I keep them in a spreadsheet on a tab labeled “article ideas” next to the tab where I track all the posts on ESI Money.

The ideas are collected from thoughts and experiences I have, books and articles I read, etc. Basically it’s a brainstorming list I can review anytime I get writer’s block (which doesn’t happen often).

Many of these ideas will not see the light of day. I thought they were good at one point (when I wrote them down) but after letting them settle I know many are terrible. At least not great for a post on ESI Money.

But there are some good ones (or at least I think they are good), so when my buddy, Jeff, from Debt Free Doctor asked if he could do a guest post for me, I went to the list and selected the topic you’ll be reading about today.

Jeff is no stranger to ESI Money readers. He’s either been the feature or author of the following:

- Millionaire Interview 80

- How to Save Money On Medical Costs

- Five Reasons You Should Invest in Storage Units and Three Ways to Do So

He and I spent a few days together a couple years ago at FinCon in Florida.

Jeff likes to live large by staying at Ritz Carlton hotels and I like to live large by having friends who stay at Ritz Carlton hotels. He had me and a few others over to his hotel for dinner, then we went to the lounge level upstairs, sat outside, and chatted for a couple hours. It was a great time and one I’m hoping to repeat in the future.

But for now, Jeff’s going to share his take on the seven financial numbers we should all track (or at least consider tracking).

After each of his numbers, I’ll share my thoughts.

Take it away Jeff…

—————————–

Peter Drucker once said, “If you can’t measure it, you can’t improve it.”

When I used to do business coaching for dentists, one of the main results they were seeking was to make more money.

Who doesn’t want to make more moola, right?

One of the first questions I would ask them was, “Who gives you the money?”

Naturally they’d answer that it was their patients which led me to the BIG question, “How many new patients do you treat each month?”

It amazed me that most of these dentists had no clue. If patients bring them the money and they want more money then they should focus on increasing their number of new patients, right?

Same goes with weight loss. If you’re trying to get that summer beach body and shed a few pounds but never step on a scale to track progress, how’s that going to work out?

You’re right, it’s not.

Drucker was spot on in stating that if you can’t measure something then you possibly can’t get any better at it.

If you don’t have a clue of what you’re starting point is and where you want to end up then you have no idea if you are succeeding or not.

Unfortunately this is exactly how most people approach their financial situation. Many think it’s too difficult and overwhelming to manage so they end up putting it off which causes it to never be addressed.

I get it. As a busy doctor, life gets hectic trying to juggle work, friends and family responsibilities.

The good news is that becoming financially successful isn’t hard. Heck, even this Louisiana redneck can do it!

I’m of the belief that keeping matters as simple as possible is the key to success. If we boil down everything to the basics, then the majority of the most important aspects of your finances can be summed up by paying attention to a handful of simple numbers.

These financial numbers are similar to what you should track for your health:

- blood pressure

- pulse

- weight

- cholesterol

Making sure that you’re in the ballpark range of what you’re shooting for will keep you going down the right path.

Tracking your progress with these numbers will allow you to make sure you’re staying on pace to become financially independent and determining how good you’re handling your day to day money situation.

What are these financial numbers you should know?

Here’s the top seven financial numbers you should keep track of…

#1 Income

I used to be a frequent Dave Ramsey show listener and was always surprised by how so few of the callers knew what their take home pay was.

Most were aware of their gross income but unsure about how much they brought home each month.

It’s vital to know exactly what is deposited into your account on a monthly basis in order to become financially successful.

Your take home pay is your salary minus the deductions, taxes and any other withholding amounts.

If your goal is to reach financial independence, then it’s a no brainer that your focus should be on growing your income!

ESI’s Thoughts

#1 and #7 could be combined, though I don’t mind breaking them out.

The income here falls into the category of what I’d call time-based ways to make money.

In addition to your career income, I’d also put side hustle income in this group — any money that you earn by trading time and effort for money.

Obviously this is a BIG one to track (and work on growing) which is why it’s listed first in this site’s name. 😉

#2 Expenses

One thing that didn’t surprise me regarding the Dave Ramsey show listeners is that most didn’t have a clue about their monthly expenses.

This is one of the main reasons why people avoid creating a budget…keeping track of all the money going out.

For high-income earners, having a substantial income is one thing. But if they don’t realize that their expenses are equal to or greater than their income, then financial success is next to impossible.

Just as easy is it is to spend money online, the same goes with tools that allow you to track expenses online too. There are plenty of apps out there that can help you keep up with where your money is going each month.

Knowing your monthly expenses is important for another reason…determining how much you should have stashed in an emergency fund.

A good rule of thumb is saving 3-6 months of your monthly expenses.

Again, it’s hard to hit this target if you’re unaware of your monthly expenditures.

ESI’s Thoughts

I’ve come a long way on the budget thing.

I used to be militant that everyone HAD to have a budget.

But you know who didn’t have one for many years? Me.

You know who else doesn’t have a budget? Millionaires (or at least many of them).

So here’s my guidance for creating, using, and tracking with a budget:

- You need one when you are just starting out to get a handle on your money, help you save money, and generally just begin on the right foot financially.

- Once you master controlling your spending, you can slowly move away from a budget — from updating it every month to every other month to twice a year to once a year to every few years. Of course some people never get to the point where they can control their spending, so they need a budget all the time.

- When you start coming in for a retirement landing (5-10 years out), you need to start a budget again to MAKE SURE you know what your spending will be in retirement. You DO NOT want to get that number wrong or you might have a very bad retirement.

BTW, though we didn’t have a budget for many years, we did track our spending by Quicken. So I knew exactly what was going out. I just didn’t hold us to any specific spending caps.

In the thoughts above you could substitute “track expenses” for “budget” and I’d be good with that too.

#3 Debt

Completing the training to become a periodontist caused my student loan bill to reach $300K.

We also had a mortgage and car loan to deal with.

After my job offer fell through two weeks before graduation, I didn’t have a clue where to turn.

Luckily I stumbled upon Dave Ramsey’s “Debt Snowball” method.

The first step involves listing your debts smallest to largest and attacking the smallest one until it’s paid off. Most would think you’d start with the one having the highest interest rate but Dave’s more focused on getting that “small win” to keep us engaged.

Dave says, “Paying off debt is not always about math. It’s about motivation. Personal finance is 20% head knowledge and 80% behavior. When you start knocking off the easier debts, you will see results and you will stay motivated to dump your debt.”

My Thoughts

When I started paying off my debts, I made the decision to start with the lowest student loan balance even though it didn’t have the highest interest rate.

Paying that $2,000 bill off allowed me to see that I was taking a step in the right direction to financial freedom.

My highest-interest student loan had a large 5-figure balance. Initially trying to tackle something that large could have potentially stalled the process if something popped up along the way (emergency) and the snowball had to be paused.

ESI’s Thoughts

This was an easy one for us.

We paid off our mortgage in the late 90’s and didn’t have debt from then on.

It’s pretty easy to track a number that’s zero for 20+ years. 😉

#4 Net Worth

Your net worth is an essential financial number that you should also continuously track.

It’s the difference between how much you own (assets) and how much you owe (liabilities). It’s a wealth scorecard so to speak.

Assets include:

- cars

- house

- real estate

- cash in accounts

- other investments

Liabilities are essentially the sum total of all your debts such as your mortgage, student and credit card loans.

Most agree that the top “earning years” would tend to be from ages 35-44.

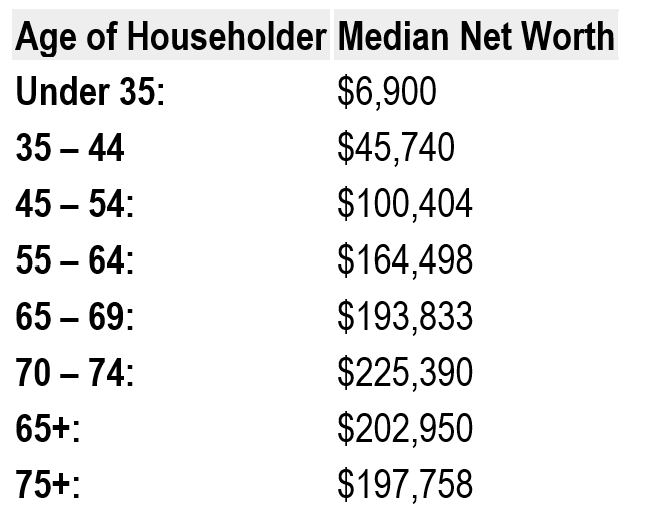

Check out the chart below of the average net worth of Americans which is surprisingly low, especially in the 35-44 category.

Net Worth Example

Here’s an example of Dr. A, a 47 year old surgeon, that’s concerned about his net worth as he’s been practicing for 10 years.

He’s interested in buying a new home but his banker needed to know what his net worth was in order to give him his best options.

He has the following:

- Home valued at $300,000

- Mortgage loan = $150,000

- Student loans = $75,000

- Duplex valued at $225,000 but owes $100,000

- Car valued at $20,000 but owes $10,000

- 401k balance = $360,000

- Cash and other investments = $100,000

This is summarized as follows:

- Assets = $1,005,000 ($300,000 + $225,000 + $20,000 + $360,000 + $100,000)

- Liabilities = $335,000 ($150,000 + $75,000 + $100,000 + $10,000)

- Assets – Liabilities = Net Worth ($1,005,000 – $335,000) = $670,000

Dr A should feel pretty good about his situation as his net worth ($670,000) is considerably higher than the average American in his age group ($100,404).

ESI’s Thoughts

I think most ESI Money readers know what net worth is and how to measure and track it.

After all, we get a lesson in it every week with the millionaire interviews.

I’ve tracked my net worth for decades (Quicken makes it super easy) and consider it my top financial metric. It’s the one I put above all others.

And as for the median net worths, how sad are those?

#5 Savings Rate

Most people approach their financial life in the reverse order. They spend what they need (and want) each month and if by chance there’s anything left over, then they consider socking it away for future use.

If you don’t save any money for the future, then you’re NOT going to have much of a future to enjoy.

Saving money is one of the key steps to achieving financial success. Money gurus and advisors suggest we save 10% of our income.

The average savings rate in America is a paltry 7%.

In the book, The Richest Man in Babylon, seven wealth building lessons were discussed.

Lesson #1 was to pay yourself first at least 10% of earnings and Lesson #2 ties into to this by recommending to live below your means.

If you spend MORE than you earn, then trying to save money is impossible.

If you’re not putting back at least 10% of your income then let that be your first goal. But if you want to have an even better future with the possibility of retiring early, then shoot for 20%+.

And next…bonus financial numbers for those in search of financial independence…

ESI’s Thoughts

We never tracked our savings rate.

We simply saved a “ton” and kept at it, knowing time would make us wealthy.

When I went back and calculated it we ended up saving 36% of our gross income over 20 years. Not bad at all.

Of course saving a ton was easier since we didn’t have a mortgage.

#6 Financial Independence (FI) Number

One of the most popular topics written about in the personal finance space is FI or financial independence.

Most start by teaching us to first calculate our FI number which tells us when we’re free from having to work.

Some base their FI number on their net worth. If that’s the case, then it’s the amount of net worth needed before becoming financially independent.

The standard rule commonly used for FI is the 4% rule.

It states that we need to accumulate up to 25 times our expenses in order to withdraw 4% of our net worth to cover those expenses (without running out of money).

For example, if you spend $100,000 per year, your FI number would be $2.5 million dollars.

Once you get to the point that your net worth is greater than or equal to your FI number then congratulations, you’re financially free!

I tend to calculate our FI number a little differently.

Instead of focusing on net worth, I focus on investment income.

My FI number formula is:

Investment income > personal expenses

You might be asking, “Where does investment income come from?”

Which leads us to our final financial number….

ESI’s Thoughts

Ugh.

One of my biggest mistakes was not tracking this.

If I had, I would have realized that I was financially independent at 42 and could have retired a decade earlier.

Double ugh.

#7 Passive Income

Investment income can be derived from multiple sources such as:

- stocks

- bonds

- real estate

When your investment income exceeds your personal expenses, you no longer need to trade time for dollars (unless you want to).

Rich Dad Poor Dad author, Robert Kiyosaki, calls reaching this point “exiting the rat race“.

We focus on passive income from real estate, specifically multifamily syndications.

By using this method, we’re able to set a much lower number to reach financial freedom as our target is on cash flow versus a set number to draw down on.

Example

Let’s use an example of someone (Ms. C) that lives comfortably on $120,000.

I understand that our friend here, ESI Money, couldn’t live on such a meager amount 🙂 but most of us “other people” could.

Now Ms. C loves to travel with her friends and the thought of being able to free up her time to do so at such a young age (44) motivated her to begin investing in her 30’s.

As soon as she became consumer debt-free, she began investing in passive real estate syndication deals with trusted sponsors.

She calculated her FI number to be roughly $1.5 million which is MUCH lower than what her financial advisor told her ($3.6 million).

At an 8% annual cash flow rate, $1.5 million would produce $120,000 per year or $10,000/month virtually tax free.

How? The benefits of depreciation offset the monthly passive income.

ESI’s Thoughts

Hahahaha! And this from Mr. Ritz Carlton! 🙂

I’m a big fan of income (passive or not) and have recently written the following:

- Passive Income, Aggressive Retirement

- Five Categories of Passive Income and How to Evaluate Them

- 28 Ways to Create Extra, Passive Income

- Three Ways to Make Money

- Ideas for Creating Income

I also detail our multiple streams of income in my annual financial updates here at the beginning of each year.

Do You Know Your Numbers?

Now you know the seven most important financial numbers that will help you track how you’re doing regarding debt, income, savings and if you’re interested, financial freedom.

Do you track all of these? Or maybe you track different ones? Let us know your thoughts in the comments below.

I am so happy you made that reference to Peter Drucker – he is one of my favorites and I truly love reading his books. You’re right – to measure success you need something quantifiable.

I’ve been tracking my overall net worth on a fairly consistent basis.

Although I used to review my net worth on a daily basis, I realize now that, that is unnecessary. So, roughly once a month I sit down and review my assets, my current liabilities. I also try to figure out my next steps as it relates to what I need to do in order to reach my millionaire goal.

In my opinion, the more I see my current progress, the more likely I am going to reach my goal in a shorter amount of time.

Thank you for sharing your thoughts!

Cheers,

Fiona

Great article to forward to adult kids and grandkids!

Thank you and yes, pass it along!

Good article and a great reminder of the importance of financial awareness.

I agree very strongly about tracking spending. My suspicion is that “budget” conveys a negative connotation to most people as it represents a constraint. Spending however is what it is… and I would argue that anyone not tracking it has no idea where they are financially. IMHO this is so much more important and tangible than Net Worth.

In our runup to retirement we tracked our spending and had a good estimate what our spending would be once we retired. One of my (many) pet peeves is the idea that you can estimate retirement based on some percentage of current working income. You must know what your spending will be and compare that to all projected sources of income in retirement.

Having said that, we have found that we’ve spent more than we thought we would. However, most of this additional spending has been in, what I refer to as, optional spending; mostly home improvements that we could have done without. I would still suggest that anyone preparing for retirement create a somewhat padded spending plan. There are so many things that don’t come under the normal budget items like mortgage, car payments etc. These extras still have a significant impact on spending… things like new glasses, computers and phone upgrades. Those still happen and should be considered.

“Having said that, we have found that we’ve spent more than we thought we would. However, most of this additional spending has been in, what I refer to as, optional spending; mostly home improvements that we could have done without.”

Your quote reminded me of a podcast I listened to recently. The guest also addressed this situation by saying that what do we do on Saturdays when we’re working during the week? Shop at Costco’s and Home Depot, right?

He then asked, what do you think happens when you retire? Everyday turns into a Saturday!! 🙂

I am tracking most of numbers. Except savings rate and FI number, which two important numbers. lol

Savings rate is confusing as saving involves pre-tax and post-tax money. But we max out both 401K and Roth IRA. 🙂

can someone please help me to understand “At an 8% annual cash flow rate, $1.5 million would produce $120,000 per year or $10,000/month virtually tax free.”? How 8% is calculated? Our expense is close to $120K, if I can learn how to calculate FI number then it would be great.

Thanks in advance!

I’m not sure what you mean.

The equation for the statement is this:

$1,500,000 * 0.08 = $120,000

Is that what you mean?

my question is where 8% is from? is it referring to return on investment? If so, getting cashflow from dividends + selling stocks?

Why would it be tax free?

Thanks!

This article may help answer your question: https://www.debtfreedr.com/how-to-retire-in-10-years-with-no-savings/

Thanks for the article link! it was a great read. Now i understand better. 🙂

An excellent blog post which talks about all the different ways to look at one’s finances. A very enjoyable read!

I think a blog post about passive income sources would be a great follow-up if you have not already done so.

https://esimoney.com/passive-income-aggressive-retirement/

https://esimoney.com/five-categories-of-passive-income-and-how-to-evaluate-them/

https://esimoney.com/28-ways-to-create-extra-passive-income/

https://esimoney.com/three-ways-to-make-money/

https://esimoney.com/ten-best-ways-to-earn-money/

Good read. And glad to see I am 7/7 on this list. Do all these.

Very good read! As a part time, pro bono financial coach, it always amazes me how many folks with good incomes are lost financially. They simply don’t take the time to learn and execute a basic financial strategy.

Personally, my wife and I keep detailed budget and net worth spreadsheets. The budget is updated regularly with totals by month. We stopped monthly net worth calculation ms for quarterly.

A financial planner friend did give me a good budgeting idea for folks who can’t manage the day to day detail. “Simply save your target percentage and spend the rest.”

Such a great post! Passive real estate investing sounds so great…just sit back and collect a check! 😂. But it seems like such a leap of faith to send a check to people you don’t know really well. How do you go about vetting these GP’s? Is this a tax nightmare?

https://esimoney.com/how-to-get-started-investing-in-real-estate-syndications-part-1/

I never tracked savings rate. I track savings amount per month/year. To me, this is a better indicator of progress made towards my NW (e.g. FI) goal. Cut spending if the savings amount isn’t what you want or go ahead and splurge more if it’s too much.

Start young and be aggressive. Unfortunately I didnt and yet fortunately I did. I didnt personally except for my 401k where I put in the max that was matched. Should have put in more. But my 2nd job, when I was 28 I went to a company that was going public. I bought 1000 shares @7.5. Bought a couple more times on huge dips, like in 2000 and 2008/09. Plus I got stock options as I was mgmt. But this was the extent of my investing. No research and investing in other opportunities. During the last few years there I started investing as when I sold options that vested I needed to put that money to use. I moved on from there in 2013 and worked for 5 more years. OH MY, we had four 3 for 2 splits and I still sold everything at $125 (my basis on the original shares was now $1.67 and shares were now 5,062) Total shares over 10,000 as noted I bought some along the way. Then had another 9600 in stock options or something like that. My 401k which we were only allowed to put 25% in our company stock was comprised of over 50% of the company stock as the growth was much more than market (S&P 500, etc). So I started early, kind of but really just because of my job. I sold everything when I had zero visibility into the company and moved my 401k in the standard Growth portfolio type options. My tax bill was over $500k (no state taxes). Thus had zero exposure remaining my prior employers stock. It is sitting at $9 ish now, was low as $4. So ya, I broke all the rules related to diversification, but I had a direct line to financials, business, and CFO and knew how we were performing. So I followed the invest in what you know and I was very close to the numbers. When I no longer had that, I diversified immediately.

My advice is to be very aggressive when young. No need to build passive income in stocks. Real Estate, YES!. Up to 45 be aggressive. After that begin moving towards capital preservation and building those other passive income streams if you have not invested in RE to date. I retired at 55 in March 2018. My wealth has continued to move up, but has had some wild swings of over $1.0M within a year because of the market gyrations. My passive income (purely dividends) is greater than my expenses, which I track and have a budget by line item. I started this a few years before retirement (which I loosely define as choice – if you love your job you can still be there but be in retirement). I dont worry if I go over a month or line item, but look at it as a guide as well as just an analytical tool. Once my passive income exceeded expenses I have moved to more aggressive stocks with the excess capital that is in my investment account.

My 401k since I was 51 has averaged a little under 12% CAGR. Is in 7 figures now. I did cost myself $90k one year (not 2020 as I learned my lesson). I felt market getting a bit toppy, so I moved my 401k into a money market fund in Dec. Was looking smart, and then in Jan it moved up over 11% in about 2 weeks or something like that. Oops. Could never get that back. I measure based on my birthday month (so my calendar for 401k only is Oct-Sept vs Jan-Dec). So my ’19/’20 gain was 29.15% and so far from Oct 2020 to date am up another 14.5%. If I moved out to protect against downfall, I would likely have missed this big gain. With my stocks I used the pandemic as an opportunity to shuffle stocks, but stayed in and even invested additional cash. It is great to have passive income, but just dont be passive about your investing.

But if I was young again, I would have started much earlier. Had a budget early and invested as much as I could. I probably would have had a roommate to lower rental costs. And I bet I would have more than double what I have now and probably be near 8 figures in wealth.

Start young, be aggressive, get a budget, and know your numbers. I have tried to work on my nephews, but they have yet to fully get it. If you do the above you likely can easily retire by 45. Took me 10 more years. My highest budget ($63k) costs are home 31% and medical 20% (and that is if really I dont need to see a doctor for anything semi serious). Oh how I miss my employer paying most of this.

My number to retire was $3.0M and my passive income very close to expenses. Yes it is conservative, but it is how I roll. You just never know so you should have some wiggle room in there. I am well above that number as of today. But with a lot in the market that could change, but will stay strong and ride it through cause I can. Still have cash of approx 17%. Love to get into Real Estate, but prices have risen so much, well over 50% since 2013 where I live, which is not on either coast.

So as you can see I track many of the key numbers presented in this article. I find it is imperative to maximize wealth building as well as for me, a financial dude, fun.

I never tracked any of those until I was close to retiring. I mean it was obvious we had excess money cause we maxed out every retirement account available to us and still had our checking account filling up. We were constantly moving money into a taxable brokerage account because we had to put it somewhere. We lived well but in a middle class way, not like most people with our income. We bought everything with cash, including cars. Paid the house off early and that reduced our expenses further. I realize we got away with not tracking things more closely only because I earned a lot and we were frugal.

The column ends with: Do you know your numbers? Maybe you track different ones? I love that question because, yes! Yes, I’ve got two of ’em.

When someone is newly independent… and they’re just starting the “Earn” phase… they absolutely need to follow the financial metric CASH FLOW MANAGEMENT.

– a rent payment will be due eventually. When the due date arrives, will there be enough to pay it on time?

There’s a difference between “Budgeting” and “Cash Flow Management”. A person can live their whole life without ever creating/following a budget. But there are very few people lucky enough to have so much money on-hand that it’s unnecessary to be mindful of bills that will be due soon.

Many people monitor their cashflow informally (a mental evaluation):

– – when a paycheck arrives

– – each time a bill arrives

Some people do it systematically:

– – using an app (like Quicken)

– – doing it as a once-per-week verification habit

Either way, make sure you’ve got enough money on-hand to pay bills you know are due soon – managing your cashflow.

When someone is newly independent… and they’re just starting the “Earn” phase… the financial metric: DISCRETIONARY SPENDING MANAGEMENT (DSM) will help them reach the “Save” phase.

Here’s how it’s done: First, Identify categories of spending that are flexible for you. EXAMPLE: I’ve got four: gas, groceries, dining & entertainment, and miscellaneous. The factor that makes these categories FLEXIBLE is that if I underspend in one of ’em, then I get to spend a little more in a different one 🙂

The second step in DSM, is to track what I spend for each of the categories I’ve chosen for myself… tracking every cent! Use an app. Use paper. Use whatever. Just track ’em and keep a running total for the week.

The third step is picking a boundary amount. Choose an amount that will be your signal for the week. Consider it a “fire alarm” that signals you to slow down (or pause) discretionary spending for the rest of the week.

There’s an optional fourth step. This is the one that moves someone from the phase of “Earn” into the phase of “Save”. At the end of the week, if you’ve spent LESS than the sum of all your boundary amounts (3rd step, above), then move the unspent money into savings. it’s gone. No longer available for future discretionary spending.

Final step: Each new week restarts the DSM process. Track discretionary spending. Pay attention to boundary amounts. Being flexible… spending less in one category to allow spending more in another.

A lot of years have passed since I was newly independent. Thanks for inviting me to tell about two additional financial metrics that remain important to me.

Great article for anyone serious about accomplishing the mission. Measuring your progress is absolutely critical for the following reasons:

1 – Tracking your progress will be extremely motivating throughout your journey.

2 – Early detection of problems will emerge and provide plenty of time to adjust accordingly

3 – The huge advantage of tracking your progress vs. paying someone else to manage your money? You’ll know exactly how you got to the finish line by doing it yourself…..pay someone else and managing money will always be a mystery.

4 – Once you hit your goal you’ll still have to manage your success going forward and now the steps necessary to document your success will be an old habit!

One last benefit when you actually track your results vs. depending on what you think you accomplished you’ll find how easy it is to deceive yourself with false assumptions. The facts will set you free!

Absolutely spot on. What you focus on does grow.

I’ve tracked most of these metrics at some point but not anymore – especially budgeting.

I’d agree that you don’t have to keep a budget once you’ve got a handle on spending. I still track everything I spend and earn, but I don’t restrict spending – it happens naturally as I’m fairly frugal.

I still track passive income and net worth, as they’re a good indicator of my progress to Fat FI.

I find it’s also important to track your annual inflation rate and your asset allocation percentage.

I need to know that my investments are going to beat inflation + withdrawal rate + taxes, otherwise I’m going to slowly erode my purchasing power.

For example, in my own market, inflation is 6%, plus 4% for the safe withdrawal and taxes based on my allocation will be 20%. Therefore, I need to make 10% nominal return (or 4% real) before taxes in order to stay flat.

In order to generate at least 4% real returns, I cannot be 90% in bonds. I need to be at least 70% in equities or another asset that generates inflation beating returns.

Thanks for the blog, this post was great and sure to share with friends asking for a start to FI.