s amazing how much one can accumulate with this sort of approach.

If You Want Something & You Can’t Afford It, Don’t Buy It – Instead, this “Want” should now be a savings goal. Ignoring this & instead choosing to purchase something via credit card & rolling that balance from month-to-month is simply put a BAD decision.

What is your favorite thing to spend money on/your secret splurge?

I would probably say Travel.

I’ve really upped my travel these past few years striving for 1 trip per quarter. I recently booked travel to Hawaii & actually splurged and bought 1st class flights. I’d have never done this before. It’s time for me to enjoy life a bit more.

One bucket list item is to rent a place in Italy for a few months & experience the life of the locals. Along the way, I’d invite friends & family to stay with me during my stay. It seems like a great way to get to know another part of the world.

INVEST

What is your investment philosophy/plan?

While growing up, I used to read a column written by Scott Burns. He would advocate for the “Couch Potato” investor approach.

I’ve described the approach elsewhere in this interview, but basically one should setup recurring transactions that transfer from checking to brokerage where the funds are then used to invest in something of choice. Typically, this works best with Mutual funds vs. ETFs or Individual Stocks, since recurring transactions can be setup for Mutual Fund Investments. It takes the price out of the decision process & creates a blended price that over time becomes advantageous.

I know, I’m describing dollar cost investing, but I can confirm growth through this approach can be significant.

As a side note, I used this approach to fund the college education for one of my son’s & the trade school + 20% down & initial contents in a home for my other son. After my son graduated from college, I decided to research just how much I ‘spent’ to accumulate those funds. I provided both of my son’s with an e-mail that included all the information of how much I invested into their individual accounts as an illustration of the power of time & consistency and what it can do when trying to grow assets.

From that e-mail I wrote the following:

Hard facts, $17,400 total invested over 19 & ¼ years turned into ~$90k in 22 & ¾ years time – or – if you want to lump both of your UGMA accounts together, $34,800 invested over 19 & ¼ years turned into ~$180k in 22 & ¾ years time.

Of course that money invested was done via a dollar cost investing method in a way that I never missed the money. And yes, I was invested into a sector specific mutual fund that performed quite well, but the message still resonates.

All of that good for my boys came from one small decision enacted early & executed over time in a way that I never missed the money.

What has been your best investment?

I would say investing in myself when I chose a more risky career path, paid immense dividends.

No doubt, making a different choice during a few critical decision points in my life, & I’m not providing this interview.

What has been your worst investment?

I’ve allowed myself to get suckered a time or two to the point it’s embarrassing to admit my mistakes.

But I once let myself get suckered into a penny stock investment. I even liquidated $20k in Apple stock when it was performing flat & diverted those funds to that investment and lost all of it. Had I stuck with Apple & continued with my long game principles, that $20k would be worth north of $140k.

What lesson did I learn? Invest in well established companies. If investing in a start-up, do your research & seek the help of professionals you trust before making the move.

What’s been your overall return?

It’s hard to say what my overall return is, but for what I can see:

- Vanguard – 10 Year Annualized ROR = 11.6%

- Merrill Lynch – 3.75 Year Annualized ROR = 14.8%

- Muni Bonds were primarily purchased when everything was low. The bonds in my portfolio have an overall unrealized ROR of 4.85% with tax free coupon payments in the neighborhood of $45k per year.

- Private Equity Investments – This is hard to say. Some of these have been held for 5 years awaiting a liquidity event. Maybe I can report back on this in a follow-up.

How often do you monitor/review your portfolio?

I monitor the market on a daily basis unless we’re experiencing a horrible day.

During the COVID panic, I simply couldn’t look at my investments as I experienced a paper loss near $1,000,000.

During rough market periods, staying the course and maintaining faith is key.

NET WORTH

How did you accumulate your net worth?

While running my consulting firm, I was making a lot of money.

However, through persistent dollar cost investing practices, I’d say over time & with consistency, I’ve also invested well.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Early in my career, it was saving. (To this day, I have friends that knew me in those days & continue to give me a hard time about being overly frugal. This is said while hosting them at my lake home. Go figure!)

Middle of my career, my strength was Earning. When my consulting firm was rocking, cash was flowing in.

Near the end of my career, I’d hope it’s going to become Investing. Ultimately, I think I’d enjoy “playing” in spaces I haven’t tried before. Perhaps in real estate or maybe in options trading. As long as the bulk of my assets stay the course they have, perhaps I could learn a new skill and monetize it in an admirable way. We’ll see….

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

Going through a divorce was probably my biggest road bump along the way.

Striving for a productive relationship with my ex-wife has been the most critical thing I can think of to rectify that challenge.

If we’re to delve into some of my financial mistakes, I described a doozy above. There are plenty of folks out there who promise to use your money in a way that promises you incredible gains. Don’t have a lazy day like I did & allow yourself to get suckered in.

What are you currently doing to maintain/grow your net worth?

Right now I’m staying the course.

The majority of my equity assets are in mutual funds, ETFs, and individual stocks that are focused in solid companies or positions I believe in.

As for the private equity investments, those are in unicorn companies that are yet to experience a liquidity event.

As for the municipals, I’ll be re-evaluating those & weeding out the less productive issuances I’m invested in. And when I do so, I’ll most likely take those funds to one of my brokerage accounts & invest the proceeds into some equities.

Do you have a target net worth you are trying to attain?

All along, I wanted an investment portfolio net worth of $4 million after all debt was covered.

I’ve reached that goal. Now, I’m thinking it possible that I could reach 8 figures. $10-12 million sounds nice.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I believe I was 38 when that happened. It had to happen again after I bought my first wife out of my company.

Alongside the housing crisis my consulting firm was starting to experience a downtrend. I didn’t need to be so cash heavy and started investing heavily in the market.

I’ve continued with that approach since & have now witnessed my investment income to be substantial enough that it’s replaced my “day job” income.

What money mistakes have you made along the way that others can learn from?

Don’t let yourself get suckered with promises of an immense return.

Strive to research your investments when investing in private companies.

What advice do you have for ESI Money readers on how to become wealthy?

Career:

- Acquire an education in something that has worthy job prospects. It’s going to be difficult creating personal wealth without surplus income.

- When you do your job, strive to do it well. If one works hard & smart, they don’t necessarily have to be the sharpest knife in the drawer to stand out.

- Confidence is a weird thing. If you have it & exude it, it will work well for you. It also allows you to bet on yourself. Just be careful to never let it come across as cockiness.

- Learn from what you do professionally, maybe there’s a side hustle opportunity that can be exposed.

Budget:

- In your early days, create a budget that allows you to live well within your means such that there is ample money to be saved.

- Remember, sometimes it’s okay to do without. If all you can afford to eat is a pb&j, then that’s not the time to treat yourself to a steak dinner.

Invest:

- Start investing early without worry over how big or little your investment is.

- Invest in a way that you don’t miss the money.

- Have faith in time. Investing is a long game that the tortoise always wins.

- Maintain an emergency fund for that unfortunate rainy day.

- Strive to diversify where possible.

FUTURE

What are your plans for the future regarding lifestyle?

I would say at this juncture, I’m at a crossroads.

I tried retirement for 15 months in 2015 – 2016 and was ready to return to work. Now, I’m contemplating retirement again.

It has nothing to do with whether or not I can afford to retire. Instead, it has everything to do with what I’ll do with my time. This is why I’m reading blogs like ESI Money, to learn from like-minded people in a similar position faced with similar decisions.

I know one thing will be key for me; I’ll need to establish a routine, otherwise I’ll flounder.

What are your retirement plans?

Of course, I’ll be looking to travel more. There is so much of this world I have yet to see. So, I expect to bump my travel budget up significantly.

However, as I contemplate retirement, I think I need to figure out what I’d like to do from day to day. A few thoughts on this….

I think I’d like to spend some of my time mentoring others on some of the simple lessons in life that have perhaps been lost with some in the generations that followed mine.

If you’ve read this interview to this point, then you may have noticed there is nothing special about the advice I’m giving. I consider most of it common sense but for some, it’s not that simple. So, helping the young and ambitious with things such as the importance of budget, the importance of living well within your means so that significant savings can occur allowing for investing and potentially looking for the side hustle opportunity. Sharing concepts and ideas such as these can really empower others to succeed in life & experience the satisfaction and dignity that comes with it.

Several of those in this blog seem to be sold on investing in single family homes and reaping the double benefit of the annuity and appreciation that can come from it. Perhaps I’ll dig into that sort of opportunity & see if it interests me. As I contemplate real estate, I think I’d like to own some destination properties (i.e. something on the coast or in the mountains) that I can leverage when I want or VRBO/AirBnB when I don’t.

One thing I know, whatever I do, I do not want it to limit where I choose to be. That’s been a hard requirement for me for some time.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

I don’t want to lose my sharpness & I want to improve my overall health.

It’s not that I’m unhealthy, but there were prior versions of myself that I know I can get back to. That will be a primary goal of mine.

I want to find things in retirement that will continue to intrigue & stimulate me & allow me to maintain relevance with others.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

It’s hard to say. I think it was always ingrained in me.

Remember, at 13 I was tracking my lawn mowing earnings in a spiral notepad & depositing all of it into my passbook savings account.

Who inspired you to excel in life? Who are your heroes?

Without a doubt, my parents. I grew up in an extremely frugal home where budgets were tight.

My mom gave me patience & the importance of saving.

My father gave me persistence & the importance of doing a job well and to full completion regardless of whether or not I liked what I was doing.

I’ve always wondered how much of me was ingrained within & how much was learned from experiences. I’m not sure, perhaps it’s a little bit of both. But when I contemplate the experiences I was given in my youth, I wouldn’t trade my frugal, tight existence I grew up within with anything anyone else has experienced. I certainly stepped out of that home extremely ambitious with plans for more.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

I haven’t read all that many books as it pertains to investing.

Most of what I read is historical in nature or thriller novels that simply entertain me.

This is another reason I’m now reading blogs such as ESI Money; so that I can identify some reading recommendations as it pertains to investing.

However, if I were to offer any particular must read, Warren Buffett’s Berkshire Hathaway annual reports are always the best.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

I randomly give to charities and my prior universities. I’m not sure what percentage I give.

However, I find it a must that I look to give back as I trend towards retirement. This is something I’ll need to delve into further.

Although not charity, over the years I’ve helped several family members covering expenses for living & educational needs. These are loans that turned into gifts.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

Last year my wife & I prepared a will and agreed to make all of my investment portfolio assets payable on death. Therefore, I’ve setup separate accounts accordingly.

For example, I have set up accounts for my grandchildren designed to support their college needs. Those will be willed directly to them.

As for the rest, I have it set up that all remaining accounts within my investment portfolio be split equally between my two sons & my wife. In the event something happens to my wife, then her third will be split equally between her 3 children.

In the event my wife & I continue to be dual home owners, my wife will choose one of the two homes & sell the other. The proceeds from that sell will be split between her & my two sons.

Bottom line, I didn’t want my choices in life to adversely affect the legacy I’ve had in mind for my boys but I also didn’t want my wife to live a lesser life than what she currently has. These thoughts were the driving forces behind my will’s setup.

Thank you very much for your thorough explanation and advice. The quote that you mentioned from the MSNBC talking head resonated with me as well. It truly does seem like a lost art that we should be living within our means – and sadly, it seems like most people don’t adhere to this simple law of finance.

I’m curious to know: What was the motivation that kept you going through the rough periods with your work? How did you manage to push through tough times?

I wish you luck on your journey to retire (potentially!) and hopefully you can pick up your travels.

Cheers,

Fiona

Hi Fiona,

Thanks for the response. I’m a very competitive person and therefore hate to lose. Work is a healthy competition for me & working within a program or project is very quantifiable. Maintaining motivation was natural when you consider failing to deliver feels like losing.

In addition, I don’t consider myself overly passionate about what I do so I’ve often wondered what drives me? And the only conclusion I’ve been able to come up with is the euphoria experienced with a job well done. Doesn’t matter what I do; it could be putting a good cut on the lawn, detailing a car, or in this case seeing a piece of work to its successful conclusion, what really gives me a kick is that euphoria I get when I know the job was well done!

I have to say, the level of detail in this interview is outstanding! Very much appreciated. Love the KC upbringing as well.

Thanks for the kind words MI-186. Now I must go and read your interview if anything, to figure out if you have KC roots!

Just know, even though I’ve lived in the Dallas market, my sports passion remains with my ROYALS & CHIEFS!

In fact, during football season, I like to proclaim my two favorite teams are the CHIEFS & whoever is playing the cowboys!

As for the rest of KC, I think what makes it so unique are all of the fresh, hole in the wall venues. It’s not that there aren’t franchise dining venues, but to know KC is to know about all of those venues that are unique to KC! And that goes beyond all of the legendary barbecue!

Thank you for being a terrific teacher. My husband and I learned a lot from the chart you created. We’re grateful for your generous details and thinking behind decisions. Your mantra of living below your means while also doing right by your colleagues and family members has great meaning. Will you be starting a blog and/or mentoring those who share your values? You have a lot to give and teach, and we, as well as many others, would love to learn from your wise counsel.

Thanks for the kind words! Since providing this interview I have decided to continue my career at minimum through 2021. The intrigue within the new opportunity was there & my wife wasn’t interested in retiring just yet. So, having something interesting to do, & not having a partner in crime, we’ve decided to push retirement off for a while. I just hope I’m not falling into OMY mode!

For those reasons, I haven’t pushed forward with mentoring others. However, if I do, I think I would enjoy writing a blog provided it has the potential to reach the intended audience. I’ll have to give it some thought.

As for individual mentoring, right now that’s limited to small gatherings with my children & their friends where they get to role their eyes while I wax poetic on the virtues of budgeting, saving & living within one’s means!

I figure if I reach one soul & they start to drink the Kool Aid, then mission accomplished!

Thanks for your reply! Your children and their friends will thank you one day 🙂 We’ll be looking out for further updates from you!

Great interview MI-240! It has to be one of the most detailed ones on ESI’s list. I loved your points about shopping the necessary evil expenses like insurance and the gimmick intro rates. I’ve done this one for years basically anytime company X raises my rate.

North Texas is a good place to work in tech fields these days. I am just East of Plano and been here for about 15 years now.

Thanks for the kind words MI-202! Yes, I think I’ll always shop down on things. It always seems to work in my favor.

And yes, the North Texas market is loaded down with IT opportunities. I’ve been in this market since 1990 & the overall growth I’ve witnessed is unbelievable.

While contemplating opening a State Farm agency, I attended this informational session & one of the speakers referred to this area as the “golden corridor”. I can’t think of a better description!

Interesting read, very very detailed…lots in common…Blue Springs High Grad, UMKC Grad (BBA emphasis Finance), Information Technology career … although mine has not been in consulting but rather 35 years of Technology leadership/officer positions within the financial services industry, Banking, Insurance, Investment Management … a short stint in Healthcare Technology all within the Kansas City metro area.

Sheesh! You’re right. We may be brothers from other mothers!

Although, I’ve gone from a Hornet (NKC HS), to a Bear (SMSU now MSU), to a ‘Roo (UMKC) & finally to a Tiger (MIZZOU).

And comparing our professional trajectories they are very similar, although even though home is KC, my working career is all from the Dallas Market.

Good luck to you! If you’re continuing in your career, the choices you’ve made should continue to serve you well!

Thank you for sharing your career and financial journey. I always am curious how different paths one can take to have some financial freedom. I am definitely hitting my lowest at this time after my highest in 2019 when I thought my career had finally taken off. My debt was almost completely paid off, just had my student loan left, and I was making a decent wage to where for the first time I could save money and start a retirement. Then,I got laid off and haven’t been able to get back on my horse. I also have been trying to finish school while laid off, but ended up graduating with , I feel a useless degree, a general studies because I ran out of money and didn’t want 10 years of classes to go down the drain without a diploma. Recently, with the Covid acts, and more programs for reskilling the workforce, I was able to get financial aid for a certificate in data analytics. So now I am happy to finally find a career path to follow without more debt. I am halfway through the classes and the next challenge is trying to find a way to gain experience. I have hope, direction, confidence, and back to being optimistic again. It’s great to hear how you were able to grow with a humble start. My parents were immigrants and became citizens in the 60’s (one early and the other late 60’s) and a modest start and two other children with non-verbal autism , so they were never in a position to help me. I can relate your beginnings for making money in your youth. I sold peaches I helped my mother grow in the back yard. I would put them in buckets, attached them to my bike, and go door to door selling them in the summer when I was a kid. I constantly counted my earnings, but I would reinvested in making fabric covers attached to small notebooks and sell them in my grades school to make a bigger profit. All of this was so I could have milk money and buy candy. Funny looking back at it. I truly enjoyed your story.

Thanks for your reply Sandra. I’m glad you enjoyed my story enough to reply. Interestingly your choice to pursue a career in Data Analytics is similar to my step daughter’s. And, so far she has had every door closed before she can walk through. Her Mom reminded her that in Sales sometimes you have to face 100 rejections before you get a single “yes”. I think that’s key for you. Keep your chin up while you’re faced with rejection. With boundless persistence, eventually someone will give you that coveted opportunity. And from there, it’s entirely up to you to prove you’re “value added”. Do that and then your career can catapult forward from there!

Btw, I love your story from your youth. Selling peaches & reinvesting those proceeds to make notebook covers for an expanded profit; that sounds like a fledgling opportunist to me!

If that fledgling opportunist remains inside you & you couple that with persistence, I have no doubt you’ll come out on the other side in much better shape.

Good luck to you!

Thank you for sharing that bit of advice! Good luck to your step daughter she is fortunate to have both of you guys behind her. Everyone needs a bit of pep talk from time to time.

It has been a pleasure!

Nice interview. The Italy rental is intriguing. I need to live a little. Do you have specific ideas how you view this logistically? Would you keep your home and just travel with what you need? Do you know of a service that connects Americans with rentals in Italy? I do consulting now myself, so need to determine when is good to get away. Thx gary

Thanks for your reply Gary! So, the “Italy” thing….

First, let me give you an update. I decided to continue in my career. The opportunity given was intriguing & my wife isn’t ready to retire. So, without a partner in crime & with enough intrigue in the opportunity, I’ve put off the RE in FIRE for now.

So, why does this matter? It’s because I’ve altered that dream for now. My wife has been sent home & can now work from wherever & I already have that sort of flexibility. So, we’ve been exploring the possibility of doing a “Staycation”. We’d grab what we need, get coverage on upkeep items for our homes & head to our destination of choice and Airbnb/ VRBO for a predetermined period of time. And then we’d go ahead and work from our destination(s) of choice.

When we started taking about “Staycation” possibilities, I threw out Italy. We agreed it would have to wait only because of the time zone difference.

However, when Italy does happen, we’ll take a similar approach by doing a long term stay via Airbnb / VRBO or some other similar service. I haven’t dug deep into this, so I don’t know what sort of property sharing services Italy might have that would be separate from Airbnb or VRBO. However, I’d expect they can be used for an Italian destination as we used Airbnb to book a condo a few years ago when we visited London.

MIZ–ZOU!!!

Great interview! Cheers to kicking off the 7 figure party at 38!

The detail was excellent- you planned your way to wealth every step of the way…outstanding!

I especially love how you have laid out your estate plan and how your wife agreed to your desired legacy/financial plan for your adult kids which existed prior to her.

Well done- Congratulations and good luck on the way to 8 figures!

M70, I’m going to assume all you typed was “MIZ”. That way I can give you a “ZOU”!

Thanks for your kind words and observations. I don’t know if fully planned my FI. But, what I do know; I did things to make sure good habits remained in place such as automatic recurring transactions. The work part was never a problem. I’ve always had a work ethic, so the habits needed to be a professional success came more naturally.

As for the estate planning, convincing my wife had its challenges. It came down to a raw, honest conversation centered around the reasons for asset separation. And during that conversation I explained to her how important it was to preserve my legacy for my boys. I also showed her the portfolio. And at that time, she realized within the proposed plan she too will be taken care of. Only then did we reach a consensus.

I’ve seen too many situations where the spouse with the legacy coming into a fresh new relationship caves. I didn’t want to be that guy.

impressive the business you built of 30+ consultants. Congrats on pulling that off, I haven’t managed to do something similar in my current field (investments), but managed to get to 5 employees on technical software side which was great. Truly important to keep up good relationships to build up such a good business!

Thanks for the kind words Charlie. Yes, my staff augmentation consulting firm was a natural side gig for me as long as I avoided any perceptions of having a conflict of interest. And I believe it was all a byproduct of what I was able to do for my clients while supporting them as a consultant.

One thing I struggled with was pivoting my business when the market required a different Engagement Management approach. But that choice was pure risk aversion on my part. No regrets though. As I mentioned before, the company certainly served its purpose so I remain happy with the decision.

Now, if I could do it again, I’d be all about putting together a similar entity. But, if I’m totally honest with myself, I’d probably conclude that’s more work than I’m willing to take on at this juncture!

MI-240, great interview. Congrats on all of your success. I have one question: how did you get access to your private company unicorn investments? Did you reach out to the companies directly? Did you invest in a Venture Capital fund? Thx

Thanks for the response MI192. I’ve worked with an investment banker who specializes in acquiring shares in private companies at a perceived discount from prior equity raises. So, the perception is I’m acquiring a piece of the company at a discount from its current valuation. Of course if the company does follow on capital raises, then my investment is subject to dilution so I view the “discount” an an offset from anticipated dilution that’s likely to occur prior to the liquidity event.

The investment banker then

offers those shares to accredited investors. I’ll typically invest in these companies for between $25k & $150k.

Some I do well with, and others the jury is still out.

This is the closest I’ve been willing to get to being a VC. And since the companies are already unicorn, I’m certainly not going to see a massive windfall like an “early in” VC might but it typically means something that’s measurably greater than what I put in.

Great advice! Especially this:

“When the gimmick rates expire, call your TV programming provider or switch to another. They will typically work with a persistent customer with hopes of preserving the relationship.” –> I do this all the time, just ask for the Customer Retention department and threaten to leave and the deals start flowing.

“Shop your Insurance. Provided the carrier performs when a claim is necessary, it’s all about the premium cost. Why pay more if someone will provide the same coverage for less?” –> Insurance is a commodity that should be bid out every year. Find a good insurance brokerage company that works with reputable companies and let them come back with the offers. We saved around $2k this year by bidding car/homeowners/umbrella out! Progressive was by far the lowest quote.

Thanks for the response SuccessTriangles!

Yes, I too work with an insurance broker & I have them shop all needed policies together. The hope is shopping auto, home 1, home 2 & umbrella together will gain me some “multi-line” savings. And similar to you, when I shopped those policies last December, I saved roughly $2k in annual premiums.

That sort of savings is worth a few phone calls done once a year.

Since I’m a huge out of market CHIEFS fan, I must have DirecTV for the Sunday Ticket. And when I call them to challenge my bill, I typically get them to offer savings that amount to approximately $70 per month. So, annualizing that to $840 is certainly worth a phone call as well!

The other huge winner is my credit card cash back savings. I believe I received -$2500 last year alone in cash back.

So, between all of the above, I’m north of $5k in annual savings.

I don’t care what one’s net worth is; this sort of prudence certainly seems well worth doing.

Great story. I will be m-252. I just want to say that we visited my sister in law and spouse in Lucca Italy where they rented an apartment for 3 months. They got to know the locals and where able to visit many areas of Italy. One of our best vacations. My favorites the hot air balloon ride over Tuscany.

Hi Gina! I read your interview. Nursing eh? My sister is a nurse practitioner & my ex-wife is also a nurse who has elevated her career to the director of OR at a surgery facility. Much love to all nurses!

Congratulation on your soon to be one year retirement anniversary! I hope to join you in the next several months!

Finally, the Italian trip you described above; in that scenario, I want to be your sister-in-law & be the apartment renter inviting friends & family to join me. So glad to hear you enjoyed that experience!

Take Care

Ah yes, we need to select a country and return the favor. So many to choose from…