I’m letting three years pass from the initial interviews to the updates, so if you’ve been interviewed, I’ll be in touch. 😉

This update was submitted in September.

As usual, my questions are in bold italics and their responses follow…

OVERVIEW

How old are you?

I am 50 and single.

Do you have kids?

I have no children, however, I’m a proud uncle quite a few times over.

What area of the country do you live in (and urban or rural)?

Since my last update, I’ve relocated from a high cost of living city in the north to a medium cost of living city in the south.

My home is still fairly urban, but the pace and density of my new city is much less than before – and it’s a lot warmer.

What was your original Millionaire Interview on ESI Money?

I was Millionaire #134.

Is there anything else we should know about you?

Around the time of my original interview, I had discovered the ‘FIRE’ concept (Financial Independence, Retire Early) – which is actually how I discovered ESI Money and started reading the other interviews. I had been living by the general principles of living well below my income since 2000 (Age 28) when I put together the first serious financial plan worksheet for myself, but didn’t know that it was a ‘thing’ with a name.

In some ways, I’m glad I didn’t know, because I haven’t gotten too caught up in the framework – more just doing things that further my goals, but for full disclosure, I’ve loosely been pursuing ‘FIRE’ since the year 2000, which explains some of the more aggressive saving/investing/planning habits. Money isn’t everything though, and for sure I haven’t scrimped and scrammed – I’ve lived in really great places and enjoyed traveling the world, alongside my career.

NET WORTH

What is your current net worth and how is that different than your original interview?

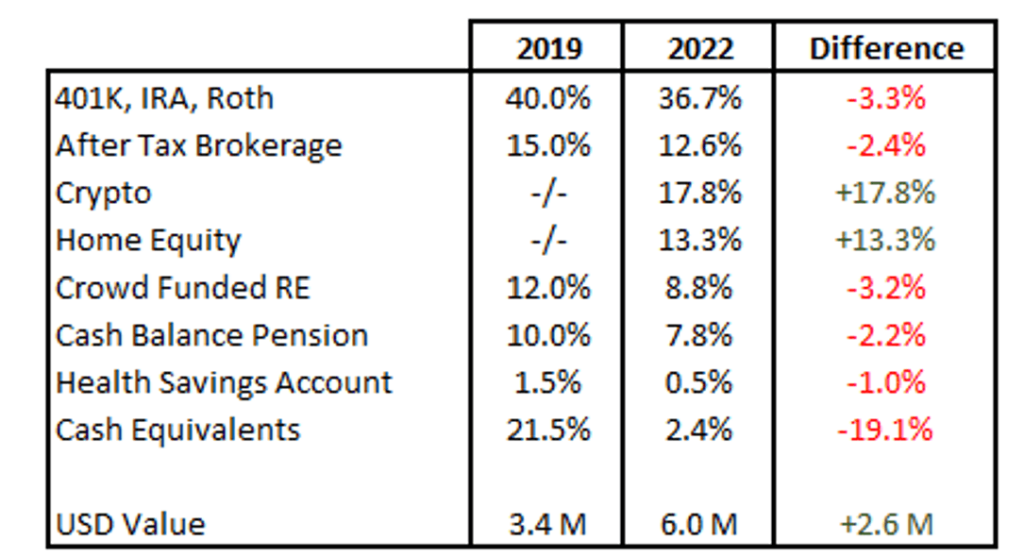

Current net worth is ~ 6 million USD. In 2019, it was 3.4 million USD. Both of these numbers include my home equity, but exclude all other physical assets (i.e. no expensive cars, art or luxury items, of which I have essentially none).

The mix of assets has changed somewhat, as indicated in the following chart. If you work it out, nearly every category increased in dollar value (the total pie got bigger), but funds got allocated to two new asset classes that now represent a sizable portion of the total NW picture (purchase of my primary home and some good fortune & timing in crypto, more on that later).

What happened along the way to make these changes?

In 2018, I had sold my prior home and was sitting on the cash from that sale. I also had a small crypto holding in 2019 when I wrote the last interview, but it wasn’t even meaningful enough to reference as something worth anything. I work in the tech field, so it’s something that I was tracking and curious about. I grew that with some cash and I guess I can only say that exposure to the right assets met timing, creating a bit of good fortune.

In 2020, I relocated to the south and bought a home, just as prices were rising. I felt under quite a bit of pressure to buy something because prices kept going up and deals were all getting multiple offers. I was starting to fear that selling my home in 2018 was a terrible idea and that I would be priced out with the buying power of cash declining rapidly. After several attempts I was finally successful.

In late 2020 and into 2021, we had a massive asset recovery in the markets off of the pandemic lows, followed by a massive rally in crypto towards the end of 2021. During that time, home values exploded in my new city. I do believe the US government created an asset bubble with post pandemic spending, because surely I saw it on my personal balance sheet.

I try to be strategic in buying and selling, but try to avoid trading frequently – at least most of the time. The crypto values went wildly higher and then came crashing back, followed by the equity markets in the early part of 2022. I just feel fortunate to have held onto some gains in both.

You can see that the HSA account declined significantly in real dollar terms…I did blow that up, losing more than half the value trying to trade a bit more frequently, since there are no tax consequences and the brokerage allows it.

Lesson learned again, the hard way – I should never trade frequently. I would say that I know better, but clearly I still needed to relearn the lesson!

What are you currently doing to maintain/grow your net worth?

Raising cash.

After recent lessons learned, and feeling like there is unprecedented uncertainty in the world at the moment, I’m saving cash for two purposes.

First, I’ve decided to pay off my house. I know many people would say that trading a tax advantaged low cost loan for full ownership is dumb – the interest rate is low and the market returns are usually better, but I don’t want to be employed by someone else much longer and having that taken care of forever will just feel…well, awesome.

Second, I want to increase my real estate holdings, so having cash ready to pounce on opportunities will be handy. If we do have a further downturn, I want to be prepared to buy when others need to sell. If things stabilize or improve, finding deals will be harder, but I still want to own more hard assets that generate a cash yield.

EARN

What is your job?

Not much has changed with my work. I’m still an upper-mid-level IT manager.

The main change is that I’ve gone fully remote and am able to work from home in my new city.

What is your annual income?

My income has increased modestly over the past three years.

It’s now about 275K plus a small bonus, depending on company performance.

How has this changed since your last interview?

Little has changed with my work since the last interview, aside from going fully remote with my employer. My superpower has been consistency both with staying at the same employer and maintaining my level of earning power by being a consistent and reliable performer.

With relatively low expenses (despite buying a nicer house in what was then a cheaper city), I’m able to use excess cash to supercharge savings and investments. I don’t [usually] trade frequently, but by being strategic about adding funds to equities and real estate, I’ve been able to keep the rates of return pretty high.

It helps that I enjoy economics, technology and following the markets every day. It’s not for everyone, but I see it as my side hustle and hobby, so it’s usually fun for me – and occasionally stressful.

Have you added, grown, or lost any additional sources of income besides your career?

My primary source of income is still my salary, although asset values have grown faster over the past three years, netting the bottom line more than my income. Of course, this year is something entirely different…with broad declines everywhere.

I’ve used my salary, along with compounding, to add assets that produce cash-flow, including dividend paying mutual funds / stocks and real estate. When I stop working, these will need to fund my life, so it’s really been motivating to build the right mix.

I’m thinking that Real Estate should pay for the fixed expenses (health, utilities, groceries, RE tax, etc.) and dividends should pay for all the discretionary items (travel, clothing, dining, etc.). I’m not afraid to spend some principal funds or use excess from either category if I have to, but it’s a mental framework that I’m building on that helps keep me diversified.

I’ve decided to dedicate the cash balance pension to long term care at end of life, much like Long Term Care (LTC) insurance. My employer pension plan (rare these days, I know – and I’m grateful!) pays out as an annuity and the payments will be larger the longer I don’t use it, much like social security. It’s guaranteed as long as I live, so I’ll never risk running out of funds at the end of life. At current rates, it’s worth about the same as a well-funded LTC policy and will continue to appreciate.

I can choose to activate it at any time and it will be far more flexible than a traditional LTC contract for whomever will have the joy of taking care of me when the time comes. This decision will allow me to spend much more aggressively in the meantime, because I can engineer spending to a fixed number of years before I activate the annuity.

I only recently came up with this idea after two things happened:

- First I tried to create an estate plan to transfer whatever I have accumulated at death. For this size of resource and all the complexities in my extended family, this became very difficult to engineer in a way that meets the mixed set of values / needs of the recipients. It made me think that transferring money after death was the least desirable option, of all available options. Maybe it’s better to make strategic gifts while I’m alive.

- Secondly, I read the book Die with Zero by Bill Perkins. It got me thinking about how to better engineer my spend-down / give-down plan. That’s when I realized that having an annuity (that I’ve already paid for through my career) for the final years was an amazing advantage. I realize that some of it may get ‘wasted’ if I wait too long, but actually the security of knowing its available is worth the most to me in my situation – and will actually allow me to spend and/or give away most of my other assets leading up to that time.

SAVE

What is your annual spending and how has it changed since your interview?

I track spending religiously through Quicken. During the pandemic, my spending went down because I wasn’t traveling, eating out with friends or buying new clothes, etc. So even from a pretty low base relative to my income, my expenses declined further, which also helped the boost in savings/investment rate.

After I purchased my house in 2020, my spending did spike on furnishing the new house, but aside from that, my normal expenses remained steady. The cost of nearly everything in my new city is marginally lower, so even though we’ve had a lot of inflation, my budget hasn’t been stretched too much by it – and working remotely, my commute and in-person working expenses have vaporized.

For the benefit of those curious about specifics, I now target annual expenses at about 60K USD, excluding any tax payments, gifts or ‘special projects’ requiring extra one-time funds, like furnishing a new house or replacing a car, which should be very infrequent. My original post had annual expenses at 70K USD in a more expensive city, where I was renting an apartment, commuting to an office, sending clothes to cleaners and eating in a work cafe.

The other major project that has consumed cash has been investments in my nieces’ and nephews’ education. I made a fixed financial commitment to all of them and have been delivering on that as they’ve aged through their studies. I’m very proud of them – and the investment in their education is something that I wouldn’t trade for anything – I’m so grateful that I have it to share.

What happened along the way to make these changes?

During the past three years, I did go through a crisis with my aging parents. Both now suffer from dementia. Caregiving during the pandemic has become a major effort.

They had some savings, but it did require diving in with both hands and feet to rescue them, resettle them and liquidate their major assets so that we could pay for their care. I only mention it here, because I know that this is a major derailleur for many people, particularly in the US where we have little safety net. I’ve also read about it in other interviews, so I know I’m hardly alone in this.

If you have living parents and don’t yet have a plan for their care (or if you’re over 75 and don’t have plan for yourself) – my only advice is twofold:

- Get a solid power of attorney established while they’re / you’re competent

- Have a plan that you and they can agree on (even a rough one) so that you know what you’ll do before it’s too late.

Often, neither parents nor kids really want to think about it, but having a plan can definitely help to avoid catastrophe and overly difficult circumstances. In my situation my parents had no plan and didn’t want to talk about it. Meanwhile their ability to help themselves devolved into making very poor choices over several years before we discovered their plight. Gratefully, my siblings and I were able to work together to right the ship just in time, but not without some painful experiences and hard choices.

It’s made me be very thoughtful as a single person about what I will do when the time comes. I can’t say that I have a good plan yet on the ‘how and where’, but I have a few ideas of what I do / don’t want and I mentioned above my plan for how to pay for it.

INVEST

What are your current investments and how have they changed over the years?

From the table above, you can see where the components of my investment plan lie. Mostly in equities (mostly low cost mutual funds – think ‘Bogleheads’ if you’re familiar), real estate projects / personal home, along with the modest pension.

Although I do have some dalliance in crypto, I don’t really see it as the core of my savings because it’s still so volatile and future uncertain. I’m sure there are some readers that would say “sell it immediately”, but I have a long term thesis that I’m willing to let play out given my technical expertise and curiosity – and I’m not dependent on the outcome either way. I was a bit reluctant to even mention it here, but it grew so much and could be a meaningful asset later, so I’ve included it. At minimum I should be able to sell it when my income is lower and I’ll owe less tax [if it’s still around and worth anything].

The real goal is to increase equity holdings and real estate such that the cash flows fund my life after working. The plan is to continue to increase those holdings and at some point, I’ll use at least some, if not all of the crypto gains to fund those further.

Because I’m still working, all dividends and RE cash flows and capital events get reinvested, once I’ve swept enough cash to pay off the primary residence.

MISCELLANEOUS

What other financial challenges or opportunities have you faced since your last interview?

Aside from a global pandemic, increased global political unrest, several major market downturns, a freaked out employer, elder care issues and a cross country move, not much!

But seriously, I know so many are struggling in these times. I’m grateful for the ability to have personal flexibility and stability of wage income during this time, since we’re talking mostly about finances. More importantly, I’m grateful to have a community around me that is loving and kind. We need more of that.

Overall, what’s better and what’s worse since your last interview?

We live in uncertain times, so it takes a lot of energy to pay attention every day to what’s going on and courage to make necessary adjustments. It can feel overwhelming sometimes, especially now that I also have financial responsibility for my parents at the moment when their needs – present and future – are also most uncertain.

That being said, having a good sense of plan and a clear strategy helps to maintain a north star. I’ve invested in having a few friends who share in helping each other with our businesses and ideas. This has been really rewarding and the shared sense of empathy has been comforting.

Living in a new city has just been better – it reminds me that place does matter and the affordability, weather and community here has definitely been an upgrade. It has required adaptation, for sure, and some of that has been hard, but net net, it’s been a really good move.

What are your plans for the future?

I was pretty sure that I would have quit working for anyone else by now, when I wrote my original interview. I actually came pretty close. But with the pandemic going on and now a lot of geopolitical uncertainty, it seemed to make sense to tough it out a bit longer.

At the moment I’m trying to decide if I really do have ‘one more year’ syndrome or if I’m being as strategic as I think I am. I take a little comfort in that I’ve made some of the hard changes already, like where to live and progress on elder care – so it does feel like good steps on the journey.

I have little intent to big ‘R’ retire, but I do want to downshift and move away from a W2 job – hopefully within the next year or two. I’ve moved to a house that I can stay in / retire in and even ‘age to dust’ in if I have to… and when I pay it off, I’ll feel pretty well positioned here.

I expect to do some more extensive travel with more free time, but doing some shorter trips in the meantime that I can squeeze into long weekends and vacation days. I know that my expenses will increase somewhat once I’ve stopped working, so just continuing to work through a plan for that.

Given that you have a bit more wisdom and experience, what advice do you have these days for ESI Money readers?

Slow and steady still wins the race. Yes, I’ve been very fortunate with a few bits of timing and luck, but mostly it’s my steady job that has paid the bills and provided the extra cash to make those other things possible over 30+ years of wage working. Also, I’ve learned [again] that I’m not good at active trading.

To make it through the tough days, the days when I really don’t want to keep going at work, etc., I just ask myself ‘under what conditions could I…?’ – and then build a life around that, trying to maximize what I can do with my time for both myself and others. It has helped me make necessary adjustments to meet my obligations, but also pursue my goals.

Finally, I guess I would just remind myself and the world that money isn’t everything. It’s only an enabler and without friends, family and community there is no point. Gratitude every day keeps things in perspective.

nice job w staying consistent w your financial plan. Amazing job also in doubling your net worth in under 5 years. The % crypto exposure is gutsy, approx $1M. That’s as large as I have ever seen. Good luck. Thank you for your update.

It’s probably closer to 2m if he kept it now. Submission was when bitcoin was around 19k in September. 2023 has been a big run. Talk about fat fire and having massive cajones! Let it ride!!

What I’d really like to know is how this particular person was able to grow their net worth from 3.4 Million to 6 Million in three years. Usually the core assumption is that an asset takes 7 years to double – so I’d love to learn what they did specifically to double their money.

Hi… I’m ESI-134 and this was my interview. You’re correct that this is what they call an ‘abnormal return’ in business school. I attribute the majority of the gains to a few simple things, for which I was not expecting, but was unwittingly prepared…

1. The Federal Reserve slashed rates to zero and then dumped trillions of dollars into the economy. This floated nearly every boat — and most of the assets that I own magically went up an unusual amount. Two asset classes outpaced everything else: Technology and Crypto. I am far from a crypto champion — and this is not a recommendation — and I do not trade it back and forth. I am reluctant to talk about it. I only bought at the right time and held it as a long term thesis. Concentrated conviction due to the stimulus programs — which I realize is much easier to do when you buy something at an extremely low basis… and not the usual financial blog advice. But it is what happened.

2. My income has been steady and I live on a fraction of what I earn — this gave me a cash pile at just the right moment. You can see in the chart above, I was sitting on the cash pile waiting for something productive to do.

3. I moved from a high-cost city with flat real estate prices to a medium-cost city with high double-digit price growth in 2020-2021. I was able to capture a remarkable one-time event in housing repricing — which I attribute to what our dear Federal Reserve did in 2020 and the flight of hundreds of thousands out of high cost cities.

Everything else that I did is what everyone who E’s, S’s & I’s does… kept contributing to 401k to the max, adding to after tax accounts, finding ways to keep my own rate of inflation low and learn something new every day to keep my skills sharp. Hope that helps a little.

it’s impressive that you were able to reduce your spending while doubling your networth, i am the same way, i found that more money i have, less i spend! material things no longer matter, it’s traveling and unique experiences that i would really splurge on, good luck with upcoming retirement and just do it already 😛