If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in September.

My questions are in bold italics and their responses follow in black.

This is part two of a long interview. In case you missed the first part, you can find it here: Millionaire Interview 293.

Let’s get started…

NET WORTH

How did you accumulate your net worth?

Last year was the first time my wife made 100K+! I am so proud of her as she had rather focused on environmental causes in her free time.

She took the lead role of managing the domestic operations for me and our zoo, arranging dinner parties and keeping an awesome tight ship around pantry management to provide for all of us which is another full time job in itself! Therefore, she chose to keep her earnings around 60K for decades. She is the queen of smart shopping and has frugal tendencies when needed. She is definitely a saver.

Time in the market is better served versus trying to time the market. After watching my small investment account grow early on, at the age of 16, I made a promise to myself that I was going to no longer work in corporate by the age of 50. Both my wife and I accomplished this by the age of 45/46 years old.

I also made another promise that I would read something personal finance related for at least 15 minutes a day. I thought if I could use those next 34 years and educate myself to learn how to make money from investments, that maybe, just maybe I could shave years off of my working years.

To me, it makes no sense to be 65/70 years old and finally have the money to travel but the body can’t because of knee/ hip replacements etc. I know that I just exaggerated, but that is how I thought at that young age but still do to a lesser extent these days. I believe that 50 is the new 30 nowadays with modern medicine, therapy and other regimens.

I selected “boring index funds” Total Stock, Total International and Total Bond for both of us to dollar cost into our purchases. I chose to go with Vanguard but Fidelity holds our “pre paid healthcare” payments for our HSA accounts after official retirement starts. After reading about the Guinea Pig Experiment at Brandon’s Mad Fientist we now front load our Roth, SEP’s and HSA’s each January.

Neither of us anticipate an inheritance or count on Social Security. I do however ensure that I am meeting the first bend point (6.5K rounded) in reference towards the Social Security lifetime earnings calculation instead of writing off too much on our joint tax return and list $0 toward their 35-year calculation. It might be there if and when we turn 70 but doubt it. If it is, we might earn an additional $5 a month.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

After reading almost all of these M-interviews over the years, my wife and my accomplishments are like another blade of grass. Individually with our own thoughts we are uncertain if we have actually accomplished anything, however if we collaborate with other like minded FI enthusiasts we can support one another to gain encouragement and validation. Both my wife and I have mostly remained unchanged with our approach with all three pillars but Saving outshines the other two areas for both of us for sure.

With respect to my wife’s privacy, I am only including my side of the equation. After the unfortunate circumstances we both experienced around divorce and financial hardships, we decided to keep our finances separate though we both do exceptionally well with being fair and even with each other by pulling our own weight without leaning on the other too much for any given month in a row throughout the year.

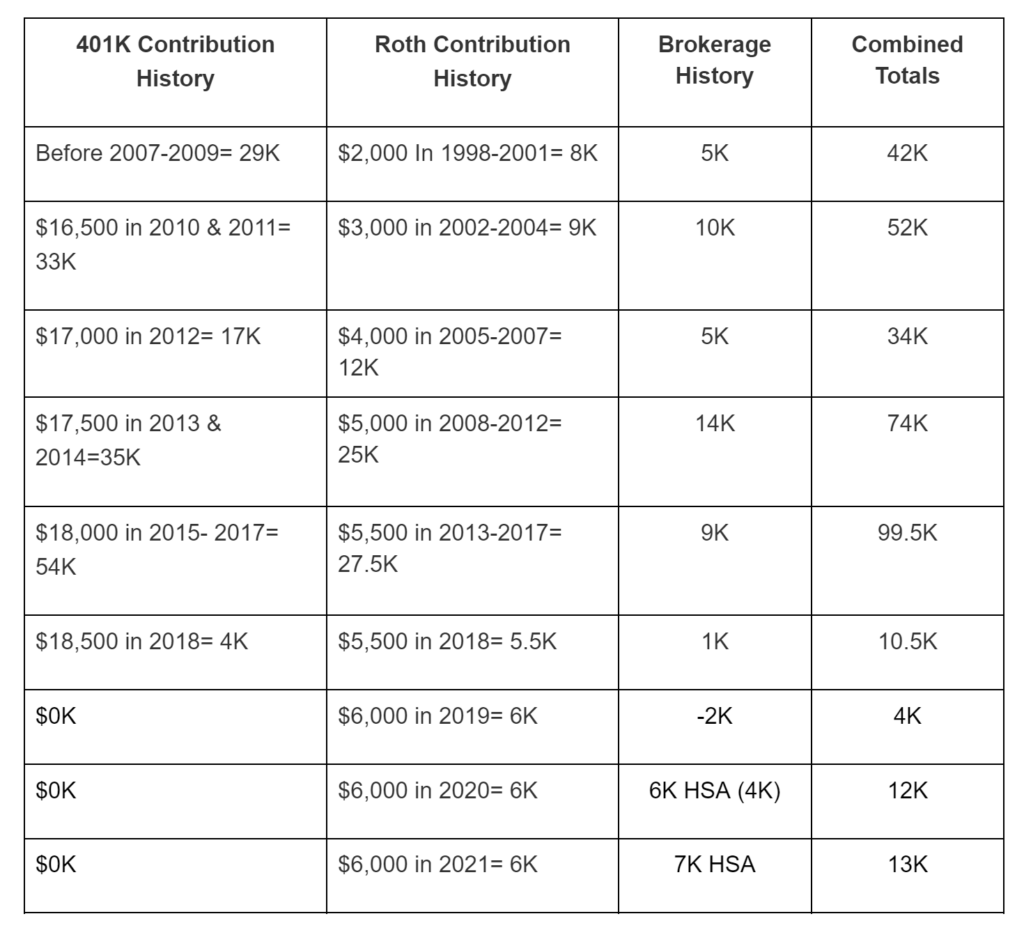

Here is my data pulled directly from one of my excel worksheets. I did not have the insight to formally track savings history prior to 2007.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

At times it was trusting that the process would work for us too. Intellectually I always knew that it was attainable. I had to even convince my wife that there was a big difference to having to work versus wanting to work. I told my wife that I wanted to put in a lot of overtime for about 20 years and compress a 30-35 year working career into a smaller time frame in exchange for a longer second act if I chose to do so. I guess that we fall into the lean FIRE camp since we choose to earn a bit to cover basic living expenses allowing our assets to percolate longer prior to our decumulation phase.

I purposely held off approaching John here at ESI Money to conduct an interview until our investable assets were north of 1M. I didn’t want the FI police to comment if our homes were included in our NW since they are not easily convertible assets to draw on. 😉

What are you currently doing to maintain/grow your net worth in a tax efficient manner?

We are still looking to grow our NW until the approximate arbitrary 3M has been obtained.

Besides moving to a tax free state, I chose to do two cash based hobbies. Our income has a 22% tax margin but rarely sees the full extent of the reported tax sting for my contributions to our family.

Below are a few strategies that we do to optimize our tax efficiency.

In general, the international fund (Traditional Rollover IRA- VTIAX) should go into a taxable account, the bond fund should go into a tax-advantaged account (ROTH- VBTLX), and the domestic equity fund (Both accounts- VTSAX) should fill in the remaining spaces.

Roth/ HSA (after tax)

Note: we wanted our assets with the highest expected returns in our Roth (VTSAX/ VTI). That’s because we have already paid taxes on investments in this account. Any future growth is tax free!

We understand, however, we are taking more risk (in terms of market volatility) in order to get higher expected returns.

If we wanted to tilt or juice your portfolio (which isn’t the point of a 3-fund portfolio!), a Roth is where you put REITs, Small Cap Value, Emerging Markets, or other asset classes with higher future expected returns (and more volatility) but we do not do this. Simplicity is key for long term maintenance in case my wife needs to manage things herself.

(401K)/ Rollover IRA (taxable)

And in our pre-tax account, think about this for a second, we actually don’t own the whole thing. The government owns part of the account. We (or our heirs) will pay taxes on the income when we decide to sell our positions. That is, we owe ordinary income taxes on any withdrawals from pre-tax accounts. So, if we take a lot of risk in your pre-tax accounts, the government takes that risk with us.

But the point of pre-tax accounts: put our tax-inefficient funds in there so we don’t suffer from tax drag. Equities have dividends which, when qualified, are taxed at the Capital Gains Rate. Bonds (and cash), on the other hand, pay interest which is taxed at ordinary rates. Thus, having bonds (VBTLX/ BND and VTSAX/ VTI) in our pre-tax account means that we don’t owe ordinary income taxes on the interest. Sweet, he shoots and scores!

Brokerage (taxable)

Finally, in our brokerage account, we placed the most tax-efficient funds. This includes US equities (VTSAX/ VTI 95% VTSAX not to exceed 3% VBTLX) that don’t pay out large dividends (and don’t churn or turn over), and international equities where we get a tax-break due to the foreign tax credit. Ideally in the 3-fund portfolio, international (VTIAX/ VXUS) should be held in this taxable. We decided to hold more US based assets but we do use VTIAX at about 15% of our investable assets.

To make tax-gain harvesting and tax-loss harvesting easier and more effective, consider setting your taxable investment accounts to use Specific Identification of Shares so you can pick individual shares to sell. If you kept the default setting FIFO accounting (First In, First Out), you may want to consider updating ASAP.

Other ways to save on Federal taxes

I buy prepaid gasoline gift cards from Walmart with cash to not have our 4K annual expense for the both of us to show up on paper. Our home taxes of 5K are paid in person and in cash. Any home remodeling that I don’t do myself is always paid in cash as well.

When is it time to rebalance our accounts?

When the stock market drops or rises (20% or more), we rebalance our allocation between stocks and bonds. [This typically means selling part of VBTLX to add to VTSAX or vice versa]. If we have 2-3 years of living expenses in our American Express savings vacation fund account and our regular checking/ savings accounts we will want to invest more during a downturn, consider investing 50% of the new money (excess of the 2nd- 3rd year) at the 20% sale price dip. For every additional 3% drop in the market, buy the remaining 10% investable funds in exchange for more stocks on sale. I would reduce to just 1.5- 2 years of living expenses so we can buy more shares while they are on sale. Doing so will end up funding our donor advised funds for ASPCA, NPR and others with minimal efforts.

Ex. If you spend 50K a year but have 150K saved up, invest the 3rd year living expense of 50K. At 20% off buy 25K worth of VTSAX, at 23% off buy another $2,500 worth, at 26% on sale buy $2,250, If the DOW drops to 29% off of the recent high level buy another $2,025 etc. You could also tax-gain harvest in years where your tax bracket is 15% or less and your capital gains tax is 0%. Just be sure you don’t sell so much gain that it moves you beyond the 15% bracket. When we stop working, increase Bond (VBTLX) position by a certain percentage. In theory, we plan to increase bonds by 5% for each 5-year period prior to stopping regular earned income. Our target at that point in time shall be about 70% equity 30% bonds. If our 3M target is obtained sooner, take some equity risk off of the table since “we have won the game“.

This example is an actual excerpt that I typed up for my wife as part of our investment plan. She needs to know how things are set up, so she can either replicate or share this content with our after death fiduciary advisor.

Do you have a target net worth you are trying to attain?

Approximately 3M on or before the ages of 52-55 2025/2028.

250K will be our initial travel budget/ emergency fund in our brokerage accounts once we both get bored of our hobbies or work. We are planning for a conservative 5% combined average return for our investments over the next 20 years or so.

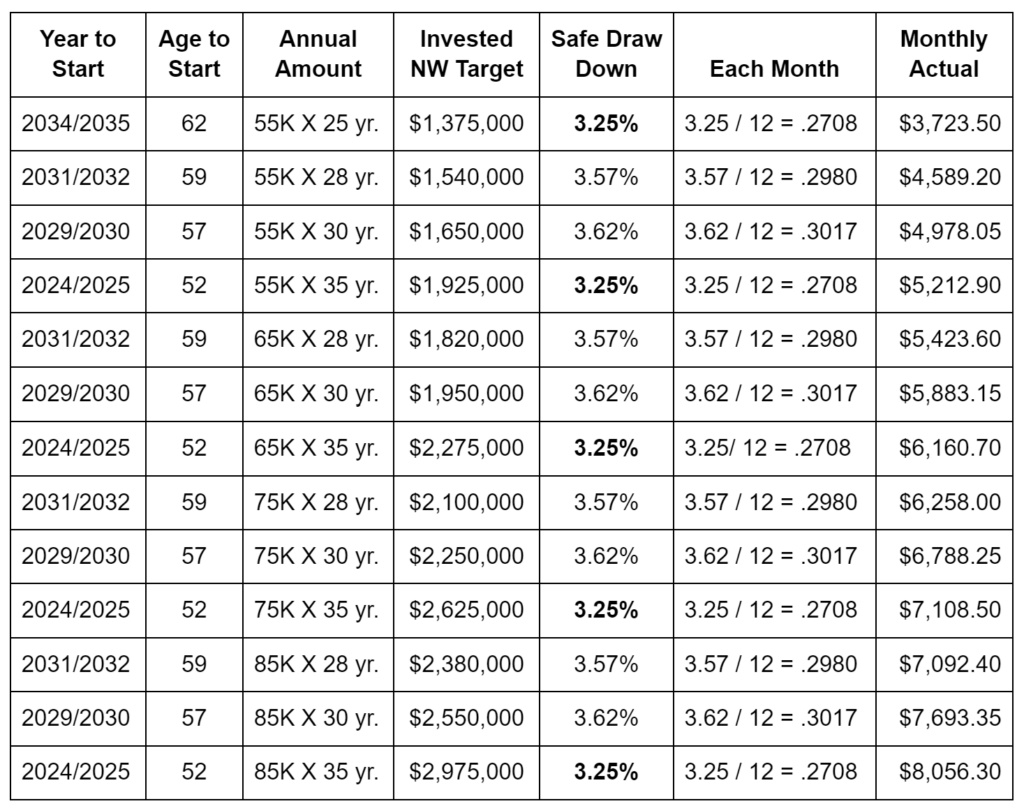

Once started, the drawdown target is 3.25% of our investable assets NOT our total net worth.

How old were you when you made your first million and have you had any significant behavior shifts since then?

We were 44/45 years old in 2018.

No changes in our behavior whatsoever other than a high five to each other over a nice dinner and a show at the theater while out for an evening on the town to celebrate.

What money mistakes have you made along the way that others can learn from?

I had previously had a play brokerage account that I used to pay $6-8 a trade to buy and to sell positions through Sharebuilder held at ING Direct. That account grew to 20K or so with individual stock pics, margin trading using puts and calls etc. The amount of time that I spent researching the trends, obsessing over market fluctuations, reviewing countless forecasts and quarterly reports could have all been saved.

I could have just bought VTI any time I had an extra bonus, had not spent my whole budget for the week or received a side gig opportunity and could have saved weeks of wasted time. I could have just dollar-cost-average in and forgotten about it.

I was conflicted at the simplicity of the Bogleheads mantra at the time. I thought that I had to work hard and put in a lot of sweat equity in order to achieve better than average market performance. I tried to do better than them but failed. I don’t know if I currently exhibit maturity or am finally tired of licking my investment wounds? Now, I am okay with being simple yet effective 85% of the time.

What advice do you have for ESI Money readers on how to become wealthy?

I guess wealth determination is subjective. I know that my wife and I are doing the same positive financial habits as we did decades ago. We will most likely continue to do the same over the coming decades as well since our process works…if it isn’t broken, why try and fix things?

Have the Rand McNally investment road map pre-populated to your own circumstances. I had one of these large paper map books tucked under the seat of my Mazda 323 (first car) so I could get to where I wanted to go when driving in unfamiliar territory. If you don’t know where you are headed, how the h@$l are you going to get there and if you don’t pick up your own boot straps, who is going to do that for you as well?

Track your spending and savings for at least three years in honest detail. If after year number one, you determine that you are spending within your budget and saving a bit until it hurts then keep doing the same for your second year of tracking. Try and actually increase the savings amount by at least 2-3% more. Rinse and repeat for the third year.

I have yet to read or talk with someone about personal finance that they were upset that they saved too much. Determine a realistic retirement goal, now work backward and start socking it away. The sooner you determine these few sub steps of the main goal the less that we actually have to save. I learned this concept at a young age with a passbook savings account but got distracted during my first few years of independent living.

The chart is an example of what I culled together after devouring Karsten’s The Safe Withdrawal Rate Series published on the Early Retirement Now website. In the goal chart below, you will see a few realistic options for my wife and myself to consider.

FUTURE

What are your plans for the future regarding lifestyle?

The DC condo rental helps to build an additional 15K+ equity annually. Once we get tired of managing that property (1,100 miles away) we will pay off the remaining primary residence to gain peace of mind of $0 debt.

We will then turn our focus to supercharge our travel brokerage accounts by continuing to invest the same mortgage and extra principal amounts as we do today.

I have already enjoyed my third summer of slowing down professionally. Imagine the freedom from previously receiving 250+ emails daily to currently 15 or so instead. 8-10 of them are personal finance related!

For now my wife continues to work for herself remotely supporting nationally known publications in the capacity of research verification prior to publications. Since she enjoys the strict 40 hour work week from home with no travel or commute, she is in no hurry to slow down. When she is ready, she will let me know.

My wife and I are extremely independent but we enjoy each other’s company in smaller doses. Since we both have so many interests that do not necessarily involve the other partner, we will have to practice sharing our independent time with one another if we decide to both hang out with each other more often. This might take us some period of adjustment if and when we decide to increase the “us” time together. Hopefully, I can convince her to join me at the starting line sooner than later so we can start to travel more than we already do.

What are your retirement plans?

Fritz at the Retirement Manifesto says to get 3-4 hobbies and try them each out for at least a year. Then make the decision to recommit to another year or drop one and find something else to putz around with.

So far after leaving the corporate world, I have tried teaching Scuba Diving, volunteering for a few causes that are important to me, yacht painting along with restoration and repair, and treasure hunting via scuba recovery. I now currently do three of the initial four part time 5-6 days a week.

Since the paid hobbies are rewarding, physical and fun I have managed to lose 35 pounds over three years as an excellent side effect of clean, stress free living. My wife has even been stimulated to dramatically drop a few herself and has already rewarded herself with a few casual clothes.

Couples Golf lessons are in our future. My wife wants to take collegiate Master Gardener classes. She also loves to make jewelry out of metal wire, stones and beads in her free time. Healthy cooking classes of fish will help to occupy time as I aim to learn how to spear fish dinners for family, neighbors and friends.

We love to entertain and have been planning to build out a stamped concrete back patio. My next projects will be to build a contemporary propane fire table and tile stairs to include a swim up bar around a new hot tub. We recently finished building a custom fence for our multiple dogs to run around and play freely.

Once my wife decides to throttle back like I have with work, it will be the perfect time for us to extensively travel Europe, West Coast, Grand Canyon, Yellowstone, Canada, New Zealand, Madagascar, Vietnam, Thailand, African Safari, Australia, Turks and Caicos, and Egypt are all on the short list. It’s not like we have given this much thought or anything. 😉

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Yes, converting to decumulation modes. I have it all figured out on spreadsheets with model simulations on pivot tables with multiple tab reference computations but not the psychological aspect part just yet.

Just like anything else in life, the fear of the unknown is real but the art of execution is more important than having contempt prior to investigation. I expect to make mistakes and not take myself too seriously. Failure to plan is encouraging a disaster to happen.

I am not naive to think that our plans won’t change but would rather lean on them to provide us with gentle guard rails to give us time to decide which direction for us to take aim and execute. No longer saving money will take us both a while to get used to.

Healthcare, starting at the age of 55, I have budgeted us to spend $2,500 monthly. If we don’t, great. More for our brokerage accounts and or HSA’s to accumulate. We will not tap into the HSA accounts for at least 20 years of starting them to let the accounts grow to gain us “free Medicare premiums” from the reinvested distributions.

We are lucky that my wife’s job currently offers us both decent enough health, vision and dental insurances. If we need to rely on ACA coverage we will do so as I am already familiar with that landscape but I would anticipate minor Federal nuances will have to be navigated.

Not having at least one to two more 20% market corrections between now and 2035 or so would be a nice time to rebalance a bit. If not, no biggie as I have a few other strategies in mind but Mr. Market could make it easier on us….pretty please.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

At a young age I was shown a FDIC bank passbook savings account booklet. It was red and looked identical to a current US passport booklet. It served as a portable ledger that contained an actual printout of recently deposited money along with each monthly accrual record since the previous deposit. If my folks did not take me to the bank for several months, I specifically remember dancing in the lobby while that old dot matrix printer was making a sound while updating my newly reported earnings.

My grandparents graciously opened an account by initially depositing $100 when I was young. There were a LOT of receipt pages that recorded birthday money or special other occasions which were deposited along with a few dollars here and there documenting all of that accrued interest. I recall that the account was producing 18% interest.

I was simply mesmerized at seeing the recorded compounding interest right in front of my very little eyes and was immediately hooked. I also saw the value of delaying gratification in order to receive “free” ice cream by just being patient. Too bad those bank issued books had a shelf life and could not be renewed after the expired term was up.

I have another funny anecdote that is a slightly embarrassing story to share. When I was 12 years old, I was presented with two summer reading books. The Joy of Sex by Alex Comfort since my folks did not want me to learn misinformation in the school bathrooms. Or I could choose the less awkward book to read by Suzie Orman The 9 Steps to Financial Freedom.

I think my folks knew that I was going to learn whatever young boys talk about with no adult supervision anyway. All I heard during TV commercials back then was about debt collection, IRS troubles and even bankruptcy. If freedom meant that I wasn’t going to get into any of that kind of trouble down the road, I was willing to trade my outside playtime by reading in exchange to be free. I liked the sound of Financial Freedom over all that perceived gushy stuff that I was not ready to learn about anyway, so I chose to read that book instead.

For whatever reason, I actually read the financial book with enthusiasm. I remember even filling out the actionable items in the book by writing down my assignments and also did my end of chapter homework. I shared the complicated parts with my mom or dad when I was stuck to get more understanding from them.

By the end of the summer I was stuffing my save, spend and donate piggy banks from my hard earned lawn mowing and paper route gigs. To date I still exhibit those same behaviors around money assignments to save, spend and donate but do so with different online accounts instead of using those old ceramic pigs.

Who inspired you to excel in life? Who are your heroes?

My maternal Grandfather. During my Eagle Scout Court of Honor, I played the recording of Wind Beneath My Wings sung by Bette Midler. To me, it says it all if you are familiar with the lyrics. My grandpa taught me the benefit of a hard day’s work. If I showed up to a meeting or appointment on time, I was late. Arrive 30 minutes early was his motto. He also instilled in me that by telling the truth always saves energy instead of trying to remember what I said.

My father encouraged me to fall, brush myself off and land on my feet. He told me at a young age that if you fail to plan, you are planning to fail. How right he and Ben Franklin were! Also he ingrained the idea that; lack of planning on your part does not necessitate an emergency on mine. Those few philosophies would serve me well in the corporate environment to plan in advance and try hard to fail.

After failing three or four times the fourth or fifth attempt would for sure land the big client that I was chasing or other achievement that I was focused on achieving. I watched him run at least three successful startup businesses by himself (Pres/ CEO) while providing for his family which I will be forever grateful for.

I am also grateful for my mother-in-law, as she has been the silent support for my wife since my wife and she are very close. She assists me with keeping the happy wife, happy life motto in check.

Most importantly, my bride encourages me to execute on my dreams and supports me emotionally. We have walked the dogs nearly twice a day for years. This allows us to have ample time to check in with each other to ensure a smooth homelike environment. In the past 12+ years since we have met, we have only raised our voices at each other twice but made up prior to going to sleep on those subjects.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

I could name all of the popular ones that most FIRE folks read that other Millionaire Interviewers have referenced already. Such as:

- Millionaire Next Door – Thomas J. Stanley, Ph.D. and William D. Danko, Ph.D.

- Secret of The Millionaire Mind – T. Harv Eker

- How Much Money Do I Need to Retire? – Todd R. Tresidder

- The Richest Man in Babylon – George S. Clason

- Your Money or Your Life – Vicki Robin and Joseph R. Dominguez

I have spent countless hours studying, relating to and comparing these strategies and beliefs to our lives in order to execute our very own DIY implementation(s).

Instead, I will recommend and write about a path that I don’t believe has been referenced to date. It is not a book but rather a collection of crowd sourced material called Bogleheads investing start-up kit. I like the Wikis format since it is best consumed as a self-service all you can digest in small bite sized pieces of information that has seven general guidelines/ steps to take.

I had the chance to read areas that interested me to compliment areas in my education that I was lacking. The content gets updated regularly and is policed and updated by a lot of smarter folks than myself. Updates such as CARES Act 2021 have already been incorporated into our material for tax compliance awareness for our consideration.

I would recommend creating an online document to keep track of your progress and possibly share it with a few colleagues that you trust for collaboration purposes if you are by chance on the same journey to FI.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

During my corporate career, I volunteered and dedicated 10 years towards a peer-to-peer train-the-trainer grass roots type organization. It eventually grew into a not for profit by the time I left the DC area. I volunteered in numerous positions and eventually moved into one of the board of directors roles. I helped to facilitate smooth operations that served the local market as well as drew from national resources of talented professionals in our industry.

My wife served on a go green initiative as a committee member at a non profit for years prior to deciding to work for herself. She along with her peers were instrumental in getting single use plastics down to a minimum by using corn starch based products instead of plastic based materials to use at the cafeteria.

She also supported the Green DC initiative which encouraged planting native trees and also supported community outreach training sessions for local residents to attend.

Finally, I volunteered to create a non profit from scratch and designed all of the behind the scenes logistical paperwork needed for Federal and State compliance. I wanted to take on the mental challenge but better yet help a cause that remains near and dear to my heart for almost 15 years.

I have another cause that I work tirelessly trying to give away what has been freely given to me. I receive a lot of assistance from others as long as I ask for help when needed. In turn, I have a chance to live a life beyond my wildest expectations.

Most of our time, not money, has been spent giving back to those causes which we believe in. We also do financial donations but would rather try to remain humble by not mentioning the specifics. It’s hard for us to equate a specific percentage of our portfolio that we have donated like other interviewees have done. I can tell you that I watch about 1-2 hours of TV a month since I would rather stay busy working regularly on causes that mean a lot to myself. I stay awake helping others regularly until late into the evening after getting up before the sunrise most days.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

We had decided to spoil our nieces and nephews a bit by either picking up their tab for air travel to come visit us or offer to pay for all of their entertainment and food during multiple visits throughout the year. They could use the help now instead of us waiting until after we are gone to bequeath shares of stock or money. We reside close enough to spring break meccas and nice family beaches to make it “worthwhile” to go visit Aunty and Uncle.

In due time, they will have families of their own and might need access to a reasonable staycation hot spot. Of course we send them home with a little something with instructions not to mention anything to mom or dad to get themselves a special treat that they have been eyeing. One time, one of them said “great, I received a special Titi and Tio dividend to purchase more VTSAX”. That statement was priceless to my wife and I.

After we are gone, our donor advisor funds will be set up for ASPCA. We find it sad that animals have to seek guardians to speak on their behalf to hopefully end cruelty and neglect.

We also have National Public Radio (NPR) in mind since they are the only public service organization that does not receive Federal funding to help keep the lights on. They rely on member donations which we intend to support our fair share. We have a few other personal causes in mind as well.

As for our siblings, we are close with them all and will assist with their future medical expense related items for them as we all age gracefully, we hope! My wife and I plan on doing this but our stealthy intentions are unannounced till date for various reasons.

Are you directly helping anyone else attain their financial goals?

I brainstorm with a few close friends and tell them what I am doing towards financial independence. I am careful to not advise them since I do not have a series 6, 7 or 63.

I let them know when I am about to do another exchange soon and what I am looking for. Ex. DOW 52 week high on 8-16-21 @ 35,631−7,126 (20% off) 28,505. I will be rebalancing away from bonds that I bought for “free” earlier this summer back into the total stock market funds to buy shares while on sale. It is not a question of if the market tanks 20% or more but rather am I ready for it when it does. Because of our combined efforts, they are well ahead of the game as well.

I helped my sister establish a few 529 accounts and gifts to minors (UGMA) for her kids. After informing the girls of their special long term savings accounts, my nieces are now even funding their own uniform accounts with their birthday, holiday and or other special event money that they might receive as gifts. The girls have their neighbors saving bottles and cans for recycling (5 cent per container) which gets invested as well.

One of my nephews took an interest in establishing a budget, emergency, investment brokerage account, HSA, as well as Roth and 401K company matched accounts. He is well on his way having already set the foundation for long term capital gains with RMD “problems” down the road. 😉 He has also consulted with me about career changes and percentage adjustments but he is the one who is taking his own positive action. I am happy for his future self that he has allowed me to influence him a bit.

What are your short-term actionable steps that you need to implement into your financial plan?

- Finalize our Revocable Living Trust

- Will- Durable Power of Attorney for Finances

- Information for Caregivers and Survivors

- Health Care Directive (which is composed of two documents in some states like Florida: a Living Will and Health Care Power of Attorney)

- Pet Care Strategy – documents naming of primary and secondary caregiver (include financial support inheritance)

- Updates to Donor Advised Fund or is it time to create a Private Foundation?

- Establish organ donation wishes

- Establish Trustee and Successor Trustee: This is the person(s) or entity that will follow your wishes as per the trust document (manage your trust) upon your death

- Final arrangements

What are your long-term term actionable steps that you need to accommodate into your retirement plan?

If needed, we will focus again on ACA subsidies like we did in 2018 and 2019 for health insurance by keeping our MAGI in check. However, my wife changed from 1099 to W2 with one of her favorite clients who offers decent health, vision and dental coverage starting 2020 for the both of us, so we do not have to presently focus on this.

Continue to read articles from my favorite financial e-deliveries. The Retirement Manifesto, ESI Money, Early Retirement Now, Investopedia, The Physician on FIRE, Can I Retire Yet, Financial Samurai, and a recently added one called Accidentally Retired (still evaluating). After subscribing to these for several years, I have learned new strategies and reminders that pop up all of the time for our continued consideration.

We plan on choosing to work for a few more years but at reduced stress levels. My wife’s client’s expectations are fairly easy for her to accommodate, so it’s one more year syndrome for her. I currently receive a bit of compensation in exchange for easy work that I enjoy. It is very rewarding for me to see measurable progress on the yacht restoration and also watch students’ joy of being able to breathe underwater for the first time. In exchange I have a paid gym membership since some of the work is a bit labor intensive. For my efforts, I get to offer wonderful outcomes for both sets of clients in exchange for reduced levels of stress as compared to my first act from 2000-2018.

If you made it this far reading this interview, I applaud your efforts to want to learn from someone who consistently likes to keep a positive mental attitude. I learned a long time ago, instead of comparing if the glass is half full or empty, why limit yourself to such a small vessel? Try choosing a swimming pool or better yet, an ocean instead!

Great job!!!

I am curious as to how paying for your gas and your property tax bills via cash lowers your federal tax obligation?

Bryan,

Since I can’t confirm or deny that 100% of the earned income will be reported on each tax return, I will let you come to your own conclusion. 😉

Most of the hobby work that I do is paid under the table and not deposited into an FDIC account. But I do report enough to make it past the first bend point for Social Security tracking purposes.

But property taxes aren’t really a secret and the manner in which they are paid doesn’t really change that. I would venture to guess that paying them in person in cash is far more conspicuous of a trigger compared to standard payment methods.

So are you trying to hide that money in the event of an audit? Hopefully the IRS doesn’t read ESI Money. 😬

Paying income tax is an exercise in integrity. There is no statute exempting income received in cash.

I agree with you full heartily Ben. I am also glad our accountant uses the barter system into our tax liabilities. We enjoy having the ability to exercise gifting at 15/30K towards causes that we believe in.