If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in January.

My questions are in bold italics and his responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 60, my wife is 65.

We have been married just under 25 years.

Dear Wife has been retired from the computer industry since shortly after we were married.

Do you have kids/family (if so, how old are they)?

We have four children between us, a boy and a girl from her prior marriage, a boy from my prior marriage, and a 10 year old boy that we adopted from birth.

The older children in their 30’s are off on their own.

We have a couple of grandchildren courtesy of my older son and his wife.

Older children are spread up and down the west coast.

What area of the country do you live in (and urban or rural)?

Currently a suburban town next to a large southwestern city.

Have lived all over the country and a little bit abroad.

I grew up as white-trash in the mid-west.

What is your current net worth?

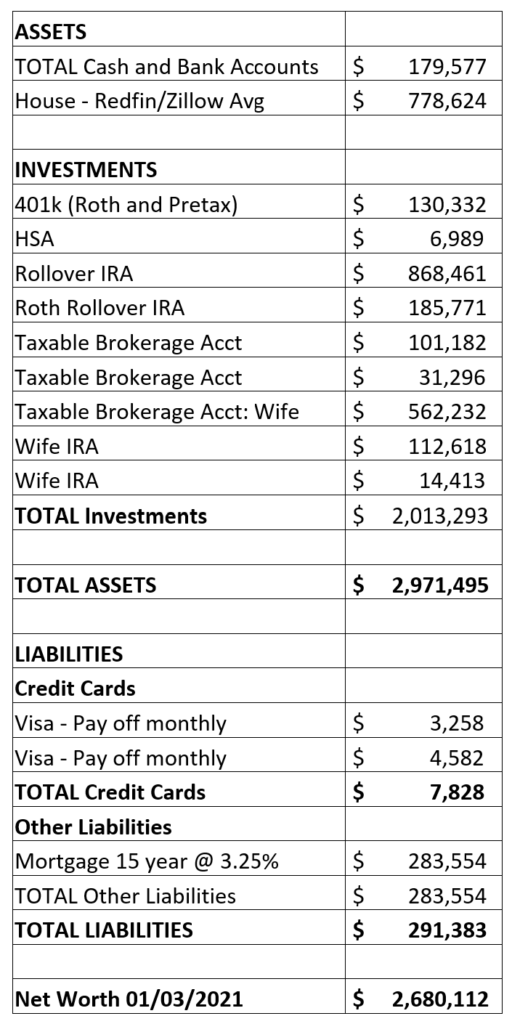

$2.68 million.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Net worth is broken out in the table below, straight out of Quicken:

EARN

What is your job?

Executive level software architect; large tech company.

What is your annual income?

Somewhere north of $300k per year is reasonably certain, with a relatively complex mix of base, bonuses, stock grants, stock dividends and a little bit of trading/covered call option selling.

Base salary is $195k, couple of bonuses total $64k at target, but can double; stock grants can go up to $150k/year.

All in, it is possible to go over $500k in the course of a year, but $400k is a more likely scenario.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I grew up on a farm, in the state just left of ESI’s old home state.

I got to work on the farm, for free, but learned a few skills that let me start multiple small businesses in high-school, like buying, fixing, and selling appliances, cars, motorcycles, and other stuff for fun and profit. This brought in maybe 4-5k per year.

Did a variety of “mechanic type” jobs while in college, but settled in on running a mobile auto repair business for most of my time in school. This brought in something like $10k/yr while going to engineering school at a mid-western state university.

Graduated after six leisurely years with a BS in Ind. Engineering. Still had $13k in school loans.

My first “real job” out of college paid $22,500/year as an engineer with a large defense contractor in Texas.

I was married at the time of graduation and was amazed at how little $22.5k seemed to be worth in a city. Worked hard, made a move in the company for a promotion, and got to $28k after two years.

The opportunity to explore owning a German auto repair shop in an urban environment appealed to me, so I quit the large company and took a management job with a small business, with the goal of learning it, and eventually buying it out from the retiring owner. Spent about 6 months operating the business before I decided that I wanted nothing further to do with the owner, so I jumped ship and went back to engineering at another large defense contractor in the region, salary jumped as well.

This was my last real fling at entrepreneurship on a small scale. I got to build factories, run engineering groups, and eventually operate and turn around businesses with most of the rest of my career.

I alternated between very large corporations and the occasional foray into sub-$200 Million corporations that were in need of fixing. I stayed at one large corporation for a dozen years, got complacent, and quit advancing. When the division shut down, I got my one and only stint of unemployment.

I spent 14 months alternating between consulting gigs and sort of half-heartedly looking for jobs. My dear wife was not fond of the lumpiness of the consulting income, and suggested that a real job with benefits might be in order, as we had just adopted the boy now living with us.

I switched fields and ultimately took a President role at a small company in need of turnaround. Succeeded, and two years later, took another one. Succeeded in that one, as well, and three years in, I thought I might stick it out until retirement, even though I was bored to death. Then something interesting happened (see Future section for details.)

My current role can only be described as a dream job for an executive that lived in the pressure cooker for many years. I now work as a consultant for a large tech company, where I help their Fortune 100 level customers adapt to modern technology. I travel the world, make many new friends, and am what I consider well paid for what I do. My wife and son are always welcome to travel with me, at my expense.

Salary and bonuses progressed nicely; I think when I ran the calculations, last, I grew my income at close to 22% per year over the past 35 years.

What tips do you have for others who want to grow their career-related income?

- Get good grades in whatever you are studying in school.

This won’t make any difference after the first job, but it opens a lot of doors in the interview process for that first job.

- Pick a field that pays well, and fits with your personality.

It is a lot easier to make money doing something that normally pays pretty well, than it is to try to make it work in something that does not. To get ahead, you will have to work harder than your peers; it might as well be doing something that you at least sort of like, since you will be doing a lot of it.

A corollary to this might include pick jobs with companies that have high profit margins. Raises will be much better. You can take a look at a company annual report and see what their gross profit margin looks like. If it is north of 30%, you will have more fun at raise time.

- Don’t be a jerk.

My dear wife has spent some time coaching me on this; it has paid off dramatically while riding the waves of industrial foolishness and corporate skullduggery. I only got laid off once in my career, towards the last day of a division’s existence. It does not hurt to be liked and trusted.

This makes the difference between mediocre and great raises; it also makes for stellar recommendations from former bosses to new bosses.

- Build a network of people that believe in you.

Stay in touch with old bosses (LinkedIn makes it easy), coworkers, customers, and others who have seen how you perform. This will make the difference in very competitive hiring situations, it will also expose opportunities that are not visible on hiring web pages. You get to be the only candidate under consideration when someone thinks of you while writing up a hiring requisition.

What’s your work-life balance look like?

Has varied from pretty awful, early on, to pretty great, these days.

Since I generally enjoy what I do, I spend too much time doing it.

However, from a balance perspective, is chatting with friends on the other side of the planet work, life, or balance?

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

I used to work on cars and motorcycles for side income while working as a young engineer. This added maybe $10-15k per year in the early days. I finally abandoned it and focused the time on advancing my main career, as opportunities presented themselves.

Currently, the stocks part of the portfolio are heavily invested in a dividend producing mix. This is spinning off about $80k per year in dividend income that I reinvest into the same or other dividend stocks.

I have also just started selling covered call options on some of the larger positions. This brought in about $25k last month, with all options expiring worthless. I think I will continue to do this, since I spent less than 3 hours total writing the calls, and glancing at them occasionally.

I have a pension that just kicked in a few months ago from a prior employer. It is good for about $40k per year, with full survivor rights to stay at the same number for Dear Wife if she outlives me.

SAVE

What is your annual spending?

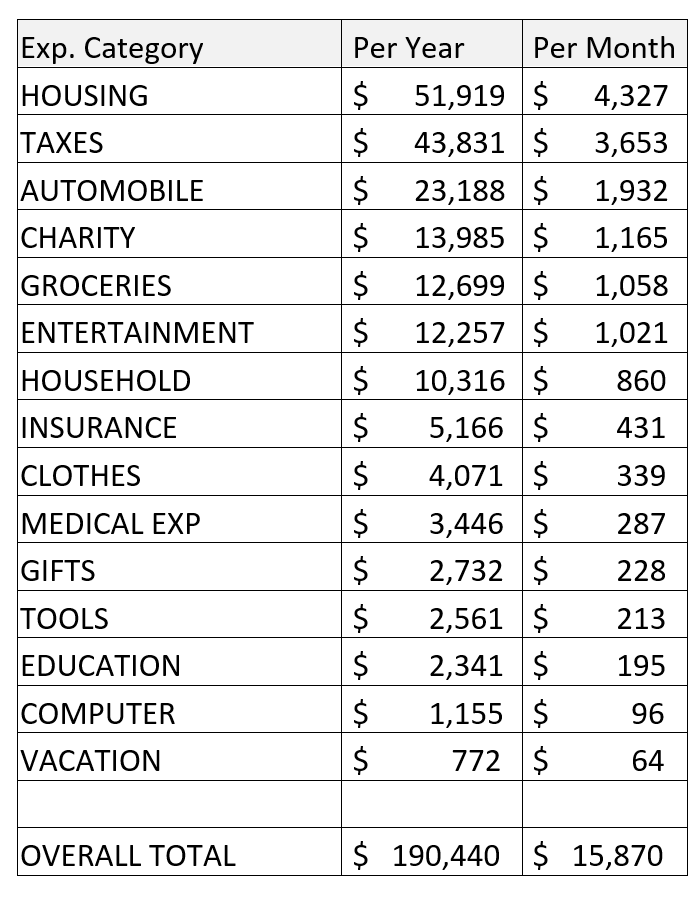

Short answer: too much! $190k, including taxes.

We have 25 years of Quicken data to look back on. Dear wife is fastidious about entering every cent off receipts, and categorizing the expenses.

The below table is rank ordered by size of expense.

Housing includes all expenses, including mortgage interest, property taxes, HOA, utilities, maintenance, etc. We live in a reasonably nice place, selected as a 4,000 sf. single floor residence with a 6 car garage (my insistence), in a warm, low tax climate. The current job was not particular about where we lived, as long as I can get to an airport reasonably quickly.

We decided to move to where we think we want to live in retirement, and get established with a social circle before full on retirement. We spent about 3 years researching locations and testing them with Air BnB trips. (Colorado Springs came in 2nd…mostly because of weather.)

Taxes are all income related taxes, including Social Security.

Automobiles includes all expenses (Maintenance, depreciation, gasoline, insurance, taxes, registration, etc.) associated with two luxury Japanese SUVs and a relatively new Japanese motorcycle. I tend to buy 3 year old, off-lease luxury Japanese cars, then run them until there is nothing left. My SUV is a 2002, with just shy of 300,000 miles on it, hers is a 2011 with about 75,000 miles.

I shopped for a used motorcycle, but surprisingly enough, pre-pandemic, I found a 2 year old motorcycle sitting brand new on a dealer showroom floor, that they were willing to take less than what everyone wanted for used ones of the same make and model in our area…So against my usual practice, I bought my first new vehicle in about 25 years.

One other interesting automobile side note: I recently tallied up the total cost per mile on my old SUV. Including everything, gasoline, maintenance, insurance, depreciation, etc., that thing has cost me $0.43 per mile to operate. Surprisingly, it still shows as worth $10k private party sale on Edmunds.com. I cannot think of something I would rather own (and pay for) than this thing, so will keep it a few more years, or until something catastrophic happens with the drivetrain. I still do most of my own maintenance, so I am not seeing much for future problems with any of the vehicles.

Charity is mostly church related, cash portion only; about 10% of net income after deductions.

Groceries could certainly be less, but we eat pretty good stuff. Most is organic; Dear Wife is a gourmet cook. Whole Foods sees way too much of this category…

Entertainment includes a lot of books; no TV subscriptions, and dining out once a week at more mom and pop type restaurants that serve good food at a reasonable price.

Insurance is mostly life insurance and what little my employer takes for health.

Yeah, Tools gets its own category. I do most car and home maintenance personally, so I buy the tools I like to do it. Dear Wife will tell you that I never met a tool that I didn’t want three of. However, she will also tell you that she has not spent much on home maintenance or car maintenance since she has known me.

I suppose I should be ashamed of the vacation category. This is data from the past two years, averaged out. During the past two years, I started my new job, and have spent most vacation at home, around the house. I tend to travel about 80% of the time, so not really eager to go somewhere on vacation. We are still exploring the new region we moved to, so living here is like a vacation from the last place on the East Coast.

What are the main categories (expenses) this spending breaks into?

Here is the break down:

Do you have a budget? If so, how do you implement it?

No budget.

Have almost everything set up to auto route to 401k, stock program, mortgage, savings, etc. Whatever is left is fair game and needs to pay off the cash back credit cards each month.

I guess if there was a shortfall in that, I would hear about it, and we would make some adjustments.

I max out all the work savings/investing opportunities, with the exception of the employee stock purchase. I put about 4% into that, since it comes with a 10% discount to market price. I limit this a little, though, due to portfolio concentration issues.

Employer 401k has the option to put after tax dollars in, then convert them instantly to a Roth 401k. Managed to get $63,500 into the 401k with Pretax, Pretax catch up, and Roth conversion, this year. Sweet…

What percentage of your gross income do you save and how has that changed over time?

It seems like we are saving close to 40% of gross income, between company stuff and private investments in the brokerage accounts.

What’s your best tip for saving (accumulating) money?

I like the autopilot approach from David Bach’s Automatic Millionaire book.

Figure out what you need to dump into the checking account to just cover reasonable expenses, then automate all savings activity to happen prior to that number.

The number going into the checking account should be just enough to force you to think about whether a purchase is really necessary (i.e. do you want it so bad that you will move money out of a savings account to buy it.)

This has worked ok for us. We dialed in a fairly lush life-style, but still feel good about savings rates.

What’s your best tip for spending less money?

Select where you live, carefully. It will dictate a lot of your expenses.

House size, expenses, commute, etc. all drive other expenses in furniture, automobile wear and tear, and other stuff like that.

What is your favorite thing to spend money on/your secret splurge?

I like motorcycle day trips; my wife enjoys a new pool that I would not have purchased.

We both like to eat pretty well.

INVEST

What is your investment philosophy/plan?

I lean towards value investing.

I have us in pretty close to 100% equities, about 80% US equity, mostly dividend stocks with yields north of 3%.

I use a few ETFs for specific sectors: VO, VONV, VYM, EWS, EWM, VXUS, VXO, ICVT, VNQ, FRT

When the career blip (layoff) happened in 2012, I moved most of the portfolio into short-term bonds, while I figured out if I was still employable at over age 52. As I took a couple of jobs over the next 5 years that I did not really like, I was slow to move out of bonds (yeah, left a lot of money on the table during the bull market.)

In 2016 I moved mostly back into equities, but did not have the research time available to own individual stocks, so mostly used Vanguard’s S&P 500 index ETF, VOO, and their Mid Cap index ETF VO. Both are low expense and highly liquid.

I have more time to read, these days, and also feel like the S&P 500 is a little too concentrated around about six tech stocks. I began diversifying into more beaten down dividend stocks over the past year. This seems to have worked pretty well, post pandemic. The goal is to get the dividend income to cover our basic expenses, before I pull the plug on the career for good.

What has been your best investment?

Bachelors Degree in Engineering, marrying Wife 2.0.

Stock wise: Qualcomm, after walking through their factory and meeting their exec team in 1997, I was impressed with how smart they all were. $3,000 invested jumped to $80,000 in a couple of months; I sold close to the peak.

What has been your worst investment?

Probably owning two vacation homes simultaneously.

Neither appreciated much, but were great sinkholes for spare cash.

Worst stock investment, well Lucent and Enron come to mind…Probably lost $12k between the two of them.

What’s been your overall return?

I see that most have a hard time answering this question. I am no exception.

Quicken does a lousy job of calculating this; brokerage accounts give a reasonable picture, but I have switched investment firms a couple of times to take advantage of their new member cash kickbacks of a couple of grand.

I usually am a couple of points ahead of the S&P 500, with the exception of the roughly 4 years I parked too much money in short-term bonds.

If I look back to about 1997, I believe it averages about 11%.

How often do you monitor/review your portfolio?

Well, I can’t resist taking a look at it in the morning, about the time the market opens, if I happen to be sitting at a computer or have my phone handy.

Most adjustments are just figuring out where to put new money in from salary or dividends.

I do seem to enjoy the writing of covered calls, though. Maybe I will watch those daily, as well.

I also like to take a look after the market closes, just for fun.

NET WORTH

How did you accumulate your net worth?

Almost all came from my salary, then making investments. Dear wife brought about $87k into the marriage; I had about a -$8k net worth when I met her. (She married me anyway, go figure.)

From the time we met in 1995 or so, I had been in a personal “turnaround” mode, post divorce and taking on a substantial amount, to me at the time, of credit card and car loan debt from the prior marriage. I think at my low point, net worth was down to about -$38k.

I got spending under control, and focused on paying down debt. One regret, I liquidated a $13k 401k fund, and paid the tax hit, to knock out some 14% credit card debt. Psychologically, it was the right thing to do, but economically, it would have been better to cut expenses further and leave the 401k alone.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Earn has been my strongest suit.

I have always felt like if worse came to worst, I could always make a living as a mechanic. Knowing that gave me a safety net to take more career risks, change roles, change fields, switch geography, etc.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

Early career days, I spent more than I earned, and married a woman that liked to spend, not save. (Wife 1.0)

Early on, I found out that if I tracked and forecast expenses in a spreadsheet, I could spend more without completely running out of money. Eventually, I figured out that if I modified the spreadsheet that I was using, to include direct transfers to savings, I could actually get ahead.

Eventually my earnings out paced my spending, and things started to progress.

The investing piece developed after marrying Wife 2.0. She had a little money in mutual funds and asked me to manage it. I was scared to death to do a bad job of managing her money, so I went on what has been a 25 year reading binge to understand investing, just a little. I read quite a few books (will mention some of them in the book question), and started to develop some investing skills, as a value investor.

I also chased growth, but mostly with index funds.

Maybe the Investing piece of ESI will end up being my strongest skill?

What are you currently doing to maintain/grow your net worth?

Keep working, over-performing on goals.

Investing in income generating stocks, that I hope will fund our living expenses indefinitely, with inflation taken into account.

Studying strategy for covered call writing.

Do you have a target net worth you are trying to attain?

Not really.

I think I would like it to be $5M, but I am more interested in what sort of income stream I can put in place, with dividends being a core piece.

How old were you when you made your first million and have you had any significant behavior shifts since then?

Net worth hit $1M at age 44. We went out to a nice dinner.

I feel kind of like a late bloomer when I read some of the other interviews. I think it should have been earlier, and it should be higher now, considering that I have been north of $200k income since about the year 2000.

On the other hand, we have never felt very deprived of anything, homes, cars, clothes, etc., but have still managed to get to a net worth of currently almost $2.7M. I guess there is something to be said for balance…

What money mistakes have you made along the way that others can learn from?

Well, spending more than I made for almost a dozen years did not help…

Marrying wrong…

Buying new cars, early on…

Multiple vacation homes…

Waiting until I was in my 30’s to figure out investing…

I guess I made a few of the usual mistakes. The thing to learn from it is that it is all fixable with a little bit of focus and effort, but it gets harder to fix the longer you wait.

What advice do you have for ESI Money readers on how to become wealthy?

The whole ESI thing is the key.

If you can earn a little more, save a little more, and invest in stuff that goes up or makes an income, it will all go in the right direction.

Time is your friend, figure this out earlier, rather than later, and it will be much easier. You know the old saying, “the best time to plant a tree is 20 years ago, the second best time is now.”

FUTURE

What are your plans for the future regarding lifestyle?

Well, when I run the calculations and Monte Carlo simulations on a couple of the investment planning sites, I think I could retire now. We might have to pay a little more attention to some of the expenses, but not much.

Three years ago, while working as the President of a division, in a company I hated, I came pretty close to calling it quits. However, a connection from my network reached out to me about a completely different sort of job, on his consulting team at a big tech company. I took the interviews that followed, took the job, and have been absolutely delighted with the role.

I am back to being a well paid individual contributor. My stress levels are way down, I like the company and people I work with, and actually enjoy the global travel (except of course this whole pandemic thing has put that on hold for a while, yet.) I consult in a field that forces me to stay current with technology, I work with young people that seem to respect my experience and opinions, and I get to benefit people working in customer owned factories by making their jobs easier.

With all that said, I may not retire for a few more years, while I figure out what ways I want to spend my time in post retirement. I have a number of hobbies, but am still looking for what I will do that will have a positive impact on people.

What are your retirement plans?

Keep expenses in check, fund retirement with Social Security, Pension, and Dividends.

Maybe a little freelance consulting in my specialty; maybe not. Demand is strong, I turn away offers on a weekly basis.

We have both traveled extensively with a couple of my prior jobs and my current one. I am particularly fond of New Zealand and Switzerland. We may decide to figure out how to spend some portion of the year in each country. The extensive travel we have both done with my work has greatly lessened the need to travel a lot in a post retirement scenario.

We have a 10 year old boy at home, that we are home-schooling (ok, that Dear Wife is home schooling, mostly.) As he progresses, I will likely be more involved in that activity in the science and math aspects. He is a unique individual, somewhere on the Autism spectrum. It is likely that he will be with us longer than usual, so will be a part of my “retirement” plan.

I would also like to spend a little more time with the two grandchildren, while they are growing up.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

As many mention, healthcare.

Most of our ways of addressing them include having enough money to buy the best care, staying in good health, to begin with, and living in an area known for good care.

Who knows how it will all work out…Staying healthy is probably the best insurance we can get.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

I really started to learn about finances when my Dear Wife turned her $87k portfolio over to me to manage, about 25 years ago.

She is very frugal, mostly, and I knew she would not be pleased if I either lost money, or failed to earn at least what she was getting from a high expense mutual fund that her prior advisor had her in.

I read about investing voraciously, with a focus on Buffet and value investing.

Net worth has been on a steady uptick, since that time period.

Who inspired you to excel in life? Who are your heroes?

Inspiration: My Dear Wife and her father. They are both quite frugal. He retired at about 50, after running a small store in a small town. His father taught him to read the Wall Street Journal, and invest in stocks. Both retired quite well off.

Heroes: Those are hard to find. I suppose scientists like Louis Pasteur that worked hard to discover things that improved quality of life on the planet. I always liked the passion that Nikola Tesla put into his work…

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

I have read most of them… favorites are:

- Stanley’s Millionaire Next Door books

- David Bach: Automatic Millionaire

- Benjamin Graham’s: The Intelligent Investor

- Tim Ferris: The 4-hour work week

- Jeff Olsen’s: The Slight Edge

- Dominguez and Robin’s: Your Money or Your Life

And for the Earn topic, I cannot think of a better book than: John Lucht’s: Rites of Passage at $1M+.

I read his first edition on the mechanics of executive recruiting, and employed some of his strategies in 1993. They worked phenomenally well and my career took off like a rocket. I sent him a note, thanking him, and ended up making a friend that lasted until he passed away a few years ago.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

Yes, about 10% of net cash, lots of clothes, household, furniture, tools, etc.

Will give time at some point towards retirement point, as well.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

Four kids will split it; not necessarily equally.

Youngest will likely have a greater need for some sort of guaranteed income due to special needs.

Some portion will end up going to a charity, dear wife and I will continue to discuss this.

Thank you so much for sharing your advice and story. I think it’s fascinating to see how you were able to pull yourself out of your childhood situation and end up in a job, where you are now.

It sounds like if you really do pick a job and field that fits your personality, you can achieve essentially anything, because it won’t feel like you are working a single day in your life.

For your youngest, do you plan to establish a sort of Special Needs Trust and/or an ABLE Account? Curious to know your thoughts there.

Good luck on your journey!

Cheers,

Fiona

Hi Fiona,

Yes, I am definitely thinking about a trust for the youngest… have not moved into action on it, while trying to get a read on his future skill sets.

He is an interesting individual; may be able to stand on his own, but I will feel better if he has some form of lifetime income to count on.

Cheers,

The Wease

Great interview, you sound just like my husband, no engineering degree but a dual auto and heavy duty mechanic. I don’t include his tools in our assets but they are likely worth over $50k, only things we pay for are tires to get onto rims, alignments and of course parts. His oldest vehicle is a 1975 Camaro he wants to fix up, he drives a 1992 Jetta. He is super handy and has saved us and our 4 kids tons of $ between cars and home maintenance. Your frugal wife sounds like me but I am the money manager; my husband has zero interest albeit he does like to spend it.

I am wondering if you can share some of your favorite dividend stocks? We have most of our assets in registered accounts but we have small investment accounts which will grow as we pull $ out of registered accounts and I need to figure out a watch list.

Hi Jane58,

Well, the past year has been pretty good for MLP’s (Master Limited Partnerships) that trade like stocks and pay out a large chunk of their earnings in dividends. I am holding SUN, ET, PSXP and will likely buy SHLX.

I also like LMT, LHX, MRK, UMB, PRGO, SPH, TRTN, RBA, VZ, BMY, PFE and PRO. I also hold IIPR, a reit focused on cannabis grow facilities, but that is a little more speculative at a high P/E.

I don’t necessarily buy and hold forever, but I think you could with any of those. You would have to figure out your risk tolerance and see if they fit, but for the most part, these seem moderately cheap, compared to the S&P500 at the moment. Most of the above pay better than 4% dividends, some significantly better.

Most of the above also seem to work pretty well selling covered call options against the stock, to bump the yield up a little and soften volatility.

Good luck on your adventures!

Cheers,

The Wease

Thanks for sharing! Have learned alot from you, and am more hopeful from your information. Please explain ETF’s? What does this stand for?

Best Regards,

Carol

https://www.investopedia.com/terms/e/etf.asp

Hi Carol,

ETF=Exchange Traded Fund. Usually a basket of stocks or other things, sometimes bonds, sometimes commodities.

I like them because there are many types for what ever mix of risk you wish to take. They are frequently lower in fees than mutual funds, and they trade during the day, like stocks, so you can move in and out of them without waiting for the market to close, like mutual funds.

You can also hold them and collect dividends (if they hold dividend paying assets), but unlike mutual funds, they don’t stick you with capital gains in your taxable account when they actually lost money. This became my biggest gripe with traditional mutual funds in a taxable account.

Cheers,

The Wease

“Don’t be a jerk.” – Life and career advice summed up in 4 short words. Love it.

I’m wondering how to get the most on my stocks. I maxed out my Roth IRA account and I just opened up a high-yield savings account. But I’m wondering if there are any other accounts that I can put my money into invest in dividend stocks to get the most that I can since I’m maxed out. I’m confused how other people in my dividend group have hundreds of thousands and their accounts if you can only do 6,000 a year I’m just starting out though.

The time is probably the difference.

20-30 years of growth will do wonders for a portfolio.

Most probably have a non retirement brokerage account that they use extra money to buy stocks/funds. If you buy the SP500 fund, you get the same dividends without having to pick individual stocks. Or buy a dividend ETF/Mutual fund. I basically own one individual stock and everything else is in ETFs. My wife has a Dividend Fund in her 401K and once she retires, I will convert it to an ETF. I don’t chase dividend stocks for a 3% return. You still need $1M in those funds to throw off $30-$40K in income.

Oh, one other possibility… if they have hundreds of thousands in an IRA type account, they may have rolled one or more 401k type accounts into the IRA, when changing employers.

Nice story. I invest some in I believe it is schd dividend etf. I would like to be able to live off pension type income and dividends and interest and not sell investments in general. I think you mention dividend stocks. Have you liked any dividend etfs? I think logistically to do this, one needs to not reinvest interest and dividends to be able to use the cash. I have so many accounts it might be a little tedious, but something to consider.

Hi Gary,

I have some cash in VONV… Vanguard’s dividend fund. Yield is about 2.2%, so not terribly exciting, but well diversified and low fees.

Cheers,

The Wease

Good interview MI-246. I am pleased to see that you were able to pivot into something that you truly enjoy right at the time you were thinking about hanging it up. I’m looking to jump to another position internally in my company, and frankly it’s not something that I have a background in at all. I just made the decision today and in the words of of Joel from Risky Business I said “WTF” and made my move. They might turn me down and not even interview me, but you never know unless you try.

Moving on to the most obvious question if you read my interview, what motorcycle did you end up buying?

Thanks MI-202, good luck on the new role. It was great for me to switch to something “completely different.”

Ended up with a Honda Africa Twin (big enduro type bike.) I have ridden mostly street bikes over the years, sport and cruisers, so it is stretching my brain a little to re-learn dirt riding on a 500+ lb. top-heavy beast. It’s a blast in the desert, though. It takes me places that my old cruiser would never have made it.

Cheers,

The Wease

It seems as if you’ve done well with selling covered call options. I was wondering if you could point me to resources (i.e. online, books, articles, etc.) regarding how to sell covered call options.

Hi Ashok,

Search for Allan Ellman on youtube. He has a wealth of decent videos on the topic.

Also, the book “Options as a Strategic Investment” 5th edition, is worth it’s massive weight in gold.

I only do the options on stocks that I would buy and hold, and I don’t use margin leverage (yet.)

Cheers,

The Wease

Thanks so much for providing this information.

I think travel is great for broadening life experiences. Ironically I live in New Zealand but my wife and I both have enjoyed travel over the years both before we met and afterwards. I have made many trips to US with the first being in mid 90’s. My wife and I generally travel there every 3 years tho Covid put hopefully a temporary stop to that last year. Explored many different states plus Canada and it’s always interesting to see how different states vary from each other. NZ is small so regional differences are not as apparent here.

One thing that interests me is that you still have a mortgage given your net worth. I am assuming there are some benefits as many of the millionaire interviews show this. Is interest tax deductible on your home? It is not here plus maximum term you can fix a mortgage in New Zealand is 5 years but I get the impression that in US it is fixed for the whole term of the mortgage

Greetings MI101,

You live in a beautiful country filled with many nice people! I somehow even became an All Blacks fan, while there, and I am not particularly big on sports. Most of my time was spent around the Auckland area, but I did get as far south as Hamilton a few times.

Regarding the mortgage; yes, the interest is Fed tax deductible, but with a $10,000 cap on that interest plus property taxes, plus state income taxes. So the reality is that I do not get an actual tax advantage from it, since my state and property taxes exceed $10k per year.

Interest is at 3.25 % on 15 year mortgage note. I am doing considerably better than that in the stock market, these days (the account that I would cash out to pay it off was up 43.95% during the last 12 months.) So I go back and forth about paying off the mortgage vs. letting the cash earn some growth in the market.

Paying off the mortgage is an absolute sure thing yield of 3.25% in after tax dollars (since I don’t get any real tax benefit from the deduction.) That is not too shabby when compared to bonds and savings vehicles. However the gains coming from the stock account are enormously alluring… 🙂

I think when I finally pull the plug on the W2 career, paying the note off will generate enough “peace of mind” to do so. However, I do not feel a strong urge to do so, right now.

Cheers,

The Wease

Adding my own 2 cents to MI101’s question. I carry a couple million dollars of mortgage debt even though I have the liquid assets to pay it all off. A substantial portion of that debt is on investment property that I’m planning to sell when I (soon) enter full retirement.

And I was planning to retire the mortgage on what will become my primary residence in retirement – though more recently rethinking that. I’m currently borrowing at a blended rate of ~3.25%, much like MI246. But, I am using interest-only mortgage products – not for the faint of heart or short of cash! These are riskier products are not available to the average borrower – generally requires a very conservative loan-to-value on the property, very high net worth, excellent credit history, and substantial liquid assets (just in case).

That said, when you can borrow millions at rates substantially below market returns, it’s like minting money, though requires extraordinary discipline to not run off and start blowing money on yachts and Ferrari’s and Learjets (one should prudently limit ones self to only 1 yacht and 1 Ferrari and only fly private as some else’s guest).

Further, the interest is tax deductible in a number of ways:

(1) There is still a good old fashioned deduction on mortgage interest associated with a primary (or vacation) residence, though I believe from memory this this is capped at mortgage debt up to $750,000 or $1mm depending on when the loan was closed (MI246, I don’t believe its capped at the $10K interest limit connected to state/local taxes though probably there are phase-outs at upper income levels).

(2) For rental income properties, the mortgage interest is fully deductible.

(3) A portion of the loans can be applied to financing for a small business (ex. inventory financing), and that is deductible against the business income.

So, I have used debt to substantially lower my tax burden and leverage my returns over the past 20 years, which has contributed greatly to increasing NW. Since I have generated a relatively high W-2 income (therefore exposed to very high taxes), that has been critically important.

Interesting to read both these responses and I can see the logic in what you both do.

I find it fascinating about how depending on where you live in the world how you do things like buying a house varies from country to country and of course the differing strategies people have to achieve this.

How did you end up with two vacation homes?

How did you exit them?

Wife wanted a place in the mountains; I went along with it. We spent a lot of time there over about 10 years; maybe 1 to 2 month blocks over a 3-4 month period.

I decided that I wanted a place out in the midwest (hunting, fishing, old friends, etc.) We worked it into the rotation, so spent 1 month or so in SoCal, a month or so in the Sierras, and a month or so in the middle of nowhere, depending upon seasons, moods, etc.

My 17 year corporate gig finally came to an end, so we decided to cut overhead while we figured out the next phase. Next couple of jobs required on-site attendance, so we would not gotten to enjoy the extra homes very much during that time. Could do it again, now, but just not that interested.

Took our time selling and got ok (not great) money back out of the places. Worst was consolidating all the stuff that had accumulated. We had set each place up as fully functional, to where we could arrive with almost nothing and have everything there (clothes, books, etc.)

It took longer to figure out what to sell and keep than it did to sell the houses.

I enjoyed that phase of life, but the mental toll on keeping track of what needed to be fixed/upgraded at 3 places got to be a grind. I don’t think I would do it again, and it did tie up a lot of capital that should have been growing in the market, instead.