Even those who earn the big bucks, have all the benefits, and have good, decent, challenging jobs get sick and tired of all the negative aspects of working at times (and over time as the crap just builds up).

I know this certainly described me. I had times where I HATED jobs/a career that I generally liked most of the time. There were many instances where I wanted to escape the grind, the stress, the terrible boss, the nagging co-workers/subordinates, the politics, the stupid “because we’ve always done it this way” excuses, and on and on.

But I was stuck. I was the sole breadwinner in our household. So I had to gut it out until one day I had had enough AND I had enough (money). So I retired.

But what if you don’t have enough to retire and you still hate your work? What do you do then?

This subject came up in the Millionaire Money Mentors forums under the heading “Any W2 folks here who hate their jobs? What’s the escape plan?”

There was quite the discussion (as you might imagine) on this subject and many great points made on both sides (those who have escaped and those who want to). BTW, the value of the feedback on a single question like this alone (not counting any of the other thousands of posts on the forums) makes joining the forums such a no-brainer! But that’s for another post on another day. 😉

One of the responses on this thread was as follows:

I agonize over this and it hits me more and more as I see people in their 50’s and 60’s drop dead. I live 60 miles north of NYC and am 52. HOCL area but not like NYC. I recently figured out all expenses to determine true needs and shared with DW who achieved spousal FIRE in March 2005. I also put together passive income and determined shortfall. End of story if we move to all cash and don’t factor Social Security or $18,000 pension we run out of money at ages 85/82. We are fine.

We agreed that I would continue working until 2024 but if I ever had enough I can give 30 days notice prior to 2024. This avoids issue of me coming home one day and saying I resigned today. I start my 750 day corporate America countdown on January 1. The countdown number seems to help me mentally.

I also think about consulting. I can use my skills but not deal with political or people aspect of W2.

I LOVED this comment! Here was someone who had the same issues most of us have (or have had) and actually did something about it. I had to know more, so I replied as follows:

Would you be willing to write up your story for me (to run on ESI Money)?

I see so many people who are stuck in a work career they dislike and actually have enough to retire if they make a few changes, but they are either too set in their ways, too afraid, or unwilling to change.

It appears you have conquered all those and telling the process you went through could help some others.

Let me know if you’re open to it and I’ll email you with some follow-up.

He responded:

I am open but most of my plan came from ESI posts. Please email me.

Now I REALLY loved his response! Most of it came from reading ESI Money! That’s music to my ears!

I sent him an email with the following:

I saw your comment that most of your plan came from ESI posts.

But I think the difference with you is that you took those posts to heart, created a plan, overcame the obstacles, and did it (or are doing it).

Most people will read a post, think about it (maybe), but fail to take action.

Anyway, I’d like to hear what happened for you (what made you want to take action, what you did, how it turned out, etc.). I think if you can tell how you met the challenges then others will have a useful roadmap as well.

He worked on the post and that’s what you’ll read below.

A few of the topics he touches on that we’ve discussed on ESI Money before include:

- Being fed up with a job and what to do about it. Not just wallowing in your misery, but actually taking action to GET OUT OF THERE and creating your own escape plan.

- Why retiring early is a good idea — because life is very, very short.

- You must TAKE ACTION! Reading a post is a good start, but then applying it to your life and getting results is where great things happen. This is one reason I wrote If You Want What I Have You Have to Do What I’ve Done — emphasis on the “DO”.

And one final note: this was sent to me in March and I edited it in early April after I got back home from Florida. Just wanted to note this as the author is even closer to quitting day than is noted below.

With that said, let me turn it over to him…

——————————-

I have been working in Corporate America since June of 1992. I started at a retail store called Jamesway as an Assistant in Training (AIT) and moved to bank operations as an operations manager in the mid-1990s. Since then, I have worked my way up at 6 different banks to a senior role making a decent corporate living.

After almost 30 years I am tired of Corporate America and the BS I deal with daily. I currently manage a team of about 95 people. I like the aspect of helping people grow, teaching them the skills to survive in the corporate world and watching them develop professionally. I hate the aspect of dealing with my peers who resist change since current processes are easy, don’t understand the modern world and act like experts publicly on things they know nothing about.

I also hate the fact that I have to rush out of the house every morning to go to work when my job can be done 75% remote. “People who work remote don’t work, as I am told”.

I really just want a second cup of coffee before I leave the house and having to commute to work prevents that.

Last background items:

- I am Millionaire 255

- I belong to the Millionaire Money Mentors (MMM) forums.

- I am 53 years old.

- We have $2.4 million saved in retirement accounts, $850k in FU money, $500k in education funds and own 3.5 homes ($1.7 million value) (sibling owns other .5).

- DW is a homemaker and two pre-college teenagers.

- We are also debt free.

I decided in the summer of 2021 that Corporate America was not good for my health. I have known this for years but it got worse this summer. Six people who I either knew directly or indirectly died in their early 50’s or 60’s. Most died suddenly and followed a similar career path as me.

This prompted me to start aggressively thinking how can I exit Corporate America? I diligently follow the MMM forum and we have lived the Millionaire Next Door life for the past 30 years.

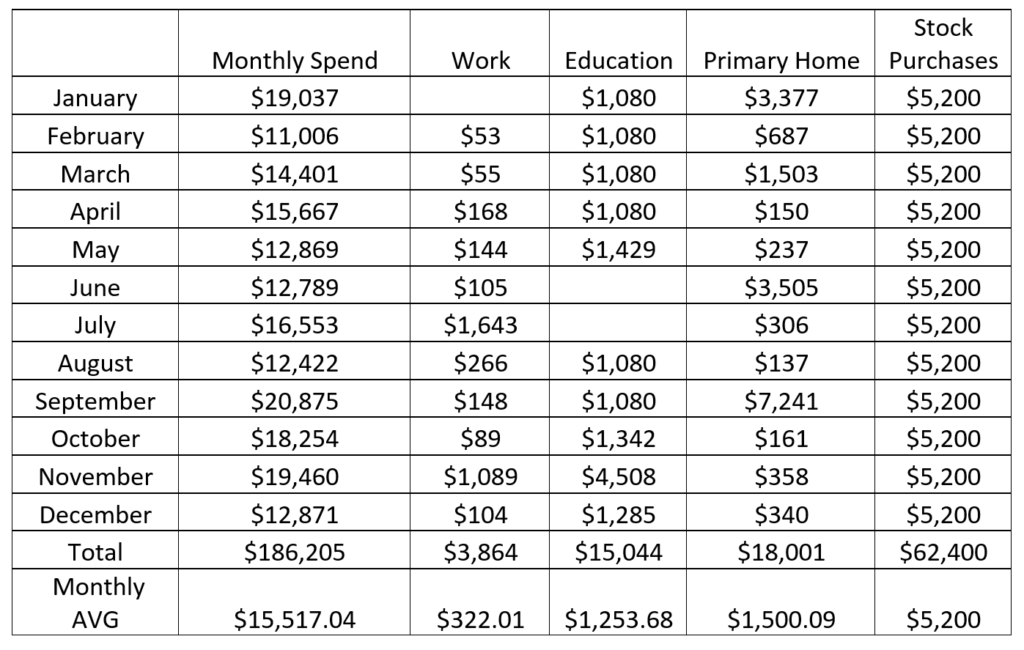

The first thing I did was to look at our expenses to understand where our money went. After about 20 hours of work I determined we spent $186,000 over the past year or $15,500 per month on average. I am very confident in this number as I pulled all transactions from primary credit card and our primary bank checking account. If you have not done this it is eye opening. We spend $600 to $700 monthly on gas and $1300 to $1500 monthly at the grocery store.

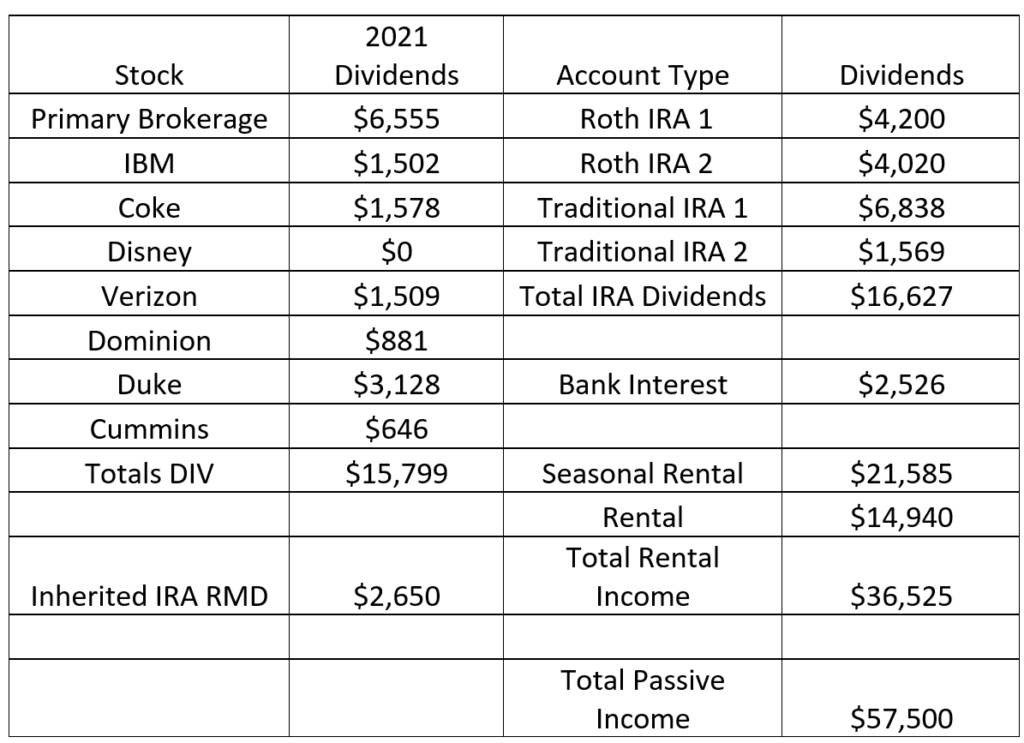

The next step was looking at our passive income. We have been buying dividend stocks since 1998 and have continued to increase purchase amounts as we earned more money.

The combination of interest, dividends, rental income and an inherited IRA RMD combined to $57,500 ($4,800 monthly).

The combination of monthly expenses and lack of passive income to support our FIRE lifestyle set me off on a three-day depression. How could I stop working with this gap and the fact that buying healthcare was not even factored in?

The below chart shows monthly expenses and four categories of expenses:

After moping for three days I went back and looked at our expenses. I noticed that we spent around $325 monthly on my job, $5200 monthly on dividend stock purchases, $1250 monthly on education and $1,500 monthly on primary residence. Once I stopped working $6,775 (job, stock purchases and education) in expenses could go away with no impact to our lifestyle. The gas expense would also be reduced but I did not factor that in. Our monthly expenses just dropped to $8,725.

We have also outgrown the neighborhood we live in and selling our primary residence would decrease expenses another $1,500 per month. This will take a few years as we have one year of high school left but then can live in the 1.5 houses mentioned above or elsewhere (the other house we’d own is a full-time rental).

I felt much more confident with the fact that the gap was down to $4,000 per month and gave me the confidence to have the conversation with DW. She has suffered with my Corporate America life for the past 20 years. Her first response was that we have one child starting college in 2022 and a second starting college in 2023 and these may be the most expensive years of our lives. Does it make sense to stop working now?

It took me a day to come back to her and explain that over the past 18 years we have been extremely diligent in saving for college. We maximized Coverdale and 529 contributions annually, saved every monetary gift the kids received in their bank account or college fund and basically we have already paid for college and it is time to spend the funds we saved. $250,000 of our college money is in either a Coverdale or 529 and if we don’t spend for college we will have tax penalties.

DW was okay with this response and then asked, “Are you really able to step away from a job making $350k to $400k annually?” This is something that I had not thought about and I do realize if you are out of the game for a few years jobs at this salary level are not easy to find.

After thinking through this, I verbalized the fact that I know longer care about money. It sucked being poor but now that we are not poor any more money does not matter to me.

We then moved to the $4,000 monthly gap, healthcare expenses and what happens if we want to go on a $15,000 vacation or have a $10,000 unexpected expense. It took a few days for me to think through this but this gap only existed until I was 59.5 or another 6.5 years. I could then access retirement funds penalty free.

I also started doing a lot of research and reviewing old MMM forum articles. I really like dividend stocks and the majority of our IRA accounts are in dividend stocks. Our Roth IRA accounts currently generate about $8,200 annually in dividends and I learned you can withdraw from a Roth IRA (owned more than 5 years) penalty free to pay healthcare expenses.

I then started researching the rule of 55. I will turn 55 in 2024 and the rule of 55 will allow me to withdraw from (only) my current employer’s 401k penalty free (not tax free) as long as I leave my job in the year I turn 55 or older. You must do these withdrawals in equal installments over (I believe) a 5 year period.

I don’t know where the market will be in 2024 but estimate my current 401k to be worth $150,000 or $30,000 per year. The gap just decreased to $1,500 monthly.

The below chart shows current passive income. Total IRA Dividends are not include in Total Passive Income number.

I still struggled with the $1,500 gap but around a week later I came to the conclusion we have $850,000 in FU money with about $150,000 in cash with a large portion earning 0.5% interest at Marcus. I have read a lot about real estate syndications but wasn’t sure who I could trust.

The MMM posting on DJE’s latest opportunity in mid-December intrigued me to do some research. I spent about 5 hours reviewing their proposal and deck. This all looked good but was marketing to me. I then started researching some of their prior deals and online tenant comments. I also did this for the deal they were pitching. There were very few negative comments and they seemed to follow the blue print they pitch in their marketing deck. I invested $50,000 and my gap just went down another $300 and now at $1,200 monthly.

I was now ready to have another conversation with DW. I showed her numbers and the fact that we had a $1,200 monthly gap that could be covered over the next 7 years with our cash savings. Either of us could also pick up part-time work or consulting work to cover the $1,200 gap and any healthcare cost gap.

She came back with the question are you sure you can walk away from the salary and the fact that if the company is sold your exit package is in the low 7 figures. I thought on this for a few days and the main reason I don’t switch jobs is the exit package. With my skill set I can get another job for a similar salary.

We then came to a compromise that helps me get through the day to day BS, continue to grow passive income and provide 24 more months to collect the exit package: Effective January 1, 2022, I started my 750 day Corporate American countdown. The countdown will end in January 2024, the year I turn 55. If at any time during that 750 day countdown I get so frustrated with the BS I can give my 30 day notice and walk out the door.

This helps me get through each day and knowing as I write this I have about 661 days left before I get to enjoy the second cup of coffee.

Hugely helpful to read the thought process. I am 1,051 days away from my date. Ran numbers also and due to a pension penalty of 5% for every year, if one retires prior to 62 y/o, I will retire at 62 years old and 1 day. This is the year I get super detailed on my expenses monthly and yearly for planning my retirement.

Great post! It’s really an inspiration as I’ve been thinking of my exit plan. I’m tired of the BS and want more time with my kids before they are grown and gone. It’s hard to think about leaving a decent paying career but money certainly isn’t everything. It’s nice to see someone making double me share the same frustrations with corporate America.

Hi Tony,

Time with the kids goes fast. One of my children starts college this year. I missed so much. Good luck to you.

Planning to exit into retirement life is, in my opinion, the starting point for a never ending task. Having been in the military for the majority of my life, then transitioning into retirement only created more issues that went beyond, yet included, financials. The best laid plans often go asunder. Your story is interesting and I think applicable to many. Thanks for sharing your thoughts and let us know more when you execute your expectations. Good fortune on your journey.

Great Post. I can relate. As I outline my expense figures I am guided by my actual expenses over the past few years to determine what that portion of my financials look like. On the income side of the equation is more of a concern to me. My goal, thru rental income, interest, dividends and other possible sources earned during retirement exceed my expenses whereby I am still generating savings and not touching my principal. Perhaps I am to much into the weeds but wonder if others attempt the same analysis.

Same question as I asked in my own comment below: Why the retirement that no principal is touched? Just to be conservative? To leave a large legacy for others? You can’t take it with you, so why not enjoy at least some of it along the way?

Hi Roger,

Two things would make me feel successful. One is having a 3-car garage and the other is generating $100,000 in passive income per year. I have been working on passive income since 1998. It is a slow journey but if you follow consistent steps it continues to grow. Dividends, real estate syndications, rental income all add up. I do believe at some point you need to spend your principle but in the most tax efficient manner as possible. I also think about I worked so hard to accumulate the principle when am I going to enjoy it. Good luck

Great article – really appreciate the effort and thought that went into it!

One question: You seem to be attempting to retire and then live until you can “access retirement funds penalty free.” And yet, you have (according to your Millionaire 255 numbers) $850K in FU money and another $500K already saved for your kids’ college. Why not ‘spend’ some of that to enable you to retire?

This leads to a broader question for all ESIMoney readers. Unlike many of you, my wife and I didn’t invest in any rental properties over the years – all of our savings went into the stock market, and sometimes gutwrenching volatility notwithstanding, oour returns have been very good. Nevertheless, when I retire (hopefully in $4M net worth, too) and in retirement, we’re going to SPEND it, with appropriate conservatism, so we have very little chance of ever running out, even if we have unexpected medical bills. And, this spending includes much more than what we ‘buy’, including supporting our favorite charities, helping our kids here and there, etc.

Unless you’re keen to leave a big inheritance (or make a massive donation to your favorite charities upon your death, why not (responsibly) spend ‘principal’ as well as ‘income’?

This is a good question to which I’ve been giving a lot of thought lately.

For us, it’s finding things to spend on that make us happier. That’s the key.

We don’t want to spend on things that make us less happy (of course) and once you’re already spending $100k per year without a mortgage (which is a lot of spending), finding new things to spend on that will increase happiness is difficult.

I’ll have a post on this issue in the fall and describe more about how we’re approaching this issue.

Hi Russ,

Great question and I may need some help with my answer. I do have $850,000 in FU money but now only $100,000 in cash. The other $750,000 is generating dividend income, real estate syndication. I could sell dividend stocks for living expenses but that would then reduce dividends. I have worked on my DRIP dividend purchases since 1998 when I could only afford $115 a month which was a stretch until today at $5200. I believe my dividend stocks are all very strong and will continue to grow for years to come. I really dont want to decrease this income stream. I do plan to spend 401 K/IRA money but dont want to give Uncle Sam one more penny than necessary. I hope this makes sense.

Enjoyed the read and congrats on your success!

A couple of thoughts:

Using the 401k 55 rule does not require 5 years of withdrawls (that I am aware of). I think you may be mixing the 55 rule with the SEPP requirements, which do require at least 5 years of withdrawls.

Agree with Russ about accessing the FU money. You could withdraw your gap and it would be less than a 2% withdrawl rate. Should be long term very safe.

Good luck and thanks for sharing!

Love the article. Make a plan and keep improving it until it allows you work freedom. Pursuing Life Adventures on a full time basis is even better than I imagined. I’d encourage to do it a little sooner than you feel you can.

Bravo! You are actively working towards living the life you want! I am curious, however, where the 3.5 homes factor into the analysis? Obviously one home is your primary residence and you address that, but are the other 2.5 homes generating returns for you that are part of the gap remediation plan?

Well done on tackling something that hits everyone, but way too many merely lament!

Hi MI-296,

One of the homes is a beach house and has been generating about $20,000 per year which is exactly what the annual ownership cost is. The challenge is that the family does not want rent anymore and we will only rent for 2 weeks this year and generate $8,000 and dont plan to rent again. One house is a full time rental and cash flows $800 per month (part of the gap analysis), and a family member lives in the .5 house. They pay all expenses and we have full access to the house. Not a great business deal but good for family member and is the right thing to do.

Great write-up! We have been thinking along similar lines. We could draw at 2% from our savings/retirement funds – as Scott C mentions above – without touching my pension or our Social Security. That’s a 30 year plan, by the way.

We’ve decided each of us will retire at/near 62. I’ll retire in 25 days (!) and go under my wife’s health insurance until she retires, then we’ll have a bit of a gap to cover health insurance.

We’ll be fine.

Congratulations on your retirement. Yes, we will all be fine. How do you feel about transitioning from save to spend? I have never been a spender and do have concerns about this. DW has no problem spending though.

We are both pretty diligent on our spending, so I don’t believe there will be an issue on that transition. We have always taken the approach of living on the lesser of our two incomes – hers – and saving as much of mine as possible, plus maxing out both of our 401K plans. Only the savings and 401K part on my end will change. When she retires, we’ll have a little more transition to do, but we have plans in place for that as well.

I am just curious how you spend so much per month on groceries, it seems kind of excessive for two people.

Just curious, what percentage of your retirement savings do you expect to spend during your retirement? Also, how does the stock market fluctuation effect if any, your percentage.