If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in April.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

G’Day! I am 49 years old and my spouse is 44.

We have been married for fourteen years.

Do you have kids/family (if so, how old are they)?

I have four children.

Two are from a previous marriage and are twenty seven and twenty five years old. The twenty seven year old moved out of home about four years ago, and the twenty five year old moved out earlier this year. Both are progressing with their own lives.

I also have a twelve year old and a ten year old.

What area of the country do you live in (and urban or rural)?

I live near one of the large capital cities on the east coast of Australia.

Our location is urban, although the ocean is nearby and so are some mountains (large hills really) and a hinterland area, so it’s a beautiful place to live.

What is your current net worth?

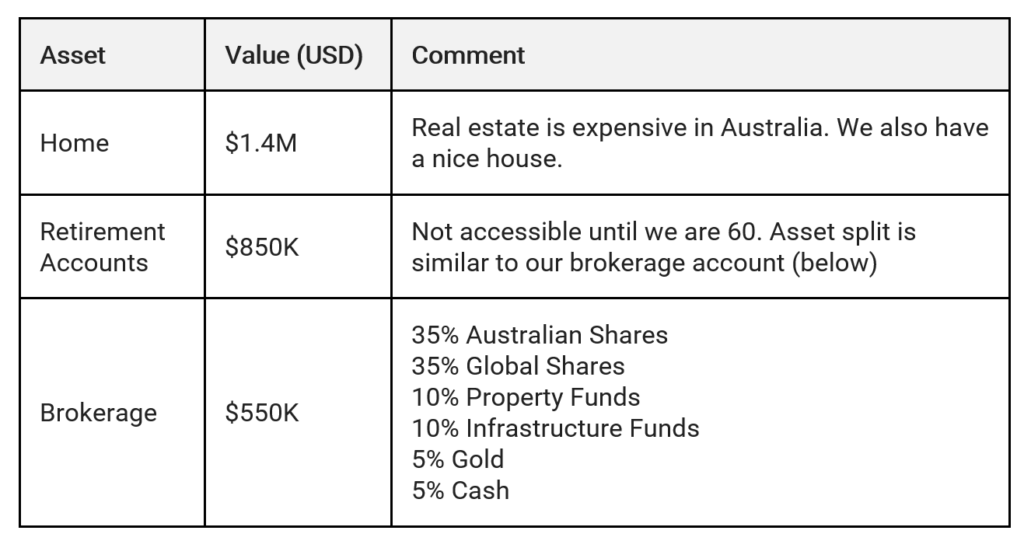

Assuming an exchange rate of $1 Australian dollar equals $0.75 US dollars, our net worth is $2.8M USD.

Given I am a citizen of Australia, I usually think in Australian dollars. During a month-long holiday to the USA in 2019, my observation was that prices for most day-to-day items in the US are very similar in dollar terms to prices in Australia, although denominated in a different currency. Thus, an item costing $50 USD in America can usually be purchased for $50 AUD in Australia.

Similarly my net worth in Australian dollars is $3.8M, which I think of buying me approximately the same lifestyle in Australia that $3.8M USD would buy in the United States. As such, I do feel like the cost of living is somewhat lower in the land of Oz.

For the rest of the article, I’ll talk in US dollars, although I will comment where there are some differences between Australian and US conditions.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

We have no debt.

EARN

What is your job?

I am a General Manager within a mid-sized company which has operations in Australia and overseas.

What is your annual income?

Compensation varies depending on the size of bonuses and the annual value of shares vesting under the long term incentive program.

Over the past few years it has been in the range of $350K – $500K.

My spouse has not been in paid employment for the past five years. She previously worked as a middle manager on a low six-figure salary, so we have taken an income hit through the decision for her not to work.

However, we have been amply repaid in the ability to have a lower stress family lifestyle, provide great support for our kids, and give me the space to complete work-based travel without feeling bad about leaving her with the kids and a full-time role.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I started work as a retail assistant during my last couple of years of high school, performing a couple of shifts a week and earning between $15 and $50 per week depending on how many hours I worked. I did not really enjoy this work, but it enabled me to save and buy a car by the time I finished high school.

My first full-time job was in my first year out of high school. My role was as a cadet with a global company, and the cadetship involved me working full time and completing my university studies on a part-time basis.

This was a great way to begin my career as I was able to combine formal study with on the job training. I estimate that by the time I finished my cadetship, 90% of the knowledge I had acquired was from on the job experience, and 10% was from my university studies. This is not to downplay the importance of a college education, and I did go back subsequently to complete a Master’s degree.

My starting salary as a cadet was around $11K. This increased to $15K in my second year. I was still living at home at this stage, and for many years, I regarded this second year as the year when I had the most discretionary income as my cost of living was negligible.

By the age of twenty four I was in my first management position leading a team of twelve (eleven of them older than me) and have continued to act in leadership positions ever since – originally in middle management and then into more senior roles. During my years in middle management, I grew my income to six figures and then towards $200K.

Over the last five years or so I have pushed my income to $300K and beyond, primarily through being eligible to participate in more lucrative incentive programs as I moved from middle management through to executive level roles.

What tips do you have for others who want to grow their career-related income?

I grew my salary and responsibility relatively quickly through a focus on hard work, delivering on every commitment that I made, building positive relationships, always volunteering to take on extra assignments, and a willingness to challenge the status quo to improve performance.

One of my early managers told me that “it’s important that your boss’s boss knows how you add value”. Although I am a relative introvert, I did focus on finding opportunities to promote the wins and achievements of my team in a way that felt authentic to me and did not feel like I was grandstanding.

Another thing that has served me well is “filling the space”. By this, I mean that if I’ve seen an opportunity for an improvement or to do something new that will add value, then I try to make time to work on that. In doing this, I first ensure I do not let any of my core responsibilities slip, and then filling the space is icing on the cake.

Underpinning this approach has been a strong focus on time management. I try to be deliberate in scheduling my time and focus on activities that I know are important. I do this by planning a week in advance and blocking out time for important tasks. I am a morning person, so I find that if I can crank out an hour or two of solid work before nine am, then it doesn’t matter what interruptions or distractions occur over the rest of the day because I have already completed the one or two critical tasks that will ensure it has been a successful day.

Finally, be a life-long learner. We live in a rapidly changing world and it is important to stay up to date with developments in your field. It is also the case that the amount of knowledge that is available to us today means there should be no excuse for not developing your capabilities to perform and lead effectively.

What’s your work-life balance look like?

Work-life balance is pretty good, although not perfect. I work from home one or two days a week which I enjoy. I usually try to go for a lunchtime run on at least one of my days in the office.

I do have a relatively long commute, but use the time on the train productively. This means that I can be disciplined about leaving work on time because I know I have two hours on the train to do work before the next work day starts (one hour going home, and another hour the next morning).

When my work doesn’t overflow, I use the time on the train for reading and managing investments. This means that when I get home I can be present for my family as I do not have work to do, and I have already had some “me time” to unwind.

Exercise is very important to me and I exercise at least four times a week, and fit in a walk on the other days.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

My career is my only source of income.

I treat dividends as investment growth, and reinvest any such income straight away.

SAVE

What is your annual spending?

Our monthly expenditure rolls up to $75K per annum which is funded from my monthly paycheck.

We also have an agreement that we will spend 50% of any windfall payments (typically short term or long term bonuses after tax, or tax refund).

In a good year, this can equate to an extra $100K+ of expenditure, which typically goes towards home renovations or holidays.

What are the main categories (expenses) this spending breaks into?

- Home maintenance: $5,600

- Electricity, Gas, Phones: $3,000

- Food: $15,000

- Sports / Hobbies: $9,000

- Holidays: $9,000 (excluding any extra we may add from bonuses)

- Clothing / Personal Care / Gifts: $12,000

- Healthcare: $3,000

- School Fees: $7,500

- Car running Costs: $6,000

- Insurances: $5,000

This equates to about $100K Australian dollars, and (based on my observation from our 2019 US holiday), I think the life we lead would cost about $100K USD if we were residents of the United States.

I pay a lot of tax (almost 50% on earnings above $160K), but don’t think about that too much, and only think in terms of after-tax dollars.

As mentioned above, we use bonuses to splurge on holidays, home, and cars where necessary.

Do you have a budget? If so, how do you implement it?

We review our budget on average once per year. This is a joint exercise with my wife. We check if our actual spending over the past twelve months is in line with what we budgeted, and we adjust the budget as necessary. We don’t track spending on a month to month basis. As long as our main working bank account is not going into the red, we are comfortable.

We maintain a number of bank accounts to help us categorise and manage our spending. For example, we have a bank account for holidays, one for clothing, one for insurance, and one for gifts. After my pay is received every month, funds get automatically pushed to these separate bank accounts (as well as to our investment account).

My wife manages the spending, and we have an agreement that she can shuffle the dollars between the accounts any way she likes. For example, if she wants more holidays, she can tighten the belt on clothing expenditure. She typically also nominates the spending priorities for lump sum payments.

What percentage of your gross income do you save and how has that changed over time?

We set aside around 25% of my monthly pay-check for the purpose of investment. We also set aside 50% of any lump sum payments that we receive.

When we still had a mortgage, we used to treat our mortgage repayments as “savings”. At that time, we also used to set aside 75% of any lump sum payments for saving – a figure we reduced to 50% when the mortgage was paid off. Our savings rate as a percentage was higher when my wife used to work, although she hasn’t done so for a number of years now.

What’s your best tip for saving (accumulating) money?

Pay yourself first is the obvious one. Money gets sent straight from my pay-check to savings account and this is a practice I have employed since starting work. I have always aimed to divert at least 50% of every pay-rise towards savings.

Drive the cheapest car that your ego will allow. The car I drive is now fourteen years old. I think we will get many more years out of it. Our “new car” was eleven years old this year when we got rid of it. I normally would have bought a used car (say 1 or 2 years old), but with the state of the used car market, prices on used cars are almost the same as new cars, so we did buy a new car earlier this year. However, it was not a luxury brand.

What’s your best tip for spending less money?

I take my lunch to work every day, and rarely eat take-away. This might not save huge amounts of dollars, but I think it goes towards mindset.

Similarly, neither my wife or I drink coffee (we don’t like the taste!), and avoid the seemingly ubiquitous multi-coffee per day habit that most of my work colleagues maintain.

We do comparison shopping for all of the major categories of bills (insurance, mobile, power) every year. This is something my wife typically looks after (as the owner of the spending side of the ledger). However, if we make savings in these areas, we don’t divert them to savings, but put them towards discretionary spending (travel, going out, etc). By being able to fund some fun-stuff, that helps maintain the discipline to keep to a reasonable saving rate.

It took me a while to learn this, and was a source of tension in the early days of our marriage as I have very simple needs and can be happy with very little spending. I think if my natural tendencies went unchecked, I would have saved at a very high rate, but never got comfortable spending any money. We managed to agree on a balance where we do have a decent savings rate, but once we’ve committed to that, there are no questions asked about spending (as long as we are not going into the red). This motivates my wife to look for savings, which enables us to spend money on fun things and improve our day-to-day quality of life.

Although it’s not a style I would have learnt on my own, in hindsight I think it’s a better way to live and I don’t think it makes sense to defer all enjoyment until some mythical future retirement date. I think my wife has helped me enjoy the journey more than I otherwise would have.

What is your favorite thing to spend money on/your secret splurge?

Our favourite things would be our home and holidays. We have a large, well-appointed house in a good location. My natural tendency would not have been to spend as much on our home as we have, although I do enjoy living in it. It has also appreciated in value over the years that we have held it, and it will likely be a source of additional funds when we “downsize” after the kids leave home.

Our last big holiday was in October 2019 when we did a five week trip around the USA. We started in San Francisco, drove through Yosemite, Death Valley, Red Canyon, the Grand Canyon and Vegas, flew to New York, flew to Florida to visit the theme parks, and took a cruise to the Bahamas. A lot of wonderful family memories were created, and it was fantastic to immerse ourselves in American life for that time.

When you live in Australia, there are no close overseas destinations, but the long flights are worth it to experience other parts of the world. Covid has cramped our style over the past couple of years, but hopefully we will be able to resume in the near future.

We also spend a lot of money on our kids and their sport. Most of the month-to-month holiday budget is for short regional or inter-state trips for them to compete (the big trips come out of bonuses). Their coaching and lessons are also expensive. However, they both love competing, and there are many life lessons to be learnt from playing competitive sport.

INVEST

What is your investment philosophy/plan?

There is a strong investment philosophy in Australia of investing in residential property. This is despite the fact that the rental yields are relatively low and it is hard to find properties where the rent covers the mortgage and running costs at the time of purchase.

The common theory is that the capital growth over time will outweigh any short term losses. Losses are also tax deductible, which adds to the appeal of that type of investment.

I have never wanted the hassle of dealing with tenants, and we also have a large amount of our wealth tied up in our family home so our investments have been share-focused for diversification. When I first started my investment journey, I used to pick a few fund managers whose style I liked for 50-60% of the portfolio, and stock pick for the remainder.

Over time, I have gradually simplified, and now have more than half of our wealth in index funds. I still have some in active managers, and still have shares in some individual companies that I have held for a long time and that I believe continue to be high quality companies.

Historically it was expensive and cumbersome to access overseas share markets, so all of my individual stocks are Australian companies. It is now much easier to access overseas markets, but I still restrict my method of accessing overseas companies to index funds and one fund manager.

What has been your best investment?

Two Australian companies, one large and one small.

CSL (Commonwealth Serum Laboratories) have created tremendous value over the past three decades. This was a government enterprise that listed in 1994 at $2.40. It’s share price peaked at over $300, although has recently pulled back to around $260. I was very late to the party (I wasn’t an investor in 1994) but have seen a five-fold return and am happy to keep holding.

Altium is a small technology company which builds software used to design printed circuit boards. I bought into Altium at around $4, and at its peak it has been more than a ten-bagger.

What has been your worst investment?

In 2010 and 2011 I progressively invested just under $30K in a small company called Matrix Composites and Engineering (MCE) at a price of $6.77, $7.90 and $8.00. I sold out at $3.32 at the end of 2011 for a loss of about $16K or just over 50% of what I put in. The current share price is $0.17, so it was probably a good decision to get out at $3.32.

The company was being heavily promoted by a fund manager as a great buy, and it grew relatively quickly from $3 when I first observed it up to $6 and then $9. Luckily, that sort of outcome has been the exception.

What’s been your overall return?

My returns have been in line with the market, and probably slightly higher, but only negligibly.

Of the individual positions that I have held over the last decade, approximately 70% have been profitable, and 30% have delivered a loss, with the average profit about twice the average loss.

How often do you monitor/review your portfolio?

I update our net worth once a month, but usually check balances a few times over the course of any given week.

I used to do it daily, so I am moving in the right direction in terms of reducing my compulsion to check.

NET WORTH

How did you accumulate your net worth?

I have never received an inheritance. I dropped myself into the deep end very early, and at the age of 21 I was married with a mortgage and a baby. My income was certainly not high at that stage. We were a single income family at that stage, but paid as much as we could afford on our home loan.

After about five years we sold our small unit (negligible capital gains) and bought a four bedroom home. I continued the process of repaying diligently, and by the time I was about 30, this disciplined saving approach meant that I had a fully paid off 4 bedroom house and was ready to start my investment journey.

I think this was a pretty good achievement for a sole income earner through their 20s.

The marriage ended shortly afterwards and I walked away with about $150K after the majority of the property settlement went to my former spouse. I bought another house to live in whilst single and started repaying as fast as I could, although child support payments took a chunk of my income. At this point, I had no investments outside of retirement accounts.

I remarried about three years later. My wife worked in middle management so with two incomes we had capacity to save and start investing. This state of affairs did not last for long as we had two children within the first four years of our marriage.

My wife worked part-time for a few more years, and her financial contribution helped us accelerate repayments on our house. We also started investing in a brokerage account at this time, but our priority was paying off the mortgage.

With the mortgage eliminated, we redirected the mortgage repayments to our brokerage account. By this time my wife had stopped working all together, but my income had grown to the point that we could save at least $100k per year.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

I think I have been an all-rounder and done reasonably well in all three dimensions.

Over the past five or so years, Earn has been my greatest strength.

However, over the course of my adult life, I would say Save has been the bedrock which has underpinned the ability to build wealth.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

The biggest road bump was divorce. That cost us $300K more than fifteen years ago.

Assuming a return of around 8%, that could have doubled twice and been worth a further $1.2M today.

Although I would not have designed my life to play out in this way, I certainly have no regrets. I have two great kids from my first marriage and I would not trade them for anything. It is also most likely the case that I would not have met my current wife when I did if my life had not unfolded the way it did. As such, I do not wish for a different outcome.

What are you currently doing to maintain/grow your net worth?

I am still working fulltime and investing 25% of monthly income, and 50% of bonus income.

We are largely fully invested. We’ll continue to do this at least until the end of 2022.

By that time, we should be very close to having investable funds of 25x our expenses.

Do you have a target net worth you are trying to attain?

Investable assets of $2.3M – $2.5M and a total net worth approaching $4M will well and truly underwrite our future.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I was 42 years old when we reached one million USD, 47 when we reached two million, and will likely reach three million at 49 assuming no major crashes. These weren’t milestones for me, because I was tracking my worth in Australian dollars.

The one thing that has changed is that we spend more of our bonus each year.

What money mistakes have you made along the way that others can learn from?

I have made many mistakes along the way. I sold down a portion of my CSL shares when I had doubled my money. I also sold portions of my Altium shares at 4x and 8x. These actions were taken in the name of risk management as the positions had grown large (especially Altium), but in hindsight, I should have just let them run.

Some may say that having an expensive home is a poor investment, and paying off the mortgage in a relatively low rate world an even worse decision. From a pure numbers perspective that would probably be correct, but it does provide a great sense of security to be mortgage free, and I do know that I could convert our house into a large investable asset at any time if absolutely required. As such, I am comfortable with the approach.

The decision to have only one income earner in the family is not a good one from a purely financial perspective. However, it has been a great choice for our kids and enabled me to work hard on my career which ultimately underpinned the strong earnings I make now.

What advice do you have for ESI Money readers on how to become wealthy?

The habits you form are the most important element.

- Saving: This is the foundation. Set aside a portion of your income before you can access it. Do whatever you like with the rest.

- Working: Plan your week, and maintain a disciplined task tracking system so that you develop a reputation for reliability.

- Learning: Spend time every week learning about yourself, personal effectiveness, work related topics, leadership, and investing.

- Exercise: Physical fitness is great for helping to maintain a positive state of mind, and provides the energy to work hard.

- Fun: My wife told me to add this one! Setting aside some time and money for fun is important, and will help to keep life enjoyable and ensure that relationships aren’t neglected and that life is lived in the moment, rather than for some future time of plenty that may never come.

FUTURE

What are your plans for the future regarding lifestyle?

I am planning to reduce working hours in about 18 months. I don’t know exactly what that will look like but am hoping to transition to consulting and reduce my hours so that I am either working part-time or working on assignments and taking breaks in between.

I would like to aim to work for around 60% of the year to cover our living expenses and let the nest egg continue to grow. This will enable me to ease into a retirement lifestyle and build a margin of safety by having our assets grow towards 30x (or hopefully a bit more) annual spending.

What are your retirement plans?

Dividend yields of Australian companies are typically higher than in the US (although capital growth lower), so that should underpin a good chunk of our annual spending.

At some stage we will sell our house and move into something smaller, but given the ages of our children, that may still be 10+ years away.

In terms of activities, I think it will include a mix of:

- Exercise: Running, tennis, golf

- Volunteering: Potentially some form of counselling

- Travel: There are still many parts of Australia we haven’t seen, let alone the world.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Unlike most Americans, I am not concerned about the cost of healthcare as we have a universal health care system which we augment with relatively cost effective health insurance.

My biggest concern is running out of money, either due to sequence of returns, longevity, or an extended period of low stock market returns (such as the Japanese have experienced since around 1990). I aim to counteract this with part-time work for a period of time, although the real risk may be that I build up too big a stash of money that we never spend.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

At the age of 16 I read a book called “Making Money Made Simple” by an Australian investment advisor called Noel Whittaker.

I learnt about the importance of paying yourself first, compounding, and investing. I was pretty keen to put my learnings into practice straight away when I started work.

Who inspired you to excel in life? Who are your heroes?

My parents gave me and my siblings a great start in life. They both came from very humble beginnings but worked hard to provide us with a loving, secure and stable upbringing, good education and a great example of how to succeed in life.

I have always been inspired by people who achieved results that no-one else has approached. These include Sir Donald Bradman (cricket) and Warren Buffett (investing).

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

I have read so many books that it’s hard to limit it to three.

I would start by recommending The Richest Man in Babylon by George S. Clason because of the timeless message about paying yourself first.

The Psychology of Money by Morgan Housel contains fascinating insights into the behavioural traits required to be successful with finances.

I also enjoyed a book called “Value.Able” by Roger Montgomery, which provides a great overview of value investing.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

The Australian philosopher Peter Singer wrote an excellent book called, “The Life You Can Save” (you can get a free copy here).

The book is based on his famous “drowning child analogy”, which states that most people would rescue a drowning child from a pond, even if it meant that their expensive clothes were ruined, so we clearly value a human life more than the value of our material possessions. Singer argues that there is no difference between saving a child drowning in front of us, and saving a child dying of a preventable disease in another part of the world. As a result, he advocates that we should divert a significant portion of the money that we spend on our possessions and instead donate it to charities who are saving the poorest people in the world.

He sets a high bar and we do not live up to the standards he suggests, but do challenge ourselves to do as much good as we can through effective altruism.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

I recently read a book called “Die with Zero” which suggests you should give money to your kids while you are still alive, and aim to run your money down to nothing by the end of your life so that you maximise the utility you get from your money.

If I were to die tomorrow, there would obviously be an inheritance for my heirs. I do think it’s important that kids make their own way in life and do not get too much handed to them on a plate because otherwise they may struggle for purpose and meaning. As a result, this is something we still need to discuss and plan, particularly once the younger children reach adulthood and no longer need support for their upbringing.

Great post. It made me a bit ‘home sick’, as my wife and I lived in Brisbane (New Farm/Teneriffe) for 6 years (2011-17).

In probably the biggest ‘financial’ mistake of my life, we didn’t become AUS citizens when we had the chance. My employer wouldn’t pay for the process (surprisingly expensive for two USA citizens) and health scares for my wife and my mom (the latter requiring us to relocate back to the USA in 2017) commanded nearly all of our attention at the time when it would have been possible (2016-17).

Looking back, Oz would have been a great place to retire – excellent and very affordable health care (as we found out all too well) and a beautiful and vibrant country in which to live. Unfortunately, visas and citizenship are nearly impossible for over 50 adults without an employer sponsor and, even with one, you have to work the 5 years in Oz to become eligible.

So, where to retire instead? Your description – “urban, although the ocean is nearby and so are some mountains (large hills really) and a hinterland area, so it’s a beautiful place to live” matches our aspirations. Time will tell – our target date is 12/31/24.

Thanks – I’m glad you enjoyed it. Your response reminded me that a single phone call about an illness or accident could render all of our plans worthless. Good luck with reaching your target date.

Just for comparison, I could easily find multiple stats similar to this; “Australia currently has the 12th highest cost of living in the world, with the USA and UK well behind at 21 and 23rd place respectively. The overall cost of living in Australia is 9% higher than the USA, but 10% cheaper than London.” This compared to colleagues who travelled to Australia for work assignments.

Continued success and good health to your family!

Having lived in Australia and now living in London – and having lived in multiple places in the U.S. before and in between – the dominant ‘variable’ in any such comparison is the cost of real estate. New York City, much of California, Syndey, Melbourne, and London are all on a different planet cost-wise than ‘the hinterlands’ of all 3 countries. Other things may be a bit more expensive, but not the 2x, 3x, and more multiples you see in real estate. We’re currently renting in London, but only while I continue to work full time. Retirement and our next (final?) stint of home ownership will definitely be somewhere else where housing is more affordable.

Thanks. Housing definitely pushes our cost of living up. So much so, that one of the major financial institutions in Australia is the so-called “Bank of Mum and Dad” because many parents choose to help their children with the deposit for their first house purchase.