Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

Here’s our latest interview with a millionaire as we seek to learn from those who have grown their wealth to high heights.

If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in February.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

This is actually the 3rd time I have done an interview for ESI Money. Going back and re-reading my own interviews has been really cool to see how life has changed along the way!

I did ESI Scale Interview 41 in 2018 and Six Figure Interview 10 in 2021.

This will give me another great “point in time” view to look forward to reviewing again in another few years!

How old are you (and spouse if applicable, plus how long you’ve been married)?

I am a 38-year-old single female.

Do you have kids/family (if so, how old are they)?

Nope. To the dismay of my mother, I am child free by choice. (Don’t feel too bad for her. My sister is going to be promoting her to Grandmother in summer 2024.)

What area of the country do you live in (and urban or rural)?

I live in a medium-sized city in the northeast.

This is my hometown, but I have also lived in Germany and one other US city in the last 5 years.

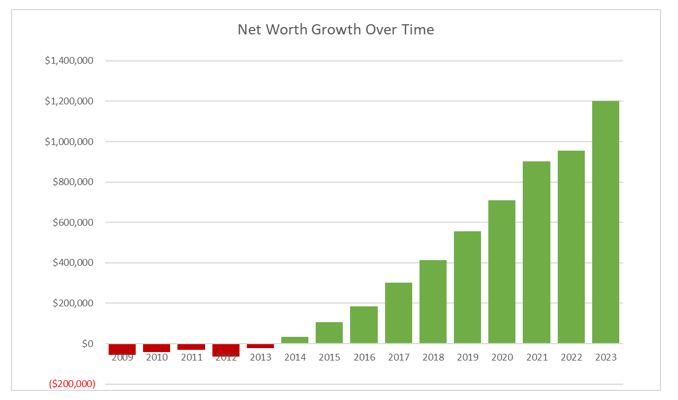

What is your current net worth?

$1.2 million as of the end of 2023.

Here is the trajectory of that growth over time:

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Assets:

- Brokerage: $599k

- 401k: $406k

- Owner-Occupied Duplex: $280k

- Vested Company Stock: $61k

- Roth: $43k

- HSA: $10k

- Cash: $30k

Liabilities:

- Mortgage on Duplex: $220k

EARN

What is your job?

What a fun time to ask me this question!

I worked for 15 years for the same company doing a multitude of jobs, lastly serving as a “Senior Director”. However, I resigned from my position in August of 2023 to take an indefinite sabbatical.

Retiring “as soon as one can” is a topic we talk a lot about on the MMM Forums. I definitely wouldn’t consider myself retired, however, I realized that money is a tool, not the goal itself, therefore I have elected to take some time now to enjoy life.

I certainly could have grinded away for another 5 years and achieved my FI#, but why wait!

But back to my profession…the first 5 years or so I was in Product Management roles and in the last decade it’s been more Project Management roles/teams. I expect that when I go back to some version of paid employment it will be in one of those areas.

What is your annual income?

TL;DR:

- $193k in 2023

- $15k rental income + $20k German pension reimbursement + ??? in 2024

In 2023, my annual base salary was $192k with 20% bonus target + RSUs. Most years I received much higher than the targeted bonus percentage though – due to good combinations of company and personal performance. For example, in 2023 my bonus was $72k or 38% and I received $40k in RSUs.

Had I stayed in role for the full year, that would have put my 2023 income just over $300k. Since I left paid employment in Aug 2023, my take home for 2023 was ‘only’ $184k as I had to walk away from the recently granted RSUs & I only had 8 months of base salary instead of 12.

Who knows what 2024 will look like since I don’t know when or how I will re-enter the workforce. I’m considering returning to full time employment, part time employment, and/or starting my own consulting business. I’m also looking at temporary roles for some “passion work” (e.g. some stuff that pays very poorly but would be very fulfilling). Being on the FI journey has allowed me this grace period to figure that out and I couldn’t be more grateful!

At minimum, in 2024 I expect $15k in rental income for one unit of my duplex to offset much of my housing costs. (I guess some would call this “house hacking” as the income from the second unit covers over 70% of the mortgage/taxes/insurance.) I also am expecting a reimbursement of over $20k from my contributions to the German Pension Program from my time working abroad.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

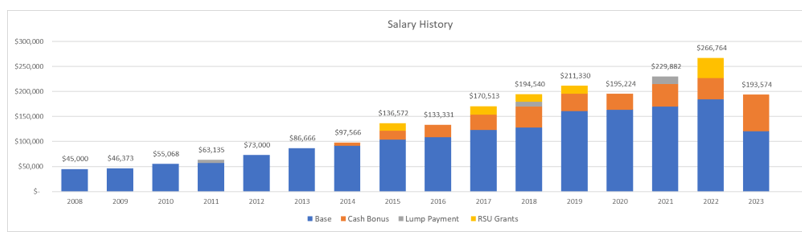

My starting salary in 2008, straight out of school for engineering, was $45k.

Per my calculations, this puts me at over 13% CAGR for my salary over 15 years.

Below you will find the 15-year history of my income.

I grew this income while staying at the same company for 15 years. I did, however, bounce around between 4 different business units in 3 different cities across 2 continents. I consistently took on additional responsibilities & climbed up many levels in the company’s career framework.

What tips do you have for others who want to grow their career-related income?

I shared a lot of tips in my Six Figure Income interview but I will reiterate some of my favorite ones here.

- Invest in yourself. Be sure gain new skills and insights every year. I did this by taking advantage of all the training/education I could get for free via my company. Sometimes this is through internal courses, and sometimes companies have a budget for external courses and certifications up to $5k/year (sometimes more!).

- It’s not enough to just ‘do good work’. You have to promote yourself as well. This is especially important for women and introverts of all genders who tend not to ‘share’ these desires with their managers as much as men and extroverts.

- Build a “Credibility Bank”. You need to make more deposits than withdraws when building relationships with people. I hate “networking” in the classic sense, but I love building relationships with people all across my company.

- Negotiate your salary!! Gah, I wish I did this more often when taking new roles – I’d be in an even better place now!

- Read! I listed some books in my other interview, but here are a few more I have read since then that helped me with my work: Multipliers; Atomic Habits; Grit; Own Your Career, Own Your Life; Mistakes I Made At Work; Creativity Inc.

What’s your work-life balance look like?

Now, it’s all life, baby!

When working it was still pretty good. Like many others, I went to work from home (WFH) in March 2020 and besides a year in a role where I was hybrid, I had been WFH again since Oct 2022. I wasn’t traveling too often in my last years.

That being said, I front loaded by career working long hours and traveling very often. The first two years of my career I travelled 35+ weeks a year and certainly didn’t have the right balance. Early on, I was willing to put in extra hours, BUT I never gave up a PTO day, had solid flexibility and autonomy in my roles and felt on the whole, I had a decent balance.

As I gained seniority in title and tenure, I took a lot more liberties in managing my time, therefore I’d say I had a pretty good work life balance in the last couple years.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

I have occasionally mentored an MBA class that pays me $3k/semester. This is at the school I did my own MBA at with a professor I built a professional connection with.

This was more to stay engaged than for the money itself (though I wasn’t going to turn it away!)

SAVE

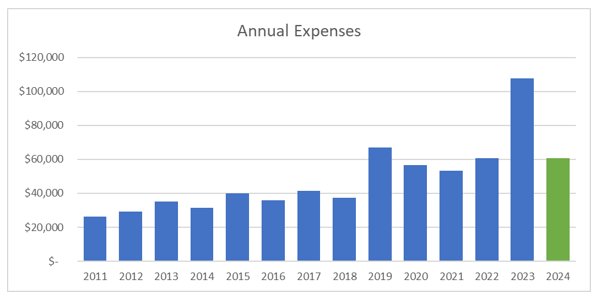

What is your annual spending?

My average annual spending has been about $65k the past few years with the exception that in 2023 I bought a duplex and incurred an additional $37k in expenses. This included $17k for the Purchase Costs (taxes, fees, initial escrow payment, etc) and $20k Renovation Costs (2 new kitchens, refinishing of floors, entire inside repainted, etc.).

I should note that I bought the duplex from a family member and therefore was “gifted” equity in the house. This is what allowed my purchase costs to be so low. I basically put next to nothing down to get to the 80% LTV ratio to avoid PMI.

I have been tracking spending for well over a decade. Here is that historical view along with my budget/estimate for 2024.

From 2011 to 2018 I was sharing major expenses with my ex so I was able to keep spending pretty low. (I also was making a lot less and therefore naturally spent less.)

From 2019-2021 I lived in Germany where housing costs were expense & I also wasn’t sharing those costs anymore, therefore expenses went up.

They have stayed up, but how it’s spent has changed (e.g. housing costs down but travel spending up).

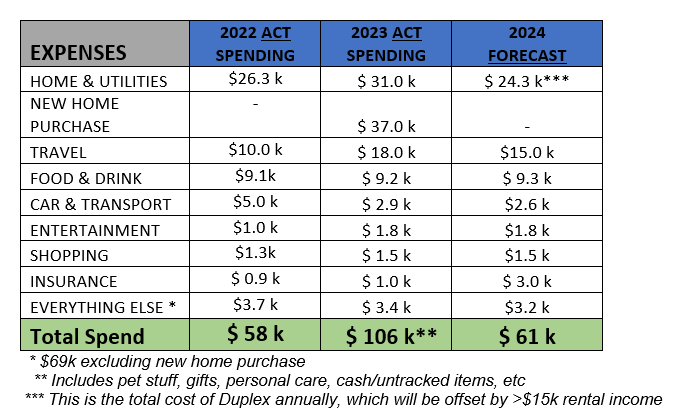

What are the main categories (expenses) this spending breaks into?

It’s very easy to see where I spend my money. More than 40% of my expenses are for housing, more than 20% for traveling, and about 15% for food and drink.

Here’s a few years as examples.

Do you have a budget? If so, how do you implement it?

I don’t necessarily budget where I stop spending once I’ve hit the desired amount, rather I would classify what I do as more of a “forecast”. Each year I layout a detailed forecast of expected spending/savings. In some cases, I force myself to spend more on certain categories.

For example, I love traveling but I was being more restrictive in spending in that category that I needed to be. I’ve been upping my planned spend in that category every year to incentive myself to spend more! I nearly doubled my spend between 2022 and 2023 in that category.

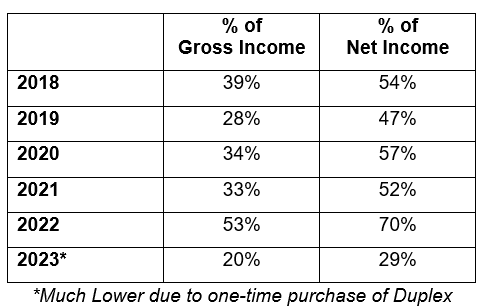

What percentage of your gross income do you save and how has that changed over time?

I moved to Credit Karma recently, so I have unfortunately lost some of my history.

This wasn’t a metric I tracked in my own spreadsheets until 2018, but this will give you a good indication of my saving habits.

Obviously, earlier in my career when I was only making $45-75k, I was nowhere near these levels of savings. I would estimate that my savings rate early on was only about 5-10%. Once I completed my MBA and increased my salary significantly, I was inching closer to 15-20%. It was only after I paid off my student loans that I started to hit these high savings percentages.

Next year I don’t expect to save much, if any, of whatever income I bring in given that I don’t even have any plans to generate income in 2024 yet.

What’s your best tip for saving (accumulating) money?

Beware of lifestyle inflation!! Don’t let your spending grow at the same rate as your income growth. As I noted before my income CAGR is about 13%. My spending CAGR is only about 6%.

Another tip is to remove barriers to savings through automation. Early on, I automated my 401k to add an additional percentage savings each year.

Later I automated moving money into my brokerage account each month. If you put these systems in place, it’s “Set it and Forget It” and helps to ensure you continue to save.

It also has helped me not to have kids. Those are incredibly expensive! That certainly wasn’t the main reason I chose to be child free, but it does help with the accumulation of monies. I am not advocating that those who desire to be parents forgo it for financial reasons, I’m just acknowledging that it’s absolutely a factor in my ability to save and why I’m 38 with $1.2m.

What’s your best tip for spending less money?

Want less. Seriously, it can really be that simple. Reduce your consumption of stuff. Your pocketbook and the environment will both be better for it.

Some books that helped me with this mindset include: Your Money or Your Life, The Psychology of Money, and Taking Stock. These all helped me to align on my personal values and what was worth of spending money on.

Also, keep your fixed expenses low. I could almost immediately eliminate $20k (1/3) of my spending if faced with some difficult life circumstance. My fixed expenses are less than $40k a year because I live in a very modest house, drive a used car, and spend very, very little on material items.

What is your favorite thing to spend money on/your secret splurge?

100% traveling and the occasional high end sushi meal!

INVEST

What is your investment philosophy/plan?

I have an incredibly simple index fund approach to investments. Though I am technically in a few different funds, they are all largely total market funds.

Over the past few years, I have maxed out my 401k, HSA, and performed a backdoor Roth IRA conversion. Additionally, I was putting roughly $5k/month into my Vanguard account.

The duplex investment is quite new and it’s also my primary home. It’s quite possible that I will move into another home in the coming years and rent out the second unit, but only time will tell. I don’t have any immediate plans to continue to acquire more real estate.

What has been your best investment?

Despite leaving them, my company stock. Haha. When I started in 2008, the stock was trading around $60/share. It’s now >$450.

For most of my tenure I participated in the ESPP which gave me a 15% purchase discount and continue to grow significantly while I waited for them to become long term capital gains. I still have $62k in vested shares which have cumulative gains of 37% in the last 2 years.

I am waiting until those become long term holds before selling to save on capital gains tax.

What has been your worst investment?

Overall, I’ve been very lucky not to make any really dumb money mistakes/investments.

I guess my big “mistake” is that I probably should have invested more earlier instead of holding so much in cash – which historically I have had a lot of. I earn and save really well, but I lost out on our good friend, compound annual interest.

What’s been your overall return?

That’s a great question. I don’t know and I’m not sure I trust the calculations on Vanguard / Fidelity.

How often do you monitor/review your portfolio?

I look at the balances a few times a week.

Formally reviewing and making adjustments is more in line with my annual review/planning that I do each year.

NET WORTH

How did you accumulate your net worth?

Through typical W2 employment income.

No inheritances, no lottery winnings, etc.

I accumulated my net worth through sound ESI principles and a little bit of luck along the way.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Earn and Save.

I was able to significantly and continuously grow my income while managing lifestyle inflation. Spending $70k as a single person is certainly not frugal, so if I had to pick one, I’d say Earn.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

Honestly, not too many. If anything, I’d say $100k in student loan debt (for both undergrad and MBA) was quite the valley to climb out of.

I alluded to an ex before…We were together for 9 years, but never married, never fully combined finances and we were also both successful in our careers. We were DINKs for sure. Separating didn’t have much effect on either of our personal finance situations.

I’m sure there have been some other bumps, but nothing that’s coming to mind right now – therefore they couldn’t have been too challenging. I haven’t taken any swings for the fences or invested in anything sketchy.

What are you currently doing to maintain/grow your net worth?

As you have read so far, I am not currently contributing to grow my net worth, rather I am leveraging it to take time off. With net expenses of $45k and almost $700k in liquid-ish assets, I have plenty of time to putz around and figure out what path I want to take next.

The privilege I have to be able to wander through life at the moment without detailed plans or goals is not lost on me. I’m the type of person who maintains a 28-tab Excel spreadsheet to track all of my financial wellbeing topics, so this lack of knowing what is next is an quite an experiment for me. As of the time of this writing I am almost 5 months into this experiment and I am loving it! 😉

Do you have a target net worth you are trying to attain?

This is something that keeps changing. In my last Six Figure Income Interview, I said:

“Longer term I want to get to FI status by age 45 so I can have more options open to me. For me FI will be a combination of about $1.5m in cash/investments and/or $25-50k of passive income streams.

I love the idea of working part-time or maybe starting a consulting business where I could take a few months off from client work to do some traveling or volunteering on occasion. Basically, I don’t think I will join the RE part of FIRE too early, but I want the option to!”

In early 2021, I joined the MMM Forums and learned a TON from the mentors. At that point, my target NW changed to $2.5M, due to reducing my risk tolerance and adjusting for some other factors (like taxes for which I wasn’t accounting for!). At that point, I was thinking about FIRE in a traditional sense and I felt like I needed to achieve complete and total financial security before exploring other ways of living my life.

Since then, through tons of reading, exploration, and self-reflection on the topic of financial independence, I have shifted my views that FIRE isn’t necessarily a destination but a journey. If you absolutely had to categorize me, you could put me in the bucket of Coast or Barista FIRE currently.

I realized that I didn’t need to wait to hit the magical number to start living a life that was more enjoyable to me. I was already in a position to do that now.

Don’t get me wrong, if I wasn’t already a single-female millionaire under the age of 40, I highly doubt I would have the beliefs I do today, nor would I have the confidence to experiment! Maybe my target net worth was really just $1m…. 😉

How old were you when you made your first million and have you had any significant behavior shifts since then?

Age 37. I hit millionaire status in Jan 2023 and at the time, other than celebrating with the MMM community in our “2023 Two Comma Club”, nothing changed. Fast forward 7 months later, and, BOY, did life change when I decided to take my sabbatical.

I’m not suggesting everyone quit their jobs the second they hit $1m, but so far, it’s working for me. 🙂

Check in with me again in a year – by then I will very likely be back to some version of paid employment.

What personal habits and/or traits have you developed that have made you successful at growing your net worth?

Well, professionally it helps being an ‘eldest daughter’ and having a classic ESTJ personality! I’d say I’m relatively extroverted, have (or maybe had) an achievement syndrome, and I’m moderately intelligent. A lot of that is just the genetic lottery that swung some professional successes in my favor.

More tactically I’d say I had the natural habit of continuous learning and I coupled that with a very unnatural habit of evaluating my emotional intelligence. There’s absolutely some classic pitfalls with my personality style, but especially since I became a people manager I have spent a lot of time trying to control those potential derailers.

What money mistakes have you made along the way that others can learn from?

I certainly am not perfect, but I don’t have any material regrets when it comes to ‘money mistakes’. As I described in the topic of “road bumps”, I certainly would have preferred not to take on so many student loans, but that education got me where I am today, so it was a worthwhile investment for me.

What advice do you have for ESI Money readers on how to become wealthy?

I don’t think it can be summed up any better or more simply than the title of this site: Earn, Save, and Invest!

Look for ways to grow your income (there are many paths), beware lifestyle inflation and how you are being marketed towards, and do your best to balance your investments to not take on extreme risks.

FUTURE

What are your plans for the future regarding lifestyle?

This is a difficult question for me to answer at the moment given this experiment / career break I am in. Unfortunately, I am not yet at a NW level for which I will never have to work again, but I do hope to more heavily balance ‘life’ over work in the future. Simply stated, I would like to keep my lifestyle level where its at, with or without work/employment.

That being said, I must admit that I have become somewhat jaded in the world of Corporate America in the past couple years. (Maybe Gen Z vibes are rubbing off on me haha.)

It’s not worth getting into the details on this, but I just don’t have the same “drive” I used to around the culture of capitalism in the US. My time in Germany, Covid, and achieving a level of financial independence has really given me good reasons to assess what I want out of life.

Therefore, moving forward any work/employment that I take on will very likely look different than it has thus far where I worked full-time(+) under W2 employment. I haven’t made any decisions yet, but I am weighing options such as (1) part-time W2 employment of 20-30 hours a week or (2) contract employment where I’d work full time, but intentionally take extended breaks (e.g. at least a few month) off in between contracts.

I’m open to other suggestions on this!

What are your retirement plans?

Some might call me semi-retired now! 😉

Originally, I planned to hit my FIRE # somewhere between age 43-45ish, but taking this time off has made me realize it’s not a race to this magical number. I suspect I wont FULLY retire until later (maybe 50+?), but I’m just pulling forward some of those “retirement years” to the present.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Beyond “will I run out of money?”, I don’t think I have a lot of concerns about retirement itself, rather just concerns about aging in general.

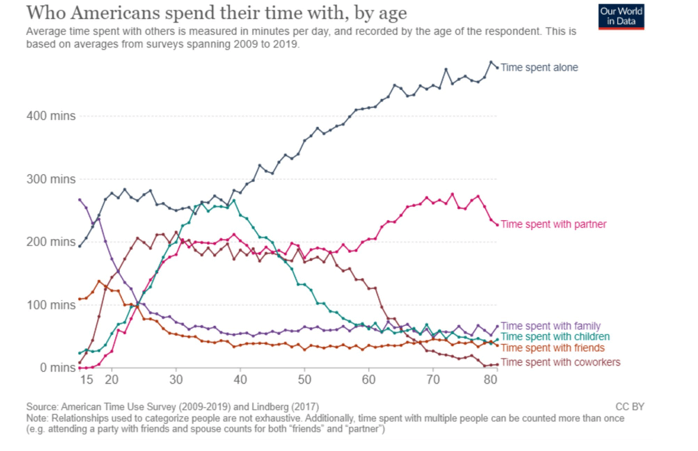

One thing I worry most about is loneliness. Maybe you have seen this graph before?

I plan to retire early, I am currently single and I don’t want children; therefore my personal graph will have me spending even more time alone every year than this somewhat depressing view!

Regarding “time spent with partner”, I have dated a lot since my ex and split up, but nothing longer than 6 months. I know I’ll be okay if I never end up in a long-term relationship again (though I do expect to and I stay optimistic about that), but I do worry about loneliness and feeling sense of community. My older relatives have so few friends – it makes me sad.

Obviously, there are plenty of you out there with thriving friendships and who are part of meaningful communities, but I see so much loneliness in my circle that it weighs on me. I have some great friends, but as you can see, the average person doesn’t spend too much time with friends (e.g. me!)

Also, since I don’t want my own kids I need to be considering what old age care might look like for me. I haven’t spent enough time considering what this will look like, but I hope to stay close to my siblings, nieces, and nephews over time so that they will have my back when the time comes.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

I am definitely self-taught. I am not only an eldest daughter, but I was the first grandchild in my mom’s family (and was so for almost 7 years!) and only the second of about 15 in my dad’s side. This led to some early spoiling for which my mom can’t believe I overcame. I also didn’t have any family members who were “good with money” to look up to, at best they were average and at worst they were VERY bad at managing it.

I can’t say exactly what age it all clicked, rather there have been multiple “ah-ha” moments throughout life. Early in life I saw some struggles of other family members that made me be extra appreciative of being “smart” with money.

After I graduated from university I had another watershed moment about debt. I had tens of thousands of dollars of student loans that I decided to pay off as quickly as possible. I then did the opposite at first, going back to get my MBA.

Upon graduation from said MBA in 2012 I had just over 100k in loans to payback. That being said, I was able to do that in less than 6 years, saving myself HUGE amounts of interest over my lifetime.

Once I paid off the loans, that’s where I really kicked my learning into high gear. I became obsessed with personal finance, consuming every book and blog I could get my hands on.

Who inspired you to excel in life? Who are your heroes?

I think if anything I have some anti-heroes in my story.

Both sets of my grandparents were small business owners, but neither was incredibly successful. My paternal grandparents did alright, but unfortunately my maternal grandfather’s 40+ year old small business was shut around the same time I was graduating high school. My grandfather was a very stubborn man and they poured WAY too much money into trying to save the failing business without being open to doing this differently. My grandfather is now 83 and still working, which is a shame but he was always a workaholic and probably would never have it any other way anyway.

That significant change in my grandparents’ circumstances, coupled with my mom (who birthed me at the young age of 18) being financially (and emotionally) dependent on others for the first 30 years really made me want to be independent in all ways. I was probably mid-teens myself when I resolved to be successful on my own. I am now HYPER independent to a fault.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

ONLY three!? I read probably 15-20 non-fiction books a year and at least half of them are related to personal finance and/or living a life worth living!

If I must narrow it down, these are three that truly changed my perspective on my own financial journey / life overall and how I want to live it.

- Die with Zero

- The Subtle Art of Not Giving a F*ck

- The Pathless Path

Caveat, these are not “getting started” books for your journey. In fact, I am grateful that I read them when I did at the point of my own life journey that I am on. There’s something about being in the right time and space to read something.

Post college I went back and re-read a lot the classics we (were supposed to) read in high school. Now that I was doing it for my own enjoyment and not for a grade, I was able to enjoy them so much more and understand them more broadly.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

Monetarily no. I guess I’m just not that charitable. I suppose I’m suppose to feel bad about this, but I haven’t felt bad enough to start donating.

I do however ad-hoc volunteer my time with multiple organizations, usually for big events. Selfishly I enjoy the aspect of interacting with people at these events, so if I can do that and also help the organization out at the same time, great.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

I certainly hope I have a long life left and that I end up applying a lot of the “Die with Zero” principles over the next 40+ years so I haven’t spent too much time planning this out yet.

As I mentioned before, I don’t have/don’t plan to have any heirs myself and I am also currently unpartnered so that eliminates standard/default options.

If something were to happen to me tomorrow, my assets have my parents set as the beneficiaries. Assuming they go before me I will probably divide the assets amongst my siblings, nieces, and nephews.

Congratulations what an accomplishment and very brave to take the leap now!

It’s all based on the cost to maintain the lifestyle you want to live.

Thank you! The decision to take the break was not one I took lightly, so I appreciate the comment!

And I agree, that’s certainly why people have vastly different goals for FIRE. I am definitely not at my goal NW for long term financial safety/stability, but I am VERY thankful to be able to take some time NOW to enjoy life, because you just never know what the future holds.

Yes are an interesting person. I don’t envy your position though. I would much rather work and be able to live an upper class lifestyle. Kids are expensive but they make our lives more interesting and fun. Wife and I are a few years older than you. Have a net worth of 4 million. I probably won’t retire until we have closer to 20 million.

It will be interesting to see if or how your views evolve with this sabbatical. Perhaps you’ll still relish the independence and simplicity of your lifestyle.

Keep us updated!

Thanks, I think? Lol, different strokes for different folks. I’m not sure what your definition of “upper class” is, but spending avg of $65k/year as a single person isn’t exactly frugal. On kids, that’s a person decision for everyone, of course.

I’m now 9+ months into my career break & still loving it. I’ve renovated my duplex, traveled to 8 countries, walked >330 miles on the Camino de Santiago, lost 10% of my body weight, read 26 books, and much more. And while not making any income for that time, my NW grown by $160k (lucky with the runup we have been having).

That said, I have started to slowly reconnect with old colleagues and I am open to starting my next role, but I’m not job hunting more than a few hours a week at this point. I’m enjoying the break a little too much, work is not nearly as appealing for these days!

Mi-403. There’s really no need to explain yourself to anyone. Focus on living the life you choose so that you feel fulfilled and happy—nothing else matters. For instance, I travel extensively and have visited over 15 new cities alone in 2023, and 6 more so far in 2024. I couldn’t be happier, and I can’t imagine doing any of this if I had kids.

You’re absolutely right about the myths surrounding “upper-class living.” Personally, I have a net worth of over eight figures, and I feel I live an “upper-class lifestyle” because of my travel experiences, not because of staying in fancy five-star hotels. I’m perfectly content with my $100/day Airbnb stays during my vacations.

Best of luck, and I love how you’ve chosen to live your life!

@MI-77, Thanks! want a travel buddy? 😉

On the topics of kids, and almost all other things, it’s really a personal choice. I’m a female in my early 50’s. We chose not to have kids and I love it. I know many others much older than me, same for them. So it’s really a choice, as long as you do what’s true to you… and not because of social pressures or because that’s what you’re supposed to do. Enjoy your life on your terms as you only get it once! 🙂

Yes, clearly, I have expressed my opinion above. Some individuals prefer not having kids and the degree of independence and cost-saving that that decision entails. I only had kids in my mid-30s. They are a ton of work and pose huge expenses, but I would rather make a ton of money and enjoy life with them.

Some individuals want to retire as soon as possible. I would probably drive my wife insane if I wasn’t at work for a significant part of most weeks. And it’s not all about collecting stuff. I like to save and invest in index funds over cars and depreciating liabilities any day. Money can buy rich experiences too. I love our neighborhood, fine-dining, and 5-star travel. Probably won’t fly business class until we have 10 million…but hotels?! Yes, give me the Ritz Carlton any day. My wife and I recently took our kids out to a posh steak house. The kids loved the fine-dining experience. Also, I spend a ton of time exercising and investing in myself too.

I want to write a lot on no children but it’s too hard to do well. Let’s just say as a dad who loves being a dad I sure do see why people decide not to have children. It’s an individual choice and I applaud people who decide what’s best for them.

As someone who worries greatly about the future of society and global warming I often feel a bit guilty for bringing kids into the world.

You certainly don’t have to answer but this seems like it may have been a bit of an abrupt decision or a layoff. I’m surprised you would voluntarily leave in August when simply hanging out another 5 months would have generated another $100K+ to your nest egg, assuming you had that option.

Enjoy the sabbatical. Nothing wrong with taking some time to recharge before you settle into your next gig.

It was definitely not an abrupt decision or a layoff – it was a well informed, long debated decision. In fact, it took over a year to make the move – many people in the MMM Forum know the story well.

I stuck around until August to collect my bonus payout & to leave on good terms. There’s always a reason to ‘stick around longer’. Had I stayed 5 more months, I would have wanted to stay more to get my next bonus. There’s always a carrot dangling out there. I didn’t want to get stuck in the “one more year” syndrome!

Very inspiring read! Do enjoy your sabbatical as there is so much more to life than acquiring things and an upper class lifestyle.

Thank you! I am still loving the time off.

That said, I am finding it humorous that multiple comments have alluded to me not living an upper class lifestyle. The very nature of me being able to take this time off in my 30s is by definition upper class. I do not have to labor to live. That’s the ultimate definition of upper class, is it not? Do I buy fancy clothes, jewelry, or belong to country clubs? No, because those things don’t bring me any joy. But I do spend a lot on the things that do bring me job. I travel extensively (I’ve been to over 50 countries), I randomly drop $200 on a Wednesday night sushi meal (did so last week), and dont think twice about buying tickets to any concert or comedy show I want to go to. I think people who have been fortunate enough to generate their wealth may have lost perspective what truly is a working class or middle class lifestyle?

Quick question… what about health insurance in this country. That’s not cheap, do you have a plan for that and how much does that cost?

You’re definitely right, it ain’t cheap!

Its costing me about $225/month for a pretty bare bones plan with a $7k deductible & 40% coinsurance. I am quite lucky to not have any chronic health issues / medications to worry about, so I call it my “in case I get hit by a bus” insurance.

I have a $30 copay for things like preventative exams, and I end up paying out of pocket for some stuff. For example, I got my IUD replaced a few months ago (cuz remember, no kids for me!) and I paid $370 out of pocket while my insurance paid $1,467.

I really enjoyed this interview. What stands out here to me is that you’re living your life intentionally and by design.

Most people , regardless of how much money they make/or have , don’t have the option to step away – they have to keep grinding to support the lifestyle and burn rate. Or they can’t take tome away because they work for someone else. ahhhhh the W-2 “lifestyle “.

As someone who had 1 kid , was divorced at 34 and has only owned businesses throughout my life , I can relate to the way that you’ve set up your plan and then worked it. Don’t expect others who aren’t able to understand.

I worked my businesses until I was 45 and now those businesses work – I don’t , choosing to travel and ski and cycle and spend time with my now-adult son. I should say I work when I want to. Work makes a fun game when you have choices – which you obviously have. Props to you for taking them.

I hit decamillionaire status last year. I still do the same things – live on about $75k per year (same as 2003) but it’s all about living intentionally. Ask me what I save/ invest that makes my garden grow. Ah yeah. And at 57 I have the luxury of time and community – not just money

People won’t get it. That’s okay. All things given , any idiot can work for money.

Keep on living by design ! I admire you.

Aww, thanks for the comments! Its funny to hear it called “by design” because I’m pretty often changing things! In some of the books I mentioned in my interview I remember reading that “Happiness is a verb” and that really resonated with me. You have to do things, take actions to be happy. I think thats the same meaning as “by design”!

And congrats on decamillionare status! And maybe loosen the purse strings a bit now?? 😉

Really enjoyed your interview. Whilst I have a few more “miles on the clock” than you I semi-retired at 58 (in early 2022) and haven not regretted it for a minute. For the last couple of years I have been doing consulting work which averages around 15 to 20 hours a week with probably 3 months a year where I don’t work as my wife (who is fully retired) and I are enjoying some travel both within New Zealand and overseas

I definitely was not ready to fully retire and current situation is the beast of both worlds. Enjoy the work as it keeps brain going yet have time for holidays plus some volunteer work I do

As for kids, as you say its everyone’s personal decision. My wife and I never had kids as we didn’t get married until mid 40’s.

Good luck with whatever you decide to do in the future. Its certainly great to have enough money behind you to have options and not just have to work to live.

Thanks for your comments! Id love to work part time/consult. I need to figure out how to make that happen in the next year.

Love this, living your best without conforming to societal pressures. Well done. I really resonate with this quote: just don’t have the same “drive” I used to around the culture of capitalism in the US.

Thanks @Financial Fives!

And I’m glad it resonated with you. It reminded me that there’s a post-script in the book Psychology of Money that I found to be a great summary of how todays consumerism in America came to be . Have you read that? I quickly found this summary online, but of course there’s a lot more insight in the post-script itself:

https://www.livingwellteamcfg.com/blog/a-brief-history-of-why-the-us-consumer-thinks-the-way-they-do

I also like this longer review: https://www.linkedin.com/pulse/psychology-money-morgan-housel-laura-werle-pmnsf/

Very interesting read and quite rare to read of a woman. Thank you for sharing.

I would like to give some option to think in a different way. I chose to work a job I am massively overqualified for. I work part time, take all 30 vacation days (Germany), my job is super easy for me and still I overarchieve all expectations and are highly valued by my bosses. The job pays all my expenses and some leftovers for investing. My stress level is like below zero. I kind of go to work to relax from my family life with two teenagers. Highly recommended lifestyle.

When you have money, you have options.

Best, Silke

Hallo Silke, danke!

That kind of job sounds absolutely perfect. I’ve just restarted my job search and that is definitely an option I am weighing. I’m struggling to get past the pay being lower so much lower since I dont KNOW if I can get away with just little effort/time, but I’m glad to hear its working for you!

I really enjoyed this article and how articulate and self aware you are. I think you are wise to take a sabbatical and do the things you want, while you can. That is really one of the big themes in “Die with Zero.” (BTW, I would love to walk the Camino.)

As for choosing to be child free, and currently partner free, it feels like you are thoughtful about it, and by posting the time-use study, aware of the trend. That said, I think women do better at this than men in forming a network of close friends.

The only suggestion I’d make is on the volunteering front. If you find something that you enjoy, it an really enrich your life with the people you meet and the activities you do. True friends are made by doing things together, and volunteering has really hit the spot for me.

Best wishes and I look forward to the next update!

Aww, thanks, very kind comments. And as for the Camino, I loved it and you should def consider it!!

I agree most women are naturally better at this. Unfortunately I dont fit into that mold as well. I am trying to make more of an effort though to connect/reconnect with friends.

As for volunteering, great points. I do some minor work now and its enjoyable. I also host a weekly craft beer meetup in my city which is quite fun & helps me connect with people. Sometimes I attend hiking meetups as well. This has been a nice way to meet new people and funny enough I’ve met the last 2 guys I dated via said meetups. (Dating apps are the WORST! 😉 )

What a great and interesting interview! I’m always impressed with young people (which for me is probably anyone under the age of 40-45 haha!) who have acquired a level of wisdom beyond their years. Some of the questions you’ve been asking yourself about the “meaning of life” (for lack of a better phrase) are ones I’ve only recently been working through.

Since I know you through the MMM, I appreciated this interview even more. You have an interesting perspective, and I share some of it wholeheartedly. I’d have to say I really love capitalism in the pure economic/incentive sense, but the “rat race” many folks put themselves in, I do not. Many times the rat race is self-inflicted by people making poor personal choices with money. It’s those people that should read, re-read, and then read your interview again. There’s a lot of wisdom to unlock in there.

See you on the MMM!

Thanks Tom! I’m sure we’ll continue the convos in MMM, but I wanted to respond to your comments here also. Good luck on your own existential crisis haha!

Anyway, I think I agree with you overall, but I also think the “rat race” is very culturally engrained. It’s hard to realize you’re in it the same way fish don’t know what water is. For me, my time living in Germany really helped me gain a perspective I wouldn’t have gotten otherwise. And Germany isn’t THAT different, but it forced me to pause and think about things in a way that I just wasn’t doing back home.

I’m MM-77, and I thoroughly enjoyed your article. I can relate to many of the points you made. Like you, I am single with no children, and I love it! The freedom to live life on my terms is incredibly rewarding.

Don’t let the naysayers get to you—those who insist you should have kids are often trying to impose their own standards on others. It’s important to tune out that noise and focus on what makes you happy. I’ve done just that, and I cherish every moment of my single life.

Regarding loneliness, I’d recommend reading “The Wealth Money Can’t Buy” by Robin Sharma, or exploring books on Stoic philosophy. I had similar concerns about loneliness when I turned 40, but adopting the right mindset has made a world of difference. Now, I don’t worry about it at all, and I’m much happier as a result.

Best of luck on your journey!

Thanks MM-77! Were in the OINK club together then?! (One Income, No Kids) And I agree, the freedom is otherworldly. That said I have realized over the last few years I am HYPER independent. I forget to invite friends to concerts or on trips because I’m content going on my own!

Honestly I don’t feel pressure to have kids, even when people try to sell me on their reasons why kids are so great. I think there’s a stigma to not wanting to have kids, but I take it all with a grain of salt. I’ve never once been in a situations where I thought, you know what would make this better, children. I’ve been this way my whole life. I wouldn’t even babysit growing up when my friends were making a killing (as 14 year olds anyway) Anyway…

Funny that you mention The Wealth Money Cant Buy. I actually started listening to the audio book when I was on the Camino. This is a good reminder to go finish it. I think I got through about 1/3 of it. Thanks for the recommendations!

Great interview! Love the charts and tables. You are my kind of people! Talk to you on MMM!

Haha, gotta have some visuals for the data!! See you in MMM!

Beautiful and thoughtful interview. I both admire and envy how you have carved out the time to take a sabbatical. In my opinion true wealth in not just a high net worth, it’s having the time one needs to live the life they choose. It’s pointless to have a $5-$10M net worth and to be owned by your bosses or owned by your customers if you’re a business owner. Beyond a certain point , time is our most precious commodity.

Also, the decision to have kids is a deeply personal one. No one should be trying to convince anyone to have children. It’s a deeply personal decision, one that only impacts only that person. enjoy your simple, intentional lifestyle. Beautiful write up!

Also,

Thanks for the kind words, MJ!

Congratulations on living the way you want to live.

I would just say that in order to keep living the way you want to live, you need to keep all options on the table. My feedback is a risk management perspective.

I think you should pay close attention to risk management, if you haven’t already done so. Perhaps address with a CFP and on MMM. You’re 38 and have invested thru one of the longest bull markets in US history, which essentially started in 2009, and most of your net worth is in the markets. Be careful regarding recency bias. The decade before 2009 was very different, seeing both the dot com bust and the Great Recession.

Inevitably, a prolonged major market correction will eventually occur, and statistically it should come sooner rather than later at this point. The Great Recession saw a roughly 50% correction in investment accounts for many Americans, and when you are drawing on your assets to live you need more than a 100% return to recover from a 50% drop. Another possibility is that the markets go nowhere for a decade while you’re drawing on your savings to live. In 2000, the S&P 500 opened the year at 1455.22. It closed 2012 at 1426.19. You only have a few months saved up in cash/cash equivalents and no separate emergency fund. What if these scenarios happen in a period of higher average inflation = stagflation? Another way to put this is to familiarize yourself with sequence of return risk (SORR) in the markets after “retirement” from income.

When something similar to these scenarios happen, do you have a plan? Can you return to a well-paying position, or will you have to start again at the ground floor? $1.2M is commendable, but with a potential for another 50+ years of life careful consideration is in order. IRA/401k is not accessible until 59.5 without a 10% penalty and forfeiture of future returns on distributed amounts.

Have you considered social security eligibility, and if eligible for how much given so many years of 0 earned income? Have you considered healthcare premiums rising with your age, and deductibles for ER/doctor visits as the unexpected arises? This may be mitigated by 0 income and healthcare subsidies in the marketplace.

Consider a Monte Carlo analysis and see what your success odds may be. Just watching out for your long-term success with this.

I must agree with 119 here. I see so much risk and 119 outlined it much better than I ever could. It seems like you are open to options and are pursuing some other work.. but sometimes doors can close. My wife learned this unfortunately… but we realized there may be consequences when she left the workforce for many years.

I love having kids and a spouse but I completely get that it’s entirely an individual choice.

I guess I’ve never been ‘owned’ by a boss or a company and I’ve always recognized life balance is super important as we are never guaranteed a ‘tomorrow’. Maybe I’ve been lucky.

Best to you going forward.

Hi @MI-119. Thanks for your comments/concerns.

The short answer is that no, I haven’t done that type of in depth analysis because I will be going back to work (likely soon) & assume I’ll be working in some capacity for at least another 5-10 years. This was never meant to be a permanent “early retirement”, it’s a sabbatical / break. In fact, this time was a test to see whether I would even enjoy early retirement (spoiler alert, it’s pretty great!). Anyway, I am actively looking at roles now to return to paid employment. I’d love to continue not working, but that’s not in the cards quite yet!

I am FULLY aware my now $1.3M will not last forever, nor is it all accessible at the moment. That said I have >10 years of accessible funds (via my brokerage & vested ex-company stock) to support my lifestyle, so I have a large margin of error for my roughly 1 year break, even if it takes me another year to find a new job (which I highly doubt). Because I am only 39 (now) I am willing to take the risk of leaving most of my money invested vs as cash, even during this break. My longer term FI # is more like $2.5M which accounts for a lot of what you are speaking about.

On the topic of jobs, I absolutely can return to a very well paying position (e.g. pushing $300k/year total like I had), albeit, I don’t necessarily want to. As I have responded in some comments, my hope is to find a job that’s less stressful/effort/time, which of course will come with less salary. I still fully expect that salary to be north of $175k for my profession which much more than covers my estimated net expenses and allows me to continue to save at a very high % rate.

And MI-117, I can appreciate the challenge when taking a significant amount of time off (e.g. many years). For sure, that would be more difficult to overcome. Maybe I’m being overly optimistic about the situation, but of the few connections I have made on my recent job hunt, most haven’t even recognized or mentioned the employment gap. Plus, I think it’s becoming increasingly common to see gaps. Not specifically due to sabbaticals or raising children, but due to the prevalence of layoffs. It’s not as taboo as it used to be in my opinion. Time will tell. I’ll come back and give an update when I land the new role!

We appreciate you sharing your story!

It will be interesting to hear the rest of the story down the road.

Cant wait to do a “Millionare Update Interview” in a few years. But until then I’ll keep sharing updates on MMM. 😉

I loved this interview! Many people collect millions of dollars, but then never use it for anything. Sometimes they use the money for security against the “what-ifs” or sometimes it is a personal scorecard for their success.

I remember reading your post about taking time off from work on MMM and love that you can stick to your vision of a fulfilling life. What’s the point of all the money if you don’t use it to make the life you want? I have never heard a story from someone who took a sabbatical or retired early and regretted the decision.

We need to hear from more people like you!

<3 Aww, thanks MI-402. I also hope to see more people like me as well! We definitely have a few in MMM, and that's so great to see.