If you’d like to be considered for an interview, drop me a note and we can chat about specifics.

This interview was conducted in April.

This one is different in a couple ways.

First of all, it’s from a friend. The author and I (and several others) have become good friends (or at least highly respected friends) with several other mentors and members of the Millionaire Money Mentors (MMM). I’m hoping most or all of them show up if I can pull off a meet-up this fall.

Second, this interview is very detailed — the longest Retirement Interview to date. As such I have broken it up into two parts. The first part follows the standard format we’ve seen in other interviews and is what’s in this post. The second part is a very insightful in-depth review of how the interviewee’s mindset changed from month to month during this process. This part will run the week after next.

My questions are in bold italics and their responses follow in black.

Let’s get started…

GENERAL OVERVIEW

How old are you (and spouse, if applicable, plus how long you’ve been married)?

I am 51, and my wife will be 50 in May.

We will be celebrating our 20th wedding anniversary this July.

Do you have kids/family (if so, how old are they)?

We have two teenagers in high school.

My son recently turned 16, and my daughter is 14.

What area of the country do you live in (and urban or rural)?

We live in Texas in the suburbs of one of its largest cities.

Is there anything else we should know about you?

I did Millionaire Interview 73 which provides some good insights as to our background and financial situation as of April 2018 (and posted in June 2018).

RETIREMENT OVERVIEW

How do you define retirement?

There is a lot of debate in the FIRE community about what retirement means to different people, and I can see all sides of the discussion.

My definition is having the financial resources to stop working full-time and having the flexibility to do whatever you want in your free time.

How long have you been retired?

I have been retired for 14 months.

Is your spouse also retired?

My wife is a stay-at-home mom, an elementary teacher before our kids were born, and has been telling our friends for many years, that she was retired, which was her way of saying she is never going back to teaching.

She now has a partner in crime.

What was your career and income before retirement?

I was an enterprise software technology consultant for 23 years and have worked for myself since 2004. During my last full year in consulting, I made $789,000, and in the 17 years I was an independent consultant, or as I liked to call it, a mercenary, I averaged $678,000 a year.

Recently, I added up all my billable hours for my 23-year consulting career (I was in the grocery business prior), and it was 79,629 hours which works out to 3,539 hours per year. With some mental gymnastics, it’s equal to almost 40 years of work in a “normal” career.

Why did you retire?

I was lucky to have enjoyed my career and every job I have ever had to some degree. Still, I realized several years ago that my real passion was making money, and my grit, focus, and hard work were always towards that goal.

I remember reading The Effect of One More Year in December of 2020, and shortly after, one of my favorite ESI blogs of all time, What Comes after ESI? The ISE Phase of FIRE which at the time felt like it was written for me. Due to Millionaire Money Mentors, which I would highly recommend, I’ve been fortune to become friends with the author.

I was coming to a bit of a crossroads as I had a lucrative, remote, 2-year contract, and it was ending in early February 2021. My initial plan was to relax and dip my toes into semi-retirement for a few months, take the summer off, and spend it doing fun stuff with my family, which seemed like an intelligent approach especially given my kids will only be teenagers once.

I started to journal inside Millionaire Money Mentors each month beginning in January 2021, which I share in-depth below, as it was a great way to collect my thoughts and get feedback. By May of 2021, it was apparent that making it permanent and starting the next chapter of my life was the right direction.

PREPARATION FOR RETIREMENT

When did you first start thinking seriously about retirement, and when did that turn into a decision to do it?

The work grind can be brutal, especially if you have a challenging and demanding career, and I was very fortunate in some ways to never have given retirement a thought until I was already “across the finish line” financially.

My plan had always been to stop working after my kids left for college. The more I thought about it, I started to think about why I was prioritizing that timeframe versus cherishing and enjoying the four years my wife and I had left with them before leaving for college. I knew that the special memories and extra time spent together would be something the whole family, especially Dad, would never forget. If you have teenagers, you only have 7% in-person parent time after high school drives home the opportunity you have to maximize time, as much as they will allow, while they are still under your roof.

It was December of 2020 when I first allowed myself to start giving retirement some high-level thought and funny as my wife initially thought I was kidding. I realized I had no desire to make the sacrifices, risks, or hard work needed, at that point in my life, to try to build generational wealth even though we plan to leave a healthy amount to each of our kids.

Things moved quickly, and in February 2021, I went to semi-retirement (aka test drive), and in late May of 2021, it changed into full retirement. I got lucky to see how much I have enjoyed my retirement. I wouldn’t have wanted to get a “taste of it” any earlier, as it would have made the final years of work more mentally difficult.

What were the significant steps you took from deciding to retire to developing a plan to do so?

I would imagine my path was pretty unique as I went from thinking about it for the first time to doing it in less than 2 months.

From a very young age, I always thought I would be a millionaire and spent a lifetime following ESI to have the flexibility and freedom to make such a decision when the time felt right.

What did your pre-retirement financials look like?

On the day that I retired, our net worth was $13.37M, which was broken down the following way:

- Hedge Funds (4) – 77%

- Self-managed Equities – 11.5%

- Cash – 7%

- Real Estate Syndications (2) – 1.5%

- Assets (House/Cars) – 3%

We had $3.5M in taxable deferred accounts such as 401K, IRA, and Defined Benefit Plans.

What was your overall financial plan for retirement?

The plan’s foundation was based on FatFire, and at the core, my goal had always been to live off and ideally continue to have my net worth grow based on investment returns and not touch any of the principles until well down the road. I think that is the approach many FatFire folks are trying to achieve, so the safe withdrawal calculations were not part of my decision-making process.

I might have a unique perspective as for most of my 40’s, I had my head down and was “chasing” a financial target that I kept moving from $1M to $2M to $5M to $10M for no real reason other than I enjoyed my job, had a passion for making money, and it never crossed my mind to consider anything different. Many people will find this strange, but I didn’t feel like I was free of money worries until I crossed $8M and assumed it had to do with ensuring our family had enough to live off investment returns and keep the principle as a margin of safety.

I will say that when you hit your number, whatever it may be, it is an unbelievable feeling of freedom and flexibility but also understand that you want to try to attain it in a “healthy” way, meaning that if you end up sacrificing relationships with your significant others, kids, friends in the pursuit you might have a few more dollars at the end of the day, or way less in case of divorce, but you definitely will not be happier. Like many things in life, it is a delicate balance, and interesting to see some recent studies have shed more light on money and happiness.

Did you make any specific moves to prepare your finances for retirement?

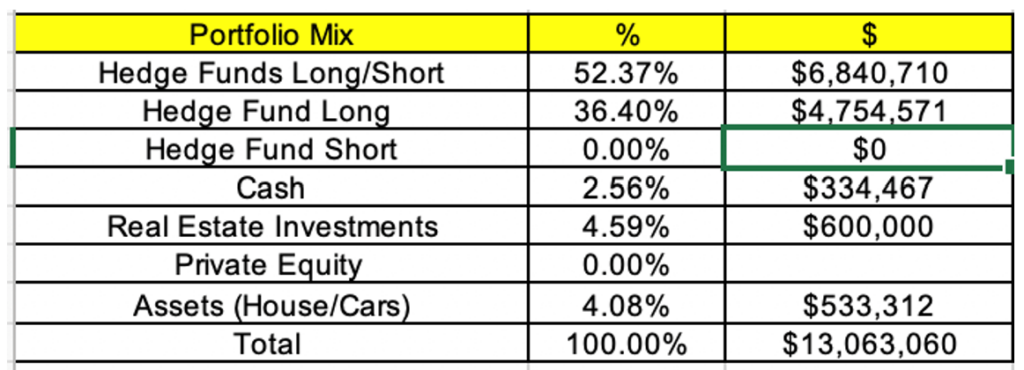

Not really, as there were some minor “tweaks” that I probably would have made even if I didn’t retire, and here is my current investment mix.

If You’ve Won the Game, Stop Playing is a thought-provoking article, and I think there is a general stereotype on how you should invest when you decide to retire. I can see wanting to be conservative and gravitate toward “safe investments” such as cash or bonds if you are precisely on your “number.” Still, both could very easily return negative returns after inflation for the privilege and feeling of safety.

For someone like myself, do I ever need to change my investment to be what historically would be called safe (i.e., 50/50 stock/bonds) just because I am getting older? Curious if any reader has reasons why in 8-9 years, just because I turned 60, I should change to be what historically would be the “norm” and “safe” to me, diversifying into real estate or other asset classes would make a lot more sense than Annuities, Bonds, Tips or Cash.

So long story short, I did not make any fundamental changes due to retirement, nor do I plan to moving forward.

Who helped you develop this plan?

My entire plan from a teenager to retirement was self-developed over the years as I have always been very self-driven with outsized personal goals versus most of my friends and peers. I always felt like I was competing against my own benchmarks and didn’t even discover the FIRE movement until I stumbled upon the ESI Money blog in mid-2017.

I am also probably unique in the fact that I never considered the 4% rule or ran Monte Carlo Simulations, as my goal was always to grow my net worth to a number that ensured a modest investment return would handle all my family’s yearly expenses and the principle was the margin of safety.

What plans did you make in advance to leave your job?

Due to the nature of my career as an independent consultant working at over 60 Fortune 1000 companies, it was very common for my contract to end and to move on to the next opportunity.

In this case, when my contract expired in February of 2021, my only course of action to kick off semi-retirement was to not be willing to accept any future opportunities.

What were your pre-retirement concerns (financial or non-financial)?

There were no financial concerns other than how I would feel mentally about not having an income coming in for the first time since I was 12 years old.

On the non-financial side, it was more of the fear of the unknown, as Mike Tyson famously said: “Everyone has a plan ’till they get punched in the mouth’,” and in this case, I was punching myself by making a conscious decision to retire.

How did you handle deciding on and paying for healthcare?

Since I had worked for myself for the previous 17 years, I was already very familiar with the options and paying it out of pocket, so everything was status quo in this area.

The inflation in healthcare premiums is concerning, though, as currently spending close to $17K a year for a high deductible plan.

How did you tell your family and friends of your plans?

This turned out to be one of the more stressful areas as I wanted to continue to be stealth wealth but at the same time honest and transparent if directly asked. I outlined my journey in the Millionaire Money Mentors, which I will share below:

March 2021

I have struggled a bit with friends on messaging as I want to keep “stealth wealth” and don’t want people to worry about us, and part of my ego doesn’t want people to think I am struggling and unemployed. It is a weird dynamic as I could transition to “managing my investments,” but that sounds pompous to me as it feels like I need to say “something” other than “retired,” so I settled into taking time off, which sounds like “unemployed/struggling”. 🙂 This is my biggest worry right now, which tells you life is pretty good, and it will be interesting to see how this evolves.

June 2021

Decided to share the public retirement with a few good friends that my wife and I hang out with that would probably not have seen it on Linkedin. My thoughts have changed slightly on this as obviously retiring at 50 means we have some dollars saved up. These friends probably sensed we are financially sound as we travel together and hang out quite a bit. However, my guess is still a bit of a surprise as most of them are younger than us (late 30’s and early 40’s), so retirement is many years away, but I feel several of them are on a good path.

Some of the reasons I did this as didn’t want to dance around this. They would have found out anyways over time, so instead, they hear it directly from me, and early on, I don’t want to hide something I am deep down proud to be able to do. Being transparent and honest is important to me, but the biggest is to see if I misjudged any and if there is a change in our relationship.

If so, life is short, and this may sound cold, but I am fortunate to have many friends and will allocate my time accordingly if this turns out to be an issue for any of them. You don’t get to pick your family, but you do get to choose your friends, and life is too short to deal with unnecessary drama when you don’t have to. Feel like my “stealth wealth” is still mostly intact as they would never guess our actual financial situation but know we have enough to make a crazy life decision, and I told two of them our backup plan is a tent in their backyard

Oct 2021

The circle of people that know I am not working has grown, and I am getting more comfortable with it, as once a few friends know, it tends to spread.

Interestingly, not one person has asked me anything detailed about it. My mother-in-law is no longer worrying either, so all is good

What did your teenage kids think of having two stay-at-home parents?

My kids are older (14/16) and leading busy lives, and saw Dad work from home for eight years as I was primarily remote during the tail of my career, and given the way I tried to manage work/life balance, they probably don’t see much difference now that I am retired.

That said, there are a lot of significant differences that I notice, such as always being available, being more present in the moment, having carefree vacations, being the driver for kids and their friends, and always being there when they will allow me to, and my guess is the whole family will look back on this time fondly.

It is interesting as one of the reasons I didn’t consider retiring until last year was the classic “Didn’t want to set a bad example and have my kids not see me working,” which reflecting was just an easy excuse as the core reason was I wanted to keep making money. There are two excellent articles on this topic that I would highly recommend:

THE ACT OF RETIRING

How did you ultimately retire?

I go into a lot of detail of the month-by-month journey (Editor’s note: this will be shared in the second part of this interview), but at the core, I started thinking about retiring in late December of 2020, and my last day of work was February 5th, 2021.

What went well?

Everything! I am still in the honeymoon stage as I went into this pretty open-minded without any preconceived ideas on exactly it would go. I have to pinch myself because this is real and gives me a sense of joy/pride to know how lucky I am to have this opportunity.

On occasion, a feeling will come over me as I reflect on how fortunate and unique my situation is, and I am filled with a sense of proudness that all my hard work paid off and has enabled me to live in a way that I get to focus on all the things that are truly important me.

What didn’t go so well?

I recently read Avoiding Retirement Regrets and can honestly say I don’t have any of these, which is probably why I still feel like I am in the honeymoon stage, 14 months later.

How did you avoid “one more year syndrome”?

Doug Nordman, who I have gotten a chance to interact with a lot in the Millionaire Money Mentors, got me to think about the opportunity costs of making more money that you don’t “really” need versus the lost time, health, missing experiences and sacrifice it takes.

There are the opportunity costs of making money at the expense of time and portions of life/time/experiences for each person, which are worth way more than money, that you can never get back. Would you rather be in your kids’ lives as teenagers, for example, as much as they let you, versus giving them some extra dollars in inheritance 30 years later? Undoubtedly, having less stress, more sleep, more time to exercise, and self-care increases the odds of staying healthier for longer.

At the end of the day, as Jerry Rice said, “Today I will do what others won’t, so tomorrow I can do what others can’t,” and tomorrow was my retirement.

RETIREMENT LIFE

How was the adjustment, especially the first few months after retirement?

Editor’s note: This is a detailed look into what the interviewee was thinking throughout the process of semi-retirement and into retirement and will be shared in part two of this interview.

How is retirement life now? What do you like about it, and what do you dislike?

It is unbelievable, and I love everything about it.

Still in the honeymoon stage and might be there for a long time. One neat aspect is depicted in this image.

What do you do with your time? What does an average day look like?

I am a real creature of habit, and here is what an average weekday looks like:

- Get up at 6 am, make the kids lunch and drive them to high school.

- Check email and answer any that need immediate attention, and I strive for a zero inbox.

- Open up Interactive Brokers Trader Workstation and see how the market is looking. Typically, this is about 2-3 hours before it opens, and read some stock-specific content.

- Check out twitter (lots of breaking news/information) as I have carefully cultivated a list of people I follow for football, investing, money, baseball, news, shopping, entertainment, travel, soccer, and golf.

- Check out InoReader (RSS reader), where I have 197 cultivated feeds that go into the following categories investing, money, baseball, football, soccer, local news, shopping, entertainment, travel, golf, and go through and bookmark about 100 articles I plan to read. This is one of the critical ways I self-learn, and I love having information pushed to me vs. pulled.

- Review, read and comment on Millionaire Money Mentors.

- Go for a ~3-hour walk as I have averaged 24,000 steps for the past several years, and during that time, I keep up with emails, take calls, read, check out Millionaire Money Mentors, and listen to audiobooks or podcasts.

- Back home around 1 pm to eat lunch or go to lunch with my wife and have been doing intermating fasting since I retired.

- From 2-4 pm varies each day as I do a lot of “Dad” stuff such as things around the house and alternate with my wife to pick the kids from school and make them an afternoon meal.

- Most evenings, I take my daughter to sports practice, where I also walk, read/listen/and learn.

- Home most days by 8:30 pm, have dinner and then watch Sports or something with my wife from 9 pm to 10:30 pm and call it a night.

What are the significant activities that fill up your time in retirement? Are there any new ones you’re planning to try?

There are many details on my significant activities in the answers above, and I am still very busy even in retirement.

One of the big reasons I decided to retire is to enjoy more quality and quantity time with my two teenagers and family/friends, so that is the core activity that I try to plan everything around.

What is your social life like?

It was almost identical to before retirement, as our social circles were made up of lifelong friends, neighbors, and kids’ sports parents. The only difference was I have a lot more flexible schedule to do things.

Due to the nature of being a road warrior and flying to work each week for the front part of my career and mainly working remote for the tail end, combined with working with over 60 customers over my consulting career, I didn’t make any lasting outside of work friends which probably made this whole process quite a bit easier.

Looking back, what would you have done differently?

Nothing as everything has gone exceptionally well.

Was there any emotional impact from leaving the workforce?

There was no emotional impact from leaving the workforce as I do not miss anything about it.

This might surprise some people, especially given that I really enjoyed my job, but I think at the core, my true passion and enjoyment were always based on making money.

As soon as I decided to stop working for money, it was surprisingly easy to close that chapter.

What surprises (financial or non-financial, good or bad), and how have you handled them?

I haven’t encountered any surprises, but I sometimes wonder if the fantastic feeling will wear off over time, given that I’m still less than 1.5 years into retirement. I sure hope not!

What are your future plans?

After a lifetime of following a detailed internal plan, I am enjoying the honeymoon stage of retirement and am currently overprotective of my time, so no specific plans.

One recommendation I would make for people retiring, especially from a W2 job, is to not consider anything along the “work spectrum” (board, charity, consulting) for 3-6 months, assuming you can afford it.

After 6 months, you will very well have a different appreciation of your time, and from first-hand experience, turning down opportunities was tough early on, but I am thrilled I did.

RETIREMENT FINANCES

How has your financial plan performed compared to what you had estimated before retirement?

When I retired in February 2021, my net worth was $13.37M, and by June 2021, it had climbed to $14.85M which was an all-time high, and today it sits at $13. 06M, so a bit of a roller coaster.

I wanted FatFire because I didn’t want to feel money worries with investment drawdowns and haven’t, but it’s still not easy going back so much from all-time highs. It’s funny as someone mentioned “Lost some of the kid inheritance” the other day, which is an interesting way to look at it.

Can you give us some insights into your post-retirement spending and income? How much do you spend annually, and on what? And where does the income to pay for your spending come from?

Our only source of post-retirement income is from dividends (~$75K) and real estate syndication interest (~$50K).

We spent $186K (not including income taxes), our highest ever in 2021. I am always a bit surprised when I pull together the yearly review, given that we live in a lower cost of living state (Texas), have no car or house payments (other than $10K in property taxes), so we spent a lot, but I guess that is the S in ISE.

We can afford our current spending and have no plans to change in the coming years.

Here is the rough breakdown of the spending and decided in 2022 to better track where the spending is going out of curiosity.

As you can see, spending is more than income, and my plan is to sell down a self-managed portfolio that currently has $650K for any living expenses shortfall.

Over time some of the $600K invested in real estate syndications will go full circle and be another source that will allow us to not have to touch our core investment portfolio if all goes well.

How are you handling Social Security, required minimum distributions, tax issues, and the like?

We haven’t gotten to that stage yet. Since my wife is 49 and I am 51.

We have quite a bit of time to decide how to handle Social Security and required minimum distributions etc.

Did you return to paid work? Why or why not?

No, I did not return to work.

Some of the typical jobs people mention in retirement are consulting, part-time work, or starting a side hustle., That is similar to what I gave to retire, so long story short, since I worked for money and have turned down multiple lucrative part-time opportunities, I slowly realize that I will probably never work again in the traditional sense.

Did you find it hard going from being a saver to a spender?

It is a bit weird to not save any money each month, and my net worth fluctuates quite a bit each month due to investments; as far as spending, it is in the same range as it was pre-retirement.

I often get joy in just the knowledge that I can buy anything I want, but at times when there is something I want (aka new Golf clubs, a new car for my wife, vacations) also don’t give it much thought from a financial standpoint as know we can afford it. Still do a lot of research as I want to get something good because that is how I am wired, but I don’t find the actual spending difficult.

That said, one thing I have been doing lately, and it might seem dumb, is when I want to spend on something a little out of the norm of my comfort zone is to use a formula a friend of mine called Jedi Math. For example, over the holidays, we tried A5 Wagyu beef which was $99.99 a pound at Costco, so it cost $200, and what I did was divide the price by my net worth to see if it would make sense and be responsible for a millionaire and for someone worth 100k to spend on the same luxury. Let me show you the math.

If you are worth $5M, then divide by 5, so it would be equal to a millionaire spending $40 and $4 for someone worth $100K. As a treat, would a millionaire buy $40 worth of steak for his family, and if the answer is yes in your mind, you are free to spend. At the core, it puts spending in a lot better context and helps lifelong savers start to exercise the spending muscle

Looking back, what do you wish you knew in advance?

Even though my ultimate decision-making process was reasonably short, it was based on a lifetime of accumulated information.

What advice do you have for those wanting to retire?

If you are a younger person reading this, I will start by encouraging you to front-load your career. When you are younger, have more energy, fewer commitments, or family, it is a lot easier to make the sacrifices both in work hours and risk that compound and can grow your career and income and set you up on a path for success that is hard to derail.

Continue to focus on earning (your career), saving, and investing as it can be a long journey often with highs and lows. One of my secrets to success is being a lifelong learner and having curiosity about each of those topics. While you are on the journey, try to ensure you have a good life balance as I see a lot of people that are ultra-successful in their careers but struggle in their home life which was not something that ever was appealing to me as having extra dollars in the bank and not being there for my wife/kids would have been very empty.

Don’t be afraid to spend money and enjoy life along the way, even if it means retiring a year or two later.

Don’t fall into the “one more year” syndrome, and there are definitely opportunity costs of making more money that you don’t really need versus the lost time, health, missing experiences, and sacrifice it takes.

For those considering retirement, assuming you have the financial means, I would say that for each person, there is a cost of making money at the expense of time and portions of life/time/experiences that you can never get back. We can all agree that having less stress, more sleep, exercise, and self-care increases the odds of staying healthier, allowing you to enjoy life once you decide to stop working.

Do you have any final words of wisdom?

Two things come to mind that I think would be very helpful for your readers.

I still remember being at a conference 13 years ago and hearing a story about Muhammad Ali on his 70th birthday saying, “Service to others is the rent you pay for your room on earth.” It moved me as very powerful if you think about it, and I started to prioritize giving back more professionally and personally.

Those words were foundational to me, and I hope my doing more motivates others to do so. After that, I dedicated about 12-16 hours a month to giving free help to customers, colleagues, complete strangers, software executives, and Wall Street analysts, which built up an incredible amount of goodwill and made me feel good paying it forward. Try to find areas where you can give back and help others as it helps you achieve your goals.

I cannot recommend Millionaire Money Mentors enough as I was one of the original members joining in September 2020. My friend Apex sums up the reason to join way better than I could in this comment:

“I joined as one of the mentors and expected to get a lot of questions from people who needed help or wanted advice. There is plenty of that, too, which is excellent, and I enjoy sharing my experiences with those questions, but there is so much wisdom on the forums from both mentors and members that I am learning new things too, which was not what I expected.

I am not sure ESI will want me to say this, but I spend so much more time on MMM that I don’t spend as much time here on ESI anymore. Frankly, the content on MMM is so much deeper, more engaging, and more relevant to me that I am drawn to it in a stronger way than I have been drawn to any other informational site I visit. It nearly replaces the content of multiple other sites.

I have never really thought about paysites as paying for themselves. You pay for something and get the value from it. You buy a steak and eat it. You enjoyed the steak but are now out the money, which was worth the trade-off. It was only a few weeks into the site when member after member started saying how they had already paid for their subscription or received much more monetary value than they paid already. I kind of brushed it off as people who maybe were just a little eager to be complimentary and enjoyed the site, but they were probably exaggerating the monetary benefits.

But I have seen people report life-changing decisions that they were already making that were going to bring considerable monetary benefits to them. I have since changed my opinion on the value proposition. Most places will promote a value proposition for their product, and I find most of its exaggerated marketing. MMM has a real tangible monetary value proposition for a lot of people. I would probably argue for most people.

This may be one of the rare instances where you truly cannot financially afford to not be on this forum, and you don’t know how rare it is for me to even suggest something like that.

MMM has leveraged a gold mine of experiences that I am not sure where else you could get access to something like this. I am very successful but have never had the level of discussions with so many successful people around so many issues that I have had here. I am willing to bet if I had been on this forum as a member 25 years ago, I would have gotten to where I am now in half the time. The secrets that everyone is always looking for that rarely exist. They are here, and they are real. They are being shared by those who personally did it, and they tell you how they did it and how to customize it to the specific situation you are asking about.

If you are thinking about it, you owe it to yourself to try it. You have a 7-day trial period, so what have you got to lose? Nothing. But you do potentially have a lot more to lose if you don’t join based on the value proposition that so many existing members have already reported and that I witness every week.

It’s pure gold.”

To read the rest of this interview, see Retirement Interview 34, Part 2.

Great interview! Congrats on your retirement and I’m glad it is working out well for you. I appreciate the detail in your interview and I’m looking forward to Part 2.

Thanks for the comment and so far so good has been a fun 18 months. Have a great weekend.

Great write up! Man, our stories are damn near identical from ages to NW and being independent consultants. The only variable would be you are definitely more aggressive than me on the investment front and I retired a few years back at 44. It’s one area that I’d say is my Achilles heel, but like you guys, our annual expenses are in the $200k range and no real need/desire to change it. Turns out a life well lived isn’t that expensive.

Only question would be is do you really feel safer being so heavily invested in hedge funds vs. indexing? I agree with the premise, and your pile is large enough to sustain a major unforeseen hit, it just seems unnecessary…or am I just a big scaredy-cat?

Thanks for the comment and kind words. Small world as sounds like our journeys were similar and congratulations on your success and early retirement.

Being a member of MMM has opened my eyes in a positive way to Indexing and would not be surprised if down the road I slowly allocate money from hedge funds to index funds. I have spent a lot of time and effort trying to find the top 5% of hedge funds and in MMM have a whole thread about my decision-making process and they tend to outperform in markets like this year as currently down about 7% vs the 20% S&P but last year they underperformed so it has been a mixed bag. All in all I have slightly beat the S&P 500 after all fees and profit-sharing but by a pretty small amount. I would recommend index funds for most readers

Great interview – thanks for the highlight and keep enjoying those weekdays!

Thanks, Dave and really enjoy your blog!

Great interview. I look forward to the second half. This is year 5 of my early retirement at 54 and I can unequivocally say you will not be bored if you remain curious, healthy and helping others. My hobbies and interests are broader than they were when I retired in 2017. Also, I agree to “do nothing” in the volunteering or side hustle front for at least 6 months once you retire. I actually gave it a year to completely decompress and focus on me and my family. This made it easier to really focus on what I wanted to do to give back. The last three years has been volunteering with homeless veterans and working with my city to create a broader plan to assist with transitional housing for those who have fallen on hard times and evicted from their homes.

Keep up the great work.

Thanks, R-19 as glad to be part of the club as not sure if I am M73 or R34 now 🙂

Congratulations on your early retirement and could not agree more with the 6 months (or more) to decompress and focus on health, family, friends, hobbies, etc and you will have a clear picture of what you want your future “chapter” to look like.

Great to see you helping out with some excellent charities.

MI-73, great interview. Couple of quick questions:

1.) are you using the Interactive Brokers Hedge Fund Marketplace? If so, any opinions on it?

2.) I may be reading this incorrectly, but since most of your money is invested in hedge funds that other people manage and only a small portion of your money is invested directly in the stock market, why do you dedicate so much time to checking the stock market each day?

3.) your spend amount is rather low. Do you plan on any house renovations or purchasing a 2nd home?

Thanks for the comment and kinds word as enjoyed your Millionaire interview and having you be a member in MMM. As far as your questions:

1. Have reviewed the hedge funds in IB out of curiosity and think they are lower quality than what you would want if you are interested in this space. Would check out the hedge fund thread in MMM as lots of good detail there.

2. It is a real passion/hobby of mine and has been for 35+ years. I won a stock-picking contest when I was 15 years old and it was probably one of the worst things that could have happened as that confidence combined with a high-risk tolerance and a gambler’s mentality caused me to underperform the market for years and it was when I was 38 (2008) that I finally got out of my own way but still love to follow it. Here is something I wrote in MMM as well

“One of the things I think people don’t appreciate is the level of effort, hard work and continuous learning that it takes to be able to “weed out” the fake experts, the “average” experts and find the top 10% or better in any given field as with limited knowledge it is often very difficult (unless you are lucky).

For example, I have been investing for 35 years (started when I was 15), have followed the market and investing as a real passion of mine, and well over the 10,000-hour rule so would put my knowledge in the top 5% of “retail investors” and that is one of the reasons I feel more confident in my ability to find the top 10% of hedge fund managers but long term risk-adjusted-performance will be the ultimate judge.”

3. Funny as this is the first time I have heard this as compared to most in the FIRE movement we have run away spending 🙂 In all seriousness, we live a great life and will have no plans to increase spending and I have crunched the numbers a few times on a beach house but given that I wouldn’t want to rent it out the financials quickly don’t make sense as an investment and I am okay with that as much prefer just to rent and have flexibility on vacation/location spots.

I really enjoyed the interview. It’s helpful to watch a trajectory of career , income , thoughts and changing “reasons” for working or retiring- especially when there’s no need for work.

Interesting. Thank you.

Thanks for the comment and it was great to be able to collect my thoughts and appreciate ESIMoney for publishing my “diary”.

Great interview and story. I, like you, looked at my time with my child as being very short. Even more so as a teenager which you point out. The sacrifices I made to make sure I was with my son after divorce from age 5 to his current age of 16, I count as the greatest and most rewarding sacrifices of my life. Your sense of security of $8M matches that of some folks interviewed in an article I read to my son years ago. The average for those 100 millionaires was $7M net worth before they really stopped “worrying” about money. I am retiring with a $3M net worth and am hopeful I can have peace of mind and no worries. Congratulations on a successful start to your well-deserved retirement. Especially love the Ali quote and implementation of giving back and paying it forward.

Thanks for the comment and kind words and pretty sure you will look back on the extra time with your son as one of the smartest decisions you ever made as the 7% of time left with them after they turn 18 is pretty eye-opening. Kids grow up way to fast.

Interesting on the article as curious if you have a link as don’t remember reading that one and the “number” is different for everyone depending on so many factors.

Congratulations on $3M NW and your upcoming retirement.

That Ali quote really impacted me as I made several changes shortly after including starting researching and creating a charitable trust (which I did a few years later) as well as the time I mentioned in the article above. Here is a comment in MMM on this as well:

“About 10 years ago l heard a speech at a corporate event and the keynote quoted Muhammad Ali from being at his 70th birthday “ Service to others is the rent you pay for your room on earth.” and it was really moving and on the flight home I made a real commitment to start giving back a lot more from a charitable standpoint as well as within my industry as a light-bulb went off on how lucky I was. Giving back has become something that played an important role in my career as was as personal life and I have never regretted it for one minute and I would say like @Steveark I might be better off financially due to it when all is said and done.”

When I read this: “Many people will find this strange, but I didn’t feel like I was free of money worries until I crossed $8M”, I realized it was probably about 8 million when I stopped worrying too. I don’t expect to get to your level, but when I recently hit 8 million I started really questioning why I continue to work. Forget 1 more year, I’m still living a 2 more years mentality.

It is interesting as the “magic number” is different for everyone but you will most likely know when you hit it. With the snowball of compounding you will definitely be at my level in a few years although hopefully I also have a new level 🙂

Thanks for the shout-outs!

The more I learn about the money, the more I learn that it’s not about the money… it’s about creating the choices for living the life you want.

Thanks, Doug, and not sure you realize how impactful your words and advice as they really got me to stop and think in a way that not sure if I would have without MMM, and very glad I did.

Really has been great to read all your advice and get to know you better in MMM as always fascinating to me how relationships can be formed and grow online to the point where you feel like you know someone that you have never meet in real life.

Lots of good information. I am more conservative on my available cash, and my stash is closer to five years (with some in three-year annuities). I know it’s a bit extreme but it gives my wife and me the ability to live our planned lifestyle without dipping into equities. Which leads to my question as to how you chose your cash relative to your spending.

Thanks for the kind words to me 5 years of cash seems like way too much but everyone’s level of comfort is different and it sounds like that works for you which is all that matters.

I don’t really have a defined hard and fast rule on emergency cash as have had up to $2M a few years ago with a planned 3 year timeline to invest vs right now have about 20K (which is too low) give we spend about 18K a month. That said, I have easy access to $ from equities and have 200K in a short-term real estate investment in Q4 that will support 2023.

For me, the key is having access within 24 hours to the $ and that makes me sleep easy at night but ideally think people should keep 6-12 months of emergency so one of those “do as I say not as I do” 🙂