If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in August.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am 47, and my husband is 48. We’ve been married for 23 years.

We are immigrants from Eastern Europe, came to the US more than 20 years ago to get master’s degrees in one of the US universities and then progress to working in the US, on work visas first, then getting green cards through our employers and then eventually becoming US citizens.

Do you have kids/family (if so, how old are they)?

We have two boys, a college-bound 18 y.o. and a 13 y.o. middle schooler.

We also support our in-laws who moved to the US about eight years ago and now live in the close vicinity.

What area of the country do you live in (and urban or rural)?

We live in the Pacific Northwest region.

More specifically, we live in a high cost of living area in Washington state.

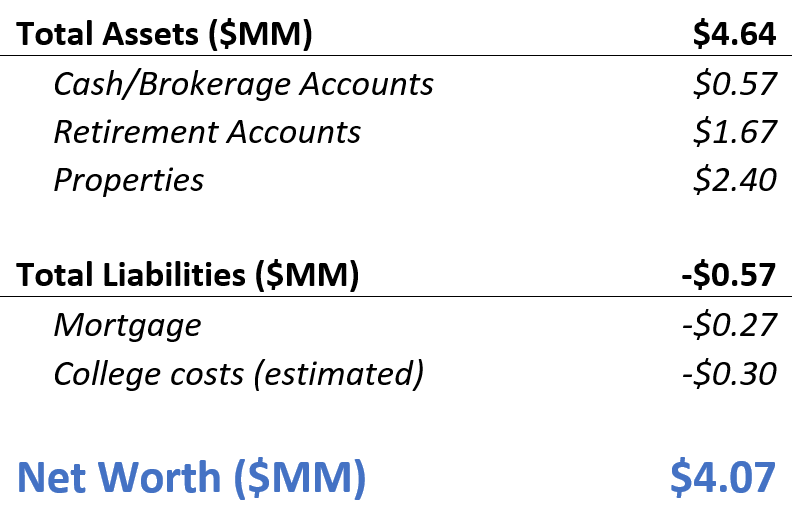

What is your current net worth?

Our current net worth is just above $4M.

That includes:

- rough value of our properties (our primary residential house, a condo where the in-laws live, and a vacation house in the Cascade mountains area) adjusted down by 10% to account for potential selling costs

- investments in our tax-deferred/brokerage/HSA/checking accounts

- mortgage for the vacation house (the primary residence and the condo are fully paid off)

- estimated college costs for both kids.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

About half of our net worth is tied up in the properties, about 35% is in the tax deferred accounts, and the rest (about 15%) are in the brokerage/checking accounts.

EARN

What is your job?

I am currently a Sr Manager of Analytics and Reporting in a major telecom company.

I graduated with Masters in Math and found a job in the field of Analytics, working for a consulting company focused on healthcare industry. That job was a bootcamp for developing expertise in many analytics tools, which are transferrable across any analytical jobs. I also got exposed to different aspects of data analytics, from data modeling to forecasting, primary and secondary market research, which had proven very useful in my future career progression.

After about 6 years in consulting, I moved to a Biotech company, a former client of mine during the consulting era, as an Analytics Manager. The work was more concentrated, instead of working with different clients across different analytics projects, I was supporting the products of a single company, focusing on depth rather than breadth. That’s also the first job in which I got to manage direct reports, which I continued to do throughout the rest of my career.

2.5 years later I got a wonderful opportunity from a friend of mine who recommended me for a position of VP in a Market Research company, located in PNW, which I gladly have taken. That job entailed leading a huge multi-million project for a major tech company in the area. That job came with significantly increased responsibilities and long hours (there was a period of a few weeks in which I recorded over 100 hours per week; it was very exhausting), but it also ended up being one of the most fun and rewarding jobs that I ever had. I had an amazing team, great bosses and colleagues, the job included periodic travel to an East coast HQ office.

With my VP counterpart for the East coast, we were able to rehaul our project from losing money to being the most profitable project for our division, the example of operational excellence. Those were the years…But alas, all good things come to an end, and this one ended as well. There was a new team on the client side, the new management in our company, and due to serious budget cuts at the client side, our project was given to a different vendor, and my job was eliminated.

Since at the time we had two mortgages (for our primary residence and for the in-law’s condo), staying without a job for long wasn’t an option, and after five months of job search, I accepted a position with another consulting company, which had a local PNW company as a client, yet the entire team was in India. In fact, I was a liaison between the two.

Unfortunately, that job came with a salary cut, which I somewhat regret to this day. I probably should have searched for a new job longer and may have landed something closer to my previous compensation. Nonetheless, after I accepted the job, I committed to it for the next two years.

The job came with long hours (spending the entire workday at the client site, working side by side with the local team, and then spending many hours after dinner on a phone with India, communicating the client needs to the offshore team and providing the feedback on the deliverables). The best (and only) perk of that job – I travelled to India twice, was able to experience the new and fascinating culture and explore Taj Mahal, among other sites.

Eventually I was able to find a full-time job at that local company that was our client and spent the next two and half years in Analytics manager role, supporting Personalized Marketing with analyzing the effectiveness of different marketing campaigns, among other things. Eventually I grew very tired of 1+ hour commute one way every day and started looking for opportunities close to home.

That’s how I ended in the current role, again leading a team of analysts, and providing analytics support for the telecom company. And I am planning this to be my last 9-5 job, and to early retire in less than two years from now!

As you can imagine, my husband was also developing his career at the same time. He started with master’s degree in electrical engineering, found a job directly related to his specialization, but then through his hobby (create an operating software on one of the earliest smartphone-like devices) he got noticed by the company whose device he was using and received an offer he couldn’t refuse. That’s how he became a software engineer and never looked back.

He is currently a Principal Engineer at one of the global consumer electronics companies, and also plans to early retire from that job in about two years.

What is your annual income?

My current annual compensation is about $200K, including a salary of about $160K and an annual bonus of about $40K.

My husband’s annual compensation is close to $300K across his salary and semi-annual bonuses.

So, in total, between the two of us, we are earning about half a million dollars (the fact unbelievable even to ourselves!).

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

Obviously, that’s not how much we started earning from the beginning of our careers.

In the first two years in the US (while in the master’s programs), we secured assistantships (teaching assistantship for me and research assistantship for my husband). So, the university was covering the costs of our education and paying us a relatively small salary ($12,700 per year for me and $10,800 for my husband).

In 2000 we found our first out of college jobs. For my husband it was $45K (I negotiated it up from the original offer of $40K) and for me $55K (I was so stunned by the number that I didn’t even attempt to negotiate…) + 10% target bonus.

While the salaries were increasing annually at the same companies, the biggest jumps in compensation we got were when changing the employment. Sad, but true, and this fact has been mentioned by many millionaires in their interviews.

Over 20 years of full-time employment (not counting college years), my compensation more than tripled (about $200K in 2020), which translates to an average growth of 6% annually. If it wasn’t for that job loss and taking the salary cut, which took me three years to get to the same level of compensation, the average annual growth would have been higher.

My husband’s compensation over the same 20 years grew at about 9% annually.

As you would expect, the growth at the companies was made possible due to hard work, desire to work long hours, commitment to the job, constantly learning on the job, openness to work on new and challenging things.

Also, a willingness to move to another place for the new opportunities. My husband and I were playing tag by pursuing new careers. When he was offered a job as a software engineer, we moved from the Midwest to the Bay Area. He started a new job, and I transferred to a regional office of my company.

When I was given an opportunity of becoming a VP in Market Research company, we moved to PNW, and my husband switched jobs to work at one of the large tech companies in the area. These two moves boosted our career growth significantly.

What tips do you have for others who want to grow their career-related income?

Work hard, never stop learning, increase your expertise, provide value, which will make you and your excellent work visible to others.

Put in long hours if necessary (especially early in the career when it’s easier physically and mentally).

And if you are doing well in your current role and have some extra bandwidth, volunteer, and seek out more opportunities.

What’s your work-life balance look like?

Right now it’s really great, especially with working from home in the last 18 months or so. As I am sometimes working from our vacation house, it feels like I am almost on vacation. It’s easy to step away from work during lunch hour and go outside, or even to take calls from the patio while listening to a river hurrying past our house, which provides extra relaxation during work hours.

Another factor contributing to the feeling of the balance is the fact that I can see the early retirement on the horizon, which makes the work stress more tolerable (this too shall pass).

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

No, our full-time jobs are the only source of income we have.

Funny enough, when we purchased our vacation house, I had grand plans of renting it out as a short-term rental (the location is great, close to many attractions such as skiing, hiking, swimming in a lake, or relaxing in a small Bavarian-style village nearby). However, after spending only a couple of weekends there, my husband decided that he likes the place for himself and wouldn’t want to have any strangers staying there…

That’s how I ended up having a great vacation place and no chance of making money off of it! I don’t complain though, since we spend time there almost every weekend and even some weekdays with the pandemic.

SAVE

What is your annual spending?

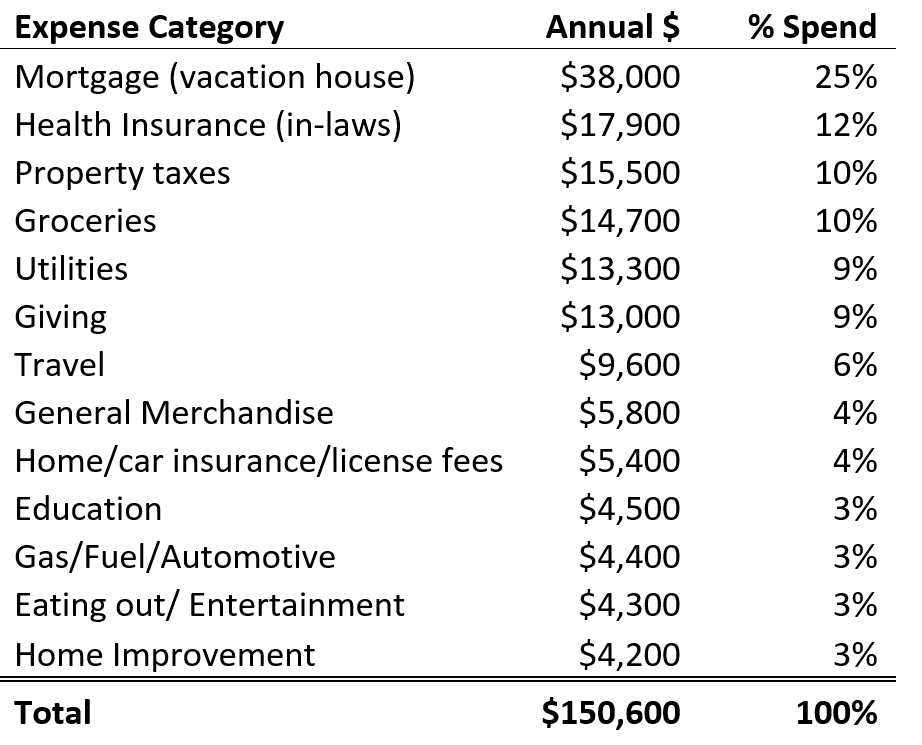

In the last 12 months (Aug 2020 to Jul 2021) we spent about $151K as a family.

What are the main categories (expenses) this spending breaks into?

The largest expense category is a mortgage for the vacation house (we decided on 15-year mortgage since it had the smallest interest rate, and we were planning to pay down the mortgage aggressively anyway).

We are also paying many expenses for our in-laws. While many of those rolled into the overall categories (utilities, property taxes, travel, etc.), the health insurance for the in-laws stands out as the second largest expense category.

Property taxes, home/car insurance, utilities, home improvement projects across all three properties roll into a sizeable chunk (25% of the total annual spend). Eventually we will sell our main house and will live mostly in the vacation house, but that’s many years out, for now we pay for the luxury of having three properties.

Travel is a relatively suppressed expense in the last year due to COVID, but it can easily go up to $15-20K across our extended family of six. We love travel!

What is not in the table above is income taxes, and we paid about $100K in 2020. THAT would be the largest expense, but it comes with high income, so we are looking forward to having to pay much lower taxes after we quit our 9-5 jobs.

Do you have a budget? If so, how do you implement it?

We don’t really have a budget, and until about 2 years ago I wasn’t tracking my expenses as closely.

But about two years ago I discovered FIRE movement (through ESI Money article about his thoughts on his first year of retirement) and got on that train.

I started reading many personal finance blogs, downloaded Personal Capital (again, the influence of the financial bloggers, such as ESI Money, Mr 1500 Days, JL Collins, etc.), linked all our financial accounts, and got sucked into the wonderful world of numbers, charts, trends, retirement planning scenarios…But I digress…

As you can guess, I am the one who is now very aware of everything that we have and, most importantly, where our money is going. I periodically scrutinize our spend categories and often look for ways to reduce some of the expenses.

For example, we used to spend $1,500-1,600 per month on groceries (mostly for a family of four). Reading about how many people spend only about $200 per person per month, I modified the way we shop, and now our average monthly grocery spend is closer to $1,200. Not perfect, but an improvement, nonetheless.

My wonderful husband is very supportive in my recent obsession with all things financial in our household and is supporting me in all and any ways. We do make the important decisions together and often discuss our financial progress (including the spend), but he trusts me with day-to-day money management.

But one thing to add – we’ve always been frugal and spent below our means. We came to the US with nothing, with the need to support our families back home, plus the ingrained desire for security. Which is why we were heavily focused on paying out our mortgages as soon as we could – the knowledge that no one can take our houses from us – priceless!

What percentage of your gross income do you save and how has that changed over time?

I can’t really think back to what we’ve been saving when we just started full-time jobs…We started saving into 401K plans from day one (about 10%), building out emergency fund to the comfortable levels, and paying out our then primary residence sooner. If I were to take a guess, we were saving between 20 and 30%.

Today, if we add employer contributions to 401K to our gross pay, and subtract all expenses listed above, including taxes, we save at least 52% of the adjusted gross pay.

What’s your best tip for saving (accumulating) money?

Get on the same page with your partner on what your goals and priorities are.

Watch your spending, but even better, earn more (in our case, through growing our careers) to increase the gap between your earnings and spending. Earning more, in my mind, could go further towards increasing that gap than just spending less.

What’s your best tip for spending less money?

Ask yourself (and your partner) whether an expense is really needed.

Go for generic versions of some goods (like Costco’s Kirkland brand or Safeway’s Select).

Set the alerts for the stuff you want to buy when it’s on sale (like CamelCamelCamel alert for Amazon merchandise).

Buy used when it makes sense (for example, we are looking for a used version of a small fridge for our college-bound student on Offer Up).

Use credit card rewards to reduce your travel expenses (or just earn cash back if you are not much into travel).

What is your favorite thing to spend money on/your secret splurge?

Travel hands down! However, we mostly have been cost conscious travelers. Camping or log cabins are our standard accommodation, especially during road trips we take as a family every year. The more luxurious accommodations are all inclusive resorts in Mexico about once a year with our extended family.

Though during the most recent road trip this summer I got the taste of travel rewards, having about a week of accommodations in Hyatt hotels, using only half of Chase Preferred welcome bonus. That was an eye-opening experience, and I can see way more travel hacking in our future. 🙂

INVEST

What is your investment philosophy/plan?

Until about two and half years ago (again, discovering FIRE does wonders to your way of thinking about money) we did not really have any investment philosophy/plan. We maxed out our 401K, and that was about it. The rest of free money was going into paying out the mortgages and building out a sizeable emergency fund.

After discovering FIRE, our investment philosophy became Simplicity. I consolidated our old 401Ks into traditional IRAs for both of us, investing into total stock market index funds. In the active 401Ks we invest in target funds.

The brokerage accounts are a little more of a mess. About 60% of those accounts are in two company stocks, which we are getting through the ESPP program. Both companies are growing nicely, and one of them has a very low-cost basis (we had those shares for a while now).

Given our current high income, it doesn’t make sense financially to sell them at this point. We will be better off selling them when we retire in about couple of years.

The other 40% are in dividend funds (my attempt at having a however small additional income stream).

We also have about one year worth of retirement expenses in cash. We are planning to increase it to two years’ worth by the time we retire, along with paying out the remaining mortgage. We won’t be buying any more equities into our brokerage accounts, the only additions would be the ESPP purchases.

What has been your best investment?

I consider investing in our education and then careers our best investing decision.

In terms of actual investment, the decision to save for retirement in 401K since day one of our full jobs, while not made fully informed, turned us into the millionaires we currently are. The money really accrues in those retirement accounts nicely, and one fine day you realize what you have.

What has been your worst investment?

The worst investment is, in my mind, not really understanding investing and not investing into the stock market until just recently.

Some, if not many, of our financial and life decisions could have been different if I knew then what I know now.

What’s been your overall return?

I honestly wouldn’t know how to answer that.

I know that we went from $0 net worth to about $4M in 21 years, but I wouldn’t know how to separate the investment returns from the compensation/saving/real estate price growth.

How often do you monitor/review your portfolio?

Did I say that I am a nerd who loves numbers?

Before having a Personal Capital account, I was tracking out net worth about once every 2-3-6 months (given how inconvenient it was to put all that information together).

Now I am checking my portfolio every day, because it’s soooo easy to open that PC app on your phone or laptop and see what’s going on in your financial life and dream about what’s next. 🙂

NET WORTH

How did you accumulate your net worth?

As I described above, our net growth was mainly a function of earning relatively well and having a decent saving rate.

We had no inheritance, but we were also fortunate to get teaching/research assistantships in our Master’s degree programs, so we did not have student debts.

We just built out net worth steady over time by earning more money through career growth, trying not to inflate our lifestyle and re-directing the available funds into reducing/eliminating our mortgages.

I remember when I was still a graduate student, I met my friend’s father (their family has also immigrated for the same country, just ten years before us), who told me that he and his family accumulated $1M over those 10 years in the US. At the time I was floored that it was even possible and decided for myself that we would also reach $1M eventually.

And we did, 11 years after starting full time jobs.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

We’ve done a good job in Earn and Save.

Not so much in Investing, though I am working on doing a better job in that area as well.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

The only serious road bump that I remember was right after getting my master’s degree and flying home to visit my family before starting my first full-time job (I already had a job offer in my pocket). When trying to return to the US, I ran into issues with my student visa (which is what I had at the time).

While a person on a student visa can work for about a year (it’s called optional professional training), since my husband already had a full-time job, the American embassy decided that I wouldn’t come back to my country (a student visa requirement) and denied me re-entry to the US. That was a very scary period, because I could see the dreams of my future life crumbling before my eyes.

Huge thanks to my then employer, who, when I notified them of my predicament, decided to speed up the application for my work visa, only so that I could come back to the US and start my job.

Everything after that was a relatively smooth sailing. You may not believe me, but we weren’t really aware of the market crushes in 2001 and in 2008. That’s probably because we weren’t really investing so we did not follow the stock market closely. Oh, we were aware of the events of 2001, and saw the value of our home purchased at the end of 2008 going down by about 30%, but since we did not plan to sell it then and there, we waited out that value decline, and in fact our house is now worth more than twice the original price we paid for it (still not planning to sell it, not in the next few years).

I do have to say that I kept my cool during the market crush of last year. At that point I was fully aware everything financial and was watching the decline in market daily. I was contemplating buying more shares during that period but since we had about 8 months of expenses worth in our checking accounts, I decided to keep that safety net, just in case (even though both of our employments were secure at the time). I was making regular monthly purchases of total market funds from every paycheck, which helped accelerate our net worth growth during 2020.

What are you currently doing to maintain/grow your net worth?

I am being more mindful about the money we get and how we make those “soldiers” work for us.

Over the next two years my focus is on paying down the remaining mortgage (buying us a piece of mind in the retirement) and adding to our cash cushion.

Those may be conservative moves, but given our timeline, it makes sense for us. I rely on the rest of the portfolio (retirement accounts, existing brokerage account, continuous ESPP purchases) to deliver the growth.

Do you have a target net worth you are trying to attain?

Using 4% SWR as a rule of thumb, my current net worth would provide $160K annually, which is enough to cover our current expenses.

However, since my husband won’t retire until we have no debt, and we also need to beef up our brokerage accounts before Roth IRA ladder matures to provide funds for annual expenses, we plan to work for two more years (I am challenging myself to reach those goals sooner, but two years is the reasonable timeframe).

I hope that by the time we reach those pre-retirement goals, our net worth will be north of $5M, which will provide for a comfortable retirement, barring any huge market crushes.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I was 37 at the time and reaching that $1M felt like a huge milestone (it was my aspiration since I was a graduate student). But I also realized that $1M is just that, a milestone, and we still had young children, and a mortgage, and families back home to support.

So we continued doing what we were doing, working, raising kids, helping families, without all of the sudden deciding that we are rich and can spend that $1M left and right.

As other people pointed out before me, the first million is the hardest and takes the longest. It took us 11 years to get to $1M in net worth, five more years to get to $2M, four years to get to $3M, and only one more year to get to $4M.

What money mistakes have you made along the way that others can learn from?

If I could turn back time, I would learn about investing in stock market much sooner. There was a period in early 2000s that I wanted to learn about investing, and even got a subscription to Money magazine, but it was too intimidating at the time, and then I got distracted by my first kid… 🙂

But having Personal Finance resources as we have now would have made learning what I wanted to learn so much easier…I am hoping to teach my kids to start thinking about money, at least letting them know that they can always find a competent money manager in me when they decide they want to learn about money…

What advice do you have for ESI Money readers on how to become wealthy?

Grow your income by being diligent, working hard and continuously learning.

Create a gap between your income and spending by keeping your lifestyle inflation in check and spending on what you value.

Invest the gap into something simple, like total market index funds.

In other words, ESI model works!

FUTURE

What are your plans for the future regarding lifestyle?

Our net worth will allow us to retire early, which we plan to do. Eventually we would move to our vacation house, where my husband will work on his hobbies (both physical DYI projects around the property and intellectually stimulating coding-related projects).

I plan to travel a lot, both with my husband as well as with my many friends and family. When not travelling, I plan to do a lot of activities, such as going to gym regularly, joining dancing groups (love ballroom dancing), reading, blogging (in fact I just started a new blog, to see how I like it), learning new languages (Duolingo rules! I am currently working on my French, studied a little bit of Italian for our trip to Italy in 2018, would need to return to studying it in depth; Spanish – to name a few).

I would love to live in different countries through slow travel, at least a few weeks at a time, to immerse into new cultures and practice my language skills.

I am also looking for more ideas to fill my bucket list, to make sure there are many things to try and experience when we are ready to do so.

What are your retirement plans?

We are planning to retire early in less than two years, once we pay down the remaining mortgage and add more funds to the brokerage accounts to cover our expenses until we can take advantage of Roth IRA conversion ladder that we plan to set up once we stop working and have no W2 income.

My husband’s employer offers a pension, which we plan to tap into when he turns 60. We expect the annual pension of about $30-35K, with survivor benefits.

Eventually we will sell our primary residence, keeping the condo in the area. That way we could have a place to stay when it becomes too lonely at our vacation place. Mostly that’s me who will miss friends if we move to the vacation property. My husband is an introvert and doesn’t anticipate having any problems living relatively remotely.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

I am worried (a little bit) about being bored in retirement, but I am continuously working on reading about different activities and making note of what I would like to do. I am more worried about my husband though, who, once he finishes his DYI projects, may run out of things to do…

Healthcare costs is a concern for all, though I hope that the elimination of the subsidy cliff for those earning above 400% FPL is here to stay past 2022, which would make the healthcare costs more affordable and manageable.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

We always have been good money managers, growing in the family with not much income, we learned to be more frugal and do many things by ourselves.

The investment part did not click until recently, but since then I’ve read a ton of personal finance blogs, listened to almost all episodes of ChooseFI podcast, distilled learnings applicable to our situation and set us on the now defined path to FI/RE.

Now that I am set with the financial aspects of getting to and financing the early retirement, I turned my focus to what to do in retirement. Since I have some concerns about being bored in retirement, I want to get inspiration and ideas from other people who already reached retirement.

Who inspired you to excel in life? Who are your heroes?

My parents were my heroes. They nurtured my interest to math and even gave me a friendly nudge to apply and get accepted to a boarding high school with math/physics focus. Studying in that school served as a landing board to being accepted to one of the best universities in my country and eventually leading to studying in the US. And the rest is history.

But if my parents did not see the potential and me and did not send a 14 year-old me to the boarding school in another town because it was better for me and my future, I would not be where I am. I am forever grateful to them and attribute a lot of my success to their support.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

I read many personal finance blogs, such as ESI Money, JL Collins, GoCurryCracker, Retirement Manifesto, Can I Retire Yet, Mad FIentist, etc., and I learned so much from them! Even though many of the topics are similar across the blogs, they are explained from different angles, which deepened my understanding of the complex financial topics.

I am also a fan of ChooseFI podcast, especially the episodes with guests. Listening to those stories help me discover new personal finance blogs to read and learn from.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

Our giving is concentrated on helping our families back home. These last few years some of my family members went through cancer ordeals, and we were helping financially so that they could afford cancer treatments.

I anticipate we would continue providing financial support to the family members in the country where we are from, helping those in need.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

Yes, definitely. But what we are hoping to achieve is to raise our kids into successful adults, so they won’t need our inheritance.

Maybe I missed it somewhere, but do you plan on selling all of your property and renting in retirement? You stated your NW will provide you $160k a year based on the 4% rule, but that math only works if you sell all of your real estate that will be sucking money from your accounts not adding to them. You are young though with super high paying jobs and it’s very likely your investable assets will get there on their own if you keep saving.

Regardless, awesome job accumulating such an impressive NW and good luck in the future!

Thank you for your comment and for wishing us luck in the future! We do plan to sell our main house, which is worth more that half of our real estate properties, and costs the most to maintain (taxes, insurance, utilities, etc.). But it won’t happen in the next few years while our youngest is in school.

I did say that today’s net worth would provide for the current expenses. And yes, a large portion of my net worth is currently tied in real estate properties. However, I expect my net worth to grow by the time of our retirement (probably by another million or more, barring major market crashes), I also expect our expenses to go down in retirement (especially after we sell the main house), to be more around $120K annually or less. Taking into account all of the above, plus the eventual sale of the main house, plus the pension, plus some social security at some point (can I add this to the picture?), and all that paints me a comfortable retirement picture 🙂

You can definitely can and should add all that stuff to the picture, you guys have kicked some retirement a$$! I just wanted to make sure it was clear to other people reading the post that the 4% rule is based on investment assets not your total NW.

Reality is you’ll probably have a gigantic pile of money left over you never get the chance to spend, so make sure to enjoy the ride along the way.

I’d be careful about holding company stock until you have a low income year to sell it. I did that when I retired. I could have sold it for a $60K profit in December but since I was retiring the next month and my income would go from over $400K to only about $100K the next year I thought I’d wait one more month to sell it. The options went underwater by the end of the month and then expired still under water so I lost the entire $60K by trying to save a few thousand dollars in taxes. Your situation is different, I was selling stock appreciation rights (SARs) and you own actual stocks, but the principle is the same. $60K isn’t enough money to do more than hurt my feelings but it did sting a little. In your case you should consider the risk that the stock could tank on you. My philosophy now is to not hold a large amount of money in any single stock but to be as diversified as possible. You guys are killing it, congratulations for representing the American dream so well. The country is so much better off with you here.

Hello Steve, thanks for your comment! You are right that there is a danger of the company stock significantly declining over time. These company stocks represent about 1.5 years of my retirement expenses, as I am planning to have at least two years in cash plus I have other forms of investment in my brokerage accounts. If the stocks value drops by a third, and I sell them, I will lose about 6 months of expenses. Vs. if I sell them now, I would need to pay 20% in capital gains… I will think hard about your advice!

And thank you for your kind words, the US of A is truly a land of opportunity, and we are the example of how it’s possible to live the American dream 🙂

Congrats. Immigrant here too and retired this January at 50 with now a $3.4M net worth and no mortgage. We shared the same philosophy when it comes to having a debt free mindset. I can assure you that you won’t have to worry about being bored. I took on a volunteer gig that is very fulfilling that spun off into other hobbies and interest. I’m curious if you can elaborate on your 2nd highest expense which is healthcare for the in-laws. It seems high to me. Did they qualify for ACA subsidies?

It’s great to have a fellow immigrant who did it, retired early with a significant net worth! Congrats to you too! I would love to hear more about your volunteer gig, sounds like fun and can lead to additional future interests and hobbies.

As for the healthcare, my in-laws are on Medicare, but because they never worked in the US, the cost of their Medicare comes to about $1,300 per month. My husband finally decided to check whether they can be eligible for healthcare subsidies. We are hoping to reduce those expenses.

I noticed you have a 13 yo middle schooler. You mention your work-life balance is great. You also say you’d love to travel much more once retired. I’m in a similar situation with a kid still in high school. He needs stability and support to stay focused on his studies/activities so I want/need to be home for him. Hence, it makes sense for me to continue working since I need to be at home anyways and I have a very good work-life balance (I work remotely from home every day now like you). Things like extended slow travel are not pratical until kids are at least in college and out of the house.

Any desire to work until both kids are in college and out of the house? Do you feel you have so much you want to do locally that you just can’t wait until your kids are more grown before quitting?

Hello Phillip! You are absolutely right, with the youngest kid still in high school, long slow travel isn’t possible. What is possible, and that’s what I am looking for in the first few years until our kid gets into college, is to spend more time in the summer traveling with our kids without the max two weeks at the time restriction and the guilt over my inability to leave work behind. It would also be possible to go on family adventures on all school breaks, not only a couple of times a year. I can also do short spontaneous trip by joining my sister in a ten day trip to a mineral springs resort (my husband would be supportive of that, he prefers to stay behind and watch after the kid). There are also many projects around the house (both houses actually) that my husband and I can work on, in addition to exploring the great outdoors we have surrounding us.

In short, I am not sure I would like to continue working at my current job when I reach the point when I don’t have to. At least that’s how I feel right now. I hope neither my husband nor I have cold feet when it comes to cutting the cord 🙂

I am a fellow PNW neighbor. Great immigration story, enjoyed reading about your success. We recently have been VRBO in the Cascade mountains trying to decide which area we like best, such a great contrast from the hustle and bustle of suburbia.

I have a niece in-law that immigrated from Vietnam in the last 5 years, she will enjoy reading your story as well, she helps her family in similar ways, she started working odd jobs, then Costco and now is making six figures at Boeing, we are very proud of her accomplishments.

Thank you for your kind words! We love the area near Leavenworth and were lucky to buy a property here a couple of years ago, before the prices went up like crazy. I hope you find what you like, the Cascade mountains are is just so beautiful…

Congratulations to your niece in-law on her success! She would need to tell her story on ESI Money one of those days 🙂 Good luck to her (and to you!) on reaching your goals!

Great interview!

What are some of the best books you’ve read as you have explored things to do in retirement?

Thanks!

You know, these days I am reading different blogs, not books. However, John from ESI Money does the reviews of the retirement books, which I am thoroughly enjoying!

I am of similar age, also an immigrant and enjoyed reading your path to success. I smiled when reading about your discovery of travel hacking. I also travelled in economy and lower level hotels until starting to collect miles a couple of years ago.

Thinking of doing an interview my self with ESI eventually to feel like being in the group 🙂

Btw: are you polish? The polish woman are the warmest people I have met. But it could be all Eastern European woman as I only know polish ones. :)

Hello Brian! Exactly my feeling, being part of the group, so do it, share your experience and your success as well!

Thank you for your kind comment, I am certainly looking to do travel hacking, partially to save money and do cheaper travel, and partially because it’s fun!

I am sure all Eastern European women are great! I am from the former USSR, so not Polish 🙂

Congratulations on achieving the American dream as immigrants. This is what makes me proud to be an American. Also, I love that you are taking care of your family! I know it’s a burden, but it’s the right thing to do!

Thank you Chuck! I was just talking to my friend and her parents (actually the ones who inspired me when I was a graduate student), and our consensus is that we wouldn’t have been able to have the same level of financial level of success if we had stayed in our own country. So yes, the American dream is achievable even for immigrants.

Taking care of our families doesn’t really feel like a burden, it’s more like we are so glad to be able to do it! And we are happy to have our parents in law nearby, makes us feel less alone here.

As a fellow Eastern European also in the field of analytics, with two children and an introverted husband:) I found this interview very inspiring. I am a little behind in my FIRE journey, but a little younger, so I hope I’ll catch up a little:) Congratulations! I’d love to know if you are open to mentoring 🙂

Hello Agnes! Wow, what a similar story! You are younger, and you will get there! I would be happy to connect with you and see if I can help in any way! I am very curious to hear about your journey and learn more about you as well. I contacted John asking him to help us connect 🙂