If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

My questions are in bold italics and his responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I’m in my late 40s as is my wife.

We have been married for nearly 20 years. Can’t believe how time has flown by.

Do you have kids/family (if so, how old are they)?

We have 3 teenage kids.

They will soon be out of the house and off to college which will be a big transition for us. I think my wife is looking forward to that more than I am. 🙂

What area of the country do you live in (and urban or rural)?

We live in the western US in a fairly urban area.

Cost of living is a bit expensive for my taste. We are considering moving out of the area into a lower cost area (with hopefully no state taxes) when the kids are out of the house.

Where we end up will largely depend on where the kids settle down. Don’t want to be too far away from the grandkids. 🙂

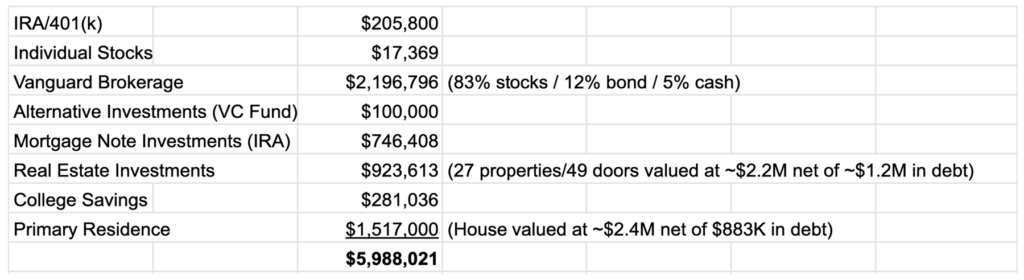

What is your current net worth?

Our current net worth is about $6M.

I try to do this calculation once a year.

About 5 years ago, I started looking at growing this as a key metric based on a few of the blogs I was reading and my mentors.

If the goal is to build wealth, I can’t think of a more important metric, but it should be done as part of pursuing a fulfilling lifestyle. I know several people that want to build wealth at all costs and suffer from a miserable lifestyle to get there.

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Just a few notes about the above table:

- I’m not a big fan of debt so the only debt I have is what I consider “good debt” (vs bad debt like credit cards, etc.) I know that we can’t always avoid bad debt, but I encourage everyone to really understand the mechanics of the “bad debt” to avoid any surprises. I use debt in nearly all of my real estate transactions to get the best returns possible. I know there are a lot of investors that prefer to pay all cash for their real estate, but I found it hard to accumulate properties at a healthy clip and get the best returns with this strategy. I also used debt to purchase my primary residence. When my wife and I retire, we will likely purchase our retirement home with all cash.

- The individual stocks are from distributions from the VC fund that we invested in. I usually don’t like investing in individual stocks with the exception of the dividend portfolio that I’m building (see next point). So I will likely sell these holdings soon.

- About $600k of the Vanguard brokerage funds are allocated to the dividend portfolio I’m building. I’m a late bloomer when it comes to dividend investing, but really love it. There aren’t that many better ways to create a tax efficient, growing passive income stream. There are a ton of tools out there to help you identify and analyze the right dividend investments. Once you understand the basics it isn’t that complicated to build a good dividend portfolio. My portfolio currently includes about 12 stocks all together. My aim is to have a dividend portfolio that yields about 10% per year with it growing at 5% by the time we “retire”.

- I use a self-directed IRA to invest in mortgage notes. Since the interest income is taxed as ordinary income, I wanted to get some temporary relief from Uncle Sam so it can grow tax deferred for a number of years. The jury is still out for me on the appeal of mortgage note investing. I was originally attracted to the double digit returns (~10-12%) but you have to always keep it invested which is hard when a mortgage note is paid off and it takes you a few months to find another suitable investment. Also, I have had a couple of foreclosures. One resulted in better returns while the other was a loss.

- I was given the opportunity to put a little money in a Tier 1 VC fund. So far the returns have been pretty good (~15%). I consider this a long-term illiquid investment. Not sure I would do this again as it is very speculative and not sure the risk-adjusted returns are worth it.

- I actually like to include the college savings accounts in my net worth. I know some people may not agree, but I think it is a valuable asset that was built with your income over time. You probably would not include this in your investable assets though.

EARN

What is your job?

I’m a senior level corporate executive at a Global 1000 company.

What is your annual income?

My income last year (2019) was approximately $1.1M, which includes a base salary, bonus and equity grants from my company.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

I tracked my income back to when I was a teenager (via the social security website). It is funny to look at how this trended over time.

My income has been a bit sporadic over the years because as I moved up, more and more of my compensation was based in equity which has fluctuated with the stock market.

The first time I earned any money was when I was in elementary school. This record store had a promotion and he wanted my friends and I to put flyers on cars. It took a couple of hours and it wasn’t that hard, but I remember the feeling that I got when he paid us (probably a couple of bucks) and I was able to go to the arcade and play a bunch of video games. That was probably the first time I directly connected working and earning money.

From there I worked in fast food restaurants in high school. One day, the owner of this Italian restaurant gave me a few lessons on life and managing money. One of the lessons he told me I will never forget. He said he has investments that make him money when he sleeps. I didn’t fully understand what he meant at the time, but it always stuck with me. He was trying to explain the benefits of passive income.

After finishing college, I took a traditional corporate job in the financial sector. I enjoyed this job as I got to use my finance degree and work with a lot of senior level executives. Income at this job was about $30K. I thought I was making a ton of money. After paying my rent and groceries, I had a lot left over. I have always been a saver and investor (started investing in stocks when I was 16) so I had money automatically transferred to my company’s 401(k) each month.

Hands down, the biggest impact on my income was getting an MBA from a top school. The job opportunities really opened up for me that was able to substantially increase my income. You can see in the chart the income trend after I received my MBA.

Earlier in my career, I was focused on getting as much cash compensation as possible. Then one of my mentors told me that most people build their wealth with equity so don’t be afraid to push for more equity (and accept lower cash compensation) in your jobs. At first it was hard to put this into action because I had 3 young kids, a mortgage and bills to pay. But I started to slowly ask for more equity as I took on different jobs and it has paid off over time although it has not always been a smooth ride.

What tips do you have for others who want to grow their career-related income?

The best advice I can give on growing your income is learn an indispensable skill and become great at it. There are a lot of people that work really hard, but either their profession or skill set is not differentiated so it is hard for them to fully maximize their earning potential.

Also, once you get into your desired field or profession it is VERY important to network. Building up an internal network (at the company) and external network has tremendously helped my career. Oftentimes networking doesn’t come naturally to most people, but please force yourself to do it. Most of my jobs either came directly from my network or college alums.

Finally, this is a great book to ready each time you start a new position: The First 90 Days by Michael D. Watkins. It has really helped me get off to a fast start on the job. Since you only make a first impression one time, it is important to get off to a good start, build credibility and achieve some early wins. This has helped me to formulate my learning plan and the best way to set expectations with key stakeholders.

What’s your work-life balance look like?

Earlier in my career (pre-kids) my work-life balance was terrible. I worked in an industry where I was at the whim of my clients at all hours of the day and night. I didn’t like the unpredictability. However, since it paid fairly well, I put up with it.

When I started having kids, the long hours really started to affect me and my family. That is when I decided to stay in the same career, but go “in-house” with a client with more predictable hours. This did help somewhat, but there were always periods of time when the work required a bunch of nights, weekends and occasional all-nighters.

During most of my career I tolerated the hours, but as I started to lose a passion for the work, it really started to weigh on me. I’m at the point now where I am looking forward to full financial independence and building the next chapter.

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

Real estate and dividend income are two other sources of income, but I’m primarily doing that to set myself up for the next chapter in “retirement”. My goal is to create $150K in after-tax income during “retirement” between these two income streams. I’m focused on these two types of income streams because they are both passive, tax-efficient and grow over time. The trifecta!!!

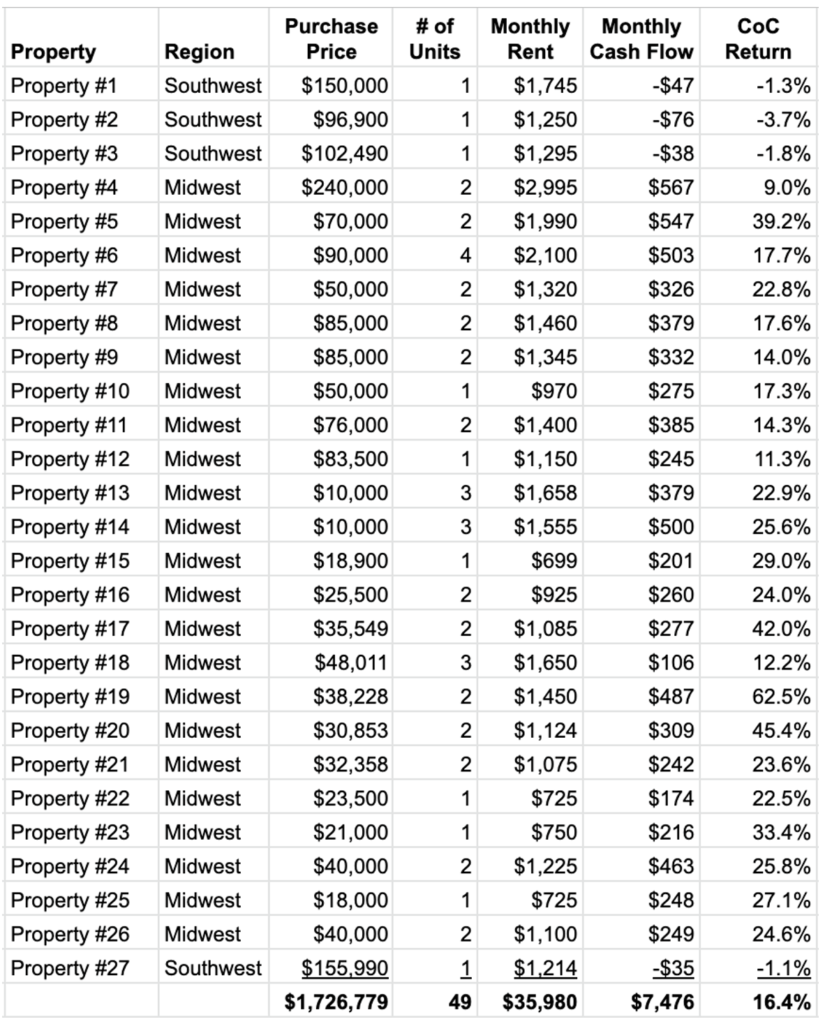

I have been investing in real estate now for over 15 years. I really love this asset class because it is stable, tax efficient and leverageable. My strategy has been to buy and hold. I have invested primarily in the Midwest where there is steady cash-flow. Although I won’t get the appreciation that other markets offer, I prefer not to speculate on property values so any appreciation I get is icing on the cake. Right now, I generate about $7,500/month in cash flow from my real estate portfolio.

I currently have 27 properties (49 doors). I generally like single family homes and duplexes in “B” / “C” class neighborhoods. The tenants in these units tend to be more stable (vs apartment buildings, tri-plexes and 4-plexes). When there is a smokin’ good deal, I will purchase a tri-plex or 4-plex.

I generally put 20%-30% down on each of the properties with as long as a term the bank will give me. Some of the properties are on a 20-year or 30-year term loan with a fixed interest rate, but many of the Midwest properties are on a 5-year term / 20-year amort. loan. I don’t particularly like that set-up, but it was the best I could find.

One of the unique things I did was put one of my Vanguard mutual funds up as collateral and take out a home equity line of credit to use as debt for several of the Midwest properties. Although this line is interest only, I pay it back as if it is an amortizing loan over 30 years. This gave me a much better rate (~4%), allowed me to move fast (as no appraisal, etc. is required) and significantly lowered my closing costs (no underwriting fee, etc.)

Since I generally look for cash flow, the primary metric I use to initially evaluate properties is cash-on-cash return. If I can get to a 15% return on my cash, I will usually do a more extensive analysis.

Over the years, I have built up a network of realtors and wholesale investors that send me deals. I also look at MLS quite a bit.

My overall portfolio is currently yielding a weighted average 16% cash-on-cash return. The properties in the southwest are the ones where I expect a bit more appreciation and therefore sacrificed cash flow.

I’m close to being done with adding to my real estate portfolio. I still have to stabilize a few of my properties and complete some renovations, but for the most part I don’t see myself adding more than a couple of properties to my portfolio. Once the properties are stabilized, I may start creating a debt snowball schedule to see if I can pay off any properties before I “retire”.

As far as dividend investing, as I mentioned this is a recent endeavor for me. I really do like the steady tax efficient growth of dividends. My goal is to build a dividend portfolio that yields 10% pre-tax. I try to pick dividend stocks with a long track record of paying growing dividends, has a yield of at least 5% and is a business I sort of understand. Currently, I’m getting about $4,250/month in dividend income.

SAVE

What is your annual spending?

This is an area that I’m not very proud of. I am frugal by nature, but my wife is not exactly the same way. I am certainly happy that my wife has helped me overcome my cheap ways over the years because we would not have a comfortable home for the family nor a lot of great vacation experiences. But I think we spend way too much money in a number of areas.

At this point, we spend over $300K per year (not including taxes). By far the biggest expenses are mortgage, kids, food and vacations. I have tried to get us on a budget or spending plan, but no such luck.

What are the main categories (expenses) this spending breaks into?

Do you have a budget? If so, how do you implement it?

As I mentioned we don’t have a budget per se, but I try my best to automate the savings and avoid unnecessary large purchases.

I track our expenses in Mint each month to make sure things don’t get out of control.

There are occasions when my wife and I talk about scaling back a bit. My wife and I tend to talk about large home purchases or renovations in advance, but sometimes it slips through the cracks.

What percentage of your gross income do you save and how has that changed over time?

Earlier in my career, I had a goal to save at least 20%. That has changed over time when I was either between jobs or took a job with low cash compensation in exchange for more equity compensation.

As I am getting closer and closer to my financial goals, it feels as if I’m tightening the reins a bit but it may seem somewhat irrational.

What is your favorite thing to spend money on/your secret splurge?

For me, paying for a nice experience is the best way to spend money.

It doesn’t always have to be expensive. I have had countless hours of fun playing $10 board games with my kids around the house or on vacation.

I did buy a nice car a couple of years ago that I really like, but I tend to own my cars a long time (15+ years) and pay cash.

My wife likes to spend money fixing up the house and going on nice vacations.

INVEST

What is your investment philosophy/plan?

My investment philosophy has evolved over the years.

When I first started investing, I tried picking individual stocks, but that went bad pretty fast in the dot com bust.

After that, I got into Vanguard index investing. This made things really simple. I just worried about asset allocation and expense ratio.

Then I got into real estate investing to fund my “retirement”.

Now I’m on the tail end of building a dividend portfolio.

Another area that has piqued my interest is mortgage note investing. I started doing this a couple of years ago but the jury is still out.

I was attracted to this area because I wanted to diversify some of my net worth away from the stock market. The stock market can be a great investment, but it is so susceptible to public opinion and mis-information. Over the long-term, you probably can’t beat the stock market as a great investment vehicle, but I still think too much reliance on it is not great.

What has been your best investment?

My best investment hands down has been getting an MBA from a top business school. This put me in another category with job opportunities and compensation.

I came from very humble beginnings, so I pinch myself nearly every day at my situation and the blessings I have received.

What has been your worst investment?

My worst investment was buying the QQQ index (full of tech. stocks) in Jan of 2000.

At the time, one of my friends asked me are you sure you want to buy this at this time. I said sure, it seemed like everything was going to go up for a while and I had missed out on the previous run ups.

Well, that was a huge mistake. What made things worse is that I held on to it far too long. I think I sold it about 3-4 years after the dot com bust. Really bad investment.

What’s been your overall return?

Hard to say at this point, but probably around 8%.

How often do you monitor/review your portfolio?

It depends if I am in building mode or changing my strategy.

When I’m in steady-state mode, I generally check my equity portfolio every quarter.

With my real estate portfolio, I generally spend a couple hours/week with my property managers reviewing vacancies and any repairs in flight.

NET WORTH

How did you accumulate your net worth?

I’m humbly proud of the fact that I was able to build my net worth without the help of any inheritance. God has blessed my family and I in immeasurable ways and I hope to pay this forward by inspiring others to achieve their financial goals.

All of my net worth came from my job income, saving a portion and investing it in various areas. I have tried to be as tax efficient as possible so I could maximize the dollars working for me.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

I think my greatest strength is my earning potential closely followed by my ability to save.

I think I have been an OK investor over the years (which has been helped by a 10-year bull market).

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

I think the biggest roadblock has been getting harmony with my wife on the value of saving and investing.

It has gotten better over the years and I now view it as a great blending of two different styles.

What are you currently doing to maintain/grow your net worth?

I’m working my corporate job for as long as necessary to get to my “retirement” goals.

I will maintain and grow my investment portfolio as well.

I don’t think I will pursue any new investment strategies at this point. I think I have stumbled upon a decent investment approach.

Do you have a target net worth you are trying to attain?

I don’t have a target net worth. I just want to get to the $150k in after-tax income then I will have a lot more flexibility.

We are probably a few years away from that.

How old were you when you made your first million and have you had any significant behavior shifts since then?

I was probably in my early 30s when I first became a millionaire, but it didn’t change much since most of my net worth at that time was in my primary residence.

I don’t put a lot of stock in being called a millionaire. Instead, I value financial independence.

Depending on your expenses, you don’t have to be a millionaire to be financially independent.

What money mistakes have you made along the way that others can learn from?

I think I was a bit too money obsessed when I was younger. I would spend hours putting our expenses in Quicken and tracking every penny. I have countless spreadsheets analyzing our expenses and investments.

I think there should be a healthy balance between monitoring your investments and being in “set it & forget it” mode. I think I have a good balance today, but it has been a journey.

The other mistakes I made were my initial investments in real estate. When I first started, I chased the appreciation deals and it didn’t quite pan out as expected. I sold a few of those homes for a modest gain, but since they were cash flow negative, I had to “feed the beast” for a number of years.

I have kept a couple of those early appreciation focused deals where the appreciation did pan out. But the cash flow is barely break-even.

What advice do you have for ESI Money readers on how to become wealthy?

The best advice I can give is keep it simple and automate as much as you can. If you automatically take the savings off the top and transfer that into an investment account, you won’t miss it. And because it is automated you don’t have to make a decision on it and can’t opt to spend it on a vacation or car.

As far as keeping it simple, I think you can’t go wrong with index funds. This allows you to remove a lot of decision-making variables and just focus on expense ratio and asset allocation. Then let time do the rest. The earlier you start this the better, but it is not too late for anyone to get started. The trick is just getting going.

FUTURE

What are your plans for the future regarding lifestyle?

During “retirement” I really want to build a business where I can teach others about personal finance.

I’m not sure what form this business will take, but I don’t want to do it for the money. I want to inspire millions of people to reach their financial goals.

I have discovered that many times it is an education issue. People just don’t understand how their finances work. But once they get a little bit of education, you would be amazed at what people can do.

What are your retirement plans?

My hope is that I can “retire” and start building the next chapter in a few years. At this point all the kids will be in college.

I would also like to leave the high cost area where we currently live to go to a lower cost warm weather location. This however will depend on where the kids settle down. I can’t imagine my wife and I will want to be that far from the kids (and eventual grandkids).

Are there any issues in retirement that concern you? If so, how are you planning to address them?

The biggest issue that concerns me is healthcare. It is so expensive and not sure the best way to adequately insure my wife and I. I will start doing some research on this in a couple of years.

We will also have to take care of a couple of aging parents. Their healthcare is largely taken care of, but there is a strong possibility that we will have to cover some expenses down the road.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

I’m not exactly sure why I gravitated to finance, but as early as I can remember, I loved business and finance. I was naturally good with numbers and math so this may have helped.

I would count and save my allowance each week. I was also eager to get a job as early as I could to make more money. I also would lend various family members money with interest. I also loved reading the Wall Street Journal and looking at the stock tables.

When I went to college, Business was a natural major, so this really stoked the flames for my desire to learn more about finances.

Who inspired you to excel in life? Who are your heroes?

I would have to say my mother has inspired me the most. She worked incredibly hard to provide everything we needed. Seeing her work that hard was the foundation for my work ethic.

There are a couple of other people who inspire me. One is Muhammad Ali. You can say what you want about his choices and politics, but he showed everyone what standing by your beliefs and sacrifice really means.

The other person is Jackie Robinson. To play the game at such a high level, under incredibly intense conditions and not have the ability to lash out is truly remarkable. I can’t imagine the punishment his psyche must have undergone. But he still preserved and succeeded against all odds.

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

My favorite money books are as follows:

- Rich Dad Poor Dad

– I read this as a teenager and it really set the foundation for how I have thought about money and working for a living.

- The Millionaire Next Door

– I read this while in college and it really helped me understand that regular people can build wealth if they are consistent and start early.

- The Courage to be Rich

– This book by Suze Orman really helped me with the fundamentals and the psychology of building wealth,

- The Warren Buffett Way

– This book was great when it came to looking at companies and understanding what makes great leadership.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

I’m on the board of a non-profit and give regularly to my church.

However, this is one area where I feel we could give more. I need to spend more time thinking about a better giving strategy and make it more consistent.

I do think that you can give to charities based on your “time, talent and treasure”.

During “retirement”, I’d like to get more involved in a church and target 1 or 2 non-profit boards to join. I’d also like to set up a scholarship fund for underrepresented kids to attend college.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

I plan to leave any remaining assets to the kids but need to think about the proper stipulations.

I love the philosophy of Shaq (the basketball player). He says his kids need “two degrees to touch my cheese”. I think there is something to be said of setting some milestones before your kids get access to their inheritance. My hope is that It teaches them the value of working towards something.

People really underestimate the value of giving the next generation a head start. This not only impacts the current generation, but many generations to come.

I am interested to know how you manage all of your rental properties. It looks like they are spread out throughout the country and that you are still working a demanding day job that would already take up a lot of your time. How do you find your properties? Who manages the properties for you? How do you find contractors and monitor their work remotely when repairs and renovations are necessary? Thanks!

TimR, thankfully, I have property managers that manage the properties so my role is to “manage the managers”. I have been with a couple of them long enough so they know what I look for in tenants and know how I want the properties maintained. It takes a ramp up period of about a year to get to this point, but once there, it doesn’t take that much time at all.

As far as finding the properties, once I figure out where in the US I want to invest, I try to locate a group of investor friendly realtors in that market. This is the hub of my relationships, because they usually refer me to contractors, lawyers, bankers etc. to round out my team on the ground there. Once I provide my criteria for the properties I’m looking for to the realtors then they send me leads. Once I find something interesting, I quickly run the numbers and if it passes my criteria, I put an offer in. Once an offer is accepted, I have an inspection done and then we negotiate a deal. It is amazing what can be done with pics, video, email and text. When I first started investing 15 years ago, it was much harder to do remotely.

For monitoring the work, I have the contractors take before and after pictures and also video. I also double check the estimates I receive with my property manager. It does take a certain amount of trust to do renovations remotely. I did get burned with one contractor in one of my units, so you can’t completely avoid mistakes. I chalked it up as a valuable lesson.

Thx

Can you give more details on how you go about locating a group of investor friendly realtors? Do you own properties you have never set foot on? I know I’d probably be uncomfortable buying a property sight unseen. How did you get over that?

And do you ever get over the feeling that the guy at the other end, whether it’s the agent, inspector, property manager or contractor, knowing you aren’t and can’t be physically present, might be out to bilk you? Did the contractor that burned you take advantage of your lack of proximity? Do you ever have problems with property managers that try to take advantage of this as well? This is my biggest obstacle to investing real estate in in lower cost parts of the country. Thanks for your insights.

MI158, happy to provide more details.

Q: Can you give more details on how you go about locating a group of investor friendly realtors?

A: I usually start with my network of real estate investor friends or bigger pockets. Once I get a list of names, I call and interview them. One of the first questions is “tell me about your clientele”. Another bonus is if the realtor is also a real estate investor.

Q: Do you own properties you have never set foot on?

A: Yes. It did take me a while to get there. My first set of properties, I did fly in to look at them, but once I built up enough trust with my team on the ground, I didn’t feel the need to visit every property. Also, with photos/videos and detailed inspection reports on each property, I got fairly comfortable.

Q: I know I’d probably be uncomfortable buying a property sight unseen. How did you get over that?

A: This is probably the biggest obstacle to remote real estate investing. I suggest taking baby steps, visit the first property, build up trust with the team on the ground and take it from there.

Q: And do you ever get over the feeling that the guy at the other end, whether it’s the agent, inspector, property manager or contractor, knowing you aren’t and can’t be physically present, might be out to bilk you?

A: Yes, I did have this feeling initially but was able to overcome it when I was able to cross-check a lot of the repairs and other issues with other sources. For example, whenever I had a big repair in one of my houses, I always had my property mgr get at least two estimates. Then I would show those estimates to other contractors that I trusted.

Q: Did the contractor that burned you take advantage of your lack of proximity?

A: Hard to say on that one. He just promised me a whole lot and he just wasn’t able to deliver. In hindsight I should not have gone with him because he was the cheapest option. I should have gone with the contractor that had more experience. Lesson learned.

Q: Do you ever have problems with property managers that try to take advantage of this as well? This is my biggest obstacle to investing real estate in in lower cost parts of the country.

A: It is really hard to know exactly what they are doing, but again it comes down to trust. I have had to change property managers twice over the past 15 years (in two different geographies). The first time was because they were not being responsive. The second time was because they were not maintaining my properties like I wanted.

Thank you so much for answering every one of my questions so thoroughly.

I had all these same questions. Thank you for asking and glad to see such thorough replies!!

Great story, congrats. A few Fu questions.

1. Care to share more on your dividend investing philosophy and where you learned it? Any book reccs?

2. Interesting you chose the active RE ownership route, I am guessing you use property manager and I am curios how this has worked for you. Has it been as passive as you thought?

3. Did you ever consider using a turn key operator?

4 Did you ever consider RE syndications or RE funds that may be more passive with similar tax treatment?

duke33, thanks. To answer your questions:

1.) My dividend philosophy is really to find companies that I somewhat understand that has a long track record of increasing dividends. I didn’t want a big portfolio. Just about a dozen or so of stocks that I can easily manage. I also wanted to have the portfolio grow to a 10% yield on cost in a few years. After some trial and error, I believe I have the right portfolio and now I’m just in monitoring mode. I didn’t read any books, but there were a few websites that were helpful including DripInvesting.org, Seeking Alpha, Motley Fool, Dividend.com, etc.

2.) I looked at all the passive income alternatives and RE seemed like the best one for me. It is leverageable, tax efficient and grows over time. When I have to ramp up a team or acquire a new property, it does take time, but it does become much more passive after about a year or so. It actually, has been fairly passive after the ramp up. I just need to provide the right parameters to my team to handle the day to day activities without requiring my approval on too many things

3.) I looked at a few, but there properties did have great returns

4.) I looked at this as well, but the cash on cash returns were not as good as the properties I found and the fees seemed too much.

Excellent article. Very well done!

Lots of similarities. Except my wife is the frugal one and I like to spend money sometimes.

I am also very proud of my what I’ve accomplished from very humble beginnings. We are a bit younger with a similar net worth. I’m starting to worry that we are too risk averse and missing growth opportunities.

I am mid 40’s and 50% in fixed income. I haven’t felt good about the market in three years and it’s really cost me. Misread how the market would react to our current President.

Very luckily for me 50% of my income is equity based in a great company that has outperformed the market for many years. So I haven’t missed the market completely. This has frankly been the biggest wealth building factor in my life.

Very impressed with your strong equities allocation. Do you plan on changing that over time?

I also want to move into a dividend portfolio. As I get closer to retirement. Which for me is about 5-7 years away. I plan on doing part time work that will provide enough income for another 5-20 years after that. I don’t plan I’m using much retirement assets until 65. But I want to be really comfortable from a mental perspective in retirement.

I have a lot of college savings and agree that is definitely part of your net worth. I also set up brokerage accounts for my kids who are not teens yet. I’d like them to have these funds sees their retirement accounts.

It sounds like you have thought about that quite a bit with your thoughts on impcting multiple generations of your family. I couldn’t agree more. My kids will never know what it’s like not having dinner because there is none. But I try to teach them about the world and help them understand how blessed we have been.

Best of luck.

gtmoney, thanks. Congrats on what you have been able to accomplish.

I do think I should lower my equity allocation at some point. It has been high over the years, but as I enter wealth preservation mode, I should lower it. I will be looking into this toward the end of the year.

Glad that we have similar views on impacting multiple generations. Providing that safety net hopefully allows the kids to be more adventurous, but not lazy.

It seems over your career you have grossed 12mm and managed to have a net worth of roughly half that. I think that is a great ratio. My Social Security gross to my net worth is more like 30% which i thought was good.

Interesting observation. I wonder what others think of this metric. Your post convinced me to pull my numbers and I am at exactly 60%. Don’t really know if that’s any good. I would like to know where others are.

Here’s a great post on this topic:

https://www.financialsamurai.com/how-much-should-my-net-worth-or-savings-be-based-on-income/

ESI, this is a great article. I have always wondered about the right metric here. IMHO, the one of the best quotes from the article is “The goal is to build your financial nut so large that it starts saving more for you than you can save on your own”

1/2 the money goes to taxes and you still need to live. 50% and higher is amazing i think.

Investment returns can greatly skew the numbers. Our net worth is around $11M at 49 years of age and I’ve been retired for 6 years not earning a big salary anymore. I was also partners in an S-Corp that I co-managed. So were distributions income because my work was the reason for these $ or was it investment income from ownership of a single stock? Also I purchased my stock for $300k but sold it for over 10X that amount. I suppose though if you just count it all as income I’m probably around the 50% range. Having paid 8 figures in taxes in my lifetime is a staggering thought!

Sounds like Ol1970 needs to do a Millionaire interview 🙂

I’ll ask. 😉

Curious what your gross earnings were when you retired at 44? This is where im having trouble trying to figure out whats right. Im 44 grossed 44mm and net worth is 13mm. Trying to retire in 4 years

My lifetime Social Security gross is $3.7M, current net worth is $6.2M, so I am at 168%. Compound interest is wonderful, especially when you start saving early. Stock funds have provided great returns during my investing lifetime, I am currently 62. In 2019 my income was $34K from a pension, but my net worth grew by over $1.1M, a lot if it while I was asleep:)

Yes that’s awesome! Definitely my plan as well. While these are prime earning years they are also prime spending years. That will change eventually.

Thats amazing. I’m 44 and my networth is 30% of my gross earnings. Need to get your level!

Hello

Congratulations on an outstanding financial profile. I have a questions regarding your dividend investing strategy using Vanguard. We have resisted using individual stocks due to my lack of interest in personally actively managing the portfolio during retirement. As a result we are using firm who charges 0.9% to actively trade and manage. We have been pleased with the results to date even during COVID however I also have Roth IRAs with Vanguard but haven’t investigated using them for passive income dividend investing. To date we have used DRIP as our strategy because we won’t access dividend payouts until later. I retired at 54 and currently 56 between pension and some 72T distributions we won’t need dividend payouts. Any advice you can give regarding Vanguard for your strategy would be appreciated.

Best of luck as you transition to retirement. Get there as fast as you can. It is wonderful.

Early Retiree #19, thanks. Congrats on your retirement. Buying individual stocks was one of the biggest obstacles I had to overcome with dividend investing. I first looked at dividend ETFs and funds, but discovered that they don’t have a good track record of paying increasing dividends. So if I had to purchase individual stocks again, I wanted a small portfolio. I also relied a lot on their dividend track record. Once I did the research and picked the portfolio, I knew I wanted to hold each stock for the long-term so it is not quite like actively managing. I don’t really care what the stock price does, I just care about the dividend. I am a big fan of Vanguard so I don’t think you can go wrong there.

This is a really great share. Yours is one of the few – (count less than 5 ). shares ive seen on this site that seems to understand true asset allocations across several financial sectors. Each of these higher net worth shares +5 million have broad exposure.

Many thoughts and questions but nothing to add. I love the way that you use spread sheets to monitor your asset classes. I also like the way that you’ve focused on passive “cash-flow” with The RE vs appreciation. I like your sensible stock market exposure. I like the way that you truly understand leveraging debt – especially in real estate as a way to scale. And I personally do not believe that your expenses are too high. You have the money. You are young. I’m super frugal as well. – read the same books etc. But you can afford your lifestyle. And the charity piece is not surprising.

You and your family sound like wonderful people. And while I congratulate you on your MBA and recognizing that It would increase your income in your chosen occupation, I believe that you’d have likely been financially successful regardless.

Can’t say enough about how much I enjoyed this.

M124, thanks for the kinds words. Really appreciate it. It is great getting feedback from this group.

Oh. One question.

Have you ever considered doing a 1031 exchange on your RE portfolio into anything else that would yield a higher income?

I ask because I have accumulated 14 doors in the past 6 years that do about $120k in profit. Mine are clustered in 2 cities and are appreciating and cash flowing. Of course my basis is WAY higher than yours. (I’m envious ). But I’ve considered doing this at some point. (Maybe not – we will see)

Thoughts ?

M124, yes, I have done three 1031 exchanges. It worked about fairly well. I was able to swap out moderately appreciating properties with negative cash flow, for properties with great cash flow and low-to-moderate appreciation. A couple of times it came down to the wire and I had to purchase one replacement property that was just below my hurdle rate. I would say if you do a 1031 exchange, if there is a way to tie up the replacement properties before you actually sell, that will take some of the pressure off. Thx

Hi MI #192,

First of all, Big Congratulations!! You are killing it. Great story.

One suggestion, you are winning and seem to have a very great situation, don’t sweat your wife’s spending part as much as you seem to do. The number is high, I get it, but you have it to spend and a great wife is more important than dying with a bigger portfolio.

I think I enjoyed your story so much because we seem to have a lot of similarities, with our situations (also a Fortune executive, with families, properties, etc..).

Really enjoyed seeing how well you are doing.

Keep it up! Best wishes!

MI#2, thanks. Really great advice. I need to loosen up a bit. I will try harder. Still trying to shake the mindset about money that comes from my humble beginnings.

Quick question – For your cash-on-cash return cut-off of 15%. Are you looking at the year 1 cash-on-cash or the stabilized cash-on-cash return?

Cheers,

MI 186

MI186, great question. I look at the 1 year cash-on-cash return. So this includes any rent ready repairs, any holding costs to get the unit filled, etc. The good thing is that the cash-on-cash return grows over time. When I had to break the rule on an occasion or two, I justified it by saying it would get to 15% within 2-3 years.

Thank you M192,

Impressive! I am actually from the Mid-west. What part of the Mid-west do you specifically target?

MI186, Primarily Wisconsin and Indiana

Thanks M192!

I actually passed along your story to my brother and he was super inspired!

You mentioned using a self-directed IRA to invest in mortgage notes. How do you have this structured and who do you use? I have a very small pension (like 33k) that is being rolled over to Fidelity right now but i’m a bit hesitant to use it to buy public equities because of the recent run in the market (although it’s a good thing!).

I was thinking of doing the self-directed IRA thing using Entrust group and just investing in a deal on Crowdstreet (I think Entrust charges $150/yr and then some other fees) OR using Groundfloor and putting it to work there since they currently charge zero fees. Any thoughts?

Great Story!

I am fascinated by your rental portfolio. How is someone at your income level (presumably with a fairly demanding day job) able to manage so many (under $50,000) remote properties? Obviously you must have some kind of management team in place. However, I would think the headaches of managing the management team would not be worth the headache (but clearly it is).

Matt, yes, I can completely understand. It does seem time consuming. See my reply above to TimR about how I manage the properties. What I would also add is that there are often many things that seem daunting at the outset, but isn’t really that bad once you get into it and if you enjoy it. I think this is one of the hardest things to do, going from zero to one. It is probably the biggest cause of people not fully realizing their potential. I would suggest to everyone to at least try it (albeit on a small scale) before deciding anything is too hard to do.

“I think this is one of the hardest things to do, going from zero to one.”

That statement right there is wisdom. I have spoken with many people who are real estate capable and want/hope/wish/plan to get into it. Those are weasel words, even though they don’t intend them to be. They truly do want to get into it, and they think this keeps them on the path. Unfortunately these weasel words just keep them on the couch. Preparation is important, but preparation is not being on the path. You are not on the path until you step onto the track, put your feet in the blocks and push off at the starting gun. Then you are on the path.

Unfortunately the path is a steeplechase race with the first hurdle being the water hurdle and it looks scary. Most people spend their time on the sidelines looking at that water hurdle trying to figure out how to clear the hurdle and the water in one jump. This of course cannot be done, but they think that’s the only safe way to get started.

Thus they never get off the couch and onto the path because they aren’t willing to get wet.

Apex, well said.

Hi there,

First of all, congrats. Great story and seems that you have strong values.

Very interested to learn a few things:

– Why did you decide on Midwest for properties vs say CO, UT or south TX, FL?

– How do you look for investor friendly Real estate agents?

– Does your RE agent usually recommend certain property managers or you tend to find them?

Cheers.

Alex, thanks. Here are a few comments on your questions:

1.) I chose the Midwest primarily for the cash flow and low asset prices. Places like TX, FL etc are great markets for appreciation, but terrible for cash flow.

2.) I usually find some good investor friendly realtors by listening to RE podcasts or on BiggerPockets.com. Takes some trial and error. Some realtors say they are investor friendly, but when you talk to them in more detail or talk to their references, they you find out otherwise.

3.) My realtor will usually recommend a few property managers which I will add to my list to interview. I usually interview the top 3-5 in any market I invest in, then decide from there.

Thank you very much for reply. Great insights. Really appreciate your honesty and time you took to reply.

Quick follow up – what city/state in your opinion/experience has best cash flowing characteristics?

P.s. On dividend investment – just 5c fro former PM at different funds – 10% and higher on Div yield is a bit dicey, unless the company has <50% payout ratio and good multiples. You can lose not only income stream but value as well. I am pretty sure you know this better than I do.

Once again, thank you.

Alex, I think a lot of Midwest cities that are in recovery mode have some good cash flow potential. Places like Detroit, Ohio, Wisconsin, Indiana, etc.

Yes, totally agree on the 10% dividend stocks. Those are risky. My point is that I like to buy solid dividend stocks (like Dividend Aristocrats) that have yields of 4-5%, that will GROW to 10% yields over time based on their historical dividend growth rates. So if I purchase a stock for $100 in 2015 that yields 5% (or $5) and then that dividend grows at 7%/year, the dividend will be $10 (or a 10% yield) by 2025 (10 years). That is my yield on the cost of the stock vs the yield on the stock if purchased in 2025. And it should continue growing from there.

Would you mind sharing or describing your specific job / job title post-MBA? It appears you cleared $400k in income around age 29. Very curious what field within the financial sector you got into? Super informative, thank you sir.

Mike, I spent part of my career in Investment Banking working on Wall Street. Then joined a few large companies doing similar work “in-house”.

I love this line.

“I don’t put a lot of stock in being called a millionaire. Instead, I value financial independence”

Love it!

Congratulations – very inspiring!!

Man I wish we could buy quality properties like that in Australia – they are SO expensive and our yields at best are 4-5%.

Jonathan, thanks. Yes, I have heard that about AUS. You may want to consider trying other markets outside of AUS. With technology today and other RE platforms it makes it easier to be a “remote control” landlord :—)

Congrats on your hard work and success. One quick question, and admittedly very nitpicky. Given your high income, is there a reason you didn’t max out tax advantaged savings? I would think you would have a much higher balance in your IRA/401K category. Clearly won’t impact your future financial security, but would have thought that would be an area of least resistance…

Great observation. I too have wondered like M192 how people have such high tax deferred balances. More like I’ve been impressed.

I’ve been contributing from day one focused more on not missing company match. I think in my early career my firms were a bit stingy and I didn’t max my contributions like I should have. I am at around $600k in 401k/ IRA balances. Mine seems low to me. But I still have 13 years before 59.

MI#1, thanks. That is a great observation. I have often wondered how others have accumulated such large tax advantaged savings. I have actually tried my best to max out my 401(k) at every job, including theIr match. So not sure why it isn’t higher. I have not done any non-tax deductible IRA contributions though as I didn’t see the benefit there.

I worked for a Japanese company for a number of years. they didn’t have publicly traded equity to offer as compensation, so they made a disproportionately large match to my 401K for a number of years. That jump started mine. my balance (which will be updated in August as part of ESI’s millionaire update series) also includes 401K balance from my wife, and since she has a 40K as well as a SEP IRA, we are at about 1.2MM or so combined…I’m 53, she just turned 50…

We max out with catchup now as well…

Hi. Quick queStion on MBA. What’s your view on part time MBA from top school? Given that one will not go through typical mid-term internship/offer from IB/MBB Management Consulting? Is it worth it? Or in other words – do you think it has as good of ROI as full-time MBA or if we compare part-time MBA vs investing that money in RE?

Thank you in advance.

Pete, I’m no expert on this topic, but I do think there is also value in a part-time MBA from a good school. The classmates you will meet, the access to the alumni network and the job search platform that the school provides will help with access to great job opportunities.

Pete, I talk a bit about my MBA experience from a Top 20 part time program in my MI-182 interview. Might help to cross reference. My income certainly hasn’t been what MI-192’s has (you can also see my pattern in my interview), but the MBA definitely helped me. It’s an important differentiator that “checks a box” in career opportunities if you intent to work in corporate America.

Awesome job. Well done! We seem to have similar paths. I have a hard time too with my wife’s spending some times but have learned to chill. Any thoughts on what you are going to do in retirement?

MI160, thanks. I have been thinking a lot about the next chapter. I sorta want to follow in the footsteps of ESI. I love helping people and sharing what I have learned along the way. I’m not a great writer so the blogging component will probably be small. I’d love to also get into financial coaching for kids and young adults. IMHO, it is so important to learn these financial lessons early in life so you have the benefit of time to compound your money.

I may have something for you to help get started/see if you like it.

Drop me a note when you get the chance.

That’s awesome and what I’m starting to do now in schools in my area. That and entrepreneurship. It is very satisfying. Curious what ESI is talking about. Would love to learn more too!

I’ll email you…

This is a great breakdown – M192. Thank you very much for sharing everything you did. I’m in early 40’s and not as far along as you but working in that direction. Impressed with your real estate portfolio in particular – my wife and I are hoping to start in that direction later this year.

I also strongly believe in dividend investing – I’m growing a dividend portfolio as well – not quite as large as yours – but heading in that direction down the road.

Thanks for a nice interview.

Brian, thanks. Appreciate that. Best of luck on your journey.

Hi,

Thanks for interview. Great stuff. What RE podcasts would you recommend?

Thanks

Keith, thanks. The RE podcasts I listen to most often are Bigger Pockets, Chad Coach Carson and Creating Wealth with RE (Jason Hartman)

Hi M-192, I loved reading your story. It’s inspiring and where I would love to end up eventually with my real estate investments. Would you be willing to talk over the phone about your real estate strategy? I’m happy to pay for your time.

M111, happy to do it. Leave your contact info in a reply or maybe ESI can connect us

Hi there,

Very interested as well in connecting and asking a few questions if you have some free time. I am in my mid 30s and would love to learn about career and REI from somebody who achieved so much. Promise to be respectful of your time. My email is balexy1983 @ gmail. My middle name is Alex. Thank you very much in advance.

Great story and thanks for sharing! It makes me think a lot about diversification into RE, especially with the world turned on it’s head in 2020.

You mention tax advantages in dividend investing – I wonder if you could elaborate? My experience was the opposite, but I was too early. I started with a small investment ($10-20k), and grew tired of an additional tax bill for a couple hundred bucks in dividends, so I shifted 100% to long term capital gains/growth investing. But I fully intend to eventually move that over to a dividend mix when the investable amount is much larger and I’m closer to “Phase II” (semi-retired/not working full time in corporate America anymore).

I will also echo your comments that it’s a balance of dividend and growth – I had some failures/washouts chasing high yields, and then learned to find stocks by watching dividend growth rate and monitoring dividend payout ratios so they don’t get too far over their skis. Have you found any other tips or metrics in finding good dividend stocks?

MI182, thanks for the kind words. As far as the tax efficiency on dividends, qualified dividends are taxed at a lower tax rate than ordinary income. In fact, if you are married and file your taxes jointly, and your income is below $80K, there are no taxes on qualified dividends or long-term cap gains.

I have read, and re-read your story and am very inspired. I wish I was friends with you so we could talk finances on a regal basis. lol.

Would you mine sharing the specific dividend stocks you settled on?

Bridget, thanks for the kind words. I settled on the following dividend stocks:

Altria Group

Global X Nasdaq 100 Covered Call ETF

Franklin Resources

Fifth Third Bancorp

AT&T

Unum

Comerica

Prudential

ExxonMobil

AbbVie

IBM

MSM

3M