If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in March.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

My wife and I are both 58 years-old and have been married for 34 years.

We met in high school and started dating after college.

Do you have kids/family (if so, how old are they)?

We have two adult children.

Our son is 29 and our daughter is 26.

Our son is on the autism spectrum and lives in a group home.

Our daughter lives in the Southwest in a major city.

What area of the country do you live in (and urban or rural)?

We live in the Midwest, in the suburbs of a major city.

What is your current net worth?

Our current net worth as of February, 2023 is approximately $2.3 million including the value of our home.

Prior to the November, 2021 downturn in the economy, our net worth was $6.5 million.

Based on the conviction I have regarding the companies whose stock we own, I am confident we will get back to where we were in 2021 and will continue to grow the asset value of our portfolio once the macroeconomic conditions improve.

I have a long-term investing mindset, understand the difference between volatility and risk and am comfortable with a higher level of risk.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Stocks and liquid assets as follows:

- My Roth 401-K: $1.3M

- My Roth IRA: $190K

- My wife’s Roth IRA: $275K

- My wife’s IRA: $9K

- HSA: $15K

- Home: $500K (mortgage will be paid-off in July, 2027)

Within the above numbers are approximately $800K in cash the majority of which are invested in a combination of ETFs comprised of the Dividend Aristocrats (companies who have consistently raised their dividends for the past 25 years) and 9-month US Treasury Bills. This is safe, boring money that keeps pace with inflation and is not subject to the up and down swings of the stock market.

The balance of our assets is in high-growth individual stocks, mainly Technology and Software as a Service (SaaS) companies that I will discuss later during this interview.

EARN

What is your job?

After 36 years, I retired in 2022, having most recently served in a Director-level position for a national building construction firm. I genuinely loved my job and the people with whom I worked. And yet with my Dad’s cancer diagnosis and other cardiac-related health concerns taking place with other members of our family, my wife and I decided that since “no one knows when our movie ends,” and since we had been disciplined savers all our lives, that we could afford to retire and take advantage of the opportunity to follow our passion of travel, spending time with our family, volunteering and focusing our time on those activities. A friend of ours reminded us of the go-go 60’s, the slow-go 70’s and the no-go 80’s…and that anything after that was a bonus.

Faced with the fact that we were a little over 20 years away from that no-go part, and since we both love outdoor activities such as hiking, biking, camping, camping and fishing, that we would grow old together doing the things we loved in the company of our friends and family for as long as possible. As my Dad says, you can’t take it with you and you don’t see many trailers behind hearses.

What is your annual income?

I retired with an income of approximately $190K/yr.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

Funny how back in 1987, straight out of college, I was offered a job for $19K/yr with no insurance benefits to serve as a construction estimator for a general contractor. I refused the offer and thought to myself, how do you expect me to live on that!?

So I took a job as a commercial construction project coordinator for $24,500/year, which back in the day was considered a good salary. I enjoyed working at this company, brought in a lot of work as a Director of Business Development at this company for 13 years and had grown my salary to $35K/year.

In 1999, I moved to a larger construction company, where my starting salary was $52K/yr, and although this was less than I had hoped for, I made that known to my hiring manager. Within a year or so, I was making over $60K/year.

My team and I were successful winning major project work including high-rise construction valued at over $50 million, which was a significant amount of money back then, considering the annual rates of inflation and escalation costs that have taken place since that time.

After 10 years, I left this company, as a statistic of the financial crisis/recession and mass unemployment that hit the Architecture, Engineering and Construction (A/E/C) industry so hard between 2007-2010. I left this company at a salary of approximately $90,000.

For 6 months, I was unemployed, as were many of my industry peers. With construction as a leading economic indicator, the economy was in the tanks and if misery liked company, I had lots of friends in our industry. The job outlook in my industry was looking so poor that college students even changed majors out of construction and architecture, which created a worker shortage.

In 2009, I began working for a large international Architectural/Engineering firm with a starting salary of $100K/year. I traveled for work overnight frequently and would often leave town on Monday and return on Friday.

The turnover of personnel at this organization was off the charts. The organization I was working for was known to be a meat grinder with no work-life balance. At our regional office, we burned through 117 Architects and Engineers during the 7 years I was there as well as 3 department heads in the group with whom I worked.

Although I learned a lot, the travel took its toll on me. I eventually developed an addiction to alcohol and checked myself into an outpatient treatment program, where I could work my job during the day and work on getting myself sober during the evenings and on Saturdays. My employer worked with me to modify my travel schedule. I am beyond grateful to have addressed this issue early, and before it got the best of me. I was fortunate, as the stories of broken families, etc. that I heard at my treatment and AA meetings were far worse than my situation.

I am convinced that had I not sought help and gotten this under control, my current financial situation today would be significantly different. I didn’t wake up one day and say, “hey, I think I’ll go wreck my life.” Rather it took place slowly over years of travel for work and burning the candle at both ends. I left this job after approximately 7 years and a salary of approximately $110K/year.

In late 2015, I contacted an acquaintance at a large, national construction company with who I had discussed the possibility of a job change to this company for some time. In addition I had been approached by one other person at this company over the years about their interest in me, and frankly a fresh start at company whose work culture was known to be exceptional. I began the final job of my career at a salary of $132K/yr.

The 6.5 years I spent here was the highlight of my career. I loved most everything about my job, my co-workers and my boss was genuinely the best boss I’ve had during my career. My performance was better than it had ever been. Our go to market approach was a seller-doer model, and at the peak, we had annual sales of $800M, and the salary was fantastic. When I retired in August, 2022, I was making $190K/yr and felt I was having an impact and making a difference in the lives of the clients we served as well as my co-workers.

What tips do you have for others who want to grow their career-related income?

Focus on bringing value to your clients and to your company. Practice quiet competence. Deliver results, for that is all that really matters to your company and your clients. You won’t have to tell people at your company what you’ve accomplished, they’ll know.

Be the best version of yourself that you can be. Always do the next right thing. Who you genuinely are as a person will speak loudly to people sitting across the table from you, weather you know it or not. Remember, people don’t always remember what you said, they always remember how you made them feel. Everyone has an internal BS meter. Be a giver, not a taker. Everyone knows which one you are. Everyone listens to WIIFM radio (What’s In It For Me).

Don’t work so hard that you do so at the expense of your family. Your kids are only kids once. Being a good role model and spending time with spouse and your kids is the most important thing you can do. Do you work to live or live to work? Only you can answer this.

What’s your work-life balance look like?

This is something I always struggled with. From the time I was 16 years old, I was a workaholic. I married an amazing wife who did the majority of the parenting while I was gone so much, although I did schedule work trips around many of the kid’s activities.

As mentioned earlier, we have a 29 year-old son with autism. At first, when we learned of his diagnosis at age 3, my wife continued to work as a school teacher. My wife received her masters degree about the same time we were married, so her salary was approximately $55K/yr in the late 1980’s. She was the primary care-giver and parent, taking our son to his many, many doctor’s appointments while I was the primary bread-winner.

Eventually, after taking the cost of having two kids in daycare into consideration, we decided it was time for my wife to take a leave of absence and eventually quit her job. Although we were fortunate to have been able to do this, there was a year or two that we did not save for retirement. Hindsight being 20/20, this was one of the best decisions we ever made, and it worked out well for us.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

No. I originally planned on consulting with my previous employer after I retired, however I am enjoying my time doing what “normal” people do, that because of being out of town frequently, my commitment to my job during my working years and being the family breadwinner, I did not have a lot of down time most of my life.

We have adequate financial resources. Once the economic slowdown moves on, I am confident our portfolio will continue to grow in a way that is similar to how it did before the economic downturn that began in late 2021.

SAVE

What is your annual spending?

We spend $145K/year before taxes.

What are the main categories (expenses) this spending breaks into?

Annual Expenses:

- $25K Travel

- $25K House Payment at 2.3 % interest rate that gets paid-off in 4 years

- $5K car payment at zero % interest rate that gets paid off in 3 years

- $3K furnace payment at zero percent interest rate that gets paid off in 2 years

Do you have a budget? If so, how do you implement it?

Short answer is no, we do not have a formal budget that we actively work through and check off expenditures each month.

We’ve always lived below our means, and have learned that doing so is the only way to become financially independent for most people.

We buy used cars, still live in our starter home and don’t have to have the brightest, shiniest and the best of everything.

That said, we like nice things, yet we are comfortable in our own skin and feel no need to flaunt our “wealth“ in front of others. Wealth resides in investments. Flashiness is not our style or something that either of us value.

At age 58, we’re at a point in our lives where we would rather spend our money on experiences than things.

What percentage of your gross income do you save and how has that changed over time?

When I was working, we invested 15 to 20% of our net income. I have been fortunate in that I invest a lot of my time in investing. It is a hobby that I enjoy, because it reminds me of business development and sales. I love the thrill of the hunt.

As soon as possible, max out your Roth IRA each year and if you have the option in your 401-K to invest into a Roth 401-K. I’m a big believer in Roth IRAs and Roth 401-Ks because this is your after tax money that the government can’t take away from you. Regular 401-Ks and IRAs are pre-tax money for which you’ll eventually need to pay the piper aka Uncle Sam.

The benefit of a Roth vehicle is not in the tax savings, rather, it’s in the fact that you won’t have Required Minimum Distributions (RMDs) once you’re in your 70s. This is only a “problem” you’ll need to deal with once your portfolio reaches 7 figures. Once you reach a million-dollar portfolio value, your doublings get bigger each time, as does the eventual tax bill.

As you may have heard, Warren Buffet’s portfolio increased far more in value during the later years of his life for this very reason.

What’s your best tip for spending less money?

Keep your eyes on the prize.

Is your prize trying to impress others with the perception of a lavish lifestyle, or are you comfortable enough in your own skin to be the Millionaire Next Door (great book by the way). Read the book, the Millionaire Next Door. It changed my life. Also read the books Think and Grow Rich and the Psychology of Money. In my opinion, there’s nothing more effective that helped me stay focused on spending less money than reading these books.

Yes, driving a Lambo and living in a McMansion may be fun, and yet we each get to put on our big boy or big girl pants and decide for ourselves. This decision by itself will have a huge impact on when you can retire.

We based our lifestyle and spending habits on our unique family requirements. That said, the previously numbers quoted in my financial assets don’t include the trust we opened for our son with disabilities or the Roth IRA we started for our daughter, or the cash we paid for her college degree or the $800/month we paid for our son’s disability services from the state. I’m a big believer in the cliche, “show me your checkbook register, and I’ll show you your priorities.”

What is your favorite thing to spend money on/your secret splurge?

Travel and meals out with my wife and family.

I grew up in a family that had very little financial means. My Dad made $14k/yr and when we were in 3rd grade, my Mom took a job as a secretary. Before this, we literally couldn’t afford to go out to eat at a restaurant. Once my Mom took a job, we got to go out to eat, but we still wouldn’t order a beverage other than water with ice.

Things improved significantly when my Dad started his own business. Yep, as you might guess, he started a residential construction company.

INVEST

What is your investment philosophy/plan?

We each have our own comfort level with risk. I have come to respect each person’s right to choose a level of comfort with risk and to invest that way.

That said, it has been my experience that many people get used their savings always being there. To grow and multiply money, one has to put it at risk. The beauty is that it can be an educated risk, which is far different than going to the casino and rolling the dice.

For me, far more of my wealth has been created through investments than the amount of principal I invested and put at risk. The power of compound interest is amazing and once I experienced it, I was hooked.

Our retirement portfolio includes 3 to 4 years of living expenses invested in boring, low-risk investments such as short-term, 9-month treasury bills and ETFs that invests in dividend aristocrat stocks, meaning these are companies that have maintained or increased their dividend for 25 years or more. This allows me to invest 100% of the rest of our assets in a concentrated portfolio of Software as a Service (SaaS) companies with handsome returns that have enabled us to retire early.

The companies in which I’ve mainly invested are Software as a Service (SaaS) companies. These are high growth, low capital intense companies that are in hyper-growth, meaning companies who are growing revenue at a minimum of 40% per year, and with very high gross margins. Revenue is almost all recurring, meaning these companies both save their customers money and help them make money to the point that their customers have a selfish reason to want to purchase their services quarter after quarter and year after year. No one customer generates more than 3 to 5% of the company’s annual revenue.

This is revenue that grows year over year, with a Dollar Based Net Retention Rate (DBNRR) or Net Dollar Retention rate of more than one. This means if their customers purchased $100,000 of their services last year, the following year they purchase $120,000 or (120%) or $130,000 (130%), because doing so either saved their customer money, helped to make them money or both. Doing business without their services makes no sense.

Companies that sell “services” such as software and use a subscription model are typically referred to as Software as a Service or SaaS. Without going down a technical rabbit thole, SaaS uses cloud computing to give customers access to software programs via the internet.

SaaS companies typically have valuations that are much higher than companies that sell “things,” that unlike SaaS, are not purchased over and over and on a recurring basis. SaaS companies that make good investments often have gross margins in the range of 60% to 140% per year.

Typically these companies could show a “profit” if they wanted to, however the SaaS company’s goal is typically to grow market share as quickly as possible and before their competition, while simultaneously innovating and introducing new services and modules to expand revenue and grow DBNRR. This “land and expand” go to market approach involves land (initial sale) and expand (grow revenue within that customer) to eventually turn them into larger customers. An effective SaaS management team manages spend on Sales and Marketing (S&M) and Research and Development (R&D) with surgical accuracy to optimize these investments just below the point of achieving a “profit.”

The best SaaS companies have revenue growth that is predictable, profitable and diverse with margins and multiples that are off the charts relative to companies that sell things.

Before investing in SaaS companies, however, be sure to know if you are comfortable with volatility, and understand the difference between volatility and risk. If you’re not comfortable with +/-30% swings in stock price (or more like 60% during the downturn that began in late 2021), SaaS may not be an approach that aligns with your ability to sleep well at night. I’ve heard investors who hold these companies say that volatility is the entry ticket to the game, and the price one must be willing to pay to achieve the potentially outsized returns that can come with investing in SaaS companies.

While I had accounting classes during college back in the 1980’s, I recently took a month long online course on financial statements explained simply that caused me to internalize and develop a better understanding of this and the key metrics that matter most when evaluating the viability of an investment and tracking its sequential (quarterly) revenue, earnings and other key metrics. For anyone who wishes to get serious about investing as a means of securing your financial future, I strongly recommend you understand financial statements. If even I can do it, I know most of you can too.

What has been your best investment?

My best and worst investments were the same company. Upstart (UPST) is a company on which we made over $1.5 million on top of our $500K principal.

Once the economic downturn took place in late 2022, I sold it for just under $500K.

I still believe the company will do well once the macroeconomic situation improves aka, war in Ukraine, inflation, interest rates, etc.

In retrospect, I hung-on too long and as much as I wanted to believe the company was going to weather the economic storm, I eventually decided there were better places for my money.

What has been your worst investment?

Upstart, definitely (see previous question.)

What’s been your overall return?

The seven years from 2015 to 2021, our portfolio grew 15X. In 2015, the value of our portfolio was approximately $400,000, and by November, 2021 our portfolio had grown to over $6M. This was done by investing in high growth Software as a Service (SaaS) companies, by adding approximately 15 to 20% of our annual income to our portfolio and with no margin and no outside infusion of cash from an inheritance. We have never received money from an inheritance.

I belong to a couple of crowdsourced investing communities where we share perspectives and ideas and there’s no pressure to buy stock in any companies and no way for people to make money on each other. It was once we reached this point that we decided to retire…and that the stock market, specifically SaaS companies literally tanked to the tune of more than 65%.

I said earlier that I have a fairly high tolerance for risk and hold a concentrated portfolio, meaning I typically own stock in 6 to 12 companies. A concentrated portfolio allows me time to really research, know and develop a conviction about each company, so when (not if) something happens that impacts the company, I have staying power to stay invested in the company or reduce my asset allocation or sell if the investing thesis has changed. I listen to the quarterly earnings calls of each company in which I own stock, and analyze how their revenue, gross margin, free cash flow and other key metrics are growing or shrinking from quarter to quarter.

How often do you monitor/review your portfolio?

As companies release earnings, I add to or reduce the asset allocation of the companies in which I am a stockholder.

I am a modified long-term buy and hold investor, meaning I frequently hold positions in companies for two or more years, and sometimes get out sooner when there are better places for my money.

NET WORTH

How did you accumulate your net worth?

Although I made a decent salary during my career, we lived under our means and were big savers.

We consistently invested 10, then 15 and then 20% of our net income each year.

The biggest contributor to our wealth accumulation was definitely investing, as I described in the previous section, “What has been your overall return.”

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

One begets the other, and we did the E, S and I simultaneously. Investing, however and the power of compound interest definitely made the biggest impact in growing our net worth.

Now that I’m retired, and no longer earn money as a salary, I earn money as an investor. In addition to staying 100% invested in the stock market other than our 3-4 years of living expenses in boring investments (to keep pace with inflation), taxes are the biggest expenses we currently have.

As the saying goes about death and taxes, I’m currently rolling most all of our assets that are not yet free from taxes into Roth investment vehicles.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

My addiction to alcohol that I described earlier in this interview and seeking outside help was by far the biggest obstacle I’ve faced.

What are you currently doing to maintain/grow your net worth?

In a word, investing.

When I retired, I did so in part because there was more than one day when I made more money in the market in a day than my entire yearly salary at my day job.

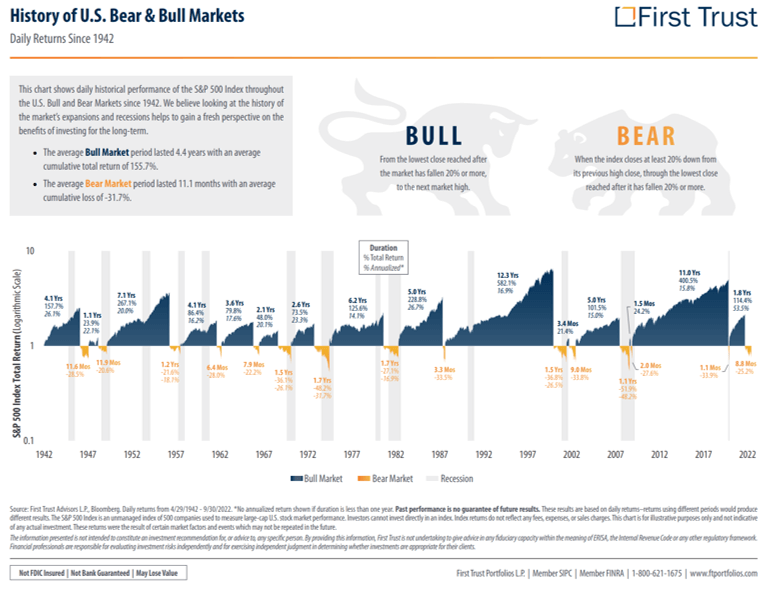

I am not counting on this being the case in the future. Historically, I believe the stock market to be the best wealth generating machine available. The following graphic proves this out. I’m a big fan of up and to the right.

Do you have a target net worth you are trying to attain?

No, however, I’ve hired a fee only financial advisor to help facilitate the roll-over of my assets into Roth investment vehicles (Roth IRAs and Roth 401-Ks).

My goals are to create generational wealth and to eventually donate as much of our portfolio as possible to marginalized people, such as those on the autism spectrum and those with cognitive impairments.

How old were you when you made your first million and have you had any significant behavior shifts since then?

At the age of 55, my net worth excluding the value of our house reached $1 million. It’s funny, because I was younger, I figuratively imagined that people who had reached this net worth walked around with tattoos on their forehead that said “I’m a millionaire!” No tattoos here.

No, we don’t spend our money much differently than we did during journey to $1 million. We’ve always lived under our means, and will probably do so for the rest of our lives.

In speaking with our fee only financial advisor, he said he’s seen this same thing play out a million times, and this is typical of a great many of the people who reach a portfolio value of $1 million.

I find that I need to give myself permission to make purchases that I wouldn’t have done before we reached a $1 million portfolio value.

What advice do you have for ESI Money readers on how to become wealthy?

Be accountable to yourself. Develop an attitude that if it’s going to be, it’s up to me.

The E, S and I of ESI Money are so inter-related, and yet for me it’s the invest part that made the difference. At a $190K/yr salary, I now have a sustainable retirement nest egg from which to draw. If your household income is half that at say $95K/yr, that just means you don’t have to save as big of a nest egg as me to maintain your current lifestyle. If you want to increase your lifestyle, then you can adjust your rate of savings, rate of (investing) return or length of time you’re invested accordingly.

Know thyself and your comfort with risk. If you’re uncomfortable with risk, invest in S&P 500 index mutual funds that are not “actively” managed by a manager, rather the mutual fund owns stock in each of the companies that comprise the S&P 500. Know that there are three main variables, time, rate of return and the amount of money (principal) you save. Each of us gets to choose which lever of the three variables that you pull.

Obviously, there are many ways to become wealthy, and what I’ve shared during this interview is simply what worked for me.

FUTURE

What are your plans for the future regarding lifestyle?

We’ll most likely maintain our current lifestyle.

We were fortunate to have been able to retire early. We plan to travel quite a bit domestically and internationally and plan to spend at least $25K/yr doing so.

What are your retirement plans?

Travel, spend time with aging parents, travel to visit our daughter, volunteer at church, spend time in a Bible study now that I’m not traveling every week.

Believe it or not, I love investing and it has been fantastic to have the time to dive deeper into this.

Remember, however that 99% of successful investing involves sitting on your hands and letting the cake bake in the oven.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

The future of our son’s wellbeing after we’re gone has been thought out by my wife and I.

He has nearly $100K in a trust in which we invested on his behalf, and plan to use this as a downpayment for a house for him.

We want to be sure that he has a house that no one can take away from him when we’re gone.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

We began investing at age 26, shortly after we were married that it began to click for me. I attended an investment presentation by David and Tom Gardner, the founders of The Motley Fool Investing Community. I read their book and began to follow them online. My passion for investing in the stock market took off from there.

I recall investing in the dogs of the Dow approach back when I had to look up their stock performance in the newspaper, because the internet had just started to become utilized, and I didn’t have access to a computer. The internet has made investing so much easier. Trades back then were anywhere from $35 to $50 per trade. Now with the proliferation of deep discount brokers and online trading, it is no longer necessary to pay for stock trades.

Who inspired you to excel in life? Who are your heroes?

My Dad. He came from a very poor family, had a paper route and paid for his own clothing at age 12 and lived in a sleeping room because his mom had multiple sclerosis to the point that she could no longer take care of him. He did not know who his biological Dad was.

Yet in spite of this, he was a family man who always provided for our family and saw that we went on vacation and took trips as a family. He eventually started his own business and I now manage my parents’ financial portfolio of more than a $1 million.

I’m proud of my Dad, and that he became the person he is. He has been a fantastic role model for me, saw that we had a Christian upbringing and he was financially successful in spite of his challenging upbringing.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

My three favorite books are:

- The Millionaire Next Door – Because it amazed me that millionaires were people who on the outside looked just like me, rather than people who flaunted their wealth.

- The Strangest Secret – An audio book that taught me, “You become what you think about.”

- Think and Grow Rich – Helped me focus on my desire to become financially independent.

During high school and college, I was not a reader. Once I graduated college, I became a voracious on-fiction reader and saw a sign at a bookstore that said “readers are leaders.” I wanted to be a leader so I could make a salary that allowed me to save money and eventually become financially independent.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

We give approximately 7% to 10% of our income to church and charities.

I genuinely believe that by the grace of God go I, and that to whom much is given, much is expected. I believe that my financial blessings are from the hand of God, and that I’m nothing more than someone who followed my God-given passion to get to this financial place in my life.

When we die, a significant portion of our estate will go to marginalized people on the autism spectrum, those with cognitive disabilities and church.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

Yes. Intergenerational wealth is important to us.

Our goal is that our children and our children’s children will be recipients of a portion of our money, and that it allows them to focus on the more important things in life besides just work and career.

What an amazing and inspiring story; well done!

A thought I would like to share with you regarding your active investing strategy. I too, have been an active investor (long-term, value plays & dividend investing) and I was very successful at accelerating the growth of my retirement accounts to reach FIRE status.

No doubt, it is both rewarding and a huge rush to experience growth > 60%. If I am being honest, at the opening, I was struggling to understand how your NW changed so dramatically. It all made sense when I read your SaaS investment strategy.

But…the phrase ”When you have won the game, stop playing” comes to mind.

Now, I am in my late 50s, so age does matter.

However, if your lifestyle didn’t significantly change when you reached 1 million, then it probably won’t change at 2M, 3M or 6.5M. So, why take on the concentrated risk? Understand, this is from someone who scored bit going long with AAPL, TSLA, DE, XOM, PSX and a few others.

I am not suggesting you completely remove all risk. However, it reminds me of the gambler in Vegas, who goes on a hot streak, but just can’t walk away from the table. And well all know, Vegas wasn’t built on the shoulders of “winners”.

I applaud your story and courage – I am very conservative and would be nervous with invested assets of $1.8m and annual spending of $145k – that has you up above a 10% withdrawal rate when factoring in taxes? Are you looking to earn extra income or dial back spending for the next couple years to combat the sequence of returns risk and uncertaintly of the next couple years?

Thank you for your question, Lisa.

The investing process I have used for the past 8 years has a CAGAR of 32% since 1989. Agree that a 10% distribution rate is higher than my preferred 4% rate, especially when the perfect unplanned macroeconomic storm of the past 2 years coincided with my retirement. I have reduced my rate of return expectations and will continue to invest. Having expected responses similar to those posted so far re: risk, and having run the numbers, having done roth conversions and considering the Bear/Bull Market graphic I included in the article, I am confident in maintaining this investing approach. Best wishes to you in your journey!

Is that a CAGR someone has ACTUALLY achieved, or is that a ‘reverse engineered’ strategy that would have hypothetically given someone 32% CAGR IF they had made all the right decisions at the right time? Because that certainly sounds WAY too good to be true…

Wow. I was uncomfortable reading this post. First million at 55 and 6.5mil at 59 and then down to 2.3mil. No offense but if this was posted on April 1, I would think it is an April fools joke. This makes no sense. Why have so much risk when retired? Withdrawal rate is super aggressive too. He is also analyzing SaaS companies like he is a professional business analyst which I am not sure how he has the background/education to do this.

I don’t get this one but to each his/her own. I would have a Plan B and Plan C if it was me. I do hope everything turns out well.

I was thinking the same. Completely agree with you.

I also read this post thinking it was a joke post and it would have been perfect for April Fool’s day! Dude!!! I was stressed out just reading about your investment strategy and withdrawal rate! And no offense, but at your age, you don’t have enough time left to be making these big risky plays. Does your financial adviser agree with your current strategies?

fascinating read. wow!. I only wish u luck and blessings for the coming years. Your desire to give to marginalized people is enviable. Can’t wait to read your retirement update, in part to see if u get back to your high water net worth mark. That’s a huge drop. Enjoy ur retirement.

Thanks for sharing and being truly transparent in your journey — an amazing life journey and can see how God has been with you along the way. Offering prayers that blessings continue to abound and the right Bible Study presents itself. And yep travel now while you can and Think and Grow Rich was one of my favorite books to include Master Keys to Riches.

Nice interview – congrats on your successes! Can you elaborate more on what caused the decrease in NW from $6.5M to $2.3M?

The performance of SaaS companies in which I was invested continued until macro economic aka Ukraine/Russia war, Interest rates spiking from 2.5% to current levels, etc.

These included DDOG, NET, CRWD, BILL, ZS & MNDY among others.

Most people invested in SaaS companies had the same “character building experience.”

Hi – I come from the SaaS world and know these companies in and out. DDOG, CRWD and ZS and market leaders and world class companies. I’ll also add SNOW to the list. These companies right now are at their 12 month low if I’m not wrong and it might be an opportunity of lifetime to invest in them.

That being said, you’re gutsy at 58 to have invested in these companies since they mainly faced the brunt of the bear market. There are also several negatives and downsides you witness when you are in the industry. That being said, it refreshing to see you optimism and belief in them.

With SaaS, companies scale up when cash is easily available and scale down their spend when cash is scarce like it is now.

No one knows if they’ll stay at the same price or get back to their all time highs. But do know there are several folks who are in the same boat as you! hope that helps.

Perspective is everything isn’t it? I am also a SaaS industry insider and agree that this experience is not unique. Even intimately understanding valuations of SaaS companies is insufficient these days. You have to understand competitive dynamics and sustainable competitive advantage.

Interestingly though, if we change the conversation from “losing” $4m in valuation in 2 years, and instead said he went from $1m to $2.3m over 6 years ($1m at 55, $6.5 at 59, and now $2.3 2 years later presumably, post pandemic), we would be talking about someone who achieved about a 14% annualized return over that period.

Most would celebrate that return as being quite strong.

The peak valuations were overpriced, but the underlying returns are still not bad at all….just volatile.

@MI-296- great comment! No one knows even within these companies on what’s the future like! Haha

which SaaS stock do think will recover and get to their all

Time highs? I’m hearing of Datadog being expensive and customers ditching it in favor of other solutions, same with snow. These are massively expensive products. If you had to pick 3 which ones would you pick and why.

Thanks for sharing your story and congratulations on your methodical and frugal approach to retirement planning! I have a question regarding your son. We also have a son on the autism spectrum who is just turning 26 and still lives with us. I’m curious as to how you went about finding a group home situation that works for him? Thanks in advance.

Did I read this correctly? Did your net worth really drop by 2/3 since the pandemic? That would be a difficult thing to face with a positive attitude- but it seems you have. Wishing you the best of luck to bring it back up, if that’s what you want.

24

he is definitely positive. It’s great that people can share successes and losses. TBH, he wouldn’t even get to 3-4 M if he wasn’t more aggressive. Wish him well.

Fascinating read. I was not familiar with many of the companies you mentioned and enjoyed browsing their stats.

Congratulations on early retirement. I have a question about your analysis of a sustainable withdrawal rate.

Plugging your current non-home invested net worth (1,789,000) and spending ($145,000) into a Monte Carlo calculator such as FIRECALC, it would predict that there is an 82% chance your investments will be depleted and you will be down to only social security as income within 30 years.

Acknowledging that there are adjustments that could influence this in a positive (spending reduces when debt is paid off and social security will begin supplementing income in 4 to 12 years) or negative ways (taxes or unanticipated future expenses).

However, I would be apprehensive that current spending exceeds a sustainable withdrawal rate. Counting on outsized investment returns to make up for unsustainable spending seems to lack sufficient predictability to rely on given the consequences of it not going as hoped.

You mentioned have a financial advisor. Can you share the advise he/she is giving you on a starting spend in the context of your current net worth?

Hope & gambling is this guy’s plan, not investing. The ending to this story is going to be sad unless he dramatically changes their spending which they won’t because gamblers always believe in their next big score coming through.

What a fascinating read. As a single mother of a 19 year old son on the Asperger’s spectrum, I applaud you for your commitment to helping others afflicted with this condition. I too believe that God has blessed me and that it is right for us to bless others. I wish you all the best and thanks so much for sharing your story.

After reading all these comments and re-reading the article I’m struck by how naive the author is in thinking that the delivery model – SaaS – is more important than what problems the software actually solves.

Obviously the author should speak for himself, but that wasn’t really what I took from the story. I felt like he was articulating a baseline case to help everyone understand why his strategy is so exclusively centered on this type of company, and how valuations are calculated. Given the types of companies in which he has invested, there is clearly more to it than JUST the delivery model, as there are now thousands of SaaS companies out there.

That being said, your point is extremely valid in that software (regardless of how it is delivered) is only as valuable as the problems it solves or the business model it enables. That’s pretty much true across B2B, B2C, on-premise and cloud software.

Annual withdrawals of $145k out of a $1,789,000 financial portfolio (we must exclude the home equity from the net worth to calculate SWRs) would be a withdrawal rate of 8.1%. That doesn’t seem very safe. But, hey, if you have the flexibility to spend 4-5% of the portfolio, $72k-$89k, that’s still a very comfortable retirement.

Sure, some of the ultra-risky, high-beta stocks might bounce back, and this will all work out beautifully even at $145 annually. But I’d assign a less-than-50% probability of this strategy working out.

So, I’d certainly like to see updates on this case in two and five years!

If you go back to a previous post, you’ll notice the probability has a track record going back to 1989 of 32% CAGAR.

As shown below, this approach has a track record of a 32% CAGAR that’s back tested to 1989. Curious how it suddenly goes to less than a 50% probability. Please explain the logic and source for determining your assignment of a 50% probability.

https://forums.millionairemoneymentors.com/t/mi-364-interview-reactions/8246/35?u=millionaire364

Yep, you convinced me now. 32% p.a. is the contractually safe and guaranteed future return for those companies. (sarcasm)

But good luck with your retirement!

You mentioned you invest for your Dad. What is your investment strategy for him? Percentage of stocks to bonds and cash and are you using low cost market ETFs like VT, VTI, VOO, VUG, QQQ, QQQE, VOOV, SDY, SCHD, VIG, IJR, RSP, or SPY or the many others to safely diversify. I own all these and several other ETFs that are sector specific to sleep better at night but have so far always done better with individual stocks trying to pick the dominant companies in each particular sector. I too owned some unprofitable software companies, but sadly sold all except a few like CRM and NOW at a loss mid first half of 2022. 2020/2021 was an exciting time for these software companies. I wish I would have bought back PLTR, AI and DKNG this year. Those suckers were hot and it was such a rush briefly owning them before things went south in 2022. I thought I was so smart that I should quite my day job and research how to start my own fund. They came back this year though if we could have just timed it right and sold 10-31-21 and bought back 1-2-23. I traded them for boring index funds which have provided a boring 16% YTD 2023. No 100%+ returns with these index funds in 12 months ever but I may allocate some new play money and get back in the high growth game as I suspect we may be in a new AI induced bull where you have to pick the winners. Best of luck to you.

40% same approach and 60% blue chips and cash.

I prefer a buy high and sell higher approach, as winners keep winning more often than not: There are many ways to make money in the stock market and my experience, conviction and risk tolerance aligns with this approach. In the future I will put a bigger $ allocation aside and as of now, will continue with this approach.

Best wishes to all who utilize the approach that best aligns with them and theirs.

364. I think that’s called momentum trading which can be very successful in a bull market but the timing factor is beyond me. I just don’t know when to sell the momentum trade. I find myself getting more conservative in my 50s. Best of luck.

That’s a smart plan 364. It’s what Nassim Nicholas Taleb refers to in his book “Antifragile” as a “barbell strategy”. The ends of the barbell don’t have to be symmetric but they do need to have vastly different risk profiles so you have some good upside and keep downside tolerable.

Thank you for sharing!

I loved your comments, “I genuinely believe that by the grace of God go I, and that to whom much is given, much is expected. I believe that my financial blessings are from the hand of God, and that I’m nothing more than someone who followed my God-given passion to get to this financial place in my life.

When we die, a significant portion of our estate will go to marginalized people on the autism spectrum, those with cognitive disabilities and church.”

Hi, thanks for sharing — I’d be interested to hear more on your approach to selecting which tech/SaaS stocks to buy and how you determine when to sell? Any reading or learning materials that you can point to? I’m a software engineer that’s worked for a publicly traded SaaS and currently work for a FAANG, so it’s been on my mind as something I’d like to get into more.