If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

My questions are in bold italics and his responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

My wife is 60 and I am 66. We have been married for 37 years.

Do you have kids/family (if so, how old are they)?

We have 4 children, ages 30, 28, 24, and 19.

What area of the country do you live in (and urban or rural)?

We’ve lived in the Midwest suburbs most of our lives. About 5 years ago we moved to a more rural area.

What is your current net worth?

About $1.6 million.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

- Roth IRA and 401K – $718K invested mostly in stock and bond index funds

- Traditional IRA and 401K – $552K also in stock/bond index funds

- Cash equivalent investments $20K – GNMA and TIPS

- Home – $300K – no mortgage.

- $42K – checking and savings

EARN

What is your job?

I am currently working in statistics/programming.

What is your annual income?

Income is currently $74K + $20K pension + $6K rent (oldest son).

Tell us about your income performance over time. What was the starting salary of your first job and how did it grow from there?

The starting salary for my first job was $10K back in 1975 – about $43K in today’s dollars.

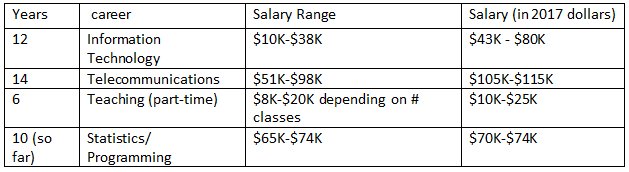

I’ve had 3 main careers. The first was in computers (IT). The second was in telecommunications. The third is the one I am currently in which is statistics/programming (the buzzword these days is “big data”).

When I was in between the second and third jobs I taught mathematics part-time at a community college. I prefer technical work and have never tried to go into management.

The following table gives a brief summary:

What tips do you have for others who want to grow their income?

1. Take advantage of opportunities to grow your skills outside of work.

Before we started a family I worked at an engineering consulting firm as a computer programmer. They offered to pay tuition toward an engineering degree. I saw a tremendous upside career-wise from getting such a degree and jumped at the chance. It took 5 years of working and going to school at night in order to get the B.S.E.E. degree. I also have 2 degrees in math, so this was my third college degree.

One of the companies I worked at had a Toastmasters club and I was invited to join. I was a member for 13 years and received the Competent Toastmaster (CTM) and Advanced Toastmaster (ATM) awards. I served as almost all of the club officers, up to and including president. If you work at a larger company, visibility becomes a big component of your evaluation. Being able to give a good presentation is a key to visibility. The training helped me to give several technical presentations as well as a number of roasts. I believe it helped me greatly with my career.

While teaching part-time I took a lot of computer classes at the community college to keep those skills current.

2. Life is 10% of what happens to you and 90% of how you react to it.

I mentioned earlier that I had 3 main careers. Each career change was preceded by a massive layoff (where 2/3 or more of the company was downsized). I hate the stress of going to work with the sword of Damocles hanging over my head. I was never actually laid off. In both cases I voluntarily gave up my job in order to be better off financially. In the first case, I interviewed around and received a job offer for a 35% increase in salary. This job offer was partially made possible by getting the electrical engineering degree I just mentioned in “take advantage of opportunities”.

In the second case, my company offered older employees an early retirement buyout. I knew the $20K/year pension (starting at age 50) was worth about $500K as a lump sum, so I thought it was a generous offer and took it. Anyone living paycheck to paycheck would have been reluctant to give up their job for a modest pension, but at the time we had about $100K in “emergency” savings so we felt pretty safe.

3. Do Work You Enjoy.

When you enjoy your work you do a better job. When you do a better job you get better evaluations and better raises. When you get paid more you enjoy your work more. An engineer would call this a feedback loop. I’ve had a good time in my career with all its twists and turns. The job changes helped to keep things interesting. I could have retired years ago, but chose to continue because I prefer being in the game.

What’s your work-life balance look like?

I’ve never had any problems with work-life balance. Going to school at night was stressful, but I managed to finish that before having kids. None of my employers have put excessive demands for working long hours. Two of my employers encouraged exercise at lunch time and provided showers/lockers for employee use. Currently I work almost exclusively from home by connecting to the computers at work through the internet. That eliminates the time I would have to spend on commuting to work.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

I taught mathematics part-time at a local community college as my main source of income for 6 years. During this period I also had a couple of contract jobs.

When I finally landed my current job I continued teaching as a side hustle for a few years.

SAVE

What is your annual spending?

I would guess that typical annual spending for us has been in the $40K-$60K range. This year will be more like $80K because we are putting new hardwood flooring in the house, redoing the roof, and our youngest daughter is going to college.

What are the main categories (expenses) this spending breaks into?

We spend money mostly on our house, cars, food, health care, and utilities.

Do you have a budget? If so, how do you implement it?

We have never had a budget. We use credit cards for convenience and to get the cash back. We always pay them off in full at the end of the month. We’ve never had any debt, other than the house mortgage which is now paid off. It helps a lot that my wife and I are on the same page about being frugal. Every year we compute our net worth to see if the big picture still looks good.

Salary-wise I’m definitely a small fry among the group of millionaire interviewees. Given that and our larger family size, we had to keep costs down. The trick is to be frugal without feeling deprived. My wife used to subscribe to the “Tightwad Gazette” which espoused that philosophy. Here’s our version of spending like a millionaire:

1. House – The rule we went by was “Don’t spend more than 25% of your income on your house mortgage payments and property tax”. Too big of a house will make you “house poor”. We don’t think of it as an investment, just a cost to keep under control.

We bought our first house when we were both working, but only looked at houses we could afford based on one income. We bought our second house (same criteria) with the thought of eventually adding on as the family got bigger. When we finally added on, we needed to refinance to get enough cash to pay for the addition. We refinanced with a 15-year mortgage in order to keep interest payments to a minimum. With our latest home purchase we downsized and were able to pay cash.

2. Cars — My wife’s father worked for an auto company, so when we bought new cars we were able to get the employee discount. We mostly bought new modestly-priced cars and kept them until they had about 60K-100K miles on them. We sold/traded-in/donated them at that mileage because we were concerned about driving cars with higher mileage. An older car is more likely to break down on the road.

3. Eating out – When we were both working we ate out often. Once we were on one income we cut way back. Now we only eat out on trips and on special occasions.

4. TV/entertainment — We have not had cable TV since 1990. We do have streaming video (much cheaper). We’ve never spent more than $400 for a TV. We occasionally go out to the movies, but mostly watch DVDs we receive as presents or borrow them from the library. I’m really big on downloading free music (Freegal Music) from the library.

5. Phones — We have inexpensive cell phone plans and smart phones. We subscribe to an inexpensive phone/internet service.

6. Meals – My wife buys food in bulk and cooks most of our food from scratch. We have 2 refrigerators and a freezer for keeping the food we buy in bulk.

7. Kids – The 2 boys shared a bedroom and the 2 girls shared a bedroom. Most clothes were purchased at garage sales and resale shops, at least until they were older. This is a good blog post with ideas for cutting costs when you have children.

What percentage of your gross income do you save and how has that changed over time?

My wife and I got married in 1980 and both worked for the first 7 years before having children. I’m guessing from our net worth at the end of the decade we saved about 30-40% of our income during that period. We were among the first to contribute to IRAs when the program began in 1981 and both saved $2K each year. We also participated in (non-retirement) savings plans with a company match. About 1985 401Ks were offered at our respective companies. We contributed 6% to get a 50% company match and have continued to contribute that amount ever since.

A year after our first child was born my wife left her job to be a full-time mom. It’s not so easy going from 2 incomes to one income and 4 children. We continued to save, but not the big percentage we had saved before. I’m guessing it was about 10-20% of our income, with most of it going into retirement savings and home equity.

What is your favorite thing to spend money on/your secret splurge?

We don’t splurge often. We spent a lot on our wedding/honeymoon. While double-income we purchased a high quality piano and occasionally went out to eat at expensive restaurants.

INVEST

What is your investment philosophy/plan?

I have a lot of friends and relatives who think that being a good investor means calling market turns and picking winning stocks. Whatever the opposite of that philosophy is – that would be me. I favor diversification and low management fees. I never try to time the market or pick the next hot stock. I primarily invest in index funds.

What has been your best investment?

My biggest win was investing in my company stock. In about 3-4 years it split twice and value multiplied to 6-7 times its original value. I sold half of it and made about $75K. The reason I sold it was in order to rebalance my portfolio.

My best investment, according to my investment philosophy, has been stock and bond index funds. They are about as diversified as you can get and have low management fees. These funds are almost disappointing in how easy they are to invest in. They also fit nicely into retirement investments (IRAs/401Ks).

What has been your worst investment?

My biggest loss was the same investment as my biggest win – my company stock. After the stock went up I held on to the other half of it. It went back down and kept going down. I still have it but its value is less than 1% of the original value. I lost about $75K.

My worst investment, according to my investment philosophy, was still my company stock, but not because it lost money. I actually ended up about even in the aggregate. It didn’t fit with my investing philosophy because it was too risky. I will discuss this further when I talk about my investing mistakes.

What’s been your overall return?

I don’t monitor this, so the best I can come up with is an estimate based on historical averages. According to CNN Money, stocks have returned about 10%/year for the last 100 years and bonds are at about 5-6%. If you use those expected returns and apply our 60% Stock/ 40% Bond mix you get an ROI of about 8%. It’s probably a little lower than that because we paid management fees prior to getting index funds.

I would estimate that we contributed a total of $175K to our 401K/IRA accounts and received $75K in matching funds. That would give us approximately $1 million in investment growth or 400% growth over 37 years (600% growth if you count the company match as growth).

Comparing that to our series of 3 house investments – the investment cost was $20K down payment + $300K for mortgage payments + $125K for property tax + $155K for additions, home improvements, and maintenance = $600K. The current value of that investment is $300K plus the $65K net profit we received when we downsized to buy the third house for an overall “growth” of $365K – $600K = -$235K or 39% loss over 32 years.

How often do you monitor/review your portfolio?

If I notice that the stock market has gone way up or way down I will review the portfolio to see if we need to rebalance to get back to the 60% Stock/ 40% Bond mix. I don’t rebalance often – only when there’s a big change. In 2008 and 2009, we rebalanced our portfolio by selling bonds and buying into the stock market. This positioned us perfectly to take advantage of the big run up in the market that followed. In 2016 and 2017 we rebalanced the other direction – selling stock and buying bonds.

NET WORTH

How did you accumulate your net worth?

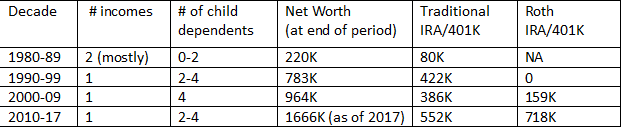

We have calculated our net worth for many years and have saved it all in a spreadsheet. I like the net worth spreadsheet because it gives us more of a long term perspective for money. The following table gives a brief summary of our net worth each decade as our savings progressed:

In many ways this was a family effort. My wife provided a second income for 8 years. She did most of the spending and kept costs down. She spent a great deal of time resolving insurance issues. The latest health insurance issue was for a $50K hospital bill that took over 6 months of follow up to get it paid.

For the three children who have attended college, they all received excellent scholarships. Two of the scholarships were full tuition, room, and board. To get good scholarships, we’ve found that it helps not just to have good scores on the ACT and SAT, but also to spend some time on school selection. We didn’t apply necessarily to the most popular schools and made a point to include some out of state schools. Colleges want to attract out of state students and will offer better scholarship money to do so.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

The main road bump was when it took me a long time to fully get back into the work force after taking the buyout. They were sending a lot of technology jobs overseas at the time, so it was very hard to get an interview for computer or telecommunication jobs.

The teaching and contract jobs kept me going, but that didn’t pay the bills as well as a full time job. Persistence and networking helped me finally get the job I have now.

My wife decided to work part time during this road bump. Even though she had previously had a professional career, she still wanted to be a full-time mother. She got a low paying job at a local YMCA where she was able to bring our children with her. We got a free membership as well as some free classes.

Strangely enough, it was during this road bump period that our net worth went over $1 million – mostly due to investment growth.

After we became millionaires, in 2008 and 2009 our net worth temporarily dropped back below $1 million due to the big drop in the stock market.

What are you currently doing to maintain/grow your net worth?

I plan to keep working for a couple more years and then retire. We’re not doing anything new in regards to the net worth.

Do you have a target net worth you are trying to attain?

I wanted to make it to $1 million because that’s the number people talk about. Our PAW number is about $1.2 million so we made that one too. If you don’t know what that is, it will be explained toward the end of the interview.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I was 53 when our net worth first went over $1 million. We initially thought that it was no big deal and that most everyone must be millionaires. Our income was not unusual, we’re supporting a larger family than most, and it seems like everywhere we look we see houses bigger than ours. There was no big excitement.

We would be really boring contestants on a TV game show. It wasn’t until I read TMND (The Millionaire Next Door) and saw a few studies on wealth distribution that I convinced myself that a million dollars is still a lot of money.

If you could rewind to when you first started out, what would you do differently?

I would definitely have tried out for the track team in high school. After that I’m happy with all of my career and personal life decisions. I see failure as an opportunity to learn so that next time maybe I can succeed, so I would keep all the failures.

What money mistakes have you made along the way that others can learn from?

1. When I started a new job in 1987, I had a 401K (about $4K) from my former employer that I wanted to roll into an IRA. I went to the bank to invest it in a CD until I could figure out a better place for it. The investment consultant suggested that I put it in a variable annuity (which I had never heard of before).

Afterward I read that variable annuities are usually bad investments that charge high management fees and are pushed by salespeople. These investments also have a penalty for early withdrawal. I waited the 10 years to get past the penalty and immediately moved it to my account at Vanguard. The whole experience gave me a healthy distrust of people selling investments.

2. I invested 40% of my 401K in my company’s stock. I also invested in an ESOP and had company stock options. I knew that from a diversification point of view it’s not a good idea to invest in single stocks, but still wanted to show my support.

I have since learned that it is an especially bad idea to invest in your own company or to at least limit such investments to 10% of your 401K. The problem is that when your company is laying off (when you need money most) is also when the company stock goes way down. As mentioned before I didn’t lose any money, but should not have taken on that much risk.

If you had to give advice to ESI Money readers about how to become wealthy, what would it be?

1. Getting out of and staying out of debt (other than home mortgage) should be the top priority. Interest payments are a direct subtraction from your net worth.

2. Keep a healthy amount of cash investments for emergencies and opportunities. For us that has been $20K – $100K.

3. Save consistently every year for retirement and don’t take any early withdrawals. If your job doesn’t provide a 401K, then contribute to an IRA. Always get the company match in your 401K.

4. Invest in something that beats inflation. We chose index funds for high historical rate of return, diversification, simplicity, low fees, and the fact that they can be part of our retirement investments.

General advice:

Set a goal for your net worth and keep track of your progress toward it. TMND contains a different metric for wealth that depends on age and income. Using this calculation you can set a reasonable goal for net worth for your age and income:

“Multiply your age times your realized pretax annual household income from all sources except inheritances. Divide by ten. This, less any inherited wealth, is what your net worth should be.”

They call this the net worth that the Average Accumulator of Wealth (AAW) should have given that age and income level. So for a household of age 50 which has income of $50K/year the AAW would have a net worth of 50 x $50K /10 = $250K. An Under Accumulator of Wealth (UAW) would have half of that amount or less. A Prodigious Accumulator of Wealth (PAW) would have double that net worth or more.

FUTURE

What are your plans for the future regarding lifestyle?

We might do some traveling. I’m getting tired of sitting at a desk most of the day and look forward to doing something that gets me out of the chair when I retire.

What are your retirement plans?

I plan to keep working for a couple more years and then retire. The main focus will be on reducing taxes and creating a decent size income stream for retirement. To that end I will wait to claim social security until age 70 and my wife will take hers at age 66½ (her full retirement age). We plan to keep converting traditional IRA investments to Roth, at least until I turn 70.

I made a calculation this year that our projected social security income + pension income + RMDs would add up to about $103K/year. This retirement income seems a bit ironic considering I’ve never actually had a salary as high as $100K.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

For the Roth you pay taxes on it up front and never have to pay taxes again. For the traditional IRA you defer paying taxes until you withdraw your money (required starting age 70½). The general advice given for choosing between Roth and traditional IRAs is that it depends on your tax rate now versus your tax rate in retirement. If your tax rate is lower now, the Roth is better and if your tax rate in retirement is lower you should pick the traditional IRA. This seemingly simple statement leads to a lot of confusing and complicated analysis. Here are a couple of conclusions I’ve drawn:

1. If you did what you were “supposed to do” and saved a lot of money in traditional IRAs and 401Ks you may be very surprised at how high your tax rate in retirement will be.

2. The RMDs (Required Minimum Distributions) that you have to make with traditional IRAs create more taxable income which can make more social security income taxable. The threshold for making social security income taxable is not indexed to inflation and more people are hit with this every year. It currently affects middle class wage earners with over $250K in traditional IRAs. The upper class are already in the higher tax brackets so early conversion to Roth won’t have much benefit for them.

The RMDs can effectively double your marginal income tax rate – possibly to over 50%. I’ve found it helpful to download the IRS Social Security Benefits worksheet in order to do a mock calculation of what taxes I will be paying in retirement. I put it into a spreadsheet format so I can see how our tax changes as I change the RMD amount.

After 16 years of conversion our traditional IRA amount is still going up. That’s mostly because it has been growing faster than our Roth conversion rate. The last 2 years we increased the conversion amount to $50K each year, but still the traditional money continues to grow. At least the Roth has become larger than the traditional part. Our goal is to get the traditional IRAs down to about $200K in the next 4 years in order to stay below the high marginal income tax window. We may also use Qualified Charitable Contributions (QCDs) to reduce the taxable part of our RMD.

MISCELLANEOUS

How did you learn about finances and at what age did it ‘click’? Was it from family, books, forced to learn as wealth grew, etc.?

I have received a lot of great advice about investing from my father over the years. He encouraged us to get the IRAs back in 1981. He suggested we invest in “No-load” mutual funds which were kind of the precursor to index funds. Later on he told us about index funds and steered us towards investing in Vanguard index funds. He also suggested that we start computing and recording our net worth in a spreadsheet at the end of each year.

My favorite books about investing are TMND and “Fooled By Randomness” by Nassim Nicholas Taleb. Fooled By Randomness talks about investing in terms of statistics and probability. The author’s view of stock market investing is that the stock market represents a random event. The book presents evidence for this case. The randomness makes it difficult to pick winning stocks and call the turns in the market. The concept of survival bias is explained. This is why mutual funds always seem to have a history of good performance – the funds with poor performance get liquidated.

The author of Fooled By Randomness is the originator of the terms “white swan event” and “black swan event”. A white swan event is an event that is rare but has been observed before (most people have seen white swans). A black swan event is an extremely rare event that could occur but has never been observed before. Black swans were not thought to exist until explorers traveled to Australia and saw them everywhere. A single stock going bankrupt is a white swan event. Every stock in an index fund going bankrupt would be a black swan event because it has never happened and almost certainly never will.

I learned a lot from newspaper articles by Scott Burns (he’s retired now). Lately I’m becoming a bit of a personal finance blog junkie.

Who inspired you to excel in life? Who are your heroes?

Family, friends, co-workers, and managers have been inspiring along the way. My hero is Scotty, the chief engineer on the Star Ship Enterprise. Captain Kirk had the power, the glory, and got all the women. Scotty was the unsung hero who made the trek through the stars possible.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

We give about $5K per year to a variety of charities. Sometimes we donate our cars to charity. We have been fortunate and think it’s important to give back to those who are less fortunate. We’ll probably be giving a QCD assuming that’s still an option when we start taking out RMDs. I am thinking about doing some sort of volunteer work in retirement.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

We have a will, but most of our money is in retirement funds and will go as specified in the beneficiary clauses of those investments. We are planning to set up a trust for our special needs son.

I am grateful to my great-great uncle who left me an inheritance of about $20K in Eastman Kodak stock. It doesn’t sound like much now, but back in the 1970’s it paid for my college education, a summer trip to Europe and my first car. I plan someday to pay it forward.

I read Fooled By Randomness and enjoyed the parts I largely understood being 24 at the time… it definitely was an advance book for my lack of experience. But if that defines a personal finance junkie then yeah I’m so that.

And you read Mr. Tako Escapes too!!! Definitely PF junkie! *Handshakes*

Interesting to hear from someone who also read Fooled By Randomness. My wife bought it for me years ago for my birthday. It’s definitely not an easy read for anyone who hasn’t studied a good amount of math. We’re a house full of math people (I have a son, daughter, and son-in-law who have degrees in math too) and it was a perfect gift for me.

Awesome interview. This stood out to me – We have not had cable TV since 1990

While other might consider that a minor thing I don’t. First off, you were probably the original cord-cutter, even before most folks got hooked on “the cord”! More importantly when you consider that the average American adult watches 35 hours of TV a week , just do the math on how much time you’ve had since 1990 to learn, improve your skills, and do other things. No wonder you achieved so much.

And so great to see another example of a millionaire without a super-high income – and 4 kids! Way to quiet the naysayers and show them it can be done!

that line stuck out to me asw well!

The only thing I will add to your statement on improving your knowledge, is that it depends on what you are watching. I’ve learned quite a bit on documentaries via Netflix !

I agree Chris, I’m a documentary junkie myself, but on Amazon Prime. That’s the only subscription service I have. Us documentary folks know that ‘some’ TV can be very educational, but we also know that those 35+ hours of TV by most Americans is mindless dribble and not doing them any good.

Oh and BTW, don’t forget PBS’s website – great stuff and some of our tax dollars already support it.

Cutting the cord was an easy decision for our family. At the time we mainly watched network TV channels which we could get with a TV antenna. It seemed like a total waste of money to spend $20/month (in 1990) just for me to watch MTV. Since then the cost has gone up considerably. We have Netflix and Amazon Prime streaming video currently. I like watching shows with no commercials.

Congrats on a great career and story. As I was reading this I was wondering how you had so much in Roth only to learn later you have been doing conversions. While I don’t doubt your analysis, I was a bit surprised to read an RMD on $250K would reduce Social Security. I would be curious to hear more about your conversion strategy details. Up until this point I have preferred taking pretax retirement to save tax $ today but this will require some more investigation.

Just to be sure, there is no reduction for Social Security specifically. There is a point at which (up to 85% of) Social Security can become taxable. The more income you have, the more Social Security becomes taxable. It’s made worse for me by my pension income. For middle income wage-earners it would be really nice to keep the taxes on Social Security lower. You can control this with Roth conversion. The calculation varies for each individual’s situation. You need to compare what your current marginal tax rate to your marginal tax rate in retirement.

For a more complete explanation of this try Googling “Scott Burns How Middle Income Retirees Pay Big Dog Tax Rates”. Warning – the math gets a little complicated.

Great interview – thank you for sharing.

This also stuck out for me (and see it all the time in the industry) in the book you highlighted:

“This is why mutual funds always seem to have a history of good performance – the funds with poor performance get liquidated.”

Active managers (not all of them though) open up +10 funds, keep them open for 3, 6, 9, and/or 12 months to establish performance and then close the ones that do not perform well.

Another item that stuck out for me was the amount of savings in your Roth accounts vs. traditional accounts. That’s an impressive percentage of after-tax savings in the Roth – regardless of the amount, I’ve tended to see individuals in your respective age range usually have a larger percentage of savings in the traditional or pre-tax accounts.

Again, thanks for sharing and congratulations on your progress. – Mike

Thanks for your comments. Survival bias is not limited to investing and can be very misleading. In World War 2 they noticed that planes coming back from war had bullet holes all over the plane except for one spot – the engine. They erroneously concluded that the engine was safe but the rest of the plane needed protection from bullets. Eventually they figured out that when a bullet struck the engine, the plane immediately went down.

There’s several reasons that few people my age have Roth savings. First, the Roth IRA didn’t exist until 1997. Even then, it took a while for people to learn the difference and why one might want a Roth IRA as opposed to traditional. Roth conversion raises your taxes now, which is generally a pretty tough sell and requires a long term perspective.

I really enjoyed this interview. Very humble, hard working, and honest.

Great interview! A few points really hit me hard:

– The “feedback loop” part. Do work you love to do!

– His annual salary never struck $100,000. If he can have a net worth of over $1 million with a salary under $100,000, why aren’t the average earners saving/investing like him?

– Frugality without living in squalor. I like that idea a lot, as life is short. You have to live life to the full or you’ll one day look back and realized you wasted it.

Thanks for your comments.

If I had one goal from providing this interview, it would be exactly your second point. That would be to provide an example of saving and investing for people whose salary is closer to middle income . That’s why I included a lot of data about income and net worth so that everyone could read it and see why saving for retirement is more than “what you’re supposed to do”. It actually is a path to wealth accumulation. Eventually you may get to a point where your money is making more money than you are.

Great interview, MI 60. I was pleasantly surprised to see so many similarities in our backgrounds. In addition, I had the same goal that you did in providing my interview.

In your case, you appear to have done everything right, while I often fell short in my quest for frugality (in addition to being comparatively mathematically challenged). Great job!

Thanks MI 45. Glad you liked the interview.

I remember your interview. I think you may have been the first interviewee from the STEM disciplines – you were a scientist. I just checked to make sure – you were in environmental science and archaeology. Also we are about the same age and net worth.

There may have been others in STEM so anyone feel to correct or add more. I think MI 50 and MI 53 were engineers. I’m kind of a mix of technology, engineering, and math.

About me “doing everything right” – For the frugality part I have to give most of the credit to my wife. Also, I think that as a scientist accumulating that net worth you have to be pretty good at math. I did have some money mistakes – the two I listed were just the bigger ones.

The author of TMND (Thomas J. Stanley, Ph.D. – who unfortunately died in a car crash several years ago) singles out engineers as the profession best able to generate wealth from income. You can Google “Thomas J. Stanley

Engineering Economic Productivity” to see his blog post. I think that this extends to many people in STEM because they have the mathematical ability to understand the advantages of saving and investing. Math is not a requirement but it sure helps.

I first read TMND eight or 10 years ago and it remains one of my favorites. I will definitely read his blog post – thanks again!

Want to become a millionaire making under $100K per year? MI #60 says “We don’t splurge often.” It may actually be as simple as that. Congrats on your success.

Thanks. FYI, the piano (note: ESI used a picture of a piano at the beginning of the interview) that we purchased in the mid-80’s was about $3.5K. I just converted that to current dollars – works out to over $8K. We are definitely capable of splurging but as I said it doesn’t happen often. We still have that piano in our living room.

What a great interview and great commentary on RMD’s. For the baby boomer generation, this is something that several great savers and investors are going to look back on and wonder why they didn’t plan better. It is not a topic a lot of people discuss but it will have significant ramifications for those that have only been contributing to the 401k and/or Traditional IRA their whole life.

Thanks. The problem with RMD’s causing taxation of Social Security benefits is a problem most people would love to have. That’s because they don’t have enough in retirement savings to cause it. It would be nice if the limit at which Social Security benefit taxation kicks in were indexed to inflation like other thresholds in the tax laws. I don’t see that happening any time soon because there aren’t enough people affected and most (as you say) are unaware of the problem.

And the liberal democrats would just cry about it being another tax break for the rich that everyone else doesn’t get 😉

Great job on your summary and on your successful saving and investing. Very inspiring!

Nice reading about how you acquired your wealth. The part about never going into debt except for Mortgage is my motto too

Thank you. The only debt I avoid that might be considered unusual is when I pay cash for cars. Sometimes I get a look of surprise when I pull out a cashier’s check to pay for a new or slightly used car.

I do that too hehe. I believe the only time to use credit for a new car is the first time, rest of the time cash

Excellent Interview.It motivates every one to Plan,Save and Invest as early as possible

with the help of a devoted wife.Job well done.Keep it up.

Thanks. It’s my wife’s birthday tonight. I think she’ll appreciate the nice comment too.

Great interview – I’ve been looking forward to reading your story ever since you commented on my ESI Scale interview (7). Really enjoyed the fact that you are a great example of how you can build significant wealth without having a massive income. Truly great work – you and your wife have made great decisions every step of the way. I hope that your retirement is even better than you’re expecting!

Thanks ESI Scale #7. Good to hear from you again. I picked up on your interview because you are working in IT and that’s what I started out in. You’re at least a decade ahead of me (at that age) in your progress toward FI. Not blaming myself for that one – retirement savings (IRA/401K) didn’t exist yet and nobody knew that many pensions plans were going to be taken away.

I’m surprised that I haven’t seen an IT millionaire yet – please let me know if I missed one. Many IT jobs have been outsourced and that hit the profession pretty hard, but I would think there are some out there. I like reading all the millionaire and ESI scale stories because each one has a unique and interesting perspective. Everyone tends to identify more with people in their own career and with a similar income.

My wife is currently in Toastmasters and just loves it. She always has fun stories to tell me when she comes home from it. Joining was a great way for her to meet new people in the community as we relocated to a different city a couple of years ago.

Congrats on your successes!

Thanks.

My Toastmasters club was through my company, so it was a great way for me to meet more people when I started there. I have a lot of good memories and friendships. Really glad I joined.

Unless you have over $5M in taxable retirement, getting to 50% in taxes is nearly impossible. You would need over $500K a year in income. If that is the case, you have a ton of money. $2M isn’t going to put you into a top bracket taking RMDs.

I think you’re missing the double taxation effect. Of course my official marginal tax rate would be about 25%. Let’s use that rate as an example.

If I add $1 more of income from my RMD that results in 25 cents in tax. If I’m over the threshold (I think it is about $40K/year for joint filers) that also pushes 85% of $1 of Social Security Income to being taxable. That means I also have to pay tax on $.85 which is another 21 cents of tax. This comes to a total of 46 cents on my $1 of income. That makes it an effective marginal tax rate of 46% – even though it’s officially only 25%.

Hope this explanation helps. The Scott Burns article I mentioned earlier gives more detailed example calculations for effective marginal rates.

Once all your Social Security has been made 85% taxable, the effective marginal rate reverts back to being the same as the official marginal rate. The government isn’t getting a huge amount of tax revenue. I just figure that if I can save taxes later by Roth conversion now I may as well do it.

Interesting . . . I decided to scrap consideration of IRAs, period, due to the uncertainties of future tax rates, epic changes, income shifts, possible mental deterioration due to aging, and who knows what else. I’m all about cash buffers to waylay any emergencies, till the end, a powerful 401(k), then a brokerage account with Vanguard. Theoretically, hitting full retirement at 67, all things considered (super affordable house completely paid off, also student loans and all debt annihilated), I should be able to mostly live off of SS plus any interest the other accounts generate, never touching principal. What actually happens is another matter, and of course health care and the cost of health insurance and/or quality of Medicare in sixteen is a huge mystery and menace to all; really too bad this country can’t set it right and forget it, but the rank profiteering and endless lobbying efforts in the millions and billions are perhaps too great to overcome. We’ll see, and yeah, looking back, Scotty and Scott Burns were both the best and remain the best, a strong example for all, except the youngsters once again think they know it all, no cognizance of what came before (socialist bloodshed), fawning over various garbage (smart phones, social media, their own narrow selves) and generalized nothingness (modern pop music, cinema, media, cable programming). The world isn’t theirs–they can’t handle the truth, and I refuse to give up the best of what was and still remains, no matter what the new breed thinks.

Oh, it’s supposed to be ‘smartphones’ (lol) . . . I wouldn’t know, having never owned one. Too smart for that sh*t.

Thanks for your comments Richard. It’s interesting what people pick up on – you’re the first one to call out Scotty (my hero from Star Trek) and Scott Burns (the now-retired money columnist that I used to enjoy reading).

I have to agree with you about smartphones. FYI, I think you can spell it as “smart phones” and people will still know what you’re saying :-). I think they are cancer-causing, mind-numbing, money-sucking useless devices – and this is coming from someone who used to work in telecommunications. I still felt like I had to get one because:

1) I need a phone in the car in case I get in a car accident and need to report it. Somewhere along the line they tore down all the pay phones, so it’s got to be some kind of cell phone.

2) People keep wanting to text me – it kind of helps to have a smart phone for that.

3) I keep seeing instructions for things that assume that the whole world has a smartphone.

So when my daughter wanted to get the latest smartphone I agreed to take her old one over. I’ve found that if I keep it in airplane mode most of the time, then it’s at least tolerable.

I am unusually bitter on them, kind of a rank holdout but also frugality, only because the ancient flip-top still works, the girlfriend still has it on her account (one of the few things she covers), along with her mother’s phone, so likes that. All I call is my bank or her for the most part, or so work can reach me. Gotta have that, bare-bones. They’ve all upgraded to smartphones anyway.

Chromebook covers the rest, all the pleasure and nonsense I can muster there (lol). So I guess I’ve got no right, just a crabapple and a neo-Luddite. Also my age–don’t trust anyone under 30!

Scrolling as I watch Making Money with Charles Payne: ‘iPHONE 11 PRO PRICE STARTING AT $999, MAX PRO AT $1099’ . . . yowza. Get your Betamax today, kids (lol).