If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview was conducted in February.

My questions are in bold italics and their responses follow in black.

Let’s get started…

GENERAL OVERVIEW

How old are you (and spouse if applicable, plus how long you’ve been married)?

My wife and I are both 49 years old, and we have been married for 27 years now.

Do you have kids/family (if so, how old are they)?

We did have a child right after we got married but she passed away before she turned 2 years old because of complications related to a congenital disorder.

We have another daughter who is now in her 20s and currently lives overseas for her PhD.

What area of the country do you live in (and urban or rural)?

We live in a metro area in the Southeastern United States.

Is there anything else we should know about you?

I am also Millionaire Interview 238 and Six Figure Interview 9.

My wife and I are both immigrants from the same country, and worked our way through from H1-B to U.S. citizenship.

RETIREMENT OVERVIEW

How do you define retirement?

Retirement for us is doing what interests us while having financial resources that can support our chosen retirement lifestyle. It’s not stopping and doing nothing which is what most people think of retirement.

It was quite funny when we “outed ourselves” to one of our closest friends, and her questions were “What are you going to do for the rest of your lives? Aren’t you wasting the decades that you have invested building your respective careers?”

After we described to her the activities that we have planned, and the framework that we’re using, she was at least relieved. However, she still thinks we’ll get bored and return back to W2 work.

How long have you been retired?

We have been retired since the end of July 2021, so we’re very early into retirement.

Is your spouse also retired?

Yes, she is also retired. More on this later.

What was your career and income before retirement?

My wife and I both have Computer Science degrees, and MBAs. She also has a Master in Computer Science degree.

We both worked in software engineering for 26 years. My last title was Vice President of Engineering for a publicly traded company while my wife was a Principal Engineer for a technology firm where she led multiple teams of software engineers both in the US and overseas.

My base salary was $230,000 with a base bonus of $75,000 which could go over 100% depending on the company’s financial performance against the financial goals. In the last 2 years, I received more than 100% of my bonus due to exceptional financial performance of my employer.

My wife’s base salary was $155,000 with a bonus of $30,000 which she received almost always 100%.

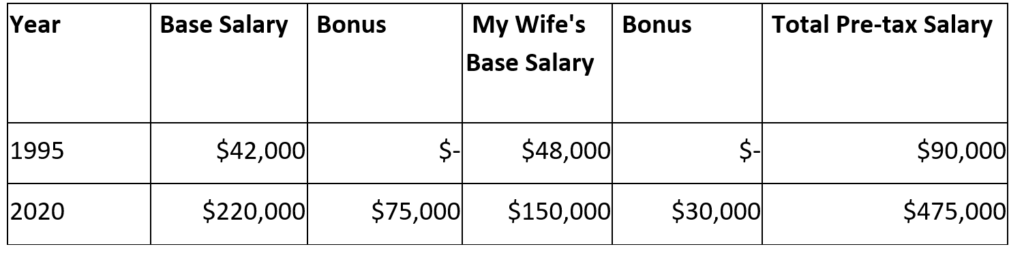

The below table shows our salary and bonus compensation when we started working compared to when we stopped working. These numbers do not include any 401(k) match, discounts in ESPP, RSUs, and stock options.

Why did you retire?

It was voluntary because we reached our Fat FIRE net worth (and more) in Q1 of 2021.

Our original plan was for my wife to stop working by the end of November 2021, and for me to follow in mid to late April 2022 because we wanted to capture the additional bonuses, RSUs, and options.

However, our plan accelerated because we wanted to take a break in 2021 after we had received the Covid vaccine, and we wanted to start a more relaxed lifestyle because we were, honestly, burnt out. Also, after valuing our remaining compensation, we thought that the money was not sufficient to offset the amount of stress that we were anticipating in the next 10 to 12 months.

I personally did not want to deal anymore with 24/7 technical operations, and with corporate politics. I used to enjoy doing them but the appeal waned after hitting FIRE. So you could also say that I had a case of senioritis. There was really not a lot of motivation left after I had decided to retire. My wife and I were excited about the next chapter of our lives together in early retirement.

PREPARATION FOR RETIREMENT

When did you first start thinking seriously about retirement and when did that turn into a decision to do it?

What prompted me to really think about retiring early was the health issues on my father’s side. The median lifespan of my father’s siblings (including him) was 53 years (my dad), and an average lifespan of 57 years. One of my uncles passed away when he was 33 years old but another when he was 80 years old. I wanted to improve my chances of extending my life by having a less stressful life, and even if I got more of my father’s, well, bad genes, I would at least have enjoyed life a bit.

Anyway, enough of the morbid talk.

As with most who have retired early, the process of accumulating assets started early. My wife and I were in our late 20s when we started to make changes in our lives so we could be financially independent. It was before the whole FIRE movement became mainstream so there was really minimal content and even terminology for the aspects of getting to FIRE. What we had in mind was starting our retirement at around 60 when we can start drawing from our 401(k) accounts.

We seriously discussed retirement after we reached our FIRE number in late 2020. We had hit our Lean FIRE number a year earlier but we didn’t think we’d hit our FIRE number so quickly. We decided to put a date in our retirement when we hit our Fat FIRE number in Q1 2021. We ended up cashing in on a big chunk of my company equity which doubled our net worth.

Lastly, as mentioned above, we had originally set my wife’s retirement date to be November 2021, and mine to be April 2022. However, we ended up accelerating that to May and July 2021.

What were the major steps you took from deciding to retire to developing a plan to do so?

1. Prepared Our Finances From Wealth Accumulation to Withdrawal

I prepared our finances for transition from wealth accumulation to withdrawal. I was and still am mostly concerned about the series of returns risk (SORR) especially during the first 5 to 10 years of retirement when SORR is high. So I read the book “Living Off Your Money” by Michael H. McClung to expose myself to other sustainable withdrawal rate strategies, and to see if I could implement one of them instead of just using 4.0% withdrawal rate or variations of it.

Additionally, I revisited our early retirement budget just so I could do one last check before we started implementing it. It all checked out; however, this exercise ended up continuing on to figuring out our marginal tax bracket which brought a welcome surprise of us likely only paying 0.20% in effective tax rate for both Federal and State.

That’s because most of our income will be coming from qualified dividends and asset liquidation which have a tax rate of 0.00% up to $83,350 in 2022. Coupled with the standard deduction of $25,900 for a married couple filing jointly and our home state not taxing dividends, we’re looking at tax-free income of up to $109,250.

Whoa, that’s awesome!

Well, I didn’t stop there, and continued to find out if doing Roth conversion for 18 years and before we turn 72 years old would have a net positive outcome compared to doing required minimum distribution (RMD) on our Traditional IRA (T-IRA) accounts. Based on the model that I created, we are looking at 68% more by slowly converting our T-IRA assets of almost $1.6MM to Roth IRA.

Well, why not!

2. Assessed our Health, the Available Health Insurance Options, and Other Insurance Needs

We wanted to maximize the use of our employer-provided insurance, so we scrambled to get our medical, dental, and vision check ups which we had postponed for more than a year due to Covid. I also found out that I was due for colonoscopy, so we had to navigate through limited schedules at our primary physicians and specialists. We had to plead to have appointments before our accelerated target retirement date.

For health insurance, I researched the various options for covering our healthcare expenses. We considered COBRA, the ACA, and healthshare plans. We eventually went with a high-deductible ACA plan so that we could continue to contribute to our Health Savings Account (HSA).

We also evaluated if we needed life insurance because we mostly relied on what our employers provided. We ended up deciding not to open a new term life insurance policy because there will be no income at risk anymore, and we have an income stream planned for the rest of our lives. However, I’m now considering a whole life insurance that would at least cover our estate taxes.

What did your pre-retirement financials look like?

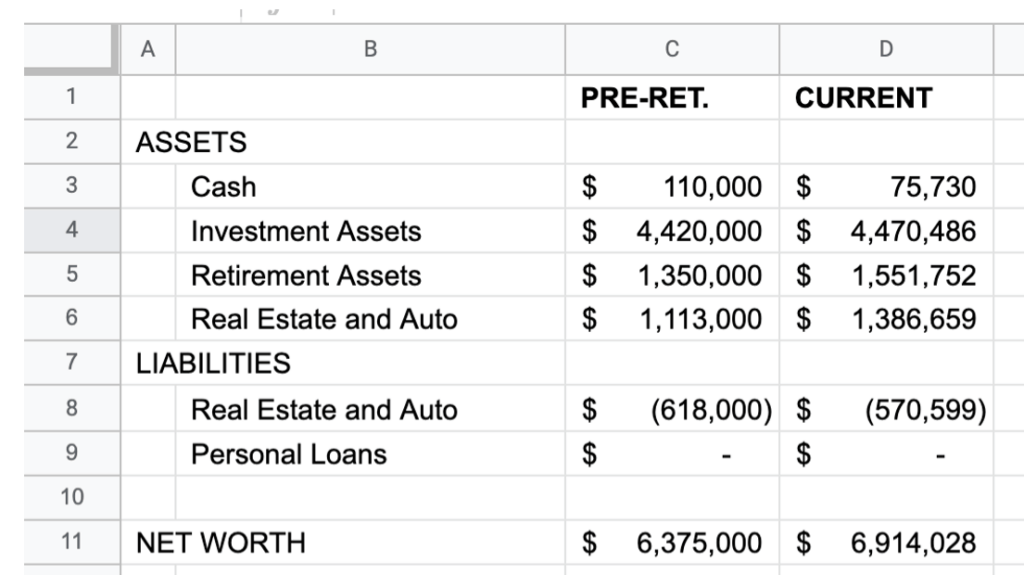

Here’s a comparison of our net worth pre-retirement and 5 months into early requirements (end of November 2021). It’s really amazing that we’re close to $7.00MM which was my original reason for setting my retirement date to April 2022 to capture my remaining RSUs, options, and bonuses.

What was your overall financial plan for retirement?

Our plan is still evolving having originally planned on withdrawing 100% of our expenses from our invested assets, to using margin loans, and now to including cover calls to generate income. Overall, here’s our current framework for funding our early retirement:

Income in Early Retirement =

- Dividends From Non-retirement Accounts

- Income From Writing Covered Call Options

- Income From Real Estate

- Margin Loan (before considering liquidation)

Estimating our annual expenses did not take long because we’ve been using budgeting software since the early 2000s. We just adjusted some budget categories, removed some, and added some. We increased our vacation allocation which now covers 33% of our budget. That budget ended up being around $15,000 per month or $180,000 per year.

Once we had a target, we iterated on various possible sources of funds to support our annual budget. Our current plan is as follows:

- Dividends From Non-retirement Accounts: between $85,000 and $100,000. Our taxable accounts returned a little over $88,000 in 2021.

- Income From Writing Covered Call Options: between $140,000 and 210,000 (pre-tax).

Those two sources should cover our living expenses, and thus, if our plan goes well, will not require liquidation of our assets.

We are diversifying into real estate in the next couple of years, so that will generate additional income. We are considering real estate syndication, and multi-unit rental properties. It will likely boil down to how much time and effort we’re willing to allocate to generate the additional income and diversification that we’re looking for.

Did you make any specific moves to prepare your finances for retirement?

We did make changes because we needed to structure our finances for withdrawal instead of accumulation. We had previously set up our allocation to be close to 100% in equities and almost 0% in bonds. So to prepare, we increased our bonds and cash to 15% of our assets and the rest in equities and REITs.

We also considered paying off our two mortgages for our two houses but we decided to postpone one and pay off the second. We figured that the net result of the money would be more if it stayed invested in the market.

However, since finding other sources of income (writing call and put options), we have since reduced our bond holdings, and are now slowly shifting to assets that are more optionable than what are currently in our portfolio.

Who helped you develop this plan?

My wife and I mostly developed our retirement plan through reading, analyses, discussions, and writing of code. We did not follow a specific template advocated by different books, sites, and bloggers because we had specific plans that did not follow the typical use case.

However, information from ESIMoney, MMM, Physician on FIRE, Curry Cracker, and others helped shape what we now call our Retirement Strategy and Plan (it’s a document that we maintain).

What plans did you make in advance to leave your job?

The biggest items were:

- Maximizing on 401(k) and ESPP contributions.

- Using our employer health insurance for medical, dental, and vision checkups and procedures.

- Coming up with a consistent story regarding our decision to leave our employers, and coming up with describing our occupation in early retirement.

Refer to “How did you ultimately retire?” for additional details.

What were your pre-retirement concerns (financial or non-financial)?

With the current Shiller PE Ratio being in the 30s, and inflation being high, sequence of returns risk (SORR) was one of my biggest concerns.

That drove us to find ways to generate some income while enjoying our retirement. I found options trading, and my wife settled on passive real estate investing.

How did you handle deciding on and paying for healthcare?

We evaluated ACA health insurance plans in healthcare.gov, health sharing plans, and COBRA. We eventually went with a high deductible ACA plan so that we could also continue to contribute to our health saving account (HSA). Our plan is to only use the HSA funds for big medical expenses in the future.

Also, I applied for an ACA subsidy because I had originally planned on paying less than 1.0% effective tax rate by not generating income other than from dividends. However, since starting doing options trading, I now have a substantial income that makes me ineligible for subsidy. I will apply for a change in income estimate soon which will remove my subsidy and the advance premium tax credit.

How did you tell your family and friends of your plans?

Our plan is to continue to be stealthy with our early retirement.

We have only informed friends and family who needed to know, and those are mostly trustees and executors named in our revocable living trusts and pour-over wills.

Why, you ask? It’s because people make wild financial assumptions when they hear people retiring in their 40s. We just don’t want to deal with all of those – people asking for money, people probing, etc.

THE ACT OF RETIRING

How did you ultimately retire?

Once we decided that we were going to retire early and that we had the finances to support the retirement lifestyle that we wanted, the first thing we did was to create a list of what we needed to do by when.

The first on the list was our annual medical, dental, and vision checks which did not happen the previous year due to Covid. This ended up having a list of its own which included mammogram, colonoscopy, wisdom teeth extraction, and new prescription eyeglasses. We wanted to make sure that we did all of them while we were still in our employer’s insurance policy.

Second on the list was the financials associated with our employers such as 401(k) contributions, and the vesting of RSUs and options. For 401(k), we created a plan so that we’d max out our contributions by our last day of employment.

For the vesting of RSUs and options, and also bonus distribution, we wanted our last day of work to be relative to the payout dates. It was because we did not know how our respective companies would respond to us quitting. Would they not payout the bonus or award the RSUs if they knew we were quitting? We did not want to take chances.

Third on the list was verifying some of our post-retirement assumptions regarding taxes, monthly “income” source, and budget. This exercise ended up bubbling up how little taxes we’d pay in early retirement because of tax rates being different for qualified dividends. That also led to a Roth conversion plan that minimized taxes during conversion and also minimized the amount subject to required minimum distribution (RMD) once we reach 72 years old. We have a combined $1.52MM in our T-IRAs to convert, so the plan calls for 20+ years of conversion.

There were unexpected questions that we had to answer. The biggest of which was “what do we do in early retirement?” 🙂

Kidding aside, we did go through the exercise of listing and prioritizing some of the pursuits that we’d like to try. We also read books to give us ideas on how to structure our daily lives in early retirement. The two books that resonated with us were The Miracle Morning, and The 5AM Club. We just tweaked them a bit to fit our situation.

For instance, instead of 1 hour allocated to silence, affirmations, visualization, exercise, reading, and scribing (S.A.V.E.R.S.), I have the entire morning for it, and the afternoon for my chosen pursuit. Am I following these frameworks to the tee? Mostly, I do but not to the tee. I don’t stress over it, I’m retired after all.

What went well?

- Adopting frameworks for transitioning to early retirement life — My wife and I work better when we have frameworks to follow. So, we have set up 4 pursuits each, we are using ISE to guide our decisions, and we have started doing these habit-forming activities.

- Coming up with a consistent story regarding our decision to leave our employers — We have two story tracks, one for work and another for non-work. My wife and I agreed on the language, and we’re sticking with them. So far the dual-story approach seems to be working well, and it also allowed us to gracefully bid farewell to co-workers.

- Maximizing pre-tax and ESPP contributions — Both my wife and I got to the $19,500 maximum 401(k) contribution before our last day of employment (end of May and early July, respectively). I also was able to get close to the maximum annual ESPP limit. We also ended up having almost no income for 3 months, so I wouldn’t suggest doing this unless you have funds set aside to support your family ahead of your retirement start date.

- Structuring our income during early retirement — We prefer to have regular income to avoid any big disruption in our cash flow, and existing processes such as paying bills, etc. We had scheduled a monthly ACH transfer to our checking account much like having a paycheck. However, we quickly updated that to be every 2 weeks instead of monthly because we discovered that once a month was disruptive to our existing payment schedule, and other expenses.

- Preparing for Roth conversion, and estimating how much taxes to pay — Although our Roth conversion plan will not start until 2022, knowing the financial impact and the tasks that we need to do for 20+ years helped with our overall financial planning. Our plan now is to convert all of our T-IRA to Roth IRA up to 22% tax bracket annually, and do it up to when we reach 72 years old to avoid RMD. We are also delaying the use of our HSA funds until much later, and for bigger medical procedures only.

- Coming up with describing our occupation in early retirement — We’re not ready to refer to ourselves as “retired”. Some implications of this relate to loan and credit applications, and legal documents and forms. That said, we are now self-employed asset managers with a combined annual salary of $250,000 per year.

- Splitting the retirement preparation — My wife and I split our preparations but we still worked as a team. I was the primary person responsible for our financial preparations while she was the secondary person reviewing my work, and making suggestions (mostly through Trello, and over dinner). She was the primary person for vacation planning, and health-related matters (e.g., check-ups, procedures, etc) while I was the person who reviewed the options and plans that she came up with.

What didn’t go so well?

- Scheduling of health-related procedures — It could be Covid-related, but some of our appointments and procedures ended up being after my original last day of employment. Fortunately, I ended up extending my transition period due to an unrelated matter, and that extension got me an extra month of health insurance with my former employer. In retrospect, I would have waited for all the medical and dental appointments and procedures to be done before submitting my resignation, or at least before my last day of employment.

- Avoiding senioritis — My wife and I originally wanted a 12-month preparation prior to our last employment date. However, we ended up accelerating that because we lacked motivation to continue to work. In retrospect, it would have been better if we had a shorter time between deciding to retire and the actual employment end date. Also, I would have attached our decision to be dependent on specific preparation milestones such as completing our health-related procedures.

- Estimating the cost of health and dental insurances — We did not estimate the ACA health plan well. My original estimate was roughly $750 per month based on my lightweight browsing of the available plans in the ACA Marketplace, but we ended up paying $1,000/month for health and dental insurance. In retrospect, I should have filtered the plans to those that have our existing primary care physicians because the lower priced ones did have them in their provider network. As an aside, if you end up enrolling in an ACA HSA plan outside of open enrollment, the contribution maximum rules are described in HSA Mid-year Changes: What Happens to Contribution Limits?

How did you ultimately find the courage to do it?

It was actually the reverse for us. We couldn’t get ourselves to stick to our 12-month plan, and decided to accelerate it.

I think in the end, our reasons for retiring early, the financial analyses, and the software that we built contributed to us getting prepared and being comfortable with our decision.

RETIREMENT LIFE

How was the adjustment, especially the first few months after retirement?

Six months in, and we are still adjusting.

My wife took the approach of not having a schedule. She wakes up between 7:00 AM and 9:00 AM, and works out for 1-2 hours. After preparing for the day and breakfast, it’s usually 12:00 PM already. In the afternoon, she does whatever she feels like doing.

As for me, I now follow a loose schedule. I do The Miracle Morning framework of “Improving PIES through Life SAVERS”. (PIES stands for Physical, Intellectual, Emotional, and Spiritual while SAVERS stands for Silence, Affirmation, Visualization, Exercise, Reading, and Scribing). I do all my SAVERS activities from 7:00 AM to 12:00 PM because, well, I don’t have to go to work :-). I have been biking 4-6 times a week for 15-30 miles which takes me 1 to 2 hours, reading 30-60 minutes on personal development, and the rest for meditation, affirmation, journaling, and visualization.

My afternoons are more “work like” where I focus more on our finances, reading technical and financial books, investing, meeting with individuals I mentor, and socializing. I sparingly logged in to Facebook and Instagram in the previous 10 years, but I have since been chatting and reconnecting with old friends and classmates.

We will likely be in this mode for another 2-3 months. I’m looking forward to dedicating my afternoons to my next pursuit which is French cooking.

My wife still seriously asks me from time to time if we made the right decision of retiring at the peak of our earnings potential. She usually affirmatively answers herself after I state that she’s welcome to work again if she wants to.

So I would say that we’re adjusting well.

How is retirement life now? What do you like about it and what do you dislike?

Every day is like Saturday. Will I get tired of it? I’ll find out soon enough. So far though, I’m enjoying the long breakfasts with my wife instead of the daily rush out the door to head to work, the time to do things that I enjoy, and the expanded interaction with family and friends.

I’m writing code again, and this time to support the management of our finances and just technical projects. I’m currently reading books on Raspberry Pi; I already have a project identified for our community.

What are the major activities that fill up your time in retirement? Are there any new ones you’re planning to try?

Apart from what I described above, we have some pursuits that we are considering. My wife has her list, but mine’s the following in order of priority:

- (Current) BMI to at least 24.9 — I’m currently at 25.3

- (Current) Options trading

- French cooking — teaching myself French techniques and cooking through Julia Child’s 2 books

- Going back to actively writing code by contributing to open source projects, and finally doing a Raspberry Pi project.

- Golfing — I used to play with a group but that was more than 10 years ago

- Improving our Bucket 2 — currently, it’s mostly REIT ETFs

What is your social life like?

With the pandemic still much active, most of my social interaction is still done remotely through the various social media platforms.

Additionally, my wife and I are now volunteers in this foundation that envisions better generational wealth in minorities through a career in software engineering and STEM in general. We still get to network in our industry and at the same time work with aspiring software engineers in their late teens in hopefully impacting their career and financial trajectory.

Unfortunately, I don’t have anyone in my circle of friends who have FIREd as well, and most of our friends are still in their early to late 40s, and early 50s, so what sucks is that they are mostly only available during weekends. That is why we are expanding our circle of friends to also include retirees in their early to mid-60s.

I am now also very active in our homeowners associations and have volunteered to lead some of the projects such as adding of common EV Level 2 chargers, and improving the internet connection for the residents and in the common places. So I’m meeting and working with new people which hopefully will translate to more social activities.

Looking back, what would you have done differently?

I wish I had accelerated our plan even faster.

Was there any emotional impact from leaving the workforce?

The biggest struggle that I had leaving the workforce was letting go.

Even though I was the Vice President of Engineering at a public company, I was still very technical and could actively participate in software design discussions with principal engineers, and review code of very junior engineers. I also started writing code in grade school, and even started my own software development business as a 19-year old college student before moving to the US to work for technology startup companies after graduating.

So the biggest struggle was leaving behind all the relationships, professional network, and technical knowledge and skills that I had developed for more than 25 years. I was known mostly for being technical throughout myself, and all of a sudden I was going to leave it all behind.

In the end, I decided that I wanted to enjoy a more relaxed life with my wife because life is short.

As an aside, I plan to continue to be technical and write code but not as a trade but more to aid in my financial analyses, and managing our financial assets.

What surprises (financial or non-financial, good or bad) have you had since retiring and how have you handled them?

It was surprising to find out that our time was quickly filled up by things that we had previously wanted to do but did not have time to do. So I allocated specific blocks of time during the day for specific things so that they are prioritized over others. For instance, I am now focusing more on personal development (exercise, reading, etc.) and no longer on professional development; my entire morning is dedicated to my personal development.

Surprisingly, my wife and I have become more patient with each other and in dealing with daily issues that we encounter. I guess with the absence of pressures from work, we’re less stressed; no surprise there.

What are your future plans?

- Continue to be curious, and to learn something new

- Travel, hike, and spend more time with our aging parents

- Just be more conscious about enjoying our journey through life

RETIREMENT FINANCES

How has your financial plan performed compared to what you had estimated before retirement?

With the market being so volatile, I do not know yet. I think it will take a few years to find out.

However, since we decided to retire and gave it a date, our portfolio has appreciated by 20% even with the recent downturn.

How are you handling Social Security, required minimum distributions, tax issues and the like?

We are not eligible for Social Security for another 14-15 years, and Medicare for another 17-18 years. Our plan is to use our savings, and taxable investments for as long as we can before tapping into our T-IRA and Roth IRA.

We also developed our Roth IRA conversion to minimize our assets that will eventually be subject to required minimum distribution (RMD), and to minimize on the taxes.

Did you return to paid work? Why or why not?

Hell no! 🙂

Kidding aside, we intend to never go back to paid work. We have our financial assets to rely on, and a flexible plan.

We would rather reduce our spending or move to our country of birth sooner (much lower cost of living compared to the US) before we go back to paid work.

Did you find it hard going from being a saver to a spender?

Being only 6 months into retirement, we are still adjusting from accumulating wealth to spending down our assets. It sure was and is still a challenge pulling from the financial bucket that we had worked so hard to fill through frugality, budgeting, saving, and investing. I also have recently started generating income from options trading, so withdrawing from our financial buckets has significantly reduced.

Luckily, we bumped into the I-S-E framework (Invest, Spend, and Enjoy) in ESIMoney. It guides us in how to think about our financial assets in relation to how to enjoy our retirement.

Just seeing the letters reversed serves as a powerful reminder that we are no longer in ESI but in ISE with investing as the anchor of the other two. We no longer have to worry too much about earning and saving, and really enjoy by spending the assets that we’ve accumulated through investing.

Looking back, what do you wish you knew in advance?

Early retirement is about giving yourself freedom to do whatever it is that interests you, and without the shackles of work restrictions and responsibilities.

What advice do you have for those wanting to retire?

Once you’ve hit your FIRE number, just plunge in.

Great retirement interview! Really enjoyed it.

Options trading is a fine hobby; I imagine that we spoke of your system over on MMM, one of the more sophisticated tracking and management systems I have seen from a retail investor.

Nice to see how your priorities have shifted and that you are enjoying the time together. Well done!

Cheers,

The Wease

Thanks you, and for your thoughtful feedback on MMM about my models, plans and tools.

Great success story! I am preparing for my retirement and gave myself a 2-year preparation period. I can attest to the senioritis claim. I didn’t recognize it as such but as I was reading your explanation it became obvious.

I have been playing the ACA game with catastrophic insurance products for several years being self-employed. I would suggest looking into Christian Health Ministries (chministries.org). I started using it at the end of last year and have been thoroughly impressed and it is a fraction of the price I was paying. Requires a little more involvement in the process but the savings is enormous, and you get to go to choose all your medical professionals.

If I want to learn about options, what is your suggestion for best books, courses, etc. to get started?

Congratulations!

Mitch

We did looking into health care sharing; however, we ended up going with an ACA plan.

As for options, I read a few books on options from Kindle Unlimited — e.g., Covered Calls for Beginners, Credit Spread Options for Beginners, and others. However, I did have prior academic knowledge of options, so what I needed were strategy formation and tactical manouvering which the books and videos fulfilled.

I also consumed the content at Project Finance, Options Alpha, and Tasty Trades before practicing using paper trading.

All in all, it took around 6 months of learning and practicing before I placed my first real order. I even started with my T-IRA before doing it in my taxable accounts

HTH and Thanks!

Congratulations on a job well done. You are brave to trade options during retirement. Cheers

Thanks, @Hospitalist. The technical aspect of options got me hooked unexpectedly. I’m still reading and learning more about other strategies; I’ve barely scrated the surface.

I dig your story, being at the highest point of your earnings and just pivoting with the mindset we have enough.

Knowing you have enough is part of the battle IMO.

Congrats and thanks for sharing.

That is the truth! Great point.

Thanks, @Dan M. I don’t think we would have pulled the plug had it not been for the hours and hours that we had spent learning, modeling, and just being very quantitative. The latter specifically helped in understanding the variables involved including identifying the actions to take on scenarios (e.g., reducing our expenses by 40% on 2 successive negative double digit market returns).

What I want to know is: how did you go from $3.2M NW in early 2021 to $6.9M now?!?!?!

Nevermind, I see it now…

” We ended up cashing in on a big chunk of my company equity which doubled our net worth.”

Thanks so much for sharing your insights! I really appreciate your time in describing your retired life. I was able to leave FT employment at age 53 for part time and contract work, and I agree that it is so freeing.

Would you mind sharing what you invest in to receive qualified dividends? Please be specific with ticker symbols if you would be so kind.

Best wishes to you and your family!

Hi Steve. We mostly invest in index funds, and don’t really optimize for dividends. The dividends that we receive are from VTI, VTV, VNQ, SPY, and VXUS.

Thanks and congrats to you as well!

“Self-employed asset managers,” eh? Interesting idea, that … although I suspect with your options trading the titling is less “imaginative” than it could be for others (‘fer instance, me! 🙃). I decided to try some credit-card travel hacking, and was disgruntled to discover the process did not go as smoothly as I had anticipated for someone with an excellent FICO, credit history and “guaranteed” cash flow of over $80k (pension+). That’s a healthy chunk of change for a single person (although certainly not as stellar as your finances. Congratulations on a job very well done!). I eventually did get the cards, but wonder if having “retired” as my “occupation” had played a role in the hold-up. Stupid when that income is not subject to the vagaries of the marketplace as W-2 income is …. but that just goes to show our society’s focus on W-2 income. As long as that focus goes for *taxing* purposes as well, a retiree can hopefully make it work to her advantage. Good luck with the ROTH conversion strategy — you have an enviable time horizon (and home state situation). Thank you, too, for the book title and informative interview.

I prevously did CC and savings account some years ago, but only a few times because I realized that that I wanted a side hustle that was more scalable.

I’m glad to be of help. Feel free to post more questions here.

What a fantastic interview. I must admit I am thoroughly impressed with your structure and discipline. I don’t know many couples who (willingly?) use Trello boards to communicate regarding the status of their various tasks and projects 🙂

Congratulations on your accomplishments. Moving to a foreign country with different legal and economic systems is difficult enough, but you have navigated it brilliantly. May you find enjoyment in each and every day of your retirement!

Thanks, @MI-296!

Regarding Trello/kanban, we have a few of boards now. 🙂 Apart from our household board, we now also have 2 more boards for our 2 next big trips. The cards help us organize our information, and identify the unresolved tasks which help us offload information so we don’t have to remember them; we just let the tool remind us (using due dates) and provide context when we switch back to the cards.

It looks like you guys retired at the top of the market. Given the current bear stock market, has it changed your confidence at all that you have sufficient funds? The seesaw of the stock market is what truly scares me about retiring early. Any insight you can provide would be most helpful.

Thank you.

The market isn’t that much of a factor for them (or at least it appears it’s not) as they have income to cover their expenses.

Having income (real estate, side hustle, dividend stocks, etc.) in retirement is a HUGE advantage, especially in a market like where seeing now, with big drops. As long as that income is solid and more than covers expenses, there’s really no worrying about the value of the assets as he/you/anyone else doesn’t need them.

PLUS, there’s lots of margin of safety. No one really needs to spend $180k in retirement and, as you see, much of it is travel, which is completely discretionary. So if worse came to worse, 1/3 of his expenses could vanish with no change in his day-to-day lifestyle.

Diversification means more than diversifying within the markets, so your retirement is not beholden to any one asset class. Some ways to mitigate that includes the real estate and dividends that ESI referred to. Building a business (primary or side hustle) that can grow and be sold around retirement is another asset that can help mitigate dependence on the equities markets. Downsizing a home when the kids move out can provide extra resources both in the form of immediate available cash and reduced ongoing costs (maintenance, property taxes, property insurance, etc).

There is a term for managing retirement when the market drops concurrently called sequence of return risk, or SORR. Simply put, it is recommended that you keep 5 years of living expenses outside of the market, so you are not forced to sell during market volatility to cover your expenses. Many keep these funds in bonds, laddered CD’s or simply a money market account for liquidity purposes.

Social security is a safety net of last resort, and some still get pensions (usually government workers these days). For some but not all, annuities can be a reasonable method to guarantee income for life.

If you have the time and inclination to study market psychology over the years, I personally sold almost all of my long market positions earlier this year, dabbling in short positions since. As a result, our retirement accounts are down less than 5% from their November 2021 peak while the Nasdaq is down currently about 29% and S&P around 20%. Unorthodox yes, but I managed this thru dot com, the Great Recession and the Covid recession, now on track for 8 figures in our retirement accounts by full retirement age. The markets can bottom in the coming months with limited further losses, or if a recession ensues can continue to drop significantly over the next year or two. Stagflation can result in years of pain. A soft landing can result in another roaring 20’s. No one knows, one can only act on the information available to them today. Most prefer to hang on during market downturns, so that makes it a little tougher when the bear cones around retirement time.

We have pretty evenly divided our assets between retirement accounts (currently limited market exposure), non-retirement accounts (currently no market exposure), real estate, and business valuation for diversification purposes. with our retirement accounts currently valued at 20% of NW. I don’t want to see a 50% drop in my market assets but won’t let it dictate my retirement plans either. For many, retirement is imposed by a layoff or health issue so it’s best to always be prepared.

Hope this helped.

@CC, what @ESIMoney said 🙂

The CAPE (aka, Shiller Adjusted PE) and inflation being high are two metrics that point to higher risks in starting retirement (erm, like now hehe). Both exacerbate the impact of SORR which I described in more detail in the interview. They both made us pause and think twice before we pulled the plug; however, our backtesting, Monte Carlo simulations, and retirement plan (and multiple backup plans) made us push through with conviction.

Additionally, the risk of SORR was what made me look for a side hustle that I would enjoy doing (something technical, intellectually challenging, but something not time consuming). Fortunately, I’m generating enough income to cover all our expenses from my options trading activities. I can easily make 2x of what I’m generating now with higher risk exposure, but I choose to take lower premiums for higher probabiity of success — I don’t need more than what I’m earning now.

@MI-119, I agree with all your points. I would even abstract diversification through mitigation of idiocycratic risks. Quantiatively, various portfolios (combinations of weighted stocks, bonds, real estate, and other assets classes) can be compared using Sharpe ratio (for risk-adjusted returns). McClung’s Living Off Your Money book goes into details. It’s highly recommended for those who want to deep dive into various algorithms (withdrawal strategies such as glidepath, prime harvesting, etc.) for asset liquidation and withdrawal (two distict activities that are merged together in the 4% rule).

That’s an interesting strategy. Also, I’m still learning more about market psychology because my curiousity is pulling me towards trying out day trading. I have previously read books by Thaler, Kahneman, Sustein, and Tversky, although, mostly for academic purposes though. We’ll see how it goes; I’m currently reading more about day trading.

Thanks guys!

Great story! As one who is aspirationally looking at some form of (hopefully!) chubbyFIRE in the next few years, I appreciate your checklist of things to do/check/watch out for!

Congratulations! It sounds like you’re set for a great next chapter!

@Tom, thanks and good luck to you. Feel free to post questions in MMM, and tag me (@p.boone) directly.

Really enjoyed reading this one, it really stood out to me. CONGRATULATIONS! So great to see the logical though process you went through, the team work between you and your wife in the process, and the forward looking goals and openness to keep growing.

Just a fun one! If SouthEastern United States is Tampa do let me know.

Cheers!

@MI#2, thank you! Although my wife and I work as a team, we don’t always see eye to eye. However, those differences in opinion spice up our dinners out, and long drives. 🙂

Great story. Welcome to early retirement. This is my fifth year since retiring at 54 in 2017. I can promise you that if your philosophy for your retirement is to Continue to be curious, and to learn something new” you will never be bored and will grow to love your decision more each year.

@Stan Early Retiree #19, thank you! I’m really hoping that my habit of curiosity and drive/willingness to learn do not fade away later in life. Well see 🙂

Congratulations on winning the game! My financial situation is similar to yours from a net worth perspective, however, the covered call income is absolutely insane. Any plans to share your learned strategies?