If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview took place in October.

Some readers may wonder if the interviewee is one that I partner with in real estate syndications. He is not. This is not a negative comment on him, it’s just that I developed my list of syndicators prior to meeting this interviewee.

I have invested with one of the syndicators on his list of partners, but I did this directly with the syndicator itself and not a fundraiser like this interviewee. Again, not that it is good or bad, just my investing style as I prefer dealing directly with the syndicator.

Just wanted to make this clear so you know there is no conflict of interest or business relationship involved in this post.

My questions are in bold italics and their responses follow in black.

Let’s get started…

OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

I’m 31 years old and my wife is 32 years old.

We have been married for 2 and half years and together for 10 years.

Do you have kids/family (if so, how old are they)?

Within the last week of this writing, we had our first child (a boy!) and could not be more thrilled/excited.

What area of the country do you live in (and urban or rural)?

We live in Southern New Hampshire, 10-15 minutes outside of one of the major cities in NH.

What is your current net worth?

$1,154,298

What are the main assets that make up your net worth (stocks, real estate, business, home, retirement accounts, etc.) and any debt that offsets part of these?

Retirement Accounts: $177,753

- 401K (VTI): $83,145

- 403B (VTI): $79,465

- Roth IRA (VTI): $15,143

Taxable Brokerage Account: $543,852

- Vanguard (VTI): $543,852

Cash: $117,333

- Checking: $21,135

- Savings: $96,198

Real Estate Syndications: $189,000 (50% of $378,000 in equity owned with business partner)

- 2 Multifamily Apartment Funds: $89,000 (based on initial equity investment, not projected final sale value)

- 6 Single Asset, Multifamily Apartment Investments: $100,000 (based on initial equity investment, not projected final sale value)

Rental Property: $53,750 (50% of equity owned with business partner, based on current sales comps ($195,000) minus projected 10% sales costs and current mortgage ($68,000))

- 1 Single Family Rental Property (Jacksonville, FL): $53,750

Crypto: $36,610

- BTC: $29,510

- ETH: $7,100

Angel Investments: $36,000 (based on initial equity investment)

- 18 Angel Investments (Seed A or earlier): $36,000

Other than the 50% mortgage on the Jacksonville rental property, we are debt free as we currently rent our townhouse, pay off our credit cards each month and paid off our student loans (about $80k each) a few years back.

EARN

What is your job?

I’m an Enterprise Sales Executive that sells Corporate Social Responsibility (CSR) software to F500 companies across a variety of different industries. The software enables companies to manage, track and produce metrics for their annual CSR and Environmental, Social, and Governance (ESG) reports, which is becoming increasingly important to institutional investors.

My wife is an Assistant Vice President in the Registrar’s Office at one of the largest online Universities.

What is your annual income?

My base salary is $140,000 and through the end of October I have earned $445,000 in sales commissions.

My wife has a base salary of $108,000 with yearly bonuses around 10-15%.

Tell us about your income performance over time. What was the starting salary of your first job, how did it grow from there (and what you did to make it grow), and where are you now?

My wife started working as a Wedding Coordinator ($35,000 starting salary) but got burned out after a few years with the grueling schedule consisting mostly of nights/weekends so she decided to take an entry-level job at one of the largest online Universities in 2013 for $39,000. It turned out to be a great decision as she’s been promoted and received strong raises/performance bonuses every single year (no surprise, as she’s incredibly talented and hard working).

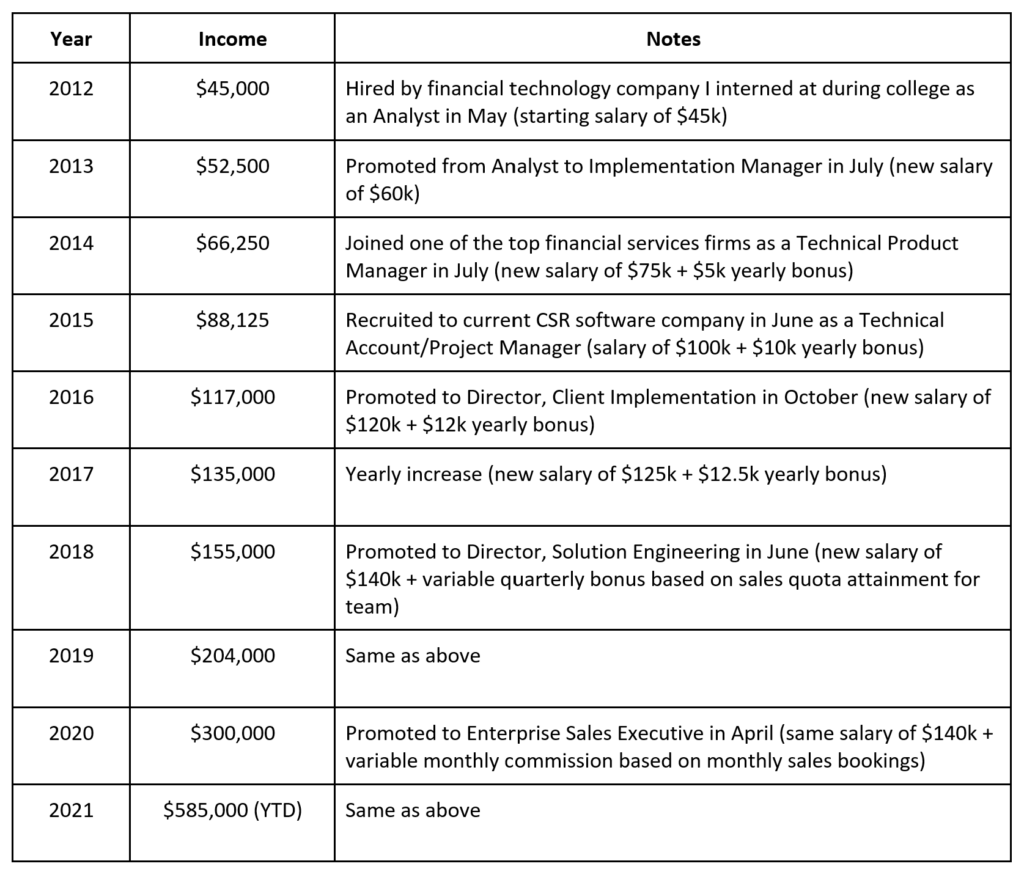

Below is a breakdown of my yearly income:

What tips do you have for others who want to grow their career-related income?

Perform at an extremely high-level.

Seems obvious, but it is critical to your future career earning potential to be seen as a top-performer.

Communicate desire for additional responsibilities and volunteer for new projects/initiatives.

As a top-performer, you can push for additional assignments that will help broaden your skill set and show leadership that you’re willing to go the extra mile. Better yet, you can volunteer for new initiatives that you have identified vs. ones assigned to you.

Research and apply to interesting opportunities at different companies on a regular basis.

Regardless if you enjoy your current role and like your existing company, you should always be researching what other opportunities exist in the market.

This could result in a better/higher paying role at a new company, leverage to get promoted and/or increased compensation at your current company and at the very least, it will help you stay informed of the companies and future roles that you might be interested in.

Find a company with strong growth potential and future career opportunities.

I’ve found that smaller companies give high-performers the best opportunity to make a strong impact, get face-time with executives, and put yourself in a position to advance your career and income faster. Larger companies tend to have very structured job levels, pay bands, and experience requirements for specific roles. This can stifle your career growth as you can get held back for promotions and compensation increases specifically because of experience/tenure, even if you would be a perfect fit for an open role.

I experienced this first hand when I worked at one of the top financial services firms and was told outright by my manager that I should leave the company, then come back after a year or so where she could hire me back three levels higher (gotta love corporate bureaucracy 🙂 ). Based on this experience, I decided to join a much smaller (sub 200 person company) and not return.

Build strong connection with a C-Suite mentor.

A smaller company provides easier access to C-Suite executives but this is still applicable even if you work for a larger company. Having a strong friendship and professional connection with a mentor is invaluable as they will be able to help you better understand the strategic initiatives of the company and provide advice/feedback on how to advance and manage your career.

My most impactful mentor (who is still a very close friend even though I no longer work with him) was critical to helping me navigate my career path and serving as a valuable advocate with other C-Suite executives.

Transition from operations to solutions/sales.

This isn’t for everyone but I firmly believe that the quickest way to increase your income is to move towards a commission-based sales role. The compensation structure of these roles varies by company but ultimately it puts high-performers in a position to be compensated based on their specific revenue contributions to the organization. Rather than needing to hit company or team goals which are outside of your control, a sales executive can control their own destiny while learning valuable skills in the process.

Initially, I was hesitant to go down this path as I cringe at the “car salesman” stereotype, but the more I was exposed to top-salespeople (especially ones that sell to large, complex companies) the more I realized that great salespeople are extremely similar to high-priced consultants. They are experts at identifying customer pain points, providing a future-state vision, developing a detailed solution plan, and helping the customer navigate through their own internal processes to move forward with the new solution.

Constantly work to sharpen and build new skills.

As you take on more responsibility and challenging roles, it is imperative that you improve and build new skill sets to ensure you can continue as a high-performer.

In addition to developing specific business and technical skills for your desired career path/industry, also focus on skills that will help you across the board such as communication (written and verbal), presentation, negotiation, leadership, problem solving, conflict management and networking (to name a few).

Focus on health and wellness to ensure peak performance at work.

Let’s say a top-athlete on your favorite NFL team (go Pats!) showed up to training camp unprepared and wildly out of shape due to a fast-food diet, heavy drinking, lack of sleep and no training. Because of this, the team drastically underperforms. How do you think the media and the fans would react (hint: not well)?

I’m of the opinion that we should be just as critical with ourselves when it comes to our performance at work. This means exercising, eating well and any other techniques to ensure we can be at our peak physically, mentally and emotionally to give ourselves the best chance of success on a daily basis.

In addition to the action items that have benefited my career above, readers should review and implement the concepts captured in ESI’s great blog – Seven Steps to Increasing Your Career Income. I wish I was aware of this resource earlier in my career but I’ve made it a point to share it with younger colleagues since I discovered it!

What’s your work-life balance look like?

Pre-COVID, it was a little crazy as I would travel domestically 3-4 times a month and internationally about once a quarter for onsite meetings with prospective and existing clients. Counting this travel time, I would average between 70-80 hours per week.

Post-COVID, has been less crazy as all client interactions have been virtual so I’m closer to 50-60 hours per week. My hope is that as business travel recovers, there will be more thought given to which meetings require onsites (which are definitely critical in certain scenarios) vs. ones that can be handled via Zoom.

In addition to my W-2 job, I also spend about 20-25 hours per week managing my real estate syndication business with my business partner (more on this below).

Do you have any sources of income besides your career? If so, can you list them, give us a feel for how much you earn with each, and offer some insight into how you developed them?

As you probably noticed from our net worth breakdown, real estate syndications are a key component of our overall portfolio. I’m a huge believer in the benefits of real estate investing and think it’s a powerful vehicle to help achieve financial freedom.

Our investments currently produce between $20,000 – $100,000+ per year (depending on exits), and the income is almost completely tax-free due to the accelerated depreciation that offsets the income.

My business partner (and best friend) have been investing in real estate in various forms since 2015. Our first strategy was to acquire 1-4 unit rental properties, in low cost areas (Jacksonville, Indianapolis, Kansas City), that were projected to have strong cash on cash returns. As busy professionals, we did not want to be active investors (especially living in New Hampshire), so we researched and partnered with “turnkey” providers that would find, renovate, rent and manage these properties then sell them to investors. By 2017 we had acquired 5 single family properties and 1 duplex.

Everything seemed great initially, but as soon as tenants started moving out we ran into serious problems. From severe property damage, to outright theft (we had two water heaters stolen from the same property within three months!), the repair costs and vacancies soon ate into our cash flow. Even worse than the nightmare tenants, the property management companies simply threw their hands up in the air and were completely unresponsive, unprofessional and offered zero solutions.

After a couple years of trying to fix these issues, we decided that it was a lost cause and started liquidating the entire portfolio (except our single family property in Jacksonville as that had a long-term tenant with a lease until 2024). Fortunately, the real estate market appreciated significantly while we owned these properties and we were able to still make a strong return on our investment.

During the time we were selling these properties, we started researching other potential real estate strategies that were truly passive and more professionally operated. Through the BiggerPockets real estate forums, we began networking with real estate syndication operators and capital raisers to learn more about the inner workings and benefits of syndications. We were instantly hooked and began heavily investing in these syndications starting in the fall of 2019.

In early 2021, as we continued to invest and network with folks in the real estate syndication community, we were asked if we were interested in raising capital for these syndications and immediately jumped at opportunity. Since that time, we have completed the FINRA licensing process, formed strategic partnerships with 10-12 different syndication operators across the country, focused on creating educational content and providing 1-2, pre-vetted, investment opportunities to our investment club each month.

We love the fact that we can help others avoid the mistakes we made in real estate and expose them to what we believe is an under-the-radar, extremely powerful vehicle to access passive real estate.

SAVE

What is your annual spending?

Our 2020 combined annual spending was $68,869 and is on track to be within that range this year as well.

What are the main categories (expenses) this spending breaks into?

Based on the categories we defined in Personal Capital, here’s the amount and percentage of total budget each represents:

- Housing: $28,818 (41.8%)

- Groceries, Restaurants and Alcohol: $11,313 (16.4%)

- Travel: $7,171 (10.4%)

- Clothes, Furniture and Miscellaneous: $6,570 (9.5%)

- Health, Fitness and Personal Care: $4,642 (6.7%)

- Utilities, Phone and Internet: $3,346 (4.9%)

- Auto and Transport: $3,311 (4.8%)

- Charitable Donations: $2,268 (3.3%)

- Entertainment: $1,430 (2.1%)

Do you have a budget? If so, how do you implement it?

We don’t have a specific budget but we track our expenses closely using Personal Capital. This involves weekly categorization (in case the default category assigned is incorrect) and a monthly review in conjunction with our monthly net worth tracking.

The main goal is to ensure our spending aligns with categories that bring value and joy (i.e. nice place to live, spending time traveling, going to restaurants/breweries with friends/family) vs. categories that don’t (i.e. expensive vehicles, fancy clothes).

What percentage of your gross income do you save and how has that changed over time?

Our gross income savings rate has increased from around 40% a few years ago to close to 70% today.

This increase is the result of our expenses staying relatively flat while our income growth has risen substantially.

Obviously, taxes are a large part of the gross income expenses but we are fortunate that we do not pay income tax in New Hampshire.

What’s your best tip for saving (accumulating) money?

These have all been mentioned in numerous other interviews but I think the core tenants are:

- Pay yourself first by saving then spending vs. spending first then saving

- Automate the savings as much as possible

- Utilize tax-advantaged vehicles to decrease taxes on income and investment gains

- Avoid lifestyle creep

- Let compounding interest/the rule of 72 do the heavy lifting

What’s your best tip for spending less money?

Avoid “keeping up with the Joneses” at all costs. YOUR spending should align with the things that bring joy and value to YOUR life, not things to impress others.

One of my favorite quotes on this topic is from Ramit Sethi’s book, I Will Teach You To Be Rich (Second Addition):

“Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”

What is your favorite thing to spend money on/your secret splurge?

My wife and I absolutely love to travel and have no issue spending a premium for great hotels, business class flights and amazing experiences.

It’s also fun to plan these trips as I enjoy finding creative ways to utilize airline miles, credit card and hotel points to optimize travel even further!

INVEST

What is your investment philosophy/plan?

My investing strategy is to diversify across non-correlated assets, using a mix of private, public and alternative investments.

At my age, I’m comfortable being very aggressive in terms of asset allocation (no bonds, low cash holdings outside of savings for an eventual down payment) in an attempt to position ourselves for maximum return.

I’m a huge proponent of low-cost index funds (VTI) but I also believe in having assets that are completely uncorrelated to the stock market and have higher return potential. Based on this, I started adding alternative investments to my portfolio about a year ago.

My current target allocation is as follows:

- Stocks: 50%

- Real Estate: 40%

- Alternatives: 10% (Crypto (80% BTC/20% ET): 5%; Angel Investments: 5%)

I’m fully aware that the alternative investments could be completely wiped out and go to zero, but I also think the potential upside outweighs that risk.

Another plus is that I very much enjoy researching, analyzing and investing in startup companies.

What has been your best investment?

Marrying my amazing wife is by far the best investment I have made, and will ever make.

There is no possible way I could have achieved anything close to what I have accomplished without her encouragement, support and guidance. Being married to someone who is extremely focused, driven and constantly working long hours is not easy but there has never been a time when I didn’t feel like she had my back 1000%.

What has been your worst investment?

Investing in 1-4 unit, out of state, “turnkey”, rental properties.

As mentioned earlier, we were able to make a positive return on all of these investments but the amount of time, energy and stress that went into owning and managing both the property and property management companies was brutal.

While this type of investing may be a great fit for certain people, I think it’s critical to evaluate whether you should be a passive or active real estate investor. As someone with a full-time job which requires many hours per week, the answer is definitely passive.

As painful as it was, I’m very grateful for that experience as it directly led to my business partner and I pivoting our investment strategy to focus on multi-family apartment syndications, which have been completely passive and have delivered strong, tax-advantaged returns.

What’s been your overall return?

Overall return broken down by asset class:

- Stocks: 24.4%

- Real Estate: 45.8% (based on rent cash flow and sales/exits)

- Alternatives: (Crypto (80% BTC/20% ET): 50%; Angel Investments: N/A – no cash flow or sales/exits at this point)

How often do you monitor/review your portfolio?

I review our net worth monthly using our Personal Capital account.

NET WORTH

How did you accumulate your net worth?

My wife and I do not come from wealthy backgrounds so inheritance and other forms of financial assistance were not available to us (which I actually think is a great thing!). More importantly, both of our parents are extremely loving, supportive and helpful (especially with their new grandson!) any time we need them.

From a financial standpoint, they both made a number of mistakes that served as lessons learned for my wife and I growing up. Seeing our parents go through bankruptcy, foreclosure, high credit card debt and overall stress about money definitely shaped how we approach our finances. Luckily, they are both doing very well financially now and have been very perceptive to our advice and suggestions.

Our net worth can mainly be attributed to aggressively growing the gap between our income and expenses. We are big believers in “control what you can control” which is why we focus on these two areas, vs. investment returns.

What would you say is your greatest strength in the ESI wealth-building model (Earn, Save or Invest) and why would you say it’s tops?

Earn is definitely at the top of the list followed by Save and Invest.

For whatever reason, earning money has always come naturally to me as I’ve been able to find and take advantage of opportunities to increase it on a relatively consistent basis.

What road bumps did you face along the way to becoming a millionaire and how did you handle them?

The biggest road bump was climbing out of over $80,000 in student loan debt which luckily took only a few years.

I wanted this debt off my personal balance sheet quickly, so early in my career I made a concerted effort to put as much money as possible from each paycheck along with throwing any bonuses, raises and tax returns at the principal.

I also lived with my parents for a couple years after college at no cost (thanks Mom and Dad!) which helped a ton as I could use the funds that would have been allocated to rent towards my student loans.

What are you currently doing to maintain/grow your net worth?

Stay focused on the things we can control and don’t stress about what we can’t.

For me, the three main areas that will directly contribute to growing our net worth are:

- Maximize W-2 Earnings: strive to become the best salesperson I can be by mastering my craft on a daily basis. It’s a huge motivator knowing that my commissions are uncapped so the potential earnings are limitless.

- Grow Real Estate Syndication Business: continue to partner with strong sponsors/operators, identify attractive markets and submarkets, educate potential investors, increase the amount of capital raised and invest our own funds in 12-15 additional deals by the end of 2022.

- Control Expenses: ensure our spending stays aligned with the areas that bring us value and joy so we can keep enjoying ourselves and at the same time, allocate a significant amount of money towards investments.

Do you have a target net worth you are trying to attain?

Yes, our target net worth is $5,000,000.

This will provide us plenty of flexibility for our expenses to grow as our family expands and a significant margin of safety so steep drops in our portfolio are non-events.

How old were you when you made your first million and have you had any significant behavior shifts since then?

We crossed the million-dollar milestone a few months back, each of us were 31 at the time.

Nothing has changed in our behavior since that time, other than reflecting on how strange it is that we are millionaires, which is wild to think about.

I’m also excited and very interested to see how quickly we can get to the next millionaire milestones. 🙂

What money mistakes have you made along the way that others can learn from?

The biggest money mistake I made was cashing out my 401k in 2014 for a downpayment on a condo I purchased.

The total amount was only around $15,000 (minus the 10% early withdrawal fee) but considering that same money now would be worth close to $40,000, it definitely serves as a painful reminder on the power of compounding.

What advice do you have for ESI Money readers on how to become wealthy?

Don’t be intimidated or think becoming wealthy is out of your reach! If you are intentional about growing the gap between your earning and spending, the power of compound interest will take care of the rest.

Along the way, make sure you are still enjoying your money and using it on things that bring you joy and value, while avoiding wasting it on things you don’t. As Paula Plant brilliantly puts it:

“YOU CAN AFFORD ANYTHING…But not everything..”

FUTURE

What are your plans for the future regarding lifestyle?

Within the next 2-3 years, my goal is to have the option of never needing to work a corporate job again.

My current company is set to go public within this timeframe so I’d like to align my retirement with that milestone.

Based on our current trajectory, that will be feasible as my wife loves her job and doesn’t see herself wanting to leave any time soon.

What are your retirement plans?

While I do want to retire from the corporate world, I certainly want to keep working on the things that I enjoy today: analyzing and investing in startups, crypto and real estate syndications. It will be great to focus on these without having to juggle the responsibilities that come with a W-2 job.

I’m also looking forward to spending more time with my friends and family, reading, exercising and traveling for longer stretches of time.

Most of all, I’m excited to have more control over my time on a daily basis.

Are there any issues in retirement that concern you? If so, how are you planning to address them?

Echoing the thoughts of many previous Millionaires, healthcare is definitely the biggest concern. Luckily, my wife has no plans of leaving her job any time soon and has fantastic healthcare coverage, but I do want to be prepared for when she is ready to retire.

To that point, I’ve closely followed the fantastic healthcare information that ESI has provided and will continue to do so as it’s opened my eyes to potential options that I didn’t even know existed.

MISCELLANEOUS

How did you learn about finances and at what age did it “click”?

I’ve always had a pretty good grasp and understanding of personal finance and loved reading about money (Rich Dad Poor Dad was an early favorite), but it really clicked for me shortly after I listened to Mr. Money Mustache on the Tim Ferriss Podcast in early 2017.

I was immediately hooked after that interview and ended up reading every one of MMM’s blog posts. From there, I found the ChooseFI podcast, which is where I first became aware of ESI and have been an avid reader ever since.

Quick rant: you would think as a finance major in college that personal finance would have really clicked at that time. Unfortunately, that’s not the case as there wasn’t a single personal finance course in the entire curriculum. To be frank, I think the fact that the vast majority of middle and high school students aren’t being required to take personal finance classes is a travesty. My view is that financial literacy is just as critical as literacy itself and it’s why I’m a huge fan of the Choose FI Foundation and the amazing work they are doing.

Who inspired you to excel in life? Who are your heroes?

My parents are definitely my heroes and I couldn’t ask for better role models. They constantly put the needs of myself and my two brothers ahead of their own and encouraged us every step of the way. Having that solid foundation of support has been critical throughout my life.

I’ve also been inspired by the countless biographies/auto-biographies I’ve read over the years. It’s enlightening and extremely motivating to dive deeply into the personal history, trials, tribulations and triumphs of some of the most impactful people in history.

There are too many to list but below are a some of my favorites:

- Titan: The Life of John D. Rockefeller, Sr. by Ron Chernow

- Buffett: The Making of an American Capitalist by Roger Lowenstein

- Warren Buffett: Inside the Ultimate Money Mind by Robert G. Hagstrom

- The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance by Ron Chernow

- Alexander Hamilton by Ron Chernow

- Benjamin Franklin by Walter Isaacson

- Steve Jobs by Walter Isaacson

- Amazon Unbound: Jeff Bezos and the Invention of a Global Empire by Brad Stone

- The Ride of a Lifetime: Lessons Learned from 15 Years as CEO of the Walt Disney Company by Robert Iger

Do you have any favorite money books you like/recommend? If so, can you share with us your top three and why you like them?

I love reading books about money and personal finance so it was difficult to trim this down to my top three:

- Set for Life: Dominate Life, Money, and the American Dream by Scott Trench: packed with detailed information and strategies to earn more, spend less and invest the difference. It also provides a great introduction to the power of real estate investing from an expert (Scott is the CEO of BiggerPockets – a fantastic real estate education website and interactive forum)

- Richer, Wiser, Happier: How the World’s Greatest Investors Win in Markets and Life by William Green: distills insightful lessons learned on investing and life in general from some of the greatest investors (Warren Buffet, Jack Bogle, Charlie Munger, Howard Marks and many more). It’s fascinating to explore and learn from the different strategies, mindsets and investing frameworks of the world’s greatest investors.

- I Will Teach You to Be Rich (Second Edition) by Remit Sethi: will help reframe how you think about spending (“Spend extravagantly on the things you love, and cut costs mercilessly on the things you don’t.”). There are also a ton of actionable tips and recommendations in each chapter that can be applied immediately to help improve your finances.

Do you give to charity? Why or why not? If you do, what percent of time/money do you give?

My wife is a volunteer at Make-A-Wish and we donate around $2,000 a year to various causes.

This is definitely an area we would like to focus more time and money over the next few years as we are both passionate about making a positive impact in the lives of others.

Do you plan to leave an inheritance for your heirs (how do you plan to distribute your wealth at your death)? What are your reasons behind this plan?

We have not discussed or started planning how we would like to handle inheritance but we will start exploring potential options/strategies now that we have a child to think about.

Shout out to the 603!

Congrats and good job on the first million… the second one comes in the blink of an eye.

Amen on the 603 (other than the brutal winters) haha

And thank you! Looking forward to seeing how quickly the next milestones arrive!

MI ??? The next million in a blink of an eye? You are familiar with 2022 market I hope which proves markets don’t always go up if experiencing 2001 and 2008 crashes didn’t teach us this lesson. This time it took a little longer. Net worths tied to the market are in rapid retreat right now. No-one is crowing about their losses like some did about their past temporary gains. First you have to hope the market doesn’t drop significantly more (Target of all the great companies dropped 25% in one day that doesn’t happen in a healthy market not to mention the Netflix and Amazon drops). The retired 4% rule guru recently wrote he went 70% cash as he is terrified of market conditions and in doing so is losing 8.5% to inflation. Second you have to hope the market claws back the steep losses. Third you have to hope the Fed doesn’t drive us into a prolonged recession or worse stagflation busting lots of peoples dreams and incinerating the FIRE movement. The next million won’t be a blink this time unfortunately. Maybe Biden can save peoples retirement portfolios, tamp down inflation and make this predicted pent up demand so called boom we have been waiting for come to fruition. I think he is sleeping on the job personally. Silent Joe Biden. We need a warrior for our economy and to ensure the pursuit of happiness promise is there for all generations.

Great interview. Congrats on doing so well so young. You have done well keeping your spending low. Keep that up a few more years and you will really be set. Maintain that big delta between spend and earn and keep investing you will continue to do well. If we continue to have a downturn in stock prices (and maybe eventually real estate) you are now in your salad years of earning and will have a great opportunity make some great investments on the cheap. When the market comes back you will benefit.

Kid on the way is the best part of your story. All that hard work and earning and life in general will be much more meaningful very soon – just wait, you will see what I mean. Kids are the best part of life – Enjoy!

Appreciate it!

And totally agree with the downturn in stock prices, hoping they stay low for some time so I can keep accumulating at a discount 🙂

Your spot on about the kids as well – it’s crazy reading this interview back as my son just turned 7-months yesterday!

Wow that’s quite the exponential increase in sales commissions!

I’m the same age, great job so far that’s pretty incredible income growth.

Would you consider REITs just as beneficial as those RE syndications?

Congrats on your child, hopefully work slows down a bit so you can enjoy that and still have a social life!

Thanks, Gary!

Work is still busy but fortunately I have a good amount of control over my schedule which helps balance time with the family.

I prefer syndications to REITs due to the tax benefits of direct ownership and the additional diversification away from the public markets (which REITs trade on). With that said, I think REITs are a great option for those looking to get exposure to real estate, without having to meet the high minimum investment. Another option would be Fundraise or one of the other crowdfunding platforms that have a low minimum as well.